- Home

- »

- Next Generation Technologies

- »

-

Buy Now Pay Later Market Size, Share, Growth Report, 2030GVR Report cover

![Buy Now Pay Later Market Size, Share & Trends Report]()

Buy Now Pay Later Market Size, Share & Trends Analysis Report By Channel (Online, POS), By End-use (Retail, Automotive), By Enterprise Size, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-499-7

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global buy now pay later market size was estimated at USD 6.13 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 26.1% from 2023 to 2030. The global buy now pay later (BNPL) transactions were estimated at over USD 200 billion in 2022. One of the main drivers is the aggregate preference among consumers for supple and suitable payment options. BNPL services enable customers to make purchases without immediate payment, providing greater financial flexibility and ease of burden from upfront charges. The increase in e-commerce has also played a significant role in driving the BNPL market’s growth. Consumers seek seamless and efficient payment methods as online shopping becomes more predominant. BNPL services integrate seamlessly into online checkout processes, enabling a swift and hassle-free payment experience. With the growth of e-commerce platforms and the widespread adoption of digital wallets, BNPL solutions have become an attractive option for both customers and merchants alike.

BNPL services address the challenge of affordability for customers. With the ability to split payments into interest-free installments, BNPL providers allow consumers to make larger purchases without facing financial strain. This has led to increased average order values and repeat business for merchants as customers feel more comfortable making substantial purchases. Moreover, the accessibility and ease of signing up for BNPL services have contributed to their popularity. Most BNPL platforms offer quick and straightforward registration processes, often requiring minimal credit checks. This inclusivity appeals to a broader consumer base, including individuals with limited credit history or lower credit scores, who may face challenges obtaining traditional credit.

In addition to consumer benefits, BNPL providers offer attractive partnerships and incentives to merchants. By partnering with BNPL platforms, retailers can attract new customers, enhance customer loyalty, and increase conversion rates. BNPL services also help merchants reduce cart abandonment rates by providing an alternative payment option encouraging customers to complete their purchases. Regulatory support and evolving payment regulations have also positively influenced the BNPL market. Governments and financial regulators in various countries have recognized BNPL services as a legitimate payment method, providing greater legitimacy and consumer confidence. This regulatory backing has encouraged BNPL providers to expand their services and explore new markets, contributing to the industry's growth.

A potential restraint in the BNPL market is the risk of increased consumer debt. As the popularity of BNPL services grows, there is a concern that consumers may become tempted to overspend, leading to a build-up of debt that could become unmanageable. To overcome this restraint and ensure responsible lending practices, BNPL providers should implement strict credit checks and assess each customer's creditworthiness before offering their services. In addition, educational initiatives and clear communication about the terms and conditions of BNPL options can empower consumers to make informed financial decisions and avoid excessive debt.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a positive impact on the BNPL market. Many people faced financial challenges and uncertainties during the pandemic, leading them to seek flexible payment options to manage their expenses. BNPL services provided an attractive solution by allowing consumers to spread their payments over time, easing financial strain. Moreover, with the closure of physical stores and restrictions on in-person shopping, there was a surge in e-commerce activities. Consumers turned to online shopping for their essential needs and non-essential purchases, and BNPL services seamlessly integrated into these digital transactions, providing a convenient and hassle-free payment method.

