Brazil Flavors Market Summary

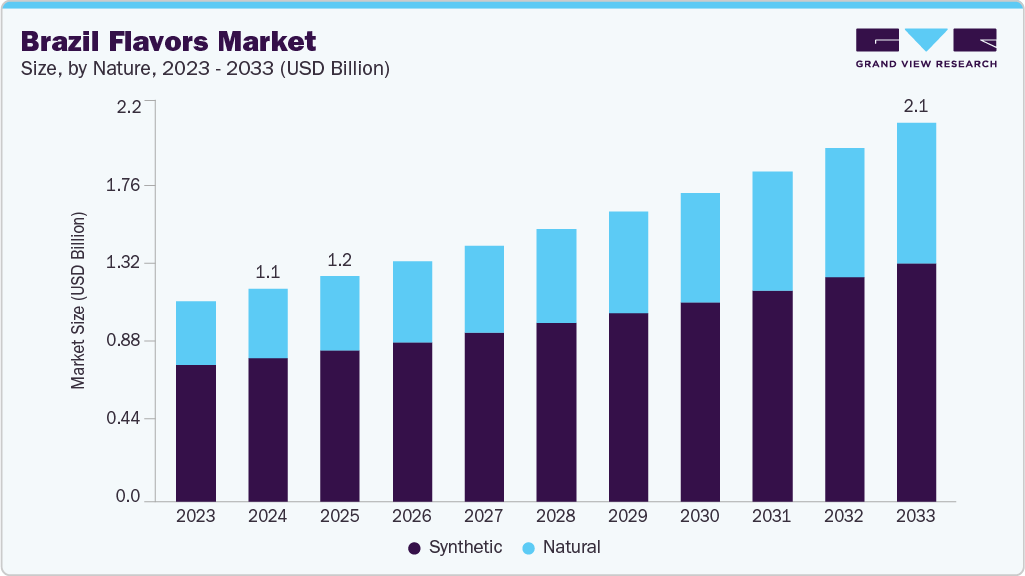

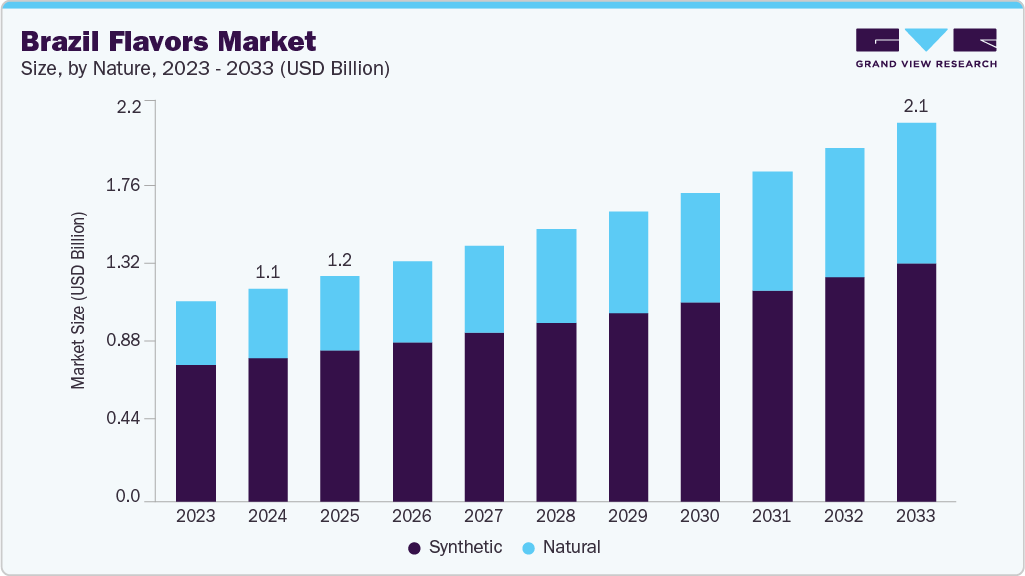

The Brazil flavors market size was estimated at USD 1.17 billion in 2024 and is projected to reach USD 2.08 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033. Growth in Brazil's flavors market is fueled by more consumers choosing natural flavors and paying closer attention to health and wellness.

