- Home

- »

- Medical Devices

- »

-

Breath Analyzers Market Size, Share & Growth Report, 2030GVR Report cover

![Breath Analyzers Market Size, Share & Trends Report]()

Breath Analyzers Market Size, Share & Trends Analysis Report By Technology (Fuel Cell Technology, Semiconductor Sensor, Infrared (IR) Spectroscopy), By Application (Drug Abuse Detection, Alcohol Detection), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-905-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

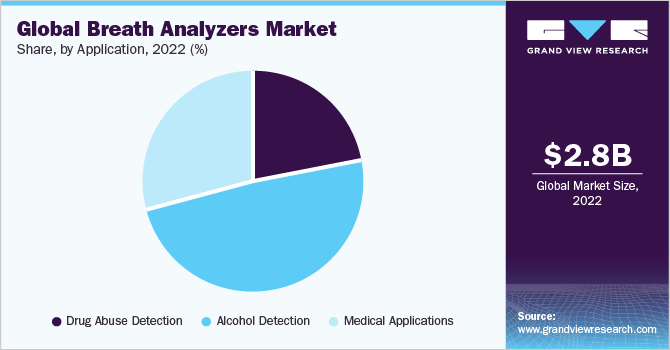

The global breath analyzers market size was estimated at USD 2.75 billion in 2022and is anticipated to grow at a compound annual growth rate (CAGR) of 16.6% from 2023 to 2030. Strict implementation of road safety laws worldwide, product advancements, initiatives by key companies, and demand for efficient and accurate medical detection devices are propelling market growth. The implementation of strict government regulations to prevent drunk driving incidents, as well as growing public awareness of the harmful repercussions of alcohol consumption, are important factors driving market revenue growth. The breath analyzer is a device that analyses a breath sample to determine a person's Blood Alcohol Content (BAC). The test depends on alcohol being present in the blood or in the breath that is being exhaled. The use of breathalyzer technology has increased due to the potential for excessive alcohol consumption to result in auto accidents.

In April 2022, the U.S. FDA approved the first COVID-19 breathalyzer test Inspect IR Systems, LLC developed. The test provides results within three minutes and detects five volatile organic compounds (VOCs) associated with COVID-19. The pandemic notably impacted the market. The pandemic also increased the demand for non-invasive testing solutions that could be performed while adhering to social distancing norms. Breathalyzers thus emerged as viable alternatives in detecting COVID-19 and other medical diseases without the risk of transmission.

Favorable government initiatives are also promoting market growth. Due to its non-invasive nature and rising demand for accurate BAC levels, breathalyzer devices are also becoming more common in the workplace. This is boosting the market for breath analyzer equipment. Its demand is anticipated to rise as it is a crucial tool for keeping track of drugs, alcohol, tuberculosis, asthma, and other illnesses.

Furthermore, the increased adoption of smart breath analyzers and the incorporation of Artificial Intelligence (AI) technology is likely to fuel market share development. Including AI technology in breathalyzers allows for real-time data processing, improving the precision of BAC testing. Furthermore, the increased popularity of e-commerce platforms, which make it easier for customers to obtain products and expand the manufacturer's distribution network, is predicted to fuel market revenue growth.

According to research from the University of Colorado Boulder and the National Institute of Standards and Technology (NIST), a new laser-based breathalyzer powered by artificial intelligence (AI) can detect COVID-19 in real time with high accuracy. This research was published in the Journal of Breath Research on April 5, 2023. This is an important development in the field of exhaled breath illness diagnosis.

Early diagnosis of diseases such as cancer, tuberculosis, and Chronic Obstructive Pulmonary Disease (COPD) plays a key role in their treatment success rate. Breath analyzers offer a quick primary diagnosis based on exhaled air contents. Growing applications in private use, such as carbon monoxide (CO) measurement in smoking cessation activities, are expected to boost market growth during the forecast period. Moreover, introducing innovative devices designed to reduce these problems is expected to drive market growth.

A rise in demand for portable and hand-held breath analyzer equipment is fueling the market's revenue growth. Due to their ease of use and convenience, these products are growing in popularity among consumers. The development of breath alyzers that can be used on smartphones drives the revenue growth in the market. In addition to real-time BAC readings, these devices contain other features like GPS tracking and emergency dialing.

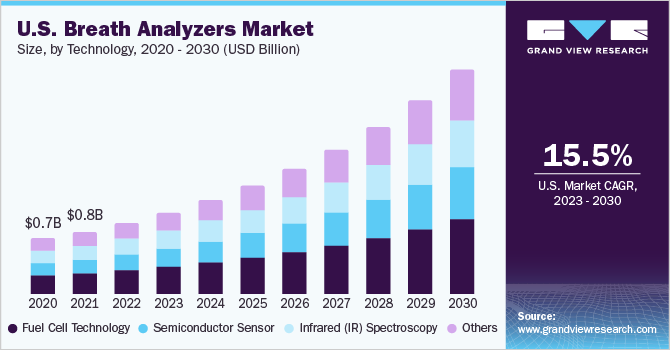

Technology Insights

Based on technology, the breath analyzers market is segmented into fuel cell technology, semiconductor sensor, and infrared (IR) spectroscopy. The fuel cell technology segment accounted for the largest revenue share of 33.9% in 2022. The use of this technology in breath analyzers has shown significant growth in the recent past. Cases of misreading ketone and acetone amounts in breath are reduced significantly owing to the alcohol sensitivity of fuel cell technology. Due to benefits such as the compact size of devices and minimum power requirements, fuel cell technology has become a gold standard for hand-held devices. The infrared (IR) spectroscopy segment is expected to grow at the fastest CAGR of 16.1% during the forecast period.

