- Home

- »

- Next Generation Technologies

- »

-

Cryptocurrency Market Size & Share, Industry Report, 2033GVR Report cover

![Cryptocurrency Market Size, Share & Trends Report]()

Cryptocurrency Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Process (Mining, Transaction), By Type (Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ripple), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-979-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryptocurrency Market Summary

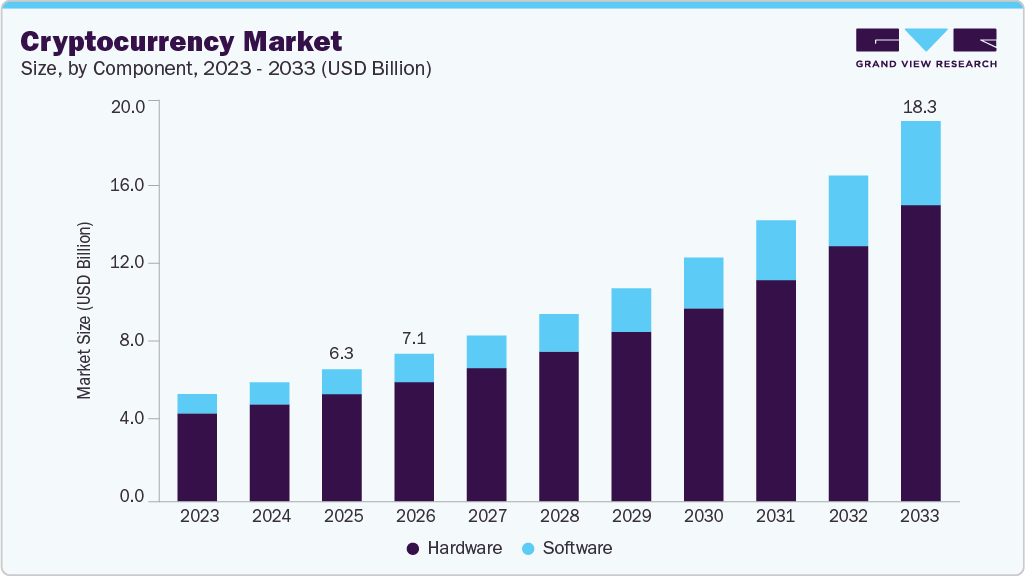

The global cryptocurrency market size is estimated at USD 6.34 billion in 2025 and is projected to reach USD 18.26 billion by 2033, growing at a CAGR of 14.5% from 2026 to 2033. The increasing adoption of distributed ledger technology is expected to drive the growth of the cryptocurrency industry during the forecast period.

Key Market Trends & Insights

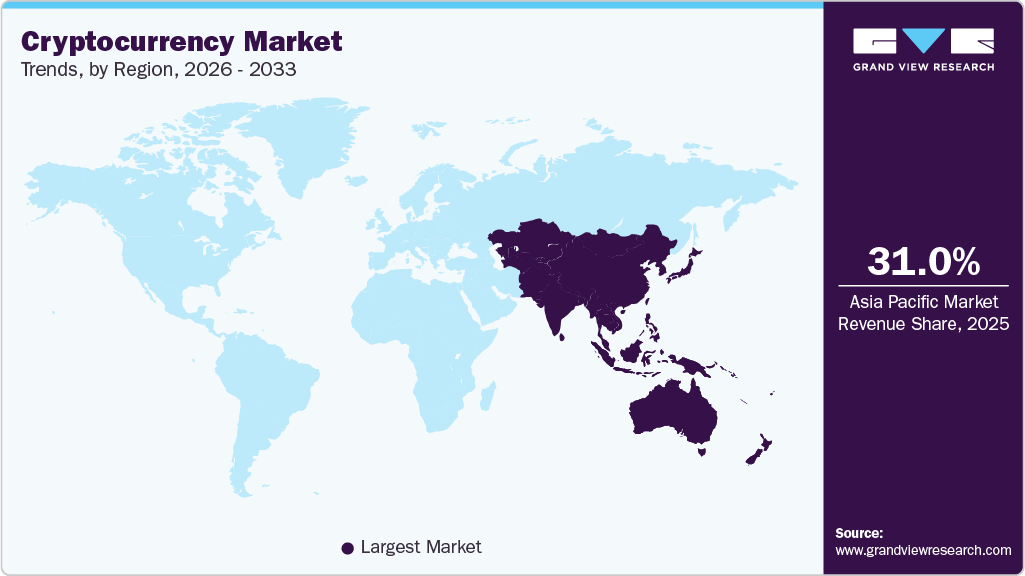

- Asia Pacific dominated the global cryptocurrency market with the largest revenue share of 31.0% in 2025.

