- Home

- »

- Medical Devices

- »

-

Bone Punches Market Size & Share, Industry Report, 2030GVR Report cover

![Bone Punches Market Size, Share & Trends Report]()

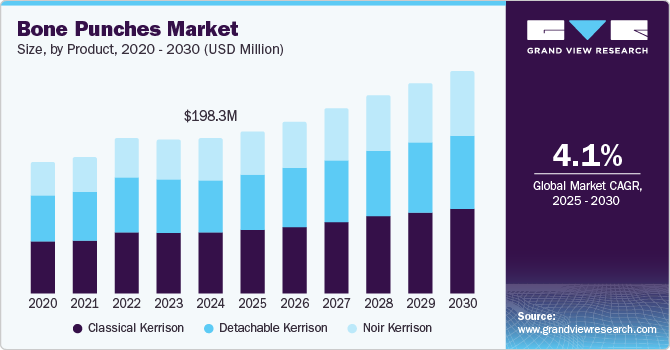

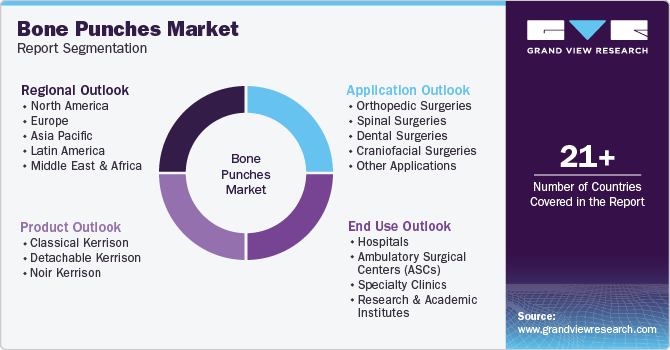

Bone Punches Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Classical Kerrison, Detachable Kerrison, Noir Kerrison), By Application (Orthopedic Surgeries, Spinal Surgeries, Dental Surgeries), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-501-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bone Punches Market Size & Trends

The global bone punches market size was valued at USD 198.30 million in 2024 and is anticipated to grow at a CAGR of 4.13% from 2025 to 2030. The rising prevalence of bone disorders such as arthritis, osteoporosis, and fractures is driving the need for surgical interventions. Bone punches are crucial in orthopedic surgeries, which are more common as these conditions rise. The demand for orthopedic surgeries is increasing globally, fueled by the aging population, sports injuries, and accidents. As joint replacements and spinal surgeries become more frequent, the need for bone punches in these procedures grows.

As the global population ages, there is a growing demand for orthopedic surgeries and treatments. Bone Punches are commonly used in orthopedic procedures such as fracture repair and joint replacement surgeries. The prevalence of bone-related diseases such as osteoporosis, arthritis, and fractures is growing, which directly drives the demand for orthopedic surgical tools, including bone punches. As per WHO, by 2030, 1 in 6 people worldwide will be aged 60 years or over.

With surgeries becoming increasingly complex, there is a heightened demand for instruments that can ensure precision and reduce complications. Bone Punches are integral to such operations, as they are designed to precisely remove or reshape bone tissue. Surgeons and healthcare providers are increasingly using high-quality tools that can lead to better patient outcomes, which contributes to the growth in the bone punches market. The rising number of orthopedic surgeries, driven by increased accidents, sports injuries, and degenerative diseases, has spurred the demand for bone punches. Accidents and trauma-related injuries, which require the removal or manipulation of bone tissue, increase the need for reliable surgical tools, further boosting the demand for bone punches.

The growth of healthcare infrastructure, particularly in emerging markets, has increased the availability of specialized surgeries, thus driving demand for Bone Punches. Hospitals and clinics in both developed and developing regions are adopting advanced surgical tools to meet patient needs. Government and private healthcare spending are increasing globally, leading to more significant investment in medical equipment and surgical tools, including Bone Punches. The increasing emphasis on regulatory approval, including from entities such as the FDA, ensures that bone punches meet safety and performance standards. These regulations help drive the adoption of high-quality instruments, as hospitals prefer to use certified tools that reduce risks. Across different markets, adherence to international health and safety standards in medical devices encourages the adoption of advanced bone punches, as healthcare facilities aim to ensure patient safety.

