- Home

- »

- Medical Devices

- »

-

Bipolar Electrosurgical Devices Market Size Report, 2030GVR Report cover

![Bipolar Electrosurgical Devices Market Size, Share & Trends Report]()

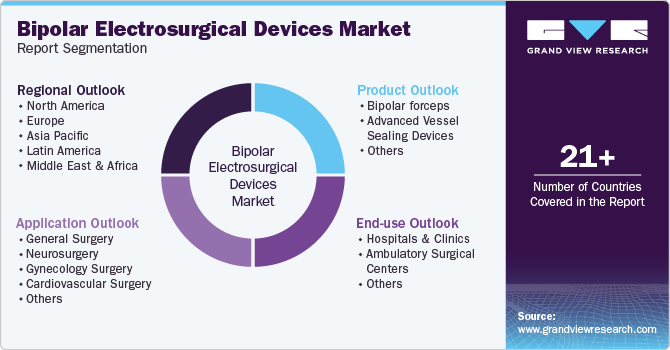

Bipolar Electrosurgical Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bipolar Forceps, Advanced Vessel Sealing Devices), By Application (General Surgery, Cardiovascular Surgery), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-505-0

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

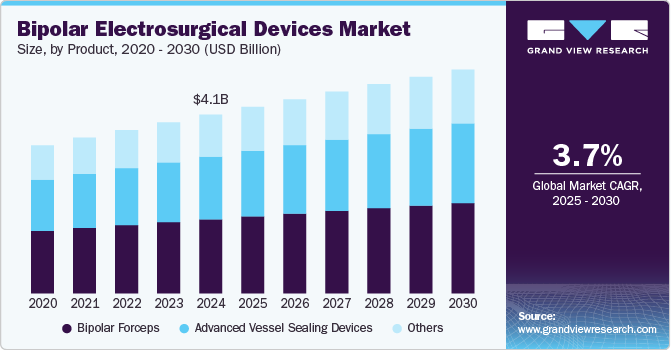

The global bipolar electrosurgical devices market size was estimated at USD 4.1 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2030. The growth of the bipolar electrosurgical devices industry is driven by rising demand for minimally invasive surgeries, advancements in electrosurgical technology, and increasing prevalence of chronic diseases requiring surgical interventions. Enhanced precision, reduced thermal damage, and faster recovery times associated with these devices boost their adoption.

The bipolar electrosurgical devices market has witnessed significant advancements in technology to enhance precision and safety during surgical procedures. Electrosurgery utilizes radiofrequency alternating current to increase intracellular temperature, enabling tissue vaporization, coagulation, or a combination of these effects. Modern electrosurgical units (ESUs) have transformed these effects by tailoring energy delivery for cutting, coagulation, sealing, or tissue approximation. ESUs convert alternating current of 50-60 Hz to a radiofrequency output of approximately 500 kHz. Advanced bipolar devices direct energy flow precisely between two electrodes, minimizing lateral thermal injury and collateral damage.

LigaSure (Medtronic) and ENSEAL (Ethicon Endo-Surgery) exemplify advanced devices that efficiently seal vessels up to 7 mm in diameter. Studies, such as those by Lamberton et al., demonstrate LigaSure's superior burst pressure and sealing speed compared to other bipolar and ultrasonic devices. Innovations like THUNDERBEAT (Olympus) combine ultrasonic and bipolar technologies for faster cutting, reliable vessel sealing, reduced thermal spread, and improved surgical visibility.

In October 2022, ZEISS Medical Technology received FDA clearance for MTLawton bipolar forceps. These copper-based alloy instruments reduce tissue adhesion and enhance thermal conduction, improving precision and efficiency during electrosurgery. These developments underscore the market's focus on advanced, user-friendly technologies that optimize surgical outcomes while minimizing risks.

Market Concentration & Characteristics

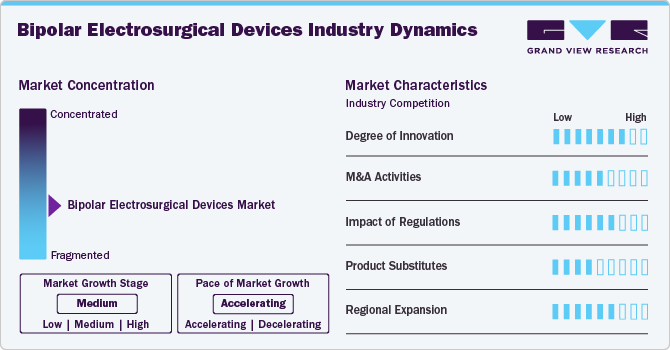

The bipolar electrosurgical devices industry is characterized by high technological innovation, driven by advancements in precision energy delivery and patient safety. It is moderately concentrated, with key players like Medtronic, Ethicon (Johnson & Johnson), Olympus, and ZEISS dominating the market. These companies focus on developing devices with enhanced vessel sealing, minimal thermal spread, and advanced features like impedance recognition. The industry's growth is fueled by rising demand for minimally invasive surgeries and the adoption of advanced surgical tools. Competition centers on device efficiency, safety, and user-friendly designs, with significant investment in research and development to maintain a competitive edge.