Channel Insights

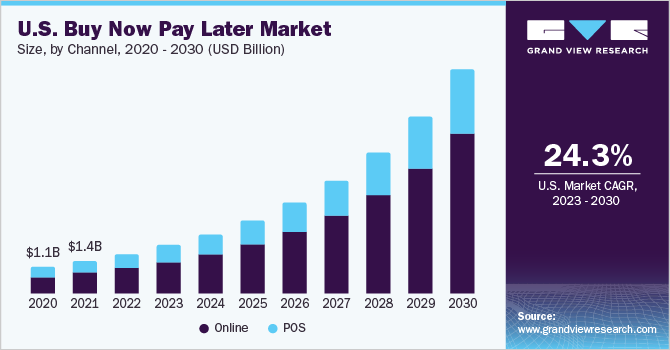

In terms of channel, the online segment dominated the market in 2022 with a revenue share of over 65.0%. Numerous businesses globally are striking partnerships to focus on adopting several methods for online payment, including BNPL, as part of their post-pandemic revival plans. For instance, in August 2021, a BNPL solution provider named Uplift, Inc. entered a partnership with Tripster, an all-in-one travel booking site. Through this partnership, Tripster enabled its customers to plan the whole vacation in a single place and pay with surprise-free monthly installments through Uplift with ease.

The POS segment is anticipated to witness a significant CAGR over the forecast period. The POS segment is increasing significantly due to its seamless integration with the shopping experience. As increasing consumers prefer to shop in physical stores and online, the convenience of using BNPL services directly at the POS enhances the appeal of this payment option. POS allows consumers to make immediate purchasing decisions without needing pre-approval or credit checks, enabling quick and frictionless transactions.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment dominated the market in 2022 with a revenue share of over 60.0%. The growth of the large enterprises segment can be attributed to these factors, including the widespread adoption of BNPL payment solutions to provide their customers with an affordable and flexible payment method for purchasing high-value products. As a result of BNPL, shoppers usually purchase more products owing to the ease of the purchase, thereby driving sales growth. Thus, BNPL helps large enterprises in significantly improving customer experience.

Small & medium enterprises (SMEs) globally are focusing on adopting BNPL solutions to help merchants increase sales conversion rates. For instance, Dukaan, a startup company that helps SMEs set up online stores, announced its partnership with Simpl, a BNPL solution provider, to offer BNPL services to Dukaan’s merchants. SMEs focus on increasing their customer base and strengthening their position in the market. As a result, the adoption of BNPL solutions is expected to increase among SMEs throughout the forecast period.

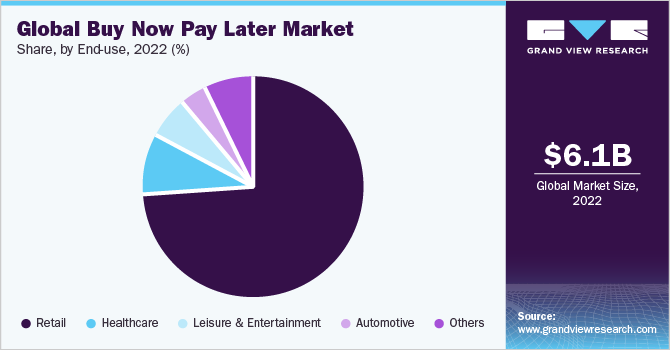

End-use Insights

In terms of end-use, the retail segment dominated the market in 2022 with a revenue share of over 73.0%. The industry is witnessing increased adoption of BNPL solutions as they allow customers to easily distribute the cost of the purchase over a time of pre-determined and interest-free payments. For instance, in October 2021, Affirm, Inc., a BNPL solution provider, announced its partnership with Theory, a clothing site for customers, to offer customers interest-free payments over time for accessories and sportswear. Such factors bode well for the growth of the segment.

The healthcare segment is anticipated to register a promising CAGR over the forecast period. The industry is witnessing an increasing adoption of BNPL payment methods as they offer a low-friction substitute to credit cards. Moreover, customers prefer BNPL payment methods in comparison to credit cards to avoid expensive compounding interest and hidden fees. Furthermore, the increasing costs associated with the treatment of several diseases such as cancer, chronic heart disease, and cardiovascular diseases are expected to drive the demand for BNPL services over the forecast period.

