- Home

- »

- Plastics, Polymers & Resins

- »

-

Building & Construction Sealants Market Trends, Industry Report, 2025GVR Report cover

![Building And Construction Sealants Market Size, Share & Trends Report]()

Building And Construction Sealants Market Size, Share & Trends Analysis Report By Resin Type (Silicones, Polyurethanes), By Technology (Water-based, Solvent-based), By Application, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-728-5

- Number of Report Pages: 174

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Bulk Chemicals

Report Overview

The global building and construction sealants market size was estimated at USD 7.01 billion in 2017. It is estimated to witness a CAGR of 6.1% from 2017 to 2025. Growing demand for bonding, fire protection, insulation, soundproofing, and cable management in the construction industry is expected to boost the market.

Sealants find a wide range of applications, such as glazing, flooring, windows, and walls and ceilings. They provide resistance to fire, changes in weather conditions, and extreme temperatures. They are used for glazing as they provide rapid adhesion build and a long-lasting bond which can accommodate a wide range of movement generated by an array of traditional and contemporary window and building designs.

Raw materials used for manufacturing sealants include resins, polyolefin, solvents, and mineral fillers. The supply of these materials is impacted by factors such as regional demand and supply variations, GDP growth rates, currency fluctuations, production outages, and unpredictable geopolitical conflicts. Several manufacturers in the market are investing significantly in R&D activities and technological innovations to reduce high operating costs and to streamline efficiencies.

Rising environmental concerns and favorable regulations by agencies, such as the Environmental Protection Agency (EPA) and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), regarding carbon emissions have fostered the development of eco-friendly and sustainable sealants. In addition, trends like the construction of green buildings and the use of lightweight chemicals are expected to provide lucrative growth opportunities.

The sealant industry is currently witnessing high competitive landscape. Market players have been continuously making efforts to reduce manufacturing costs and develop new design & assembly solutions. Dow Chemicals, BASF SE, and The 3M Company are the key players within the building and construction sealants market.

Resin Type Insights

The silicone segment acquired the highest market share of 35.5% in 2017, in terms of revenue. They are known for efficient sealing as well as weatherproofing joints of structural components. Silicone sealants also prevent elements to inter-lock and contribute to long-lasting quality.

The polyurethane segment is expected to witness the fastest CAGR of 6.0%, in terms of volume, during the forecast period. Polyurethane sealants are widely used across several industries, particularly in the construction and automotive sector. These are majorly adopted for sealing fuel and oil tanks or on any surface that is exposed to oil and corrosive mixtures.

The growth of the plastisol sealants segment is driven by the good peel resistance and high flexibility offered by these products. However, their tendency to malfunction when subject to heavy load and limited heat resistance restricts their growth in the market.

Emulsion sealant is a one-component system with good adhesion properties, even without the use of a primer. It is paintable and provides good UV radiation resistance. One of the primary reasons for its diverse application is the ease of use and clean up along with the low cost. They also provide fast skinning and good packing stability.

Technology Insights

The water-based sealant segment led the market in 2017 with a volume share of 45.9%. The long-lasting bondability of the product is likely to fuel its utilization in construction as well as woodwork projects over the forecast period. The product typically does not require a caulking gun and is therefore preferred globally across several industries. The low odor of water-based sealants is yet another reason for its widespread application in indoor activities.

The reactive and other sealants are expected to expand at a CAGR of 6.1%, in terms of revenue, during the forecast period. The low modulus reactive silicone sealants are useful and are comparatively cheap. It adheres to a number of diverse building substrates and is thus preferred by several companies globally.

The solvent-based building & construction sealants are ideal for bonding diverse materials that provide long-lasting adhesion stability. They have high tensile strength bonds and are considered more reliable. These are often used to fill the gap between two materials and remove unevenness among two substrates.