Key Market Trends & Insights

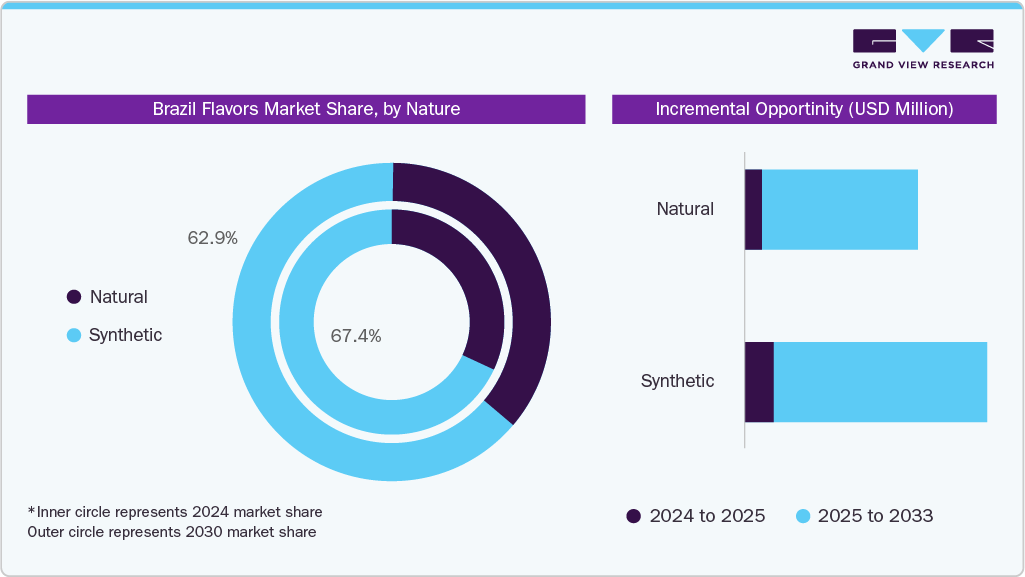

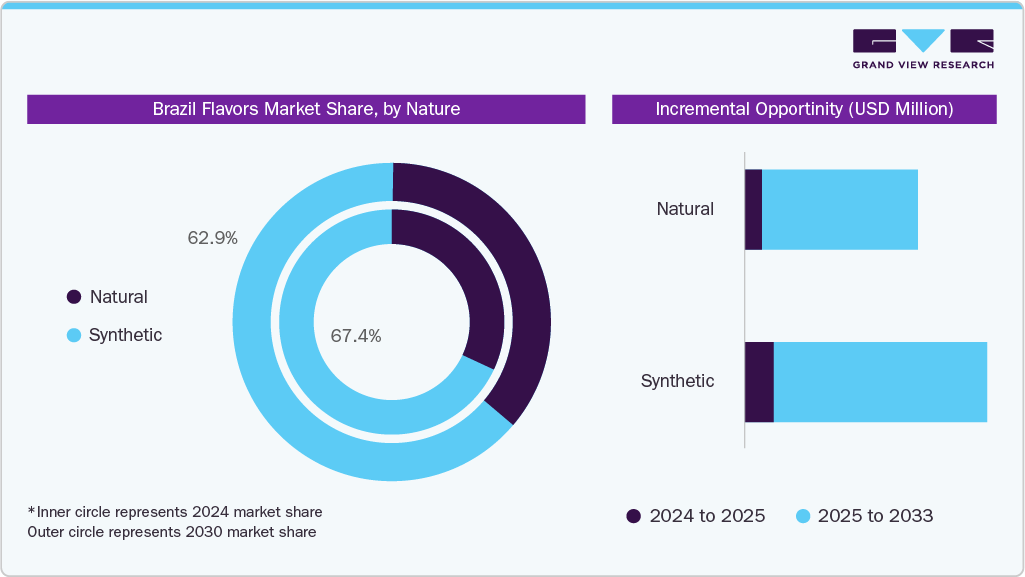

- By nature, the synthetic segment held the highest market share of 67.4% in 2024.

