- Home

- »

- Advanced Interior Materials

- »

-

Bolt Extractor Set Market Size & Share, Industry Report 2033GVR Report cover

![Bolt Extractor Set Market Size, Share & Trends Report]()

Bolt Extractor Set Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Manual Bolt Extractor Sets, Power-Compatible Bolt Extractor Sets), By End-use (Industrial & Manufacturing, Construction & Infrastructure), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-853-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bolt Extractor Set Market Summary

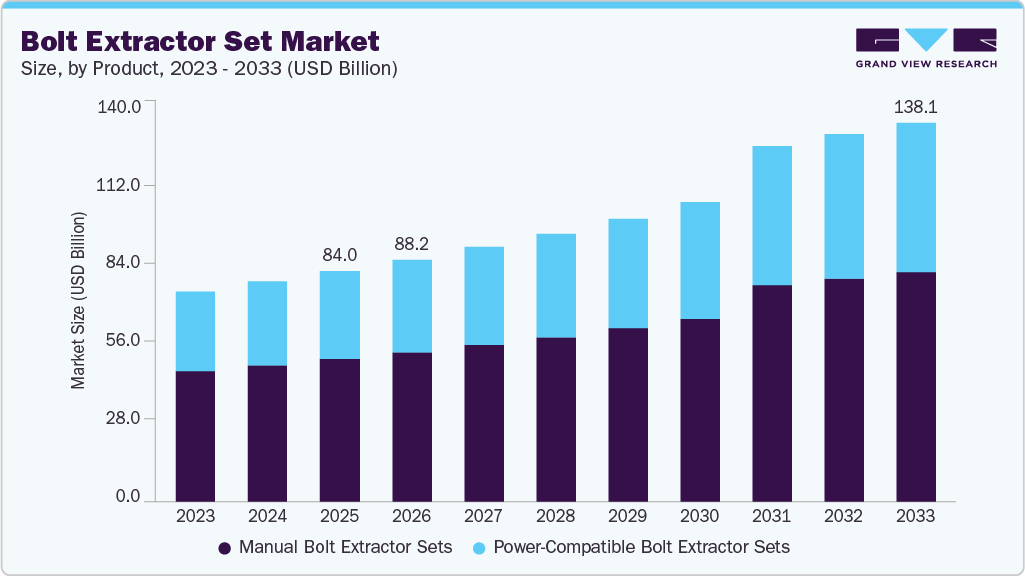

The global bolt extractor set market size was estimated at USD 84.03 billion in 2025 and is expected to reach USD 138.14 billion by 2033, growing at a CAGR of 6.6% from 2026 to 2033. The demand for bolt extractor sets is increasing due to the rising need for efficient solutions to remove damaged, stripped, or rusted fasteners across automotive, construction, and industrial maintenance applications.

Key Market Trends & Insights

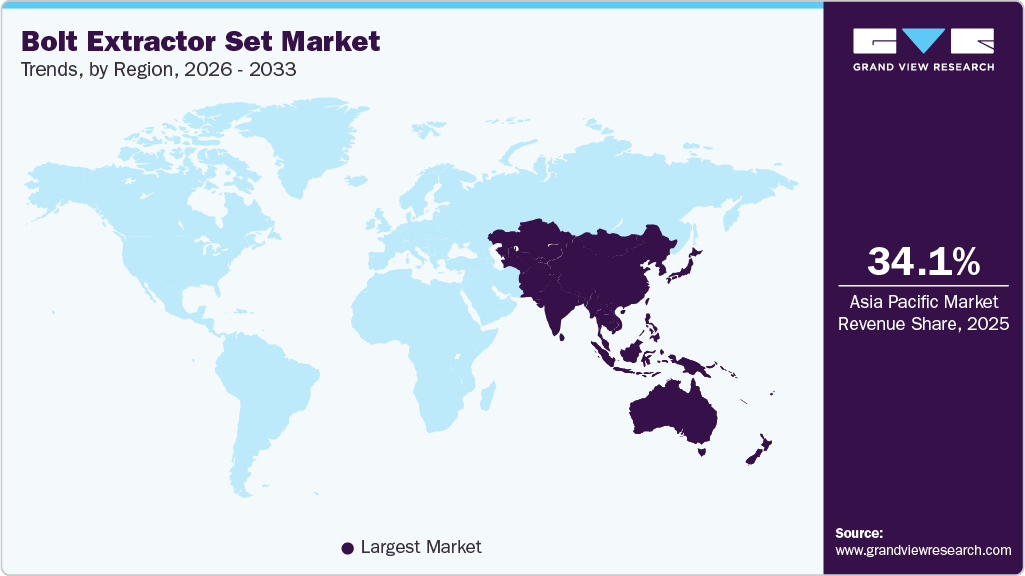

- Asia Pacific dominated the bolt extractor set market with the largest revenue share of 34.1% in 2025.

