- Home

- »

- Next Generation Technologies

- »

-

Blockchain Technology Market Size & Growth Report, 2030GVR Report cover

![Blockchain Technology Market Size, Share & Trends Report]()

Blockchain Technology Market Size, Share & Trends Analysis Report By Type, By Component, By Application, By Enterprise Size, By End-use, By Offering, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-329-4

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

Blockchain Technology Market Size & Trends

The global blockchain technology market size was valued at USD 17.46 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 87.7% from 2023 to 2030. The escalating demand for secure and transparent transactions across many industries is driving the market growth. Blockchain's decentralized and immutable ledger system ensures the integrity and transparency of transactions, making it especially appealing to sectors such as finance, healthcare, and supply chain management. Businesses across these domains are increasingly integrating blockchain solutions to enhance security and transparency in their operations.

The adoption of blockchain technology for optimizing supply chain processes is witnessing a surge. The ability to trace and verify the origin and journey of products in real-time curbs fraud and significantly improves traceability and overall supply chain efficiency. Consequently, an increasing number of enterprises are leveraging blockchain's potential to transform their supply chain management, driving the technology's growth. Moreover, the surging interest in cryptocurrencies and digital assets is another driver responsible for the growth.

Since blockchain serves as the underlying technology for most cryptocurrencies, the rising popularity of digital currencies like Bitcoin and Ethereum has inevitably directed considerable attention to the technology itself. Many organizations are now exploring how blockchain can be used to create and manage digital assets, including Central Bank Digital Currencies (CBDCs), further propelling the market's expansion. Furthermore, the escalating need for secure and efficient cross-border payments and remittances propels blockchain's adoption. Traditional international payment systems often involve multiple intermediaries, resulting in delays and exorbitant costs. In stark contrast, blockchain-based solutions offer faster, cost-effective, and transparent cross-border transactions, driving their adoption in the finance and remittance sectors.

Governments and regulatory bodies worldwide also recognize blockchain technology's transformative potential. They are actively introducing supportive policies and regulations that encourage its widespread adoption. This regulatory clarity not only attracts substantial investments but also fosters the development of innovative blockchain solutions across industries. In addition, the increasing engagement of major corporations and tech giants significantly influences the blockchain landscape.

One of the prominent restraints challenging the blockchain technology market is the issue of scalability. As the adoption of blockchain technology grows across various industries, particularly in financial services and supply chain management, the networks are experiencing increased congestion, slower transaction speeds, and higher fees. This scalability challenge can hinder widespread adoption, especially when blockchain is expected to handle large volumes of transactions. To overcome this restraint, developers, and innovators in the blockchain space are actively working on scaling solutions. Layer 2 solutions, such as Ethereum 2.0, aim to improve scalability by processing transactions off the main blockchain, thus alleviating congestion and reducing fees.

COVID-19 Impact Analysis

The blockchain technology market witnessed growth amid the COVID-19 pandemic. Blockchain technology plays a vital role in developing a platform for managing the pandemic. Various hospitals are using blockchain technology for tracking the COVID-19 vaccine. Two Hospitals, in Warwick (London) and Stratford-upon-Avon, are using blockchain technology to monitor the storage of the temperature-sensitive COVID-19 vaccine.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. Innovations such as cryptocurrency, non-fungible tokens (NFTs), tokenization of assets, blockchain-as-a-service, and the blend of artificial intelligence (AI) with blockchain are reshaping the market. These transformative trends are offering convenience, security, and accessibility, revolutionizing today’s financial landscape.

The blockchain technology market can be characterized by a moderate level of merger and acquisition (M&A) activities by the leading players. Blockchain technology market players are adopting this strategy in order to expand their product reach, harness technological strengths, and consolidate their position in a continuously changing market while balancing growth and industry integration.

The blockchain technology market has a very high impact on regulations. Regulatory constraints with respect to sales regulations, securities laws, anti-money laundering requirements, ownership and licensing requirements, and taxation are shaping the security standards, compliance measures, and operational protocols in the market.

The blockchain technology market has very few substitutes. These substitutes include Directed Acyclic Graphs (DAGs), distributed ledger, and hashgraphs among others. However, these substitutes are still evolving and have not gained the popularity equivalent to the blockchain technology, hence, are inferior.

The blockchain technology market experiences significant end-user concentration in personal and business domains, spanning industries like finance, healthcare, IT & telecom, and retail & e-commerce. Embracing blockchain for secure transactions, data integrity, and diversified business applications, users showcase varied preferences and demands.

Type Insights

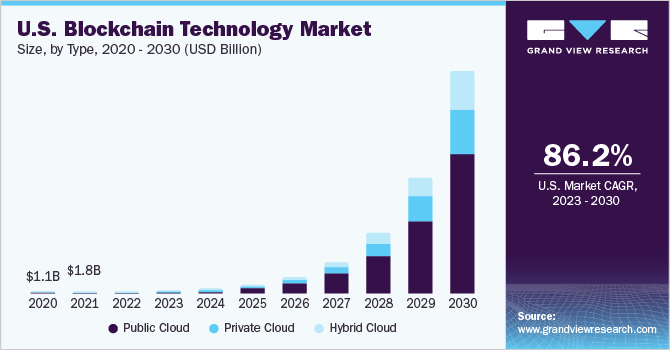

The public cloud segment dominated the market in 2022 and accounted for more than 61.0% share of the global revenue. Public cloud providers offer a scalable and cost-effective infrastructure for deploying blockchain solutions. This scalability is vital as blockchain networks grow and require additional resources to support increasing transaction volumes. Moreover, public cloud providers have invested significantly in security and compliance measures, which are crucial in blockchain applications, particularly in sectors like finance and healthcare, where data integrity is paramount.

The private cloud segment is anticipated to witness significant growth over the forecast period. Private cloud services include the provision of dedicated infrastructure and resources exclusively for organizations. The private cloud enables companies to reverse transactions at cost-effective transaction rates. This is driving the growth of the segment. Furthermore, the rise in the adoption of private cloud by large enterprises and small & medium enterprises is one of the major factors driving the segment growth.

Component Insights

The infrastructure & protocols segment dominated the market in 2022 and accounted for more than 61.0% share of the global revenue. The increasing demand for blockchain standards and protocols such as Ethereum, Openchain, and Hyperledger is driving the segment growth. The users demand protocols as they enable them to share information reliably and securely across cryptocurrency networks. Thus, the benefits offered by infrastructure and protocols are contributing to the segment's growth.

The middleware segment is expected to witness significant growth over the forecast period. Middleware helps developers build applications more efficiently. A middleware tool is mainly used in the healthcare sector to automate the authentication of clinical data. Growing investments in the healthcare sector are expected to drive the segment growth. Middleware tools track the laboratory performance metrics, which is also one of the factors driving the growth of the segment.

