- Home

- »

- Homecare & Decor

- »

-

Camping & Caravanning Market Size, Industry Report, 2033GVR Report cover

![Camping And Caravanning Market Size, Share & Trends Report]()

Camping And Caravanning Market (2026 - 2033) Size, Share & Trends Analysis Report By Revenue Type (Vehicle Rental, Pitch/Campsite Rental), By Trip Length (Short-stay, Medium-stay, Medium-stay), By Age Group, By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-044-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Camping And Caravanning Market Summary

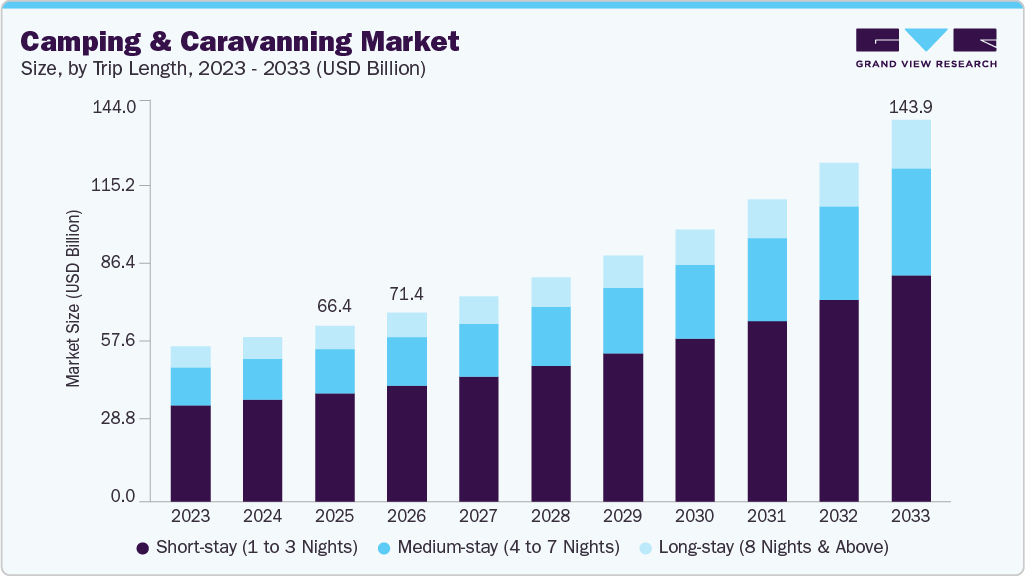

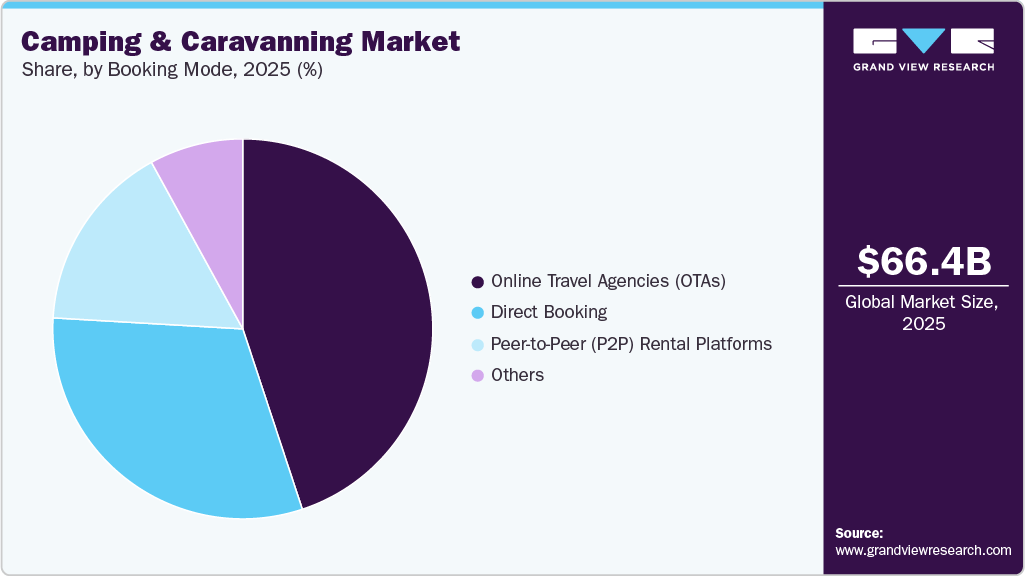

The global camping and caravanning market size was estimated at USD 66.37 billion in 2025 and is projected to reach USD 143.93 billion by 2033, growing at a CAGR of 10.2% from 2026 to 2033. The rebound in nature-based tourism is driving increased demand for camping and caravanning, supported by record visitation to public parks and outdoor destinations.

