- Home

- »

- Medical Devices

- »

-

Blood Ketone Meter Market Size And Share Report, 2030GVR Report cover

![Blood Ketone Meter Market Size, Share & Trends Report]()

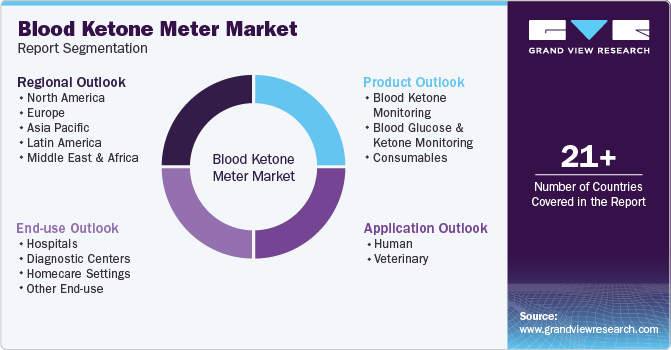

Blood Ketone Meter Market Size, Share & Trends Analysis Report By Product Type (Ketone Monitoring, Glucose And Ketone Monitoring), By Application (Human, Veterinary), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-617-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Blood Ketone Meter Market Size & Trends

The global blood ketone meter market size was estimated at USD 461.9 million in 2023 and is expected to experience a CAGR of 6.9% from 2024 to 2030. The key growth driving factors for this market are the rise in health-conscious customers, increased awareness about healthy lifestyles, the growing prevalence of chronic diseases such as diabetes, and the easy accessibility of the product. In addition, people who have adopted ketogenic diets are increasingly using blood ketone meters to monitor their performance during their diet routine.

According to the National Diabetes Statistics Report by the U.S. Center for Disease Control and Prevention (CDC), 38.4 million people have diabetes in the U.S. Out of this, 29.7 million people, including 29.4 million adults, have a clear diagnosis of diabetes. The rising prevalence of diabetes and increasing number of people with pre-diabetic conditions is expected to generate greater demand for blood ketone meters.

Key companies in the medical technology industry, such as Abbott and Keto-Mojo, are constantly enhancing their diverse portfolios with innovative products backed by research and development. For instance, Abbott has introduced the freestyle optimum/precise neo blood glucose and ketone monitoring system for personal use and the freestyle optimum/ precise neo H blood glucose and ketone monitoring system for hospital use.

Growing innovation, rising competition in the market between global medical technology organizations, and the availability of multiple alternatives for users are some of the factors fueling market growth. In addition, increasing awareness regarding the significance of preventive care in terms of diabetes and related conditions is projected to propel the market further in the approaching years.

Product Type Insights

The blood glucose and ketone monitoring meter segment captured the largest revenue share of 51.3% in 2023. These meters are designed and developed by prominent companies for home use by professionals and patients. Ease of use, compact size, quicker delivery of test results, and memory features for keeping logs of readings are some of the major factors that have generated an upsurge in demand for the product.

The blood ketone monitoring segment is expected to experience a CAGR of 7.5% from 2024 to 2030. Diabetic patients and those who have pre-diabetic conditions extensively use this product to monitor their ketone levels constantly. Increasing awareness regarding the prevalence of diabetic ketoacidosis and the risks associated with it is expected to raise demand for blood ketone monitoring products in upcoming years.

Application Insights

The human application segment dominated the blood ketone market in 2023. Constant monitoring with the help of blood ketone meters develops the possibility of a faster recovery in patients who are diagnosed with diabetic ketoacidosis. Patients with insulin dependency are recommended to use these meters to observe the ketone levels at regular intervals to prevent severe health issues that can caused by undesired levels.

Blood ketone meters are also utilized in veterinary applications. Often, these are utilized to identify ketonemia prevalent in cats and diabetic ketoacidosis in dogs. Growing pet care expenses, the availability of such preventive care products, the rising number of pet owners, and technological advances in product specifications are expected to drive growth for this segment in the approaching years.

End-use Insights

The hospital segment held the largest revenue share in 2023. The increase in hospital admissions, especially for older patients who have diabetes, is anticipated to propel the growth of this segment. Hospitals are increasingly using blood technology solutions such as blood ketone meters to monitor patients' health closely, as conditions such as diabetic ketoacidosis pose terminal risks for individuals with type-1 diabetes mellitus.

The home care settings segment is expected to experience a lucrative CAGR from 2024 to 2030 owing to the increasing use of blood ketone meters to monitor the blood ketone levels of patients who are assisted with home care services. Often, home care services are provided to patients who have been suffering from one or more chronic diseases for a longer time, which makes them prone to further complications with even subtle changes in elements such as blood ketone levels.

