- Home

- »

- Medical Devices

- »

-

Breast-conserving Surgery Market Size, Industry Report 2033GVR Report cover

![Breast-conserving Surgery Market Size, Share & Trends Report]()

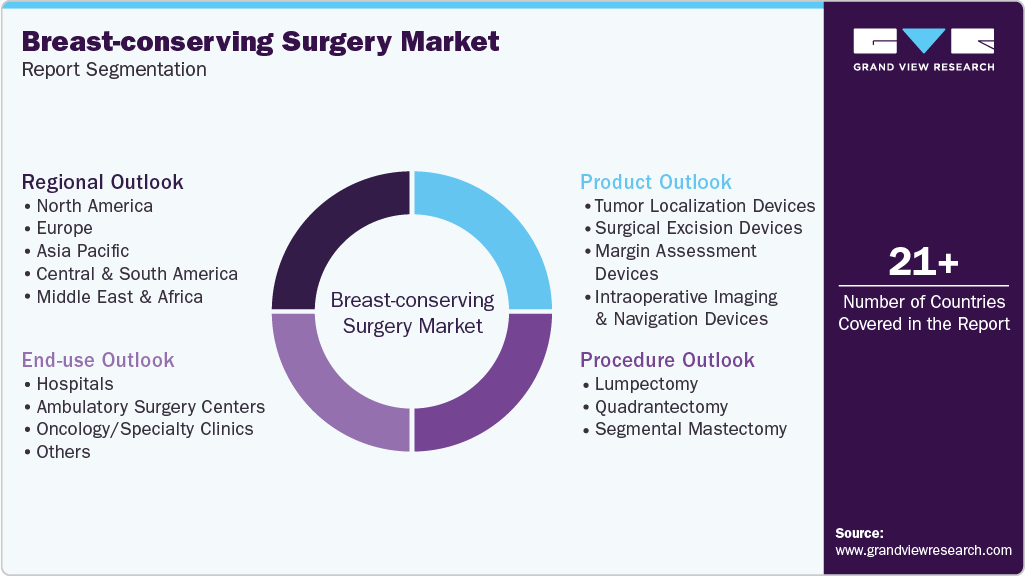

Breast-conserving Surgery Market (2025 - 2033) Size, Share & Trends Analysis Report By Procedure (Lumpectomy, Quadrantectomy, Segmental Mastectomy), By Product (Margin Assessment Devices), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-653-1

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Breast-conserving Surgery Market Summary