Key Market Trends & Insights

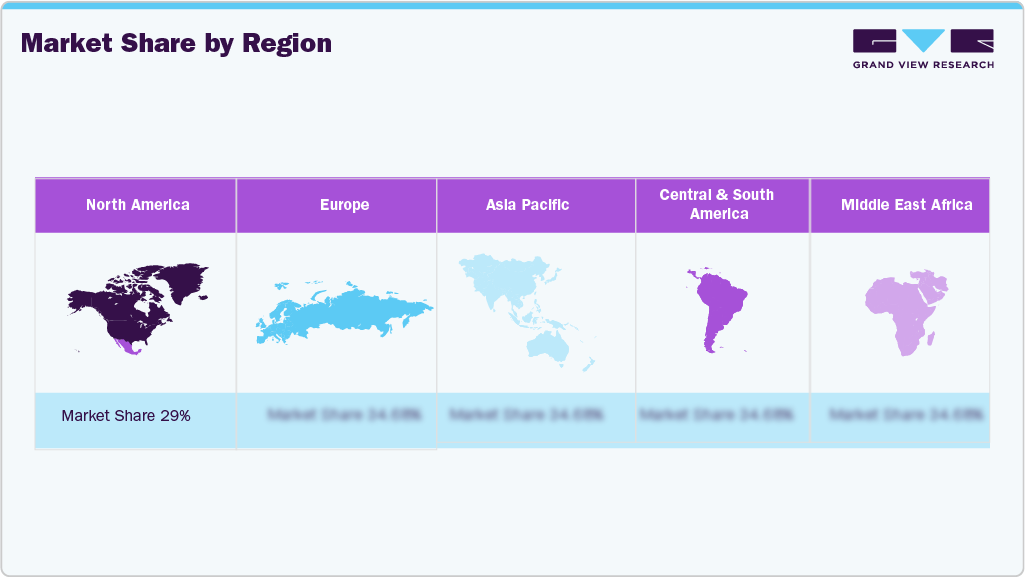

- Europe dominated the global camping and caravanning market with the largest revenue share of 57.7% in 2025.

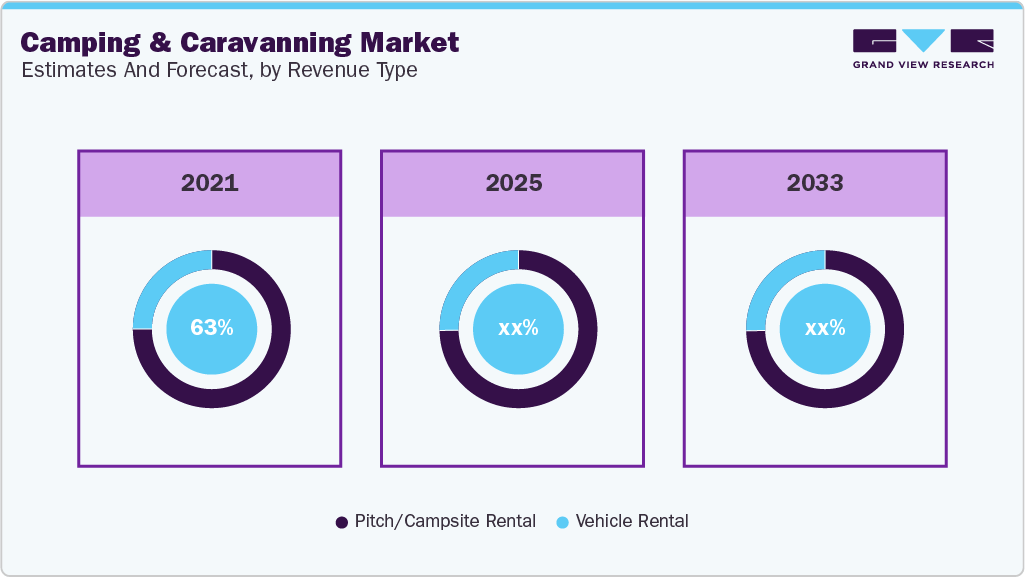

- By revenue type, the pitch/campsite rental, camping, and caravanning segment led the market with the largest revenue share of 61.7% in 2025.

