- Home

- »

- Drilling & Extraction Equipments

- »

-

Calcium Bromide Market Size & Share, Industry Report, 2030GVR Report cover

![Calcium Bromide Market Size, Share & Trends Report]()

Calcium Bromide Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Industrial, Medical), By Region (North America, Europe, Asia Pacific, Latin America, Middle East Africa), And Segment Forecasts

- Report ID: GVR-4-68040-593-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Calcium Bromide Market Summary

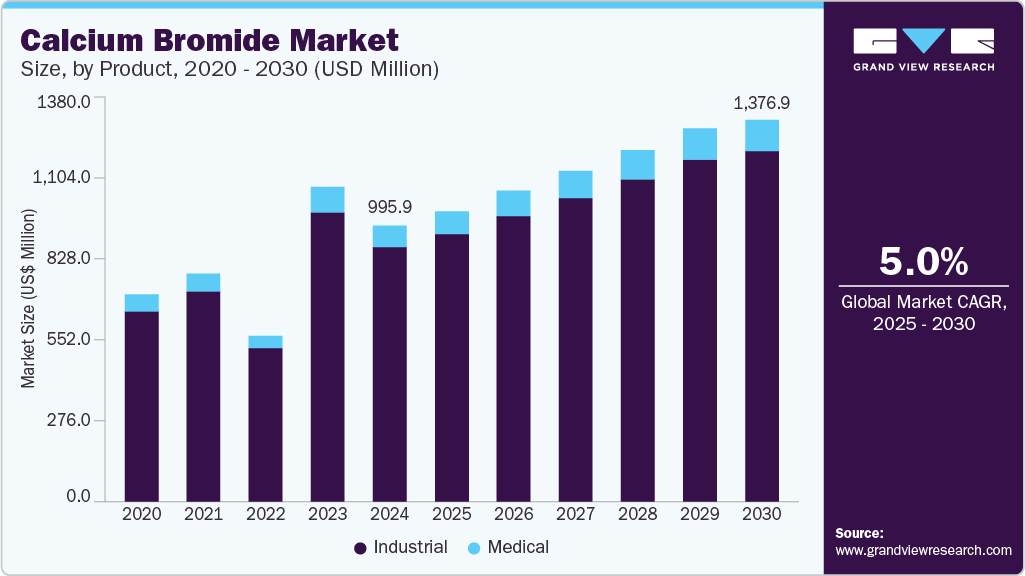

The global calcium bromide market size was estimated at USD 995.9 million in 2024 and is projected to reach USD 1,376.9 million by 2030, growing at a CAGR of 5.0% from 2025 to 2030. The global market is poised for consistent growth through 2030, supported by rising demand in oil & gas drilling operations.

Key Market Trends & Insights

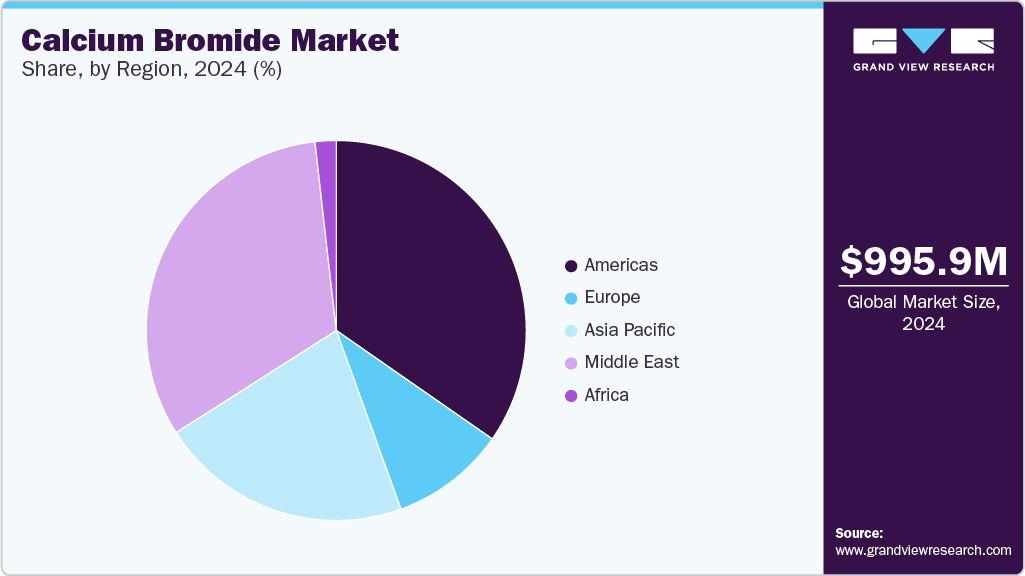

- The North America dominated the calcium bromide market with the largest revenue share of 34.67% in 2024.

- Based on product, the industrial grade segment led the market with the largest revenue share of 92.07% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 995.9 Million

- 2030 Projected Market Size: USD 1,376.9 Million

- CAGR (2025-2030): 5.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Along with increasing medical applications, particularly in neurology and sedation. The global market is poised for consistent growth through 2030, supported by rising demand in oil & gas drilling operations, along with increasing medical applications, particularly in neurology and sedation.