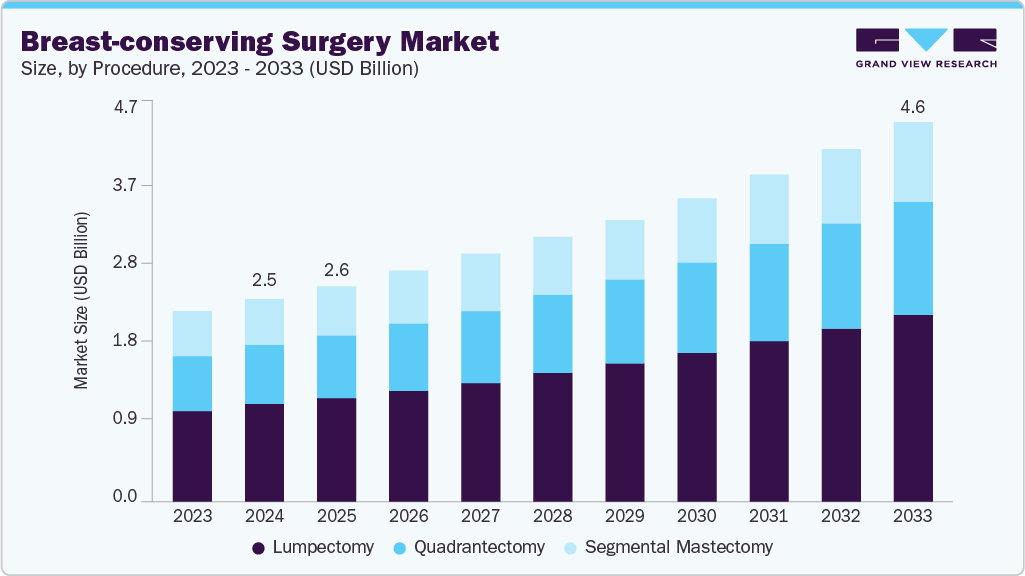

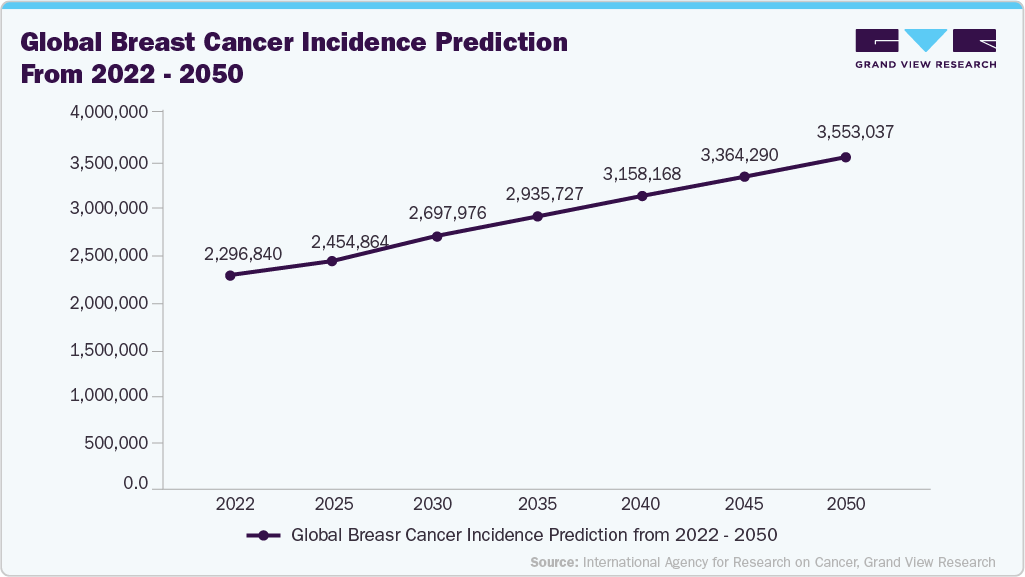

The global breast-conserving surgery market size was estimated at USD 2.45 billion in 2024 and is projected to reach USD 4.58 billion by 2033, growing at a CAGR of 7.26% from 2025 to 2033. The growth is attributed to the rising incidence of breast cancer and a growing emphasis on early detection and intervention.

Key Market Trends & Insights

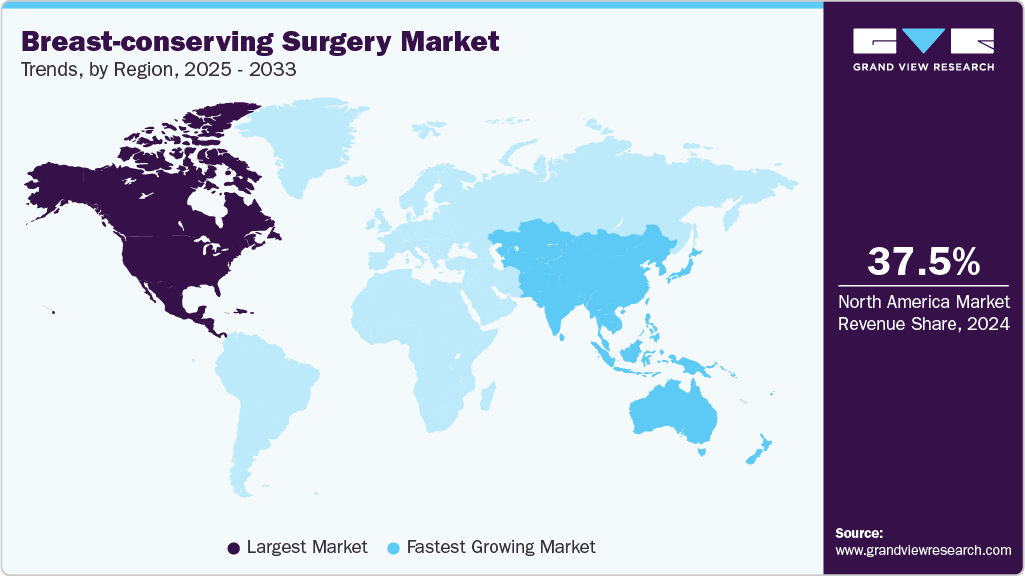

- North America dominated the breast-conserving surgery market with the largest revenue share of 37.45% in 2024.