The bipolar electrosurgical devices market exhibits moderate innovation, with Double Bipolar Electrosurgical Units representing a significant advancement. These devices enhance surgical precision and safety by using two active electrodes to deliver electrical energy directly to target tissues. Unlike monopolar units, they eliminate the need for a grounding pad, ensuring current flows exclusively between electrodes, reducing unintended tissue damage. This precise energy control minimizes thermal spread and allows for delicate procedures with greater accuracy. Their innovative design has transformed electrosurgery, making these units essential tools in modern operating rooms, reflecting the industry's commitment to advancing surgical technology and patient outcomes.

Regulations play a crucial role in shaping the bipolar electrosurgical devices industry by ensuring safety, efficacy, and quality. Regulatory agencies like the FDA and European Medicines Agency enforce stringent standards for product design, clinical testing, and manufacturing processes. Compliance with these regulations is essential for obtaining market approvals and maintaining consumer trust. Regulations also drive innovation, as manufacturers must continually improve devices to meet evolving safety and performance requirements. However, navigating complex regulatory frameworks can pose challenges, potentially delaying product launches and increasing costs. Ultimately, these regulations foster a safer healthcare environment while promoting advancements in electrosurgical technologies.

Mergers and acquisitions (M&A) significantly shape the market, enabling companies to expand portfolios, enhance market reach, and accelerate innovation. Leading players often acquire smaller firms with specialized technologies to strengthen competitive positions and meet evolving surgical demands. M&A activities also facilitate resource pooling, advancing research and development efforts to create safer, more efficient devices. For instance, strategic acquisitions by major medical device companies have bolstered technological integration, such as combining bipolar and ultrasonic energy systems.

In the bipolar electrosurgical devices industry, product substitutes include alternative surgical energy technologies like monopolar devices, ultrasonic energy systems, and advanced laser-based surgical tools. These substitutes offer comparable functionalities, such as tissue cutting, coagulation, and vessel sealing. Ultrasonic devices, for example, provide lower thermal spread, while laser systems enable high-precision dissection. However, bipolar devices maintain an edge in minimizing unintended tissue damage due to their targeted energy delivery. The choice of substitute often depends on procedural requirements, cost, and surgeon preference. Innovations integrating multiple energy modalities, like hybrid devices, further challenge standalone bipolar technologies, influencing market dynamics and adoption rates.

The bipolar electrosurgical devices market is expanding globally, driven by advancements in surgical procedures and a growing demand for minimally invasive surgeries. North America leads in market share due to the high adoption of advanced medical technologies, strong healthcare infrastructure, and increasing surgeries. Europe follows with growth fueled by rising awareness of precision surgeries. Asia Pacific is witnessing rapid growth due to improving healthcare infrastructure and rising healthcare expenditures. The market is further supported by the aging population, increased surgical procedures, and the demand for precise and safer electrosurgical devices in various medical disciplines.

Product Insights

The bipolar forceps segment accounted for the largest revenue share of 41.4% in 2024. This is attributed to its extensive use in minimally invasive surgeries, offering precise tissue handling and coagulation with minimal thermal spread. Bipolar forceps are widely adopted in neurosurgery, gynecology, and ophthalmology due to their enhanced safety and efficacy. Technological advancements, such as disposable and reusable options, further drive demand. The growing prevalence of chronic conditions requiring surgical intervention and the increasing focus on patient safety contribute to this segment's growth, solidifying its position as a key driver of market revenue.

The advanced vessel sealing devices segment is projected to grow at the fastest CAGR due to increasing demand for minimally invasive surgical techniques and their ability to enhance procedural efficiency. These devices offer precise vessel sealing, reduced blood loss, and shorter operative times, making them highly valuable in complex surgeries like oncology and gynecology. Technological advancements, such as integration with energy-based systems and improved ergonomic designs, further drive adoption.