Application Insights

The payments segment dominated the market in 2022 and accounted for more than 44.0% share of the global revenue. Blockchain technology improves payment system efficiency, minimizes operating costs, and offers transparency. These benefits provided by blockchain technology are increasing its use in payment solutions, thus driving the segment growth. Furthermore, blockchain reduces the need for a middleman in payment processing, which is also a major factor driving the segment growth.

The digital identity segment is anticipated to grow at the highest CAGR over the forecast period. The segment is experiencing rapid growth due to its potential to address critical challenges in the digital age. As our lives become increasingly digitized, the need for secure and portable digital identities has become paramount. Blockchain technology offers a unique solution by providing a decentralized and tamper-proof ledger to verify and manage digital identities. This innovation has garnered significant interest, especially in sectors like finance, healthcare, and government, where identity verification is crucial.

Enterprise Size Insights

The large enterprises segment dominated the market in 2022 and accounted for more than 67.0% share of the global revenue. Large enterprises operating in sectors such as insurance, financial services, healthcare, and supply chain are increasingly making efforts to digitalize their offerings, which is creating a demand for blockchain technology among them. Large enterprises such as BBVA, Intesa Sanpaolo, Barclays, and HSBC are using blockchain technology to streamline their KYC and fund processes. They have access to adequate capital and different assets to adopt new technologies introduced in the market.

The small & medium enterprise segment is anticipated to grow at the highest CAGR over the forecast period. Small & medium enterprises face difficulties in scaling their tasks such as financing, processing payments, and selecting ancillary services essential for global expansion. Blockchain technology helps them reduce issues in the areas of subsidizing and exchanging accounts. Furthermore, secure and safe information exchanges and smart contracts offered by blockchain technology help small & medium enterprises streamline supply chains. Furthermore, blockchain-based storage applications enable small businesses to store data safely and cost-effectively, which is driving the demand for blockchain among small businesses.

End-use Insights

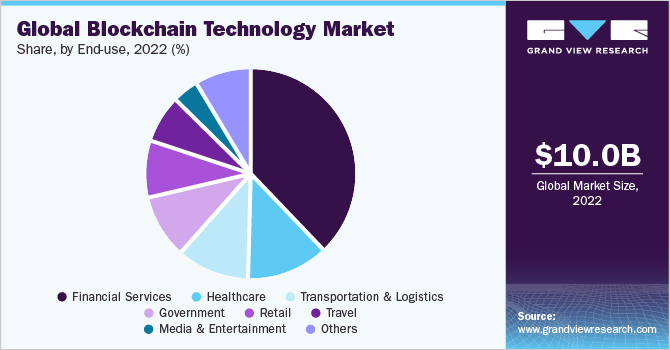

The financial services segment dominated the market in 2022 and accounted for more than 37.0% share of the global revenue. Blockchain technology in BFSI is leveraged for managing financial transactions taking place in businesses. Blockchain technology provides secure and efficient transactions, and this is driving the demand for the technology in financial services. The technology is expected to be widely adopted in this vertical owing to factors such as rising cryptocurrencies, high compatibility with the industry ecosystem, rapid transactions, Initial Coin Offerings (ICOs), and reduced total cost of ownership.

The healthcare segment is anticipated to grow at the highest CAGR over the forecast period. The increasing number of regulations for protecting consumer data is increasing the adoption of blockchain technology in the healthcare market. Governments across the globe are implementing stringent regulations to protect consumer information owing to the growing incidents of data theft and breaches. For instance, the European Union data protection law, the General Data Protection Regulation (GDPR), became effective in May 2018. GDPR aims to safeguard EU citizens from privacy and data breaches. Such regulations are impelling companies across the globe to make investments in enhancing data security. Furthermore, the COVID-19 pandemic has increased the demand for digitalization across the healthcare sector, which thereby created the need for blockchain technology across the sector.

Regional Insights

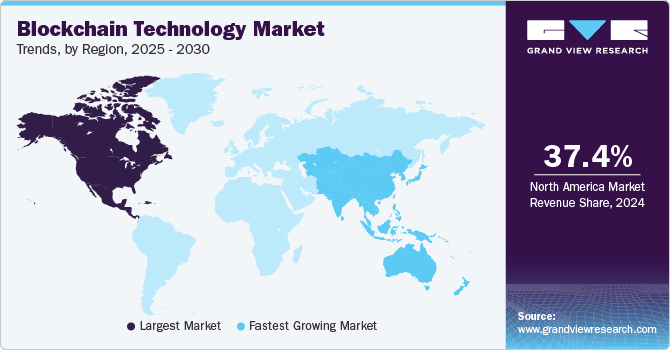

North America dominated the blockchain technology market in 2022 and accounted for over 37.0% share of the global revenue. The region boasts a robust ecosystem of tech startups, established corporations, and leading research institutions, creating a fertile ground for blockchain development. Silicon Valley, in particular, has been a hotspot for blockchain startups and venture capital investments. Moreover, North America is home to a diverse range of industries, from finance and healthcare to supply chain management and energy, all of which recognize the transformative potential of blockchain technology.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The governments of countries such as China, Japan, and India are promoting the use of blockchain technology in recent days. They are promoting the use of blockchain owing to benefits such as high transparency and increased efficiency provided to multiple industries. In 2019, the South Korean government announced an investment of USD 880 million in blockchain development projects.

Key Companies & Market Share Insights

The competitive landscape of the market is highly fragmented. The key players are focused on strategies such as partnerships to strengthen their market position. For instance, in August 2023, Aptos Labs, known for developing a layer 1 blockchain, founded by ex-Facebook personnel to resurrect the abandoned Diem project (previously known as Libra), is widening its array of tools and services. This expansion involves using Microsoft's Artificial Intelligence (AI) technology. Aptos intends to introduce novel offerings that integrate AI and blockchain technology through this partnership. A notable addition is the Aptos Assistant, a chatbot designed to respond to user inquiries about the Aptos ecosystem. It will also serve as a resource hub for developers creating smart contracts and Decentralized Applications (dApps).

The market players are also focused on enhancing their product offerings to better cater to the changing needs of users and stay competitive. As a result, market players are investing more in research and development to enhance their product offerings. Furthermore, the companies are also collaborating with universities worldwide to support technical development, academic research, and innovation in cryptocurrency and blockchain technology.

Key Blockchain Technology Companies:

- IBM Corporation

- Microsoft Corporation

- The Linux Foundation

- Blockchain Tech LTD

- Chain

- Circle Internet Financial, LLC=

- Deloitte Touche Tohmatsu Limited

- Digital Asset Holdings, LLC

- Global Arena Holding, Inc. (GAHC)

- Monax Labs

- Ripple

Recent Developments

-

In December 2023, RYVYL, a blockchain ledger-based payments platform, partnered with R3, a distributed ledger technology company. Through this collaboration, the companies have launched ‘RYVYL Block,’ a blockchain-as-a-service platform. The platform aims to simplify the adoption of blockchain technology for businesses with high-volume processing environments.

