- Home

- »

- Medical Devices

- »

-

Blood Glucose Monitoring Devices Market Size Report, 2030GVR Report cover

![Blood Glucose Monitoring Devices Market Size, Share & Trends Report]()

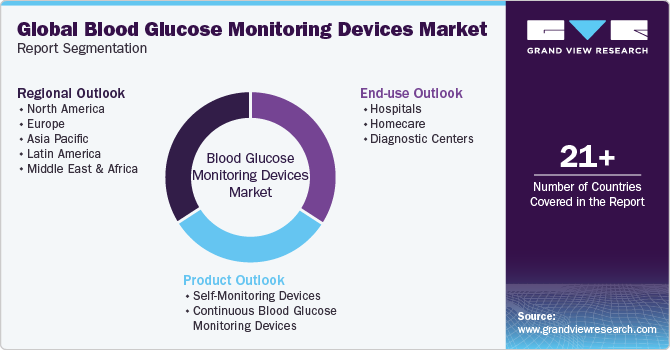

Blood Glucose Monitoring Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Self-Monitoring Devices, Continuous Glucose Monitoring Devices), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-688-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Glucose Monitoring Market Summary

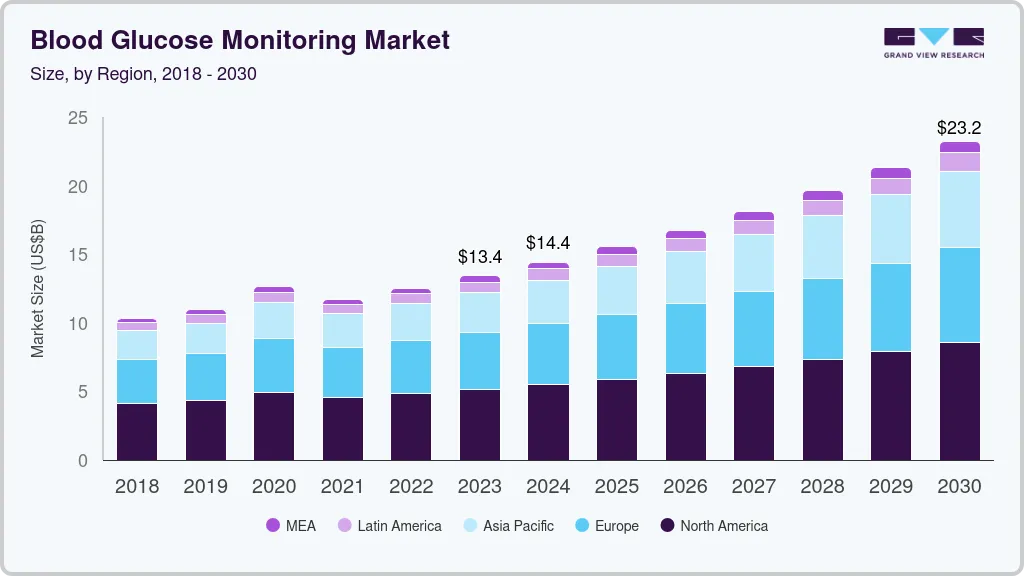

The global blood glucose monitoring market size was estimated at USD 13.43 billion in 2023 and is projected to reach USD 23.21 billion by 2030, growing at a CAGR of 8.25% from 2024 to 2030. The market is primarily influenced by the growing prevalence of diabetes and growing elderly population susceptible to conditions like diabetes.

Key Market Trends & Insights

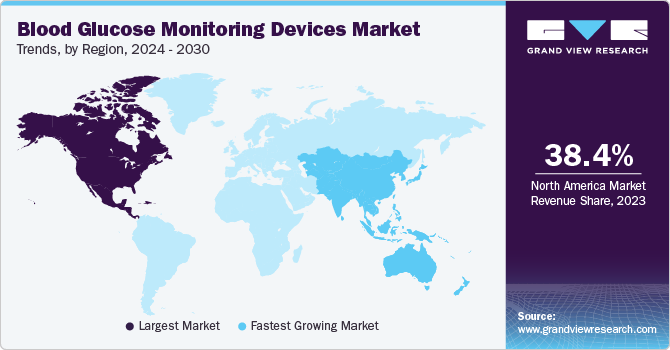

- North America led the market and accounted for a share of 38.44% in 2023.