- By trip length, the short stay segment led the market with the largest revenue share of 61.4% in 2025.

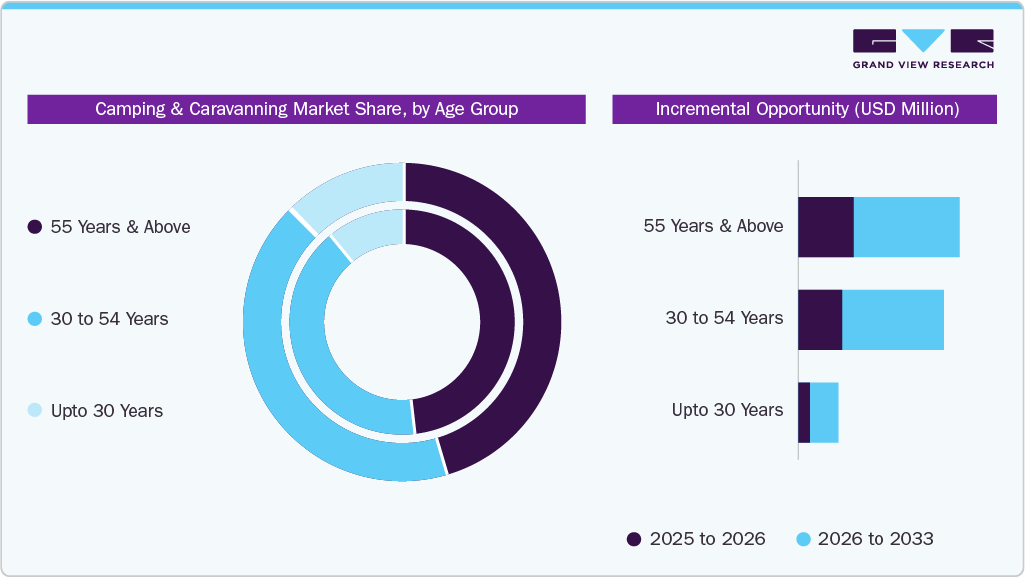

- By age group, the 55 years and above age group segment led the market with the largest revenue share of 48.8% in 2025.

- By booking mode, the online travel agencies (OTAs) segment led the market with the largest revenue share of 45.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 66.37 Billion

- 2033 Projected Market Size: USD 143.93 Billion

- CAGR (2026-2033): 10.5%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

In the U.S., national parks recorded unprecedented recreation visits in 2024, reflecting a stronger preference for domestic, outdoor, and overnight travel.Similarly, in the European Union, camping grounds and RV parks accounted for a meaningful share of tourist accommodation nights, highlighting a shift away from traditional hotel stays. These trends underscore growing consumer interest in self-contained, flexible travel experiences close to nature, creating opportunities for campground and RV park operators to expand infrastructure, enhance on-site services, and adopt integrated reservation and access systems to meet rising demand.

