- Home

- »

- Advanced Interior Materials

- »

-

Chillers Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Chillers Market Size, Share & Trends Report]()

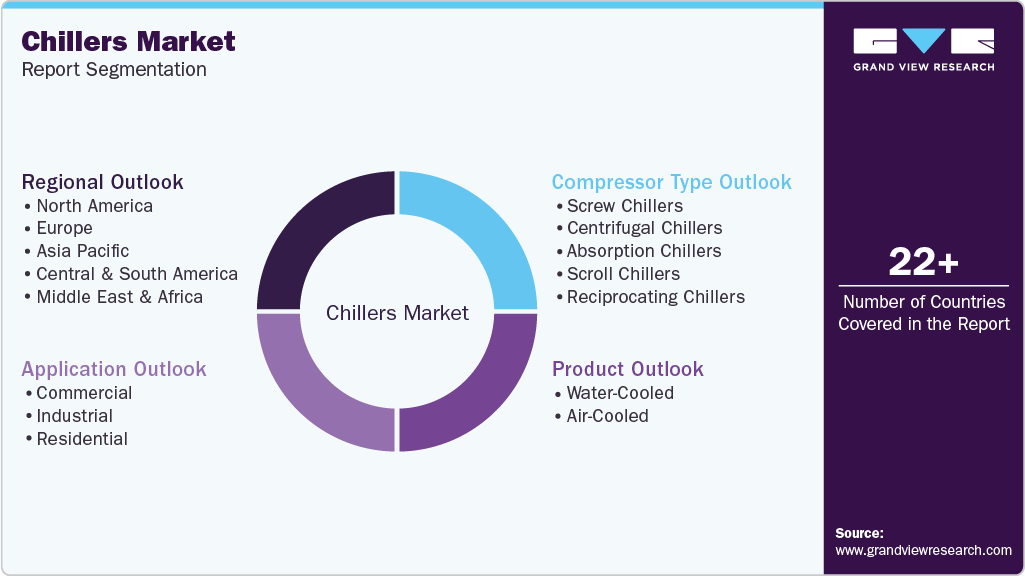

Chillers Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Water-Cooled, Air-Cooled), By Application (Industrial, Commercial), By Compressor Type (Screw Chillers, Centrifugal Chillers, Absorption Chillers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-923-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Chillers Market Summary

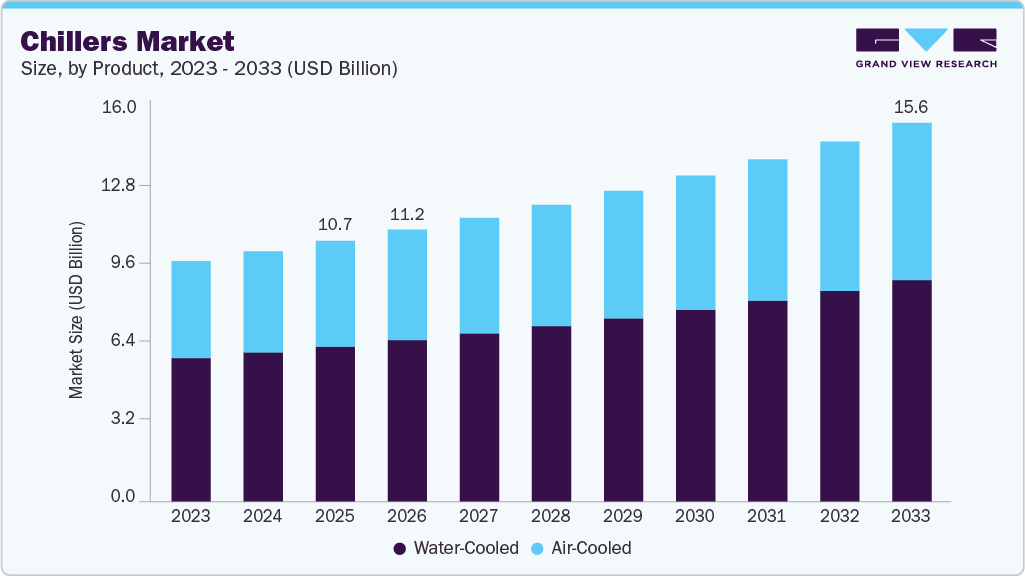

The global chillers market size was valued at USD 10,758.6 million in 2025 and is projected to reach USD 15,643.1 million by 2033, growing at a CAGR of 4.9% from 2026 to 2033. The market is driven by the rising need for cost-effective and energy-efficient space cooling applications in commercial and industrial sectors.

