- Home

- »

- Biotechnology

- »

-

Bioprocess Automation Software Market Size Report, 2033GVR Report cover

![Bioprocess Automation Software Market Size, Share & Trends Report]()

Bioprocess Automation Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Distributed Control Systems, Supervisory Control & Data Acquisition, Manufacturing Execution Systems), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-810-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioprocess Automation Software Market Summary

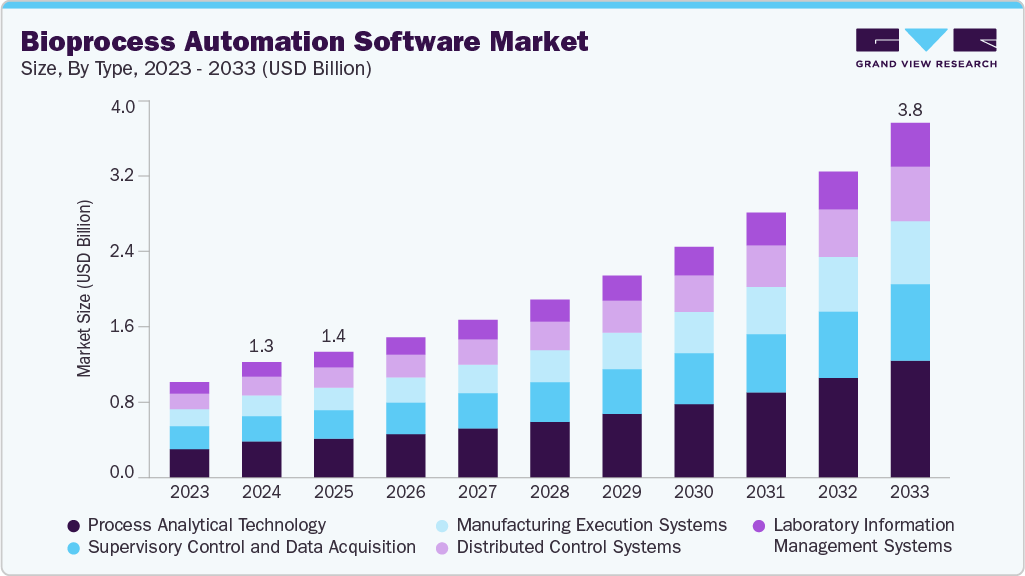

The global bioprocess automation software market size was estimated at USD 1.25 billion in 2024 and is projected to reach USD 3.84 billion by 2033, growing at a CAGR of 13.84% from 2025 to 2033. The industry is driven by the rising adoption of digitalization and automation in biomanufacturing, enhancing efficiency and process consistency.

Key Market Trends & Insights

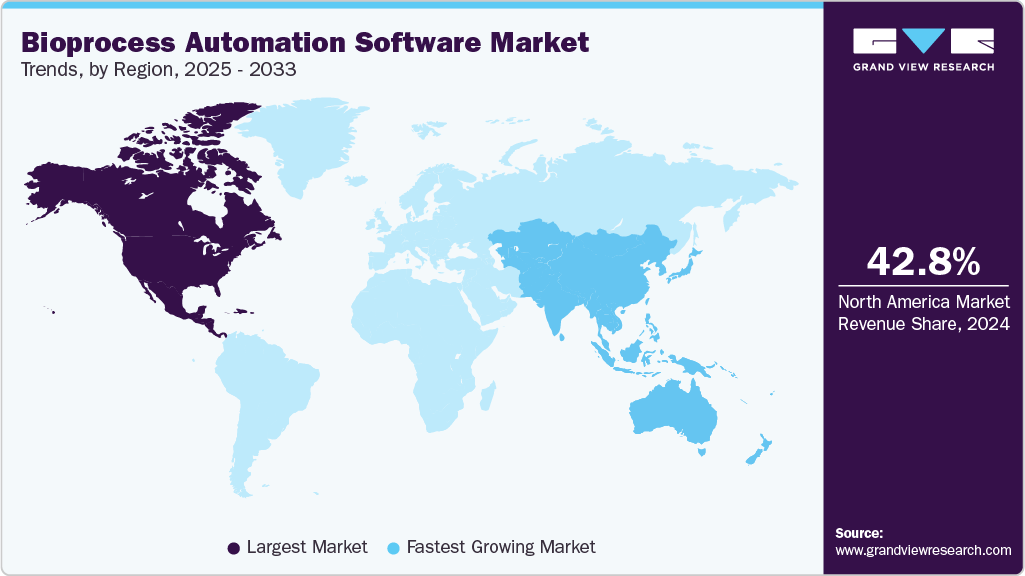

- The North America bioprocess automation software market held the largest share of 42.78% of the global market in 2024.