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of growth is accelerating. The industry is characterized by a high degree of growth due to the increasing government funding propels scientific advancements and encourages collaboration between researchers, medical professionals, and technology developers.

The industry is experiencing a significant degree of innovation, with manufacturers constantly developing new and improved tools to meet the demands of modern surgery. Innovations in ergonomic designs, material technology, and precision mechanisms are enhancing the functionality and efficiency of bone punches.

Regulations are critical in shaping the industry, ensuring that medical instruments meet safety, quality, and performance standards. Regulatory bodies such as the FDA (Food and Drug Administration) in the U.S. and the European Medicines Agency (EMA) in Europe set stringent requirements for product approval, sterilization standards, and clinical safety. While these regulations help maintain high standards and protect patient safety, they can also increase the time and cost of bringing new products to market.

The industry is witnessing moderate mergers and acquisitions (M&A) as companies look to expand their product portfolios, enter new markets, or strengthen their technological capabilities. M&A activities lead to consolidating resources, increasing market reach, and acquiring new technologies. This trend enables companies to offer a broader range of bone punch tools and solutions, catering to a more extensive customer base and responding more effectively to market demands.

While bone punches are a crucial surgical instrument, alternatives and substitutes are available for specific applications, such as drills, chisels, and bone cutters. However, these substitutes lack the precision, control, and specialized functionality bone punches offer in specific surgeries, particularly spinal and orthopedic procedures.

The industry is experiencing significant regional expansion, driven by growing healthcare infrastructure, increasing surgical procedures, and rising awareness about advanced surgical tools in developed and emerging markets. In North America and Europe, where healthcare facilities are well-established, the demand for high-quality bone punches is robust, and the market is mature. However, the market is also rapidly expanding in Asia-Pacific, Latin America, and the Middle East, where improving healthcare infrastructure, rising geriatric population, and growing access to medical technologies fuel demand for advanced surgical instruments.

Product Insights

Classical Kerrison held the largest market share in 2024. Classical Kerrison bone punches are essential in spinal surgeries, such as spinal decompression, laminectomy, and spinal fusion procedures. They are also frequently used for bone excision and joint reconstruction in orthopedic surgeries. Their versatility across multiple types of surgeries has made them a standard tool in operating rooms. The Classical Kerrison bone punch's design gives surgeons excellent control and precision when cutting or removing bone tissue. This is important in delicate spinal surgeries, where accuracy is crucial for successful outcomes.

The detachable Kerrison segment is expected to grow at the highest CAGR during the forecast period. Customization, versatility, and growing demand in modern surgical settings. Its detachable design allows for easy replacement or adjustment of components, making it highly adaptable for various procedures, particularly in complex spinal surgeries. The tool’s portability and improved efficiency appeal to outpatient settings and ambulatory surgical centers, where quick turnover and flexibility are crucial. Its ergonomic design helps reduce surgeon fatigue during prolonged surgeries, while its precision suits the trends in minimally invasive surgeries. With ongoing advancements in surgical technology and the rising demand for specialized surgical tools, the detachable Kerrison is becoming the preferred choice for many surgeons, driving its rapid growth in the market.

Application Insights

Orthopedic surgeries held the largest market share of around in 2024. Bone punches are essential in surgeries involving bone tissue manipulation, such as joint replacements, fracture repairs, bone grafting, and arthroscopic procedures. The growing incidence of orthopedic conditions such as osteoarthritis, sports injuries, and degenerative bone diseases has significantly increased the demand for surgical interventions. Furthermore, with advancements in minimally invasive surgical techniques, the demand for bone punches is rising, as these surgeries rely on tools that provide precision and facilitate quicker recovery. As orthopedic surgeries become more prevalent and advanced, the bone punches market sees sustained growth, with the orthopedic segment being the most significant contributor.

The spinal surgeries segment is expected to grow at the fastest CAGR during the forecast period. Spinal surgeries, such as spinal fusion, laminectomy, and decompression procedures, require the use of specialized instruments like bone punches to manipulate bone tissues and facilitate precise bone cutting or grafting. As the prevalence of spinal disorders, including degenerative diseases, spinal trauma, and deformities, continues to rise, the demand for spinal surgeries increases. These procedures require highly accurate and controlled bone manipulation, which drives the use of bone punches.