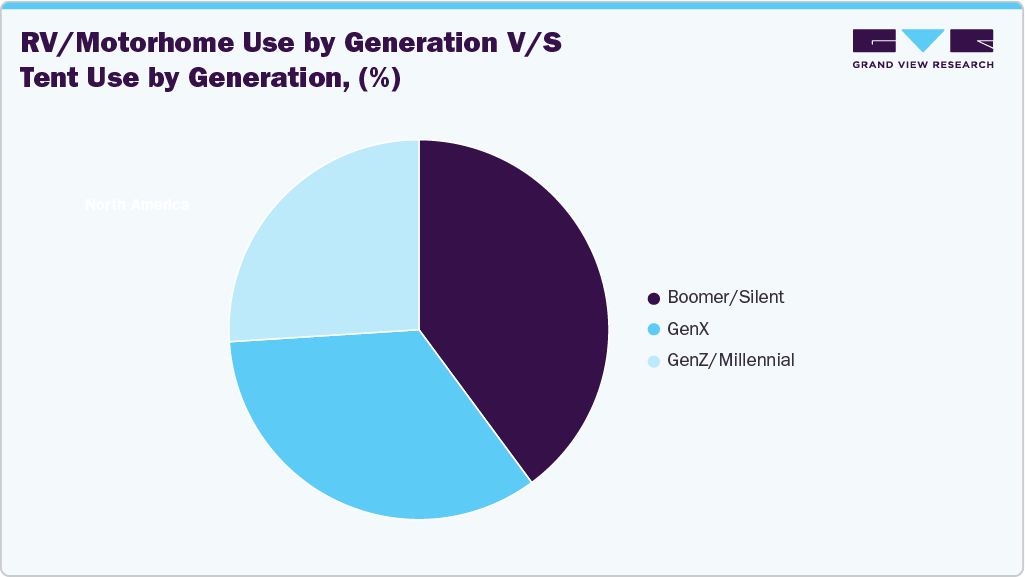

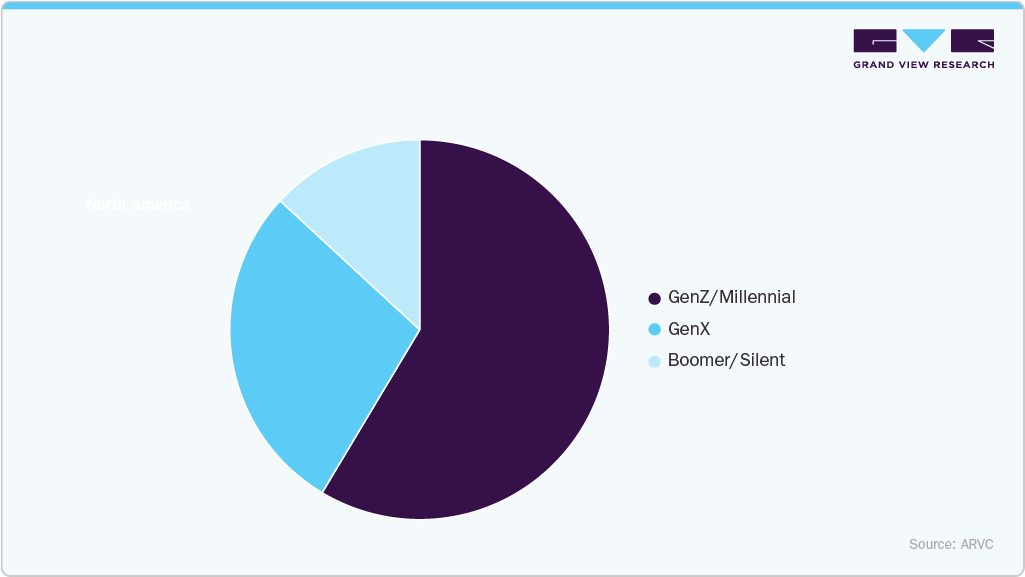

The camping and caravanning industry is no longer seen only as a low-cost travel option. For many consumers, it has become a preferred travel style that offers control over travel plans, privacy, and closer contact with nature. There has been an increasing demand for caravan rentals, RVs, campervans, and organized campsites with basic facilities. Including renters, there are 30 million RV aficionados. There is also a growing section of travelers interested in off-road or remote camping. This is especially prevalent among younger and adventure-focused users.

In addition, travel duration has become more varied than in the past. Short breaks of two to four nights are common, especially for people living in cities who use camping for weekend trips. At the same time, longer stays of one week or more continue to attract retirees, remote workers, and travelers who prefer slower journeys. According to statistics, almost 2.5 million people invested in RVs during COVID-19.

Several patterns are currently influencing how individuals journey within this segment. Eco-friendliness is turning into a requirement, particularly in Europe and other established markets. Campsite operators and vehicle suppliers are incorporating environmentally friendly approaches to satisfy this demand. Luxury camping choices and glamping are increasingly favored by families and those camping for the first time. In addition, technology plays a role with mobile applications utilized for planning routes, making reservations, and locating campsites. Another growing trend is flexible travel linked to remote work, where people combine work and travel for longer periods.