Application Insights

The general surgery segment dominated the market and accounted for a 30.6% share in 2024 and is anticipated to grow at the fastest CAGR from 2025 to 2030, driven by the high volume of procedures requiring precision and safety. Bipolar devices are widely used in general surgeries for tissue dissection, coagulation, and vessel sealing due to their reduced thermal spread and enhanced control. The growing prevalence of conditions like hernias, appendicitis, and gallbladder disorders boosts the demand for such devices. Advancements in electrosurgical technology and the increasing adoption of minimally invasive techniques further propel this segment. Additionally, the emphasis on reducing intraoperative complications and improving patient recovery strengthens its dominance in the market.

End Use Insights

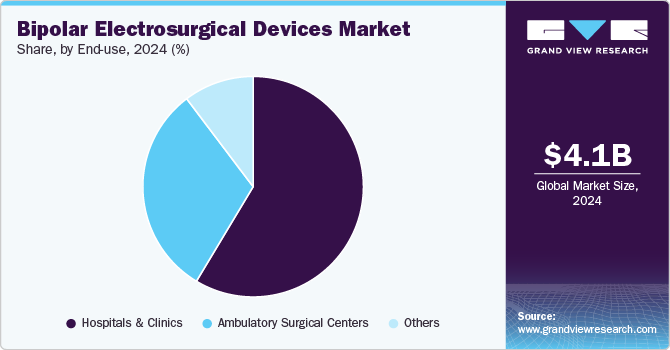

The hospitals & clinics segment dominated the market with the largest revenue share of 58.6% in 2024, due to the high volume of surgical procedures performed in these facilities. Hospitals and clinics benefit from well-established infrastructure, advanced equipment, and skilled professionals, ensuring widespread adoption of bipolar devices for precise and safe surgical applications. The growing prevalence of chronic conditions requiring surgery, along with an increasing emphasis on minimally invasive procedures, further boosts demand. Additionally, rising healthcare expenditure and the expansion of multispecialty hospitals globally contribute to this segment's dominance, reinforcing its critical role in driving market revenue.

The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR over the forecast period, due to the increasing preference for outpatient surgeries. ASCs offer cost-effective, high-quality care with shorter recovery times, making them an attractive option for minimally invasive procedures requiring bipolar devices. The growing number of ASCs, coupled with advancements in electrosurgical technology, enhances their capability to perform complex surgeries. Additionally, the rising prevalence of chronic conditions and a shift toward value-based care models drive demand for precision surgical tools in ASCs, positioning this segment for rapid growth during the forecast period.

Regional Insights

North America dominated the bipolar electrosurgical devices industryand held a dominant position, capturing 43.4% of the global revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40-50 million surgeries annually for conditions like cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments.

U.S. Bipolar Electrosurgical Devices Market Trends

The U.S. bipolar electrosurgical devices industry is expected to expand due to a rising number of surgical procedures, increasing chronic conditions requiring surgical interventions, and healthcare infrastructure advancements. The population aged 50 and older in the U.S. will grow by 61.11%, from 137.25 million in 2020 to 221.13 million by 2050, with chronic disease cases in this group projected to rise 99.5%, from 71.522 million to 142.66 million. The presence of leading companies and research institutions fosters innovation in the bipolar electrosurgical devices sector. Furthermore, regulatory support and investments in healthcare technology drive market growth.

Europe Bipolar Electrosurgical Devices Market Trends

The Europe bipolar electrosurgical devices industry is expected to grow during the forecast period, largely driven by the high prevalence of chronic diseases, which contribute to 80% of the EU's overall disease burden. This significant healthcare challenge poses a threat to the sustainability of healthcare systems.

The bipolar electrosurgical devices market in the UK is experiencing notable growth due to the increasing prevalence of chronic diseases such as diabetes and the growing elderly population. According to the UK Department of Health & Social Care, the number of individuals aged 85 and older is projected to rise by one million between 2021 and 2036.

The France bipolar electrosurgical devices market is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

The bipolar electrosurgical devices market in Germany is primarily fueled by the rising prevalence of chronic diseases. According to the International Diabetes Federation, in 2021, 10% of Germany's adult population of 62,027,700 had diabetes, amounting to 6,199,900 cases. This growing burden significantly drives the demand for advanced surgical tools.

Asia Pacific Bipolar Electrosurgical Devices Market Trends

The Asia Pacific bipolar electrosurgical devices industry is growing rapidly due to rising chronic diseases like cancer, diabetes, and cardiovascular conditions, particularly in China, India, and Japan. With 1.4 million cancer diagnoses in India in 2022, demand for advanced surgical tools is surging. Additionally, the adoption of minimally invasive techniques and innovations in surgical technology, such as bipolar electrosurgical devices, is enhancing patient outcomes. Hospitals are increasingly investing in modern instruments to improve care, driving market growth across the region.

