- Home

- »

- Medical Devices

- »

-

Body Contouring Devices Market Size & Share Report, 2030GVR Report cover

![Body Contouring Devices Market Size, Share & Trends Report]()

Body Contouring Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Noninvasive and Minimally Invasive Devices, Invasive Devices), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-621-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Body Contouring Devices Market Summary

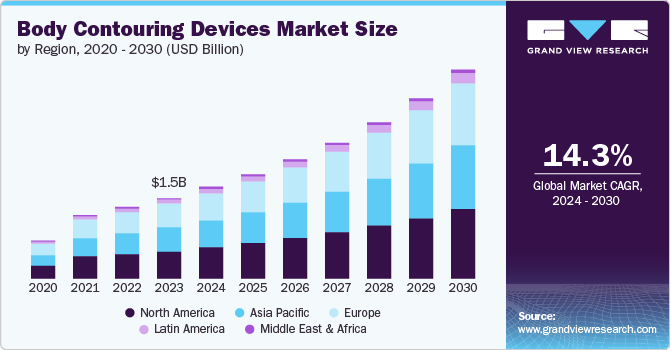

The global body contouring devices market size was estimated at USD 1.50 billion in 2023 and is projected to reach USD 3.86 billion by 2030, growing at a CAGR of 14.3% from 2024 to 2030. Body contouring devices can be invasive and non-invasive, or minimally invasive, and aim to reshape an area of the body.

Key Market Trends & Insights

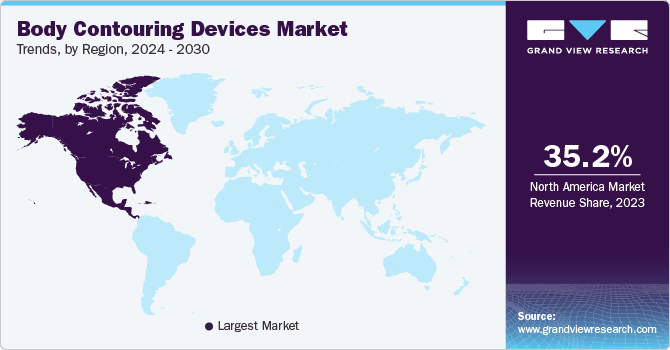

- North America dominated the global body contouring devices market, with a revenue share of 35.2% in 2023.

- The Asia Pacific body contouring devices market is expected to grow at the fastest CAGR from 2024 to 2030.

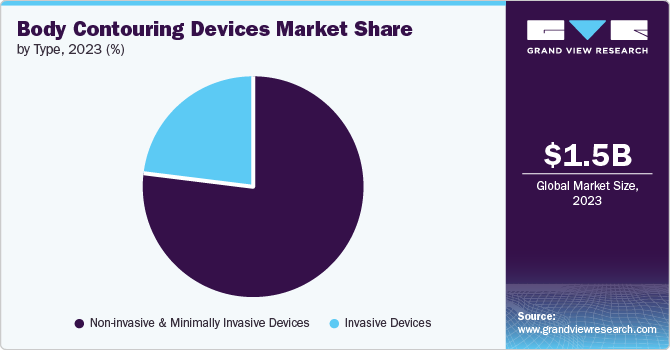

- By type, The noninvasive and minimally invasive devices segment led the market, with a revenue share of 77.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.50 Billion

- 2030 Projected Market Size: USD 3.86 Billion

- CAGR (2024-2030): 14.3%

- North America: Largest market in 2023

This can be done surgically via liposuction or through less invasive methods like cryo lipolysis, injection lipolysis, radiofrequency lipolysis, and laser lipolysis. The main goal of body contouring procedures is to eliminate unwanted and achieve firmness in the treatment area. Rising cases of obesity across the globe due to unhealthy lifestyles are anticipated to drive the global market. Improved safety and efficacy of these techniques resulting in increased life expectancy are also expected to boost their demand. Initiatives, such as M&A, novel product launches, and partnerships undertaken by major companies for product research and distribution are expected to drive the market further in the coming years.

Non-invasive fat reduction or nonsurgical fat reduction includes minimally invasive treatments that break down stubborn subcutaneous fat pockets beneath the skin. Major factors driving market growth include rising demand for body contouring treatment, as it is non-invasive and requires no downtime after completion of the procedure. SculpSure, developed by Cynosure, Inc., is a non-invasive body contouring laser device that targets and destroys around 24% of unwanted fat cells in 25 minutes.

A sedentary lifestyle is a major underlying cause of obesity, disease, and disability. Levels of physical inactivity are virtually high in all developed and developing countries. According to the World Health Organization (WHO), in 2022, 1 in 8 people worldwide were living with obesity. Increased urbanization has contributed immensely to the increase in sedentary lifestyles which in turn escalated the prevalence of obesity globally.

Type Insights

Noninvasive and minimally invasive devices dominated the market and accounted for a share of 77.5% in 2023. Entry of various products, investment by market players, and high demand for non-invasive and minimally invasive procedures due to their safe and cost-effective nature are driving the market. The market expansion is fueled by the growing popularity of noninvasive body contouring treatments that do not require any recovery time.

Invasive devices are anticipated to grow significantly at a CAGR of 13.0% over the forecast period. Invasive body contouring procedure, Liposuction or lipolysis, has remained one of the most popular and in-demand plastic surgery procedures for body contouring and is particularly effective in removing fat in the legs, abdomen, back, arms, face, and neck. According to the American Society of Plastic Surgeons (ASPS), liposuction was the second-most carried out procedure in the U.S. after breast augmentation, with 211,067 procedural volumes in 2020.