Calcium bromide, an inorganic compound typically available as a white crystalline powder or in brine form, is valued for its high-density, non-damaging nature in oilfield and medical uses. Its hygroscopic and water-soluble properties make it ideal for formulating clear brines used in well completion fluids and drilling.

The calcium bromide industry is expanding steadily due to growing offshore exploration and deep-well activities, especially in the Middle East, Gulf of Mexico, and Asia Pacific regions. However, environmental concerns, handling complexities, and competition from alternatives such as zinc bromide may temper the pace of adoption in certain applications.

Calcium bromide's unique properties-high solubility, thermal stability, and non-damaging nature-make it an essential compound in deep-well operations and sensitive formation zones. However, its handling complexity and the presence of substitute chemicals like zinc bromide and cesium formate could pose restraints. Nevertheless, expanding offshore drilling activities and pharmaceutical R&D involving bromide-based sedatives are expected to create new avenues.

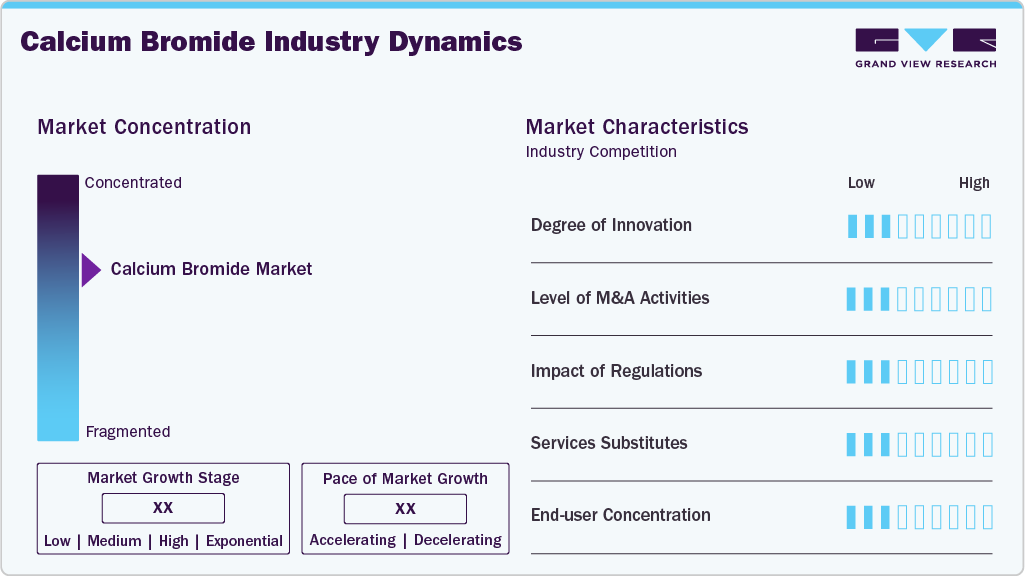

Market Concentration & Characteristics

The calcium bromide industry is moderately consolidated, with a few key players holding significant shares due to proprietary formulations, vertically integrated supply chains, and long-term contracts with oilfield service providers. The market dynamics are shaped by technological innovations in fluid systems, strategic regional expansions, and backward integration into bromine production.

Key market characteristics include high entry barriers due to chemical handling regulations, product purity requirements, and the necessity of approvals from agencies such as REACH, EPA, and regional oil ministries. Major manufacturers also offer formulation support and on-site fluid management services, differentiating themselves from low-cost producers.

The threat of substitution remains moderate, particularly from zinc- and formate-based brines in specific high-pressure high-temperature (HPHT) environments. However, calcium bromide retains cost and compatibility advantages in a range of mid- to deep-well conditions.

Product Insights

The industrial grade segment led the market with the largest revenue share of 92.07% in 2024. The industrial segment dominated the market in 2024 and is forecasted to maintain its lead. Oil & Gas sub-segment is the primary driver, accounting for the largest consumption share due to its use in CBFs for well drilling, completion, and workover operations. Demand is particularly high in offshore basins in the Middle East, North America, and Asia Pacific. The increasing complexity of reservoir conditions is reinforcing calcium bromide's utility in ensuring well integrity and safety.

Although a relatively small segment, medical applications of calcium bromide are expanding gradually. Historically used as a sedative and anticonvulsant, its modern-day relevance is limited to research-based pharmaceutical manufacturing, especially in niche neurology drug formulations. Renewed interest in bromide-based molecules for calming and anti-epileptic functions may drive research-oriented demand in Europe and Asia.

Regional Insights

North America dominated the calcium bromide market with the largest revenue share of 34.67% in 2024, bromide, driven by extensive upstream oil & gas activity in the U.S. Gulf Coast and shale-rich regions. Regulatory compliance and technical performance requirements have encouraged the use of bromide-based brines. Moreover, the presence of major service companies and chemical formulators in the region boosts localized demand.