- The cryptocurrency industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By component, the hardware segment led the market with the largest revenue share of 81.2% in 2025.

- By hardware, the application-specific integrated circuit segment accounted for the largest market revenue share in 2025.

- By software, the exchange software accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.34 Billion

- 2033 Projected Market Size: USD 18.26 Billion

- CAGR (2026-2033): 14.5%

- Asia Pacific: Largest market in 2025

Moreover, increasing usage of cryptocurrencies for cross-border remittances is expected to fuel market expansion due to the reduction in consumer fees and exchange charges. Recent developments in Artificial Intelligence (AI) are expected to have a huge impact on the cryptocurrency industry. The rising popularity of AI-based cryptocurrency platforms has inspired several businesses to focus on the development of AI technology. For instance, in November 2024, VanEck launched a new exchange-traded note (ETN) focused on the Sui blockchain, expanding access to decentralized finance (DeFi) investments for European investors. This ETN is listed on Euronext Paris and Amsterdam, enabling investors to gain exposure to the SUI token without the need to purchase or hold it directly. The Sui blockchain, developed by Mysten Labs, is designed for high transaction speeds and scalability, enabling multiple transactions to be processed simultaneously, thereby addressing the limitations faced by older blockchains like Bitcoin and Ethereum.

The growing prominence of cryptocurrency as a decentralized asset class has drawn significant investment from private venture firms, contributing to the market's ongoing expansion. In November 2024, the cryptocurrency industry reached a remarkable milestone, with its total market capitalization hitting a record high of USD 3.2 trillion, according to CoinGecko. This surge in value reflects a growing interest and investment in various cryptocurrencies, driven by factors such as increased institutional adoption, advancements in blockchain technology, and the expansion of decentralized finance (DeFi) platforms.

One of the key factors driving the growth of digital currency is the increasing number of businesses that now accept cryptocurrency as a legitimate payment method. In addition, the adoption of digital currency by major corporations such as Tesla Inc. and MasterCard Inc. is anticipated to boost industry expansion. For instance, in November 2021, MasterCard Inc., a financial services company, allowed its network partners to enable their customers to purchase, trade, and hold digital currency using a digital wallet. Moreover, the business offered digital currency as a reward for the clients who participated in loyalty programs.

Government bodies across the globe are focusing on devising laws to regulate cryptocurrencies. The European Union has developed the Markets in Crypto Assets (MiCA) law to create a legal framework specifically designed for the crypto asset market. Additionally, in February 2022, the Indian government took a step towards legalizing cryptocurrency by announcing a 30.0% tax on any income generated from the transfer of digital currencies. Cryptocurrencies, such as Bitcoin, have been gaining traction in high-inflation countries, including Argentina, Zimbabwe, and Brazil, as their local currencies devalue.

Although Bitcoin is a cutting-edge financial technology, its growth is expected to be constrained by the lack of regulations and a unified standard for exchanging digital currency. Regulators from around the world are concerned about the use of cryptocurrencies for illicit purposes, which poses a significant barrier to the market's expansion. However, law enforcement agencies are making efforts to seize illegally acquired cryptocurrency, which bodes well for the market growth.

Component Insights

The hardware segment led the market with the largest revenue share of 81.2% in 2025. Factors such as higher processing speed and reduced power consumption of cryptocurrency miners are expected to drive the growth of the hardware segment. The shifting consumer expectations have led many businesses to develop bitcoin mining hardware. Hardware such as graphics processing units, which are swift, effective, and stable, is needed to create mining devices. Such factors are projected to generate considerable growth prospects for the industry during the forecast period.

