- Home

- »

- Biotechnology

- »

-

Bioremediation Market Size, Share & Growth Report, 2030GVR Report cover

![Bioremediation Market Size, Share & Trends Report]()

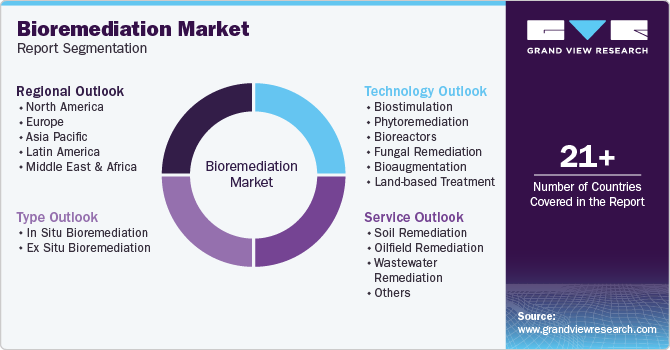

Bioremediation Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (In Situ, Ex Situ), By Technology (Biostimulation, Phytoremediation), By Service (Soil Remediation, Oilfield Remediation), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-955-6

- Number of Report Pages: 129

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioremediation Market Summary

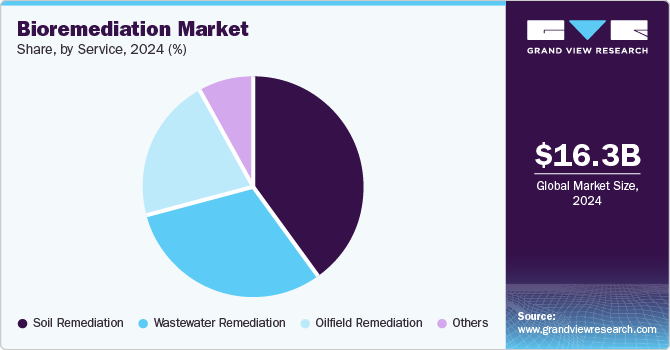

The global bioremediation market size was estimated at USD 16,343.6 million in 2024 and is projected to reach USD 29,372.6 million by 2030, growing at a CAGR of 10.5% from 2025 to 2030. The market is anticipated to witness growth due to rapid industrial development in recent years that has led to widespread contamination of several environmental landscapes, such as oceans, freshwater systems, forests & agricultural lands, among others.

Key Market Trends & Insights

- North America bioremediation market is held the largest share in 2024.

- U.S. is expected to register the highest CAGR from 2022 to 2030.

- By type, in situ bioremediation segment held the largest market share of 56.63% in 2024.

- By technology, phytoremediation segment held the largest market share of 32.05% in 2024.

- By service, soil remediation segment held the largest market share of 39.67% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16,343.6 Million

- 2030 Projected Market Size: 29,372.6 Million

- CAGR (2025-2030): 10.5%

- North America: Largest market in 2024

Similarly, mismanagement of plastic waste, crude oil spills, increasing production of greenhouse gases, and release of chemical pollutants such as polycyclic aromatic hydrocarbons, bisphenol-A, pyrethroids pesticides, and dioxanes, have led to worsening environmental outcomes and increasing the demand for bioremediation services.

The COVID-19 pandemic has led to an increased awareness about disinfection, sterilization, and remediation of contaminated areas in public spaces and homes. As the SARS-CoV-2 virus continues to undergo mutations, causing recurrent waves of infection cases around the globe, demand for bioremediation services for reducing the risk of contamination is expected to rise. Similarly, large quantities of personal protective equipment and face masks used have led to new challenges for disposal and treatment of medical waste, which present new growth opportunities for bioremediation.

Contamination-related issues are highly prevalent in industrially developed regions which generate large quantities of waste. For instance, in the European Union alone, more than 2.8 million sites have been estimated to have potential contamination, which can lead to negative health consequences, such as congenital abnormalities, cancer, low birth weights, and high mortality rates. Therefore, high demand for bioremediation is expected from such areas in the near future.