- The blood glucose monitoring devices market in the U.S. held the largest share in 2023

- By product, the self-monitoring blood glucose devices segment led the market and accounted for a share of 66.37% in 2023

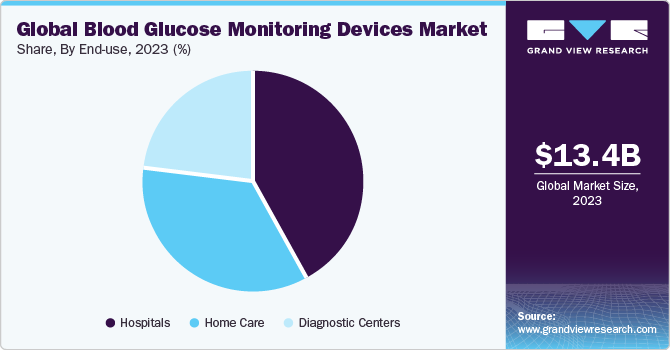

- By end-use, the hospital end-use segment led the market in 2023 and accounted for a share of 41.78% of the global revenue.

Market Size & Forecast

- 2023 Market Size: USD 13.43 Billion

- 2030 Projected Market Size: USD 23.21 Billion

- CAGR (2024-2030): 8.25%

- North America: Largest market in 2023

In addition, market growth is driven by rising awareness of preventive measures for diabetes and the introduction of new products. Diabetes, a widespread and growing global concern, is characterized by the pancreas' inability to efficiently produce insulin, leading to elevated blood glucose levels. According to the International Diabetes Federation, approximately 537 million individuals were diagnosed with diabetes in 2021, and projections indicate an anticipated rise to 643 million by 2030 and 783 million by 2045.

Blood glucose monitoring (BGM) devices play a crucial role in supporting individuals with diabetes in numerous ways. Firstly, they empower both patients and healthcare professionals to identify elevated or reduced blood glucose levels, enabling timely adjustments to treatment plans. This capability serves as a protective measure by promptly confirming acute hypoglycemia or hyperglycemia, ensuring the well-being of patients. In addition, these devices enhance self-care practices, offering individuals greater control over their diabetes management. Moreover, the technology associated with blood glucose monitoring not only aids in immediate intervention but also serves as a valuable tool for patient education on diabetes and its effective management.

The prevalence of diabetes tends to increase with age, and older adults are more susceptible to developing diabetes or experiencing complications related to the disease. As the geriatric population increases, so does the pool of individuals at risk of diabetes, creating a greater demand for blood glucose monitoring devices. For instance, based on the National Diabetes Statistics Report, in 2021, in the U.S. 27.2 million adults aged 65 years or older had prediabetes. Studies have shown that real-time continuous glucose monitoring (CGM) is effective and safe in adults aged 65 years and older with type 2 diabetes. Participants aged 65 years and above showed a significant improvement in their hemoglobin A1c (HbA1c) levels, which indicates better control of blood glucose levels when using CGM compared to blood glucose monitoring (BGM). These results underscore the potential value of CGM devices as a beneficial tool for effectively managing diabetes in the elderly population.

The COVID-19 pandemic has significantly impacted the market. The pandemic highlighted healthcare disparities and technology importance, including BGM devices. Regulatory changes, such as relaxed requirements for obtaining continuous glucose monitoring (CGM), have increased access to these devices, particularly benefiting those who can benefit from the technology. Furthermore, the use of real-time continuous glucose monitoring (rtCGM) was observed during lockdowns for improved glycemic control, reducing the time in range & glucose variability, thereby significantly boosting the overall market growth.

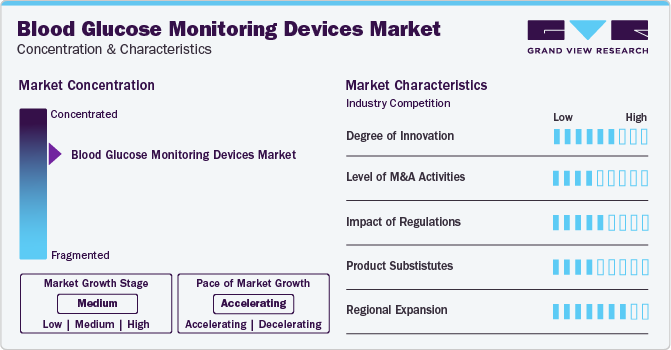

Market Concentration & Characteristics

The innovation in blood glucose monitoring devices has been substantial, leading to growth in the market. This includes developments in microminiaturization, new sensor technologies, and transcutaneous devices