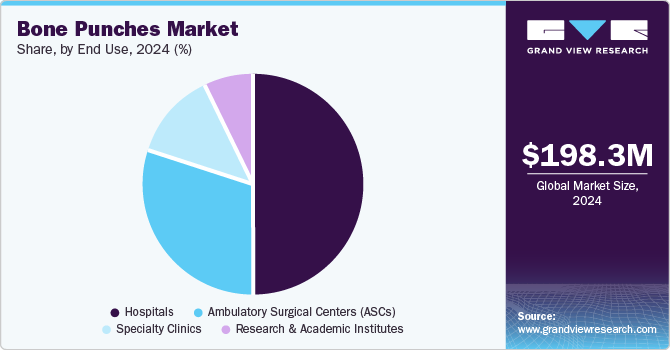

End Use Insights

Hospitals held the largest market share in 2024. Hospitals are the primary settings for complex and high-risk orthopedic surgeries, requiring advanced tools such as bone punches for bone grafting, joint replacement, and fracture repairs. They are equipped with specialized surgical teams and advanced technologies, making them the preferred choice for patients needing specialized care. The demand for bone punches in hospitals is further driven by the increasing number of orthopedic surgeries performed, including those for trauma, sports injuries, and degenerative bone diseases. Hospitals also tend to have a broad patient base, ranging from emergency cases to elective surgeries, contributing to the sustained demand for bone punches. As a result, hospitals remain the dominant segment in the bone punches market.

Ambulatory Surgical Centers (ASCs) are expected to grow at a substantial rate during the forecast period. ASCs are preferred for outpatient procedures because they offer lower costs and the convenience of same-day discharge. This trend and the rise in minimally invasive surgeries have led to a growing demand for specialized tools like bone punches. ASCs are also known for their cost-effectiveness, making them attractive to patients and insurers for orthopedic procedures. With the increasing prevalence of bone-related injuries and degenerative joint diseases, ASCs are expanding their orthopedic surgery capabilities, further driving the need for bone punches.

Regional Insights

North America bone punches market dominated the global industry in 2024. The region benefits from advanced healthcare infrastructure, which supports the adoption of specialized surgical tools such as bone punches. In addition, the high prevalence of orthopedic and dental disorders, such as osteoporosis and arthritis, increases the demand for surgical interventions that rely on these instruments. Technological advancements in surgical tools also significantly offer greater precision and improved outcomes, further driving the market.

U.S. Bone Punches Market Trends

The bone punches market in the U.S. held a significant share in 2024. The increasing prevalence of orthopedic and dental disorders, such as osteoporosis, arthritis, and dental diseases, requires surgical interventions where bone punches are essential tools. In addition, advancements in surgical techniques, including more precise and effective bone punches, improve outcomes and reduce recovery times, further boosting demand. The aging population in the U.S. is also contributing to market growth, as older individuals are more prone to musculoskeletal and dental conditions.

Europe Bone Punches Market Trends

The bone punches market in Europe is experiencing significant growth. The aging population across European countries, coupled with a rise in orthopedic and spinal conditions such as arthritis, osteoporosis, and degenerative disc diseases, is driving the demand for bone punches used in surgeries such as joint replacements, spinal decompressions, and trauma-related procedures. The need for precise and minimally invasive surgical tools, such as bone punches, is increasing as these procedures become more common.

The UK bone punches marketis expected to show significant growth. The presence of leading medical device manufacturers and the increasing availability of innovative bone punch products, including ergonomically designed and disposable options, further drive market growth. The rising awareness among healthcare professionals about the benefits of advanced surgical tools and continued research and development is expected to propel the bone punches market in the UK.

Asia Pacific Bone Punches Market Trends

The bone punches market in Asia Pacific is experiencing rapid growth due to the rising prevalence of orthopedic and spinal disorders, including conditions such as osteoporosis, arthritis, and degenerative spine diseases, which is driving demand for bone punches used in surgical procedures. The aging population in countries such as Japan, China, and India, combined with an increase in trauma-related injuries, further fuels the need for surgical interventions.

China bone punches market is growing at a lucrative rate. The growing popularity of minimally invasive surgeries, which rely on precision tools, further propels market growth. China's expanding medical device manufacturing industry and collaborations with international players enhance product availability and affordability. Moreover, the rising number of skilled surgeons and improved patient awareness about advanced surgical treatments are supporting the sustained growth of this market.