Key Market Trends & Insights

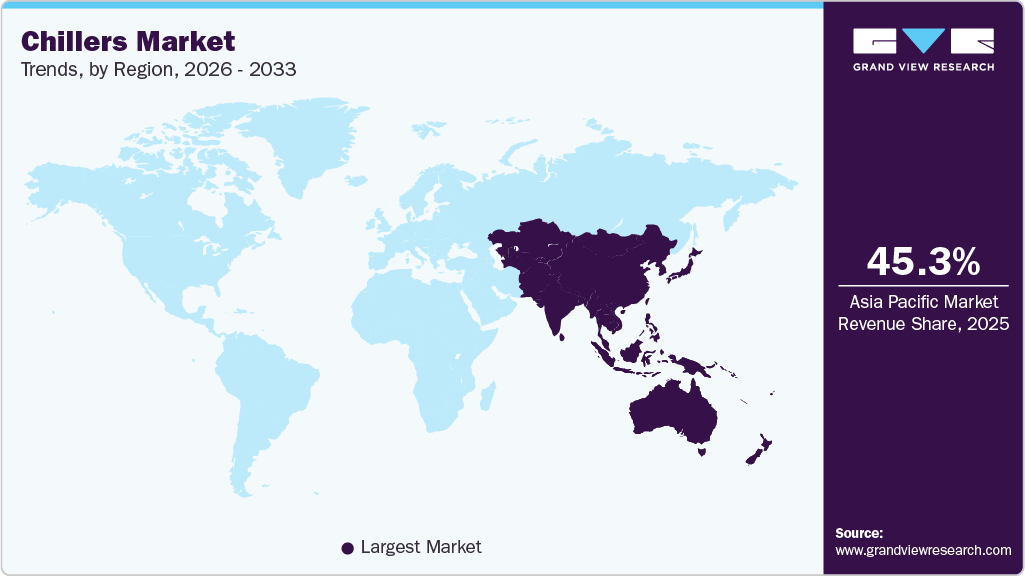

- Asia Pacific dominated the chillers market with the largest revenue share of 45.3% in 2025.

- By product, water-cooled chillers held a significant share of the market and accounted for a share of 59.4% in 2025.

- By application, commercial application segment holds substantial share in the chillers market around 48.9% in 2025.

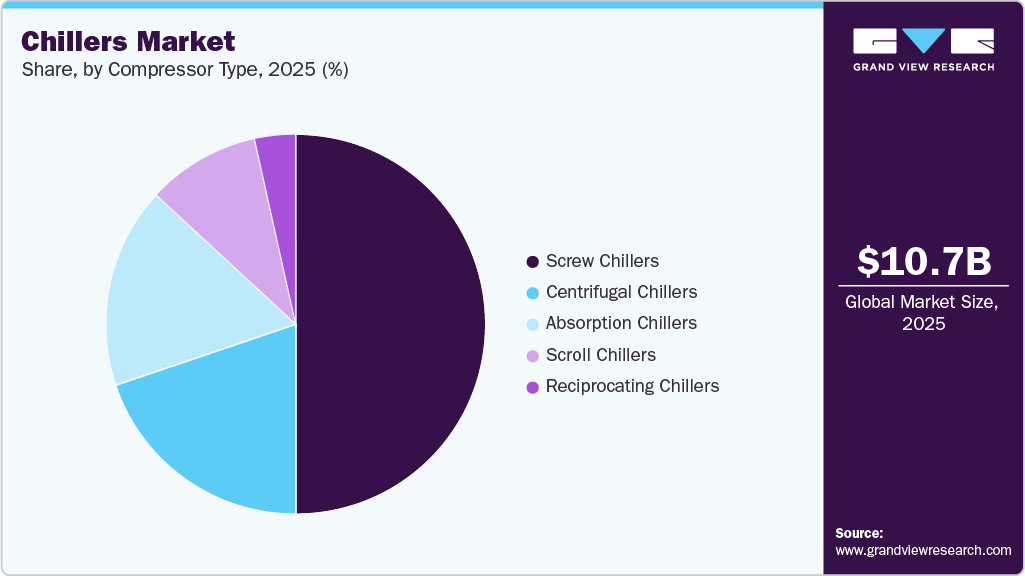

- By compressor type, the screw chillers compressor type segment dominated the market and accounted for 50.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10,758.6 Million

- 2033 Projected Market Size: USD 15,643.1 Million

- CAGR (2026-2033): 4.9%

- Asia Pacific: Largest market in 2025

This, in turn, will likely augment the demand for chillers over the forecast period. According to the U.S. Census Bureau, non-residential commercial construction spending has risen nearly 7% in 2024 compared to the previous year, with manufacturing projects experiencing a notable 23% growth. Additionally, data centers, which are essential for housing computer systems and servers for data storage and processing, continue to see substantial investments. For instance, Meta recently announced a USD 5 billion investment in a data center project in rural Louisiana. This surge in construction spending, particularly in manufacturing and data centers, is significantly driving the demand for advanced chiller systems. Both sectors require efficient, high-capacity cooling solutions to maintain optimal operational conditions, further fueling the growth of the chillers market as companies invest in infrastructure that supports temperature-sensitive environments.