Several market players, such as Medtronic Plc, F. Hoffmann-La Roche Ltd., and Abbott, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories

Regulations significantly shape the growth and development of the blood glucose monitoring devices market. For instance, the European Union's regulation requiring evidence of state-of-the-art medicine for CE marking has raised concerns that Simple Blood Glucose (SMBG) meters may no longer qualify as a state-of-the-art method for self-monitoring

Potential substitutes for blood glucose monitoring devices include the Eversense CGM, a subcutaneous implant device made by Senseonics, which measures glucose in interstitial fluids every 5 minutes and sends the data to a smartphone. This helps patients to manage their diabetes

BGM device manufacturers are strategically expanding regionally to tap into growing markets and address diverse healthcare needs. This approach allows for customization of products to meet regional preferences and regulatory requirements, fostering broader accessibility

Product Insights

The self-monitoring blood glucose devices segment led the market and accounted for a share of 66.37% in 2023 due to its affordability and user-friendly nature. Self-monitoring of blood glucose (SMBG) plays a crucial role in daily diabetes management using a glucose meter to measure blood sugar levels. In addition, other SMBG devices like testing strips and lancets are used to manage glucose levels individually. The development and launch of a novel SMBD device are anticipated to drive segment growth during the forecast period.

The continuous blood glucose monitoring (CBGM) devices segment is expected to show lucrative growth during the forecast period. CBGM is a critical tool for managing type 1 diabetes, especially in preventing severe hypoglycemia. These devices continuously monitor blood sugar levels, offering real-time readings every five minutes. Sub-divided into insulin pumps, sensors, and transmitters/receivers, CBGM employs a small sensor under the skin to measure glucose levels, with the transmitter wirelessly transmitting data to a monitor.

End-use Insights

The hospital end-use segment led the market in 2023 and accounted for a share of 41.78% of the global revenue. The rising cases of hospitalization of diabetic patients and increased hospital expenditures have led to increased adoption of BGM devices as they provide practitioners with instantaneous, reliable data and enhance patients' quality of life by providing accurate treatment plans. This adoption extends to both outpatient and inpatient hospital settings, where hospitals benefit from additional provisions for storing and transferring patient information. Notably, during the COVID-19 pandemic, the FDA permitted the use of CGM devices in hospitals, indicating potential future growth in this segment in anticipation of similar healthcare challenges.

The home care segment is expected to show lucrative growth from 2024 to 2030. The landscape of home-based glucose monitoring has been transformed by SMBG, emerging as the predominant method globally for short-term glucose level tracking. SMBG empowers individuals, whether with or without diabetes, to measure their blood sugar levels conveniently at home. This approach enables patients to assess the impact of their treatment strategies, encompassing factors like diet, insulin, exercise, and stress management, based on the obtained readings.

Regional Insights

North America led the market and accounted for a share of 38.44% in 2023. The region boasts a large pool of target population with a high prevalence of diabetes, driving the demand for innovative and technologically advanced blood glucose monitoring devices. In addition, well-established healthcare infrastructure, widespread awareness about diabetes management, and favorable reimbursement policies contribute to the high demand for products in the region.

U.S. Blood Glucose Monitoring Devices Market Trends

The blood glucose monitoring devices market in the U.S. held the largest share in 2023 owing to key factors, such as the rising prevalence of diabetes in the country. According to the Centers for Disease Control and Prevention, in 2020, 34.2 million individuals in the U.S., or 10.5% of the population, had diabetes. Furthermore, poor diet, rising obesity cases, and supportive government measures are projected to have a positive impact on the market growth.

Europe Blood Glucose Monitoring Devices Market Trends

The Europe regional market is expected to witness significant growth over the forecast period due to an increasing awareness of and demand for product devices in the region.

The UK blood glucose monitoring devices market is expected to grow over the forecast period due to a range of factors, such as the growing preference of patients for BGM as a tool for their treatment, supportive reimbursement policies, and the presence of key market players in the country.

The blood glucose monitoring devices market in Germany is expected to grow over the forecast period. This growth can be attributed to several factors, such as increasing number of obese populations, which is more susceptible to diabetes, and the growing disease burden in the country

The France blood glucose monitoring devices market is expected to grow significantly over the forecast period. This growth can be attributed to a range of factors, such as poor diet habits, unhealthy lifestyles, high prevalence of disease, and well-established healthcare infrastructure.