Latin America Bone Punches Market Trends

The bone punches market in Latin America is primarily driven by the rising prevalence of orthopedic and spinal disorders, fueled by an aging population and increasing cases of trauma-related injuries. The growing adoption of minimally invasive surgical techniques, which often require precision instruments like bone punches, is also a significant factor.

Middle East and Africa Bone Punches Market Trends

The bone punches market in the Middle East and Africa is driven by the rising medical tourism, particularly in countries such as the UAE and South Africa. This is contributed by increasing the adoption of high-quality surgical instruments. However, challenges such as disparities in healthcare access across the region are being mitigated by international collaborations and efforts to improve healthcare delivery in underdeveloped areas.

Saudi Arabia bone punches market is driven by the rising incidence of orthopedic and spinal conditions, such as osteoporosis, arthritis, and degenerative spine disorders, which is a significant driver fueled by an aging population and sedentary lifestyles. In addition, the growing number of sports injuries and trauma cases has increased the demand for surgical interventions requiring bone punches. As part of Saudi Vision 2030, government investment in healthcare infrastructure has also played a crucial role by enhancing hospital facilities and promoting the adoption of advanced medical technologies.

Key Bone Punches Company Insights

Key players operating in the bone punches market are undertaking various initiatives to strengthen their market presence and increase the reach of their product types and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Bone Punches Companies:

The following are the leading companies in the bone punches market. These companies collectively hold the largest market share and dictate industry trends:

- Acumed, LLC

- Aesculap, Inc. (by B. Braun Company)

- Arthrex, Inc.

- Becton, Dickinson and Company

- CONMED Corporation

- Exactech, Inc.

- G Source, Inc.

- Innomed, Inc.

- Integra LifeSciences Holdings Corp.

- Johnson & Johnson Services, Inc.

- Karl Storz GmbH & Co.

Recent Developments

-

In November 2024, Aesculap, Inc. launched its next-generation SQ.line KERRISON Bone Punches. These instruments are engineered to meet the strict demands of spinal and cranial neurosurgery, providing surgeons and medical staff with dependable and comfortable tools.

-

In April 2022, TeDan Surgical Innovations (TSI) announced the launch of the single-use, sterile Phantom Multi-Bite Kerrison Rongeur, and Phantom Bone Collector for spinal procedures such as laminectomy and decompression.

Bone Punches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 215.42 million

Revenue forecast in 2030

USD 263.76 million

Growth Rate

CAGR of 4.13% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Segment Scope

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, & MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Acumed, LLC, Aesculap, Inc. by B. Braun Company, Arthrex, Inc., BD, CONMED Corporation, Exactech, Inc., G Source, Inc, Innomed, Inc., Integra LifeSciences Holdings Corporation, Johnson & Johnson Services, Inc., Karl Storz GmbH & Co.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bone Punches Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bone punches market report on the basis of product type, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Classical Kerrison

-

Detachable Kerrison

-

Noir Kerrison

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgeries

-

Spinal Surgeries

-

Dental Surgeries

-

Craniofacial Surgeries

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

-

Research and Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bone punches market size was estimated at USD 198.30 million in 2024 and is expected to reach USD 215.42 million in 2025.

b. The global bone punches market is expected to grow at a compound annual growth rate of 4.13% from 2025 to 2030 to reach USD 263.76 million by 2030.

b. North America dominated the bone punches market, with a share of 33.29% in 2024. Due to its well-established healthcare infrastructure and the high adoption of advanced surgical tools and techniques. The region's dominance is further driven by the growing prevalence of orthopedic conditions, such as osteoporosis and arthritis, and an increasing number of trauma and sports-related injuries.

b. Some key players operating in the bone punches market include Acumed, LLC, Aesculap, Inc. by B. Braun Company, Arthrex, Inc., BD, CONMED Corporation, Exactech, Inc., G Source, Inc., Innomed, Inc., Integra LifeSciences Holdings Corporation, Johnson & Johnson Services, Inc., Karl Storz GmbH & Co.

b. Key factors driving the market growth include the growing incidence of conditions such as osteoporosis, arthritis, and other bone-related diseases, which are fueling the demand for bone punches in surgical procedures. The rise in road accidents, falls, and sports-related injuries has led to a higher volume of orthopedic surgeries requiring bone punches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.