The software segment is expected to grow at the fastest CAGR during the forecast period. The growth can be attributed to the increasing demand for software designed for the exchange and mining of cryptocurrencies. The development of software to manage the massive volume of data generated by cryptocurrencies is expected to support the segment's growth. Furthermore, the growing demand for cryptocurrencies around the globe has increased the demand for crypto wallets and crypto exchange software, which is expected to augment the segment growth.

Hardware Insights

The application-specific integrated circuit segment accounted for the largest share in 2025. Application-specific integrated circuits (ASICs) are electronic circuits designed explicitly for mining virtual currencies such as Bitcoin, Litecoin, and Ethereum. Several companies are adopting ASIC miners to mine cryptocurrency, with the growing need for low-energy consumption devices for mining crypto. Additionally, ASIC requires less maintenance and enable efficient use of energy, which is expected to support the growth of the segment.

The graphics processing unit segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to the increasing demand for GPUs for cryptocurrency mining, as they offer high processing speeds and consume less power. Several cryptocurrency miners are encouraged to consider using a GPU for cryptocurrency mining.

Software Insights

The exchange software segment accounted for the largest market revenue share in 2025. The use of exchange software is essential for completing cryptocurrency transactions since it facilitates the conversion of cryptocurrency coins to fiat currencies and vice versa. The growing development of crypto exchange software to provide seamless trading of cryptocurrency is anticipated to aid the segment's growth. For instance, in March 2021, Openware Inc., a Fintech software company, launched a crypto-exchange software platform, Exchange Liquidity Network (ELN), named OpenDAX3. It is designed to provide enhanced exchange services, facilitating the trading of cryptocurrencies, assets, and security tokens.

The wallet segment is expected to register at the fastest CAGR during the forecast period. The growth of the segment can be attributed to the increased usage of cryptocurrency wallets, as they offer consumers online tools for securely managing and storing blockchain assets. The ability to store and exchange various cryptocurrencies, including Bitcoin, Litecoin, and Ethereum, is made possible via multi-asset cryptocurrency wallets. In addition, several companies that offer cryptocurrency wallet services are focusing on creating crypto wallets that enable users to send or receive cryptocurrencies through mobile applications. For instance, in January 2022, Robin Hood, a cryptocurrency wallet service provider, launched its upcoming beta version of cryptocurrency wallets. The wallet is designed to enable its customers to trade, send, and receive cryptocurrencies using the Robinhood application.

Process Insights

The mining segment accounted for the largest market revenue share in 2025. Blockchain transactions are validated and verified as part of the mining process. New coins are added to the current supply chain through mining activities. To provide cryptocurrency miners with a better mining experience, many businesses around the world are concentrating on implementing and building crypto miner farms. These crypto miner farms are well-positioned to run their mining operations, as they receive electricity from the public grid.

The transaction segment is expected to register at the fastest CAGR during the forecast period. The need for high-performance transaction services among organizations is rising as a result of the rapid development of technological advancements such as digitization and automation. As a result, many players worldwide are concentrating on creating Wallet as a Service (WaaS) to offer safe digital wallet choices for the businesses to carry out their transactions effectively to meet the demand for high-performance transactions. For instance, in November 2021, Crypto APIs, a blockchain development company, launched Wallet as a Service (WaaS) in partnership with Sepior, a Fintech company. WaaS was created to provide small & medium businesses, institutions, and enterprises with a secure and reliable multicurrency digital wallet to carry out cryptographic transactions.

Type Insights

The bitcoin segment accounted for the largest market revenue share in 2025. Bitcoin is a virtual currency operating as a decentralized alternative payment method. The emergence of Bitcoin Exchange Traded Funds (ETFs) is anticipated to surge the volume of global bitcoin trades during the forecast period. For instance, in May 2022, the Purpose Bitcoin ETF in Canada experienced the largest inflow of USD 207 million.

Ethereum is projected to grow at the fastest CAGR over the forecast period. Ethereum is an open-source software platform that enables users to develop a wide range of decentralized applications. Due to the proliferation of new projects using the Ethereum network, there has been a considerable increase in network traffic, which is directly related to the expansion of the Ethereum market. Smart contracts were initially applied to algorithm-based financial transactions with Ethereum.