The bipolar electrosurgical devices market in Japan is expanding as the aging population contributes to a higher prevalence of chronic diseases. Research indicates that over 90% of adults aged 75 and older in Japan are affected by at least one chronic condition, driving demand for advanced medical solutions like bipolar electrosurgical devices.

The Japan bipolar electrosurgical devices market is expected to grow over the forecast period. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The bipolar electrosurgical devices market in India is set for significant growth, driven by the increasing prevalence of gastrointestinal disorders and colorectal cancer. With colorectal cancer cases rising at an estimated 5% annually, the demand for minimally invasive procedures has surged. India's aging population, projected to reach 20% by 2050, further fuels this demand.

Latin America Bipolar Electrosurgical Devices Market Trends

The Latin America bipolar electrosurgical devices industry is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Bipolar Electrosurgical Devices Market Trends

The Middle East and Africa bipolar electrosurgical devices industry is growing due to increasing surgical procedures, a rising prevalence of chronic conditions, and improving healthcare infrastructure. Enhanced access to medical facilities and the adoption of advanced technologies are fueling demand for effective bipolar electrosurgical devices.

The bipolar electrosurgical devices market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Bipolar Electrosurgical Devices Company Insights

The competitive scenario in the bipolar electrosurgical devices market is highly competitive, with key players such as Baxter, BD., and Pfizer Inc. holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Bipolar Electrosurgical Devices Companies:

The following are the leading companies in the bipolar electrosurgical devices market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Medicom

- Baxter

- HemoSonics

- Hemostasis, LLC

- Medline Industries

- Pfizer Inc.

- Johnson & Johnson

- HemCon Medical Technologies Inc.

- Integra LifeSciences

- Teleflex Incorporated

Recent Developments

-

In August 2024,Olympus introduced two new jaw designs for its PowerSeal sealer/divider portfolio: the Curved Jaw double-action (SJDA) and single-action (CJSA). With three jaw designs and shaft lengths, PowerSeal supports diverse surgical techniques. These single-use devices offer ergonomic, multifunctional features, requiring less squeeze force while maintaining jaw force and sealing performance in laparoscopic and open surgeries.

-

In September 2022, Olympus launched the THUNDERBEAT Open Fine Jaw Type X, a single-use hybrid ultrasonic and bipolar electrosurgical instrument for open surgeries like thyroidectomy. Available in Japan, with global launches, it boosts surgical efficiency by combining functions into one device. It features enhanced precision, improved visibility, and reduced thermal damage risk.

-

In June 2021, Ethicon, part of Johnson & Johnson Medical Devices Companies, launched the ENSEAL X1 Curved Jaw Tissue Sealer, an advanced bipolar device enhancing procedural efficiency, sealing strength, and tissue access compared to LigaSure Maryland. Designed for colorectal, gynecological, bariatric, and thoracic surgeries, it marks the first in Ethicon's upcoming advanced laparoscopic device series.

Bipolar Electrosurgical Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.2 billion

Revenue forecast in 2030

USD 5.1 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B. Braun Melsungen; AG Boston Scientific Corporation; Bovie Medical Corporation; BOWA-electronic GmbH & Co.KG; CONMED Corporation; Erbe Elektromedizin GmbH; Johnson & Johnson; Medtronic; Olympus Corporation; Smith & Nephew Plc.; Innoblative Designs.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bipolar Electrosurgical Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the bipolar electrosurgical devices market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bipolar forceps

-

Advanced Vessel Sealing Devices

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Neurosurgery

-

Gynecology Surgery

-

Cardiovascular Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global market for bipolar electrosurgical devices was estimated at USD 4.1 billion in 2024 and is expected to reach USD 4.2 billion in 2025.

b. The global market for bipolar electrosurgical devices is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2030, reaching USD 5.1 billion by 2030.

b. North America dominated the bipolar electrosurgical devices market with a share of 43.4% in 2024. This is attributable to the rising demand for minimally invasive surgeries and the increasing prevalence of chronic diseases.

b. Some key players operating in the bipolar electrosurgical devices market include B. Braun Melsungen; AG Boston Scientific Corporation; Bovie Medical Corporation; BOWA-electronic GmbH & Co.KG; CONMED Corporation; Erbe Elektromedizin GmbH; Johnson & Johnson; Medtronic; Olympus Corporation; Smith & Nephew Plc.; Innoblative Designs.

b. Key drivers of bipolar electrosurgical devices market growth include the rising prevalence of diseases like diabetes and arthritis, which require surgical interventions, and the growing demand for safer, advanced medical technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.