- Home

- »

- IT Services & Applications

- »

-

Camp Management Software Market Size Report, 2030GVR Report cover

![Camp Management Software Market Size, Share, & Trends Report]()

Camp Management Software Market (2024 - 2030) Size, Share, & Trends Analysis Report By Deployment (Cloud, On-Premises), By Functionality (Registration and Booking, Payment and Billing), By End Use (Educational Institutions), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-442-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Camp Management Software Market Trends

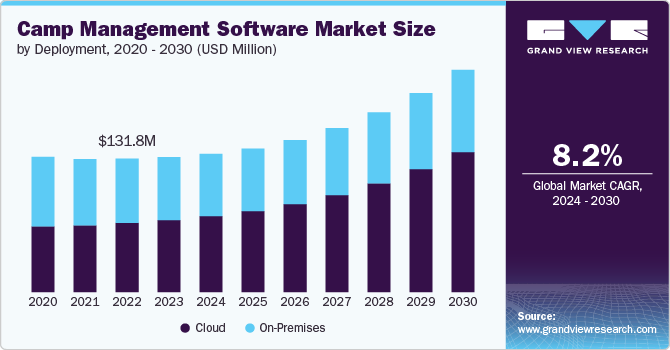

The global camp management software market size was valued at USD 133.3 million in 2023 and is anticipated to grow at a CAGR of 8.2% from 2024 to 2030. Several key factors drive the growth of the camp management software market. First, the increasing complexity of camp operations, including the need to manage large volumes of data related to participants, staff, and logistics, has necessitated the adoption of specialized software solutions. Additionally, real-time data access and communication demand have made digital platforms essential for efficient camp management. Furthermore, the growing emphasis on safety, compliance, and personalized experiences for camp participants has pushed organizations to invest in advanced software tools to streamline operations and enhance service delivery. Finally, integrating emerging technologies such as cloud computing and mobile applications has further accelerated market growth, providing more scalable and accessible solutions for various camp management needs.

The increasing complexity of camp operations, characterized by the need to manage large volumes of data related to participants, staff, and logistics, significantly drives the camp management software market. As camps grow in scale and diversity, the manual handling of tasks such as registration, scheduling, resource allocation, and communication becomes increasingly challenging and prone to errors. This complexity demands robust software solutions to automate and streamline these processes, ensuring accuracy, efficiency, and real-time access to critical information. By enabling centralized management of data and operations, camp management software reduces administrative burdens and enhances the overall experience for participants and staff. This heightened need for efficiency and precision in managing complex operations is a key factor propelling the adoption and growth of camp management software in the market.

The growing emphasis on safety, compliance, and personalized experiences for camp participants is a significant driver of the camp management software market. In an environment where the well-being of participants is paramount, camps are increasingly required to adhere to stringent safety standards and regulatory compliance. This has led to a demand for software solutions that can efficiently manage safety protocols, track compliance with regulations, and ensure secure data handling. Additionally, the expectation for personalized experiences tailored to the needs and preferences of each participant has further intensified the need for sophisticated management tools. Camp management software enables camps to deliver customized services, such as individualized activity planning, dietary accommodations, and targeted communication, all while maintaining a high standard of safety and compliance. This dual focus on safety and personalization is a crucial factor driving the market's expansion as organizations seek to enhance the quality of their services while meeting evolving expectations and regulatory requirements.

Deployment Insights

The cloud deployment segment accounted for the largest market share of over 53% in 2023 in the camp management software market. The adoption of cloud-based camp management software is primarily driven by its flexibility, scalability, and cost-effectiveness. Cloud solutions allow camps to access their management systems from any location with an internet connection, providing real-time data access and collaboration across multiple sites. This is particularly advantageous for camps with diverse or geographically dispersed operations, enabling seamless communication and coordination. Additionally, cloud-based software typically requires lower upfront investment and reduces the burden of maintaining IT infrastructure, as the service provider handles updates and maintenance. The ability to scale resources according to demand makes cloud solutions appealing to camps with fluctuating participant numbers or seasonal operations.

The on-premises segment is anticipated to grow at a significant CAGR during the forecast period. The adoption of on-premises camp management software is driven by the need for greater control, customization, and data security. Organizations prioritizing having direct oversight of their IT systems often prefer on-premises solutions, as they offer the ability to tailor the software to specific operational needs and integrate it more deeply with existing systems. Furthermore, on-premises software allows organizations to maintain data on their servers, which can be crucial for camps that handle sensitive participant information or operate in regions with strict data protection regulations. This level of control and security is particularly important for camps with unique operational requirements or those operating in sectors where data privacy is a critical concern.

