- Home

- »

- Animal Health

- »

-

Bovine Artificial Insemination Market, Industry Report, 2033GVR Report cover

![Bovine Artificial Insemination Market Size, Share & Trends Report]()

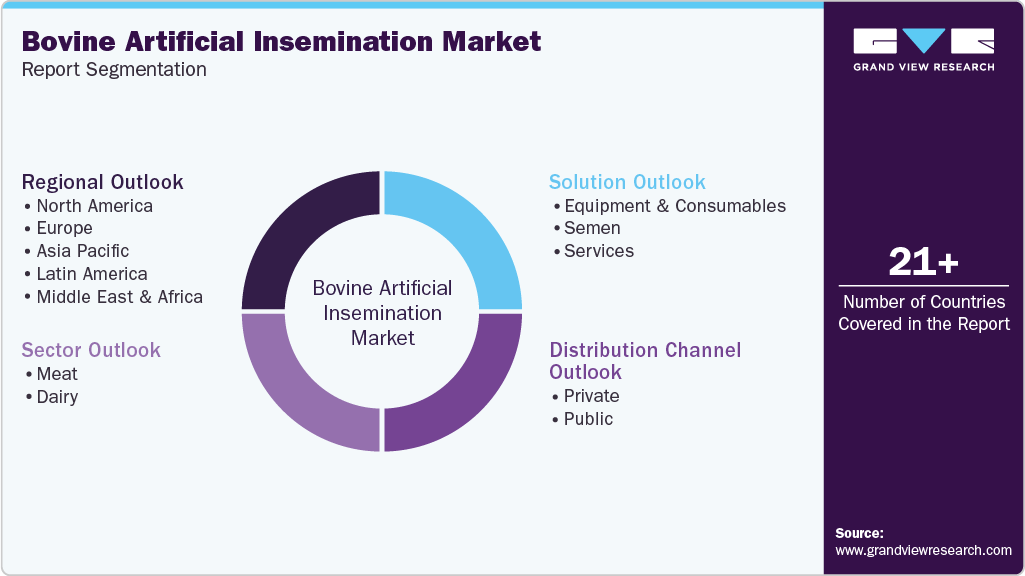

Bovine Artificial Insemination Market (2026 - 2033) Size, Share & Trends Analysis Report By Solution (Equipment & Consumables, Semen, Services), By Distribution Channel (Private, Public), By Sector, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-066-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bovine Artificial Insemination Market Summary