On the blockchain network, smart contracts are written instructions that facilitate the execution of transactions. As Ethereum upgrades to Ethereum 2.0, which requires less energy and is less expensive to mine, the first-mover advantage is anticipated to support the growth of the cryptocurrency during the forecast period.

End-use Insights

The trading segment led the market with the largest revenue share of 28.72% in 2025. Trading in cryptocurrencies enables users to purchase, sell, and view their asset balances, as well as obtain deposit addresses. Several browser technology providers are forming alliances with blockchain technology firms to enable their clients to trade cryptocurrencies easily.

The retail & e-commerce segment is projected to grow at the fastest CAGR over the forecast period. The rising number of retail & e-commerce companies that are accepting cryptocurrencies as an official payment method is one of the major factors driving segment growth. Several cryptocurrency payment processors are forming strategic partnerships with e-commerce companies to boost the adoption of digital currencies for payments.

Regional Insights

The North America cryptocurrency market is anticipated to grow at a significant CAGR during the forecast period. The presence and concentration of prominent cryptocurrency farms such as Riot Blockchain, Marathon Digital, and Bitfarm make North America a promising market for cryptocurrency mining. Moreover, the increasing adoption of cryptocurrencies used for payments in malls and restaurants has created more growth opportunities for crypto miners in the region, which, in turn, is boosting the cryptocurrency industry in North America.

U.S. Cryptocurrency Market Trends

The cryptocurrency market U.S. accounted for the largest market revenue share in North America in 2025. Major financial institutions and corporations in the U.S. are increasingly recognizing the potential of cryptocurrencies as a viable asset class. Investment firms, banks, and asset managers are including cryptocurrencies in their portfolios, driven by growing client demand and the desire to diversify investment offerings. This mainstream acceptance in the country drives growth of the cryptocurrency industry.

Europe Cryptocurrency Market Trends

The cryptocurrency market in Europe was identified as a lucrative region in 2025. The progressive regulatory landscape is driving the growth of the market. The European Union has introduced comprehensive regulations, such as the Markets in Crypto-Assets Regulation (MiCA), aimed at standardizing and legitimizing the use of cryptocurrencies across member countries. These regulations bring greater transparency and security, making it easier for companies to operate while increasing investors' confidence.

The UK cryptocurrency market is expected to grow at a rapid CAGR during the forecast period, due to the increasing interest of institutions in the cryptocurrency industry. Several prominent financial institutions and fintech companies are incorporating crypto assets into their portfolios, recognizing digital currencies as an alternative investment and a potential hedge against market volatility.

Asia Pacific Cryptocurrency Market Trends

Asia Pacific dominated the global cryptocurrency market with the largest revenue share of 31.0% in 2025 and is expected to grow at the fastest CAGR from 2026 to 2033. The presence of cryptocurrency-related startups and projects in the region drives the growth of the market. Countries such as South Korea and Hong Kong are investing heavily in blockchain research and development, and have developed infrastructure that facilitates the use of cryptocurrencies for various applications, including payments and smart contracts. This active innovation ecosystem, combined with strategic investments in cryptocurrency mining, is driving the growth of the cryptocurrency industry in the region.

The cryptocurrency market in Japan is expected to experience rapid growth in the coming years, driven by an increasing emphasis on blockchain and cryptocurrency innovation. The government actively promoted the development of blockchain technology through various initiatives and partnerships with private companies, fostering a favorable environment for crypto innovation.

The China cryptocurrency market held a substantial market share in 2025, owing to its dominating position in mining hardware production. Chinese manufacturers, particularly companies like Bitmain, are major suppliers of mining equipment used globally. The country’s advanced manufacturing capabilities and economies of scale allow Chinese companies to produce high-performance hardware that is in high demand for cryptocurrency mining operations across the globe, thereby driving the growth of the market.

Key Cryptocurrency Company Insights

Some of the key companies in the cryptocurrency industry include Advanced Micro Devices, IncBinance,Bit fury Group Limited, NVIDIA Corporation, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Advanced Micro Devices is a semiconductor company with a significant presence in the cryptocurrency industry, primarily through its production of high-performance graphics processing units. Their Radeon series of GPUs have gained a reputation among cryptocurrency miners for their ability to efficiently handle the complex calculations needed to mine digital currencies such as Bitcoin, Ethereum, and other altcoins. These GPUs are built to deliver excellent performance when it comes to parallel processing, which is essential for the high demands of cryptocurrency mining.

