- Home

- »

- Medical Devices

- »

-

Bioprosthetics Market Size And Share, Industry Report, 2030GVR Report cover

![Bioprosthetics Market Size, Share & Trends Report]()

Bioprosthetics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Allograft, Xenograft), By Application (Cardiovascular, Plastic Surgery & Wound Healing), By Region, And Segment Forecasts

- Report ID: 978-1-68038-980-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioprosthetics Market Size & Trends

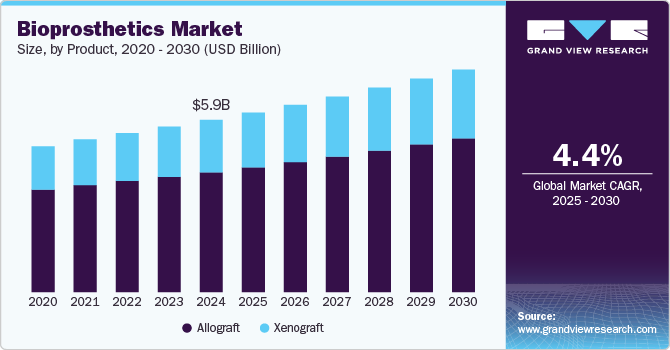

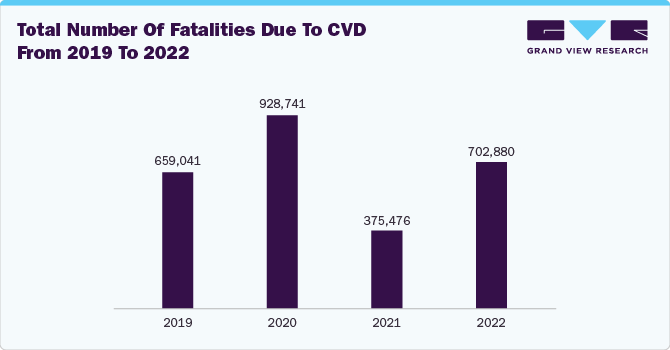

The global bioprosthetics market size was estimated at USD 5.91 billion in 2024 and is projected to grow at a CAGR of 4.40% from 2025 to 2030, owing to increasing cardiovascular disease (CVD) and the growing geriatric population globally. Bioprosthetics are the parts or tissue of humans or animals used in medical implantations. Increasing CVD-related deaths such as high blood pressure, stroke, and coronary heart disease are expected to accelerate the use of bioprosthetics devices such as heart valves and implantation. For instance, the Stroke Association, a stroke charity in the UK, reported that annually, 100,000 people have strokes in the UK.

According to the World Health Organization (WHO), by 2050, the world's population of people aged 60 or above is expected to reach 2.1 billion. Moreover, changing lifestyles, physical inactivity, and high consumption of alcohol and cigarettes are among the factors contributing to cardiovascular diseases such as coronary heart disease and cerebrovascular disease. Moreover, CVD is the leading cause of death globally, causing more than 17.9 million deaths per year. Thus, such factors are anticipated to boost the market growth over the forecast period.

Furthermore, rising investment in research and development and advancements in healthcare technologies are expected to propel the market's growth. For instance, in June 2024, Esper Bionics, a developer of Ukrainian bioprosthetics, received USD 5 million in funding. The YZR Capital, a venture fund based in Germany, led the funding round, with co-financing from the venture capital arm of Horizon Capital u.ventures and the European Bank for Reconstruction and Development.

Advancements in bioprosthetics technologies, devices, and tissue engineering that are widely accepted in medical specialties are driving the market. Moreover, researchers and healthcare providers are increasingly investigating how different treatments work together to enhance effectiveness and lower resistance risks from malignant cardiovascular diseases. For instance, in October 2024, Medtronic, a MedTech company in Western Europe, introduced the Avalus Ultra bioprosthesis valve. This valve facilitates ease of use during implantation and throughout the patient's lifetime. It provides clear visibility for future valve-in-valve procedures.