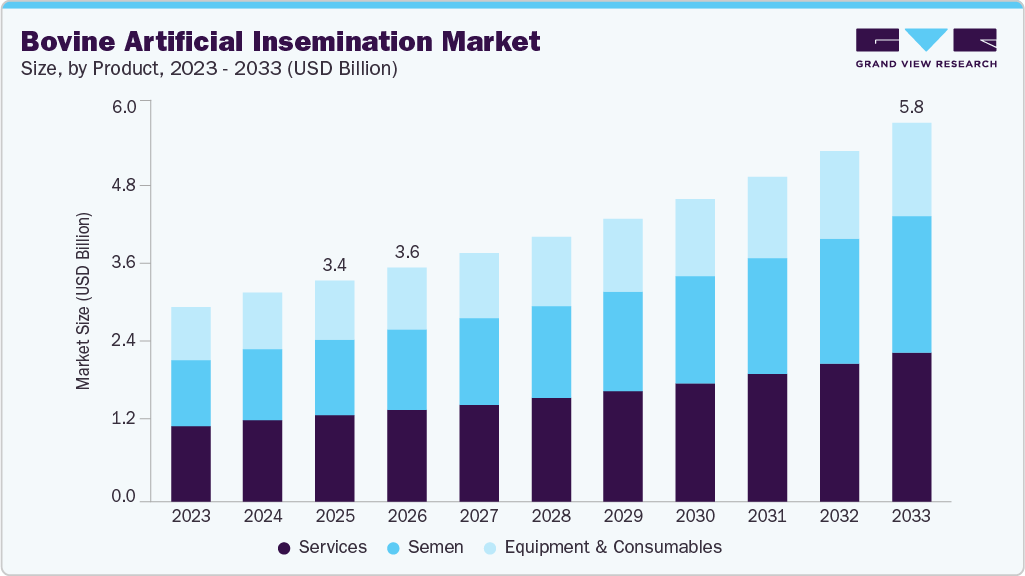

The global bovine artificial insemination market size was estimated at USD 3.39 billion in 2025 and is projected to reach USD 5.80 billion by 2033, growing at a CAGR of 7.10% from 2026 to 2033. The market is primarily driven by the rising demand for meat, dairy, and dairy products, advancements in veterinary reproductive technologies, the need for sustainable food production, and supportive actions taken by governments and market participants.

Key Market Trends & Insights

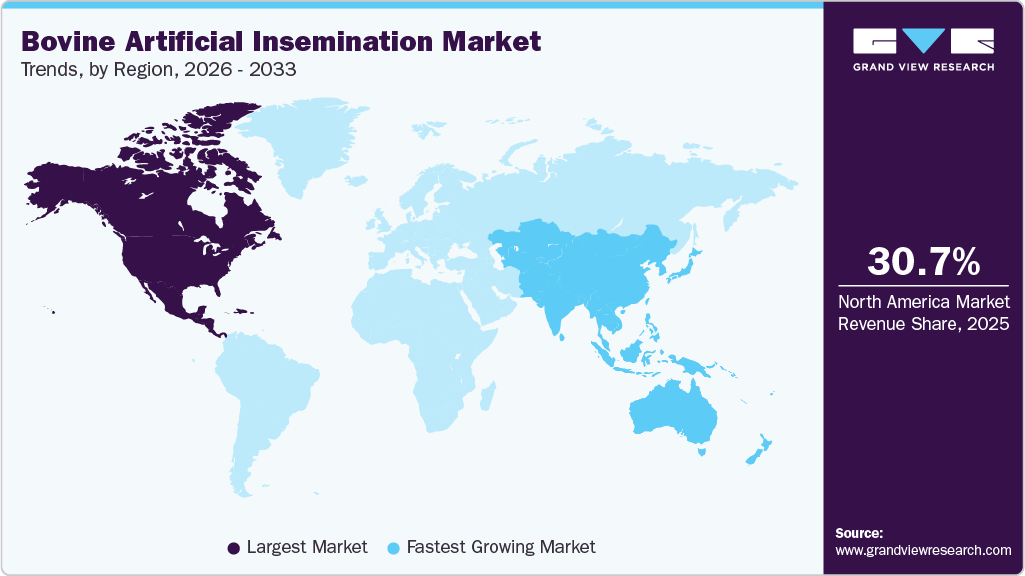

- North America bovine artificial insemination market held the largest revenue share of 30.67% in 2025.

- U.S. dominated the North America region with the largest revenue share in 2025.

- By solutions, services held the largest share of 39.02% of the market in 2025.

