- Home

- »

- Consumer F&B

- »

-

Bouillon Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Bouillon Market Size, Share & Trends Report]()

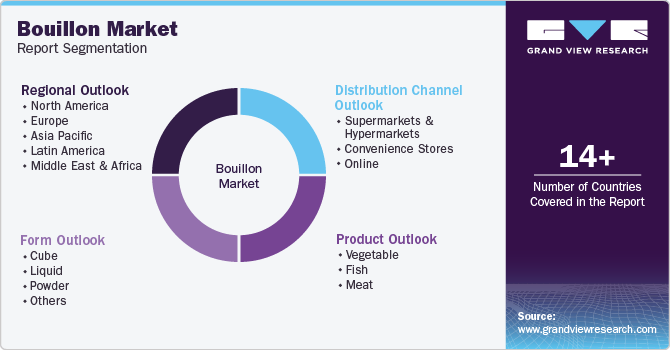

Bouillon Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Meat, Vegetable, Fish), By Form (Cube, Liquid, Powder), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-929-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bouillon Market Summary

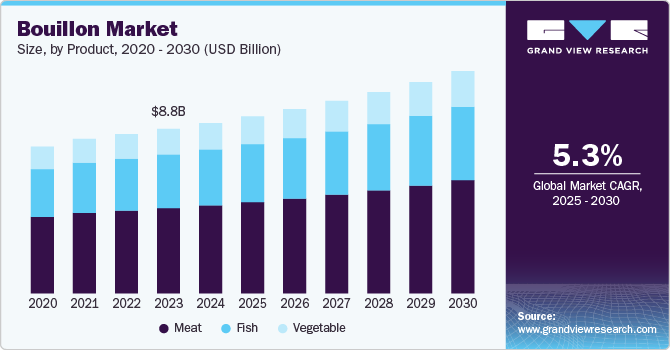

The global bouillon market size was valued at USD 8.78 billion in 2023 and is projected to reach USD 11.86 billion by 2030, growing at a 4.5% from 2024 to 2030. The market growth was propelled by the increasing demand for convenience food and the growing awareness regarding health benefits of bouillon products as these products are rich in proteins, vitamins, minerals, and nutrition.

Key Market Trends & Insights

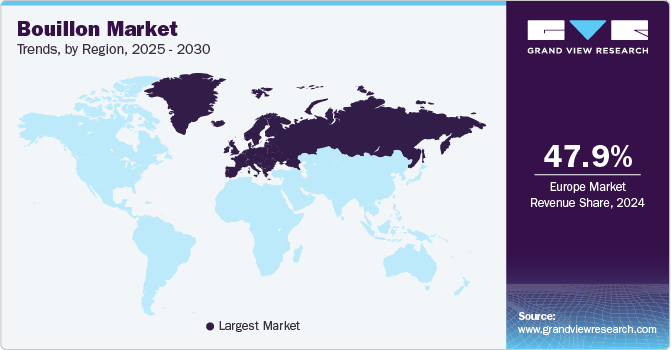

- Europe bouillon market held the largest share of 47.9% in 2023

- The North America bouillon market held 24.0% of the market share in 2023.

- By product, Meat dominated the market with a 51.8% share in 2023

- By form, Powder form is expected to grow at a CAGR of 5.2% over the forecast period.

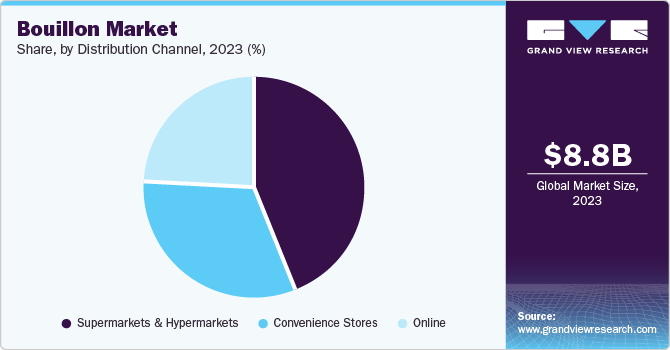

- By distribution channel, Supermarkets & hypermarkets held market share of 44.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.78 Billion

- 2030 Projected Market Size: USD 11.86 Billion

- CAGR (2024-2030): 4.5%

- Europe: Largest market in 2023

Additionally, the increasing popularity of vegan and gluten-free diets has further fueled the demand for bouillon products that cater to these dietary preferences. Changing lifestyle of people and inclination towards consumption of easy to make and healthy food products are projected to push the overall market demand over the forecast period.