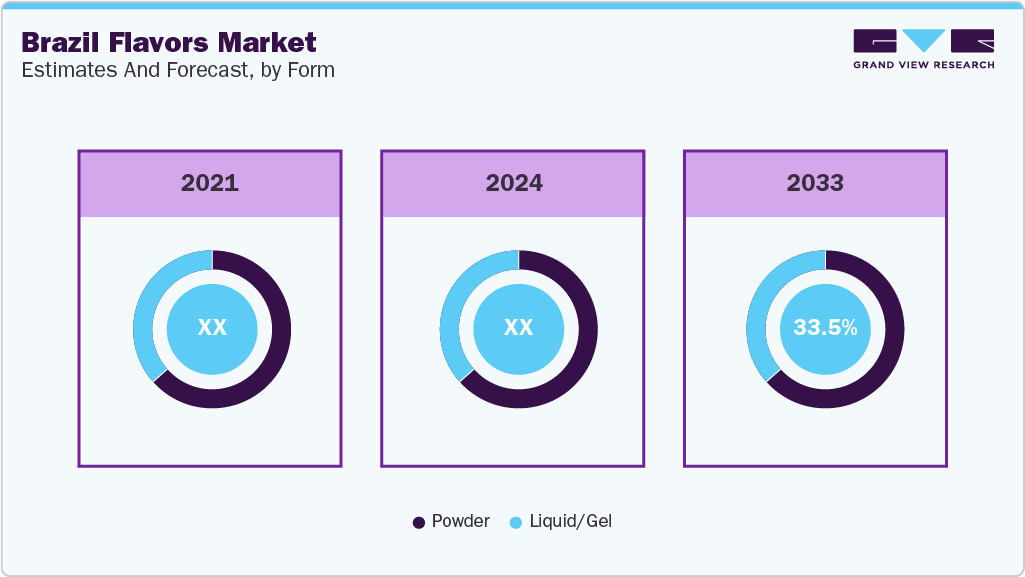

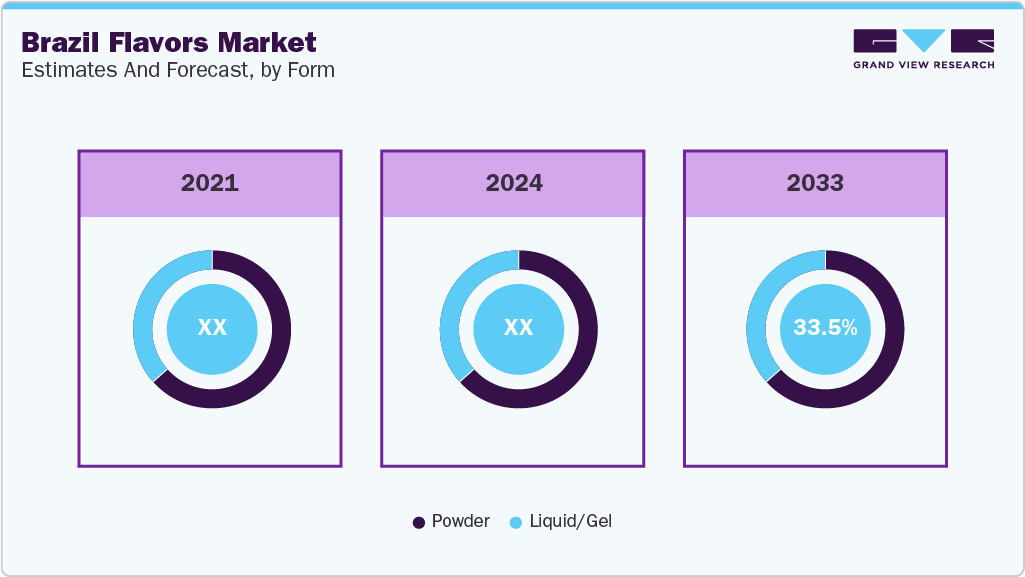

- Based on form, the powder segment is projected to grow at the fastest CAGR of 7.1% from 2025 to 2033.