Consumer Insights

Modern travelers are increasingly seeking comfort, convenience, and a “home away from home” experience, even when camping or caravanning. This evolving demand has driven the growth of premium RV rentals, upscale caravan parks, and high-amenity campsites. These accommodations offer enhanced features such as fully equipped kitchens, en-suite bathrooms, Wi-Fi, and climate control features traditionally associated with hotels, which are now being incorporated into outdoor and mobile travel experiences.

Similarly, the global tourism sector has embraced the trend towards outdoor experiences. Research from the U.S. National Park Service found that RV park visitation increased by 20% over the past five years, as travelers opted for self‑contained travel. This rise in park visitation corresponds with increased demand for motorhome and RV rentals. In 2023 alone, RV park bookings in the U.S. grew by 8.6%, with an associated increase in RV rental bookings, particularly among first-time RV renters.

Trends in the Premium Camping & Caravanning Market

Region

Premium RV Park Occupancy

Luxury Motorhome Registrations

Average Spend Per Trip (USD)

Growth in High-Amenity Campsites (%)

Europe

85% (2023)

10% year-on-year increase

$1,200 per trip

15% increase (2023-2024)

North America

80% (2023)

8% year-on-year increase

$1,500 per trip

12% increase (2023-2024)

Asia-Pacific (Australia)

75% (2023)

5% year-on-year increase

$950 per trip

10% increase (2023-2024)

Source: ECF, North American RV Association, Australian Caravan Industry Association

As nature-based tourism rebounds globally, public lands and national/state parks are seeing record-high visitation, offering a robust opportunity for camping and caravanning service providers to leverage existing infrastructure. In 2024, the National Park Service (NPS) in the U.S. recorded a record 331.9 million recreation visits across its park system, a 2% increase over 2023, driven in part by increased preference for domestic, outdoor travel and overnight stays. Meanwhile, in the European Union, overall tourist accommodation nights in 2024 exceeded 3 billion for the first time; of those, 13.5% were accounted for by camping grounds, recreational vehicle parks, and trailer parks.

These trends indicate growing interest among travelers for outdoor accommodation and RV park-based stays instead of traditional hotels. As more people seek self-contained, flexible travel experiences, often in proximity to nature, demand for RV parks, campgrounds, and related facilities stands to increase. This presents an opportunity for the expansion of campground infrastructure, enhancement of services (e.g., sanitary facilities, EV charging, convenience stores, guided nature-based activities), and integration of reservation, logistics, and park access systems to cater to growing demand.

Apart from vehicles, buyers are investing more in premium camping equipment, rather than simple beginner-level items. According to Condor Ferries, in 2017, USD 3 billion was spent on camping equipment in the U.S. Significant increases are noticeable in tents, sleeping systems fitted for various climates, modular outdoor furnishings, and space-saving cooking setups. Numerous campers currently evaluate gear via rentals before committing to purchases, utilizing services to experiment with caravans, camper vans, and rooftop tents prior to acquiring their own. This trial-based approach has accelerated ownership decisions and reduced risk for first-time buyers, helping expand the market beyond experienced campers to families and casual users.

These trends show that travelers are increasingly willing to spend more for premium, experience-oriented travel, with the demand for luxury motorhomes and high-amenity RV parks expected to continue rising. Furthermore, as the concept of glamping becomes more mainstream, the camping industry’s value proposition is shifting toward luxury and convenience, reinforcing its growth trajectory.

Revenue Type Insights

The pitch/campsite rental segment led the market with the largest revenue share of 61.7% in 2025. Rising interest in outdoor recreation, nature-based tourism, and wellness-oriented travel has encouraged consumers to choose camping and caravanning as alternatives to traditional hotel stays. Families and younger travelers value the freedom to customize itineraries, travel at their own pace, and access less crowded destinations, while caravanning offers a balance between comfort and outdoor experience.

The vehicle rental segment is expected to grow at the fastest CAGR of 11.5% from 2026 to 2033. Consumers are increasingly seeking cost-efficient and personalized travel options that allow greater control over itineraries, accommodation, and safety, particularly in the post-pandemic period. Rising interest in nature-based tourism, road trips, and experiential travel has made camping and caravanning attractive alternatives to traditional hotel-based holidays. In parallel, improvements in vehicle rental platforms, wider availability of campervans and recreational vehicles, and enhanced campsite infrastructure have lowered barriers to entry, enabling a broader consumer base, including families and first-time users, to adopt these travel formats.

