- Home

- »

- Medical Devices

- »

-

Bioprosthetics Market Size, Share & Growth Report, 2030GVR Report cover

![Bioprosthetics Market Size, Share & Trends Report]()

Bioprosthetics Market Size, Share & Trends Analysis Report By Product (Allograft, Xenograft), By Application (Cardiovascular, Plastic Surgery & Wound Healing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-980-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Bioprosthetics Market Size & Trends

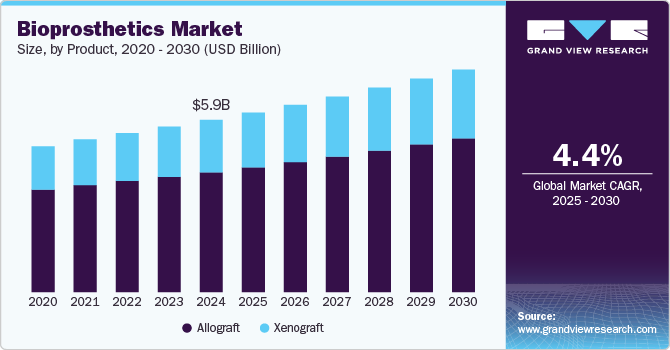

The global bioprosthetics market size was valued at USD 5.68 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030, owing to increasing cardiovascular disease (CVD) and growing geriatric population globally. Bioprosthetics are the parts or tissue of human or animals that are used in medical implantations. Increasing CVD related deaths such as high blood pressure, stroke and coronary heart disease are expected to accelerate the use of bioprosthetics devices such as heart valves and implantation. Furthermore, the rising investment in research & development and advancements in healthcare technologies is likely to propel the market growth.

According to the World Health Organization (WHO), by 2050, the world’s population of people aged 60 or above is expected to reach 2.1 billion. Moreover, changing lifestyle, physical inactivity, high consumption of cigarettes and alcohol are among the factors contributing to the cardiovascular disease such as coronary heart disease and cerebrovascular disease. Moreover, CVD is leading cause of death globally, causing more than 19.8 million deaths per year.

Advancements in bioprosthetics technologies devices and tissue engineering that are widely accepted in medical specialties is driving the market. Moreover, researchers and healthcare providers are increasingly investigating how different treatments can work together to enhance effectiveness and lower resistance risks from malignant cardiovascular diseases.

Product Insights

Xenograft dominated the market and accounted for a share of 70.4% in 2023. A xenograft bioprosthetics heart valve is a replacement of heart valves implanted from animals. The growth can be attributed to rising demand for treating cardiovascular diseases as it offers numerous advantages such as higher survival rates and improved stability.

Allograft is anticipated to witness the fastest CAGR during the forecast period owing to increasing geriatric population and advancement in allograft procedures. An allograft is a tissue or organ transplant from one individual to another within the same species. The aging population worldwide is leading to rise in CVD requiring tissue repair. The allograft prosthesis stands out for its superior implant survival and functional performance, leading to enhanced long-term results.

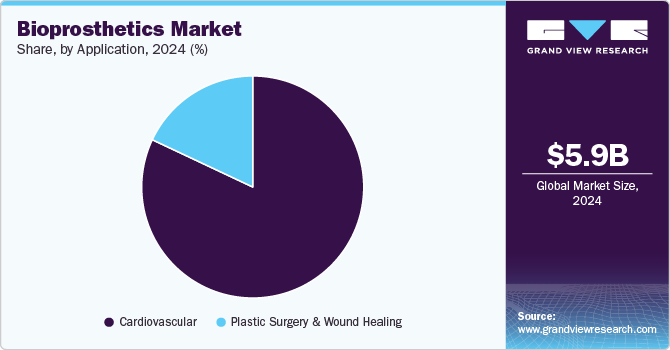

Application Insights

The cardiovascular segment dominated the market in 2023. The growth can be attributed to the increasing number of patients with cardiovascular diseases and rising cases of valves replacement along with the growing demand for minimally invasive procedure. The breakthrough in technology such as bioprosthetics valves implants are becoming more biocompatible, reducing the risk of rejection and improving patient outcomes.

The plastic surgery and wound healing segment is projected to grow at a CAGR of 9.6% during the forecast period, owing to rising demand for minimally invasive surgery and advancement in technology. Minimally invasive surgeries are rising as they require less incisions, causes less pain and have shorter recovery period. Moreover, the collaboration between researchers and industry partners are driving advancements in bioprosthetic for plastic surgery & wound healing segment.

Regional Insights

North America bioprosthetics market held a dominant position in 2023 owing to increasing prevalence of cardiovascular diseases and developed healthcare infrastructure. Cardiovascular disease is the major cause of death in North America accounting for 1 in every 5 deaths. The rising capital expenditure and health insurance coverage in countries such as U.S. and Canada is driving the region growth.