The demand for compact and easy-to-use analyzers is expected to provide a platform for the growth of the market in the near future. Owing to the accuracy in detecting breath alcohol, devices equipped with this technology are easily approved by regulatory authorities from various countries. Fuel cell technology can also be combined with infrared spectrometry to get real-time and accurate data, especially when a large number of subjects are being examined.

Semiconductor-based breathalyzers are also in great demand due to their low cost and portability, propelling the segment's expansion. The semiconductor oxide sensors detect alcohol in the breath. Because they are lightweight and portable, electronic breathalyzers are an excellent choice for personal use. These are often used at work, notably in law enforcement, where quick and precise findings are required.

Application Insights

Based on application, the breath analyzer market is segmented into drug abuse detection, alcohol detection, and medical application. The alcohol detection segment accounted for the largest revenue share of 49.0% in 2022. The increasing number of traffic accidents caused by drunk driving and drug use has increased demand for breath analyzers, which aid in determining the blood alcohol concentration in a breath sample and the presence of various substances. A precise amount of exhaled breath is run through an analyzer containing a potassium dichromate and sulfuric acid solution to detect alcohol. The amount of alcohol in the air sample affects the solution's color in a way proportional to the blood alcohol content.

The medical application segment is expected to grow at the fastest CAGR of 17.0% during the forecast period. In May 2022, the BreFence Go breath test developed by Breathonix Pte Ltd. received provisional approval from Singapore authorities for COVID-19 testing. Also, the InspectIR COVID-19 Breathalyzer developed by InspectIR Systems, LLC, was granted EUA by the U.S. FDA in April 2022.

Technological developments have enabled the detection of Volatile Organic Compounds (VOC) through breath analyzers. Detection of VOCs is expected to aid in the early diagnosis of conditions, including cardiopulmonary diseases and lung and breast cancer. VOCs can also play as biomarkers to assess disease progressions. These developments are expected to expand the clinical applications of these analyzers. Applications of breath analyzers are currently limited to drug abuse, alcohol detection, and diagnosis of asthma and gastroenteric conditions.

The National Institute of Criteria and Technology (NIST) has created criteria for law enforcement breathalyzers' accuracy, dependability, and performance. The standards are revised regularly to reflect the most recent technological and reliability developments. According to the World Health Organization (WHO), alcohol is a factor in 20 to 30% of all traffic deaths in the U.S.

Regional Insights

In 2022, North America dominated the market and accounted for the largest revenue share of 43.6% owing to the highly developed economy, high product adoption rates, and awareness about road traffic safety. The region is expected to continue its dominance during the forecast period owing to the widening application of these devices. The market size is expected to show lucrative growth due to a rise in short and easy product approval procedures.

Asia Pacific is expected to grow at the fastest CAGR of 18.1% during the forecast period. Major markets in the region include India, China, Japan, Australia, and Malaysia. The usage of breath analyzers in these countries is still limited to law enforcement departments and surgery rooms of hospitals. Untapped markets of breathalyzers used privately and in restaurants/bars offer a huge opportunity for regional growth.

Key Companies & Market Share Insights

The breath analyzers market is fragmented with the presence of many small and medium-sized players owing to low entry and exit barriers to new entrants. Companies entering with innovative products have great scope for growth as the demand for innovative products is high.

Market players are involved in deploying strategic initiatives, which include product advancements, sales & marketing activities, and expansion of distribution networks, among others. For instance, in February 2022, FoodMarble Digestive Health Ltd. launched the AIRE 2−a personal digestive breath tester. Some prominent players in the global breath analyzer market include:

-

Drägerwerk AG & Co. KGaA

-

Lifeloc Technologies, Inc.

-

Quest Products, Inc.

-

Intoximeters

-

Alcohol Countermeasure Systems Corp.

-

AK GlobalTech Corp.

-

Bedfont Scientific Ltd.

-

Tanita

-

Lion Laboratories

-

Shenzhen Ztsense Hi-Tech Co., Ltd

Breath Analyzers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.2 billion

Revenue forecast in 2030

USD 9.3 billion

Growth rate

CAGR of 16.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Drägerwerk AG & Co KGaA; Lifeloc Technologies. Inc.; Quest Applications, Inc.; Intoximeters; Alcohol Countermeasure Systems Corp.; AK GlobalTech Corp.; Bedfont Scientific Ltd.; Tanita; Lion Laboratories; Shenzhen Ztsense Hi-Tech Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breath Analyzers Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breath analyzers market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuel Cell Technology

-

Semiconductor Sensor

-

Infrared (IR) Spectroscopy

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Abuse Detection

-

Alcohol Detection

-

Medical Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breath analyzers market size was estimated at USD 2.75 billion in 2022 and is expected to reach USD 3.2 billion in 2023.

b. The global breath analyzers market is expected to grow at a compound annual growth rate of 16.6% from 2023 to 2030 to reach USD 9.3 billion by 2030.

b. North America dominated with the largest revenue in 2022 with a 43.6% share. This dominance is attributed to a highly developed economy, high adaption rates, and awareness about road traffic safety. The region is expected to continue dominating over the forecast period owing to the widening application of these devices.

b. Some key players operating in the breath analyzers market include Drägerwerk AG & Co. KGaA; Lifeloc Technologies, Inc.; Quest Applications, Inc.; Intoximeters; Alcohol Countermeasure Systems Corp.; AK GlobalTech Corp.; Bedfont Scientific Ltd.; Tanita; Lion Laboratories; and Shenzhen Ztsense Hi Tech Co., Ltd.

b. Key factors that are driving the breath analyzers market growth include the growing demand for breath analyzers from law enforcement agencies and other institutions such as schools, sports, and offices to minimize alcohol abuse.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."