-

In October 2023, DTCC, a global financial services industry leader, announced the acquisition of a digital asset infrastructure developer, Securrency Inc. With this acquisition, DTCC is expected to leverage Securrency Inc.’s technology to embed digital assets within its existing services and products, develop regulatory-compliant and new blockchain-based offerings, and explore new use cases within the industry.

-

In September 2023, LayerZero, a cross-chain messaging protocol, partnered with Google Cloud to elevate its infrastructure. This collaboration designates Google Cloud as the primary oracle provider for LayerZero, ensuring that all transactions transmitted across blockchains by LayerZero's dapps will undergo verification through Google Cloud.

Blockchain Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.46 billion

Revenue forecast in 2030

USD 1,431.54 billion

Growth rate

CAGR of 87.7% from 2023 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, component, offering, application, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; Australia; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

IBM Corporation; Microsoft Corporation; The Linux Foundation; Blockchain Tech LTD; Chain; Circle Internet Financial, LLC; Deloitte Touche Tohmatsu Limited; Digital Asset Holdings, LLC; Global Arena Holding, Inc. (GAHC); Monax Labs; Ripple

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blockchain Technology Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the blockchain technology market based on type, component, offering, application, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Application & Solution

-

Infrastructure & Protocols

-

Middleware

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Platform

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Digital Identity

-

Exchanges

-

Payments

-

Smart Contracts

-

Supply Chain Management

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Banking & Financial Services

-

Government

-

Healthcare

-

Media & Entertainment

-

Retail & eCommerce

-

Transportation & Logistics

-

Travel

-

Manufacturing

-

IT & Telecom

-

Real Estate & Construction

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the blockchain technology market include IBM Corporation; Microsoft Corporation; Linux Foundation; and R3. Some other key players in the market include BTL Group; Chain Inc.; Deloitte; Circle Internet Financial Limited; Global Arena Holding, Inc. (GAHI); Post-Trade Distributed Ledger; Ripple; and Eric Industries.

b. Key factors that are driving the blockchain technology market growth include increasing merchants accepting cryptocurrency and growing interest in blockchain among financial institutions.

b. The global blockchain technology market size was estimated at USD 10.02 billion in 2022 and is expected to reach USD 17.46 billion in 2023.

b. The global blockchain technology market is expected to witness a compound annual growth rate of 87.7% from 2023 to 2030 to reach USD 1,431.54 billion by 2030.

b. North America dominated the blockchain technology market with a share of 37.77% in 2022. This is attributable to the faster adoption of innovative technologies in developed countries such as the U.S., and Canada.

Table of Contents

Chapter 1 Blockchain Technology Market: Methodology and Scope

1.1 Research Methodology

1.2 Research Scope and Assumptions

1.3 List of Data Sources

Chapter 2 Blockchain Technology Market: Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Blockchain Technology Market: Industry Outlook