- The bioprocess automation software industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the process analytical technology segment held the highest market share of 31.50% in 2024.

- By application, the downstream processing segment held the highest market share in 2024.

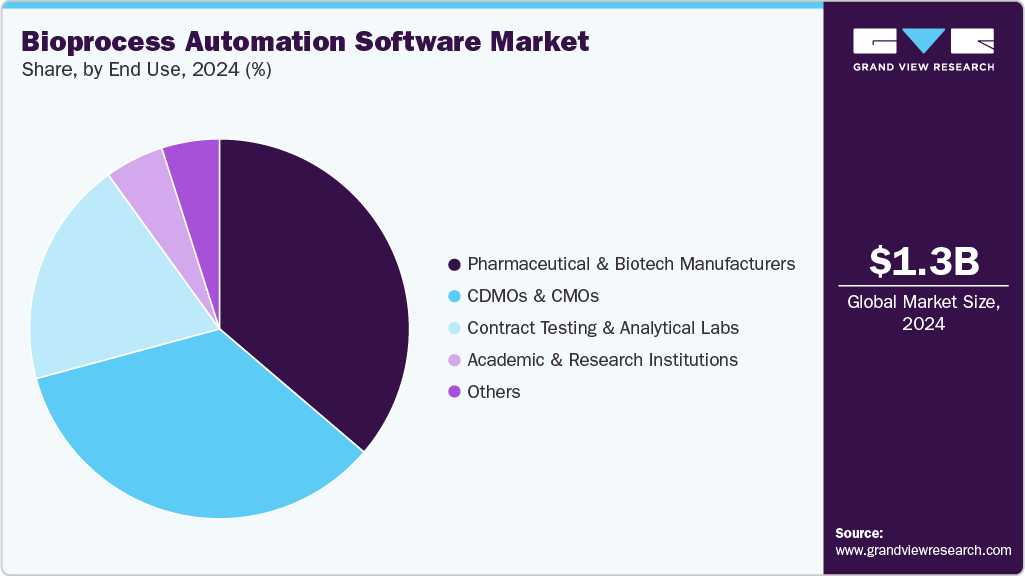

- By end use, the pharmaceutical & biotech manufacturers segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.25 Billion

- 2033 Projected Market Size: USD 3.84 Billion

- CAGR (2025-2033): 13.84%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, growing demand for real-time monitoring and advanced data analytics supports quality control and regulatory compliance.

Rising Adoption Of Digitalization And Automation In Biomanufacturing Processes

The rising adoption of digitalization and automation in biomanufacturing processes is a major driver of the bioprocess automation software market, as pharmaceutical and biotechnology companies increasingly seek to enhance efficiency, reduce variability, and ensure regulatory compliance. Automation software enables seamless integration of upstream and downstream operations, real-time monitoring of critical parameters, and advanced process control through platforms like MES, SCADA, and PAT. By replacing manual, error-prone tasks with intelligent data-driven systems, manufacturers can achieve faster scale-up, improved batch consistency, and optimized resource utilization. This digital shift is also aligned with the industry’s move toward continuous bioprocessing and Industry 4.0 principles, making automation software central to achieving smarter, more connected, and more agile production environments.

The need for bioprocess automation is anticipated to increase as the world's healthcare system depends more on biology for novel treatments, making it an essential part of contemporary pharmaceutical production. Automation in bioprocessing allows manufacturers to optimize production workflows, improve consistency, and increase throughput without compromising quality. Biopharmaceutical companies can produce larger biologics with reduced variability, faster turnaround times, and lower operational costs by integrating robotics, AI, and advanced monitoring systems.

Growing Demand For Real-Time Monitoring And Data Analytics In Bioprocessing

The growing demand for real-time monitoring and data analytics in bioprocessing is driving the adoption of advanced automation software that enables continuous oversight and optimization of critical manufacturing parameters. As biopharmaceutical production becomes more complex, real-time data collection and analysis help manufacturers detect process deviations early, maintain product quality, and ensure regulatory compliance. Technologies such as Process Analytical Technology (PAT), Manufacturing Execution Systems (MES), and cloud-based analytics platforms allow seamless integration of data across upstream and downstream processes, supporting predictive decision-making and faster process adjustments. This trend reflects the industry’s shift toward data-driven manufacturing, where real-time insights empower greater efficiency, process transparency, and consistent product outcomes.

