- Home

- »

- Homecare & Decor

- »

-

Business Travel Market Size, Share & Growth Report, 2030GVR Report cover

![Business Travel Market Size, Share & Trends Report]()

Business Travel Market Size, Share & Trends Analysis Report By Traveler (Solo, Group), By Purpose (Marketing, Meetings, Trade, Product Launch), By Industry (Corporate, Government), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-258-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Business Travel Market Size & Trends

The global business travel market size was estimated at USD 1,372.80 billion in 2023 and is expected to grow at a CAGR of 9.1% from 2024 to 2030. The integration of business travel across various industries has become indispensable, driven by factors such as the expanding globalization of commerce, the rise in travel and tourism, and the growing presence of younger professionals combining business trips with leisure activities.

Business travel serves various purposes such as establishing partnerships, conducting joint ventures, meeting suppliers and customers, maintaining inter-company relations, and promoting products or services. According to The Global Business Travel Association's 2022 study across 72 countries and 44 industries, 85% of business travelers reported that travel is essential for achieving their business objectives. Furthermore, more than three-fourths of respondents anticipate significantly increased work-related travel in 2023 compared to 2022.

The revival of business travel carries substantial economic implications, impacting industries like hospitality, transportation, and events. The uptick in travel leads to greater demand for hotels, airlines, and venues, thereby stimulating economic growth within these sectors. The expansion of business travel into emerging markets, notably in Africa and Asia, has far-reaching implications for global market growth. Companies aiming to capitalize on opportunities in these regions must tailor their strategies, opening up new channels for collaboration and economic advancement.

Multinational corporations such as Apple and Samsung are strategically extending their business travel initiatives into emerging markets across Asia and Africa. Their objectives include not only participating in local events but also fostering partnerships and exploring avenues for growth in these vibrant regions. A recent change is the transition to remote or hybrid work models. The survey indicates that this shift is now the prevailing approach, with two-thirds of respondents stating that a substantial portion of their organization now operates remotely.

This transition underscores the increased importance of travel for meeting with existing customers to enhance customer retention, engaging with potential customers to drive business development and expand the customer base, collaborating with partners to review business growth strategies, and working closely with team members to brainstorm new business opportunities in person.

Market Concentration & Characteristics

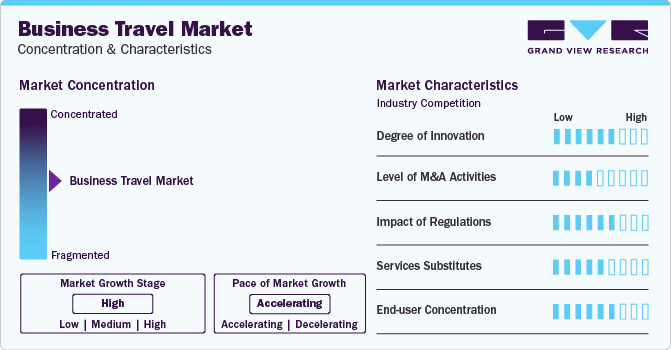

The degree of innovation in the business travel market is high, with companies constantly developing new products and services to cater to the evolving needs of travelers. This includes advancements in technology, such as mobile apps for booking and itinerary management, as well as new concepts in accommodations and transportation to enhance the travel experience.

Regulations are vital for ensuring the safety and quality of services offered. Compliance with rules and guidelines is necessary for businesses to operate, impacting their service offerings and operational procedures. Adhering to these regulations can also influence customer trust and satisfaction, as clients seek assurance that their travel needs are met in a safe and compliant manner.

Service substitutes in the business travel industry include virtual meetings, remote conferencing, and telepresence technologies, which offer cost-effective alternatives to in-person meetings. These substitutes are increasingly popular due to their ability to reduce travel expenses and environmental impact while maintaining effective communication and collaboration.

End-user concentration is a significant factor shaping competitive dynamics in the market. Manufacturers often compete to establish and maintain relationships with key customers, such as major retailers or distributors. This focus on key customers can influence product development and marketing strategies to meet specific demands and retain market share.

