- Home

- »

- Distribution & Utilities

- »

-

Building-integrated Photovoltaics Market Size Report, 2030GVR Report cover

![Building-integrated Photovoltaics Market Size, Share & Trends Report]()

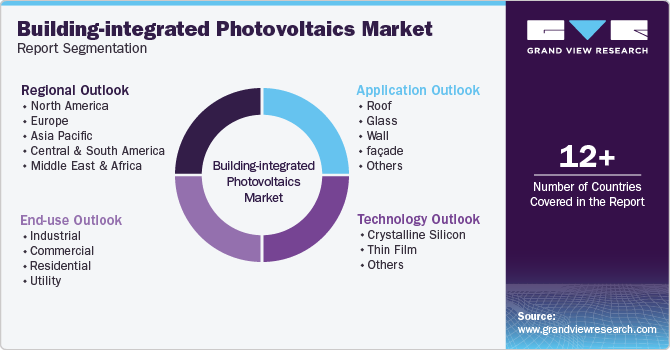

Building-integrated Photovoltaics Market Size, Share & Trends Analysis Report By Technology (Crystalline Silicon, Thin Film), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-301-0

- Number of Report Pages: 220

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

BIPV Market Size & Trends

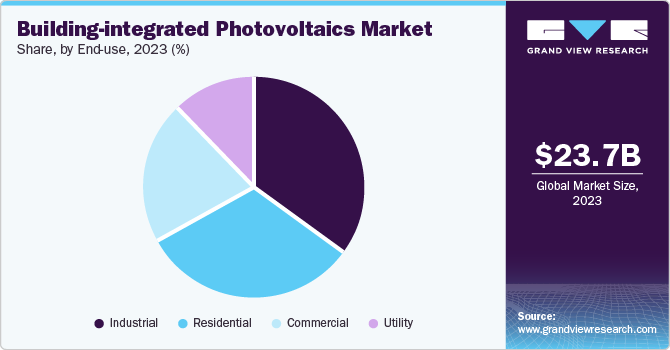

The global building-integrated photovoltaics market size was estimated at USD 23.67 billion in 2023 and is projected to grow at a CAGR of 21.2% from 2024 to 2030. Rapid expansion of the solar photovoltaic (PV) installation capacities of different countries, coupled with increasing demand for renewable energy sources, is expected to drive the building-integrated photovoltaics (BIPV) market growth across the world.

Increased awareness for energy security and self-sufficiency and favorable government legislations, coupled with the unilateral obligation of countries such as Germany, Italy, France, the UK, the U.S., China, Japan, and India to the Kyoto Protocol, designated to reduce greenhouse gas (GHG) emissions, are also expected to promote the market growth in the coming years.

The presence of a consumer base with high disposable income levels and the increasing affinity toward integrated installations in residential and commercial buildings in the country are anticipated to boost the demand for the product over the forecast period. In addition, the growing innovation in the domain is projected to increase the operational efficiency of the product, translating into market growth.The market globally is likely to be driven by the growing demand for alternate sources of energy. The demand for building-integrated photovoltaics is likely to be fueled by the high need for integrated roof systems in commercial and industrial establishments. Improvements in the manufacturing technology of thin film BIPV modules and the rising efficiency of the product are expected to drive the market over the forecast period.

The government of France offers the highest FiTs for electricity generated through photovoltaic components, which are essentially integrated into buildings. Capacity generated by photovoltaics integrated into building envelopes accounts for a substantial share of the overall accumulated, installed capacity generated by photovoltaics in the country. The country offers high subsidies and benefits pertaining to the use of building integrated photovoltaics in a bid to encourage such installations in the country.