In addition, in areas where factories are located in the vicinity of natural water sources, persistent issues with water pollution are observed due to contamination of local water supplies. Similarly, soil contamination with metals such as lead, mercury, and other heavy metals & toxic chemicals, which leach into the soil, pose a significant threat to crops grown in the area. Here, bioremediation presents a promising option for cleaning of contamination sites and offers a long-term solution for restoration of the environment.

Furthermore, demand for biological remediation of industrial pollutants is driven by key advantages offered by the technique over traditional physical and chemical methods. For instance, traditional methods such as the use of oxidizing agents, pollutant adsorption, electrochemical treatments, and others, may fail to achieve the desired reduction in the concentrations of contaminants, and are non-specific & expensive to use. Bioremediation techniques not only overcome these shortcomings, but also offer a versatile, efficient, and low energy footprint solution for contaminant removal, which can positively affect market growth.

Over the past few years, an increasing number of government agencies and public health organizations have been involved in promoting the adoption of bioremediation methods. For instance, government entities such as the U.S. Environmental Protection Agency hosts the Superfund program for cleanup of the country’s most contaminated sites. Furthermore, in February 2022, the America COMPETES Act of 2022 was passed in the U.S. and was set to undertake the National Engineering Biology Research and Development Initiative, for providing funding opportunities for bioremediation and related bioengineering solutions.

Type Insights

In situ bioremediation segment held the largest market share of 56.63% in 2024. The technique refers to treatment of contaminations at the original site without the need to excavate or pump out the contaminated materials. It involves the use of technologies such as bioventing, bioslurping, biosparging, natural attenuation, and others. The technique can be controlled by manipulation of factors such as aeration, nutrient concentration, moisture content, etc. to enhance the activity of organisms and accelerate the degradation rate. Hence, the method is highly suitable for applications such as treatment of groundwater with low contaminant concentrations, where oxygen availability can be increased by pumping air in the soil subsurface.

On the other hand, the ex-situ bioremediation segment is expected to grow at a significant rate. The ex-situ bioremediation involves the use of composting, landfarming, soil biopiles, and slurry reactors to treat the contaminated materials away from the original location. The technique is widely used for the treatment of contaminated soil for removal of hydrocarbons. However, excavation of contaminated materials can lead to additional expenses in the remediation process, which can limit the growth of the segment.

Technology Insights

Phytoremediation segment held the largest market share of 32.05% in 2024. Demand for technology is fueled by its applications for removal of heavy metals, radionuclides, organic contaminants, and pesticides with help of plants. It involves the use of techniques such as rhizodegradation, rhizofiltration, phytovolatilization,phytoextraction, and phytostabilization, among others, for treatment of pollutants. The segment is anticipated to grow further due to low costs of phytoremediation as compared to other technologies, and ability to sustainably remove organic and inorganic pollutants from soil and water.

Fungal remediation is expected to grow at the highest CAGR of 16.04% during the forecast period, as fungi can demonstrate a wide range of metabolic capacities and can tolerate high concentrations of polluting agents. Fungi represents a promising option for degradation of recalcitrant pollutants by production of a variety of intracellular and extracellular enzymes, such as cytochrome P450 and peroxidases, respectively. These factors are likely to accelerate the adoption of fungal remediation technologies in the near future and boost market growth.

Service Insights

Soil remediation segment held the largest market share of 39.67% in 2024. The service involves removal of soil contaminants originating from sources such as dumping of chemicals, improper waste disposal, pipe leaks & spills, and others. Demand for soil remediation is supported by the high extent of soil degradation caused by industrial pollutants, agrochemicals and municipal waste. For instance, according to the United Nations, globally over 3.2 billion people are affected by degradation of land and soil. As a result, the increasing need for soil remediation is expected to significantly contribute to the market growth.

Oilfield remediation is projected to grow at the highest CAGR of 13.43% over the forecast period due to rapid expansion of the crude oil industry and development of eco-friendly oilfield remediation options. Surging oil prices in recent months have led to a high pressure for increasing oil production in countries such as the U.S. Moreover, recent advancements in omics technologies such as metagenomics & metatranscriptomics have enabled the use of microbial-based oilfield remediation strategies. Similarly, the use of biosurfactants for increasing the bioavailability of oil constituents has accelerated the adoption of oilfield bioremediation activities.