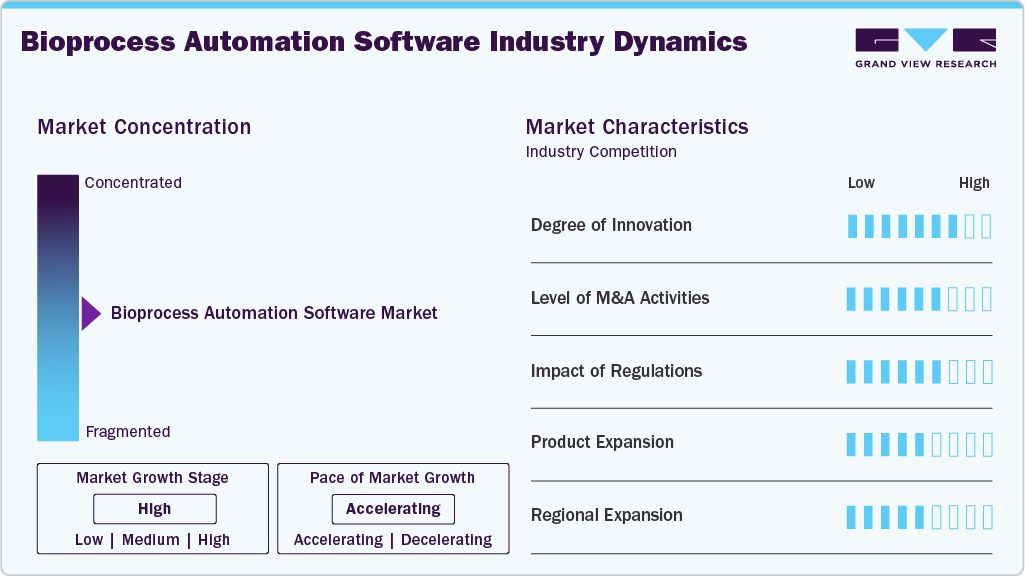

Market Concentration & Characteristics

The degree of innovation in the industry is a key driver shaping its rapid growth. Advances in robotics, artificial intelligence (AI), machine learning, and the Internet of Things (IoT) enable highly sophisticated, integrated systems that can monitor and control complex bioprocesses in real time. These developments lower variability and enhance product quality by allowing adaptive control, process optimization, and predictive analytics. Additionally, manufacturers can swiftly scale production or adjust to new biologics, gene therapies, and personalized medicines thanks to the emergence of modular and flexible automation platforms.

The industry is witnessing a moderate to high level of mergers and acquisitions (M&A) activity, as major players seek to expand their technological capabilities, product portfolios, and global reach. To develop their knowledge of AI, robotics, and digital biomanufacturing, well-known bioprocess solution providers are purchasing automation technology companies and specialized startups.

Regulations significantly impact the industry, as stringent guidelines govern biopharmaceutical manufacturing to ensure product safety, quality, and efficacy. Agencies like the U.S. FDA, EMA, and other global regulators require consistent adherence to Good Manufacturing Practices (GMP). This encourages businesses to implement automated systems that improve traceability, reduce human error, and guarantee compliance. Automation facilitates quicker regulatory approvals by supplying accurate, validated data and helps maintain standardized documentation and quality control.

Product expansion is a key driver in the industry, as companies continuously develop advanced systems to meet the evolving needs of biopharmaceutical manufacturing. Numerous companies are also growing their product lines with AI-powered software designed for biologics, vaccines, and cell and gene therapies. Manufacturers can adopt innovative solutions that increase productivity, lower costs, and shorten time-to-market thanks to this ongoing expansion of product offerings, strengthening competitive positioning.

Regional expansion is emerging as a strong market driver in the bioprocess automation software industry, as companies aim to strengthen their global presence and tap into high-growth regions. Leading players are expanding manufacturing facilities, R&D centers, and partnerships across Asia-Pacific, Latin America, and the Middle East, where rising investments in healthcare infrastructure and biomanufacturing are creating new opportunities. This global push for regional expansion diversifies revenue streams and positions companies closer to emerging markets, accelerating the adoption of automated bioprocess software worldwide.

