- Home

- »

- Sensors & Controls

- »

-

Biophotonics Market Size, Share And Trends Report, 2030GVR Report cover

![Biophotonics Market Size, Share & Trends Report]()

Biophotonics Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (In-Vitro, In-Vivo), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-871-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biophotonics Market Size & Trends

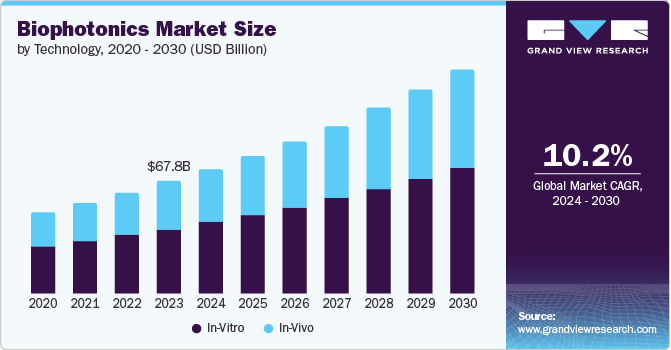

The global biophotonics market size was valued at USD 67.81 billion in 2023 and is projected to grow at a CAGR of 10.2% from 2024 to 2030. The increasing geriatric population, rising frequency of chronic diseases, growing government initiatives, increasing healthcare amends, and incorporating IT into the healthcare application are expected to fuel the market during the forecast period. The upsurge in the number of photonic components in the prevailing healthcare instruments for value enhancement and higher accuracy & sensitivity is projected to impact the market in the next few years significantly. Furthermore, the administration of environmental dynamics, including water and food sources, is further anticipated to fuel the market growth.

Technological advancements over the past decade and their espousal in the medical sector are anticipated to drive market demand in the near future. Furthermore, the emergence of nanotechnology, coupled with the increasing demand for home-based Point-of-Care (POC) devices, is expected to spur market growth in the near future. Improvements in optical technologies in the aerospace and telecom sectors, paired with the availability of private and government funds for R&D such as NNI (National Nanotechnology Initiative), are also expected to impact market growth favorably.

Biophotonics is used to develop various optical technologies that enable the interaction of light or photons with various biological organisms, molecules, cells, and tissues. Biophotonics is classified into two categories, namely clinical applications and research. Research is further bifurcated into three categories: photo mechanics, spectroscopy, and fiber optic sensors. Photomechanics is used in dentistry to analyze the relationship between strain gradients and macroscopic mechanical stress. Spectroscopy helps in studying the interaction between radiated energy and matter. Lastly, fiber optic sensors remotely assess chemical and physical parameters.

Given that large volumes of clinical and biological data are being generated and gathered at an unprecedented scale and speed, big data technologies and machine learning are increasingly used in biomedical and healthcare research. The current analytical approaches used in biophotonics can only gather information from the surface of datasets, thereby causing the loss of critical information these datasets can provide. This has led to integrating technologies, such as machine learning and big data, to perform a detailed analysis of these datasets and obtain more useful information.

Machine learning techniques can help users detect more complex and subtle signals and particle detection. Although researchers have managed to capture very high-content images that indicate the location of numerous molecules of moving particles, some of these images tend to have very low contrast, a noisy background, and indistinct edges, thereby making it difficult to determine the accurate number of particles present in the image and necessitating to determine the precise number of particles manually. To eliminate these complexities, researchers have started using machine learning techniques, whereby the computer is trained to distinguish and determine individual particles in the image. The detailed analysis and extraction of critical information machine learning could propel the adoption of biophotonics.

Technology Insights

In-vitro accounted for the largest market revenue share in 2023 and is expected to maintain its lead throughout the forecast period. This is attributed to the increasing demand for advanced diagnostic and imaging technologies in healthcare. Government initiatives fuel market growth, for instance, the National Cancer Institute launched an innovative molecular analysis technologies (IMAT) program for improving diagnosis and treatment. Biophotonics is crucial in providing non-invasive and label-free techniques for studying biological samples, such as cells and tissues, in vitro. The growing need for accurate and efficient in-vitro diagnostics has propelled the demand for biophotonics in this segment.

The in-vivo segment is expected to register the fastest CAGR during the forecast period. The growing demand for non-invasive and real-time imaging techniques in medical diagnostics drives segment growth. In-vivo imaging technologies based on biophotonics offer the capability to visualize cellular and molecular processes within living organisms without requiring invasive procedures or sample extraction. The ability to non-invasively monitor and analyze complex biological processes in real-time drives the in-vivo segment growth in the market.