3.1 Market Segmentation and Scope

3.2 Blockchain Technology Market - Value Chain Analysis

3.3 Blockchain Technology Market - Market Dynamics

3.3.1 Market driver analysis

3.3.1.1 Increasing acceptance of cryptocurrency among merchants

3.3.1.2 Growing market for alternative cryptocurrencies

3.3.1.3 Growing interest in blockchain among financial institutions

3.3.2 Market restraint analysis

3.3.2.1 Regulatory uncertainty

3.3.3 Market opportunity analysis

3.3.3.1 Instant settlement of financial transactions

3.3.3.2 Netting and clearing process to achieve an optimized settlement

3.4 Blockchain Technology Market - Market Adoption Timelines

3.5 Blockchain Technology Market - Porter’s Five Forces Analysis

3.6 Blockchain Technology Market - PESTEL Analysis

3.7 Blockchain in the Public Sector Market - Use Case Analysis

3.7.1 Exonum land title registry - Georgia

3.7.2 uPort decentralized identity - Zug, Switzerland

3.7.3 Government of Estonia

3.7.4 U.S.

3.7.5 Smart Dubai

3.8 Blockchain Technology Cost Analysis

3.8.1 Blockchain development through outsourcing

3.8.1.1 Hiring a blockchain development team

3.8.1.2 Blockchain app development cost

3.8.1.3 Blockchain wallet development

3.8.1.4 Smart contract development

3.8.2 Blockchain solutions fundamental cost

3.8.2.1 Transaction volume

3.8.2.2 Transaction size

3.8.2.3 Node hosting method

3.8.2.4 Consensus protocol

3.8.3 Blockchain cost model

3.8.3.1 Assumptions

3.8.3.2 Cost model

3.9 Blockchain in the Public Sector Market - Funding Initiative Analysis

3.9.1 Blockchain funding initiatives in the public sector

Chapter 4 Blockchain Technology Type Outlook

4.1 Blockchain Technology Market Share by Type, 2022 & 2030

4.2 Public Cloud

4.2.1 Public cloud blockchain technology market, 2017 - 2030

4.3 Private Cloud

4.3.1 Private cloud blockchain technology market, 2017 - 2030

4.4 Hybrid Cloud

4.4.1 Hybrid cloud blockchain technology market, 2017 - 2030

Chapter 5 Blockchain Technology Component Outlook

5.1 Blockchain Technology Market Share by Component, 2022 & 2030

5.2 Application & Solution

5.2.1 Blockchain technology application & solution market, 2017 - 2030

5.3 Infrastructure & Protocols

5.3.1 Blockchain technology infrastructure & protocol market, 2017 - 2030

5.4 Middleware

5.4.1 Blockchain technology middleware market, 2017 - 2030

Chapter 6 Blockchain Technology Offering Outlook

6.1 Blockchain Technology Market Share by Offering, 2022 & 2030

6.2 Platform

6.2.1 Blockchain technology platform market, 2017 - 2030

6.3 Services

6.3.1 Blockchain technology services market, 2017 - 2030

Chapter 7 Blockchain Technology Application Outlook

7.1 Blockchain Technology Market Share by Application, 2022 & 2030

7.2 Digital Identity

7.2.1 Blockchain technology market in digital identity, 2017 - 2030

7.3 Exchanges

7.3.1 Blockchain technology market in exchanges, 2017 - 2030

7.4 Payments

7.4.1 Blockchain technology market in payments, 2017 - 2030

7.5 Smart Contracts

7.5.1 Blockchain technology market in smart contracts, 2017 - 2030

7.6 Supply Chain Management

7.6.1 Blockchain technology market in supply chain management, 2017 - 2030

7.7 Others

7.7.1 Blockchain technology market in other applications, 2017 - 2030

Chapter 8 Blockchain Technology Enterprise Size Outlook

8.1 Blockchain Technology Market Share by Enterprise Size, 2022 & 2030

8.2 Large Enterprises

8.2.1 Blockchain technology market in large enterprises, 2017 - 2030

8.3 Small & Medium Enterprises

8.3.1 Blockchain technology market in small & medium enterprises, 2017 - 2030

Chapter 9 Blockchain Technology End Use Outlook

9.1 Blockchain Technology Market Share by End Use, 2022 & 2030

9.2 Banking & Financial Services

9.2.1 Blockchain technology market in banking & financial services, 2017 - 2030

9.3 Government

9.3.1 Blockchain technology market in government, 2017 - 2030

9.4 Healthcare

9.4.1 Blockchain technology market in healthcare, 2017 - 2030

9.5 Media & Entertainment

9.5.1 Blockchain technology market in media & entertainment, 2017 - 2030

9.6 Retail & eCommerce

9.6.1 Blockchain technology market in retail & eCommerce, 2017 - 2030

9.7 Transportation & Logistics

9.7.1 Blockchain technology market in transportation & logistics, 2017 - 2030

9.8 Travel

9.8.1 Blockchain technology market in travel, 2017 - 2030

9.9 Manufacturing

9.9.1 Blockchain technology market in manufacturing, 2017 - 2030

9.10 IT & Telecom

9.10.1 Blockchain technology market in IT & telecom, 2017 - 2030

9.11 Real Estate & Construction

9.11.1 Blockchain technology market in real estate & construction, 2017 - 2030

9.12 Energy & Utilities

9.12.1 Blockchain technology market in energy & utilities, 2017 - 2030

9.13 Others

9.13.1 Blockchain technology market in other end uses, 2017 - 2030

Chapter 10 Blockchain Technology Regional Outlook

10.1 Blockchain Technology Market Share, by Region, 2022 & 2030

10.2 North America

10.2.1 North America blockchain technology market, 2017 - 2030

10.2.2 North America blockchain technology market, by type, 2017 - 2030

10.2.3 North America blockchain technology market, by component, 2017 - 2030

10.2.4 North America blockchain technology market, by offering, 2017 - 2030

10.2.5 North America blockchain technology market, by application, 2017 - 2030

10.2.6 North America blockchain technology market, by enterprise size, 2017 - 2030

10.2.7 North America blockchain technology market, by end use, 2017 - 2030

10.2.8 U.S.

10.2.8.1 U.S. blockchain technology market, 2017 - 2030

10.2.8.2 U.S. blockchain technology market, by type, 2017 - 2030

10.2.8.3 U.S. blockchain technology market, by component, 2017 - 2030

10.2.8.4 U.S. blockchain technology market, by offering, 2017 - 2030

10.2.8.5 U.S. blockchain technology market, by application, 2017 - 2030

10.2.8.6 U.S. blockchain technology market, by enterprise size, 2017 - 2030

10.2.8.7 U.S. blockchain technology market, by end use, 2017 - 2030

10.2.9 Canada

10.2.9.1 Canada blockchain technology market, 2017 - 2030

10.2.9.2 Canada blockchain technology market, by type, 2017 - 2030

10.2.9.3 Canada blockchain technology market, by component, 2017 - 2030

10.2.9.4 Canada blockchain technology market, by offering, 2017 - 2030

10.2.9.5 Canada blockchain technology market, by application, 2017 - 2030

10.2.9.6 Canada blockchain technology market, by enterprise size, 2017 - 2030

10.2.9.7 Canada blockchain technology market, by end use, 2017 - 2030

10.2.10 Mexico

10.2.10.1 Mexico blockchain technology market, 2017 - 2030

10.2.10.2 Mexico blockchain technology market, by type, 2017 - 2030

10.2.10.3 Mexico blockchain technology market, by component, 2017 - 2030

10.2.10.4 Mexico blockchain technology market, by offering, 2017 - 2030

10.2.10.5 Mexico blockchain technology market, by application, 2017 - 2030

10.2.10.6 Mexico blockchain technology market, by enterprise size, 2017 - 2030

10.2.10.7 Mexico blockchain technology market, by end use, 2017 - 2030

10.3 Europe

10.3.1 Europe blockchain technology market, 2017 - 2030

10.3.2 Europe blockchain technology market, by type, 2017 - 2030

10.3.3 Europe blockchain technology market, by component, 2017 - 2030

10.3.4 Europe blockchain technology market, by offering, 2017 - 2030

10.3.5 Europe blockchain technology market, by application, 2017 - 2030

10.3.6 Europe blockchain technology market, by enterprise size, 2017 - 2030

10.3.7 Europe blockchain technology market, by end use, 2017 - 2030

10.3.8 U.K.

10.3.8.1 U.K. blockchain technology market, 2017 - 2030