Type Insights

The process analytical technology segment led the market with a 31.50% revenue share in 2024. PAT-integrated automation software allows continuous monitoring, analysis, and adjustment of parameters such as pH, temperature, and dissolved oxygen, ensuring process consistency and regulatory compliance. By combining advanced sensors, data analytics, and machine learning algorithms, PAT software helps manufacturers achieve higher process efficiency, reduced batch failures, and faster release times. The increasing regulatory emphasis on Quality by Design (QbD) and real-time release testing further accelerates the adoption of PAT-enabled automation platforms, positioning them as essential tools for next-generation biomanufacturing.

The laboratory information management systems segment is expected to grow at a significant CAGR over the forecast period. LIMS software automates the collection, storage, and analysis of laboratory data across multiple stages of bioprocessing, minimizing manual errors and improving data integrity. By integrating with other automation platforms such as MES and PAT, LIMS enables seamless data flow from R&D to production, supporting real-time decision-making and efficient quality control. The growing focus on digital laboratories, coupled with the need for centralized data management in biologics development, is propelling the demand for LIMS-based bioprocess automation solutions.

Application Insights

The downstream processing segment led the market with a 33.34% share in 2024. The increasing focus on improving efficiency and product recovery in downstream processing is a major driver of the bioprocess automation software market. Automation software enables precise control, monitoring, and optimization of purification steps such as filtration, chromatography, and centrifugation, which are critical for achieving high product yield and purity. By integrating real-time data analytics and process control systems, biomanufacturers can minimize variability, reduce manual intervention, and ensure consistency across batches. Additionally, as biologics and cell-based therapies become more complex, automation software for downstream processing supports scalability and compliance with regulatory standards, driving their growing adoption across commercial and clinical manufacturing facilities.

The data management segment is anticipated to experience the fastest CAGR during the forecast period. As bioprocessing generates massive volumes of complex data from various sources, including sensors, analyzers, and control systems, automation software equipped with advanced data management capabilities helps centralize, analyze, and visualize this information in real time. The increasing adoption of cloud-based platforms, AI-driven analytics, and integrated digital ecosystems further enhances the ability of manufacturers to manage end-to-end process data efficiently, driving the shift toward smarter, more connected bioprocessing environments.

End Use Insights

The pharmaceutical & biotech manufacturers segment captured the largest market share of 36.24% in 2024. As these companies face rising pressure to enhance productivity, ensure consistent product quality, and comply with stringent regulatory requirements, automation software provides a robust solution for streamlining complex bioprocessing workflows. By integrating systems such as MES, LIMS, and PAT, manufacturers can achieve real-time process monitoring, data-driven optimization, and reduced human error.

The CDMOs & CMOs segment is projected to grow at the fastest rate during the forecast period. These organizations manage diverse projects for multiple clients, and automation software enables them to maintain high operational efficiency, consistent product quality, and regulatory compliance across varying production scales. Integrated systems such as MES, SCADA, and PAT allow CDMOs and CMOs to monitor processes in real time, optimize resource utilization, and ensure faster turnaround times. Additionally, growing demand for flexible, data-driven manufacturing and digital batch records is pushing these service providers to adopt advanced bioprocess automation software, helping them stay competitive in a rapidly evolving biopharmaceutical landscape.

Regional Insights

North America dominated the global bioprocess automation industry with a share of 42.78% in 2024, supported by advanced healthcare infrastructure, strong R&D investment, and the presence of leading biopharmaceutical companies. Automation technology adoption has been accelerated by the region's established supply networks and a growing emphasis on precision medicine and the production of cell and gene therapies. The need for effective, scalable, and compliant bioprocess solutions will support revenue growth in the upcoming years due to the growing elderly population and the rising disease prevalence.

U.SBioprocess Automation Software Market Trends

The bioprocess automation software market in the U.S. is driven by strong biopharmaceutical R&D investments, early adoption of digital biomanufacturing technologies, and the presence of major industry players such as Thermo Fisher Scientific and Rockwell Automation. The push toward continuous manufacturing, coupled with stringent FDA regulations on process monitoring and data integrity, is encouraging wider adoption of automation software across production facilities. Additionally, government initiatives promoting advanced biologics manufacturing and digital transformation in life sciences are further fueling market growth.

Europe Bioprocess Automation Software Market Trends

The bioprocess automation software market in Europe is propelled by the region’s robust biologics and biosimilars manufacturing base, as well as growing emphasis on GMP compliance and sustainable production. Companies in countries like Germany, France, and Switzerland are increasingly adopting integrated automation platforms to enhance process control, traceability, and operational efficiency. The European Medicines Agency’s (EMA) focus on digital quality assurance and data-driven process validation also supports the adoption of automation software across biopharmaceutical operations.