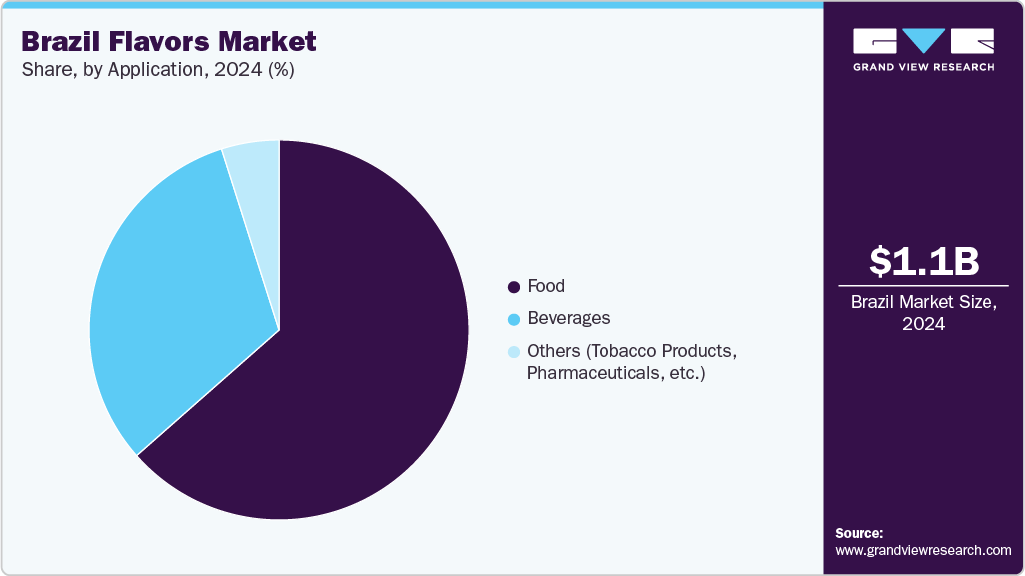

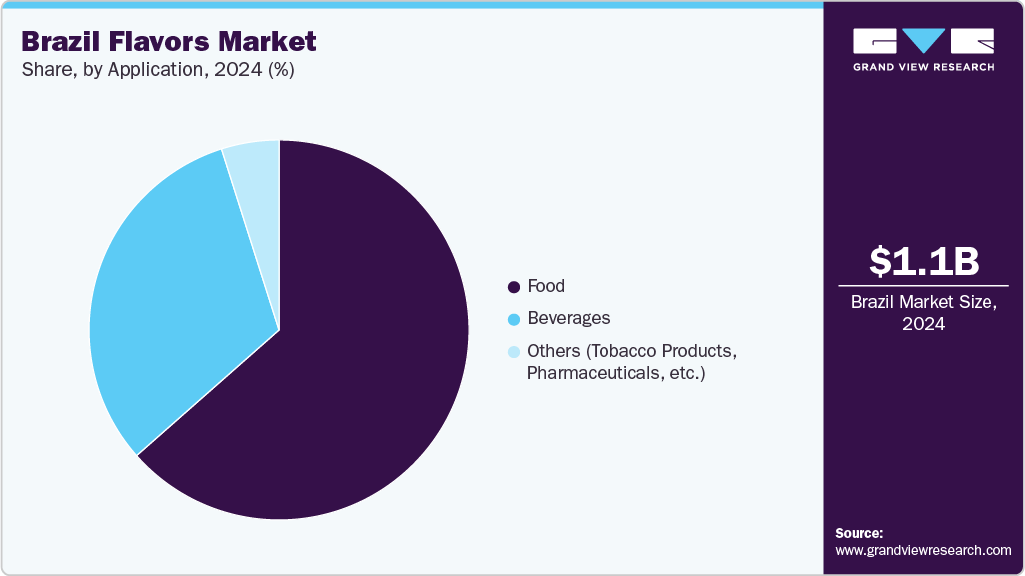

- By application, the food segment held the highest market share of 65.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.17 Billion

