- Home

- »

- Plastics, Polymers & Resins

- »

-

C9 Resin Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![C9 Resin Market Size, Share & Trends Report]()

C9 Resin Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Paint & Coating, Adhesive & Sealants, Printing Ink, Rubber & Tire, Others), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-526-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

C9 Resin Market Size & Trends

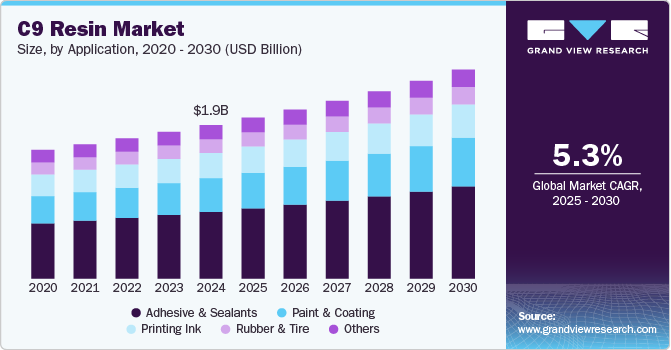

The global C9 resin market size was estimated at USD 1.97 billion in 2024 and is expected to expand at a CAGR of 5.3% from 2025 to 2030. The market is experiencing growth due to its widespread application across multiple industries, primarily in adhesives, coatings, printing inks, and rubber compounding. One of the primary drivers is the growing demand for hot-melt adhesives in the packaging and construction sectors.

The rising use of C9 resins in coatings and paints is also contributing to market growth. These resins improve gloss, adhesion, and chemical resistance, making them essential in automotive and industrial coatings. As global vehicle production recovers and infrastructure projects expand, the need for high-performance coatings is increasing across the world. The construction sector, particularly in emerging economies such as China, India, and Southeast Asia, is also witnessing a boom, leading to heightened demand for protective coatings. This trend is further supported by stricter regulations on VOC (volatile organic compound) emissions, pushing manufacturers to develop eco-friendly, high-solid coatings incorporating C9 resins.

The printing ink industry’s growth is another critical factor driving the market. These resins play a vital role in enhancing the performance of flexographic and gravure printing inks, which are widely used in packaging, publications, and labeling applications. The shift towards sustainable and water-based inks has led to increased demand for modified C9 resins with improved solubility and dispersion properties. Moreover, the rise of digital printing and flexible packaging has strengthened the need for high-performance resins that ensure superior adhesion and print quality on diverse substrates, including plastic films and paperboard.

In addition, the rubber and tire industry is a significant consumer of C9 resins. These resins function as reinforcing agents in rubber formulations, enhancing tackiness and processability. With the rising global production of tires, particularly in the automotive and aviation sectors, the demand for rubber-processing chemicals, including C9 resins, is expected to grow. For instance, leading tire manufacturers are increasingly using hydrocarbon resins to improve the mechanical properties and durability of tires, aligning with the growing demand for high-performance and fuel-efficient tires.

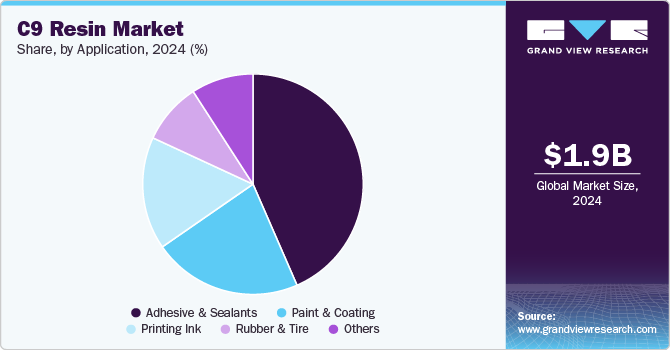

Application Insights

The adhesive & sealants segment recorded the largest market share of over 43.0% in 2024. C9 resin is a key ingredient in adhesives and sealants, particularly in hot melt adhesives, pressure-sensitive adhesives, and construction sealants. It enhances tackiness, adhesion strength, and flexibility, making it essential for industrial bonding applications. The resin is commonly used in packaging, woodworking, footwear, and automotive adhesive formulations. The growth of the packaging and construction industries is a major driver for C9 resin in adhesives and sealants.

