- Home

- »

- Electronic Devices

- »

-

Camping Cooler Market Size, Share & Growth Report, 2030GVR Report cover

![Camping Cooler Market Size, Share & Trends Report]()

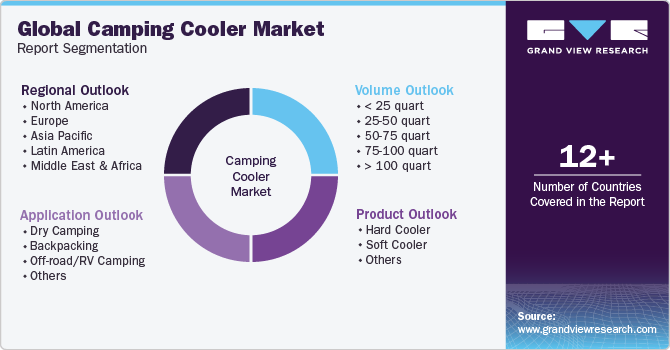

Camping Cooler Market (2023 - 2030) Size, Share & Trends Analysis Report By Volume (< 25 quart, 25-50 quart, 50-75 quart, 75-100 quart, > 100 quart), By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-556-4

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Camping Cooler Market Summary

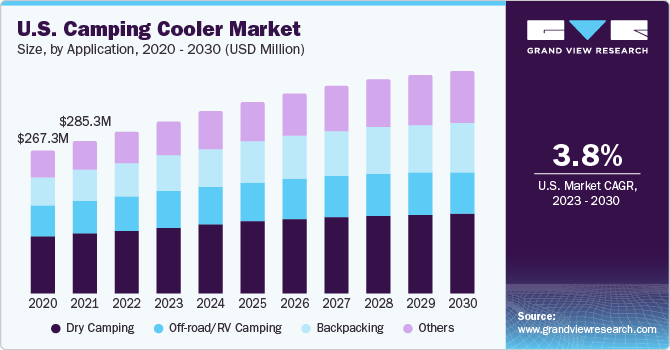

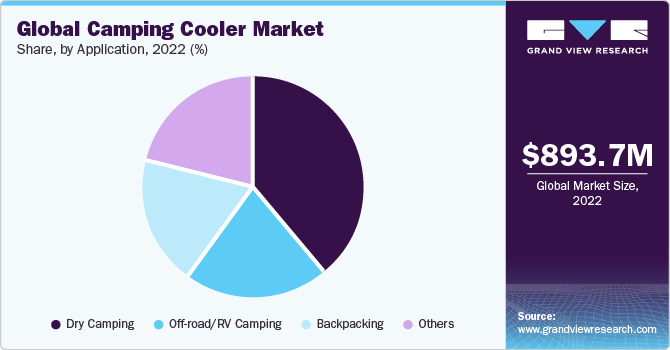

The global camping cooler market size was estimated at USD 893.7 million in 2022 and is projected to reach USD 1,207.9 million by 2030, growing at a CAGR of 3.5% from 2023 to 2030. The growing popularity of outdoor recreational activities such as off-roading and hiking among travelers is a leading factor driving the market.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 38.7% in 2022.

- Latin America region is expected to grow with fastest a CAGR of 4.7% over the forecast period.

- By volume, the market is segmented into 100 quarts.

- By product, hard coolers segment are expected to emerge as the dominant segment over the forecast period. In 2022, it accounted for 60.6% of the overall revenue.

- By application, the dry camping segment accounted for the largest revenue share of over 38.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 893.7 Million

- 2030 Projected Market Size: USD 1,207.9 Million

- CAGR (2023-2030): 3.5%

- North America: Largest market in 2022

- Latin America: Fastest growing market

In addition, better technologies used for manufacturing lightweight chillers that can retain ice for a longer duration will contribute to market growth over the coming years. In North America, there has been a significant rise in consumers taking road trips in summers, which boosts sales of outdoor chillers. Decreasing fuel prices in the U.S. have resulted in a number of consumers seeking off-road activities. The importance of a camping cooler box has increased owing to factors such as a shift in consumer mindset toward spending on road trips and adventure vacations.