U.S. Bioprosthetics Market Trends

The U.S. bioprosthetics market dominated the North America market in 2023 owing to rising prevalence of heart disease such as coronary heart disease and increasing healthcare expenditure. The presence of well-developed healthcare infrastructure and advanced devices for cardiovascular surgery is further expected to propel the market growth. The rising number of CVD in the country is accelerating the growth. For instance, according to American Heart Association 61% of U.S. adults are likely to be diagnosed with cardiovascular disease by the end of 2050.

Europe Bioprosthetics Market Trends

The Europe bioprosthetic devices market was a lucrative region in 2023 owing to rising geriatric population, large number of CVD patient and technological advancements. Europe is hub to some of largest key players and established healthcare systems. Moreover, the rapid growth of aging population in Europe is contributing in region growth. For instance, according to the European Commission, more than one-fifth of Europe’s population was aged 65 years or above and the median age for the region reached 44 years, as of January 2023.

The bioprosthetics market in UK is accounted for the largest revenue share in 2023 owing to rising number of cardiovascular diseases. The UK has strong healthcare system with access to effective bioprosthetics devices such as cardiac valve products. Moreover, the growing awareness and high preference among citizens & patients about minimally invasive procedures is accelerating the region growth.

The Germany bioprosthetic market is expected to grow rapidly during the forecast period driven by its robust healthcare system with advanced technologies and rising geriatric population. Germany’s aging population is facing an increasing prevalence of cardiovascular diseases such as rheumatic heart disease and cerebrovascular disease.

Asia Pacific Bioprosthetics Market Trends

The Asia Pacific bioprosthetics market is anticipated to witness the fastest CAGR of 5.3% during the forecast period, owing to increasing patient awareness and developing healthcare sector in emerging countries such as India, China, Indonesia and Malaysia. The growing case of CVD is likely to contribute to the region’s growth. Hypertension and high blood pressure is the leading cause of deaths in Asia Pacific supported by changing lifestyle, unhealthy diet and increasing smoking and alcohol consumption.

The bioprosthetics market in China is held a substantial market share in 2023, owing to rising aging population and increasing cases of strokes and coronary heart disease in the country. The increasing aging population in China is a significant contributor to varios disorders. According to the World Health Organization, by the end of 2040, an estimated 400 million people aggregate to approximately 28% of population will be over age 60.

The India bioprosthetics market is expected to witness significant growth during the forecast period due to rising disposable income, increasing healthcare expenditure and rising CVD cases in the country. Moreover, the rising disposable incomes allows people to invest in healthcare to protect their families, which is another factor contributing to the growth.

Key Bioprosthetics Company Insights

Some of the key companies in the bioprosthetics marketinclude, Johnson & Johnson (Ethicon, Inc.), Edwards Lifesciences Corporation, Medtronic. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Bioprosthetics Companies:

The following are the leading companies in the bioprosthetics market. These companies collectively hold the largest market share and dictate industry trends.

- LeMaitre Vascular, Inc.

- Braile Biomédica

- Labcor Laboratórios Ltda

- Medtronic

- Rua Life Sciences Plc (Aortech International Plc.)

- LivaNova PLC (Sorin Group)

- Organogenesis Inc.

- Humacyte Global, Inc.

- Johnson & Johnson (Ethicon, Inc.)

- Artivion, Inc. (CryoLife, Inc.)

- Abbott (St. Jude Medical, Inc.)

- Edwards Lifesciences Corporation.

- JenaValve

Recent Developments

-

In May 2024, Edwards Lifesciences announced the launch of the Sapien 3 Ultra Resilia valve in the European region. It is the only TAVR system incorporating the organization’s Resilia tissue technology.

-

In April 2024, Medtronic launched Avalus Ultra Valve. It is a next generation surgical aortic tissue valve that has been built on ten years of clinical experience with Avalus valve. And is designed for wase of implant, straightforward sizing and clear visibility for future ViV/valve-in-valve procedures.

-

In September 2021, Abbott announced the approval of Epic valve for treating people in requirement of aortic and mitral valve replacement. These next generation devices are build off the company’s Epic Surgical Valve Platform, which has strong clinical outcomes.

Bioprosthetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.9 billion

Revenue forecast in 2030

USD 7.6 billion

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

LeMaitre Vascular, Inc.; Braile Biomédica; Labcor Laboratórios Ltda; Medtronic; Rua Life Sciences Plc (Aortech International Plc.); LivaNova PLC (Sorin Group); Organogenesis Inc.; Humacyte Global, Inc.; Johnson & Johnson (Ethicon, Inc.); Artivion, Inc. (CryoLife, Inc.); Abbott (St. Jude Medical, Inc.); Edwards Lifesciences Corporation.; JenaValve

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioprosthetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioprosthetics market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Allograft

-

Xenograft

-

Porcine

-

Bovine

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Plastic Surgery & Wound Healing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."