Market Concentration & Characteristics

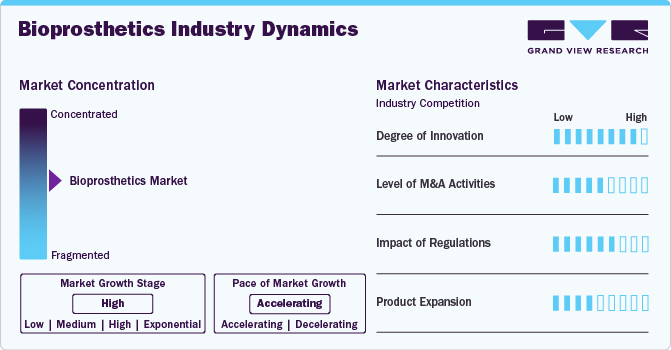

The global bioprosthetics industry is characterized by a high degree of innovation, owing to growing investments and increasing research activities to advance research. For instance, in January 2024, LATTICE MEDICAL received funding of USD 6.13 million for its LIPOTEC project. The LIPOTEC research program, focused on the MATTISSE bioprosthesis, seeks to secure reimbursement for the device across all therapeutic applications in breast reconstruction by integrating upcoming European clinical trials after receiving CE marking.

The bioprosthetics industry is characterized by medium merger and acquisition activity by the leading players, owing to several factors, including the desire to expand the business to cater to the growing demand for bioprosthetics and to maintain a competitive edge.

Bioprosthetics must meet strict regulatory requirements to ensure high quality, safety, and effectiveness standards, positively impacting market growth. In the U.S., the regulatory framework for bioprosthetics, such as prosthetic devices made from biological materials or developed to integrate with biological tissues, is governed by the Food and Drug Administration (FDA).

Several market players are expanding their business by launching new products and getting approvals from regulatory authorities to strengthen their market position and expand their product portfolio. For instance, in March 2023, Abbott received U.S. FDA approval for its Epic Max stented tissue valve to treat people with aortic regurgitation or stenosis.

Product Insights

By product, the allograft segment dominated the market and accounted for a share of 69.6% in 2024, owing to the increasing geriatric population and advancement in allograft procedures. An allograft is a tissue or organ transplant from one individual to another within the same species. The aging population worldwide is leading to a rise in CVD, requiring tissue repair. The allograft prosthesis stands out for its superior implant survival and functional performance, enhancing long-term results. For example, CryoValve AORTIC ALLOGRAFT, provided by Artivion, Inc., includes a complete aortic root along with the attached anterior mitral leaflet, offering various options for surgical implantation.

The xenograft segment is anticipated to witness the fastest CAGR during the forecast period, owing to advancements in allograft procedures. A xenograft bioprosthetic heart valve is made from animal tissue and transplanted into a human. The growth is attributed to rising demand for treating cardiovascular diseases, as it offers numerous advantages, such as higher survival rates and improved stability. For example, Edwards Lifesciences Corporation provides the Carpentier-Edwards PERIMOUNT Magna Ease pericardial bioprosthesis, designed for patients with significantly advanced aortic valvular disease who require replacement of their natural valve with a prosthetic option.

Application Insights

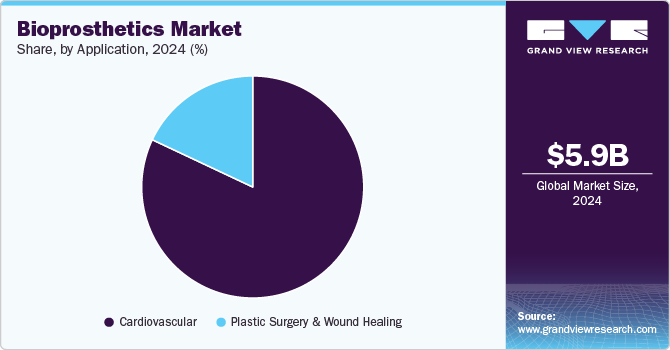

By application, the cardiovascular segment dominated the market with a revenue share of 82.0% in 2024 and is anticipated to witness the fastest CAGR during the forecast period. Factors such as the increasing number of patients with cardiovascular diseases, rising valve replacement cases, and the growing demand for minimally invasive procedures. For instance, according to the Government of the UK, in March 2023, over 1,879,000 people in England were diagnosed with coronary heart disease (CHD). Moreover, technological breakthroughs, such as bioprosthetic valve implants, are becoming more biocompatible, reducing the risk of rejection and improving patient outcomes.