-

Binance is a cryptocurrency exchange ecosystem. Various solutions such as Binance Exchange, Binance Academy, Binance Charity, Binance Info, Binance Labs, Binance Launchpad, Binance Research, Binance Trust Wallet, and Binance chain come under the company Binance Holdings Ltd. All these solutions cater to different needs and requirements, which enable the smooth functioning and use of blockchain and cryptocurrency.

Key Cryptocurrency Companies:

The following are the leading companies in the cryptocurrency market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Binance

- Bit fury Group Limited

- Bit Go, Inc.

- Bit Main Technologies Holding Company

- Intel Corporation

- NVIDIA Corporation

- Ripple

- Xapo Holdings Limited

- Xilinx, Inc.

Recent Developments

-

In December 2025, Binance launched Binance Junior, a new parent-supervised crypto savings account for children aged 6-17 years. The account allows parents to open, monitor, and control all activities, including funding the account and disabling it at any time. Children (13 years and older, depending on local rules) can initiate transfers within strict daily limits. Still, trading and transfers to non-parent adults are restricted for safety. Savings in the Junior account grow through Binance Flexible Simple Earn, ensuring exposure to crypto without trading risks. Binance aims to help families introduce children to financial literacy and digital-asset savings, while emphasising that crypto markets remain highly volatile and risky.

-

In November 2024, Ingenico and Crypto.com announced a significant partnership aimed at revolutionizing payment solutions for merchants worldwide by enabling cryptocurrency transactions. This collaboration introduced a "plug-and-play" system that enables Ingenico's merchants to seamlessly accept cryptocurrency payments while ensuring that funds are settled in local currencies, such as GBP, EUR, AUD, and USD, thereby mitigating the currency risk associated with cryptocurrency volatility.

-

In November 2024, Coinbase launched an Engineering Hub in Singapore in partnership with the Singapore Economic Development Board (EDB), aiming to enhance the local developer ecosystem and support blockchain innovation in the region. This initiative is designed to empower local engineers by providing them with essential resources and training, thereby fostering innovation and advancing Singapore's capabilities in blockchain technology.

Cryptocurrency Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.08 billion

Revenue forecast in 2033

USD 18.26 billion

Growth rate

CAGR of 14.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, process, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Advanced Micro Devices, Inc.; Binance; Bit fury Group Limited; Bit Go, Inc.; Bit Main Technologies Holding Company; Intel Corporation; NVIDIA Corporation; Ripple; Xapo Holdings Limited; Xilinx, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryptocurrency Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cryptocurrency market report based on component, process, type, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Central Processing Unit

-

Graphics Processing Unit

-

Application-Specific Integrated Circuit

-

Field Programmable Gate Array

-

-

Software

-

Mining Software

-

Exchange Software

-

Wallet

-

Payment

-

Others

-

-

-

Process Outlook (Revenue, USD Billion, 2021 - 2033)

-

Mining

-

Transaction

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Bitcoin

-

Bitcoin Cash

-

Ethereum

-

Litecoin

-

Ripple

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Banking

-

Gaming

-

Government

-

Healthcare

-

Retail & E-commerce

-

Trading

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cryptocurrency market size was estimated at USD 6.34 billion in 2025 and is expected to reach USD 7.08 billion in 2026.

b. The global cryptocurrency market is expected to grow at a compound annual growth rate of 14.5% from 2026 to 2033 to reach USD 18.26 billion by 2033.

b. The Asia Pacific dominated the cryptocurrency market with a share of 31.0% in 2025. The presence of cryptocurrency mining companies such as Ebang International Holdings, Inc., Bitmain Technologies Limited., Canaan, Inc., and others are expected to support the market growth in the region.

b. Some key players operating in the cryptocurrency market include Advanced Micro Devices, Inc; Binance; Bitfury Group Limited, BitGo, Inc.; Intel Corporation; NVIDIA Corporation; Ripple; Xapo Holdings Limited, Xilinx, Inc.

b. Key factors that are driving the market growth include high charges of cross-border remittance and transparency of distributed ledger technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.