- Home

- »

- Advanced Interior Materials

- »

-

Boom Lifts Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Boom Lifts Market Size, Share & Trends Report]()

Boom Lifts Market (2022 - 2030) Size, Share & Trends Analysis Report By Engine Type (Electric, Engine-powered), By Product (Trailer Mounted Booms, Vehicle Mounted Boom), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-992-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global boom lifts market size was estimated at USD 10.4 billion in 2021. It is expected to expand at a compounded annual growth rate (CAGR) of 6.4% from 2022 to 2030. An increase in construction and infrastructural activities across the globe are expected to open new growth avenues for players in the industry. Boom lifts witnessed a major disruption in growth due to the unprecedented effect of the global pandemic. Some of its major end-use industries including construction, transportation & logistics were hit hard by the pandemic. These sectors witnessed challenges such as project delays, contract cancellation, and supply-chain disruption. Furthermore, the shutdowns of numerous construction sites including industrial facilities due to lockdowns still remain in place.

According to the U.S. Census Bureau, retail e-commerce sales grew in the second quarter of 2022 by 2.7% as compared to the first quarter. Transportation & logistics companies often deal with goods in humongous quantities, making it difficult to load them manually on transportation vehicles. Therefore, boom lifts enable logistic companies to move heavy goods easily, and as a result, are extensively used in the transportation & logistics industry.

In transportation and logistics, boom lifts are used for moving heavy cargo materials. Boom lifts are also used in daily warehouse maintenance which offers efficient navigation through narrow aisles. The growth in the transportation & logistics industry is attributable to the growing e-commerce retail coupled with rising global trade activities

Boom lift enables easy and safe reach for high aerial works in construction with a strong platform. Growing demand for residential & non-residential construction and maintenance of old buildings are expected to facilitate the demand for boom lifts. According to the U.S. census bureau, the total construction activity in March 2022 increased by 11.7%, as compared to March 2021. The industry’s growth is attributed to increased construction activities, especially high-rise building projects.

Boom lift market operations rely heavily on the skills and efforts of the workforce and management group. The operations benefit from their expertise, understanding of the industry, and experience. Since there is a severe shortage of qualified workers in the market, competition for highly skilled labor remains fierce. As a result, it is anticipated that the lack of an adequately skilled workforce will have a detrimental effect on the operations and financial standing of industry participants, impeding the expansion of the market.

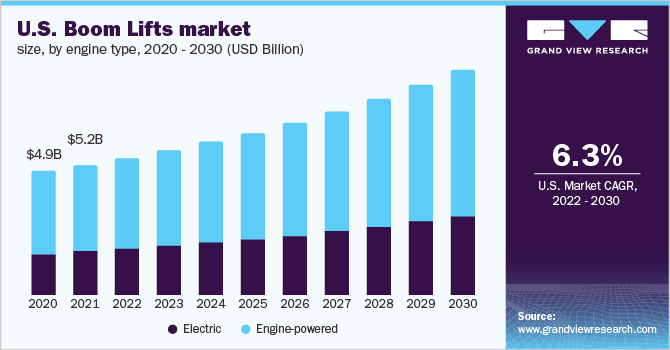

Engine Type Insights

The engine-powered segment dominated the market and accounted for 66.1% of the global revenue share in 2021. The increased demand for the diesel engine-powered segment for usage in outdoor applications to move heavy loads remains a strong driver of growth. They are designed for utilization in worst-case loading applications as they have high vertical reach and enhanced load-carrying capacity.

The engine-powered boom lift can be deployed in remote locations owing to the easy availability of diesel or other petroleum products. Major benefits of engine-powered boom lifts include superior performance, high durability, and unmatched versatility, which continue to drive growth.

The electric engine type segment is expected to grow at a CAGR of 6.8% over the forecast period. They are suitable for usage in confined spaces wherein horizontal movement of the operator is necessary. These lifts are designed for utilization in side-by-side work environments. The electric segment has compact storage length and self-leveling platforms.

The compact design of electric boom lifts makes them suitable for use in warehouses that have narrow aisles and confined spaces. They allow technicians to access and perform tasks in difficult-to-reach areas of commercial and institutional buildings. Moreover, the electric segment offers high efficiency and has low operating costs owing to long-duty cycles between two charges.