- The breast-conserving surgery market in the U.S. accounted for the largest market revenue share of 81.12% in North America in 2024.

- Based on procedure, the lumpectomy segment led the market with the largest revenue share of 47.56% in 2024.

- Based on product, the surgical excision devices segment led the market with the largest revenue share of 61.88% in 2024.

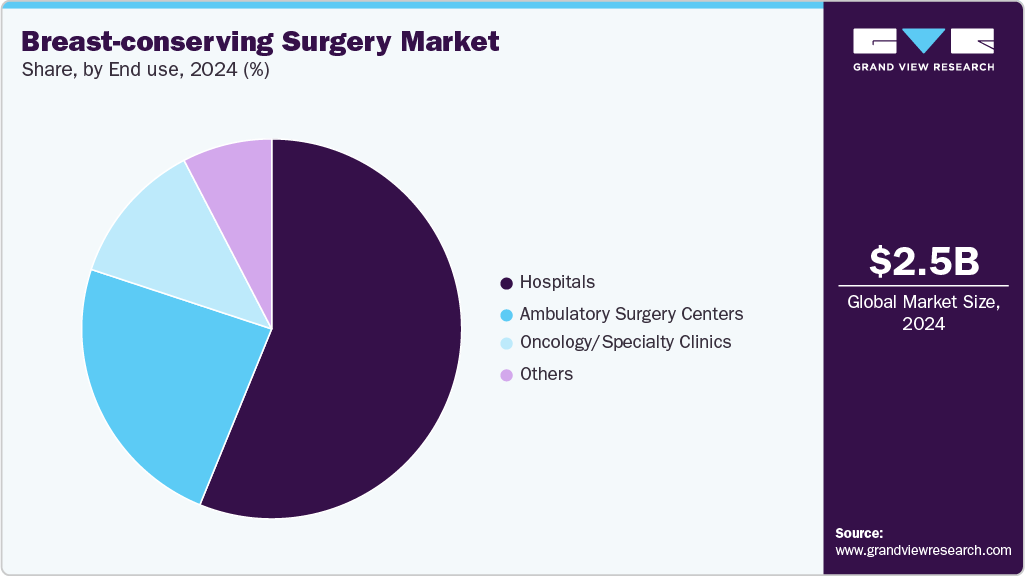

- By end use, the hospitals segment led the market with the largest revenue share of 56.17% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.45 Billion

- 2033 Projected Market Size: USD 4.58 Billion

- CAGR (2025-2033): 7.26%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

There is an increasing preference among patients for procedures that preserve both cosmetic appearance and breast function, driving demand for less invasive surgical options. For instance, according to a report by the American Cancer Society, in 2024, an estimated 310,720 new cases of invasive breast cancer and 56,500 cases of ductal carcinoma in situ (DCIS) are expected to be diagnosed among women in the U.S. Additionally, 42,250 women are projected to lose their lives to breast cancer. The rising preference for cosmetic and functional preservation drives growth in the breast-conserving surgery (BCS) market.

Unlike traditional mastectomy, which involves the complete removal of the breast, BCS focuses on excising the tumor while retaining as much of the natural breast tissue and appearance as possible. This approach aligns with the increasing demand from patients, especially younger women, for procedures that not only treat cancer effectively but also maintain physical aesthetics, body image, and quality of life. Functional benefits such as preserved sensation and less physical trauma contribute to improved emotional well-being and postoperative satisfaction.