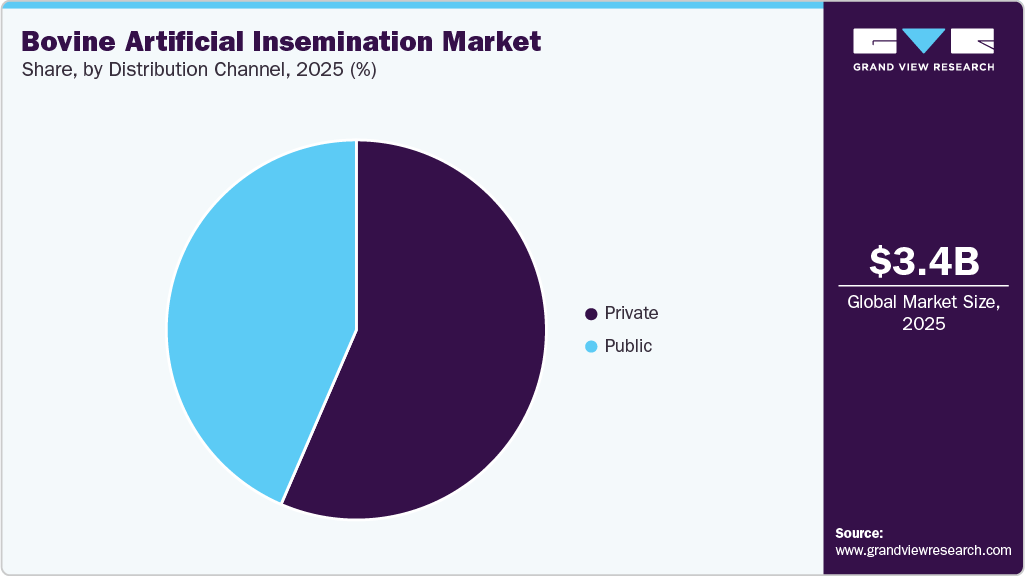

- By distribution channel, the private dominated with a market share of 56.19% in 2025.

- By sector, the dairy held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.39 Billion

- 2033 Projected Market Size: USD 5.80 Billion

- CAGR (2025-2033): 7.10%

- North America region: Largest market in 2025

- Asia Pacific region: Fastest growing market

For example, the government of India authorized the plan in February 2025 to "Establish 1500 MAITRIs (Multipurpose AI Technicians in Rural India)," with a project cost of INR 12.15 crores (USD 1.40 Mn), according to an article published by the Odisha Livestock Resources Development Society. By creating Multi-Purpose Artificial Insemination Technicians in Rural India (MAITRIs), the project's primary objective is to increase the productivity of the current bovine population by expanding the coverage of artificial insemination.

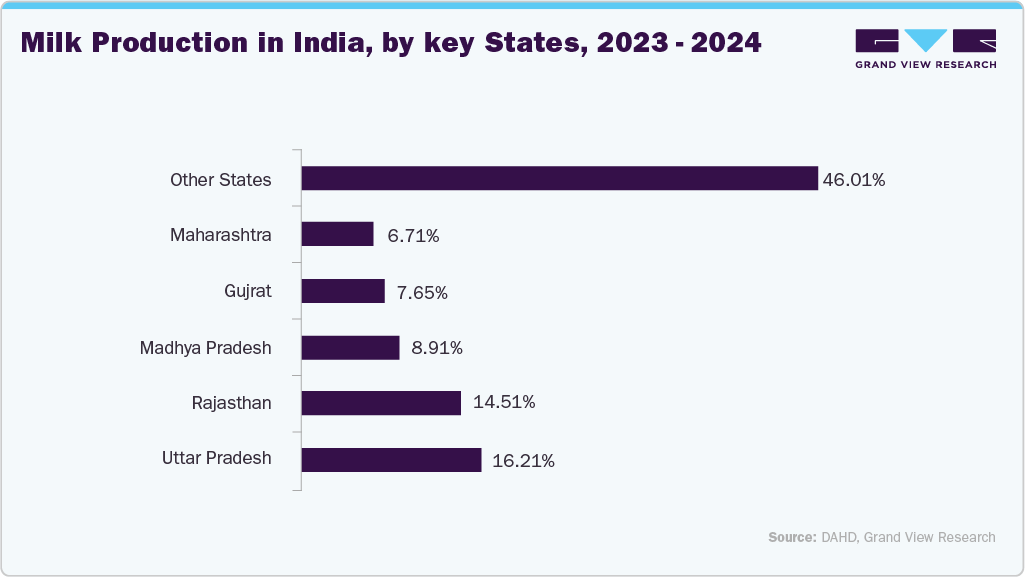

The increasing demand for dairy products is a key market driver. As the global population grows and dietary preferences shift toward higher protein consumption, the need for enhanced livestock productivity rises. Bovine AI is crucial in meeting this demand by improving genetic traits, increasing milk yield, and enhancing quality. For instance, according to an article published by The Hindu, in November 2024, India’s milk output increased by 3.78% in 2023-2024 compared to 2022-2023 predictions. Uttar Pradesh leads the nation in milk production, accounting for 16.21% of total milk output.