The plastic surgery and wound healing segment is expected to witness significant CAGR growth over the forecast period, owing to rising demand for minimally invasive surgery and technological advancement. According to the American Society of Plastic Surgeons (ASPS), overall cosmetic procedures performed on men rose 6%. Moreover, implementing minimally invasive techniques is fueling a beneficial impact on the segment growth. Moreover, overall growth in cosmetic surgery procedures witnessed a 5% increase annually, according to the 2023 ASPS Procedural Statistics.

Regional Insights

The North American bioprosthetics market held a dominant position in 2024, with a revenue share of 37.1%, owing to the increasing prevalence of cardiovascular diseases and developed healthcare infrastructure. For instance, according to the Centers for Disease Control and Prevention, one person dies from CVD in the U.S. every 33 seconds. Moreover, the presence of numerous leading biopharmaceutical companies, favorable reimbursement policies, and significant investments in R&D drive market growth.

U.S. Bioprosthetics Market Trends

The U.S. bioprosthetics market dominated the North America market in 2024 owing to the rising prevalence of heart diseases such as coronary heart disease and increasing healthcare expenditure. Moreover, market players are expanding their business in the country, which promotes market growth. For instance, in September 2022, Medtronic, a medical technology company, expanded the U.S. market release of its Evolut FX TAVR system, the transcatheter aortic valve replacement (TAVR) system.

Europe Bioprosthetics Market Trends

The Europe bioprosthetic market is anticipated to register considerable growth during the forecast period, owing to the large number of CVD patients and technological advancements. In addition, the rising preference for minimally invasive surgeries fuels market growth. The region's strong focus on research and development fosters continuous innovation in developing bioprosthetics, enhancing product efficacy and patient outcomes.

The UK bioprosthetic market is anticipated to register considerable growth during the forecast period. The UK has a strong healthcare system and access to effective bioprosthetic devices such as cardiac valve products. Moreover, the growing prevalence of CVD is accelerating the country's market growth. For instance, according to the British Heart Foundation, 2.3 million individuals in the UK live with CHD, around 830,000 women and 1.5 million men.

Asia Pacific Bioprosthetics Market Trends

The Asia Pacific bioprosthetics market is anticipated to witness the fastest CAGR growth over the forecast period, owing to increasing patient awareness and a developing healthcare sector in emerging countries such as India, China, and Thailand. Hypertension and high blood pressure are the leading causes of death in Asia Pacific, supported by changing lifestyles, unhealthy diets, and increased smoking and alcohol consumption. Thus, such factors led to a rise in demand for bioprosthetics devices.

Australia bioprosthetics market is anticipated to register considerable growth during the forecast period, owing to increasing cases of strokes and coronary heart disease in the country. For instance, according to the Australian Bureau of Statistics (ABS) 2022 National Health Survey (ABS 2023c), 1.3 million Australians aged 18 and above live with one or more conditions related to stroke, heart, and vascular disease.

Latin America Bioprosthetics Market Trends

The Latin America bioprosthetics industry is anticipated to witness considerable growth over the forecast period. Growing preference for minimally invasive surgeries and increasing awareness about the use of bioprosthetics for various therapeutic procedures are anticipated to propel the market growth. Rising disposable income and rapid technological advancements in bioprosthetics promote market growth.

The Brazil bioprosthetics market is anticipated to witness the fastest growth over the forecast period. Patients and healthcare providers increasingly prefer bioprosthetics as advanced medical solutions that offer longer-term benefits and better outcomes. Moreover, a strong focus on research and development fosters continuous innovation in prosthetics technologies, further driving market growth.