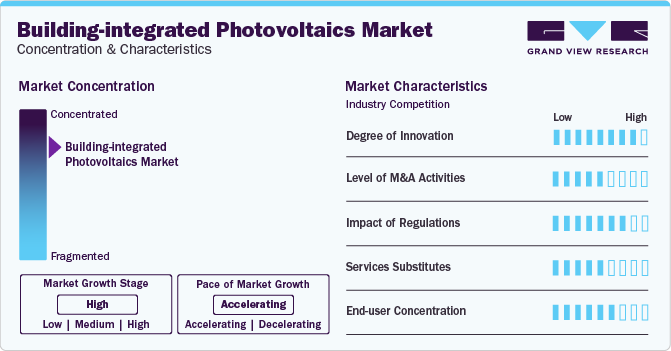

Market Concentration & Characteristics

The rapid expansion of the solar photovoltaic (PV) installation capacities of different countries, coupled with increasing demand for renewable energy sources, is expected to drive the market growth across the world. Increased awareness for energy security and self-sufficiency and favorable government legislations, coupled with the unilateral obligation of countries such as Germany, Italy, France, the UK, the U.S., China, Japan, and India to the Kyoto Protocol, designated to reduce greenhouse gas (GHG) emissions, are also expected to promote the market growth in the coming years.

Leading players in the market have adopted the strategies like new product launches, mergers & acquisitions and collaborations to maintain their shares in the global market. For instance, in June 2022, Mitrex, a Canadian company that manufactures building integrated photovoltaic systems, unveiled the largest tandem photovoltaic panel, that can generate up to 800W of power in total. The panels have unique anti-reflecting technology and are made of monocrystalline silicon solar cells that optimize the generation of electrical energy.

Technology Insights

Based on technology, the market has been further divided into crystalline silicon, thin film and others. The crystalline silicon segment led the market with the largest revenue share of 70.9% in 2023.Crystalline silicon cells can be integrated into building roofs by using smart mounting systems, which replace the sections of the roof while keeping its integrity intact. This type of integration does not account for large investments and provides high efficiency. Another option of integration is the replacement of roof tiles with crystalline silicon cells. In addition, the market witnesses the use of anti-reflective coatings, which aid the capture of solar energy and provide superior efficiency. Crystalline silicon has the highest energy conversion efficiency at present; commercial modules typically convert 13%-21% of the incident sunlight into electricity.

The thin film segment accounted for the revenue share of 22.2% in 2023 and the market is expected to witness at a sustainable CAGR over the forecast period, due to rapid technological advancements leading to the introduction of advanced products. Thin film BIPVs are readily used in case of considerable weight constraints for the building. In such cases, the building envelope is unable to support the weight of crystalline silicon integration, leading to high demand for thin film integrated installation. Thin film is advantageous as it can be used for curved surfaces owing to its superior flexibility

The other technology segment includes advanced integrated photovoltaic manufacturing technologies such as dye sensitized cells (DSC) and organic photovoltaics (BIOPV). The demand is expected to be driven by the superior energy bandgap of organic photovoltaics. Rapid technological advancements have led to a significant increase in the efficiency of organic PVs, which is anticipated to boost their demand over the forecast period.

Application Insights

Based on application, the roofs segment led the market with the largest revenue share of 66.9% in 2023. The roof segment will maintain its lead throughout the forecast period.Photovoltaics integrated with building roofs are known to exhibit efficiency due to improved incidence of light on the roof surface. The segment accounted for the highest market share in 2021, owing to the higher strength and improved aesthetic appeal of integrated roofs and skylights. The demand for building integrated roofs is expected to increase over the forecast period due to the development of superior products.

The market is anticipated to have a steady growth in all segments as the demand for BIPV increases. Superior efficiency of solar walls due to strong incident sunlight is expected to drive the demand for BIPV in walls over the forecast period. Introduction of advanced low-weight solar panels is expected to facilitate the demand for building integrated walls. The development of advanced solutions such as the combination of amorphous silicon transparent glass solar panels with an opaque glazing unit is likely to drive the demand for BIPV in these applications. The use of double and triple-glazed insulating glass in BIPV walls is also expected to boost the product demand over the forecast period.

BIPV facades experience high demand, primarily in the developed economies that have a well-established electricity distribution system. The demand for the integration of photovoltaics with facades is driven by their increasing installation in the commercial sector. Glass integrations are expected to grow on account of high transparency of integrated systems coupled with superior integration of glass and BIPV cells. The development of photovoltaic materials with high absorption is expected to propel the product demand over the forecast period.