- China leads the regional bolt extractor set market, driven by strong manufacturing and a booming automotive aftermarket.

- By product, the power-compatible bolt extractor sets segment is expected to grow at the significant CAGR of 7.1% over the forecast period.

- By end use, the energy & utilities segment is expected to grow at the Significant CAGR of 7.3% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 84.03 Billion

- 2033 Projected Market Size: USD 138.14 Billion

- CAGR (2026-2033): 6.6%

- Asia Pacific: Largest market in 2025

Aging vehicle fleets and infrastructure assets require frequent repair and maintenance, leading to higher usage of specialty hand tools such as bolt extractors. Growth in DIY culture, especially among automotive enthusiasts and home improvement users, is also contributing to demand expansion. Additionally, downtime costs in industrial settings are pushing technicians to adopt tools that minimize repair time. Bolt extractors offer a cost-effective alternative to replacing entire components, further driving their adoption.Key demand drivers include growth in automotive repair and maintenance activities, particularly in aftermarket services and independent garages. Expansion of construction activities and industrial machinery installations has increased the frequency of seized or broken bolts, boosting extractor usage. The rise in mechanization across manufacturing and processing industries has created recurring requirements for maintenance tools. E-commerce platforms have improved accessibility of professional-grade bolt extractor sets to individual users and small workshops. Increasing focus on workplace efficiency and precision repair tools is encouraging adoption. Technological improvements in tool materials and gripping mechanisms enhance reliability and user confidence.

Product innovation focuses on advanced alloy steel compositions and heat-treated materials to improve strength and corrosion resistance. Multi-piece universal extractor kits compatible with metric and imperial fasteners are gaining popularity. Manufacturers are introducing spiral flute and reverse-thread designs that provide a stronger grip on damaged bolts. Compact, impact-rated extractor sets compatible with power tools are becoming a key trend. Ergonomic packaging and organized storage cases enhance user convenience. Branding and lifetime warranty offerings are increasingly used as competitive differentiators. Smart marketing through digital platforms and professional endorsements is shaping buying decisions.

Market Concentration & Characteristics

The industry is moderately fragmented, with the presence of several global hand tool manufacturers and a large number of regional and private-label brands. Established players compete based on brand reputation, durability, and breadth of product offerings, while smaller players compete aggressively on price. Entry barriers are relatively low due to standardized manufacturing processes, which support fragmentation. However, premium brands maintain strong customer loyalty in professional and industrial segments. OEM partnerships and retail distribution networks play a crucial role in market positioning. Private-label products sold through e-commerce platforms intensify competition.

Substitutes for bolt extractor sets include drilling, welding nuts onto damaged bolts, locking pliers, and grinding techniques. Powered extraction tools and chemical rust removers can reduce reliance on manual extractors in certain applications. However, these substitutes are often more time-consuming, skill-intensive, or costlier. Bolt extractor sets offer a quicker, safer, and more controlled solution, limiting the threat of substitution. In professional environments, extractors are often preferred due to precision and reduced risk of part damage. The availability of low-cost extractor kits further weakens substitute threats.

Product Insights

The manual bolt extractor set segment held the highest revenue share of 61.9% in 2025, due to its wide usage in automotive workshops, small repair garages, and DIY applications. These tools are affordable, easy to use, and do not require additional power equipment, making them suitable for a broad range of users. Many technicians prefer manual extractors for precision work and controlled bolt removal. Their availability in multi-size kits and compatibility with standard hand tools also support strong demand. The segment benefits from steady replacement demand and high accessibility across retail and online channels.