Traveler Insights

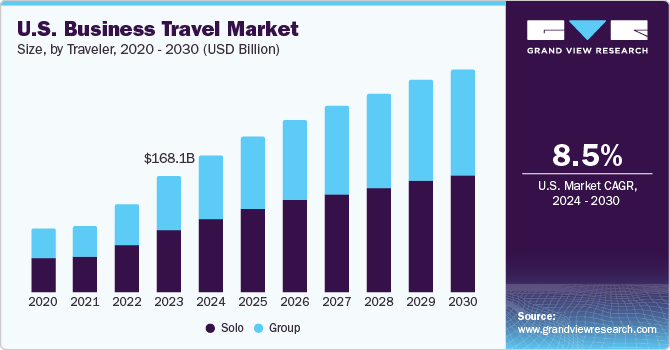

The solo business travelers segment held the largest revenue share of 51% in 2023. Solo business travel involves individuals embarking on professional trips independently, navigating diverse tasks ranging from client meetings to attending conferences without the presence of colleagues. It offers a unique opportunity for personal growth, networking, and adaptability, requiring individuals to manage their schedules, accommodations, and interactions efficiently while representing their company's interests.

The group business traveler segment is projected to grow at a CAGR of 9.6% from 2024 to 2030. With the increasing prevalence of remote work, many companies have adapted their approaches to business travel, seeking alternative methods to convene the entire team for brainstorming sessions, goal setting for future quarters, and fostering a strong company culture. These adjustments aim to harness the benefits of in-person collaboration, which may be lacking in remote work setups, while also accommodating the evolving dynamics of the modern workplace.

Industry Insights

The business travel by corporate industry accounted for a revenue share of around 66% in 2023. Business travel for corporate employees encompasses journeys undertaken by professionals on behalf of their respective companies for various business purposes such as attending meetings, conferences, client visits, training sessions, and other work-related activities, aiming to fulfill organizational objectives and facilitate business operations.

The business travel by government industry is projected to grow at a CAGR of 11.4% over the forecast period. Business travel is essential for promoting diplomatic relations, advancing national interests, facilitating international cooperation, and addressing global challenges. Additionally, government officials may also travel abroad for training, education, or official visits to enhance their expertise and knowledge in specific areas relevant to their roles.

Purpose Insights

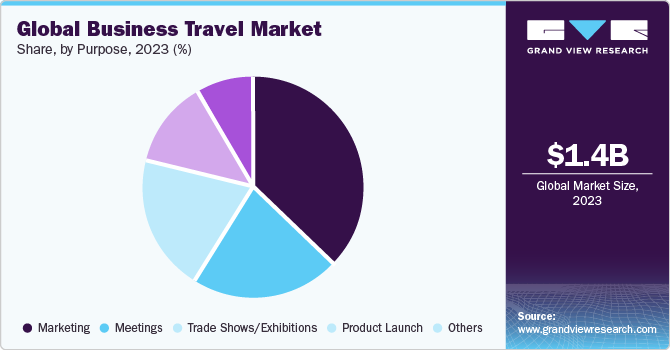

The business travel for marketing accounted for a revenue share of around 37% in 2023. Business travel plays a pivotal role in marketing products, services, and companies, facilitating face-to-face interactions with clients, partners, and prospects. Whether attending industry conferences, conducting sales meetings, or participating in trade shows, it provides opportunities to showcase offerings, build relationships, and expand market reach, ultimately driving growth and visibility.

The business travel for product launch is projected to grow at a CAGR of 10.9% over the forecast period of 2024-2030. Business travel for product launches is an essential aspect of marketing strategy, involving professionals traveling to various locations to introduce new products or services to target audiences. This establishes credibility, and differentiates products in competitive markets, ultimately contributing to the success and market penetration of the newly launched products.

Regional Insights

North America held 27% of the global revenue share in 2023. The rise in business travel in North America is influenced by several key factors such as favorable economic conditions and world-class infrastructure and services, driving the growth of corporate travel budgets.