The others application segment includes shading and membranes. The demand for such products is high in residential installations due to the development of lightweight materials for use in uneven surfaces. The installations do not generally use crystalline silicon photovoltaic module, as the structure is incapable of supporting heavy weight.

End-use Insights

Based on end use, the residential segment led the market with the largest revenue share of 34.7% in 2023. The demand for building-integrated photovoltaics in the residential sector is expected to be driven over the forecast period owing to increasing awareness regarding the use of renewable sources of energy for electricity generation among consumers. However, the high cost of integration of photovoltaics into the building envelope is expected to act as a restraint for the market growth over the forecast period.

The demand for residential BIPVs is likely to stem from favorable regulations by various authorities coupled with the high subsidies and other monetary benefits provided by the national governments. Increasing adoption of integrated solutions by residential areas in Germany and France is expected to drive product demand over the forecast period.

The demand for building-integrated photovoltaics in commercial establishments is likely to be fueled by the growing number of retrofit projects using these installations. The high emphasis on the aesthetic appeal of solar energy-harnessing systems, primarily in commercial establishments, is likely to fuel the product demand in this sector.

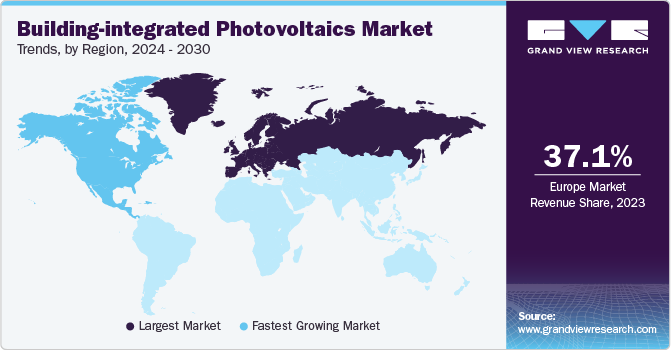

Regional Insights

The building-integrated photovoltaics market in North America is anticipated to grow at the fastest CAGR over the forecast period. The demand for building-integrated photovoltaics in the North America region is anticipated to grow at the fastest CAGR during the forecast period, on account of the rising adoption of aesthetically appealing solar energy-harnessing systems. In addition, the high disposable incomes of consumers in the region, primarily the U.S. and Canada, and the advances in the production technologies of BIPV solar panels are likely to lead to an increased demand for the product over the next seven years. The demand for the product is anticipated to remain high in economies such as China and Japan owing to the increasing efforts by governments to adopt these solutions. Consumers in the region exhibit a high demand for renewable energy sources in order to reduce the impact of non-renewable energy sources on the environment.

U.S. BIPV Market Trends

The building-integrated photovoltaics market in U.S. is expected to grow at a significant CAGR of 22.1% from 2024 to 2030. The U.S. market is expected to be driven by the high demand for these installations in the country’s residential sector. The presence of a consumer base with high disposable income levels and the increasing affinity toward integrated installations in residential and commercial buildings in the country are anticipated to boost the demand for the product over the forecast period. In addition, the growing innovation in the domain is projected to increase the operational efficiency of the product, translating into market growth.

Europe BIPV Market Trends

Europe dominated the building-integrated photovoltaics market with the largest revenue share of 37.1% in 2023.Favorable outlook toward renewable energy coupled with consumer awareness for the same in European countries is likely to drive the market growth over the forecast period. Germany and Italy are increasingly emphasizing the use of solar energy, which is expected to translate into higher adoption of BIPV, thus promoting market growth over the forecast period.