The power-compatible bolt extractor sets segment is expected to grow at a significant CAGR of 7.1% over the forecast period, due to increasing demand for faster and more efficient repair processes. These extractors are designed to work with impact drivers and power drills, helping technicians remove stubborn or heavily rusted bolts quickly. They are widely adopted in industrial maintenance and high-volume automotive workshops where productivity is critical. Growing mechanization and time-sensitive repair operations are driving adoption. Improved material strength and impact resistance are further supporting segment growth.

End Use Insights

The industrial & manufacturing segment held the highest revenue market share of 27.3% in 2025, because large-scale facilities require frequent maintenance of machinery and equipment. Damaged or seized bolts are common in heavy machinery, production lines, and mechanical systems. Regular servicing and preventive maintenance create a consistent demand for bolt extractor sets. Industrial users also prefer durable, high-performance tools, contributing to higher average selling prices. Continuous expansion of manufacturing activities globally supports steady segment dominance.

The energy & utilities segment is expected to grow at a significant CAGR of 7.3% over the forecast period, due to increasing maintenance needs in power plants, oil & gas facilities, and renewable energy installations. Equipment in these sectors operates under harsh conditions, leading to corrosion and bolt damage. Regular inspection and repair activities require reliable extraction tools to minimize downtime. Expansion of renewable energy infrastructure and grid modernization projects further drives demand. The need for durable, corrosion-resistant extractor sets is particularly strong in this segment.

Regional Insights

Asia Pacific bolt extractor set market accounted for the largest revenue share of 34.1% in 2025, due to its large automotive manufacturing base, expanding construction sector, and high concentration of small repair workshops. Rapid industrialization in China, India, and Southeast Asia generates sustained demand for maintenance tools. Availability of cost-effective manufacturing and local brands supports high market penetration. Growth in e-commerce enables wide distribution across urban and semi-urban areas. Rising vehicle ownership and the need for two-wheeler maintenance further support demand. The region benefits from strong aftermarket services. Price sensitivity encourages the adoption of bundled tool kits.

China Bolt Extractor Set Market Trends

China bolt extractor set industry leads the regional market, driven by extensive manufacturing activities and a strong domestic automotive aftermarket. Local manufacturers offer competitively priced extractor sets, increasing adoption among small garages and industrial users. Export-oriented production supports global supply. Increasing focus on product quality and material standards is evident. Demand is supported by ongoing infrastructure maintenance projects. Growth in DIY automotive repair also contributes to volumes. Online retail channels play a major role in sales.

Europe Bolt Extractor Set Market Trends

The bolt extractor set market in Europe is supported by stringent vehicle maintenance norms and a strong industrial base. Automotive repair standards encourage the use of precise and damage-minimizing tools. Demand is prominent in Germany, France, and the UK. Sustainability trends encourage long-lasting, high-quality tools. Professional workshops dominate demand over DIY users. Premium pricing is accepted for certified quality tools. Distribution through specialty tool retailers remains strong.

Germany bolt extractor set market represents a mature and quality-driven market with strong demand from the automotive and industrial maintenance sectors. Precision engineering standards favor high-grade extractor sets with superior material properties. OEM-aligned workshops prefer branded tools. Industrial machinery maintenance drives consistent demand. Product certifications and compliance influence buying behavior. Innovation in ergonomic and high-torque designs is evident. Market growth remains stable but resilient.

North America Bolt Extractor Set Market Trends

The bolt extractor set market in North America shows steady demand, driven by a mature automotive aftermarket and strong DIY culture. Professional mechanics prefer premium extractor sets with higher durability standards. Growth in pickup trucks, commercial vehicles, and aging fleets supports replacement demand. High labor costs encourage efficient repair solutions. Major brands dominate distribution through hardware chains and online platforms. Warranty-backed products influence purchasing decisions. Technological improvements in extractor designs are well-received.

The bolt extractor set market in the U.S. is driven by strong automotive maintenance activity and widespread home improvement practices. Professional-grade extractor sets are widely adopted in workshops and service centers. Growth in electric vehicle servicing also requires specialized fastener removal tools. E-commerce penetration has expanded access to niche and premium brands. Brand loyalty plays a key role in purchasing. Demand remains replacement-driven with steady growth. Innovation focuses on impact-rated and corrosion-resistant products.