Furthermore, the study estimates that the country produced 239.30 million tons of milk in 2023-2024, representing a compound annual growth of 5.62% over the previous ten years, according to Union Minister Rajiv Ranjan Singh. The total quantity of milk produced in 2022-2023 was 230.58 million tonnes. India is first in the world in terms of milk output.

Historical Development and Key Innovations in Bovine Artificial Insemination Market:

Time Period

Technology/Innovation

Description

Impact on Industry

1930s-1940s

First commercial AI services

Initial commercialization of AI technology using fresh semen

Limited range (24-hour viability), established basic protocols

1950s

Glycerol-based cryopreservation

Discovery that glycerol could protect sperm during freezing

Enabled long-term storage and international transport of genetic material

1960s

Liquid nitrogen storage (-196°C)

Standardization of deep-freeze storage technologies

Extended semen viability indefinitely, created a global genetics market

1970s

Improved Holstein genetics

Dedicated breeding programs with progeny testing

Dramatic milk yield increases, establishment of genetic evaluation systems

1980s

MOET (Multiple Ovulation Embryo Transfer)

Combined AI with superovulation and embryo transfer

Accelerated genetic improvement from superior female lines

1990s

Computer-based genetic evaluations

Introduction of BLUP (Best Linear Unbiased Prediction) methods

More accurate bull selection, identification of economically valuable traits

1995-2000

Flow cytometry sex-sorting

Development of commercial X/Y sperm sorting technologies

Enabled gender-specific inseminations, revolutionized herd management

2000-2005

Genomic selection

First genomic enhanced evaluations

Reduced generation interval, improved selection accuracy

2005-2010

SNP chip technology

High-density genetic markers (50K+ SNPs)

