- Home

- »

- Advanced Interior Materials

- »

-

Building Acoustic Insulation Market Size & Share Report 2030GVR Report cover

![Building Acoustic Insulation Market Size, Share & Trends Report]()

Building Acoustic Insulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Glass Wool, Rock Wool, Foamed Plastic), By Application (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-726-6

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Building Acoustic Insulation Market Summary

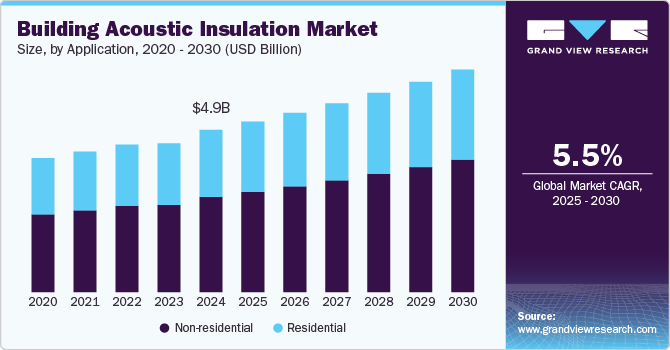

The global building acoustic insulation market size was estimated at USD 4.96 billion in 2024 and is projected to reach USD 6,813.6 million by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The market growth is attributed to the rising construction activities due to rapid urbanization and industrialization.

Key Market Trends & Insights

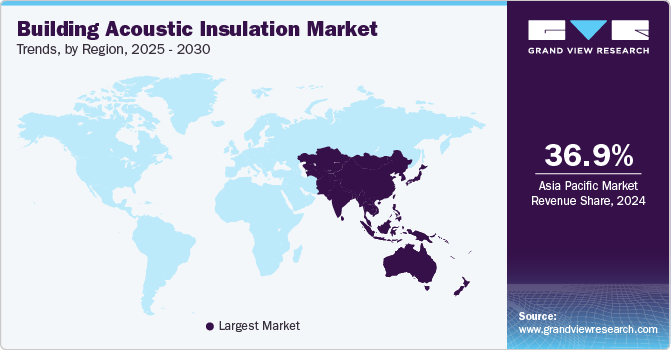

- The Asia Pacific building dominated the building acoustic insulation market and held 36.9% in 2024.

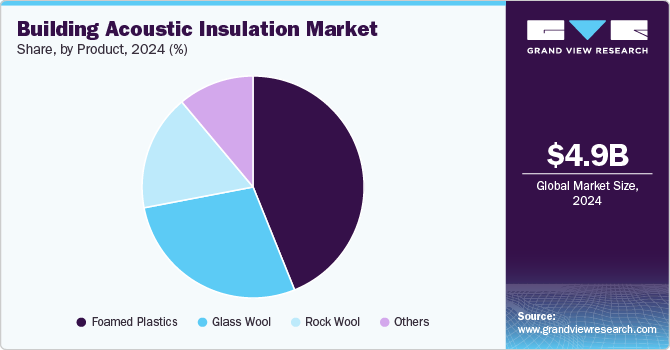

- Based on product, the foamed plastic segment led the market and accounted for a revenue of USD 43.9 billion in 2024.

- Based on application, the non-residential construction segment accounted for the largest share in 2024 and is expected to grow at a CAGR of 5.5%.

Market Size & Forecast

- 2024 Market Size: USD 4.96 Billion

- 2028 Projected Market Size: USD 6,813.6 Million

- CAGR (2025-2030): 5.5%

- Asia Pacific: Largest market in 2024

This in turn, is expected to increase the number of new projects, primarily in the residential and non-residential construction sectors. With the growing purchasing power and standard of living, the use of entertainment centers such as theaters and music studios is also on the rise. Such centers are required to maintain the perfect acoustic environment, which can be fulfilled using acoustic insulation.

Noise pollution has become a significant health concern, studies show its adverse effects on mental and physical well-being, including stress, hearing loss, and sleep disturbances. As awareness of these issues rises, homeowners, businesses, and public building authorities are prioritizing soundproofing solutions. Acoustic insulation plays a vital role in mitigating unwanted noise, making spaces more livable and reducing the harmful impacts of noise pollution. The increasing demand for healthier living and working environments directly boosts the growth of the acoustic insulation market.