In addition, the food manufacturing and hospitality industries have significantly contributed to the growth of the bouillon market. Bouillon is a staple ingredient in many cuisines and its use in food processing and preparation is widespread. The increasing number of quick-service restaurants and food processing businesses globally has driven the demand for bouillon products. Furthermore, the emphasis on food safety and quality control in the food processing sector has led to a growing preference for high-grade bouillon products.

Moreover, e-commerce platforms played a crucial role in expanding the market for bouillon products. The rapid growth of online retail has made it easier for consumers to purchase bouillon products, broadening the market reach for producers. This trend is particularly significant in regions where traditional retail channels are less developed.

Furthermore, economic factors such as rising disposable incomes and evolving lifestyles have propelled the demand for bouillon products. As consumers’ purchasing power increases, they have become more inclined to spending on premium and convenient food products. This holds particularly true in emerging markets where economic growth has resulted into higher disposable incomes and changing consumer behaviors.

Product Insights

Meat dominated the market with a 51.8% share in 2023 owing to the increasing consumer demand for rich and savory flavors in their meals. Meat-based bouillon products, known for their depth and complexity, are highly favored for enhancing the taste of various dishes. This preference for flavorful and convenient meal solutions aligns with the broader trend of seeking ready-to-use food products that simplify cooking without compromising on taste. Meat bouillon products are often rich in proteins, vitamins, and minerals, making them a favorable option for health-conscious consumers looking to add nutritional value to their meals. Moreover, increasing awareness regarding the benefits of meat consumption in the Asia Pacific region is expected to increase the demand for meat bouillon products in the coming years.

The vegetable segment is projected to grow at the fastest CAGR over the forecast period. The market surge is driven by the increasing consumer preference for plant-based diets with the emergence of veganism. These products cater to the growing number of consumers seeking meat-free alternatives that provide rich flavors and nutritional benefits. In addition, consumers have become increasingly aware of the health benefits associated with vegetable-based diets, such as lower cholesterol levels and reduced risk of chronic diseases. Vegetable bouillon products, often free from gluten, lactose, cholesterol, and fat, align well with these health trends, which makes them a popular choice among health-conscious consumers.

Form Insights

Cube form secured the dominant market share in 2023 due to the increasing demand for convenient and time-saving cooking solutions. Bouillon cubes offer a quick and easy way to enhance the flavor of various dishes. This convenience factor is particularly appealing in urban areas where fast-paced lifestyles necessitate efficient cooking methods. Furthermore, the growing popularity of ready-to-eat and processed foods has stimulated the market forward. As more consumers turn to these food options, the demand for bouillon cubes, which are used to add depth and richness to such meals, has surged. Additionally, the rising awareness and preference for flavorful, home-cooked meals have contributed to the popularity of bouillon cubes, as they provide a simple way to achieve restaurant-quality flavors at home.

Powder form is expected to grow at a CAGR of 5.2% over the forecast period. Bouillon powder, often available in low-sodium and organic variants, caters to health-conscious individuals looking for healthier alternatives to traditional bouillon cubes or liquid broths. The ability to control the amount of seasoning added to dishes makes bouillon powder a preferred choice for those monitoring their salt intake. Moreover, the versatility of bouillon powders has been another significant market driver. These can be easily incorporated into a wide range of recipes including soups, stews, sauces and marinades, providing a rich and consistent flavor profile.

Distribution Channel Insights

Supermarkets & hypermarkets held market share of 44.4% in 2023. These retail outlets are strategically located in urban and suburban areas, which makes them easily accessible to a large consumer base. Their widespread presence ensures that bouillon products are readily available to a diverse range of customers. Moreover, these retail outlets typically stock a wide range of bouillon products, including different forms and flavors, catering to varied consumer preferences. The variety and convivence enhances the shopping experience and boost sales in these retail outlets.