Trip Length Insights

The short stays (1 to 3 nights) segment led the market with the largest revenue share of61.4% in 2025. The demand for camping and caravanning for short stays of one to three nights is increasing as consumers seek flexible, low-commitment travel options that fit into busy lifestyles. Short breaks allow travelers to disconnect from routine without the planning, cost, or time requirements of longer vacations, making them particularly attractive to working professionals and families. Proximity to urban centers, improved campground infrastructure, and the availability of well-equipped caravans and camper vans have further supported this trend. In addition, growing interest in outdoor recreation, wellness, and nature-based experiences has encouraged travelers to opt for frequent, short camping trips as convenient and affordable leisure escapes.

The medium stay (4 to 7 nights) segment is expected to grow at the fastest CAGR of 12.1% from 2026 to 2033. The demand for camping and caravanning for medium stays of four to seven nights is increasing as travelers seek a balance between short weekend breaks and longer, cost-intensive holidays. This duration allows consumers to slow down, explore destinations in greater depth, and fully disconnect from routine work schedules without committing to extended time away. Medium-length stays are particularly attractive to families and couples, as they provide enough time to justify travel distance, set-up effort, and site fees while remaining affordable compared to longer vacations.

Age Group Insights

The 55 years and above age group segment led the market with the largest revenue share of48.8% in 2025. Many older consumers now prioritize leisure activities that offer freedom of movement, closer contact with nature, and the ability to travel at a self-directed pace without the constraints of fixed itineraries. Improved health, higher disposable incomes, and longer post-retirement travel periods are enabling this age group to invest more time and resources in recreational travel. In addition, modern caravans and recreational vehicles increasingly offer enhanced comfort, safety features, and accessibility, making them well-suited to the needs of older travelers.

The up-to-30-year age group is projected to grow at the fastest CAGR of 12.5% from 2026 to 2033. Demand for camping and caravanning among the up-to-30-year age group is increasing as younger consumers increasingly prioritize experiential, flexible, and budget-conscious travel over traditional tourism. This demographic values outdoor experiences that offer a sense of freedom, adventure, and social connection, while also aligning with sustainability and wellness preferences. Camping and caravanning allow younger travelers to customize itineraries, travel in small groups, and access nature-based destinations without the high costs associated with hotels or packaged tours. In addition, strong exposure to outdoor lifestyles through social media, influencer content, and peer sharing has amplified interest in road trips, van life, and campsite-based holidays, making camping and caravanning an attractive and aspirational travel choice for this age group.

Booking Mode Insights

The online travel agencies (OTAs) segment led the market with the largest revenue share of45.7% in 2025. Camping and caravanning bookings through online travel agencies (OTAs) are increasing as consumers increasingly seek convenience, transparency, and flexibility when planning outdoor travel. OTAs enable travelers to compare campgrounds, caravan parks, and motorhome sites across regions in real time, view availability, assess pricing, and access verified reviews, which reduces uncertainty and simplifies decision-making. The growing integration of camping and caravanning inventory into mainstream travel platforms has also expanded visibility among first-time and urban travelers who may not traditionally use specialist outdoor booking channels.

The Peer-to-Peer (P2P) rental platforms segment is estimated to grow at the fastest CAGR of 12.2% from 2026 to 2033. P2P platforms allow first-time and occasional users to access caravans, motorhomes, and camping equipment without the high upfront costs and long-term ownership commitments associated with purchase. This model aligns well with younger travelers and families who prefer trial-based usage before buying, as well as with the broader shift toward the sharing economy. In addition, P2P rentals expand access to a wider variety of vehicle types and configurations, enable localized supply in underserved regions, and support spontaneous, short-duration trips.

Regional Insights

The camping and caravanning market in the North America held the significant share of 27% in 2025. Consumers are increasingly seeking outdoor, experience-driven travel that offers flexibility, privacy, and closer engagement with nature, particularly after the pandemic accelerated interest in domestic and road-based tourism. Rising accommodation costs and inflation have also made camping and RV travel a more cost-effective alternative to hotels, especially for families and long-distance travelers. In addition, improvements in RV comfort, connectivity, and eco-friendly features have broadened the appeal of caravanning beyond traditional retirees to younger demographics and remote workers.