Latin America Bolt Extractor Set Market Trends

The bolt extractor set market in Latin America shows moderate growth driven by expanding automotive aftermarket services and infrastructure maintenance. Price-sensitive consumers favor value-for-money extractor kits. Growth in used vehicle fleets supports repair tool demand. Local distributors and importers dominate the market. Adoption is higher in Brazil and Mexico. Informal repair workshops contribute significantly to volume demand. Market growth is gradual but consistent.

Middle East & Africa Bolt Extractor Set Market Trends

The bolt extractor set market in the Middle East & Africa is supported by construction activity, industrial maintenance, and vehicle servicing needs. Demand is driven by commercial vehicles operating in harsh environments that cause bolt corrosion. Oil & gas maintenance activities support tool usage in the Middle East. Import dependency is high, with a preference for durable, corrosion-resistant tools. Growth in automotive service centers supports demand. Africa shows gradual adoption with increasing urbanization. The market remains price-sensitive but opportunity-rich.

Key Bolt Extractor Set Company Insights

Some of the key players operating in the bolt extractor set market include NEIKO, GEARWRENCH

-

NEIKO is recognized for its broad portfolio of automotive and specialty hand tools positioned in the mid-price segment. The company is known for producing durable bolt extractor sets made from hardened alloy steel, catering to both professional mechanics and serious DIY users.

-

GEARWRENCH operates as a premium professional hand tool brand with a strong reputation for engineering innovation and performance reliability. The brand is widely adopted by professional mechanics, industrial technicians, and service centers. GEARWRENCH bolt extractor sets emphasize precision machining, advanced gripping geometry, and compatibility with impact tools.

WORKPRO and Drill Hog are some of the emerging market participants in the bolt extractor set market.

-

WORKPRO targets the mass market and DIY segment by offering comprehensive, affordable tool kits designed for home maintenance and light professional use. The company emphasizes wide accessibility through global online marketplaces and retail chains. WORKPRO bolt extractor sets focus on versatility and user-friendly packaging rather than heavy-duty industrial performance.

-

Drill Hog is a specialized tool manufacturer focused on high-performance drill bits and extractor tools, with a strong emphasis on durability and warranty assurance. The brand is particularly known in the U.S. market for heavy-duty bolt extractor sets designed for extreme conditions. Drill Hog highlights USA-focused manufacturing, cobalt and premium steel materials, and lifetime warranties.

Key Bolt Extractor Set Companies:

The following key companies have been profiled for this study on the bolt extractor set market.

- IRWIN Tools

- GEARWRENCH

- NEIKO

- CRAFTSMAN

- Topec

- RIDGID Tool Company

- Drill Hog

- WORKPRO

- Grip Edge

- Norseman Drill & Tool

Bolt Extractor Set Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 88.17 billion

Revenue forecast in 2033

USD 138.14 billion

Growth rate

CAGR of 6.6% from 2026 to 2033

Base year for estimation

2025

Actual estimates/historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; China; Japan; India

Key companies profiled

IRWIN Tools; GEARWRENCH; NEIKO; CRAFTSMAN; Topec; RIDGID Tool Company; Drill Hog; WORKPRO; Grip Edge; Norseman Drill & Tool

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bolt Extractor Set Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bolt extractor set market report on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manual Bolt Extractor Sets

-

Power-Compatible Bolt Extractor Sets

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

Industrial & Manufacturing

-

Construction & Infrastructure

-

Energy & Utilities

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global bolt extractor set market size was estimated at USD 84.03 billion in 2025 and is expected to reach USD 88.17 billion in 2026.

b. The global bolt extractor set market is expected to grow at a compound annual growth rate of 6.6% from 2026 to 2033 to reach USD 138.14 billion by 2033.

b. The manual bolt extractor segment held the highest revenue share of 61.9% in 2025, driven by its wide use in automotive workshops, small repair garages, and DIY applications.

b. Some key players in the bolt extractor set market include IRWIN Tools, GEARWRENCH, NEIKO, CRAFTSMAN, Topec, RIDGID Tool Company, Drill Hog, PotlatchDeltic Corporation, Norseman Drill & Tool, and Grip Edge.

b. Rising automotive and industrial maintenance activities, aging equipment and vehicle fleets, increasing construction work, growth of DIY repairs, and the need for fast, damage-free removal of seized or stripped fasteners are the key factors driving the bolt extractor set market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.