Identification of genetic markers for production and health traits

2010-2015

Sexed-semen efficiency improvements

Second-generation sorting technologies with improved fertility

Increased adoption rates, reduced cost per conception

2015-2018

Portable ultrasound-guided AI

Development of affordable on-farm technologies

Improved timing accuracy, higher conception rates

2018-2020

AI robot prototypes

Initial development of automated insemination systems

Reduced labor requirements, standardized procedures

2020-2023

CRISPR gene editing applications

Research into precise genetic modifications

Potential for disease resistance traits, still in the regulatory phase

2023-2024

AI-powered estrus detection systems

Machine learning algorithms with wearable sensors

Improved insemination timing, reduced labor costs

Market Concentration & Characteristics

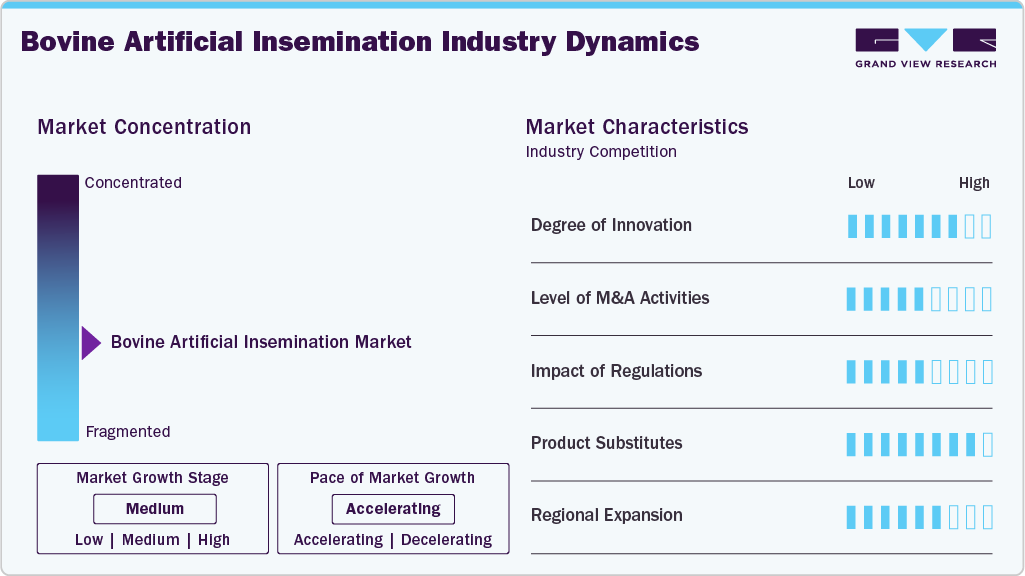

The bovine artificial insemination industry is moderately concentrated and the pace is accelerating, characterized by strong technological innovation, widespread adoption of genetic improvement programs, and growing integration of AI and biotechnology. It features high competition among global players, strong government support for breeding programs, and increasing demand for productivity enhancement and disease resistance in dairy and beef cattle.

The industry is experiencing a high degree of innovation owing to industry players actively attempting to launch novel products and services to enhance the bovine insemination process. For example, in March 2024, IMV Technologies introduced BovIntel, a groundbreaking ultrasound software for bovine fertility assessment. It enhances accuracy, accessibility, & training for vets, improving pregnancy rates and efficiency in dairy herd management. With real-time analysis and easy integration into existing equipment, artificial insemination strategies for better outcomes are revolutionized.

The participants conduct a moderate level of mergers and acquisitions, which attempt to consolidate their services and product portfolios. For instance, in January 2025, IMV Technologies acquired Conception Ro-Main Inc., a key Canadian swine production company, enhancing its farm animal business with AI-driven and IoT-enabled reproductive innovations.

Regulations have a high impact on the market. This is due to continuously evolving government regulations and policies, trade agreements, government support and incentives, intellectual property rights, and animal welfare regulations. For instance, international trade agreements and tariffs can impact the import and export of bovine genetic material, affecting the availability and pricing of semen and other related products. On the other hand, government initiatives, subsidies, and financial assistance programs help promote genetic improvement, sustainable agriculture, and livestock productivity.

The threat of internal substitutes in this market is high due to the presence of several normal vs. sexed semen providers, suppliers of equipment and consumables, and AI service providers that compete to gain market share within their individual segments. External substitutes include alternative breeding methods, such as natural mating. The threat from external substitutes is comparatively low, as AI offers numerous advantages regarding genetic improvement, disease control, and reproductive efficiency. These benefits make AI a preferred method for many farmers and reduce the likelihood of significant substitution. Overall, the threat of substitutes is moderate.

The market is experiencing a moderate level of regional expansion, owing to increasing adoption in developing economies, government breeding initiatives, and demand for superior cattle genetics. Emerging markets in Asia-Pacific, Latin America, and Africa are witnessing strong growth due to improved veterinary infrastructure, farmer training programs, and access to advanced reproductive technologies.

Solution Insights

Service accounted for the largest revenue share of 39.06% in 2025. This can be attributed to bovine AI techniques becoming more popular and widely used in major markets. For instance, over 31.5 million semen straws have been sold globally by Urus Group, one of the industry’s top companies. AI is the most practical and cost-effective biotechnology tool for getting better genetics to farmers’ doorsteps.

The semen segment is anticipated to grow at the fastest CAGR over the forecast period. This segment is further bifurcated into normal (conventional) and sexed semen. Among them, the sexed semen segment is expected to grow with the highest growth rate. Farmers can use sexed sperm to improve genetics in their herds and raise their chances of having a heifer calf. According to VikingGenetics, approximately 70% of VikingJersey semen sold by the company in 2020 was sexed semen. The segment is expected to rise in the coming years as a result of increasing market stakeholder initiatives and growing knowledge of the advantages of sexed semen.

Sector Insights

Based on sector, the dairy segment dominated the market in terms of share in 2025 and growth rate over the forecast period. This can be due to the increasing milk production, consumption of dairy & dairy products, and the requirement for sustainably sourced animal protein, which are some of the main reasons influencing the segment share. The demand for bovine dairy products, such as milk and cheese, dwarfs the demand for bovine meat. According to May 2024 data published by FAO, 965.7 million MT of milk were produced worldwide in 2023. Furthermore, Asia is estimated to be the largest milk-producing region, with 46% of the global milk production. According to another 2024 press release by PIB, India alone is responsible for producing over 230 million MT of milk, making it the largest producer in the world, followed by China.