U.S. Camping And Caravanning Market Trends

The camping and caravanning market in the U.S. is expected to grow at a significant CAGR of 7.6% from 2026 to 2033. The demand for camping and caravanning in the U.S. is increasing as consumers seek affordable, flexible, and nature-based travel experiences, particularly in response to rising travel costs and a growing preference for domestic tourism. In addition, the expansion of national and state park infrastructure, improved campground amenities, and the influence of social media showcasing outdoor lifestyles have further reinforced camping and caravanning as attractive, accessible, and experience-driven travel options across the country.

Europe Camping & Caravanning Market Trends

Europe dominated the global camping and caravanning market with the largest revenue share of 57.7% in 2025. The demand for camping and caravanning in Europe is increasing due to a combination of shifting travel preferences, economic considerations, and lifestyle trends. European travelers are increasingly seeking flexible, self-directed, and nature-oriented holidays that allow them to avoid crowded urban destinations while maintaining control over costs and itineraries.

Camping and caravanning offer a cost-effective alternative to traditional accommodation, particularly amid rising hotel prices and inflationary pressures across the region. In addition, growing environmental awareness is encouraging travelers to opt for low-impact, outdoor experiences, which are supported by Europe’s well-developed network of campsites and caravan parks.

Asia Pacific Camping & Caravanning Market Trends

The camping and caravanning market in the Asia Pacific is expected to grow at the fastest CAGR of 16.2% from 2026 to 2033. Rising disposable incomes, expanding middle-class populations, and improved road infrastructure in countries such as Australia, New Zealand, Japan, South Korea, and parts of Southeast Asia are making road travel more accessible and attractive. Younger consumers and families are increasingly seeking experiential travel that offers outdoor recreation, wellness benefits, and a break from crowded urban environments. In addition, the influence of social media, growing awareness of sustainable travel, and post-pandemic preferences for self-contained accommodation have accelerated interest in camping equipment, campervans, and caravans across the region.

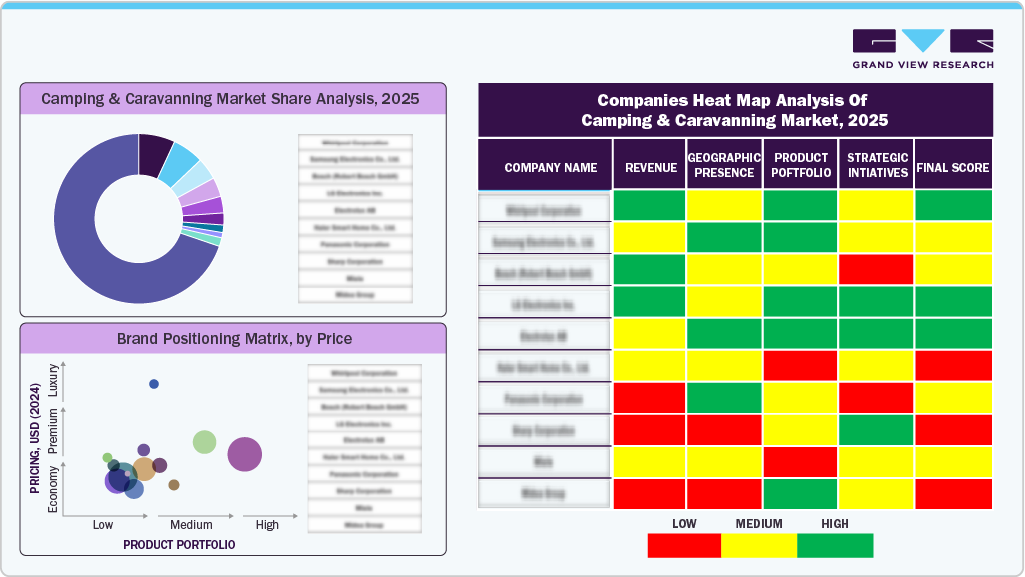

Key Camping And Caravanning Company Insights

The camping and caravanning industry features various global, regional, and local players, making it a highly competitive market. The world’s leading companies are using partnerships, collaborations, acquisitions, mergers, and agreements as strategies to withstand the intense competition and increase their market share. Camping and caravanning service providers and product manufacturers are investing heavily in technological advancements to develop innovative products and integrate new technologies and features that conserve energy and enhance efficiency.