The paint & coatings application segment is expected to grow at the fastest CAGR of 5.6% over the forecast period. The increasing demand for high-performance coatings in construction, automotive, and industrial applications is driving the adoption of C9 resin. Furthermore, the growing infrastructure development in emerging economies and rising investments in commercial and residential buildings are fueling the need for durable coatings.

C9 resin is widely used in the printing ink industry due to its excellent solubility, fast-drying properties, and enhanced adhesion to different surfaces. It provides superior gloss, pigment dispersion, and resistance to smudging, making it ideal for high-quality printing applications such as newspapers, magazines, packaging materials, and flexible films. The rapid expansion of the packaging industry, particularly flexible packaging and labels, is a primary driver for C9 resin in printing inks.

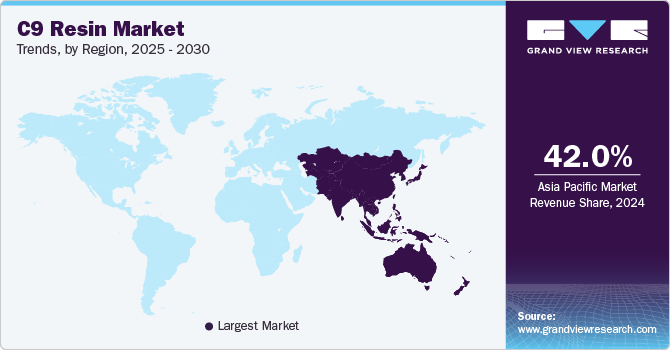

Region Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 42.0% in 2024 and is anticipated to grow at the fastest CAGR of 4.8% over the forecast period. The region's robust manufacturing sector, particularly in China, India, and South Korea, has created substantial demand for C9 resin in adhesives, coatings, and rubber applications. For example, India's growing construction sector has increased demand for adhesives and sealants, where C9 Resin serves as a key raw material. The expansion of electronics manufacturing in countries such as Vietnam, Thailand, and Malaysia has also boosted demand for specialized adhesives and protective coatings made with C9 Resin.

China C9 Resin Market Trends

The C9 resin marketin Chinais growing significantly. This growthcan be attributed to its largest adhesives market, coupled with its booming tire manufacturing sector. Besides, its massive petrochemical industry, particularly its steam cracking capacity, is driving market growth in the country. Besides, it has numerous naphtha crackers and integrated refinery-petrochemical complexes that produce C9 fraction as a byproduct of ethylene production. Major facilities such as Sinopec Zhenhai and PetroChina Daqing generate substantial volumes of C9 aromatics, which are then processed into C9 hydrocarbon resins. This abundant feedstock availability gives Chinese manufacturers a significant cost advantage.

North America C9 Resin Market Trends

The C9 resin market in North America is growing due to the region's robust manufacturing sector, particularly in the adhesives, coatings, and rubber industries. Major automotive manufacturers in the U.S. and Mexico rely heavily on C9 Resin-based products for various applications, including tire production and automotive coatings. The presence of leading companies such as ExxonMobil Corporation and Eastman Chemical Company also strengthens the regional market through continuous innovation and product development.

The U.S. C9 resin market growth can be attributed to its robust petrochemical infrastructure and significant production capacity of C9 resin feedstock. The country's shale gas revolution has led to increased availability of naphtha and other petrochemical derivatives, providing cost-effective raw materials for C9 resin production. Major petrochemical complexes along the Gulf Coast, particularly in Texas and Louisiana, have integrated operations that efficiently convert crude oil derivatives into C9 resins, allowing major petrochemical companies to maintain competitive production costs.