The rise of green building initiatives, where sustainability and energy efficiency are central, is another crucial driver of the acoustic insulation market. Many insulation materials, such as mineral wool and cellulose, not only provide soundproofing but also enhance thermal performance, reducing energy consumption. By integrating acoustic insulation into eco-friendly construction projects, builders meet both environmental standards and acoustic comfort requirements. As countries push for more sustainable urban development, the demand for acoustic insulation solutions that complement green architecture is on the rise.

Innovation in material science has led to the development of advanced acoustic insulation products that offer superior soundproofing along with additional benefits like fire resistance, durability, and environmental friendliness. These innovations are particularly appealing in high-end construction projects where premium acoustic performance is required. Moreover, the increasing availability of lightweight and easy-to-install products makes it easier for builders to incorporate acoustic insulation in both new constructions and renovation projects, further driving market expansion.

Product Insights

Foamed plastic building acoustic insulation led the market and accounted for a revenue of USD 43.9 billion in 2024.The demand for foamed plastic is likely to grow on account of the high investments in construction industries over the projected period. In addition, on account of rising disposable income of consumers and changing consumer preferences, coupled with favorable regulations pertaining to the use of sustainable building materials, is expected to drive the market during the forecast period.

The cost-effectiveness and resistance to dust and moisture accumulation offered by foamed plastics are expected to fuel their demand across the world. Their tough and resilient surface also offers these plastics a high degree of puncture resistance. Moreover, foamed plastics inhibit any potential for microbial or fungal growth in insulated areas. These characteristics are expected to drive demand for foamed plastics in acoustic insulation applications during the forecast period.

Rock wool product segment is expected to grow at fastest CAGR of 6.0% in the forecast period owing to rising demand for environmentally robust insulation materials in the construction industry for various applications such as roof, ceiling, floor, and internal wall insulation is expected to have a positive impact on the market during the projected period.Rock wool insulation has high density, which makes it highly resistant to the flow of air and excellent at noise reduction and sound absorption in buildings. Due to this, it is used in commercial buildings such as movie and performance theaters, clubs and pubs, conference rooms, libraries, and music studios.

Application Insights

The non-residential construction segment accounted for the largest share in 2024 and is expected to grow at a CAGR of 5.5% during the forecast period from 2024 to 2030. The rapid growth of office buildings, hotels and motels, restaurants, malls, warehouses, gyms, and recreational buildings developed by general contractors, design-build companies, and project managers. Acoustic insulation improves the performance and productivity of employees, enables effective communication among employees, and ensures their privacy, which is likely to boost the demand for building acoustic insulation during the projected period.

As urban populations grow and cities become more congested, noise pollution from traffic, construction, and neighbors has become a major concern for homeowners. The demand for peaceful, quiet living environments is driving the adoption of acoustic insulation solutions in residential buildings. Buyers, especially in high-density urban areas, are increasingly prioritizing soundproofing in homes, apartments, and condominiums to ensure comfort and tranquility.

Regional Insights

With increasing awareness of climate change and energy conservation, there is a rising demand for energy-efficient buildings across North America. Acoustic insulation materials not only help with soundproofing but also improve a building’s thermal insulation, reducing heating and cooling energy consumption. Homeowners and builders are prioritizing insulation products that offer both sound and energy performance benefits, which aligns with growing trends in green building practices and energy-efficient home certifications like LEED.

U.S. Building Acoustic Insulation Market Trends

The U.S. construction industry, particularly in metropolitan areas, is experiencing a steady rise due to population growth, urbanization, and increased housing demand. Both residential and commercial construction projects are incorporating acoustic insulation to meet the growing need for noise control. High-density housing developments, office buildings, and public infrastructure projects are focusing on acoustic comfort, propelling the demand for soundproofing solutions in the U.S.

Asia Pacific Building Acoustic Insulation Market Trends

Asia Pacific building dominated the building acoustic insulation market and held 36.9% in 2024 and is projected to grow at the fastest CAGR of 6.2% in terms of revenue during the forecast period 2025-2030. This growth can be attributed to the ongoing developments in terms of infrastructure and the flourishing construction industry in countries such as China, India, Japan, and South Korea. Moreover, governments are working to improve building quality through the adoption of minimum acoustic insulation requirements, which is propelling the growth of the product in the region.