Regional Insights

In terms of region, North America dominated the market in 2022 with a revenue share of over 29.0%. The regional market growth can be attributed to the presence of a large number of prominent players in the region. Moreover, numerous fintech companies in this region are entering into partnerships with entertainment companies to offer BNPL services for booking hotels. For instance, in September 2021, Uplift, Inc., a BNPL solution provider, announced its partnership with SeaWorld Parks & Entertainment, Inc., an American Theme Park and entertainment company. Through this partnership, Uplift, Inc. offered its BNPL payment options for booking hotels for SeaWorld San Antonio, SeaWorld Orlando, and SeaWorld San Diego.

Asia Pacific is anticipated to register the fastest CAGR of 28.4% over the forecast period. The region is experiencing rapid population growth, with a rising number of tech-savvy consumers who readily embrace digital payment solutions and e-commerce platforms. The widespread availability of smartphones and internet connectivity in countries like China, India, and Southeast Asian nations has further fueled the adoption of BNPL services, making it a popular payment method for online shopping. This trend has been supported by the region's diverse and dynamic retail landscape, with well-established e-commerce giants and innovative startups. These retailers actively collaborate with BNPL providers to offer flexible payment options, expanding their customer base and driving increased sales.

Key Companies & Market Share Insights

The market is moderately fragmented. BNPL is a useful service for both customers and merchants. In March 2023, Apple introduced a new feature called Apple Pay Later, enhancing its digital wallet capabilities by offering customers the option to pay for online purchases in installments. This move aligns with the trend of BNPL, allowing users to split their payments into four installments over six weeks, with the initial installment due at the time of purchase. Moreover, Apple Pay Later enables users to apply for interest-free loans, ranging from USD 50 to USD 1000, directly within the wallet app, facilitating seamless online or in-app purchases without incurring fees. This innovation reflects Apple's commitment to providing flexible and user-friendly payment solutions to its customers.

BNPL payment method is increasingly gaining popularity among customers to make purchases in stores and online. Numerous retailers are focusing on adopting the BNPL solution to enable their customers to avail of installment loans without interest, thereby creating new growth opportunities for the BNPL solution providers. Furthermore, various e-commerce platforms are offering similar BNPL payment options to their customers, which is anticipated to drive the growth of the BNPL market over the forecast period. Some prominent players in the global buy now pay later market include:

-

Affirm, Inc.

-

Klarna Inc.

-

Splitit Payments, Ltd.

-

Sezzle

-

Perpay Inc.

-

Zip Co, Ltd

-

PayPal Holdings, Inc.

-

AfterPay Limited

-

Openpay

-

LatitudePay Financial Services

-

HSBC Group

Buy Now Pay Later Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.63 billion

Revenue forecast in 2030

USD 38.57 billion

Growth rate

CAGR of 26.1% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Channel, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Sweden; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; KSA; South Africa

Key companies profiled

Afterpay Limited; PayPal Holdings, Inc.; Affirm, Inc.; Klarna Inc.; Splitit Payments, Ltd.; Sezzle; Perpay Inc.; Openpay; LatitudePay Financial Services, HSBC Group; Zip Co, Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Buy Now Pay Later Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global buy now pay later market report based on channel, enterprise size, end-use, and region:

-

Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online

-

POS

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail

-

Consumer Electronics

-

Fashion & Garment

-

Others

-

-

Healthcare

-

Leisure & Entertainment

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Kingdom Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global buy now pay later market size was estimated at USD 6.13 billion in 2022 and is expected to reach USD 7.63 billion in 2023.

b. The global buy now pay later market is expected to grow at a compound annual growth rate of 26.1% from 2023 to 2030 and is expected to reach USD 38.57 billion by 2030.

b. North America dominated the buy now pay later market with a share of 29.9% in 2022. The regional market growth can be attributed to the presence of a large number of prominent players in the region.

b. Some key players operating in the buy now pay later market include Afterpay; PayPal Holdings, Inc.; Affirm, Inc.; Klarna Inc.; Splitit; Sezzle; Perpay Inc.; Openpay; and LatitudePay.

b. Key factors that are driving the buy now pay later market growth include the increasing number of internet users and the numerous benefits offered by BNPL platforms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."