Major vendors in the market, such as Pelican Products, Inc.; Igloo Products Corp.; Grizzly Coolers; ORCA Coolers; and Bison Coolers, are based in the U.S. These companies are emphasizing on expanding their product portfolio by launching chillers with improved technologies and unique features, such as dry ice compatibility, seamless rotationally-molded construction, and use of rip-stop polyester fabric for developing folding and collapsible travel chillers.

For instance, in September 2017, Pelican Products Inc., a manufacturer of iceboxes, drinkware, and portable lighting systems announced the launch of Pelican Elite, a 48-can-sized soft side cooler with features including sweat-proof interior fabric, detachable padded shoulder strap, press and buckle, and high-density closed-cell foam insulation to facilitate ice retention for a longer time span.

Vendors such as Engle Coolers and Yeti Coolers, LLC are focused on upgrading their existing products. For instance, in January 2017, Engel Coolers upgraded the outer 500 denier rip-stop polyester fabric of its backpack chillers to 600 denier rip-stop polyester fabric.

Camping and outdoor cooler suppliers are focusing on developing products based on the changing consumer trends. The suppliers offshore the manufacturing of cooler chests to a low-cost manufacturing destination such as China, the Philippines, Japan, or India. However, there has been an evident shift in the trend as suppliers are observed partnering with raw material manufacturers in onshore locations in order to meet the excess demand from users.

For instance, Yeti Coolers, LLC offers a wide product range, including collegiate, tank, hopper, roadie, and tundra coolers. The tundra coolers are manufactured in the U.S. and the Philippines, whereas rambler drinkware and hopper coolers are manufactured in China. With the increasing demand for coolers and drinkware in the U.S., major players such as Bison Coolers, ORCA Coolers, Igloo Products Corp., Grizzly Coolers, and Pelican Products, Inc. have started manufacturing their products in the U.S.

Outdoor recreational activities include mountain expedition such as hiking, forest activities such as hunting and camping, and water activities such as fishing and rafting. Most common recreational activities include running, camping, hunting, fishing, and off-roading. It has been observed globally that outdoor recreational activities contribute to social benefits such as employment and personal satisfaction by reducing stress and obesity rates. Owing to these benefits, there have been increased investments in outdoor activities.

Developments in camping equipment have enabled manufacturers to replace outdated equipment with newer models. Some developments include MPOWERED Luci, a solar charged lantern producing up to 80 lumens of light for 15 square feet area; Sawyer Squeeze Water Filter System, which filters water by filling the water bag and squeezing the water out through the filter attached to the bag; Powertraveller Powermonkey Extreme, which is a rugged, waterproof, and portable solar charger; and Yeti Tundra 35 coolers featuring T-Rex lid latches, which are heavy-duty rubber latches made with patented technology, AnchorPoint tie-down slots, and NeverFail hinge system having two hinge pins and an interlocking design. These technologically advanced camping equipment models are expected to boost the demand for newer products.

Volume Insights

By volume, the market is segmented into <25 quarts, 25-50 quarts, 50-75 quarts, 75-100 quarts, and >100 quarts. The 50-75 quarts segment accounted for the largest market share of around 38.1% in 2022. The rising popularity of outdoor activities, including camping, hiking, and fishing, has driven the demand for camping coolers. As more individuals and families engage in outdoor adventures, the need for reliable and spacious cooling solutions becomes increasingly apparent, further boosting sales in the 50-75 quarts segment.

The <25 quarts segment is expected to grow at the fastest CAGR of 6.0% during the forecast period. Consumer demand for <25 quarts chillers is expected to increase significantly over the forecast period as these are compact, lightweight, and are available in soft as well as hard product variants. Soft iceboxes are compact and are available in sling and backpack styles. Thus, they are very convenient to carry as compared to large-sized hard coolers.