Other dairy products are also in demand worldwide. According to January 2024 data published by Daily Herd Management, global cheese consumption is estimated at 21.6 million MT in 2024, a 5.7% increase compared to 2019. These factors ensure the segment continues to dominate in share and CAGR throughout the forecast period.

The meat segment is the second fastest growing over the forecast period. According to a USDA Foreign Agricultural Service report, 61.66 million pounds of meat were produced from beef for 2024-25. The market is fueled by rising global demand for high-quality beef and efficiency-focused breeding programs. Producers increasingly adopt AI technologies to enhance herd genetics, improve meat yield, and ensure consistent quality. Advanced reproductive techniques, including genomics and precision breeding, are being integrated to optimize production.

Distribution Channel Insights

Private dominated with a market share of 56.49% in 2025 and the highest CAGR over the forecast period since most market participants engage in direct or indirect sales efforts through distribution alliances. For instance, Genex (Urus Group) offers online shopping for numerous herd care products and bovine genetics. Customers can look through the company’s web catalog for product alternatives. STgenetics’ online catalogs include the Colored Breeds Specialist Catalogue and Beef Add-on Specialist Catalogue to make shopping more convenient for clients. Other significant players, including ABS, provide comparable online buying opportunities. Holstein, Norwegian Red, Brown Swiss, Jersey, St. Jacob’s, and Ayrshire are among the dairy semen alternatives ABS provides.

The public segment is the second fastest growing market, driven by government initiatives and cooperative programs supporting livestock improvement. Public-sector involvement promotes widespread access to AI technologies, enhances herd genetics, and strengthens rural farming communities. Subsidies, training, and awareness campaigns drive adoption, making this segment increasingly influential in improving productivity, sustainability, and overall efficiency in cattle breeding.

Regional Insights

The North America bovine artificial insemination market held the highest share of 30.67% in 2025, attributed to the wide-scale use of Artificial Insemination (AI) techniques and the increasing need to meet consumer demands for sustainable animal protein sources. AI has given farmers more control over the genetic makeup of their cattle. To breed cows with similar traits, they can choose sires with particular traits such as high milk production, illness resistance, or meat yield. According to the 2024 data by Holstein Association of USA, Holstein cows make up over 90% of the dairy cattle population in the U.S., and more than 70% of cows in the country are kept in factory farms.

U.S. Bovine Artificial Insemination Market Trends

The bovine artificial insemination market in the U.S. is likely to be driven by an increase in the number of AIs conducted to enhance farm animal genetics and reproduction. AI is the most used cattle reproduction method in the country. In addition, the industry is growing due to the rising usage of AI for milk production. For instance, according to 2024 data from the National Institute of Food & Agriculture (NIFA), more than 60% of dairy cows in the country are bred using the AI method.

Europe Bovine Artificial Insemination Market Trends

The bovine artificial insemination market in Europe is expected to grow, fuelled by the presence of local companies and supportive government measures. VikingGenetics, for instance, continuously creates innovative solutions that meet the requirements of dairy and cattle farmers. In July 2023, the European Commission (EC) initiated an integrated program called Cordis, intended to encourage and enhance research into the biological understanding of fertility in bovine and other animal species. Such initiatives act as an accelerating factor in the market.

Germany bovine artificial insemination market has approximately 10.8 million cattle, including 3.7 million dairy cattle. In the EU, Germany has the second-largest herd of cattle overall and the largest herd of dairy cattle. Cattle production in Germany has a long history; the industry is highly organized and has a wealth of breeding experience, including farm-based artificial insemination, slaughter, & milk production. Sustainable breeding programs and effective farm management are built on the most advanced standards of dairy and milk cow performance & testing. The country is actively promoting knowledge-sharing and innovation in AI. For instance, as per January 2024 reports by the European Forum of Farm Animal Breeders (EFFAB), the country is hosting the 34th European Congress for AI Vets in October 2024. Such conferences aim to gather experts worldwide to share knowledge and research on animal AI.

