- Home

- »

- Communication Services

- »

-

Business Process as a Service Market Size Report, 2030GVR Report cover

![Business Process as a Service Market Size, Share & Trends Report]()

Business Process as a Service Market Size, Share & Trends Analysis Report By Business Process (Human Resource Management), By Organization Size (SMEs), By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-094-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

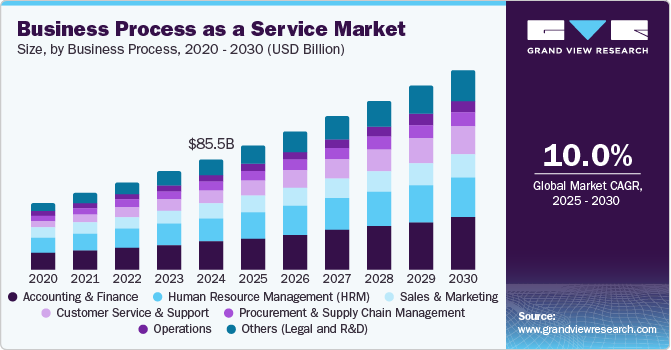

The global business process as a service market size was valued at USD 85.5 billion in 2024 and is projected to grow at a CAGR of 10.0% from 2025 to 2030. The growth of this industry is attributed to the increasing adoption by numerous businesses that seek to enhance performance and reduce costs, the emergence of technologies such as the Internet of Things (IoT) and robotic automation, the increasing integration of cloud computing, and the growing availability of pay-per-use portfolios.

The immense growth in competition, global scale of operations, increased dependence of service delivery on technology, and data-driven business processes have encouraged businesses to focus on adopting advanced technologies and reduce costs in every possible way. Companies are seeking effective cloud services and other alternatives to outsource different dynamics of operations to improve productivity, increase focus on core business activities, and attain cost-effectiveness.

In addition, the availability of affordable alternatives related to human resources, technology solutions, logistics, and other business functions in certain regional markets, such as Asia Pacific, has attracted large enterprises and several SMEs from North America and Europe. The emergence of cloud computing technology has enabled businesses with remote monitoring capabilities and assisted industries in achieving operational excellence while focusing on key business processes with in-house teams.

Services offered through the business process as a service model include various elements, including outsourcing processes such as training and development, procurement, human resource management, recruitment, sales and marketing, financial assistance, and more. Businesses with large-scale operations and footprints across multiple continents often outsource such processes to concentrate their resources on fundamental business activities such as manufacturing, innovation, research, and more.

Business Process Insights

Based on business processes, the accounting and finance segment dominated the global market and accounted for a revenue share of 25.4% in 2024 primarily driven by aspects such as the growing use of customer data in accounting and financial business processes, the increasing digital footprint of companies from different industries, and the rising availability of efficient services offered by key business process as a service (BPaaS) providers. In addition, a few more factors, such as the lack of skilled professionals within the organization, availability of scalable solutions through BPaaS models, cost savings through reduced employee costs, training costs, and more, are expected to drive growth for this segment.

The customer service and support segment is anticipated to experience the fastest CAGR from 2025 to 2030 attributed to the increasing number of organizations focusing on enhanced customer experiences and aiming to attain higher customer engagement. However, instead of hiring an in-house team of resources dedicated to customer service, communication, support calls, and related activities, businesses prefer to employ services offered by BPaaS providers, which include a dedicated team of resources, streamlined processes, alignment with the company’s core values, ethical standards compliance, and more. This ensures cost savings, effective customer communication, and enhanced business performance for numerous businesses.

Organization Size Insights

The large enterprise segment accounted for the largest revenue share in 2023. The global footprint of multinational companies and large-scale operations of other domestic players develops requirements for service assistance on multiple fronts, such as customer services, human resources, training and development, procurement, logistics, supply chain, and more. The large enterprises are also equipped with resources and capabilities to outsource such operational activities to BPaaS providers, which enables businesses to put core business functions at the center of concentration. The availability of cost-effective outsourcing alternatives in multiple countries such as India, China, Japan, Ireland, Germany, and others is expected to develop lucrative growth opportunities for this segment in the approaching years.