- 2033 Projected Market Size: USD 2.08 Billion

- CAGR (2025-2033): 6.7%

The expanding food and beverage industry in the country is further boosting this demand. In addition, new ways of delivering flavors in powdered and liquid forms are helping brands meet the rising need for flavors in beverages, dairy products, and confectionery. Brazil’s flavors sector has grown into a dynamic, innovation-focused market shaped by the country’s diverse culinary culture and rising demand for new taste experiences. Food and beverage companies use more local, natural, and exotic flavors as consumer preferences shift. There is also a clear move toward clean-label, plant-based, and healthier options, driving experimentation and reformulation across categories. Flavor blends customized for beverages, confectionery, and savory snacks are increasingly important in this evolving landscape. In July 2025, Brazilian flavor specialist Duas Rodas unveiled a new line of natural powdered flavors designed specifically for beverages. The company brought these latest innovations to the spotlight during the Expo Food Tech Ingredients event, held at the Centro de Exposições Jockey in Lima, Peru, where they engaged with industry professionals and showcased their commitment to natural, high-performance solutions.

Brazil is set to play a major role in the Latin American flavors market with rapid urbanization, rising middle-class spending, and the growth of regional brands. More consumers now want clean-label products and clear ingredient information, leading to greater use of natural flavors, especially in liquid and encapsulated forms. Local manufacturers prioritize sustainability and stable sourcing, helping natural product development maintain its pace. The industry's outlook remains strong, driven by better extraction technologies and the wider use of flavors across new food categories.

Nature Insights

The synthetic segment dominated the Brazil flavors market and accounted for a revenue share of 67.4% in 2024. This shows the market’s strong use of nature-identical synthetic flavors. These flavors copy the structure of natural ones but are cheaper, stable, and easy to produce at scale. In Brazil, they are common in beverages, confectionery, and dairy products to keep the taste consistent for mass production. The country’s large processed food industry and local raw materials help support this trend.

The natural flavors segment is expected to grow at the fastest CAGR of 8.3% from 2025 to 2033. This growth is driven by Brazil’s rising consumer demand for clean-label and health-focused products, leading manufacturers to expand natural flavor use in beverages, confectionery, and dairy. In September 2024, Coca‑Cola Brazil launched “Crystal Flavor,” a sugar-free, additive-free sparkling water using natural fruit, herb, and spice aromas to meet Brazil’s demand for healthy, clean-label drinks. This move aligns with rising consumer interest in natural flavors while offering a soda-like experience without sweeteners, supporting the market shift toward nature-based beverage options in Brazil. Brazil has a strong local base in fruits and botanicals, which supports the natural flavors segment through domestic sourcing and sustainability initiatives. As consumers continue to seek authentic, natural tastes, the segment is positioned for steady growth in Brazil’s evolving flavors market.

Form Insights

The powder form segment accounted for the largest revenue share of the Brazil flavors industry in 2024. Its long shelf life, ease of handling, and lower transport costs make them a practical choice for manufacturers aiming for high-volume, consistent production. The segment also aligns with Brazil’s growing packaged food sector, where powdered seasonings and beverage mixes are popular for home and on-the-go consumption. As companies continue to expand product lines with new taste profiles, the stability and versatility of powder flavors are expected to keep them at the forefront of Brazil’s flavors market in the coming years.

The liquid/gel form segment is projected to grow at the second-fastest CAGR from 2025 to 2033.This growth is driven by increasing use in soft drinks, dairy beverages, ice creams, and confectionery, where liquid and gel flavors blend easily and deliver faster flavor release. Their ability to disperse evenly in liquid bases helps manufacturers maintain product consistency while speeding up production lines.

Application Insights

The food segment dominated the Brazil flavors market with a revenue share of 65.0% in 2024. This leadership is driven by growing demand for processed and convenience foods, the rapidly expanding food service sector, and shifting consumer preferences toward flavored dairy, snacks, and savory products. Brazil’s sauces, spices, and seasonings market is increasing as consumers seek bold, artisanal, and health-oriented flavors, pushing flavor houses to innovate in clean-label seasoning solutions tailored to retail and foodservice needs.