Asia Pacific Blood Glucose Monitoring Devices Market Trends

The blood glucose monitoring devices market of Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030. The region's substantial population, particularly in countries like China and India, contributes to a large pool of potential patients. In addition, improving healthcare infrastructure, a growing middle-class population with higher healthcare expenditures, and technological advancements in blood glucose monitoring devices are creating a conducive environment for market expansion.

The China blood glucose monitoring devices market is accounted for the largest share of the regional market in 2023. The country's vast population, coupled with a rising incidence of diabetes, creates a substantial market demand. For instance, as per the Statista report, in 2021, China documented the highest global count of diabetes patients, reaching 129 million individuals, constituting approximately 8.5% of the population.

The blood glucose monitoring devices market in Japan is expected to grow over the forecast period. Due to the increasing geriatric population, there is a high prevalence of age-related diabetes, which is likely to boost the demand for BGM devices to monitor glucose levels.

The India blood glucose monitoring devices market is expected to grow over the forecast period. India’s large population coupled with an increasing prevalence of diabetes and improving healthcare infrastructure are the factors driving market growth in the country.

Key Blood Glucose Monitoring Devices Company Insights

Some of the key players operating in the market include Abbott, Medtronic Plc., and Novo Nordisk. The company's primary strategies involve a comprehensive understanding of the strengths and weaknesses of major market participants, anticipation of future market trends, identification of opportunities and challenges, and proactive decision-making based on insights into emerging technologies and evolving consumer preferences.

Insulet Corporation and Glysens. are some of the emerging market players in the market. These players focus on niche segments, leveraging specialized technologies to differentiate themselves.

Key Blood Glucose Monitoring Devices Companies:

The following are the leading companies in the blood glucose monitoring devices market These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific (Patheon)

- Abbott

- Medtronic plc

- F. Hoffmann-La Roche Ltd

- Ascensia Diabetes Care Holdings AG

- Dexcom, Inc.

- Sanofi

- Novo Nordisk

- Insulet Corporation

- Ypsomed Holdings

- Glysens Incorporated

Recent Developments

-

In March 2023, Abbott received U.S. FDA approval for the integration of its FreeStyle Libre 3 and FreeStyle Libre 2 integrated continuous glucose monitoring (iCGM) system sensors with automated insulin delivery (AID) systems. Both the FreeStyle Libre 3 and FreeStyle Libre 2 sensors are currently accessible in the U.S., with approval for use in individuals aged four years and older

-

In February 2023, Ascensia Diabetes Care Holdings AG, the developer of the CONTOUR BGM system portfolio, globally partnered with SNAQ, a mobile application offering nutritional insights for individuals managing diabetes

-

In November 2021, Intuity Medical launched the POGO automatic blood glucose monitoring system for diabetes patients in the U.S. This device launch helps improve patient's quality of life

Blood Glucose Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.42 billion

Revenue forecast in 2030

USD 23.21 billion

Growth rate

CAGR of 8.25% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Medtronic Plc; F. Hoffmann-La Roche Ltd.; Ascensia Diabetes Care Holdings AG; Dexcom, Inc.; Sanofi; Novo Nordisk; Insulet Corp.; Ypsomed Holdings; Glysens Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase option

Global Blood Glucose Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood glucose monitoring devices market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-monitoring Devices

-

Blood Glucose Meter

-

Testing Strips

-

Lancets

-

-

Continuous Blood Glucose Monitoring Devices

-

Sensors

-

Transmitter & Receiver

-

Insulin Pumps

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Care

-

Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood glucose monitoring devices market size was estimated at USD 13.43 billion in 2023 and is expected to reach USD 14.42 billion in 2024.

b. The global blood glucose monitoring devices market is expected to grow at a compound annual growth rate of 8.25% from 2024 to 2030 to reach USD 23.21 billion by 2030.

b. North America dominated the blood glucose monitoring devices market with a share of 38.44% in 2023. This is attributable to the rising incidence of diabetes coupled with an increasing number of product launches.

b. Some key players operating in the blood glucose monitoring devices market include Abbott Laboratories, Medtronic plc, F. Hoffmann-La Roche Ltd, Ascensia Diabetes Care, Dexcom, Inc., Sanofi, Novo Nordisk, Insulet Corporation, Ypsomed Holdings, Glysens Incorporated

b. Key factors that are driving the blood glucose monitoring devices market growth include increasing healthcare expenditure related to diabetes and technological advancement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.