Product Insights

The others product segment accounted for a dominant revenue share of 56.5% in 2021. It comprises self-propelled boom lifts, which include both, electricity-driven and diesel models. They are convenient and highly flexible. The rotation and articulation of these lifts allow them to out-maneuver various obstacles without the requirement of repositioning their bases.

Truck mounts, also known as vehicle-mounted boom lifts, are access platforms that are mounted on the chassis of lorries, trucks, or vans. These are specially modified with outriggers to ensure high performance and stability. They are frequently used by local government agencies and utility companies to preserve and construct general roadside infrastructures such as street lights and telecommunications.

The trailer-mounted booms product segment is expected to grow at a CAGR of 7.5% over the forecast period. These lifts are suitable for a variety of outdoor and indoor industrial and construction applications. They have self-leveling hydraulic outriggers that stabilize booms, making them highly safe and sturdy.

Crawler/spider are mobile elevating work platforms that are stable and leveled as they have four stabilizer legs. These lifts can be maneuvered in a variety of ways to get workers into corners, tight spaces, and difficult-to-reach areas. Crawler/spider booms are lightweight and extremely compact when stowed for transportation, making them simple to transport to job sites.

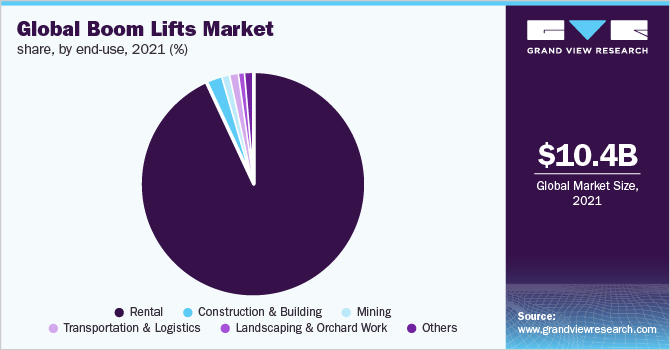

End-use Insights

The rental segment dominated the market and accounted for 93.5% of global revenue in 2021. Rental firms are being forced to increase the size of their fleets as a result of rising demand for boom lifts from the construction, mining, warehousing, logistics, manufacturing, and automotive industries.

In the construction industry, achieving massive output in a short duration is often crucial for controlling costs. Boom lifts are utilized at construction sites to quickly finish the strenuous labor process in place of erecting scaffolding. Boom lifts are designed to operate at heights that are above the capabilities of other machinery.

Boom lifts are necessary for performing routine maintenance and repairs on electrical transmission lines and streetlights. These are key duties of government agencies like electricity boards, municipal corporations, and other agencies. A significant increase in the demand for boom lifts is expected owing to the rising government spending on construction and maintaining infrastructure in developing nations.

Transportation & logistics is projected to grow at a CAGR of 7.6% over the forecast period. Boom lifts are necessary for large logistics facilities, multi-layer stacking, and efficient storage of goods. These warehouses exhibit constrained spaces and congested passageways. Therefore, boom lifts are a suitable option for material handling, loading, and unloading. The boom lifts help minimize any risks or injuries to workers.

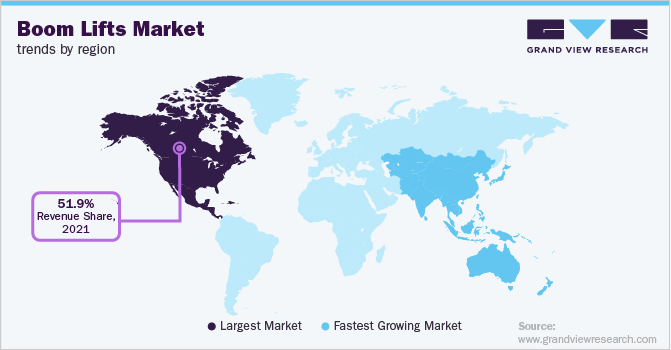

Regional Insights

North America accounted for 51.9% of the global revenue share in 2021. Boom lifts are widely used in the construction industry to reach elevated areas easily and safely for painting, cutting tree branches, and other electrical & plumbing-related tasks. Rapid infrastructural development and rising government investment in residential and commercial construction are expected to augment the demand in North America.