The UK bioprocess automation software market is driven by rising investments in biopharma innovation and the expansion of advanced therapy manufacturing facilities. The government’s support for Industry 4.0 initiatives and digital manufacturing under programs like the UK Life Sciences Vision is encouraging the use of MES, LIMS, and PAT systems. Moreover, the growing number of biotech start-ups and CDMOs seeking scalable, compliant automation solutions is accelerating software adoption in the country.

The bioprocess automation software market in Germany leads the European region due to its strong engineering expertise, advanced biomanufacturing infrastructure, and commitment to digitalization. German pharmaceutical and biotech firms are rapidly integrating automation tools for real-time monitoring, predictive maintenance, and data analytics to ensure high-quality production. Supportive initiatives and collaborations between software developers and bioprocess equipment manufacturers further enhance the country’s leadership in automated bioprocessing solutions.

Asia Pacific Bioprocess Automation Software Market Trends

The bioprocess automation software market in Asia Pacific is witnessing rapid growth due to expanding biomanufacturing capabilities, increasing biologics production, and supportive government policies promoting automation and digitalization. Countries such as China, Japan, India, and South Korea are investing heavily in modernizing their pharmaceutical sectors, leading to greater adoption of automation software. The region’s growing pool of skilled bioprocess engineers and the rise of local biotech start-ups are also boosting demand for cost-effective, flexible automation platforms.

In China, government-backed initiatives such as “Made in China 2025” and growing investments in biopharmaceutical R&D are driving the adoption of bioprocess automation software. Local manufacturers are increasingly implementing MES and PAT systems to enhance product quality and meet international regulatory standards. The country’s expanding biologics manufacturing capacity and partnerships with global automation companies are accelerating the digital transformation of its bioprocessing sector.

The bioprocess automation software market in Japan is driven by its strong focus on precision manufacturing, advanced technology integration, and compliance with global quality standards. The country’s leading biopharma companies are adopting digital twins, PAT-based process control, and AI-powered analytics to optimize bioprocess efficiency and consistency. Additionally, government initiatives encouraging automation in life sciences and aging population-driven demand for biologics further strengthen the market outlook.

Middle East And Africa Bioprocess Automation Software Market Trends

The bioprocess automation software market in the Middle East and Africa (MEA) is still in its infancy, but it has a lot of promise owing to investments in biomanufacturing facilities, medical research, and healthcare infrastructure. Through government-sponsored programs and public-private partnerships, nations like the United Arab Emirates, Saudi Arabia, and South Africa are spearheading the adoption of automated platforms. The growing demand for precision therapies, personalized medicine, and advanced manufacturing technologies is driving the region's slow but steady adoption of bioprocess automation.

In Kuwait, market growth is primarily driven by increasing government focus on developing a knowledge-based economy and enhancing pharmaceutical manufacturing capabilities. Investments in biopharmaceutical infrastructure, coupled with efforts to adopt international quality and automation standards, are promoting the integration of bioprocess automation software. Collaborations with global biotech and technology firms are further enabling local manufacturers to implement modern, data-driven bioprocessing systems for improved efficiency and compliance.