10.3.8.2 U.K. blockchain technology market, by type, 2017 - 2030

10.3.8.3 U.K. blockchain technology market, by component, 2017 - 2030

10.3.8.4 U.K. blockchain technology market, by offering, 2017 - 2030

10.3.8.5 U.K. blockchain technology market, by application, 2017 - 2030

10.3.8.6 U.K. blockchain technology market, by enterprise size, 2017 - 2030

10.3.8.7 U.K. blockchain technology market, by end use, 2017 - 2030

10.3.9 Germany

10.3.9.1 Germany blockchain technology market, 2017 - 2030

10.3.9.2 Germany blockchain technology market, by type, 2017 - 2030

10.3.9.3 Germany blockchain technology market, by component, 2017 - 2030

10.3.9.4 Germany blockchain technology market, by offering, 2017 - 2030

10.3.9.5 Germany blockchain technology market, by application, 2017 - 2030

10.3.9.6 Germany blockchain technology market, by enterprise size, 2017 - 2030

10.3.9.7 Germany blockchain technology market, by end use, 2017 - 2030

10.3.10 France

10.3.10.1 France blockchain technology market, 2017 - 2030

10.3.10.2 France blockchain technology market, by type, 2017 - 2030

10.3.10.3 France blockchain technology market, by component, 2017 - 2030

10.3.10.4 France blockchain technology market, by offering, 2017 - 2030

10.3.10.5 France blockchain technology market, by application, 2017 - 2030

10.3.10.6 France blockchain technology market, by enterprise size, 2017 - 2030

10.3.10.7 France blockchain technology market, by end use, 2017 - 2030

10.4 Asia Pacific

10.4.1 Asia Pacific blockchain technology market, 2017 - 2030

10.4.2 Asia Pacific blockchain technology market, by type, 2017 - 2030

10.4.3 Asia Pacific blockchain technology market, by component, 2017 - 2030

10.4.4 Asia Pacific blockchain technology market, by offering, 2017 - 2030

10.4.5 Asia Pacific blockchain technology market, by application, 2017 - 2030

10.4.6 Asia Pacific blockchain technology market, by enterprise size, 2017 - 2030

10.4.7 Asia Pacific blockchain technology market, by end use, 2017 - 2030

10.4.8 China

10.4.8.1 China blockchain technology market, 2017 - 2030

10.4.8.2 China blockchain technology market, by type, 2017 - 2030

10.4.8.3 China blockchain technology market, by component, 2017 - 2030

10.4.8.4 China blockchain technology market, by offering, 2017 - 2030

10.4.8.5 China blockchain technology market, by application, 2017 - 2030

10.4.8.6 China blockchain technology market, by enterprise size, 2017 - 2030

10.4.8.7 China blockchain technology market, by end use, 2017 - 2030

10.4.9 Japan

10.4.9.1 Japan blockchain technology market, 2017 - 2030

10.4.9.2 Japan blockchain technology market, by type, 2017 - 2030

10.4.9.3 Japan blockchain technology market, by component, 2017 - 2030

10.4.9.4 Japan blockchain technology market, by offering, 2017 - 2030

10.4.9.5 Japan blockchain technology market, by application, 2017 - 2030

10.4.9.6 Japan blockchain technology market, by enterprise size, 2017 - 2030

10.4.9.7 Japan blockchain technology market, by end use, 2017 - 2030

10.4.10 Australia

10.4.10.1 Australia blockchain technology market, 2017 - 2030

10.4.10.2 Australia blockchain technology market, by type, 2017 - 2030

10.4.10.3 Australia blockchain technology market, by component, 2017 - 2030

10.4.10.4 Australia blockchain technology market, by offering, 2017 - 2030

10.4.10.5 Australia blockchain technology market, by application, 2017 - 2030

10.4.10.6 Australia blockchain technology market, by enterprise size, 2017 - 2030

10.4.10.7 Australia blockchain technology market, by end use, 2017 - 2030

10.4.11 India

10.4.11.1 India blockchain technology market, 2017 - 2030

10.4.11.2 India blockchain technology market, by type, 2017 - 2030

10.4.11.3 India blockchain technology market, by component, 2017 - 2030

10.4.11.4 India blockchain technology market, by offering, 2017 - 2030

10.4.11.5 India blockchain technology market, by application, 2017 - 2030

10.4.11.6 India blockchain technology market, by enterprise size, 2017 - 2030

10.4.11.7 India blockchain technology market, by end use, 2017 - 2030

10.4.12 South Korea

10.4.12.1 South Korea blockchain technology market, 2017 - 2030

10.4.12.2 South Korea blockchain technology market, by type, 2017 - 2030

10.4.12.3 South Korea blockchain technology market, by component, 2017 - 2030

10.4.12.4 South Korea blockchain technology market, by offering, 2017 - 2030

10.4.12.5 South Korea blockchain technology market, by application, 2017 - 2030

10.4.12.6 South Korea blockchain technology market, by enterprise size, 2017 - 2030

10.4.12.7 South Korea blockchain technology market, by end use, 2017 - 2030

10.5 South America

10.5.1 South America blockchain technology market, 2017 - 2030

10.5.2 South America blockchain technology market, by type, 2017 - 2030

10.5.3 South America blockchain technology market, by component, 2017 - 2030

10.5.4 South America blockchain technology market, by offering, 2017 - 2030

10.5.5 South America blockchain technology market, by application, 2017 - 2030

10.5.6 South America blockchain technology market, by enterprise size, 2017 - 2030

10.5.7 South America blockchain technology market, by end use, 2017 - 2030

10.5.8 Brazil

10.5.8.1 Brazil blockchain technology market, 2017 - 2030

10.5.8.2 Brazil blockchain technology market, by type, 2017 - 2030

10.5.8.3 Brazil blockchain technology market, by component, 2017 - 2030

10.5.8.4 Brazil blockchain technology market, by offering, 2017 - 2030

10.5.8.5 Brazil blockchain technology market, by application, 2017 - 2030

10.5.8.6 Brazil blockchain technology market, by enterprise size, 2017 - 2030

10.5.8.7 Brazil blockchain technology market, by end use, 2017 - 2030

10.6 MEA

10.6.1 MEA blockchain technology market, 2017 - 2030

10.6.2 MEA blockchain technology market, by type, 2017 - 2030

10.6.3 MEA blockchain technology market, by component, 2017 - 2030

10.6.4 MEA blockchain technology market, by offering, 2017 - 2030

10.6.5 MEA blockchain technology market, by application, 2017 - 2030

10.6.6 MEA blockchain technology market, by enterprise size, 2017 - 2030

10.6.7 MEA blockchain technology market, by end use, 2017 - 2030

10.6.8 Kingdom of Saudi Arabia (KSA)

10.6.8.1 Kingdom of Saudi Arabia (KSA) blockchain technology market, 2017 - 2030

10.6.8.2 Kingdom of Saudi Arabia (KSA) blockchain technology market, by type, 2017 - 2030

10.6.8.3 Kingdom of Saudi Arabia (KSA) blockchain technology market, by component, 2017 - 2030

10.6.8.4 Kingdom of Saudi Arabia (KSA) blockchain technology market, by offering, 2017 - 2030

10.6.8.5 Kingdom of Saudi Arabia (KSA) blockchain technology market, by application, 2017 - 2030

10.6.8.6 Kingdom of Saudi Arabia (KSA) blockchain technology market, by enterprise size, 2017 - 2030

10.6.8.7 Kingdom of Saudi Arabia (KSA) blockchain technology market, by end use, 2017 - 2030

10.6.9 UAE

10.6.9.1 UAE blockchain technology market, 2017 - 2030

10.6.9.2 UAE blockchain technology market, by type, 2017 - 2030

10.6.9.3 UAE blockchain technology market, by component, 2017 - 2030

10.6.9.4 UAE blockchain technology market, by offering, 2017 - 2030

10.6.9.5 UAE blockchain technology market, by application, 2017 - 2030

10.6.9.6 UAE blockchain technology market, by enterprise size, 2017 - 2030

10.6.9.7 UAE blockchain technology market, by end use, 2017 - 2030

10.6.10 South Africa

10.6.10.1 South Africa blockchain technology market, 2017 - 2030

10.6.10.2 South Africa blockchain technology market, by type, 2017 - 2030

