- Home

- »

- Organic Chemicals

- »

-

Bromine Derivatives Market Size, Industry Report, 2030GVR Report cover

![Bromine Derivatives Market Size, Share & Trends Report]()

Bromine Derivatives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tetrabromobisphenol A, Calcium Bromide), By Application (Flame Retardants, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-010-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bromine Derivatives Market Summary

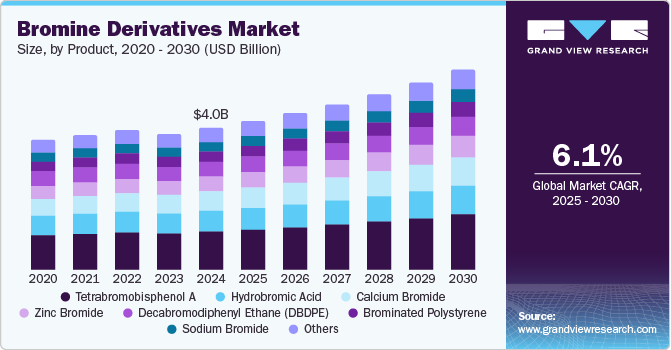

The global bromine derivatives market size was valued at USD 4.00 billion in 2024 and is projected to reach USD 5.65 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. This growth can be attributed to the increasing demand for high-performance flame retardants in the electronics, automotive, and construction industries, as these sectors prioritize safety standards.

Key Market Trends & Insights

- The Asia Pacific bromine derivatives market dominated the global market and accounted for the largest revenue share of 51.1% in 2024%.

- The bromine derivatives market in North America held a significant revenue share in 2024.

- By product, the Tetrabromobisphenol A (TBBPA) dominated the global bromine derivatives industry with the highest revenue share of 26.9% in 2024.

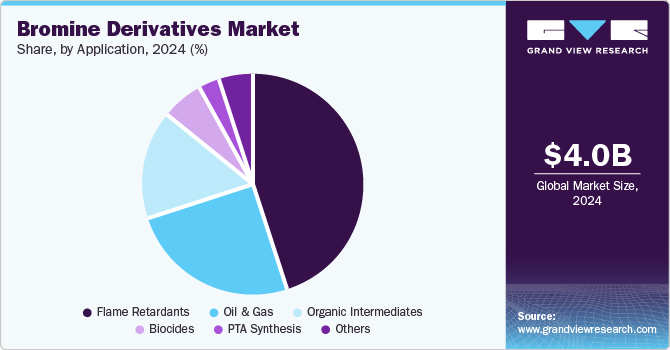

- By application, the flame retardants led the market and accounted for the largest revenue share of 45.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.00 Billion

- 2030 Projected Market Size: USD 5.65 Billion

- CAGR (2025-2030): 6.1%

- Asia Pacific: Largest market in 2024

In addition, the expansion of the pharmaceutical industry is crucial, with bromine derivatives playing a vital role in drug synthesis. Furthermore, adopting hydraulic fracturing and horizontal drilling techniques in the oil and gas industry boosts demand for bromine derivatives, enhancing their global market presence. Bromine derivatives are chemical compounds derived from bromine. They are essential in various applications, such as flame retardants, pharmaceuticals, and water treatment. The market for these derivatives is witnessing significant growth, primarily fueled by the rising demand for flame retardants across multiple sectors. Industries, including electronics and automotive, increasingly utilize bromine-based flame retardants to meet stringent safety regulations, enhancing product safety.

The automotive sector, in particular, emphasizes the need for effective flame-retardant materials to mitigate fire risks associated with engine overheating and electrical failures. The oil and gas industry is a major contributor to this market, as bromine derivatives are vital in drilling and completion fluids.

Furthermore, the water treatment industry is increasingly adopting bromine derivatives for disinfection processes, spurred by growing environmental concerns and the necessity for clean water. Moreover, the pharmaceutical sector also plays a role in market growth, with bromine derivatives integral to drug synthesis and developing new therapies. Furthermore, there is a rising demand for bromine-based biocides to ensure effective microbial control in various industrial applications.

Product Insights

Tetrabromobisphenol A (TBBPA) dominated the global bromine derivatives industry with the highest revenue share of 26.9% in 2024. This growth can be attributed to its extensive use as a flame retardant in consumer electronics and electrical components. In addition, as safety regulations tighten globally, the demand for TBBPA is increasing, particularly in producing large-screen devices and smart technology. Furthermore, advancements in technology and the rise of the Internet of Things are further propelling its market growth as manufacturers seek reliable materials to enhance fire safety in their products.

Calcium bromide is expected to grow at a CAGR of 7.0% over the forecast period, owing to its application in various industries, including oil and gas, where it is used as a drilling fluid. The expansion of shale gas exploration is significantly boosting its demand. Furthermore, calcium bromide is used in water treatment, responding to the growing need for effective disinfection solutions. Moreover, its effectiveness as a brine solution in various applications also contributes to its increasing popularity, making it a vital component in the bromine derivatives market.

Application Insights

The flame retardants led the market and accounted for the largest revenue share of 45.4% in 2024, primarily driven by stringent safety regulations. In addition, there is an increasing demand for effective flame retardants in the electronics, automotive, and construction sectors. This heightened focus on fire safety prompts manufacturers to incorporate bromine-based solutions to enhance product safety and compliance with regulatory standards.

The oil and gas segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2030, owing to their essential role in drilling fluids and completion fluids used during extraction processes. In addition, the rising activities related to hydraulic fracturing and horizontal drilling techniques are increasing the demand for bromine compounds, which are crucial for efficient drilling operations. Furthermore, the expansion of shale gas exploration further drives the need for these derivatives, as they provide effective solutions for high-temperature and deep-water drilling challenges.