Small and Medium Enterprises (SMEs) segment is expected to register the fastest CAGR during the forecast period. SEMs, operating at comparatively lower scales than large enterprises and generating lesser revenues, are constantly seeking effective solutions that can save resources such as time and money. SMEs worldwide have adopted BPaaS for multiple functions such as invoice and recurring payments management, procurement, human resources management, client communication, automated marketing, asset management and maintenance, cloud-based solutions, financial advisory, supply chain management, and more.

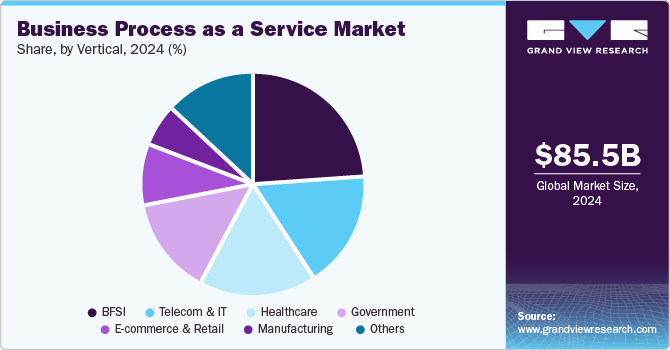

Vertical Insights

Based on vertical, the BFSI segment accounted for the largest revenue share of the global industry in 2024. Banks, financial services providers, and insurance companies often prefer employing prominent providers' BPaaS offerings for benefits such as agility, reduced costs, enhanced efficiency, greater control over processes, increased focus on core activities, improved security, and more. The rapid pace of digital transformation has exposed numerous BFSI industry participants to immense risks posed by internet-based crimes and cyberattacks. BPaaS solutions provide protection and security to businesses through its offerings and ensure improved risk management. These aspects are fueling the growth of this market.

Healthcare segment is expected to experience the fastest CAGR of 12.6% from 2025 to 2030. The growth of this segment is primarily driven by the benefits offered by the BPaaS offerings designed for the healthcare industry, including cost savings, the utility of enhanced technology infrastructures without upfront investments, reduced risks of human errors, access to highly trained and skilled professionals, seamless implementation, and more.

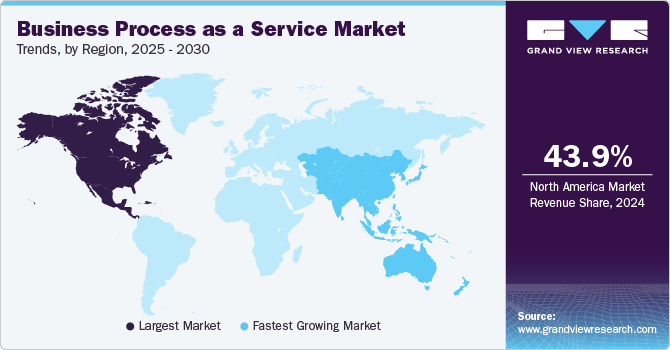

Regional Insights

North America BPaaS market held the largest revenue share of 43.9% in 2024. The increased remote work and global approach adopted by numerous businesses in terms of operations and market penetration have significantly developed a rise in the demand for effective outsourcing solutions that are capable of managing and coordinating distributed teams efficiently. As companies expand their operations across different regions and embrace remote work, they face challenges in maintaining seamless communication, collaboration, and process management. BPaaS addresses these challenges by offering comprehensive tools and platforms to support remote and global operations. These solutions enable businesses to integrate and streamline their processes across various locations, ensuring consistent and effective workflow management despite geographical distances.

U.S. Business Process as a Service Market Trends

The U.S. business process as a service (BPaaS) market dominated the North America industry with a share of 72.2% in 2024. This market is primarily influenced by factors such as the country's increasing adoption of cloud computing, the growing availability of multiple service providers that offer cost-effective solutions and enhanced process assistance from different regions, including Asia Pacific and Europe, and the increasing digital transformation activities initiated by organizations and governments in the country.

Europe Business Process as a Service (BPaaS) Market Trends

Europe is identified as a lucrative region for the business process as a service (BPaaS) market. The regional industry is driven by increasing demand for BPaaS due to its ability to provide crucial expertise, flexibility, and scalability in outsourced business functions. BPaaS leverages technological advancements, assures adherence to rules, and improves disaster recovery, allowing companies to gain a competitive edge and concentrate on fundamental skills. The rapid rate of digital transformation, increasing adoption of the latest technology innovation in multiple industries, and inclination towards remote monitoring are expected to fuel growth for this market during the forecast period.