Regional Insights

North America body contouring devices market dominated the market and accounted for a market revenue share of 35.2% in 2023. This is attributed to the rising geriatric population, strong medical infrastructure, well-established reimbursement policies, the existence of key market players, and advancements in aesthetic body contouring procedures. Moreover, Moreover, attributes like high acceptance and openness towards body contouring treatments, and soaring appearance-conscious customer pool is likely to propel the non-invasive body contouring market in the region of North America.

U.S. Body Contouring Devices Market Trends

The U.S. body contouring devices market dominated the North America market in 2023. As consumers become more aware of their appearance and seek ways to enhance their physical attributes in the country, a significant shift has occurred from traditional surgical methods to non-invasive alternatives. With rising obesity rates across the continent, there is a growing need for effective solutions to manage and address excess body fat. Body contouring devices offer an attractive option for individuals seeking to complement their weight loss efforts or achieve specific body shape goals.

Europe Body Contouring Devices Market Trends

Europe body contouring devices market was identified as a lucrative region in 2023. The increasing awareness of body image and wellness is fueling the market growth. The growing popularity of cosmetic treatments for self-improvement has expanded the market. Furthermore, the rising number of older adults in the region and advancements in anti-aging methods have resulted in a surge in the requirement for body contouring methods.

The UK body contouring devices market is expected to grow rapidly in the coming years. In the UK, there is a growing preference for non-surgical treatments that offer effective body shaping with minimal downtime and reduced risks compared to traditional surgical options. This shift is largely due to the convenience and lower risk associated with non-invasive procedures, making body contouring devices more attractive to individuals seeking aesthetic improvements without needing recovery periods.

Asia Pacific Body Contouring Devices Market Trends

Asia Pacific body contouring devices market is anticipated to register the fastest CAGR over the forecast period. Asian countries such as China, Japan, and India are emerging economies with well-developed healthcare infrastructure and facilities and are now more focused on leading based on R&D activities. Asian countries have been a long renowned hub for aesthetic procedures. Numerous fat reduction procedures are carried out in countries like China, South Korea, and Japan per year, cost-effective and high-quality treatment, rising disposable income, and growing obese & geriatric population are driving the market in the APAC region.

China body contouring devices market held a substantial market share in 2023. The proliferation of clinics and wellness centers in the country that offer body contouring treatments increases consumer access to these services. As more establishments incorporate advanced body contouring technologies into their offerings, the market becomes more competitive and accessible. Additionally, the rise of specialized aesthetic clinics and the growing focus on holistic wellness contribute to the increasing availability and popularity of body contouring devices.

Key Body Contouring Devices Company Insights

Some of the key companies in the body contouring devices market include Cynosure, Inc., Alma Lasers, Merz Pharma Gmbh, Allergan, Syneron Medical Ltd. and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Cynosure, Inc. offers various body contouring devices for noninvasive fat reduction and skin tightening. One of their products is SculpSure, a laser system explicitly focused on reducing fat cells. Another device is the TempSure Firm handpiece, designed to enhance skin tightness and texture. These products are included in Cynosure's more comprehensive range of aesthetic devices, which also target hair removal, skin rejuvenation, and other issues.

-

Alma Lasers offers diverse body contouring devices designed to address various aesthetic concerns, including fat reduction, skin tightening, and cellulite treatment. Their products include the Accent Prime system, which utilizes ultrasound and radiofrequency technologies to deliver effective body sculpting results with minimal downtime.

Key Body Contouring Devices Companies:

The following are the leading companies in the body contouring devices market. These companies collectively hold the largest market share and dictate industry trends.

- Cynosure, Inc.

- Alma Lasers

- Allergan Plc

- Merz Pharma Gmbh

- Candela Medical Ltd.

- Solta Medical Bausch Health Companies, Inc.

- Lutronic Corporation

- InMode Ltd

- Fotona

- Sofwave Medical LTD

- Sciton Inc

- Lumenis

Recent Developments

-

In April 2024, Cartessa Aesthetics launched PHYSIQ 360, a groundbreaking non-invasive body contouring treatment designed to enhance patient aesthetic outcomes. This innovative technology combines muscle stimulation and fat reduction techniques for comprehensive body sculpting results.

-

In January 2024, Cynosure, Inc. merged with Lutronic Aesthetic Lasers to enhance its capabilities in delivering cutting-edge solutions for various aesthetic procedures. The merger is expected to improve its ability to provide advanced treatments for skin rejuvenation, body contouring, and other aesthetic procedures.

Body Contouring Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.69 billion

Revenue forecast in 2030

USD 3.86 billion

Growth Rate

CAGR of 14.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Cynosure, Inc.; Alma Lasers; Merz Pharma Gmbh; Allergan; Syneron Medical Ltd.; Bausch Health Companies, Inc.; Lutronic Corporation; InMode Ltd; Fotona; Sofwave Medical LTD,; Sciton Inc.; Lumenis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Body Contouring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global body contouring devices market report based on type and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-invasive and Minimally Invasive Devices

-

Nonsurgical Skin Resurfacing

-

Nonsurgical Skin tightening

-

Cellulite treatment

-

Others

-

-

Invasive Devices

-

Liposuction

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.