10.6.10.3 South Africa blockchain technology market, by component, 2017 - 2030

10.6.10.4 South Africa blockchain technology market, by offering, 2017 - 2030

10.6.10.5 South Africa blockchain technology market, by application, 2017 - 2030

10.6.10.6 South Africa blockchain technology market, by enterprise size, 2017 - 2030

10.6.10.7 South Africa blockchain technology market, by end use, 2017 - 2030

Chapter 11 Competitive Analysis

11.1 Recent Developments & Impact Analysis, By Key Market Participants

11.2 Company Categorization

11.3 Vendor Landscape

11.3.1 Key company ranking/company market share analysis, 2022

11.4 Company Analysis Tools

11.4.1 Company market position analysis

11.4.2 Competitive dashboard analysis

Chapter 12 Competitive Landscape

12.1 IBM Corporation

12.1.1 Company overview

12.1.2 Product benchmarking

12.1.3 Strategic initiatives

12.2 Microsoft Corporation

12.2.1 Company overview

12.2.2 Product benchmarking

12.2.3 Strategic initiatives

12.3 The Linux Foundation

12.3.1 Company overview

12.3.2 Product benchmarking

12.3.3 Strategic initiatives

12.4 Blockchain Tech LTD

12.4.1 Company overview

12.4.2 Financial information

12.4.3 Product benchmarking

12.4.4 Strategic initiatives

12.5 Chain

12.5.1 Company overview

12.5.2 Financial information

12.5.3 Product benchmarking

12.5.4 Strategic initiatives

12.6 Circle Internet Financial, LLC

12.6.1 Company overview

12.6.2 Financial information

12.6.3 Product benchmarking

12.6.4 Strategic initiatives

12.7 Deloitte Touche Tohmatsu Limited

12.7.1 Company overview

12.7.2 Financial information

12.7.3 Product benchmarking

12.7.4 Strategic initiatives

12.8 Digital Asset Holdings, LLC

12.8.1 Company overview

12.8.2 Product benchmarking

12.8.3 Strategic initiatives

12.9 Global Arena Holding, Inc. (GAHC)

12.9.1 Company overview

12.9.2 Financial information

12.9.3 Product benchmarking

12.9.4 Strategic initiatives

12.10 Monax Labs

12.10.1 Company overview

12.10.2 Product benchmarking

12.10.3 Strategic initiatives

12.11 Ripple

12.11.1 Company overview

12.11.2 Product benchmarking

12.11.3 Strategic initiatives

List of Tables

TABLE 1 Blockchain technology market - Industry snapshot & key buying criteria, 2017 - 2030

TABLE 2 Global blockchain technology market, 2017 - 2030 (USD Million)

TABLE 3 Global blockchain technology market, by region, 2017 - 2030 (USD Million)

TABLE 4 Global blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 5 Global blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 6 Global blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 7 Global blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 8 Global blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 9 Global blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 10 Regulatory bodies adopting distributed ledger technologies

TABLE 11 Timeframe required to carry out a financial transaction

TABLE 12 List of other blockchain projects

TABLE 13 ICO launch cost structure

TABLE 14 Industry-wise app development cost

TABLE 15 Inputs

TABLE 16 Cost structure

TABLE 17 Average transaction cost

TABLE 18 Breakeven Analysis

TABLE 19 Public cloud blockchain technology market, 2017 - 2030 (USD Million)

TABLE 20 Public cloud blockchain technology market, by region, 2017 - 2030 (USD Million)

TABLE 21 Private cloud blockchain technology market, 2017 - 2030 (USD Million)

TABLE 22 Private cloud blockchain technology market, by region, 2017 - 2030 (USD Million)

TABLE 23 Hybrid cloud blockchain technology market, 2017 - 2030 (USD Million)

TABLE 24 Hybrid cloud blockchain technology market, by region, 2017 - 2030 (USD Million)

TABLE 25 Blockchain technology application & solution market, 2017 - 2030 (USD Million)

TABLE 26 Blockchain technology application & solution market, by region, 2017 - 2030 (USD Million)

TABLE 27 Blockchain technology infrastructure & protocol market, 2017 - 2030 (USD Million)

TABLE 28 Blockchain technology infrastructure & protocol market, by region, 2017 - 2030 (USD Million)

TABLE 29 Blockchain technology middleware market, 2017 - 2030 (USD Million)

TABLE 30 Blockchain technology middleware market, by region, 2017 - 2030 (USD Million)

TABLE 31 Blockchain technology platform market, 2017 - 2030 (USD Million)

TABLE 32 Blockchain technology platform market, by region, 2017 - 2030 (USD Million)

TABLE 33 Blockchain technology services market, 2017 - 2030 (USD Million)

TABLE 34 Blockchain technology services market, by region, 2017 - 2030 (USD Million)

TABLE 35 Blockchain technology market in digital identity, 2017 - 2030 (USD Million)

TABLE 36 Blockchain technology market in digital identity, by region, 2017 - 2030 (USD Million)

TABLE 37 Blockchain technology market in exchanges, 2017 - 2030 (USD Million)

TABLE 38 Blockchain technology market in exchanges, by region, 2017 - 2030 (USD Million)

TABLE 39 Blockchain technology market in payments, 2017 - 2030 (USD Million)

TABLE 40 Blockchain technology market in payments, by region, 2017 - 2030 (USD Million)

TABLE 41 Blockchain technology market in smart contracts, 2017 - 2030 (USD Million)

TABLE 42 Blockchain technology market in smart contracts, by region, 2017 - 2030 (USD Million)

TABLE 43 Blockchain technology market in supply chain management, 2017 - 2030 (USD Million)

TABLE 44 Blockchain technology market in supply chain management, by region, 2017 - 2030 (USD Million)

TABLE 45 Blockchain technology market in other applications, 2017 - 2030 (USD Million)

TABLE 46 Blockchain technology market in other applications, by region, 2017 - 2030 (USD Million)

TABLE 47 Blockchain technology market in large enterprises, 2017 - 2030 (USD Million)

TABLE 48 Blockchain technology market in large enterprises, by region, 2017 - 2030 (USD Million)

TABLE 49 Blockchain technology market in small & medium enterprises, 2017 - 2030 (USD Million)

TABLE 50 Blockchain technology market in small & medium enterprises, by region, 2017 - 2030 (USD Million)

TABLE 51 Blockchain technology market in banking & financial services, 2017 - 2030 (USD Million)

TABLE 52 Blockchain technology market in banking & financial services, by region, 2017 - 2030 (USD Million)

TABLE 53 Blockchain technology market in government, 2017 - 2030 (USD Million)

TABLE 54 Blockchain technology market in government, by region, 2017 - 2030 (USD Million)

TABLE 55 Blockchain technology market in healthcare, 2017 - 2030 (USD Million)

TABLE 56 Blockchain technology market in healthcare, by region, 2017 - 2030 (USD Million)

TABLE 57 Blockchain technology market in media & entertainment, 2017 - 2030 (USD Million)

TABLE 58 Blockchain technology market in media & entertainment, by region, 2017 - 2030 (USD Million)

TABLE 59 Blockchain technology market in retail & eCommerce, 2017 - 2030 (USD Million)

TABLE 60 Blockchain technology market in retail & eCommerce, by region, 2017 - 2030 (USD Million)

TABLE 61 Blockchain technology market in transportation & logistics, 2017 - 2030 (USD Million)

TABLE 62 Blockchain technology market in transportation & logistics, by region, 2017 - 2030 (USD Million)

TABLE 63 Blockchain technology market in travel, 2017 - 2030 (USD Million)

TABLE 64 Blockchain technology market in travel, by region, 2017 - 2030 (USD Million)

TABLE 65 Blockchain technology market in manufacturing, 2017 - 2030 (USD Million)

TABLE 66 Blockchain technology market in manufacturing, by region, 2017 - 2030 (USD Million)

TABLE 67 Blockchain technology market in IT & telecom, 2017 - 2030 (USD Million)