The UK business process as a service market is expected to grow at a significant CAGR from 2025 to 2030. The presence of multiple large enterprises, increasing digital transformation activities in the country, growing government digital footprint, unprecedented growth in data dependency of business processes, and economic constraints leading to cost reduction initiatives by businesses are expected to develop growth for BPaaS in this market.

Asia Pacific Business Process as a Service Market Trends

Asia Pacific business process as a service (BPaaS) market is anticipated to grow at fastest CAGR of 12.0% over forecast period. The growth of this region is attributed to the rising establishment of new businesses in the retail and consumer goods industries in economies such as China, India, and Japan. Furthermore, the increasing use of cloud computing in the Asia-Pacific region drives growth in the business process as a service (BPaaS) market. Companies from North America, Europe, and other areas have been outsourcing multiple business processes such as procurement, training & development, recruitment, customer assistance, and others to BPaaS providers in the region. These aspects are expected to influence the growth of this market in the coming years.

India BPaaS market held a substantial revenue share of the regional industry in 2024. The rapid economic growth, digital transformational activities, increased availability and accessibility to the internet and advanced technologies such as AI, IoT, machine learning, and others, increasing focus of various BPaaS providers on engaging numerous industry applications and government support for enhanced foreign investments are some of the key growth driving growth for this market.

Key Business Process As a Service Company Insights

Some of the key companies in the business process as a service (BPaaS) market include Accenture, Capgemini, Cognizant, DXC Technology Company, ExlService Holdings, Inc., Fujitsu, Genpact, HCL Technologies Limited, and others. To address the growing competition in the industry, companies have adopted strategies such as expansion of service portfolios, new launches, adoption of advanced technologies, and collaborations with other organizations.

-

DXC Technology assists worldwide businesses in managing their essential systems and operations, updating IT, enhancing data structures, and guaranteeing security and scalability on public, private, and hybrid clouds. The largest companies and government organizations rely on DXC to implement services that enhance performance, competitiveness, and customer experience in their IT environments.

-

Accenture, a global provider of professional services, provides business process as a service (BPaaS) solutions to optimize operations and increase organizations' flexibility. Accenture’s BPaaS solutions include population health and care value initiatives, optimizing workforce performance and productivity by leveraging data-driven operations in human resources, implementing intelligent automation and analytics in the finance sector, and more.

Key Business Process As A Service Companies:

The following are the leading companies in the BPaaS market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Capgemini

- Cognizant

- DXC Technology Company

- ExlService Holdings, Inc.

- Fujitsu

- Genpact

- HCL Technologies Limited

- IBM

- Infosys Limited

- NTT DATA Group Corporation

- Sutherland

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- Wipro

Recent Developments

-

In May 2024, DXC Technology, a major market participant in the technology service provision industry, introduced its newly developed portfolio addition of DXC Fast RISE, with SAP service, which is expected to enable customers to speed up their S/4HANA projects.

-

In January 2024, SPS, one of the major market participants from Zürich, Switzerland, introduced an outcome-based, pay-per-use modeled BPaaS solution, which offers an enhanced service approach and focuses on trusted domain expertise, talent, and technology. The outcome-based structure of the newly added portfolio offering is set to assist clients in shifting from CapEx(Capital expenses) to OpEx (Operational expense) experience.

Business Process as a Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 95.9 billion

Revenue forecast in 2030

USD 154.3 billion

Growth rate

CAGR of 10.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Business process, organization size, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

Accenture; Capgemini; Cognizant; DXC Technology Company; ExlService Holdings, Inc.; Fujitsu; Genpact; HCL Technologies Limited; IBM; Infosys Limited; NTT DATA Group Corporation; Sutherland; TATA Consultancy Services Limited; Tech Mahindra

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Process as a Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global business process as a service (BPaaS) market report based on business process, organization size, application, and region.

-

Business Process Outlook (Revenue, USD Billion, 2018 - 2030)

-

Human Resource Management (HRM)

-

Accounting and Finance

-

Sales & Marketing

-

Customer Service and Support

-

Procurement & Supply Chain Management

-

Operations

-

Others (Legal and R&D)

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and Medium Enterprises

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Telecom & IT

-

Manufacturing

-

E-commerce & Retail

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."