Asia Pacific is projected to grow at a CAGR of 8.4% over the forecast period. Growing infrastructure development activities in the Asia Pacific have created lucrative growth opportunities for machinery rental companies, thereby, augmenting the demand for these products in the region.

According to the AEW, real estate investment managers, the EU is expected to register promising growth in transportation & logistics activities owing to increased e-commerce sales. Growing transportation & logistics activities are likely to boost the boom lifts market growth, where they are used for warehouse management and lifting heavy cargo.

The demand for these products in Central & South America is expected to be driven by factors such as government investments in infrastructural development, and the construction of residential complexes, offices, healthcare facilities, and factories. In addition, rapid growth in the logistics sector, coupled with rapid developments in the e-commerce industry, is expected to drive product demand during the forecast period.

Key Companies & Market Share Insights

The market features the presence of both large-scale and medium-scale equipment manufacturers. The major players include JLG Industries, HAULOTTE GROUP, Dinolift Oy, LEGUAN LIFTS OY, Skyjack, A Time Manufacturing Company, Niftylift (UK) Limited, and TEUPEN. These companies are aggressively investing in R&D activities for product advancements in order to thrive in the highly competitive market.

Furthermore, the key manufacturers continue to strengthen their regional presence by collaborating with local players offering similar products and services to augment their market presence and achieve a competitive advantage over global peers. Similarly, companies also implement inorganic growth strategies in order to enhance their product portfolio. Some prominent players in the global boom lifts market include:

-

JLG Industries

-

HAULOTTE GROUP

-

Dinolift Oy

-

LEGUAN LIFTS OY

-

Skyjack

-

A Time Manufacturing Company

-

Niftylift (UK) Limited

-

TEUPEN

Boom Lifts Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 11.05 billion

Revenue forecast in 2030

USD 18.28 billion

Growth rate

CAGR of 6.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Engine type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; France; U.K.; Spain; China; India; Japan; Australia; South Korea; Argentina; Brazil; Saudi Arabia; South Africa

Key companies profiled

JLG Industries; HAULOTTE GROUP; Dinolift Oy; LEGUAN LIFTS OY; Skyjack; A Time Manufacturing Company; Niftylift (UK) Limited; TEUPEN; OMMELIFT; Terex Corporation; Dexterlifts Oy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

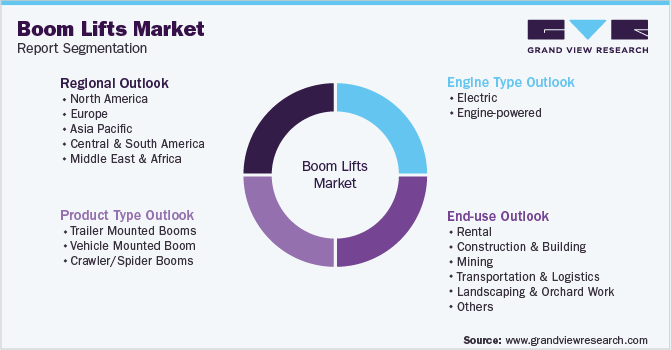

Global Boom Lifts Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2030. For this study, Grand View Research has segmented the global boom lifts market report based on engine type, product, end-use, and region:

-

Engine Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Electric

-

Engine-powered

-

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Trailer Mounted Booms

-

Vehicle Mounted Boom

-

Crawler/Spider Booms

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Rental

-

Construction & Building

-

Mining

-

Transportation & Logistics,

-

Landscaping & Orchard Work

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Spain

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global boom lifts market size was estimated at USD 10.44 billion in 2021 and is expected to be USD 11.05 billion in 2022

b. The global boom lifts market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2022 to 2030 to reach USD 18.28 billion by 2030.

b. North America dominated the boom lifts market with a revenue share of 51.9% in 2021. Rapid infrastructural development and rising government investment in residential and commercial construction are expected to augment the demand for boom lifts in North America.

b. Some of the key players operating in the Boom lifts market include: JLG Industries, HAULOTTE GROUP, Dinolift Oy, LEGUAN LIFTS OY, Skyjack, A Time Manufacturing Company, Niftylift (UK) Limited, TEUPEN, OMMELIFT, Terex Corporation, Dexterlifts Oy

b. Key factors that are driving the boom lifts market growth include rising construction and infrastructural activities across the globe is expected to open new growth avenues

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.