Regional Insights

North America bioremediation market is held the largest share in 2024, due to presence of sophisticated infrastructure, high industrial growth & waste production, and presence of key market players such as Regenesis Corporation, Probiosphere, Inc., and Xylem, Inc, among others. In addition, the region hosts substantial research potential for bioremediation that is likely to drive advancements in technology and promote market growth. For instance, a study published in the journal of Applied and Environmental Microbiology in September 2021, demonstrated the presence of marine bacteria in the Canadian Arctic region that are capable of degrading hydrocarbons, such as oil and diesel.

U.S. Bioremediation Market Trends

The U.S. bioremediation market is driven by stringent environmental regulations, such as the Clean Water Act and the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA). Increasing incidents of industrial spills and contamination in soil and water resources necessitate advanced remediation techniques. Additionally, a strong focus on sustainability and the adoption of green technologies has led to investments in bioremediation for pollution control. Government support for research and development, as well as growing partnerships between private and public sectors, further bolster market growth.

Europe Bioremediation Market Trends

In Europe, the bioremediation market benefits from strict environmental policies like the European Green Deal and various directives aimed at waste management and pollution reduction. The market is also propelled by a shift towards sustainable environmental solutions, particularly in response to soil and water contamination from industrial activities.

The UK bioremediation market is influenced by regulatory frameworks such as the Environmental Protection Act, which emphasizes sustainable waste management and pollution control. The market has seen a rise in bioremediation applications for remediating contaminated industrial sites, including brownfield redevelopment projects. Growing public awareness about the environmental impacts of traditional remediation methods, alongside government-backed research initiatives, has increased the adoption of microbial and phytoremediation solutions.

In France, bioremediation market is gaining traction due to government initiatives focused on reducing industrial pollution and promoting soil health. The French government's focus on maintaining high environmental standards aligns with the EU's regulatory frameworks, fostering demand for eco-friendly cleanup technologies like bioremediation. Increasing incidents of chemical spills and contamination in agricultural lands have further spurred the use of microbial bioremediation techniques.

Germany's bioremediation market is driven by the country’s commitment to high environmental standards and its focus on the sustainable cleanup of contaminated sites. The market benefits from strict regulations regarding soil protection and water pollution control, as well as a strong culture of environmental responsibility. Industrial activities and historical contamination in regions like the Ruhr Valley have necessitated bioremediation solutions. Moreover, advancements in biotechnology and a robust research infrastructure have led to the development of more effective bioremediation techniques.

Asia Pacific Bioremediation Market Trends

Asia Pacific is estimated to grow at a rapid rate over the forecast period. This can be attributed to increasing awareness about environmental protection, and production of large quantities of hazardous waste due to rising economic development in the region. Furthermore, the region consists of a large population and relatively under-developed waste management systems in developing countries, such as Pakistan, Cambodia, and others. These factors can lead to worsening contamination issues and are anticipated to accelerate the market growth.

The Chinese bioremediation market is driven by the country's efforts to address severe soil and water pollution, often resulting from rapid industrialization. The government's initiatives, such as the Soil Pollution Prevention and Control Action Plan, have created a favorable environment for the adoption of bioremediation technologies. There is also increasing investment in research and development for microbial remediation, as China seeks sustainable solutions to mitigate the impact of industrial waste.

Japan’s bioremediation market is influenced by the country’s focus on technological innovation and environmental sustainability. The market is driven by the need to manage soil contamination resulting from industrial activities, including those related to electronics and chemical manufacturing. Japan's strict environmental regulations, such as the Soil Contamination Countermeasures Act, support the adoption of advanced remediation technologies.

MEA Bioremediation Market Trends

The bioremediation market in the Middle East and Africa is growing due to the region's need to manage oil spills and industrial pollution, particularly in countries with extensive oil extraction activities. Countries like the UAE and South Africa are increasingly adopting bioremediation methods for soil and water contamination. The region also faces challenges such as water scarcity, which has led to a focus on sustainable solutions for pollution management.