Key Camping And Caravanning Companies:

The following are the leading companies in the camping and caravanning market. These companies collectively hold the largest Market share and dictate industry trends.

- EUROPEAN CAMPING GROUP

- Sandaya

- Siblu Holiday Parks

- Roompot

- Capfun

- First Camp

- Huttoppia

- EuroParcs

- Yelloh Village

- Hu Holding S.p.A. (Human Company)

- Outdoorsy

- Cruise America

- Road Bear RV Rentals

- Indie Campers

- Apollo RV/Apollo Tourism & Leisure

Recent Developments

-

In November 2025, Bihar introduced two ultra-luxury caravan buses, functioning as mobile five-star hotels with amenities like AC living space, sleeper berths, kitchen, bathroom, Wi-Fi and entertainment, allowing tourists to explore heritage sites such as Nalanda, Rajgir, Bodh Gaya and Vaishali without hotel stays, with tariffs of about ₹20,000 per full day (₹75/km, 250 km minimum) and a special 12-hour Patna city package for ₹11,000.

-

In March 2025, Eurocamp launched a major European expansion for 2025, adding 36 new holiday parks across key markets including France, Italy, Croatia, Germany, and the Netherlands. This launch significantly broadens its footprint and elevates its scale to more than 400 parks across Europe, reinforcing Eurocamp’s leadership in the camping and caravanning sector.

-

In December 2024, Sandaya launched two new campsite destinations, Le P'tit Bois, a 5-star campsite near Saint-Malo in Brittany, and Domaine La Franqui, a luxury glamping and boardsports-oriented site on the La Franqui peninsula in Occitania.

Camping And Caravanning Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 71.43 billion

Revenue forecast in 2033

USD 143.93 billion

Growth rate

CAGR of 10.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Revenue type, trip length, age group, booking mode, age group, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Netherlands; Norway; Sweden; Switzerland; Croatia; Austria; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa.

Key companies profiled

EUROPEAN CAMPING GROUP; Sandaya; Siblu Holiday Parks; Roompot, Capfun; First Camp; Huttoppia, EuroParcs; Yelloh Village; Hu Holding S.p.A. (Human Company);Outdoorsy; Cruise America; Road Bear RV Rentals; Indie Campers; Apollo RV/ Apollo Tourism & Leisure

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Camping And Caravanning Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global camping and caravanning market report based on the revenue type, trip length, age group, booking mode, and region.

-

Revenue Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Vehicle Rental

-

Caravan Rentals

-

Recreational Vehicle (RV) Rentals

-

Campervan Rentals

-

-

Pitch/Campsite Rental

-

-

Trip Length Outlook (Revenue, USD Million, 2021 - 2033)

-

Short stay (1 to 3 Nights)

-

Medium stay (4 to 7 Nights)

-

Long stay (8 Nights & Above)

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Upto 30 Years

-

30 to 54 Years

-

55 Years & Above

-

-

Booking Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct Booking

-

Online Travel Agencies (OTAs)

-

Peer-to-Peer (P2P) Rental Platforms

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Norway

-

Sweden

-

Switzerland

-

Austria

-

Croatia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global camping and caravanning market accounted for USD 66.37 billion in 2025 and is expected to reach USD 71.43 billion by 2026.

b. The global camping and caravanning market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.5% from 2026 to 2033 to reach USD 143.93 billion by 2033.

b. The pitch/campsite rental, camping, and caravanning dominated the market, accounting for a 61.7% share in 2025. Rising interest in outdoor recreation, nature-based tourism, and wellness-oriented travel has encouraged consumers to choose camping and caravanning as alternatives to traditional hotel stays.

b. Some of the key players operating in the camping and caravanning market include Suncamp holidays, Hipcamp, Inc., Recreation.gov, Harvest Hosts, MAKEMYTRIP PVT. LTD, EUROPEAN CAMPING GROUP, Campnab, Thousand Trails, KAMPGROUNDS OF AMERICA, INC., International Palamos, among others.

b. The key factors that are driving the global camping and caravanning market include growing interest in travel and tourism among the consumers and increasing participation in outdoor activities such as hiking, fishing, and camping.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.