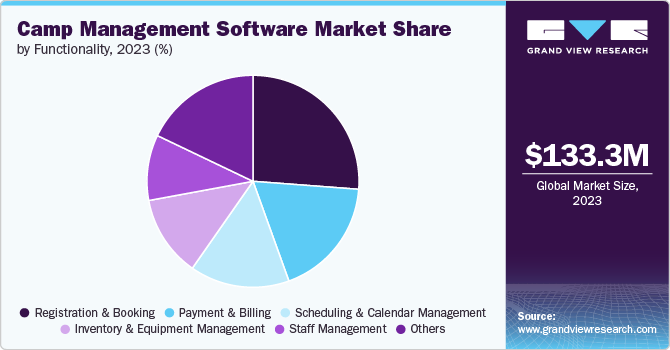

Functionality Insights

The registration and booking segment accounted for the largest market share in 2023 in the camp management software market. The adoption of camp management software for registration and booking is driven by the need for efficiency, accuracy, and user convenience in handling participant enrollment processes. As camps often deal with large registrations within tight timeframes, manual systems can lead to errors, delays, and dissatisfaction among participants. Camp management software streamlines the registration and booking process, offering features such as online forms, real-time availability updates, and automated confirmations. This reduces administrative burdens and enhances the participant experience by providing a seamless and accessible registration process. The ability to easily manage group bookings, special requests, and last-minute changes further increases the appeal of such software, driving its adoption across various types of camps.

The payment and billing segment is anticipated to grow at the highest CAGR of over 10% during the forecast period. The adoption of camp management software for payment and billing is driven by the demand for secure, efficient, and transparent financial transactions. Camps handle various payment methods and schedules, often requiring the management of installment plans, discounts, and refunds. Manually processing these transactions can be time-consuming and prone to errors, leading to potential financial discrepancies and participant dissatisfaction. Camp management software simplifies the payment process by automating billing, tracking payments, and generating invoices, all while ensuring compliance with financial regulations. Additionally, integrating secure payment gateways within the software enhances trust and convenience for participants, further encouraging the adoption of such solutions. The ability to provide clear, accurate billing information and support various payment options is a key factor driving the increased use of payment and billing features in camp management software.

End-use Insights

The sports & recreational camps segment accounted for the largest market of over 35% in 2023 in the camp management software market. The need for efficient organization, participant engagement, and tailored activity management drives the adoption of camp management software for sports and recreational camps. These camps often involve a variety of specialized programs, training sessions, and competitions that require precise scheduling, resource allocation, and participant tracking. Camp management software allows these camps to efficiently coordinate activities, manage equipment, and monitor participant progress, ensuring that each aspect of the camp runs smoothly. Additionally, the software enhances communication between coaches, participants, and parents, providing real-time updates and personalized schedules. The ability to offer a structured yet flexible experience that caters to individual needs and preferences is a significant factor driving the adoption of camp management software in the sports and recreational sector.

The corporate camps segment is anticipated to grow at the highest CAGR during the forecast period. The adoption of camp management software for corporate camps is driven by the need for streamlined logistics, compliance management, and enhanced participant experience. Corporate camps often focus on team building, training, and professional development, requiring meticulous planning and execution. Camp management software facilitates the efficient coordination of these events by automating tasks such as participant registration, accommodation management, and activity scheduling. Moreover, the software ensures compliance with corporate policies and legal requirements, including data privacy and safety standards. For corporate clients, the ability to customize the camp experience to align with organizational goals and ensure high professionalism is crucial. The demand for seamless, scalable solutions that enhance operational efficiency, and the overall experience of corporate camps is a key driver behind the adoption of camp management software in this sector.

Regional Insights

North America held the major share of over 37% of the camp management software market in 2023. The camp management software market in North America is characterized by the growing integration of advanced technologies such as artificial intelligence (AI) and data analytics. Camps increasingly adopt AI-driven tools for personalized participant experiences, predictive scheduling, and enhanced safety measures. The emphasis on digital transformation and the use of mobile applications for real-time communication and management is also a significant trend, driven by the high demand for efficiency and convenience among camp organizers and participants alike.

U.S. Camp Management Software Market Trends

The camp management software market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., the camp management software market strongly emphasizes customization and integration with other software systems. U.S. camps are looking for solutions that can be tailored to specific operational needs and easily integrated with existing platforms such as CRM systems, payment gateways, and communication tools. The trend toward offering comprehensive, all-in-one management solutions that enhance operational efficiency, and participant satisfaction is particularly prominent in the U.S. market.