In Saudi Arabia, the bioremediation market is driven by increased industrial activities, including oil and gas operations, which create a need for effective environmental cleanup methods. Governmental initiatives and investments aimed at reducing pollution and restoring contaminated sites, are boosting demand for bioremediation technologies.

The market growth is propelled by a focus on addressing pollution from petroleum and chemical industries. Government-supported environmental projects, especially those targeting oil spill remediation and soil contamination, contribute to the adoption of bioremediation solutions. Increased environmental awareness also supports market expansion.

Key Bioremediation Company Insights

The market players operating in the market are adopting product approval to increase the reach of their products in the market and improve the availability of their products, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Bioremediation Companies:

The following are the leading companies in the bioremediation market. These companies collectively hold the largest market share and dictate industry trends.

- Newterra Ltd.

- Sumas Remediation Service Inc.

- Probiosphere, Inc.

- Drylet, Inc.

- Xylem, Inc

- Regenesis Corporation

- Aquatech International Corporation

- Envirogen Technologies, Inc.

- MicroGen Biotech Ltd.

- Oil Spill Eater International Inc.

Recent Development

-

In May 2023, Allonnia has announced the launch of Allonnia 1,4 D-Stroy, a bioremediation solution designed to degrade 99% of 1,4-dioxane in contaminated groundwater. This compound, often referred to as a "forever chemical," poses significant environmental challenges due to its persistence in the environment.

-

In September 2021, a study published in the journal of Applied and Environmental Microbiology, demonstrated the presence of marine bacteria in the Canadian Arctic region that are capable of degrading hydrocarbons, such as oil and diesel.

-

In March 2021, Allonnia received an investment worth USD 20 million to strengthen its bioremediation portfolio for oil sand-related pollutants. This expanded the company’s offerings and improved its market presence.

-

In June 2020, the Indian Government released an advisory aimed at the treatment and disposal of solid waste using bioremediation processes to reclaim landfill sites. This directive was specifically targeted at Urban Local Bodies, highlighting the growing focus on bioremediation as a viable solution in the country.

Bioremediation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.81 billion

Revenue forecast in 2030

USD 29.37 billion

Growth rate

CAGR of 10.52% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Newterra Ltd.; Sumas Remediation Service Inc.; Probiosphere, Inc.; Drylet, Inc.; Xylem, Inc; Regenesis Corporation; Aquatech International Corporation; Envirogen Technologies, Inc.; MicroGen Biotech Ltd.; Oil Spill Eater International Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Bioremediation Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global bioremediation market report on the basis of type, technology, service, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In Situ Bioremediation

-

Ex Situ Bioremediation

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Biostimulation

-

Phytoremediation

-

Bioreactors

-

Fungal Remediation

-

Bioaugmentation

-

Land-based Treatment

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Soil Remediation

-

Oilfield Remediation

-

Wastewater Remediation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioremediation market size was estimated at USD 16.34 billion in 2024 and is expected to reach USD 17.81 billion in 2025.

b. The global bioremediation market is expected to grow at a compound annual growth rate of 10.52% from 2025 to 2030 to reach USD 29.37 billion by 2030.

b. North America dominated the bioremediation market with a share of 35.97% in 2024. This is attributable to the presence of sophisticated infrastructure, high industrial growth & waste production, and presence of key market players such as Regenesis Corporation, Probiosphere, Inc., and Xylem, Inc, among others.

b. Some key players operating in the bioremediation market include Newterra Ltd.; Sumas Remediation Service Inc.; Probiosphere, Inc.; Drylet, Inc.; Xylem, Inc; Regenesis Corporation; Aquatech International Corporation; Envirogen Technologies, Inc.; MicroGen Biotech Ltd.; Oil Spill Eater International Inc.

b. Key factors that are driving the bioremediation market growth include rapid growth in industrialization & increasing environmental deterioration, advancements in synthetic technologies, and increasing government support for bioremediation research and innovations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.