Asia Pacific Bovine Artificial Insemination Market Trends

The Asia-Pacific bovine artificial insemination market is strengthening at the fastest CAGR of 8.09% over the forecast period as dairy output and regulatory reforms accelerate adoption of advanced breeding technologies across the region. According to FAO, Asia remained the world’s largest milk-producing region in 2023 with nearly 419 million tons of output a 2.1% annual increase, driven by growth in key markets such as India, China, Japan, and Kazakhstan. Rising dairy demand has pushed governments to modernize breeding systems, exemplified by India’s December 2025 enforcement of the Tamil Nadu Bovine Breeding Act, which mandates bull registration, veterinary fitness certification, and licensing of private agencies for AI and frozen-semen production. This shift toward structured, certification-based breeding is expected to expand private participation, stimulate investment in genetic materials and AI equipment, and strengthen India’s role in regional supply. Similar modernization efforts in China and Japan, where sex-sorted semen, genomic selection, and frozen-semen technologies are increasingly adopted illustrate how growing milk production and regulatory support are collectively driving sustained growth and technological upgrading in the Asia-Pacific bovine AI market.

India bovine artificial insemination market is growing due to many factors. According to May 2024 data published by PIB, the dairy sector contributes to over 5% of India’s GDP. The country leads the world in milk production, contributing to over 25% of the global milk output. Furthermore, with a CAGR of over 6%, India is producing over 230 million metric tons of milk as of 2023. To meet the requirements of the global dairy industry, the Ministry of Fisheries, Animal Husbandry and Dairying, and the Government of India leveraged AI and IVF technologies with sex-sorted semen to produce female calves. In addition, schemes such as the Rashtriya Gokul Mission & National Project for Cattle and Buffalo Breeding support bovine AI procedures at the farm instead of a dedicated AI center.

Latin America Bovine Artificial Insemination Market Trends

The bovine artificial insemination market in Latin America is expected to be driven by the increasing prevalence of STDs in cattle and improving livestock productivity. In addition, increased meat consumption and rising technology usage in breeding will likely drive market growth over the forecast period. Brazil, Mexico, and Argentina are all part of the Latin American market. Furthermore, there is a growing need for AI practices in animals due to the increasing demand for superior breeds of animals on a global scale.

Brazil bovine artificial insemination market is expected to be driven by the growing use of fixed-time artificial insemination (FTAI). Brazilian farmers have started using this technique to increase earnings, which has resulted in the introduction of sires with superior genetics. Population growth is increasing food demand, raising questions about how to produce enough animal proteins to fulfill the rising need. In 2024, the country recorded the highest level of cattle slaughtering, i.e., an increase of 24.1% in Q1 2024 over the last quarter of 2023. Raw milk production was at a record high of 6.20 billion liters, a 3.4% rise.

Middle East & Africa Bovine Artificial Insemination Market Trends

The bovine artificial insemination market in the MEA is driven by increased artificial insemination procedures. Cattle held the majority of the market share, propelling the market. Egypt, Iran, and South Africa constitute the MEA market. Companies use artificial insemination to create breeds resistant to diseases and enable them to thrive in various environments. For instance, Sion, a company based in Israel specializing in artificial insemination and cattle breeding, launched a novel breeding program to supply cattle genetics that can cope with humid and hot conditions. Technicians inseminated nearly 95% (i.e., more than 450,000) of dairy cows in Israel as part of this program.

Saudi Arabia bovine artificial insemination market is driven by rising animal health concerns, rapid genetic advancements, and increased livestock production. The country’s cattle herds face a problem of low reproduction rates. As of October 2025, under the Animal Husbandry Infrastructure Development Fund (AHIDF) projects worth USD 36.61 million and over 38,000 MAITRIs were launched to boost livestock productivity, artificial insemination, and rural livelihoods, reinforcing India’s commitment to sustainable agricultural and livestock growth.