Favorable outlook toward renewable energy coupled with consumer awareness for the same in European countries is likely to drive the market for BIPV over the forecast period. Germany and Italy are increasingly emphasizing the use of solar energy, which is expected to translate into higher adoption of BIPV, thus promoting industry growth over the forecast period. In addition, the region witnessed introduction of multiple regulations such as Renewable Energy Directive 2009/28/EC, National Renewable Energy Action Plan (NREAP), Solar Europe Initiative, and Energy Performance of Buildings Directive (EPBD) coupled with advanced products in a bid to attract consumers toward building-integrated photovoltaic

The building-integrated photovoltaics market in Germany held over 42.8% share in the Europe in 2023.The Germany market has emerged as one of the primary adopters of BIPV on account of the positive government regulations such as German Renewable Energy Sources Act that introduced feed in tariffs scheme and hence encouraged the generation of electricity through solar.

The France building-integrated photovoltaics market is anticipated to grow at a significant CAGR of over 18.7% during the forecast period. The French government is promoting the use of solar panels by providing various incentives and tax credit options. For instance, individuals investing in solar energy plants are eligible for an income tax credit (Crédit d'Impôt). Moreover, reduced VAT rate is eligible for individuals who install photovoltaic installations on buildings. These incentives are anticipated to drive the installation of BIPV in France.

Asia Pacific BIPV Market Trends

The building-integrated photovoltaics market in Asia Pacific is predicted to be driven by the growing consumer awareness about commercial and industrial applications of these installations. In addition, the demand for the product is anticipated to remain high in economies such as China and Japan owing to the increasing efforts by governments to adopt these solutions. Consumers in the region exhibit a high demand for renewable energy sources in order to reduce the impact of non-renewable energy sources on the environment.

The China building-integrated photovoltaics market held over 30.0% share in the Asia Pacific in 2023.China is expected to emerge as one of the lucrative markets for building-integrated photovoltaic solutions. The Chinese government has shown affinity toward the adoption of PV and BIPV solutions and invited applications from its regional government under the Golden Sun program to provide a boost to their growth. Under the program, crystalline silicon PV modules and amorphous silicon thin-film modules are required to display minimum conversion efficiency rates of 15% and 8% respectively. The high demand for these installations in the economy and rising efforts by the government to promote their use are likely to drive the market growth over the forecast period.

The building-integrated photovoltaics market in Japan is anticipated to grow at the fastest CAGR of over 19.9%. The high demand for BIPV-integrated walls and roofs and the rising use of such installations are expected to drive the market for BIPV in Japan over the forecast period. It is anticipated to expand in the wake of increased consumer spending on the installation of energy generation systems.

Central & South America BIPV Market Trends

The building-integrated photovoltaics market in Central & South America is estimated to drive the market growth over the forecast period. In addition, the demand for BIPV systems in the region is predicted to increase due to their application in the industrial and commercial sectors. Furthermore, the market in CSA, primarily in Brazil and Argentina, witnesses’ high potential due to the increased installation of solar energy-harnessing systems.

The market for the BIPV is projected to register the fastest CAGR during the forecast period, on account of the rising adoption of the product in the region. The market in the region is estimated to drive the market growth over the forecast period. In addition, the demand for BIPV systems in the region is predicted to increase due to their application in the industrial and commercial sectors. Furthermore, the market in CSA, primarily in Brazil and Argentina, witnesses’ high potential due to the increased installation of solar energy-harnessing systems.

The Brazil building-integrated photovoltaics market held over 48.8% share in the Central & South America in 2023.The commercial industry in the region is expected to emerge as a major end use of BIPV installations. The segment is likely to grow at the fastest CAGR over the forecast period, on account of the efforts taken toward maximizing the use of renewable energy sources in commercial establishments. In addition, the residential segment is anticipated to account for a limited market revenue share due to the presence of low- and middle-income consumers in the region.

Middle East & Africa BIPV Market Trends

The building-integrated photovoltaics market in Middle East & Africa is anticiapated to grow at the fastest CAGR during the forecast period. The demand for BIPV in the MEA region is projected to rise on account of the growing market and high adoption of renewable energy sources. The market is estimated to expand on account of increasing affinity of consumers and major companies toward adopting BIPVs to reduce their dependence on non-renewable energy sources. The introduction of BIPV in buildings is likely to emerge as a major trend in the region, facilitated by government intervention.