The demand for calcium bromide in industrial end use is valued for its chemical resistance and thermal stability, making it suitable for facilities exposed to aggressive substances and high temperatures. Applications in industrial flooring, waste containment, and precast components are expanding as industries seek materials that offer both performance and sustainability.

U.S. Calcium Bromide Market Trends

The calcium bromide market in the U.S. is experiencing increased interest in geopolymer concrete, particularly in infrastructure rehabilitation projects. The material's durability and eco-friendly characteristics support the country's efforts to modernize aging infrastructure sustainably.

Asia Pacific Calcium Bromide Market Trends

The calcium bromide market in the Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. This region is witnessing growing demand due to the rise of offshore gas fields and environmental policies mandating mercury control. China and India are emerging as key markets due to their extensive power generation infrastructure and expanding oilfield services sectors. Japan and South Korea also show small but steady demand in medical-grade applications.

Europe Calcium Bromide Market Trends

The calcium bromide market in Europe is anticipated to grow at a significant CAGR during the forecast period. Europe’s demand for calcium bromide is modest but steady, led by pharmaceutical and environmental sectors. Regulatory support for low-emission coal-fired power generation supports industrial usage. However, the shift toward renewable energy could temper long-term demand in some applications.

Latin America Calcium Bromide Market Trends

The calcium bromide market in the Latin America is anticipated to grow at a substantial CAGR during the forecast period. Latin America holds potential, especially in Brazil, Argentina, and Mexico, where upstream E&P projects are expanding. However, inconsistent regulatory frameworks and limited bromine feedstock availability present challenges.

Middle East & Africa Calcium Bromide Market Trends

The calcium bromide market in the Middle East & Africa is anticipated to grow at a significant CAGR during the forecast period. The Middle East holds a substantial share, fueled by deep-well and offshore drilling projects in countries like Saudi Arabia, UAE, and Oman. National oil companies (NOCs) in the region favor high-performance fluid systems, including calcium bromide, for well stability. Local sourcing of bromine in the region supports cost-effective production.

Key Calcium Bromide Company Insights

The calcium bromide industry is served by a mix of global chemical companies and specialized fluid service providers. Leading players engage in capacity expansions, backward integration into bromine production, and regional partnerships to secure long-term contracts.

-

Albemarle Corporation: Albemarle is one of the leading global suppliers of bromine and its derivatives, including calcium bromide. The company operates integrated production facilities with bromine extraction and brine formulation units located in the United States and Jordan. Albemarle’s stronghold in the North American and Middle Eastern oilfield markets allows it to maintain long-term supply relationships with major oilfield service providers

-

ICL Group: ICL is a vertically integrated bromine producer headquartered in Israel, offering a wide range of bromine-based chemicals including calcium bromide. The company leverages Dead Sea bromine resources and focuses on delivering high-purity brines for oilfield and environmental applications. ICL has a strong commercial footprint in Asia, especially China and India, and actively collaborates with regional partners for distribution.

Key Calcium Bromide Companies:

The following are the leading companies in the calcium bromide market. These companies collectively hold the largest market share and dictate industry trends.

- ICL

- Jordan Bromine Company

- LANXESS

- Shandong Dongxin Chemical Industry Co., Ltd.

- TETRA Technologies, Inc.

- Petra Industries Pvt. Ltd.

- Blue Line Industries

- Weifang Shengkai Chemical Co., Ltd

- Tokyo Chemical Industry Co., Ltd.

Calcium Bromide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,048.5 million

Revenue forecast in 2030

USD 1,376.9 million

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Turkey; Hungary; Poland; Russia; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Australia; New Zealand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

ICL, Albemarle Corporation, Jordan Bromine, Company, LANXESS, Shandong Dongxin Chemical Industry Co., Ltd., TETRA Technologies, Inc., Petra Industries Pvt. Ltd., Blue Line Industries, Weifang Shengkai Chemical Co., Ltd, Tokyo Chemical Industry Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Calcium Bromide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global calcium bromide market report based on product and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Oil & Gas

-

Others

-

-

Medical

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Turkey

-

Hungary

-

Poland

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global calcium bromide market size was estimated at USD 995.9 million in 2024 and is expected to reach USD 1048.5 million in 2025.

b. The global calcium bromide market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 1,376.9 million by 2030.

b. North America dominated the calcium bromide market with a share of 34.7% in 2024. This is driven by increasing demand in the oil and gas industry, particularly for shale gas production and deep-sea exploration

b. Some key players operating in the caclium bromide market include ICL, Albemarle Corporation, Jordan Bromine, Company, LANXESS, Shandong Dongxin Chemical Industry Co., Ltd., TETRA Technologies, Inc., Petra Industries Pvt. Ltd., Blue Line Industries, Weifang Shengkai Chemical Co., Ltd, Tokyo Chemical Industry Co., Ltd.

b. Calcium bromide, an inorganic compound typically available as a white crystalline powder or in brine form, is valued for its high-density, non-damaging nature in oilfield and medical uses. Its hygroscopic and water-soluble properties make it ideal for formulating clear brines used in well completion fluids and drilling.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.