Key Bovine Artificial Insemination Company Insights

Key market players focus on genetic innovation, strategic partnerships, and global expansion to strengthen their competitive positions. Genus plc (through ABS Global) leads genetic improvement programs and precision breeding technologies; STgenetics specializes in advanced sex-sorted semen and genomic selection tools; and CRV Holding emphasizes sustainable breeding strategies and high-performance dairy genetics. Semex Alliance focuses on genomic advancements and fertility-enhancing solutions, while IMV Technologies provides critical AI equipment and cryopreservation technologies across the industry. URUS Group integrates multiple breeding service brands (such as Alta Genetics and GENEX) to deliver data-driven reproductive management solutions. Together, these companies drive innovation in bovine reproduction through genomic testing, artificial insemination optimization, and digital herd management platforms that enhance productivity and animal genetics worldwide.

Key Bovine Artificial Insemination Companies:

The following are the leading companies in the bovine artificial insemination market. These companies collectively hold the largest market share and dictate industry trends.

- Genus Plc

- IMV Technologies

- SEMEX

- Jorgensen Laboratories

- URUS Group

- STgenetics

- National Dairy Development Board

- Munster Bovine

- World Wide Sires, Ltd

- CRV

Recent Developments

-

In March 2025, the Indian government launched a sex-sorted semen scheme to increase female calf births to 90%, ensuring a steady population of high-yielding cows in Rajasthan. The state has procured 1 lakh doses of sex-sorted semen to be produced within Rajasthan in collaboration with NDDB.

-

In September 2024, Indian Immunologicals launched the indigenous IVF media ‘Shashthi’ in collaboration with NDDB, enabling laboratory-based fertilization, healthier embryo selection, and advancing bovine reproductive technology to enhance India’s dairy and animal husbandry sector.

-

In February 2024, Cogent Breeding and Sainsbury's beef supply chain entered a partnership. This partnership increases the access of farmers involved in Sainsbury's Gamechanger program to Cogent’s genetics.

Bovine Artificial Insemination Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.59 billion

Revenue forecast in 2033

USD 5.80 billion

Growth rate

CAGR of 7.10% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, distribution channel, sector, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Poland; Netherlands; Sweden; Denmark; Norway; Japan; India; China; South Korea; Australia; New Zealand; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Egypt; Iran; Qatar; Oman

Key companies profiled

Genus Plc; IMV Technologies; SEMEX; Jorgensen Laboratories; URUS Group; STgenetics; National Dairy Development Board; Munster Bovine; World Wide Sires, Ltd; CRV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bovine Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bovine artificial insemination market report based on solution, distribution channel, sector, and region:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment & Consumables

-

Semen

-

Normal (Conventional)

-

Sexed

-

-

Services

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Public

-

-

Sector Outlook (Revenue, USD Million, 2021 - 2033)

-

Meat

-

Dairy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

New Zealand

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Egypt

-

Iran

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global bovine artificial insemination market size was estimated at USD 3.39 billion in 2025 and is expected to reach USD 3.59 billion in 2026.

b. The global bovine artificial insemination market is expected to grow at a compound annual growth rate of 7.10% from 2026 to 2033 to reach USD 5.80 billion by 2033.

b. By Solutions, the service segment accounted for the largest revenue share of 39.06% in 2025. This can be attributed to the fact that bovine AI techniques are becoming more popular and widely used in major markets. For instance, over 31.5 million semen straws have been sold globally by Urus Group, one of the industry’s top companies. AI is the most practical and cost-effective biotechnology tool for getting better genetics to farmers’ doorsteps.

b. Some key players operating in the bovine artificial insemination market include Genus Plc, IMV Technologies, SEMEX, Jorgensen Laboratories, URUS Group, STgenetics , National Dairy Development Board, Munster Bovine, World Wide Sires Ltd and CRV.

b. Rising demand for meat, dairy, and dairy products, advancements in veterinary reproductive technologies, the need for sustainable food production, and supportive actions taken by governments and market participants are some of the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.