Regional Insights

The Asia Pacific bromine derivatives market dominated the global market and accounted for the largest revenue share of 51.1% in 2024. This growth can be attributed to the rapid expansion of the pharmaceutical and electronics industries. In addition, with increasing healthcare awareness and a growing population, the demand for pharmaceuticals is surging, leading to higher utilization of bromine derivatives in drug synthesis. Furthermore, the electronics sector's reliance on flame retardants for safety compliance is propelling market growth.

China Bromine Derivatives Market Trends

The bromine derivatives market in China led the Asia Pacific market and held the largest revenue share in 2024, driven by substantial industrial growth, particularly in the electronics and automotive sectors. In addition, the country's focus on enhancing fire safety regulations has led to increased adoption of brominated flame retardants. Furthermore, China's booming pharmaceutical industry is creating significant demand for bromine derivatives in drug formulation.

Middle East & Africa Bromine Derivatives Market Trends

The Middle East and Africa bromine derivatives market is expected to grow at the fastest CAGR primarily due to the expanding oil and gas sector. In addition, the demand for drilling fluids containing bromine derivatives is rising with increased exploration activities in shale gas and offshore reserves. Furthermore, growing investments in chemical manufacturing and water treatment applications drive the need for brominated compounds. Moreover, the region's focus on enhancing industrial safety standards also contributes to the increasing adoption of flame retardants across various sectors.

North America Bromine Derivatives Market Trends

The bromine derivatives market in North America held a significant revenue share in 2024, driven by stringent safety regulations mandating using flame retardants in consumer products. Furthermore, the automotive industry’s emphasis on fire safety features has led to increased demand for brominated compounds. Moreover, technological advancements and a growing focus on sustainable practices encourage manufacturers to adopt innovative solutions involving bromine derivatives, further propelling market growth in this region.

The U.S. bromine derivatives market is expected to be driven by its robust chemical manufacturing base and a strong emphasis on research and development. In addition, the increasing use of brominated flame retardants in electronics and construction sectors is a significant driver. Furthermore, regulatory pressures to enhance product safety are prompting manufacturers to incorporate more bromine derivatives into their products, ensuring compliance with safety standards while fostering innovation within the industry.

Europe Bromine Derivatives Market Trends

The growth of the bromine derivatives market in Europe is largely attributed to stringent environmental regulations that promote the use of safer chemical alternatives. The electronics and automotive industries are increasingly adopting brominated flame retardants to meet these regulations. Furthermore, advancements in pharmaceutical applications create new opportunities for bromine derivatives. Moreover, countries such as Germany are leading this trend with their strong focus on sustainability and innovation, positioning Europe as a key player in the global bromine derivatives landscape.

Key Bromine Derivatives Company Insights

Key companies in the global bromine derivatives industry include Tata Chemicals Ltd., Lanxess Corporation, Honeywell International Inc., and others. These players employ strategies focused on innovation and sustainability. They invest in research and development to create eco-friendly products that comply with stringent environmental regulations. Furthermore, these companies form strategic partnerships and collaborations to enhance their market presence and expand their product offerings.

-

Albemarle Corporation manufactures products used in chemical synthesis, flame retardants, oil and gas well drilling fluids, and water purification. The company operates primarily in specialty chemicals, providing high-performance solutions for pharmaceuticals, agriculture, and industrial processes. Their extensive portfolio includes flame retardants, clear brine fluids, and other performance chemicals that cater to diverse industrial needs.

-

Tosoh Corporation manufactures bromine and its derivatives for flame retardants, agricultural chemicals, and pharmaceutical applications. Operating within the specialty chemicals segment, the company provides innovative solutions that meet the stringent safety and performance standards required by various industries.

Key Bromine Derivatives Companies:

The following are the leading companies in the bromine derivatives market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corporation

- Tata Chemicals Ltd.

- Lanxess Corporation

- Honeywell International Inc.

- Tosoh Corporation

- Israel Chemicals Limited

- Tetra Technologies Inc.

- Hindustan Salts Ltd.

- Jordan Bromine Company Ltd.

- Morre-Tec Industries, Inc.

- Beacon Organosys

Recent Developments

-

In November 2023, Lupin Limited, a global pharmaceutical leader, launched Rocuronium Bromide Injection in the U.S., following FDA approval for its ANDA by Caplin Steriles Limited. Available in 50 mg/5 mL and 100 mg/10 mL multiple-dose vials, this generic version of Zemuron is used as an adjunct to general anesthesia for rapid sequence intubation and muscle relaxation during surgery. Rocuronium bromide, a notable bromine derivative, had estimated annual sales of USD 54 million in the U.S. market.

Bromine Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.20 billion

Revenue forecast in 2030

USD 5.65 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Russia, China, India, Japan, Brazil

Key companies profiled

Albemarle Corporation; Tata Chemicals Ltd. Lanxess Corporation; Honeywell International Inc.; Tosoh Corporation; Israel Chemicals Limited; Tetra Technologies Inc.; Hindustan Salts Ltd.; Jordan Bromine Company Ltd.; Morre-Tec Industries, Inc.; Beacon Organosys

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bromine Derivatives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global bromine derivatives market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Brominated Polystyrene

-

Tetrabromobisphenol A

-

Calcium Bromide

-

Sodium Bromide

-

Zinc Bromide

-

Hydrobromic Acid

-

Decabromodiphenyl Ethane (DBDPE)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flame Retardants

-

Organic Intermediates

-

Oil & gas

-

Biocides

-

PTA Synthesis

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.