China building acoustic insulation market is rising due to increased awareness among Chinese consumers about the negative health effects of noise pollution, such as stress, sleep disorders, and reduced productivity, is increasing the demand for soundproof living and working environments. This trend is driving the adoption of acoustic insulation materials in residential, commercial, and healthcare sectors, as more people prioritize soundproofing to create peaceful and healthy indoor environments.

Middle East & Africa Building Acoustic Insulation Market Trends

The region's booming tourism and hospitality industry, especially in countries like the UAE and Saudi Arabia, has led to a rise in the construction of hotels, resorts, and entertainment facilities. Acoustic comfort is critical in these sectors, as hotels and resorts must meet international standards for noise control to provide a peaceful and relaxing experience for guests. This demand for superior soundproofing has driven the adoption of acoustic insulation materials in the design and construction of new hotels and resorts.

Europe Building Acoustic Insulation Market Trends

As urbanization continues across Europe, particularly in major cities like London, Paris, and Berlin, the demand for multi-family housing, such as apartment complexes and high-rise residential buildings, is rising. Noise pollution in densely populated areas is a growing concern for residents, leading to increased demand for acoustic insulation to reduce noise transmission between units. This trend is especially prominent in countries like Germany, France, and the UK, where urban housing development is booming.

Key Building Acoustic Insulation Company Insights

Prominent players operating in the market include Saint Gobain S.A., Owens Corning, Rockwool A/S, Armacell, and Kingspan Group.

-

Saint-Gobain offers a comprehensive range of acoustic insulation products designed to improve soundproofing in various applications. Their portfolio includes solutions such as glass wool, rock wool, and cellulose insulation, which effectively reduce noise transmission in residential and commercial buildings. Additionally, the company provides specialized acoustic panels and soundproofing systems tailored for specific construction needs, contributing to enhanced acoustic comfort and energy efficiency in living and working environments.

-

Owens Corning’s building acoustic insulation products are designed to enhance indoor comfort and energy efficiency while significantly reducing sound transmission. Their product offerings include fiberglass batts and rolls, soundproofing boards, and spray-applied insulation, catering to both residential and commercial applications. With a focus on high-performance materials, Owens Corning aims to meet diverse customer needs while promoting a quieter and more energy-efficient built environment.

Key Building Acoustic Insulation Companies:

The following are the leading companies in the building acoustic insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Saint Gobain S.A.

- Owens Corning

- Rockwool A/S

- Armacell

- Kingspan Group

- Knauf Insulation

- BASF SE

- Johns Manville

- Fletcher Insulation

- Cellecta Inc.

Recent Development

- In August 2021, Owens Corning launched its PINK Next Gen Fiberglas Insulation, a significant advancement in building insulation technology. This new product line is designed to provide superior thermal and acoustic performance while prioritizing sustainability and environmental responsibility. The PINK Next Gen™ insulation features a more sustainable manufacturing process that reduces energy consumption and greenhouse gas emissions, aligning with the company’s commitment to reducing its carbon footprint.

Building Acoustic Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,221.5 million

Revenue forecast in 2030

USD 6,813.6 million

Growth Rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France;

Italy; Belgium; Poland; China; India; Japan;

Brazil; Saudi Arabia; UAE

Segments covered

Product, application, region

Key companies profiled

Saint Gobain S.A.; Owens Corning; Rockwool A/S; Armacell; Kingspan Group; Knauf Insulation; BASF SE; Johns Manville; Fletcher Insulation; Cellecta Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Building Acoustic Insulation Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global building acoustic insulation market based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass Wool

-

Rock Wool

-

Foamed Plastic

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

ItalyBelgium

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global building acoustic insulation market size was estimated at USD 4.96 billion in 2024 and is expected to reach USD 5,221.5 million in 2025.

b. Foamed plastic dominated building acoustic insulation market in 2024 owing to the high investments in construction industries during the projected period.

b. Some of the key players operating in the building acoustic insulation market include Saint Gobain S.A.; Owens Corning; Rockwool A/S; Armacell; Kingspan Group; Knauf Insulation; BASF SE; Johns Manville; Fletcher Insulation; Cellecta Inc.

b. The key factor which is driving building acoustic insulation market is rising construction activities due to rapid urbanization and industrialization.

b. The global building acoustic insulation market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 6,813.6 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.