The beverages segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by a surge in demand for flavored water, functional drinks, and RTD beverages. Key factors include rising health consciousness, premiumization of beverage experiences, and expanding urban populations seeking convenient, flavorful hydration options. Health-focused trends such as sugar reduction, immunity-boosting ingredients, and natural flavor preferences push manufacturers to innovate with fruit, herbal, and botanical flavors in beverages.

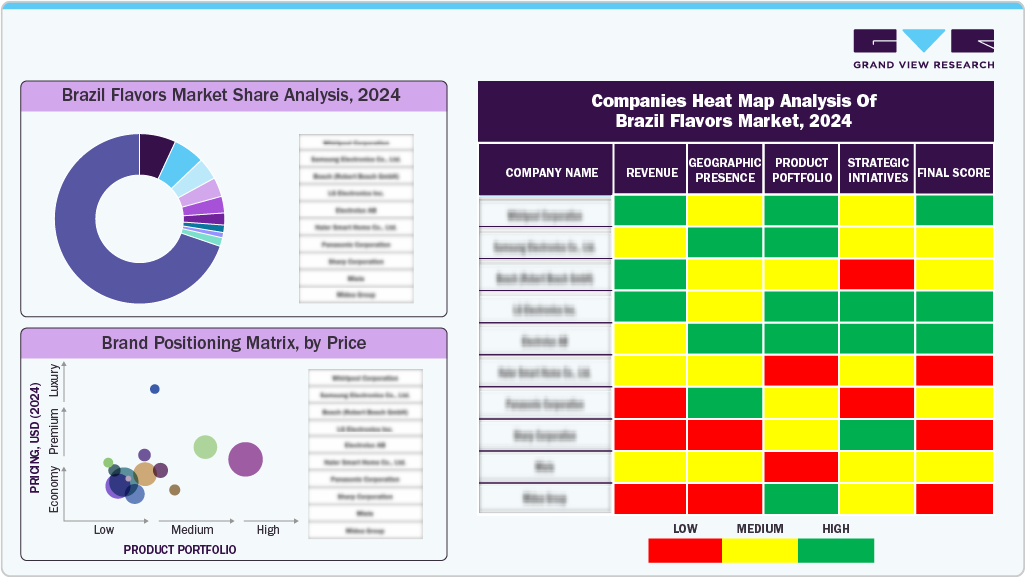

Key Brazil Flavors Company Insights

Some key companies operating in the market include Duas Rodas, International Flavors & Fragrances Inc., Symrise, dsm-firmenich, and others.

-

Duas Rodas, founded in 1925 in Santa Catarina, is Brazil’s leading flavors and ingredients manufacturer with over 3,000 products. It operates three production plants and six R&D centers in Brazil, developing flavors, extracts, and essential oils while exporting to over 70 countries with a strong focus on innovation.

Key Brazil Flavors Companies:

- Givaudan

- International Flavors & Fragrances Inc.

- Symrise

- dsm-firmenich

- Sensient Technologies Corporation

Recent Developments

-

In July 2025, Duas Rodas showcased its natural flavor and ingredient solutions at Expo Food Tech Ingredients in Peru, reinforcing its commitment to the growing demand for health-focused products within the flavor market.

-

In July 2025, Solina Foods, a French savory-ingredients company, agreed to acquire New Max, a Brazilian player in flavoring systems, savoury solutions, and natural colorants. This development marks Solina’s first entry into the region and is expected to enhance its capabilities and presence in the Brazilian food ingredients sector.

Brazil Flavors Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.24 billion

|

|

Revenue forecast in 2033

|

USD 2.08 billion

|

|

Growth rate

|

CAGR of 6.7% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD Million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Nature, form, application

|

|

Key companies profiled

|

Duas Rodas; Givaudan; International Flavors & Fragrances Inc.; Symrise; dsm-firmenich; Sensient Technologies Corporation

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Brazil Flavors Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Brazil flavors market report based on nature, form, and application:

-

Nature Outlook (Revenue, USD Million, 2018 - 2033)

-

Form Outlook (Revenue, USD Million, 2018 - 2033)

-

Application Outlook (Revenue, USD Million, 2018 - 2033)