Europe C9 Resin Market Trends

The C9 resin market in Europe is growing primarily due to its robust automotive and construction industries, which are major consumers of these resins. Countries such as Germany, France, and Italy have extensive automotive manufacturing bases that use C9 resins in various applications, including adhesives for interior components, sealants, and protective coatings. For instance, major automotive manufacturers such as Volkswagen and BMW incorporate these resins into their production processes to improve the durability and performance of vehicle components.

Germany C9 resin market is primarily driven by its robust chemical manufacturing infrastructure and strong automotive industry. The country's strategic location in central Europe, combined with its excellent logistics infrastructure, allows German manufacturers to efficiently distribute C9 resins throughout the European Union.

Key C9 Resin Company Insights

The market is characterized by a moderately competitive landscape. Both global and regional players strive to enhance product quality, expand production capacity, and cater to diverse end-use industries such as adhesives, coatings, and rubber compounding. Competition is driven by factors such as raw material availability, product innovation, and strategic partnerships with downstream industries. Emerging players from China and Southeast Asia are intensifying competition by offering cost-effective alternatives, while established players focus on sustainability and advanced polymerization technologies to differentiate themselves.

Key C9 Resin Companies:

The following are the leading companies in the C9 resin market. These companies collectively hold the largest market share and dictate industry trends.

- Arakawa Chemical Industries Ltd

- Cray Valley

- DuPont

- Eastman Chemical Company

- ECPlaza Network Inc.

- Exxon Mobil Corporation

- Henan Anglxxon Chemical Co., Ltd

- Henan Sanjiangyuan Chemical Co., Ltd.

- Kemipex

- Kolon Industries, Inc.

- Lesco Chemical Limited

- Neville Chemical Company

- Puyang Ruisen Petroleum Resins Co., Ltd

- Shanghai Jinsen Hydrocarbon Resins Co., Limited

- ZEON CORPORATION

Recent Development

-

In June 2023, Cray Valley, a TotalEnergies affiliate, achieved a key milestone in commercializing sustainable certified renewable resins for the tire industry. The company is manufacturing certified renewable resins at its Carling Saint-Avold platform in France using the ISCC PLUS mass balance approach.

C9 Resin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.06 billion

Revenue forecast in 2030

USD 2.68 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Arakawa Chemical Industries Ltd; Cray Valley; DuPont; Eastman Chemical Company; ECPlaza Network Inc.; Exxon Mobil Corporation; Henan Anglxxon Chemical Co., Ltd; Henan Sanjiangyuan Chemical Co., Ltd.; Kemipex; Kolon Industries, Inc.; Lesco Chemical Limited; Neville Chemical Company; Puyang Ruisen Petroleum Resins Co., Ltd; Shanghai Jinsen Hydrocarbon Resins Co., Limited; ZEON CORPORATION.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global C9 Resin Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global C9 resin market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paint & Coating

-

Adhesive & Sealants

-

Printing Ink

-

Rubber & Tire

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global C9 resin market size was estimated at USD 1.97 billion in 2024 and is expected to reach USD 2.06 billion in 2025.

b. The global C9 resin market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 2.68 billion by 2030.

b. Asia Pacific accounted for the largest revenue share of over 42.0% in 2024 owing to region's robust manufacturing sector, particularly in China, India, and South Korea which has created substantial demand for C9 resin in adhesives, coatings, and rubber applications.

b. Some key players operating in the C9 resin market include Arakawa Chemical Industries,Ltd, Cray Valley, DuPont, Eastman Chemical Company, ECPlaza Network Inc., Exxon Mobil Corporation, Henan Anglxxon Chemical Co.,Ltd, Henan Sanjiangyuan Chemical Co., Ltd..• Kemipex, and Kolon Industries, Inc.

b. Key factors that are driving the market growth include its widespread application across multiple industries, primarily in adhesives, coatings, printing inks, and rubber compounding.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.