The rising prevalence of breast cancer is a primary driver of the BCS market, as it directly increases the number of patients requiring surgical intervention. With improved awareness, widespread screening programs, and advancements in diagnostic technologies, more breast cancers are being detected at earlier stages-making a larger proportion of patients eligible for breast-conserving procedures instead of full mastectomy. Early-stage diagnosis not only supports better outcomes but also aligns with growing patient preferences for less invasive treatments that preserve breast appearance and function. As the global burden of breast cancer continues to rise, healthcare systems are increasingly integrating BCS into standard care pathways, fueling demand for specialized surgical tools, localization technologies, and post-operative care solutions.

Technological advancements in wireless localization and AI-based margin assessment are revolutionizing the breast-conserving surgery (BCS) market, significantly improving surgical precision, reducing reoperation rates, and enhancing patient outcomes. Traditionally, wire-guided localization was used to pinpoint tumor sites, but this method posed several challenges, such as patient discomfort, scheduling constraints, and the risk of wire displacement. In contrast, wireless localization systems (e.g., RFID or magnetic seed-based technologies) offer greater flexibility, improved accuracy, and a better overall surgical experience for both patients and surgeons.

Simultaneously, AI-powered margin assessment tools are transforming intraoperative decision-making. These technologies analyze tissue samples in real-time to determine if cancerous cells remain at the surgical margins, allowing surgeons to make immediate adjustments and achieve clean margins during the first procedure. This greatly reduces the need for second surgeries, shortens recovery time, and improves clinical efficiency.

Technological Advancements

Company Name

Product Launch

KOLs

BD

In March 2025, BD (Becton, Dickinson and Company) announced that the first patient had been treated in its Investigational Device Exemption (IDE) clinical trial, marking a key step toward obtaining Premarket Approval (PMA) from the U.S. Food and Drug Administration (FDA). The trial aims to evaluate the use of the GalaFLEX LITE Scaffold in reducing the recurrence of capsular contracture (CC) during breast revision surgery

"This milestone marks a significant advancement in our efforts to achieve FDA Premarket Approval for our first breast indication for GalaFLEX LITE Scaffold and reinforces the company's commitment to improving patient outcomes through innovative technologies that reduce surgical complications," said Rian Seger, worldwide president of the BD Surgery business. "Our team has worked closely with the FDA to help address a critical medical complication arising from implant-based breast surgery, and the first patient treated brings us closer to delivering a much-needed solution."

MOLLI Surgical (Stryker)

In April 2023, MOLLI Surgical announced the launch of two innovative products: MOLLI 2 and MOLLI re.markable. These latest additions include the industry’s first tool designed to ensure precise lesion marking, representing a significant step forward in the evolution of surgical care. With these advancements, MOLLI Surgical reinforces its commitment to enhancing the patient experience, improving surgical precision, and empowering physicians with greater confidence in the operating room.

“As a surgeon, my ultimate goal is always to help as many patients as possible while delivering the highest quality of care. These two products, used separately or together, will be a game changer for me in the operating room,” said Dr. Rakhshanda L. Rahman, Medical Director of the Breast Center of Excellence at the UMC Cancer Center. “MOLLI 2 will make it easier than ever to deliver exceptional outcomes and experiences for my patients.”