Application Insights

The flooring application is anticipated to expand at the fastest CAGR of 6.0%, in terms of volume. There are several wood flooring sealants that are environment-friendly and provides sound dampening effects, thus preferred for subfloor heating purposes. They provide rigid grab, improvised bonding strength, and improved hardness which are suitable for timber floors

The roofing segment is estimated to capture the second highest market share of 19.8% in 2017, in terms of revenue. Roofing sealants are manufactured to withstand harsh climate which increases its application scope in both commercials as well as residential sectors. For roofing and facade purposes, polyurethane sealants are being increasingly used owing to fast and easy setting properties apart from their versatility to bond.

The walls and ceilings are also another major application scope for the product in sectors such as angle intersections that fall under tile and wall panels. The walls and ceilings including angle intersections require durable and long-lasting products for sealing. Manufacturers are focusing on innovation of new age products that can cater to the demand from complex applications such as soundproofing ceilings.

Window sealing is a very crucial application sector of the product. Innovative construction sealants are manufactured to control intrusion of water and air into the building. The window sealants solve the purpose of both restoration projects as well as new structural development projects.

Function Insights

The bonding function is estimated to capture a significant market share of 30.0% in 2017, in terms of revenue. Construction sealants are highly used for bonding windows with ferrous and non-ferrous plates. They are also used for bonding decorative panels, tabletops which include wood and metal surfaces.

The protection segment is estimated to expand at a CAGR of 5.5%, in terms of volume. Fire protection is one of the significant functions of the product. Increasing awareness regarding building safety is expected to drive the growth of this segment over the forecast period.

Polyurethane sealants are used across diverse applications for their excellent insulation properties. Companies are expanding their product portfolios to include foam sealants for windows and doors to ensure better durability and endurance against crosswinds. They provide excellent insulation and also help enhance the indoor air quality by preventing air leaks, thereby reducing greenhouse gas emissions.

For soundproofing, seams are sealed with acoustic sealants to prevent sound seepage. They are designed to reduce sound transmissions and are non-flammable. The product is applied to wood, metal studs, gypsum boards, and concrete, where they stay flexible throughout and adheres firmly to the surface. These products prevent air infiltration and provide a seal against air-borne sounds.

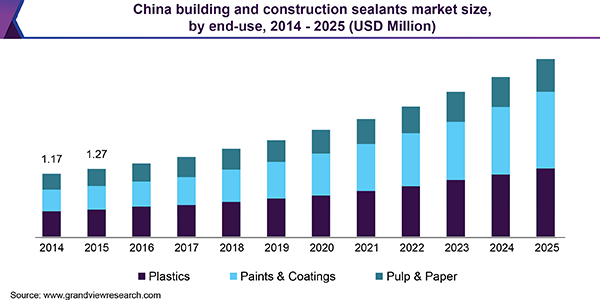

End-use Insights

The residential complex is the leading end-use segment in the global market. The segment is estimated to hold the largest market share of 48.8%, in terms of revenue, in 2017. The global residential property infrastructure development is estimated to register a stable CAGR over the foreseeable future. The rising population and demand for luxurious homes are the significant factors for growth.

The commercial use is estimated to witness a CAGR of 5.3%, in terms of volume, during the forecast period. The increasing number of businesses across the globe is likely to facilitate the construction of commercial buildings, thereby augmenting the growth. Polyurethane sealants are widely used across several applications for both internal as well as external renovation and restructuring purposes.

The industrial sector is one of the key factors contributing to GDP and economic development. Several government initiatives across Asia Pacific, Europe, and North America are focusing on industrial development to increase the employment rate and to stabilize the economy. This is anticipated to fuel the construction sector, thereby, propelling the utilization of sealants in the forthcoming years.

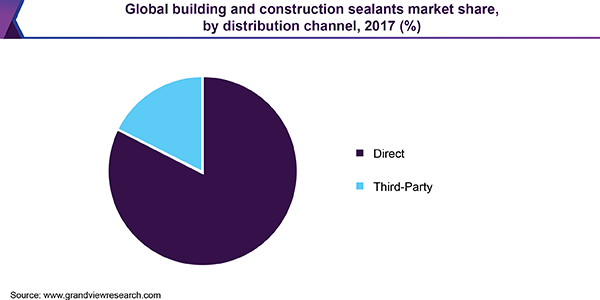

Distribution Channel Insights

The direct distribution channel is estimated to generate the highest revenue with a market share of 82.5% in 2017. The companies generally rely on a direct supply chain network which is strong and reliable. The demand for construction sealants is witnessing significant growth in developing economies, which has led to the establishment of stable networks by the manufacturers to cope with the rising demand.