TABLE 68 Blockchain technology market in IT & telecom, by region, 2017 - 2030 (USD Million)

TABLE 69 Blockchain technology market in real estate & construction, 2017 - 2030 (USD Million)

TABLE 70 Blockchain technology market in real estate & construction, by region, 2017 - 2030 (USD Million)

TABLE 71 Blockchain technology market in energy & utilities, 2017 - 2030 (USD Million)

TABLE 72 Blockchain technology market in energy & utilities, by region, 2017 - 2030 (USD Million)

TABLE 73 Blockchain technology market in other end uses, 2017 - 2030 (USD Million)

TABLE 74 Blockchain technology market in other end uses, by region, 2017 - 2030 (USD Million)

TABLE 75 North America blockchain technology market, 2017 - 2030 (USD Million)

TABLE 76 North America blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 77 North America blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 78 North America blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 79 North America blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 80 North America blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 81 North America blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 82 U.S. blockchain technology market, 2017 - 2030 (USD Million)

TABLE 83 U.S. blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 84 U.S. blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 85 U.S. blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 86 U.S. blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 87 U.S. blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 88 U.S. blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 89 Canada blockchain technology market, 2017 - 2030 (USD Million)

TABLE 90 Canada blockchain technology market, by type, 2017 - 2030 (USD million)

TABLE 91 Canada blockchain technology market, by component, 2017 - 2030 (USD million)

TABLE 92 Canada blockchain technology market, by offering, 2017 - 2030 (USD million)

TABLE 93 Canada blockchain technology market, by application, 2017 - 2030 (USD million)

TABLE 94 Canada Blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 95 Canada blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 96 Mexico blockchain technology market, 2017 - 2030 (USD Million)

TABLE 97 Mexico blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 98 Mexico blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 99 Mexico blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 100 Mexico blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 101 Mexico blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 102 Mexico blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 103 Europe blockchain technology market, 2017 - 2030 (USD Million)

TABLE 104 Europe blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 105 Europe blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 106 Europe blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 107 Europe blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 108 Europe blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 109 Europe blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 110 U.K. blockchain technology market, 2017 - 2030 (USD Million)

TABLE 111 U.K. blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 112 U.K. blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 113 U.K. blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 114 U.K. blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 115 U.K. blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 116 U.K. blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 117 Germany blockchain technology market, 2017 - 2030 (USD Million)

TABLE 118 Germany blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 119 Germany blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 120 Germany blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 121 Germany blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 122 Germany blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 123 Germany blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 124 France blockchain technology market, 2017 - 2030 (USD Million)

TABLE 125 France blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 126 France blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 127 France blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 128 France blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 129 France blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 130 France blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 131 Asia Pacific blockchain technology market, 2017 - 2030 (USD Million)

TABLE 132 Asia Pacific blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 133 Asia Pacific blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 134 Asia Pacific blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 135 Asia Pacific blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 136 Asia Pacific blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 137 Asia Pacific blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 138 China blockchain technology market, 2017 - 2030 (USD Million)

TABLE 139 China blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 140 China blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 141 China blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 142 China blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 143 China blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 144 China blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 145 Japan blockchain technology market, 2017 - 2030 (USD Million)

TABLE 146 Japan blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 147 Japan blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 148 Japan blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 149 Japan blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 150 Japan blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 151 Japan blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 152 Australia blockchain technology market, 2017 - 2030 (USD Million)

TABLE 153 Australia blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 154 Australia blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 155 Australia blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 156 Australia blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 157 Australia blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 158 Australia blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 159 India blockchain technology market, 2017 - 2030 (USD Million)

TABLE 160 India blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 161 India blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 162 India blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 163 India blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 164 India blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 165 India blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 166 South Korea blockchain technology market, 2017 - 2030 (USD Million)

TABLE 167 South Korea blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 168 South Korea blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 169 South Korea blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 170 South Korea blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 171 South Korea blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 172 South Korea blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 173 South America blockchain technology market, 2017 - 2030 (USD Million)

TABLE 174 South America blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 175 South America blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 176 South America blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 177 South America blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 178 South America blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 179 South America blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 180 Brazil blockchain technology market, 2017 - 2030 (USD Million)

TABLE 181 Brazil blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 182 Brazil blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 183 Brazil blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 184 Brazil blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 185 Brazil blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 186 Brazil blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 187 MEA blockchain technology market, 2017 - 2030 (USD Million)

TABLE 188 MEA blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 189 MEA blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 190 MEA blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 191 MEA blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 192 MEA blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 193 MEA blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 194 Kingdom of Saudi Arabia (KSA) blockchain technology market, 2017 - 2030 (USD Million)

TABLE 195 Kingdom of Saudi Arabia (KSA) blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 196 Kingdom of Saudi Arabia (KSA) blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 197 Kingdom of Saudi Arabia (KSA) blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 198 Kingdom of Saudi Arabia (KSA) blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 199 Kingdom of Saudi Arabia (KSA) blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 200 Kingdom of Saudi Arabia (KSA) blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 201 UAE blockchain technology market, 2017 - 2030 (USD Million)

TABLE 202 UAE blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 203 UAE blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 204 UAE blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 205 UAE blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 206 UAE blockchain technology market, by enterprise size, 2017 - 2030 (USD Million)

TABLE 207 UAE blockchain technology market, by end use, 2017 - 2030 (USD Million)

TABLE 208 South Africa blockchain technology market, 2017 - 2030 (USD Million)

TABLE 209 South Africa blockchain technology market, by type, 2017 - 2030 (USD Million)

TABLE 210 South Africa blockchain technology market, by component, 2017 - 2030 (USD Million)

TABLE 211 South Africa blockchain technology market, by offering, 2017 - 2030 (USD Million)

TABLE 212 South Africa blockchain technology market, by application, 2017 - 2030 (USD Million)

TABLE 213 South Africa blockchain technology market, by enterprise size, 2017 - 2030 (USDs Million)

TABLE 214 South Africa blockchain technology market, by end use, 2017 - 2030 (USD Million)

List of Figures

FIG. 1 Market segmentation and scope

FIG. 2 Global blockchain technology market, 2023 - 2030 (USD Million)

FIG. 3 Blockchain technology market - Value chain analysis

FIG. 4 Blockchain technology market - Market dynamics

FIG. 5 Blockchain technology market - Key market driver impact

FIG. 6 Market capitalization of internet-based currencies, July 2019 (USD Billion)