U.S. Business Travel Market Trends

The business travel market in the U.S. is expected to grow at a CAGR of 8.5% from 2024 to 2030. The tech industry in the U.S., in particular, has demonstrated substantial growth in business travel, with many companies investing in travel to attend conferences, industry networking sessions, and other events. Also, certain industries, like finance and pharmaceuticals, have shown substantial growth in business travel, reflecting the importance of these sectors in the U.S. economy.

Asia Pacific Business Travel Market Trends

The Asia Pacific business travel market held a revenue share of around 32% in 2023. According to the SAP Concur Global Business Travel Survey published in June 2023 based in Asia Pacific, 94% of global business travelers are ready to undertake business trips in the next year. Additionally, 92% believe that the success of their future career hinges on effective business travel over the next 12 months, citing the importance of maintaining (42%) and establishing (41%) client relationships. A significant portion (38%) also views business travel as crucial for staying abreast of the latest trends, technology, and advancements.

Europe Business Travel Market Trends

The business travel market in Europe is projected to grow at a CAGR of 10.6% from 2024 to 2030. According to the GBTA Business Travel Index published in November 2023, the frequency of business travel in Europe reflects global patterns. Sixty-seven percent of Europeans anticipate traveling the same or more often in 2023 compared to 2019, while approximately one in three (29%) expect to travel less frequently. Sustainable travel options remain a significant motivator, with multi-modal trips making up nearly a third of recent business travels. Europe is at the forefront of providing alternative, more environmentally friendly travel solutions.

Key Business Travel Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Business Travel Companies:

The following are the leading companies in the business travel market. These companies collectively hold the largest market share and dictate industry trends.

- American Express Company

- BCD Group

- Booking Holdings

- Expedia, Inc.

- Corporate Travel Management

- Hogg Robinson Ltd

- CWT Solutions

- Wexas Travel

- Frosch International Travel

- Travel Leaders Group

Recent Developments

-

In November 2022, BCD Travel solidified its technology development partnership with Sabre, aiming to enhance collaboration and boost booking volumes through expanded cooperation.

-

In April 2021, Flight Centre Travel Group, renowned as an Australian travel agency, and Gimmonix, an Israeli travel technology developer, reaffirmed their ongoing collaboration aimed at modernizing Flight Centre's digital connectivity infrastructure.

Business Travel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,626.22 billion

Revenue forecast in 2030

USD 2,749.46 billion

Growth rate

CAGR of 9.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Traveler, purpose, industry, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

American Express Company; BCD Group; Booking Holdings; Expedia, Inc.; Corporate Travel Management; Hogg Robinson Ltd ; CWT Solutions; Wexas Travel; Frosch International Travel; Travel Leaders Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Travel Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the business travel market report based on traveler, purpose, industry, and region:

-

Traveler Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solo

-

Group

-

-

Purpose Outlook (Revenue, USD Billion, 2018 - 2030)

-

Marketing

-

Meetings

-

Trade Shows/Exhibitions

-

Product Launch

-

Others

-

-

Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

Corporate

-

Government

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business travel market was estimated at USD 1,372.80 billion in 2023 and is expected to reach USD 1,626.22 billion in 2024.

b. The global business travel market is expected to grow at a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 2,749.46 billion by 2030.

b. Asia Pacific dominated the business travel market with a share of around 32% in 2023. The market in the region is witnessing rapid economic growth, increasing trade partnerships, and the proliferation of multinational corporations establishing regional headquarters.

b. Some of the key players operating in the business travel market include American Express Company; BCD Group; Booking Holdings; Expedia, Inc.; Corporate Travel Management; Hogg Robinson Ltd; CWT Solutions; Wexas Travel; Frosch International Travel; Travel Leaders Group

b. Key factors that are driving the business travel market growth include the expanding globalization of commerce, the rise in travel and tourism, and the growing presence of younger professionals combining business trips with leisure activities

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."