The third-party distribution segment is predicted to expand at a CAGR of 5.2% during the forecast period. In regions that have low construction activities related to commercial sites or residential complexes, the demand for the product is always flat. The timely request of sealants requires a cost-effective and efficient third-party distribution channel that has a strong regional presence. The companies in these regions focus on such distribution channels to increase efficiency and save money.

Regional Insights

Asia Pacific witnessed the highest adoption of construction sealants, accounting for 40.0% market volume share in 2017. It is also expected to be the fastest-growing region during the forecast period. The rapidly growing construction industry, especially in India, China, and Indonesia is the primary factor driving growth.

Central and South America are anticipated to be the second fastest-growing region during the forecast period, with a CAGR of 8.0% in terms of revenue. Introduction of initiatives such as Leadership in Energy and Environmental Design (LEED) certification in 2007 and efforts for the development of green buildings via initiatives like the Green Building Council Brasil (GBC) are likely to positively affect the regional growth over the years to come.

Europe is predicted to be one of the major contributors to the market by 2025. The European Commission; responsible for construction activities in the region, is consolidating the internal market to enhance performance as well as to increase the profitability of the sector. Strategies such as Construction 2020 and EU Construction and Demolition waste proposal are expected to drive the market for bio-based construction sealants in the region.

Key Companies & Market Share Insights

The competitive landscape of the global market includes major players like Sika AG, 3M, Dow Corning, and H.B Fuller who have fairly consolidated the market. Due to the increasing demand for renewable technologies, the companies are expected to launch new products from bio-based resources and unlock new pockets for revenue generation.

The significant strategies adopted by key players to remain competitive in the market include partnerships, collaborations, new product launches, and business expansion.

Building and Construction Sealants Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 7.7 billion

Revenue forecast in 2025

USD 11.2 billion

Growth Rate

CAGR of 6.1% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, Brazil

Key companies profiled

Sika AG, 3M, Dow Corning, H.B Fuller, BASF SE, Henkel AG & Co. KGaA, Bostik SA, Wacker Chemie AG, Pidilite Industries Limited, and Pecora Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global building and construction sealants market report on the basis of resin type, technology, function, end-use, distribution channel, and region:

-

Resin Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Silicone

-

Polyurethane

-

Plastisol

-

Emulsion

-

Polysulfide

-

Butyl-based

-

-

Technology Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Water-based

-

Solvent-based

-

Reactive

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Flooring

-

Packaging

-

Food & Beverages

-

Construction

-

Automotive

-

Others

-

-

Function Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Bonding

-

Protection

-

Insulation

-

Glazing

-

Soundproofing

-

Cable management

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Residential

-

Industrial

-

Commercial

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Direct

-

Third-party

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global building and construction sealants market size was estimated at USD 7.7 billion in 2019 and is expected to reach USD 8.2 billion in 2020.

b. The global building and construction sealants market is expected to grow at a compound annual growth rate of 6.1% from 2019 to 2025 to reach USD 11.2 billion by 2025.

b. Silicone Sealant dominated the building and construction sealants market with a share of 35.3% in 2019. This is attributable to efficient sealing as well as weatherproofing joints of structural components along with preventing elements from inter-locking and contributing to long-lasting quality.

b. Some key players operating in the building and construction sealants market include Sika AG, 3M, Dow Corning, H.B Fuller, BASF SE, Henkel AG & Co. KGaA, Bostik SA, Wacker Chemie AG, Pidilite Industries Limited, and Pecora Corporation.

b. Key factors that are driving the market growth include growing demand for bonding, fire protection, insulation, soundproofing, and cable management in the construction industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."