Europe Camp Management Software Market Trends

The camp management software market in Europe is growing significantly at a CAGR of over 7% from 2024 to 2030. In Europe, the camp management software market is focusing more on data privacy and compliance with regulations such as the General Data Protection Regulation (GDPR). European camps are adopting software solutions that offer robust data protection features and compliance management tools. Additionally, there is a rising demand for multilingual and multi-currency functionalities within the software, catering to the diverse and international nature of many camps across the region.

Asia Pacific Camp Management Software Market Trends

The camp management software market in the Asia Pacific is growing significantly at a CAGR of over 10% from 2024 to 2030. In the Asia-Pacific region, the camp management software market is experiencing rapid growth due to increasing digital adoption and the expansion of the recreational and educational camp sectors. There is a significant trend towards cloud-based solutions driven by the need for scalability and cost-effectiveness. Additionally, the growing middle class and rising disposable incomes in countries such as China and India fuel demand for more organized and sophisticated camp experiences, leading to increased adoption of management software.

Key Camp Management Software Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2023, Vermont Systems, a leading recreation management and payment processing solutions provider for municipalities, golf clubs, universities, colleges, and the U.S. Military, has announced its strategic acquisition of BrainRunner Inc., a Toronto-based company known for its SaaS solution for camp management and registration.

-

In April 2024, DocNetwork announced the successful completion of both the SOC 2 Type 1 audit and HIPAA audit for its SchoolDoc and CampDoc platforms. These external audits, conducted by Sensiba LLP, confirm that DocNetwork's information security practices, policies, procedures, and operations adhere to the Service Organization Control (SOC) 2 standards for availability, security, processing integrity, confidentiality, and privacy, as well as the Health Insurance Portability and Accountability Act (HIPAA) standards for business associates.

Key Camp Management Software Companies:

The following are the leading companies in the camp management software market. These companies collectively hold the largest market share and dictate industry trends.

- ACTIVE Network, LLC

- Amilia Enterprises Inc.

- Bookwhen Ltd

- BrainRunner Inc

- Campminder, LLC

- CIRCUITREE

- Cottonwood Software, LLC

- DocNetwork, Inc.

- Regpacks Online Registration and Payments Software

- UltraCamp LLC

Camp Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 136.6 million

Revenue forecast in 2030

USD 219.5 million

Growth Rate

CAGR of 8.2% from 2024 to 2030

Actual data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, functionality, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ACTIVE Network, LLC; Amilia Enterprises Inc.; Bookwhen Ltd; BrainRunner Inc; Campminder, LLC; CIRCUITREE; Cottonwood Software, LLC; DocNetwork, Inc.; Regpacks Online Registration and Payments Software; UltraCamp LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

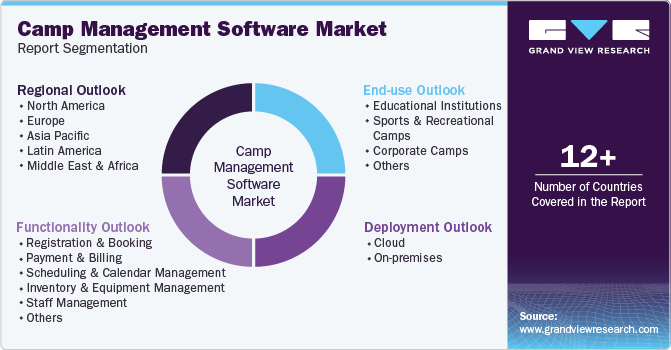

Global Camp Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the camp management software market report based on deployment, functionality, end use, and region.

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Registration and Booking

-

Payment and Billing

-

Scheduling and Calendar Management

-

Inventory and Equipment Management

-

Staff Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Educational Institutions

-

Sports & Recreational Camps

-

Corporate Camps

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global camp management software market size was estimated at USD 133.3 million in 2023 and is expected to reach USD 136.6 million in 2024

b. The global camp management software market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 219.5 million by 2030

b. North America dominated the camp management software market with a market share of 37.9% in 2023. The camp management software market in North America is characterized by the growing integration of advanced technologies such as artificial intelligence (AI) and data analytics. Camps increasingly adopt AI-driven tools for personalized participant experiences, predictive scheduling, and enhanced safety measures.

b. Some key players operating in the camp management software market include ACTIVE Network, LLC, Amilia Enterprises Inc., Bookwhen Ltd, BrainRunner Inc, Campminder, LLC, CIRCUITREE, Cottonwood Software, LLC, DocNetwork, Inc., Regpacks Online Registration and Payments Software, and UltraCamp LLC.

b. Several key factors drive the growth of the camp management software market. First, the increasing complexity of camp operations, including the need to manage large volumes of data related to participants, staff, and logistics, has necessitated the adoption of specialized software solutions. Additionally, real-time data access and communication demand have made digital platforms essential for efficient camp management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.