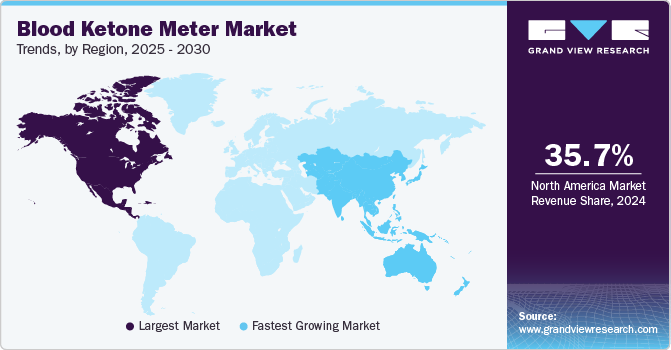

Regional Insights

The North America blood ketone market held the largest share of 40.3% in 2023. This is primarily due to the continuous increase in the number of users, the growing number of diabetic patients, awareness regarding the significance of monitoring blood ketone levels, and the presence of key market participants in the region. The regional market comprises the U.S., Canada, and Mexico. According to epidemiology/health services research published by the American Diabetes Association in October 2022, Mexico experienced approximately 148,437 diabetes-related deaths in 2020. The continuous growth in a newly diagnosed case of diabetes is expected to drive demand for this industry in the regional market.

U.S. Blood Ketone Meter Market Trends

The U.S. blood ketone market dominated the regional market. It is primarily due to a rise in patients suffering from pre-diabetic and diabetic conditions. Blood ketone meters are extensively used by professionals in hospitals and by patients in home settings. According to the U.S. Center for Disease Control and Prevention, 7.6 million people who are 18 or older have prediabetes in the U.S., which accounts for 38.0 % of the country's population.

Europe Blood Ketone Meter Market Trends

The blood ketone meter market in Europe was identified as a lucrative region. According to the International Diabetes Federation, 1 in 11 people are diagnosed with diabetes, and USD 189 billion was spent on diabetes in 2021. In addition, 1.1 million deaths were recorded due to diabetes in 2021. The region has developed a growing demand for glucose and ketone monitoring meters.

Germany blood ketone meter market is expected to experience significant growth from 2024 to 2030. This is primarily due to the rising number of diabetes patients in the country and the availability of easy-to-use technology solutions related to ketone monitoring. The advancements in technology and the presence of companies offering innovation-backed products are expected to propel growth in the German industry.

Asia Pacific Blood Ketone Market Trends

The blood ketone market in Asia Pacific is projected to experience an upsurge in demand for blood ketone meters from 2024 to 2030. This is mainly owing to factors such as easy access and availability of blood ketone meters, the presence of online platforms offering such solutions, increasing awareness about the necessity of monitoring blood ketone levels, enhancing healthcare infrastructure in the region, and more. The growing acceptance and use of self-monitoring technology solutions are expected to fuel market growth for this industry.

India blood ketone meter market is identified as one of the key markets for this industry. According to the World Health Organization (WHO), approximately 77 million adults over the age of 18 in India suffer from type 2 diabetes, and as many as 25 million people are diagnosed with prediabetes. Improved quality of healthcare services, growing use of self-monitoring devices, and rise in awareness about risks associated with diabetic ketoacidosis are driving demand for blood ketone meters in the country.

Key Blood Ketone Meter Company Insights

Some key companies in the market are Abbott Laboratories, APEX Biotechnology Corporation, EKF Diagnostics, and others. Due to the rising availability of technology-based solutions and new entrants in the industry, the major players in the market have adopted strategies such as innovation, product differentiations, collaborations, technology transfers, and more.

-

Abbott, one of the large global medical technology and pharmaceutical companies from the U.S. offers solutions such as the Abbott Precision Xceed Pro meter and FreeStyle Optium Neo for diabetes patients who need to monitor their blood glucose and blood ketone levels.

-

Nova Biomedical, a medical technology company that offers advanced blood testing solutions, has subsidiaries in eight countries and distribution networks across 91 countries. In terms of the blood ketone market, the company offers two distinct products: Nova Max Plus and Nova Vet blood ketone meters.

Key Blood Ketone Meter Companies:

The following are the leading companies in the blood ketone meter market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- APEX Biotechnology Corporation

- TaiDoc Technology Corporation

- EKF Diagnostics

- Nova Biomedical

- KETO-MOJO

Recent Developments

-

In March 2024, the U.S. Food & Drug Administration (FDA) approved the first-ever over-the-counter continuous glucose monitor. Dexcom Stelo Glucose Biosensor System is designed and developed by Dexcom, Inc., specializing in manufacturing and distributing glucose monitoring (CGM) systems.

Blood Ketone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 492.3 million

Revenue forecast in 2030

USD 734.8 million

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Abbott Laboratories; APEX Biotechnology Corporation; TaiDoc Technology Corporation; EKF Diagnostics; Nova Biomedical; KETO-MOJO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Ketone Meter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood ketone meter market report based on product type, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Ketone Monitoring

-

Blood Glucose and Ketone Monitoring

-

Consumables

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Human

-

Veterinary

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood ketone meter market size was estimated at USD 461.9 million in 2023 and is expected to reach USD 492.3 million in 2024.

b. The global blood ketone meter market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 734.8 million by 2030.

b. The blood ketone monitoring segment dominated the global blood ketone meter market and accounted for the largest revenue share of over 40.0% in 2023.

b. Some key players operating in the blood ketone meter market include Abbott Laboratories, APEX Biotechnology, TaiDoc Technology Corporation, EKF Diagnostics, Nova Biomedical, and KETO-MOJO.

b. Key factors that are driving the blood ketone meter market growth include awareness regarding the benefits of blood ketone meters, technological advancements, developing healthcare infrastructure, increasing hospital admissions, and rising diabetes-related complications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."