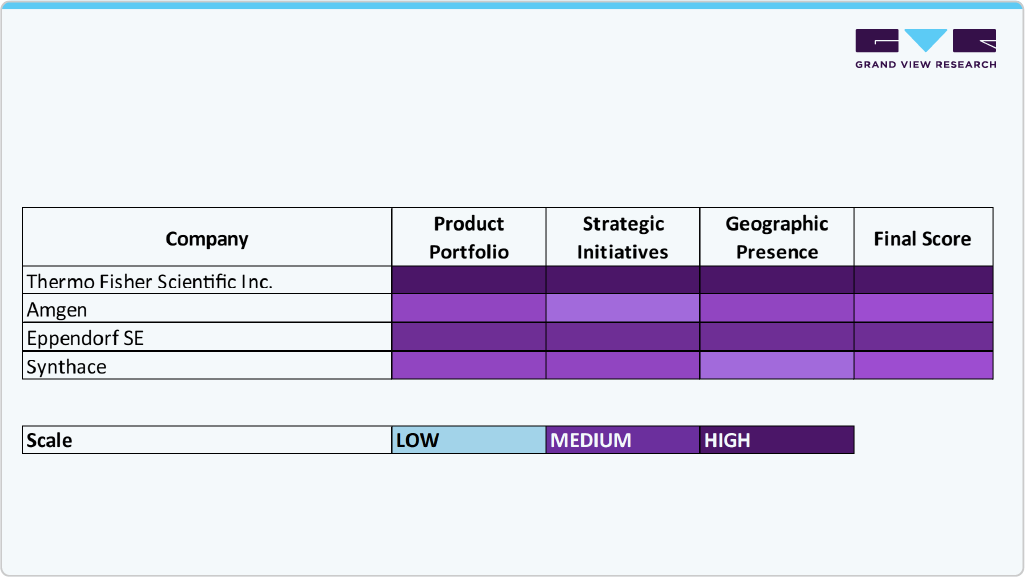

Key Bioprocess Automation Software Companies Insights

Key players operating in the bioprocess automation software market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Bioprocess Automation Software Companies:

The following are the leading companies in the bioprocess automation software market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Rockwell Automation

- Agilitech

- Amgen

- Andrew Alliance (Waters)

- Synthace

- Merck KGaA

- Eppendorf SE

- Bioengineering AG

Recent Developments

-

In June 2025, Sartorius Stedim Biotech completed a major expansion at its Aubagne, France headquarters, nearly doubling cleanroom and lab space, adding automated production and logistics systems, and enhancing R&D for innovative bioprocess solutions.

-

In June 2025, Cytiva announced a $1.6 billion program of strategic investments aimed at expanding its global bioprocessing supply and capacity, including manufacturing, media capacity, and related automation and supply chain capabilities.

Bioprocess Automation Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.36 billion

Revenue forecast in 2033

USD 3.84 billion

Growth rate

CAGR of 13.84% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Rockwell Automation; Agilitech; Amgen; Andrew Alliance (Waters); Synthace; Merck KGaA; Eppendorf SE; Bioengineering AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

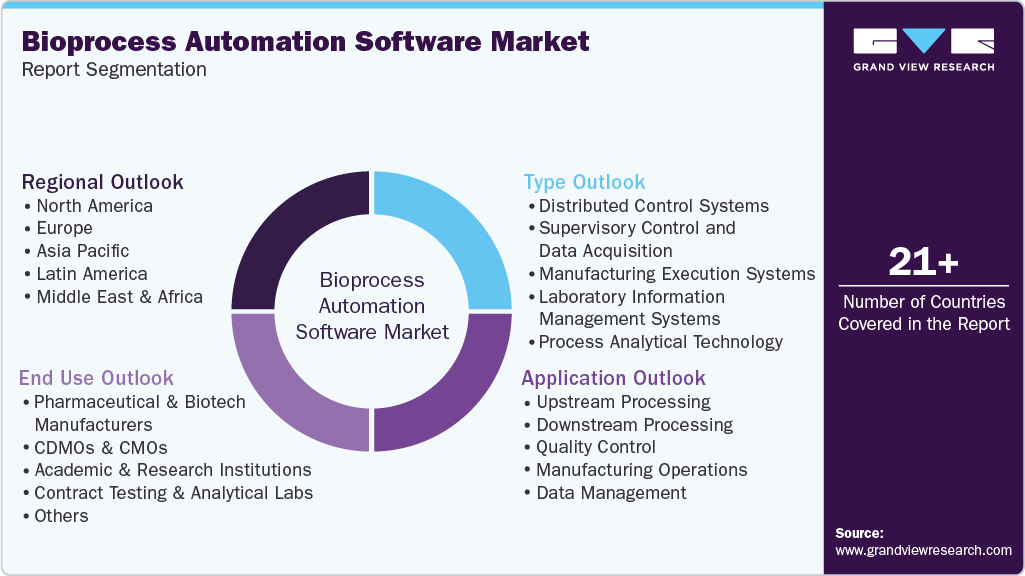

Global Bioprocess Automation Software Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bioprocess automation software market report on the basis of type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Distributed Control Systems

-

Supervisory Control and Data Acquisition

-

Manufacturing Execution Systems

-

Laboratory Information Management Systems

-

Process Analytical Technology

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Upstream Processing

-

Downstream Processing

-

Quality Control

-

Manufacturing Operations

-

Data Management

-

-

End use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & biotech manufacturers

-

CDMOs & CMOs

-

Academic & research institutions

-

Contract testing & analytical labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.