Middle East & Africa Bioprosthetics Market Trends

The MEA bioprosthetics industry is anticipated to witness considerable growth over the forecast period. Government initiatives to increase reimbursement coverage is one of the key factors expected to drive market growth during the forecast period. Patients are becoming more aware of the availability of bioprosthetic solutions for treating various chronic conditions, and the demand for these devices is growing.

The bioprosthetics market in the UAE is expected to experience the highest growth during the forecast period. The country has a robust healthcare system that offers advanced medical services and technologies to its citizens. This rising demand for high-quality healthcare and minimally invasive treatment options drives market expansion in the UAE.

Key Bioprosthetics Company Insights

Key participants in the bioprosthetics market are focusing on devising innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and geographical expansions.

Key Bioprosthetics Companies:

The following are the leading companies in the bioprosthetics market. These companies collectively hold the largest market share and dictate industry trends.

- LeMaitre Vascular, Inc.

- Braile Biomédica

- Labcor Laboratories Ltda.

- Medtronic

- Rua Life Sciences Plc (Aortech International Plc.)

- LivaNova PLC (Sorin Group)

- Organogenesis Inc.

- Humacyte Global, Inc.

- Johnson & Johnson (Ethicon, Inc.)

- Artivion, Inc. (CryoLife, Inc.)

- Abbott (St. Jude Medical, Inc.)

- Edwards Lifesciences Corporation.

- JenaValve

Recent Developments

-

In December 2024, Meril Life Sciences, a medical equipment company in India, introduced the Myval Octapro transcatheter heart valve (THV), which has obtained CE mark approval for transcatheter aortic valve replacement (TAVR).

-

In May 2024, Edwards Lifesciences Corporation introduced the SAPIEN 3 Ultra RESILIA valve in Europe. This is the only transcatheter aortic heart valve that features the organization's innovative RESILIA tissue technology to improve the valve's durability.

Bioprosthetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.16 billion

Revenue forecast in 2030

USD 7.64 billion

Growth rate

CAGR of 4.40% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

LeMaitre Vascular, Inc., Braile Biomédica, Labcor Laboratories Ltda., Medtronic, Rua Life Sciences Plc (Aortech International Plc.), LivaNova PLC (Sorin Group), Organogenesis Inc., Humacyte Global, Inc., Johnson & Johnson (Ethicon, Inc.), Artivion, Inc. (CryoLife, Inc.), Abbott (St. Jude Medical, Inc.), Edwards Lifesciences Corporation., JenaValve

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Bioprosthetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioprosthetics market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Allograft

-

Xenograft

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Plastic surgery & wound healing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioprosthetics market size was estimated at USD 5.91 billion in 2024 and is expected to reach USD 6.16 billion in 2025.

b. The global bioprosthetics market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 7.64 billion by 2030.

b. North America dominated the bioprosthetics market with a share of 37.14% in 2024. This is attributable to the presence of clearly-defined reimbursement models, prominent industry players, and the large patient volume present in this region coupled with stringent regulatory policies increasingly ensuring patient safety and maintaining high treatment efficacy standards.

b. Some key players operating in the bioprosthetics market include LeMaitre Vascular, Inc., Braile Biomedica, Inc., Labcor Laboratorios Ltd., Maquet Metinge Group, Medtronic Plc., Aortech International Plc, CryoLife, Inc., Sorin Group, Humacyte, Inc., Ethicon, Inc., Life Cell Corporation, Organogenesis, Inc., St. Jude Medical, Inc., Edwards Lifesciences Corporation, and JenaValve Technology GmbH.

b. Key factors that are driving the bioprosthetics market growth include increasing prevalence of cardiovascular disorders,such as rheumatoid heart disease, and coronary and peripheral artery diseases, and the resultant, corresponding demand for long-term relief coupled with the expanding geriatric population characterized with a higher susceptibility to develop degenerative cardiac diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.