Application Insights

Analytics sensing accounted for the largest market revenue share in 2023. The increasing demand for point-of-care testing (POCT) and portable diagnostic devices is fueling the growth of the analytics sensing segment. Biophotonics-based analytics sensing technologies can be miniaturized, integrated into portable devices, and provide rapid and accurate diagnostic results at the point of care.

Microscopy is expected to register the fastest CAGR during the forecast period. Advancements in automation and the integration of microscopy systems have propelled market growth. These technological advancements not only enhance microscopy's capabilities but also contribute to ease of use, data analysis, and overall workflow optimization. The demand for integrated and automated microscopy solutions drives market growth.

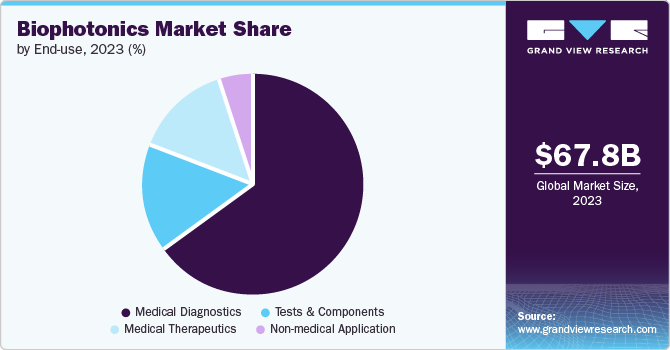

End Use Insights

The medical diagnostic segment accounted for the largest market revenue share of 65.5% in 2023, owing to its adoption by several end-users, which include healthcare providers, instrument manufacturers, medical institutes, and research laboratories. However, due to its environmental screening and monitoring capabilities, the non-medical application is expected to gain prominence over the forecast period.

The non-medical application is anticipated to register the fastest CAGR during the forecast period. Due to its environmental screening and monitoring capabilities, the non-medical application is expected to gain prominence over the forecast period. The upsurge in the study regarding pathogen exposures in agricultural food items, unceasing blood monitoring, and inhibition of unauthorized data visualization is projected to drive the market for several non-medical applications significantly.

Regional Insights

North America biophotonics market accounted for the largest market revenue share of 37.3% in 2023, owing to the surging R&D initiatives, increasing investments in the healthcare industry, and accessibility to excellent infrastructure. The rising aged population and the growing number of cancer patients are expected to spur regional market growth during the next few years. Significant technological advances have increased the role of optical techniques in treating problems related to medical and life science problems. Optical technology is used for various applications, including clinical treatment of patients and investigations carried out at the molecular level. Vendors across all regions are carrying out mergers and acquisitions, conferences, and others to accelerate optical techniques such as Biophotonics.

U.S. Biophotonics Market Trends

The U.S. biophotonics market dominated the North America market in 2023. An increasing number of conferences to study the advances in biophotonics and other optical techniques are being conducted in the U.S. The Optical Society carried out OSA Biophotonics Congress, where they discussed the advancements in applications such as optical instrumentation, life science imaging, molecular probe development, and others. United States Congress has provided various funds from the FY2019 budget to determine opportunities for biophotonics in gene therapy research, immunotherapy research, Alzheimer’s research, and other projects. The funds will also be provided to increase medical technology manufacturing in the U.S.

Europe Biophotonics Market Trends

Europe biophotonics market was identified as a lucrative region in 2023. As the demand for advanced diagnostic and treatment solutions grows, biophotonics technologies are becoming essential in addressing these healthcare challenges. For instance, biophotonic imaging techniques such as optical coherence tomography (OCT) are being used to improve the diagnosis and monitoring of conditions like cardiovascular diseases and cancer. In countries such as Germany and the UK, there has been a significant uptake of these technologies in clinical settings, contributing to the growth of the biophotonics market.

Germany biophotonics market is anticipated to grow significantly over the forecast period. The country’s regulatory framework is designed to promote innovation while ensuring the safety and efficacy of new technologies. The Federal Institute for Drugs and Medical Devices (BfArM) and other regulatory bodies work to streamline the approval process for biophotonics products, facilitating their entry into the market. This supportive regulatory environment encourages investment and fosters the development of new biophotonics technologies, further driving market growth in Germany.