Product Insights

By product, the market for camping cooler has been segmented into hard, soft, and others. Hard coolers are expected to emerge as the dominant segment over the forecast period. In 2022, it accounted for 60.6% of the overall revenue, which is attributed to the rising demand for hard chillers in the North American and European regions. Outdoor recreational activities are considered a prominent contributor to the growth of this segment.

Adoption of soft chillers is growing at a rapid pace owing to several benefits such as its low price and lightweight structure as compared to hard iceboxes. Availability of soft coolers in different variants, including lunch boxes, shoulder bags, and backpacks, is expected to boost its sales over the forecast period.

The others segment is expected to grow at the fastest CAGR of 6.0% during the forecast period, which is attributed to the adoption of high-quality drinkware by youngsters during camping and adventurous activities. In May 2017, Igloo Products Corp. launched a new hydration line of stainless products, including drinkware. The hydration line comprises sporting goods, outdoor, and houseware categories. Special features in the hydration range of products include vacuum insulation, dual-walled Tritan technology, and superior foam insulation.

Application Insights

By application, the market has been segmented into dry camping, backpacking, off-road/ RV camping, and others. The dry camping segment accounted for the largest revenue share of over 38.8% in 2022. The popularity of off-roading is also increasing substantially, especially in developed countries where heavy engine cars designed for off-roading are more in demand.

Adoption of camping and outdoor chillers in the North American and European regions is significantly higher than in developing regions. Camping is one of the most popular summer activities in Iceland. A large number of Irish vendors offer rental services for essential equipment for hiking trips, which is anticipated to drive the market.

In North America, national parks and forests, such as the Congaree National Park, Ocala National Forest, and Bankhead National Forest, are popular destinations for dry camping. Rising footfall of travelers to these locations is projected to significantly boost demand for chillers in the region. With increasing number of travelers opting for solo hiking and trekking trips, demand for compact soft chillers and drinkware is expected to be on a rise. The segment is projected to grow at a faster rate as compared to the hard chillers segment.

The backpacking segment is expected to grow at the fastest CAGR of 5.9% during the forecast. Backpacking coolers have become increasingly popular due to the increased interest in outdoor activities, improved technology, affordability, and convenience. Newer models are lighter, more durable, and more efficient at keeping food and drinks cold. They are also more affordable and easier to pack and carry, which makes them a convenient and practical way to store food and drinks while on the trail.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 38.7% in 2022. The U.S. is the largest market owing to continuous increase in the number of travelers opting for hiking and recreational activities. As most manufacturers of chillers and associated products are based in the U.S., marketing and selling them within the country is easier as compared to marketing brands at other locations. Familiarity of consumers with known chiller brands is a factor driving the U.S. market.

According to the Bureau of Economic Analysis, in the North American region, the annual consumer spending on outdoor recreational activities amounts to around USD 887 billion, which is greater than the spending on many basic amenities including education, gasoline and fuels, and pharmaceuticals. Outdoor recreational activities are considered as one of the most common pastimes in the U.S. Individuals spend most of their time and money on activities such as water sport, camping, trail sport, cycling, and skateboarding than on the movie tickets, video games, and home entertainment.

Latin America region is expected to grow with fastest a CAGR of 4.7% over the forecast period. Backpacking coolers have become increasingly popular in Latin America due to the region's warm climate, growing tourism, affordability, and convenience. Backpacking coolers are especially popular in countries like Mexico, Costa Rica, and Peru, which are known for their scenic and outdoor activities. According to a report published by the World Travel & Tourism Council, spending on both domestic and international travel in Latin America has increased in 2018 as compared to the previous year. Major camping destinations in Brazil, including Bahia, Porto Seguro, Pousada, and Santa Clara, are expected to witness robust growth in tourism, thereby driving the market in Latin America.

Key Companies & Market Share Insights

Major participants are engaged in enhancing their existing products with improved technology for longer ice retention in order to keep pace with consumer demand and competition in the market.