Key Building-integrated Photovoltaics Company Insights

BIPV manufacturers have been implementing various strategies such as new product developments, partnerships, joint ventures, agreements, and collaborations, among others, to maximize their market penetration and to cater to the changing requirements of the architects and construction contractors.

Key Building-integrated Photovoltaics Companies:

The following are the leading companies in the building-integrated photovoltaics market. These companies collectively hold the largest market share and dictate industry trends.

- SolarWindow Technologies, Inc.

- AGC Inc.

- Hanergy Mobile Energy Holding Group Limited

- The Solaria Corporation

- Heliatek GmbH,

- Carmanah Technologies Corp.

- Greatcell

- Tesla

- BELECTRIC

- ertex solartechnik GmbH

Recent Developments

-

In March 2024, Fraunhofer ISE and partners announced development of standardized BIPV facade solution with motive to simplify use of facades for photovoltaics

-

In January 2024, Arctech announced expansion in Turkey with strategic partnership with Alpon Energy for BIPV solutions

-

In October 2023, Solar Frontier and LONGi announced strategic technical partnership to expand BIPV market in Japan

Building-integrated Photovoltaics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.3 billion

Revenue forecast in 2030

USD 89.8 billion

Growth rate

CAGR of 21.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Thousand sq. m., Capacity in MW, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, Volume forecast, Capacity forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Russia; Poland; Hungary

Germany; Netherlands; France; Austria; Switzerland; Belgium; UK; Denmark; Norway; Sweden; Spain; Portugal; Italy; Greece; Croatia

China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil

Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

SolarWindow Technologies, Inc.; AGC Inc.; Hanergy Mobile Energy Holding Group Limited; The Solaria Corporation; Heliatek GmbH,; Carmanah Technologies Corp. ; Greatcell; Tesla ; BELECTRIC; ertex solartechnik GmbH; Canadian Solar; Onyx Solar Group LLC ; NanoPV Solar Inc. ; SOLAXESS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Building-integrated Photovoltaics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the global building-integrated photovoltaics market report based on technology, application, end-use, and region:

-

Technology Outlook (Volume, Thousand sq m, Capacity, MW, Revenue, USD Million, 2018 - 2030)

-

Crystalline Silicon

-

Thin Film

-

Others

-

-

Application Outlook (Volume, Thousand sq m; Capacity, MW; Revenue, USD Million, 2018 - 2030)

-

Roof

-

Glass

-

Wall

-

façade

-

Others

-

-

End-use Outlook (Volume, Thousand sq m; Capacity, MW; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

Utility

-

-

Regional Outlook (Volume, Thousand sq m; Capacity, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Eastern Europe

-

Russia

-

Poland

-

Hungary

-

-

Western & Central Europe

-

Germany

-

Netherlands

-

France

-

Austria

-

Switzerland

-

Belgium

-

-

Western & Central Europe

-

UK

-

Denmark

-

Norway

-

Sweden

-

-

Southern Europe

-

Spain

-

Portugal

-

Italy

-

Greece

-

Croatia

-

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global building-integrated photovoltaics market size was estimated at USD 23.67 billion in 2023 and is expected to reach USD 28.30 billion in 2024.

b. The global building-integrated photovoltaics market is expected to witness a compound annual growth rate of 21.2% from 2024 to 2030 to reach USD 89.80 billion by 2030.

b. The crystalline silicon segment occupied the largest BIPV market share of about 70.0% in 2023 owing to the conventional use of these C-Si modules in photovoltaic energy installations. Growing demand for integrated modules with enhanced efficiency is bound to provide a major boost to segment growth.

b. Some key players operating in the BIPV market include AGC Inc.; Nippon Sheet Glass Co. Ltd; Solaria; and Heliatek, among others

b. The global building-integrated photovoltaics market is expected to register substantial growth owing to the rising awareness about green infrastructure including zero-emission buildings. BIPV provides a sustainable and effective solution for retrofitting structure exteriors, enhancing energy efficiency, and providing significant savings in conventional power consumption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."