Asia Pacific Biophotonics Market Trends

Asia Pacific biophotonics market is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is witnessing a surge in conditions such as cancer, diabetes, and cardiovascular diseases, which is driving demand for advanced diagnostic tools. In India, biophotonic technologies like fluorescence imaging and spectroscopy are expanding in research and clinical settings to enhance disease detection and monitoring. The growing healthcare burden is pushing for adopting biophotonics solutions that offer non-invasive, accurate, and efficient diagnostic capabilities.

Japan biophotonics market is expected to increase in the coming years. Biophotonics tools are used in Japan to analyze patient-specific data for tailored treatment plans, particularly in oncology and genomics. This emphasis on precision medicine drives the demand for sophisticated biophotonic technologies to provide detailed molecular insights and support individualized healthcare strategies.

Key Biophotonics Company Insights

Some of the key companies in the biophotonics market include Olympus Corporation, ZEISS Group, Hamamatsu Photonics K.K, and others.

-

Olympus Corporation focuses on developing advanced imaging technologies that enhance understanding of biological processes at the cellular and molecular levels. Their offerings include high-resolution microscopes with cutting-edge optics and imaging software that facilitate detailed visualization of live cells and tissues.

-

ZEISS Group offers a diverse selection of premium imaging systems and microscopy solutions. Their collection includes confocal microscopes, super-resolution microscopes, light sheet microscopes, and electron microscopes, each featuring advanced optics and digital imaging technologies. The company also provides specialized microscopy customized for specific purposes like life sciences, materials science, and industrial quality control, further establishing its dominance in Biophotonics.

Key Biophotonics Companies:

The following are the leading companies in the biophotonics market. These companies collectively hold the largest market share and dictate industry trends.

- Affymetrix Inc. (Thermo Fisher Scientific Inc.)

- BD (Becton, Dickinson and Company)

- ZEISS Group

- Olympus Corporation

- Hamamatsu Photonics K.K

- Zecotek Photonics Inc.

- IDEX

- IPG Photonics Corporation

- TOSHIBA CORPORATION

- Oxford Instruments

- PerkinElmer Inc.

Recent Developments

-

In April 2024, BD (Becton, Dickinson, and Company) announced the launch of BD FACSDiscover S8 Cell Sorters, expanding its portfolio with the introduction of advanced image-enabled spectral cell sorters. This innovative technology represents a significant leap forward in biophotonics, the study and application of light-based technologies in biological systems. BD’s new technology enables scientists to gain deeper insights into cellular heterogeneity and functionality.

-

In November 2023, at the Society for Neuroscience (SfN) annual meeting, ZEISS Group showcased state-of-the-art imaging technologies that leverage advanced fluorescence microscopy techniques. These innovations enable researchers to visualize cellular structures and processes with unprecedented clarity and precision. These innovations include enhanced resolution capabilities and faster imaging speeds, critical for capturing dynamic biological events in real time.

Biophotonics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 75.21 billion

Revenue forecast in 2030

USD 134.83 billion

Growth Rate

CAGR of 10.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S., Canada, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Mexico, KSA, UAE, and South Africa

Key companies profiled

Affymetrix Inc. (Thermo Fisher Scientific Inc.); BD (Becton, Dickinson and Company); ZEISS Group; Olympus Corporation; Hamamatsu Photonics K.K; Zecotek Photonics Inc.; IDEX; IPG Photonics Corporation; TOSHIBA CORPORATION; Oxford Instruments; PerkinElmer Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biophotonics Market Report Segmentation

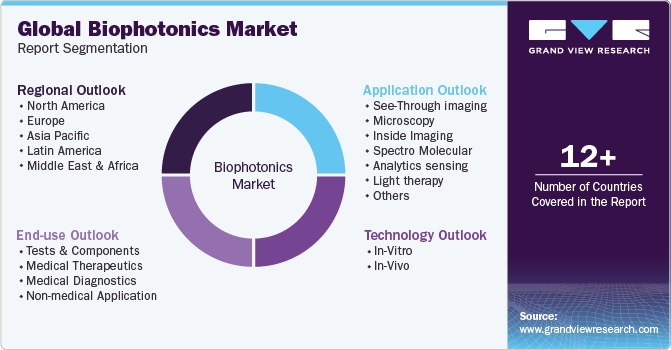

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biophotonics market report based on technology, application, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

In-Vitro

-

In-Vivo

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

See-Through imaging

-

Microscopy

-

Inside Imaging

-

Spectro Molecular

-

Analytics Sensing

-

Light Therapy

-

Surface Imaging

-

Biosensors

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Tests and Components

-

Medical Therapeutics

-

Medical Diagnostics

-

Non-medical Application

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

United Arab Emirates

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.