Online distribution channels are expected to emerge as the fastest growing segment during the forecast period with the increasing consumer preference for the convenience and ease of online shopping. With busy lifestyles and the rise of digital technology, consumers have turned to e-commerce platforms to purchase their groceries, including bouillon products. Additionally, e-commerce platforms offer a wide variety of bouillon products, including different flavors, forms, and dietary options including organic, low-sodium, vegan. This extensive range allows consumers to easily find and purchase products that meet their specific preferences and dietary needs.

Regional Insights

Europe bouillon market held the largest share of 47.9% in 2023 owing to the increasing consumer demand for natural and organic food products. European consumers have become increasingly health-conscious and have sought bouillon products that are free from artificial additives, preservatives, and Monosodium Glutamate (MSG). This trend is particularly strong in countries including Germany, France, and Italy, where there is a high consumption of soups and sauces with a significant preference for premium and organic bouillon products.

North America Bouillon Market Trends

The North America bouillon market held 24.0% of the market share in 2023 owing to the convenience and versatility of bouillon products. Bouillon cubes, powders, and liquids offer a quick and easy way to add depth and flavor to a variety of dishes. In addition, technological advancements in food processing and packaging have further enhanced the quality and shelf life of bouillon products. Innovations in these areas ensure that the products retain their nutritional value and flavor over extended periods, meeting consumer expectations for high-quality, long-lasting food items.

U.S. Bouillon Market Trends

The bouillon market in the U.S. is expected to be driven by the expansion of the foodservice industry, including restaurants, catering services, and ready-to-eat meal providers, over the forecast period. These establishments rely heavily on bouillon products to enhance the flavor of their dishes efficiently and consistently. The versatility of bouillon, which can be used in a wide range of culinary applications, makes it a staple ingredient in professional kitchens across the country.

Asia Pacific Bouillon Market Trends

The Asia Pacific (APAC) bouillon market accounted for 14.7% share in 2023. The diverse culinary traditions within the APAC region, including Chinese, Japanese, Indian, and Southeast Asian cuisines, often rely on bouillon products to create rich and flavorful dishes. Furthermore, consumers have become increasingly aware of the health benefits associated with natural and organic ingredients, leading to a surge in demand for bouillon products that are free from artificial additives and preservatives. The rising popularity of vegan and gluten-free diets has further propelled the market for vegetable-based and gluten-free bouillon products.

Key Bouillon Company Insights

The global bouillon market is fiercely competitive featuring key players such as Nestle, International Dehydrated Foods, Inc., The Unilever Group, McCormick & Company, Incorporated, and others. The companies have increasingly focused on new product designs as per the latest consumer preferences for flavor and health benefits to acquire a larger market share.

-

Hormel Foods Corporation is an American multinational food processing that produces a wide range of products, including deli meats, ethnic foods, and pantry staples and operates through several segments, including retail, foodservice, and international.

Key Bouillon Companies:

The following are the leading companies in the bouillon market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- The Unilever Group

- International Dehydrated Foods, Inc.

- McCormick & Company, Incorporated

- Hormel Foods Corporation

- The Kraft Heinz Company

- Michael Foods, Inc.

- Goya Foods, Inc.

- Proliver

- Homegrown Family Foods

Recent Development

-

In September 2024, Better Than Bouillon announced the launch of a new Organic Beef Pho Base from the company’s Culinary Collection.It is made with roasted beef, beef stock, ginger & anise, and helps consumers to make a flavorful pho broth.

-

In October 2023, Hormel Foods Corporation launched HERB-OX Cold Water Dissolve Beef and Chicken Bouillon. These are the first of their kind, dissolving in cold water to revolutionize the preparation of soups, gravies, stews, and more, providing convenience and flavor.

Bouillon Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.10 billion

Revenue forecast in 2030

USD 11.86 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Form, Distribution Channel, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, France, Germany, Itay, Spain, UK, China, India, Japan, Brazil, Argentina, South Africa

Key companies profiled

Nestlé; The Unilever Group; International Dehydrated Foods, Inc.; McCormick & Company, Incorporated; Hormel Foods Corporation; The Kraft Heinz Company; Michael Foods, Inc.; Goya Foods, Inc.; Proliver; Homegrown Family Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bouillon Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bouillon market report based on product, form, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vegetable

-

Fish

-

Meat

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Cube

-

Liquid

-

Powder

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.