Source: BD, Stryker, Grand View Research

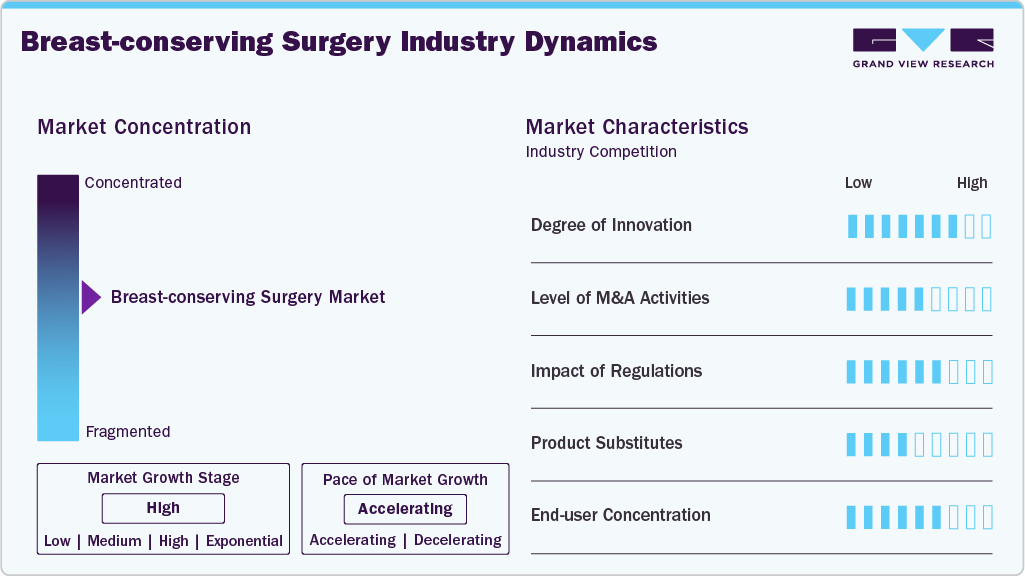

Market Concentration & Characteristics

The industry is experiencing a high degree of innovation, driven by the degree of innovation in the breast-conserving surgery (BCS) market being notably high, driven by the integration of advanced technologies and evolving surgical techniques to improve clinical outcomes and patient experience. Transitioning from traditional wire-guided localization to advanced wireless systems such as magnetic seeds and radar-based devices has significantly enhanced surgical precision and workflow efficiency. In parallel, adopting AI-powered intraoperative margin assessment tools enables real-time decision-making, reduces re-excision rates, and increases surgeon confidence.

Regulatory frameworks are pivotal in shaping the BCS industry by establishing safety, efficacy, and quality standards for both devices and procedures. Stringent approval pathways-such as FDA’s Premarket Approval (PMA) and 510(k) clearances for localization systems, imaging devices, and margin-assessment technologies-ensure that only rigorously tested innovations reach clinical use, promoting clinician and patient trust. Concurrently, regulations governing radiation therapy protocols and post-operative care guidelines influence the adoption of BCS by defining the multidisciplinary treatment pathways required for optimal outcomes.

The industry has seen a moderate to high level of M&A activity over the past several years, driven by larger medical device and diagnostics companies seeking to strengthen their oncology portfolios with advanced localization and margin-assessment technologies. For instance, in April 2024, Hologic, Inc. announced the signing of a definitive agreement to acquire Endomagnetics Ltd (Endomag), a privately held company specializing in breast cancer surgery technologies. The acquisition is valued at approximately $310 million, subject to working capital and other customary closing adjustments.

Product substitutes for breast-conserving surgery (BCS) primarily include more radical surgical and non-surgical treatment options that patients and clinicians may consider based on clinical presentation, patient preference, or resource availability. The most direct alternative is mastectomy, either skin-/nipple-sparing or straightforward, which removes the entire breast and often obviates the need for post-operative radiation. For patients unfit for surgery or seeking non-invasive approaches, percutaneous ablative techniques (e.g., radiofrequency or cryoablation) can target small tumors under image guidance, though long-term outcomes data remain limited.

The end-use concentration in the industry is relatively high, with a significant portion of procedures performed in specialized healthcare settings such as oncology hospitals, breast cancer centers, and ambulatory surgical centers (ASCs). These facilities typically have the necessary infrastructure, multidisciplinary teams, and advanced technologies (e.g., wireless localization systems and intraoperative imaging) to perform BCS effectively. Large academic medical centers and urban hospitals account for a dominant share due to their access to advanced tools, highly trained surgeons, and participation in clinical trials. Meanwhile, ambulatory surgical centers are emerging as key growth hubs, especially in developed markets, driven by their cost efficiency, shorter wait times, and increasing patient preference for outpatient procedures. This demand concentration among specialized centers reinforces the importance of equipping high-volume facilities with innovative BCS solutions to meet the rising patient load.