FIG. 7 Blockchain technology market - Key market challenge impact

FIG. 8 Blockchain technology market - Key market opportunity impact

FIG. 9 Blockchain technology market - Market adoption timelines

FIG. 10 Global FinTech investment scenario

FIG. 11 Blockchain technology market - Porter’s five forces analysis

FIG. 12 Blockchain technology market - PESTEL analysis

FIG. 13 Economic potential of blockchain by sectors

FIG. 14 Blockchain adoption by industry, 2018

FIG. 15 Blockchain venture capital funding and deals

FIG. 16 Blockchain funding deals by industry, 2018

FIG. 17 Blockchain technology market, by type, 2022

FIG. 18 Blockchain technology market, by public cloud, 2022

FIG. 19 Blockchain technology market, by private cloud, 2022

FIG. 20 Blockchain technology market, by hybrid cloud, 2022

FIG. 21 Blockchain technology market, by component, 2022

FIG. 22 Blockchain technology market, by application & solution, 2022

FIG. 23 Blockchain technology market, by infrastructure & protocol, 2022

FIG. 24 Blockchain technology market, by middleware, 2022

FIG. 25 Blockchain technology market, by offering, 2022

FIG. 26 Blockchain technology market, by platform, 2022

FIG. 27 Blockchain technology market, by services, 2022

FIG. 28 Blockchain technology market, by application, 2022

FIG. 29 Blockchain technology market, by digital identity, 2022

FIG. 30 Blockchain technology market, by exchanges, 2022

FIG. 31 Blockchain technology market, by payments, 2022

FIG. 32 Blockchain technology market, by smart contracts, 2022

FIG. 33 Blockchain technology market, by supply chain management, 2022

FIG. 34 Blockchain technology market, by others, 2022

FIG. 35 Blockchain technology market, by enterprise size, 2022

FIG. 36 Blockchain technology market, by large enterprises, 2022

FIG. 37 Blockchain technology market, by small & medium enterprises, 2022

FIG. 38 Blockchain technology market, by end use, 2022

FIG. 39 Blockchain technology market, by banking & financial services, 2022

FIG. 40 Blockchain technology market, by government, 2022

FIG. 41 Blockchain technology market, by healthcare, 2022

FIG. 42 Blockchain technology market, by media & entertainment, 2022

FIG. 43 Blockchain technology market, by retail & e-commerce, 2022

FIG. 44 Blockchain technology market, by transportation & logistics, 2022

FIG. 45 Blockchain technology market, by travel, 2022

FIG. 46 Blockchain technology market, by manufacturing, 2022

FIG. 47 Blockchain technology market, by IT & telecom, 2022

FIG. 48 Blockchain technology market, by real estate & construction, 2022

FIG. 49 Blockchain technology market, by energy & utilities, 2022

FIG. 50 Blockchain technology market, by others, 2022

FIG. 51 Blockchain technology market, by region, 2022

FIG. 52 Blockchain technology market - Regional takeaways

FIG. 53 North America blockchain technology market - Key takeaways

FIG. 54 U.S. blockchain technology market

FIG. 55 Canada blockchain technology market

FIG. 56 Mexico blockchain technology market

FIG 57 Europe blockchain technology market - Key takeaways

FIG. 58 U.K. blockchain technology market

FIG. 59 Germany blockchain technology market

FIG. 60 France blockchain technology market

FIG. 61 Asia Pacific blockchain technology market - Key takeaways

FIG. 62 China blockchain technology market

FIG. 63 India blockchain technology market

FIG. 64 Japan blockchain technology market

FIG. 65 South Korea blockchain technology market

FIG. 66 Australia blockchain technology market

FIG. 67 South America blockchain technology market - Key takeaways

FIG. 68 Brazil blockchain technology market

FIG. 69 MEA blockchain technology market - Key takeaways

FIG. 70 KSA blockchain technology market

FIG. 71 UAE blockchain technology market

FIG. 72 South Africa blockchain technology market

FIG. 73 Blockchain technology market - Key company ranking analysis, 2022

FIG. 74 Blockchain technology market - Company market position analysis, 2022

FIG. 75 Blockchain technology market - Competitive dashboard analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Blockchain Technology Type Outlook (Revenue, USD Million, 2017 - 2030)

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Blockchain Technology Component Outlook (Revenue, USD Million, 2017 - 2030)

- Application & Solution

- Infrastructure & Protocols

- Middleware

- Blockchain Technology Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Platform

- Services

- Blockchain Technology Application Outlook (Revenue, USD Million, 2017 - 2030)

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- Blockchain Technology Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Blockchain Technology End Use Outlook (Revenue, USD Million, 2017 - 2030)

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- Blockchain Technology Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- North America Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- North America Blockchain Technology Market, by Offering

- Platform

- Services

- North America Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- North America Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- North America Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- U.S.

- U.S. Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- U.S. Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- U.S. Blockchain Technology Market, by Offering

- Platform

- Services

- U.S. Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- U.S. Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- U.S. Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- U.S. Blockchain Technology Market, by Type

- Canada

- Canada Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Canada Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- Canada Blockchain Technology Market, by Offering

- Platform

- Services

- Canada Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- Canada Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- Canada Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- Canada Blockchain Technology Market, by Type

- Mexico

- Mexico Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Mexico Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- Mexico Blockchain Technology Market, by Offering

- Platform

- Services

- Mexico Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- Mexico Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- Mexico Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- Mexico Blockchain Technology Market, by Type

- North America Blockchain Technology Market, by Type

- Europe

- Europe Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Europe Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- Europe Blockchain Technology Market, by Offering

- Platform

- Services

- Europe Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- Europe Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- Europe Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- U.K.

- U.K. Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- U.K. Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- U.K. Blockchain Technology Market, by Offering

- Platform

- Services

- U.K. Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- U.K. Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- U.K. Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- U.K. Blockchain Technology Market, by Type

- Germany

- Germany Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Germany Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- Germany Blockchain Technology Market, by Offering

- Platform

- Services

- Germany Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- Germany Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- Germany Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- Germany Blockchain Technology Market, by Type

- France

- France Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- France Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- France Blockchain Technology Market, by Offering

- Platform

- Services

- France Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- France Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- France Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- France Blockchain Technology Market, by Type

- Europe Blockchain Technology Market, by Type

- Asia Pacific

- Asia Pacific Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Asia Pacific Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- Asia Pacific Blockchain Technology Market, by Offering

- Platform

- Services

- Asia Pacific Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- Asia Pacific Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- Asia Pacific Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- China

- China Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- China Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- China Blockchain Technology Market, by Offering

- Platform

- Services

- China Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- China Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- China Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- China Blockchain Technology Market, by Type

- Japan

- Japan Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Japan Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- Japan Blockchain Technology Market, by Offering

- Platform

- Services

- Japan Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- Japan Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- Japan Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- Japan Blockchain Technology Market, by Type

- Australia

- Australia Blockchain Technology Market, by Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Australia Blockchain Technology Market, by Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

- Australia Blockchain Technology Market, by Offering

- Platform

- Services

- Australia Blockchain Technology Market, by Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

- Australia Blockchain Technology Market, by Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

- Australia Blockchain Technology Market, by End Use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

- Australia Blockchain Technology Market, by Type

- India