Key Camping Cooler Companies:

- Yeti Coolers, LLC

- AO Coolers

- The Coleman Company Inc.

- Pelican Products Inc.

- Outdoor Active Gear

- Igloo Products Corp

- Grizzly Coolers

- Bison Coolers

- Orca

- Stanley Black & Decker, Inc.

Recent Developments

-

In June 2023, the World Tourism Organization (UNWTO) and the Development Bank of Latin America (CAF) partnered to boost investment in sustainable and resilient tourism in Latin America and the Caribbean. The partnership will focus on promoting and retaining investment in the tourism sector and on targeting it towards projects and initiatives that will help to build a more sustainable and resilient tourism sector in the region.

-

In June 2023, Polaris In., an American automotive manufacturer and power sports, launched a limited-edition Patriot Northstar Cooler in partnership with two military-focused foundations, Wounded Warriors Canada and the Gary Sinise Foundation. It possesses advanced features such as TravelLock Tie-Downs, IceLock Sealing ComfortCarry Handles, and NoSlip Rubber Feet. These features simplify the loading-hauling process and also protect goods.

-

In April 2023, Igloo Expanded the Eco Collection by introducing recycled coolers, including peanuts and park project collaborations. The first of its type, Igloo's ECOCOOL hardside coolers, was created in the U.S. from a recycled resin compound generated from discarded plastic yogurt cups and milk jugs.

-

In November 2022, Pelican Products, Inc., a maker of durable, mission-critical protective containers and coolers based in the U.S., launched the Pelican 8QT Personal Cooler with a lunchbox cooler that delivers all-day cold retention.

-

In May 2022, American Outdoors delivered new and stylish coolers for adventurous customers. The original soft-sided cooler manufacturer created the new Leopard Series line for women specially for women that prefer fashionable equipment for outdoor activities.

-

In September 2021, Swedish business Dometic Group AB (PUBL) acquired Igloo Products Corp., the U.S.-based manufacturer of ice chests, drink containers, and accompanying accessories. The acquisition aims to significantly strengthen Igloo's portfolio and distribution network in North America.

-

In March 2021, Perfect Game, a baseball scouting company based in the U.S., announced the commencement of a multiyear partnership with YETI. Through this partnership YETI aims to provide best-in-class baseball and softball playing to players.

Camping Cooler Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 946.2 million

Revenue forecast in 2030

USD 1,207.9 million

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Volume, Product, Application, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Yeti Coolers, LLC.; AO Coolers; The Coleman Company Inc.; Pelican Products Inc.; Outdoor Active Gear; Igloo Products Corp.; Grizzly Coolers; Bison Coolers.; Orca; Stanley Black & Decker, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Camping Cooler Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global camping cooler market report on the basis of volume, product, application, and region:

-

Volume Outlook (Revenue, USD Million, 2017 - 2030)

-

< 25 quart

-

25-50 quart

-

50-75 quart

-

75-100 quart

-

> 100 quart

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Hard Cooler

-

Soft Cooler

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Dry Camping

-

Backpacking

-

Off-road/RV Camping

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global camping cooler market was estimated at USD 893.7 million in 2022 and is expected to reach USD 946.2 million in 2023.

b. The global camping cooler market is expected to grow at a compound annual growth rate of 3.5% from 2023 to 2030, to reach USD 1,207.9 million by 2030.

b. The 50-75 quarts segment accounted for the highest revenue share of close to 38.1% in 2022 and is expected to dominate the overall market throughout the forecast period.

b. Some key players in the camping cooler market include Yeti Coolers, LLC.; AO Coolers; The Coleman Company Inc.; Pelican Products Inc.; Outdoor Active Gear; Igloo Products Corp.; and Bison Coolers.

b. Key factors that are driving the market growth include growing popularity of outdoor recreational activities such as off-roading and hiking among travelers and better technologies used for manufacturing lightweight chiller to retain ice for a longer duration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.