Procedure Insights

On the basis of procedure, the lumpectomy segment held the largest share in 2024. This growth can be attributed to its widespread adoption as the standard surgical approach for early-stage breast cancer. Lumpectomy involves the removal of the tumor and a margin of surrounding tissue while preserving the rest of the breast, making it a preferred option for patients seeking oncological safety with minimal cosmetic compromise. Its dominance is further supported by strong clinical evidence showing comparable survival rates to mastectomy when followed by radiation therapy. Additionally, advancements in localization technologies, intraoperative imaging, and oncoplastic techniques have significantly improved the precision and outcomes of lumpectomy procedures.

Quadrantectomy segment is expected to witness significant growth over the forecast period. Owing to its expanding role in managing larger or more complex tumors while preserving part of the breast. Quadrantectomy involves removing approximately one-quarter of the breast tissue, making it more extensive than a lumpectomy but less radical than a full mastectomy. Its growth is driven by advances in imaging, preoperative planning, and oncoplastic techniques, allowing surgeons to achieve clean margins and favorable cosmetic outcomes even in larger resections.

Product Insights

On the basis of product, the surgical excision devices segment held the largest share in 2024. This growth can be attributed to the core instruments used in tumor removal procedures such as lumpectomy and quadrantectomy. These devices-including scalpels, electrosurgical units, ultrasonic dissectors, and radiofrequency ablation tools-are essential for achieving clean margins and precise tissue dissection while minimizing damage to surrounding healthy tissue. Their versatility, widespread availability, and critical role in ensuring oncologic safety make them the most frequently utilized product category during breast-conserving procedures. In addition, the integration of advanced technologies such as energy-based cutting, real-time feedback mechanisms, and minimally invasive surgical systems has enhanced the efficiency and precision of these devices, further solidifying their market leadership.

The tumor localization devices segment is expected to witness the fastest CAGR of 9.07% over the forecast period. This growth can be attributed to the global shift toward minimally invasive, precision-guided surgical procedures. As early-stage breast cancer diagnoses rise due to enhanced screening programs, more tumors are being detected at sizes and depths that are non-palpable, making accurate localization essential for effective removal. Wireless, patient-friendly alternatives, such as magnetic seed markers, radiofrequency identification systems, and radar-based devices, rapidly replace traditional wire-guided localization. These innovations offer greater surgical flexibility, improved patient comfort, and reduced procedure delays-factors accelerating adoption among hospitals and ambulatory surgical centers.

End Use Insights

On the basis of end use, hospitals dominated the market in 2024. This can be attributed to its comprehensive infrastructure, access to advanced surgical technologies, and availability of multidisciplinary cancer care teams. Hospitals-particularly tertiary care and academic medical centers-are equipped with the necessary resources, such as intraoperative imaging systems, wireless localization devices, and oncoplastic surgical expertise, essential for performing complex BCS procedures like lumpectomies and quadrantectomies. Moreover, hospitals often handle a higher volume of breast cancer cases, especially those identified through national screening programs, making them the primary treatment centers. Favorable reimbursement policies, government support for breast cancer programs, and the presence of radiology and pathology departments under one roof further strengthen hospitals’ position as the preferred setting for breast-conserving surgeries.

However, the ambulatory surgical centers segment is projected to witness the fastest growth rate over the forecast period. This can be attributed to the increasing shift toward cost-effective, outpatient-based surgical care. ASCs offer a streamlined alternative to hospital-based procedures by reducing overhead costs, minimizing patient wait times, and enabling same-day discharge, making them an attractive option for early-stage breast cancer patients eligible for minimally invasive lumpectomy or tumor excision.

Regional Insights

North America breast-conserving surgery market dominated the global industry with the largest revenue share of 37.45% in 2024. The growth is attribute to the rising breast cancer incidence, early detection programs, and a strong preference for minimally invasive, cosmetically favorable procedures. The region benefits from the widespread adoption of advanced localization technologies (such as wireless magnetic and radar-guided systems) and AI-based margin assessment tools that improve surgical precision and reduce reoperation rates. The presence of major players like Hologic, BD, and Endomag further accelerates innovation and market maturity.

U.S. Breast-conserving Surgery Market Trends

The breast-conserving surgery market in the U.S. is characterized by high adoption of advanced surgical technologies, driven by increasing breast cancer incidence and a strong healthcare infrastructure that supports early diagnosis and personalized treatment. There is a clear shift toward minimally invasive, breast-preserving techniques, fueled by growing awareness of cosmetic outcomes and quality-of-life considerations among patients. The widespread use of wireless localization systems (e.g., Magseed, LOCalizer) and intraoperative imaging for margin assessment is helping to reduce reoperation rates and improve clinical efficiency.

Europe Breast-conserving Surgery Market Trends

The breast-conserving surgery market in Europe is witnessing robust growth, supported by strong public health policies, increasing breast cancer screening rates, and a widespread preference for breast-preserving treatment among early-stage patients. Many countries across Europe, including Germany, France, and the UK, have well-established national screening programs that enable early detection-making a larger proportion of patients eligible for BCS. Reimbursement frameworks and public funding in countries with universal healthcare systems further support access to breast-conserving procedures. However, variations in healthcare infrastructure between Western and Eastern Europe can impact the uniformity of technology adoption. Overall, Europe remains a progressive and innovation-friendly market for BCS, with increasing demand for patient-centered, functionally and cosmetically optimal surgical solutions.

The UK breast-conserving surgery market is experiencing stable growth, driven by strong national screening programs, a rising focus on early breast cancer detection, and evolving surgical standards that prioritize both oncologic safety and cosmetic outcomes. The NHS Breast Screening Programme plays a critical role in identifying early-stage cancers, which are ideal candidates for breast-conserving procedures. Additionally, growing investment in ambulatory and day-case surgery infrastructure supports the trend toward minimally invasive, outpatient-based BCS procedures.

Asia Pacific Breast-conserving Surgery Market Trends

The breast-conserving surgery market in Asia Pacific is expected to experience the fastest CAGR of 8.48% from 2025 to 2033. Fueled by a rising burden of breast cancer, expanding access to healthcare services, and increasing awareness about early detection and breast-preserving treatment options. Countries such as China, Japan, South Korea, India, and Australia are at various stages of adopting BCS, depending on healthcare infrastructure, cultural perceptions, and technological availability. In developed markets like Japan and Australia, breast-conserving surgery is widely practiced, supported by government-led screening programs, advanced imaging systems, and the growing use of wireless localization tools.

China breast-conserving surgery (BCS) market is undergoing a quick transformation, driven by rising breast cancer incidence, growing public awareness, and increasing investments in healthcare infrastructure. Traditionally, mastectomy was more common due to late-stage diagnosis and cultural preferences. However, with improved access to early screening programs and diagnostic technologies, more cases are being identified early, making patients eligible for BCS. Major urban hospitals and Tier 1 medical centers increasingly adopt oncoplastic surgical techniques and wireless localization technologies (such as magnetic seed systems), supported by government initiatives promoting modern oncology care. In addition, China’s rising middle-class population and growing health insurance coverage are expanding access to advanced surgical options.

Latin America Breast-conserving Surgery Market Trends

The breast-conserving surgery (BCS) market in Latin America is showing significant growth, supported by rising breast cancer awareness, improving access to early detection programs, and increased focus on patient-centered surgical care. Countries like Brazil and Argentina are leading the region in adopting BCS, particularly in urban areas where specialized oncology centers and skilled surgeons are more accessible. Early-stage breast cancer detection is becoming more common due to national screening campaigns and the growing availability of mammography services, which has led to a higher number of patients qualifying for BCS over mastectomy.

Middle East Africa Breast-conserving Surgery Market Trends

The breast-conserving surgery (BCS) market in the Middle East & Africa (MEA) region is gradually emerging, supported by rising breast cancer incidence, improving healthcare infrastructure, and growing awareness around early diagnosis and breast-preserving treatment options. Countries like Saudi Arabia, UAE, South Africa, and Kuwait are at the forefront of adopting BCS procedures, particularly in private hospitals and tertiary care centers. Government-led initiatives and public health campaigns have increased screening uptake, allowing more patients to be diagnosed early, and making them suitable candidates for BCS.

Key Breast-conserving Surgery Companies Insights

Key players operating in the breast-conserving surgery market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Breast-conserving Surgery Companies:

The following are the leading companies in the breast-conserving surgery market. These companies collectively hold the largest market share and dictate industry trends.

- Hologic, Inc

- Dilon Technologies

- Argon Medical Devices

- Merit Medical Systems

- KUBTEC

- Stryker

- SamanTree Medical

- Perimeter Medical Imaging AI

- Xeos

- BD

- Mammotome (Danaher)

- CairnSurgical Inc.

- Innoblative Designs

Recent Developments

-

In March 2025, BD (Becton, Dickinson and Company) announced that the first patient had been treated in its Investigational Device Exemption (IDE) clinical trial, marking a key step toward obtaining Premarket Approval (PMA) from the U.S. Food and Drug Administration (FDA). The trial aims to evaluate the use of the GalaFLEX LITE Scaffold in reducing the recurrence of capsular contracture (CC) during breast revision surgery.

-

In April 2024, Hologic, Inc. announced the signing of a definitive agreement to acquire Endomagnetics Ltd (Endomag), a privately held company specializing in breast cancer surgery technologies. The acquisition is valued at approximately $310 million, subject to working capital and other customary closing adjustments.

-

In April 2023, MOLLI Surgical announced the launch of two innovative products: MOLLI 2 and MOLLI re.markable. These latest additions include the industry’s first tool designed to ensure precise lesion marking, representing a significant step forward in the evolution of surgical care. With these advancements, MOLLI Surgical reinforces its commitment to enhancing the patient experience, improving surgical precision, and empowering physicians with greater confidence in the operating room.

Breast-Conserving Surgery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.61 billion

Revenue forecast in 2033

USD 4.58 billion

Growth rate

CAGR of 7.26% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, procedure, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Hologic, Inc; Dilon Technologies; Argon Medical Devices; Merit Medical Systems; KUBTEC; Stryker; SamanTree Medical; Perimeter Medical Imaging AI; Xeos; BD; Mammotome (Danaher); CairnSurgical Inc.; Innoblative Designs.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast-conserving Surgery Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global breast-conserving surgery market report on the basis of procedure, product, end use, and region:

-

Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Lumpectomy

-

Quadrantectomy

-

Segmental Mastectomy

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tumor Localization Devices

-

Wire-guided localization

-

Magnetic seed localization

-

Radar-based localization

-

Others

-

-

Surgical Excision Devices

-

Electrosurgical units/devices

-

Scalpels/forceps/retractors/clamps

-

Vacuum-assisted biopsy systems

-

Others

-

-

Margin Assessment Devices

-

Intraoperative Imaging & Navigation Devices

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgery Centers

-

Oncology/Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast-conserving surgery market size was estimated at USD 2.45 billion in 2024 and is expected to reach USD 2.61 billion in 2025.

b. The global breast-conserving surgery market is expected to grow at a compound annual growth rate of 7.26 % from 2025 to 2033 to reach USD 4.58 billion by 2033.

b. North America dominated the breast-conserving surgery market with a share of 37.45% in 2024. This is attributable to the rising breast cancer incidence, early detection programs, and a strong preference for minimally invasive, cosmetically favorable procedures. The region benefits from the widespread adoption of advanced localization technologies (such as wireless magnetic and radar-guided systems) and AI-based margin assessment tools that improve surgical precision and reduce reoperation rates.

b. Some key players operating in the breast-conserving surgery market include Hologic, Inc; Dilon Technologies; Argon Medical Devices; Merit Medical Systems; KUBTEC; Stryker; SamanTree Medical; Perimeter Medical Imaging AI; Xeos; BD; Mammotome (Danaher); CairnSurgical Inc.; Innoblative Designs.

b. Key factors that are driving the market growth include the rising incidence of breast cancer and a growing emphasis on early detection and intervention. There is an increasing preference among patients for procedures that preserve both cosmetic appearance and breast function, driving demand for less invasive surgical options

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.