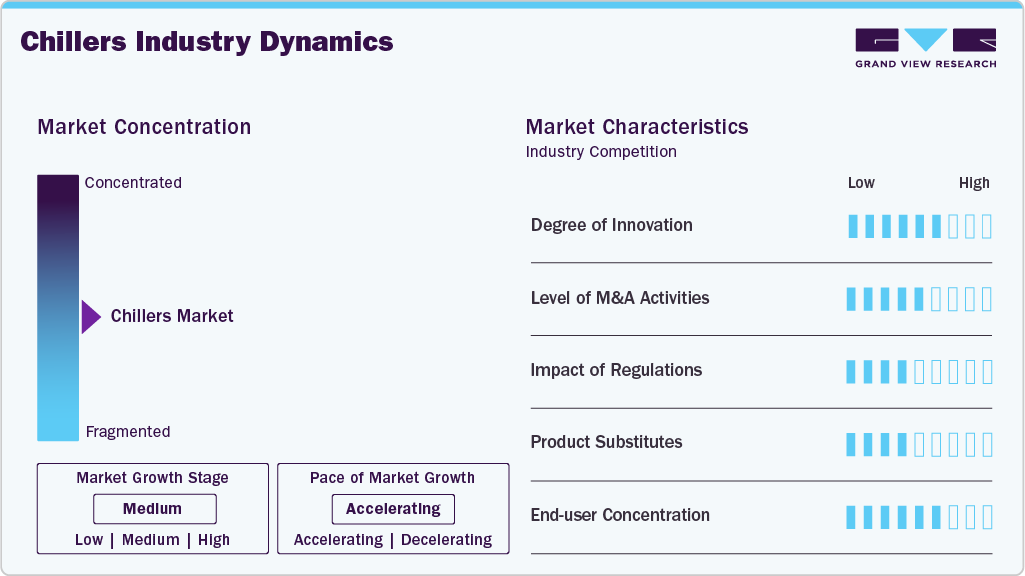

Market Concentration & Characteristics

The chillers market is characterized by a relatively high level of industry concentration, with a few key players holding a significant share of the market. Prominent global manufacturers, such as Carrier, Trane, and Johnson Controls, have established a strong presence in the region, owing to their advanced technological capabilities and expansive distribution networks. These companies cater to the growing demand across a wide range of industries, including commercial real estate, manufacturing, healthcare, and data centers, which require efficient cooling solutions. The demand for chillers in the region is rising due to increasing industrial activities, urbanization, and the need for energy-efficient systems, driving the growth of these key players.

A key characteristic of the chillers market is its rapid growth, driven by factors such as industrialization, urban expansion, and a heightened focus on energy efficiency. As countries in the region continue to develop their infrastructure and industrial sectors, the demand for cooling systems, including air-cooled and water-cooled chillers, is expected to rise significantly. The increasing emphasis on environmental sustainability, energy-saving technologies, and the growing demand for air conditioning in both residential and commercial sectors have further accelerated this trend.

Another defining feature of the chillers market is the diversity in consumer requirements and product types, driven by the varying industrial and commercial sectors across the region. For example, the healthcare sector in countries like Japan and South Korea requires high-performance chillers to ensure precise temperature control in sensitive environments such as hospitals and laboratories. In contrast, industrial sectors in countries like China and India demand heavy-duty, energy-efficient systems to meet the cooling needs of factories, manufacturing plants, and data centers. This variation in demand has created a fragmented market with products tailored to specific applications, prompting manufacturers to continually innovate in order to address these diverse requirements.

Drivers, Opportunities & Restraints

The growing demand for energy-efficient and environmentally friendly cooling solutions is a key driver for the chiller market. As industries and commercial sectors face increasing energy costs, businesses are opting for advanced chillers that reduce power consumption. Additionally, stringent government regulations aimed at lowering carbon footprints are encouraging the adoption of eco-friendly refrigerants and more efficient systems. This shift towards sustainability is propelling market growth.

High initial investment costs and ongoing maintenance expenses are significant restraints for the chiller market. While energy-efficient models can offer long-term savings, the upfront cost of advanced chillers remains prohibitive for many businesses. Furthermore, the need for specialized installation and skilled technicians increases the operational costs. These factors limit the adoption of chillers, especially in cost-sensitive markets.

The increasing demand for smart, connected chiller systems presents a notable opportunity in the market. IoT-enabled chillers, offering real-time monitoring and predictive maintenance, are gaining traction in sectors like healthcare and data centers. Furthermore, the shift toward sustainable refrigerants and energy-efficient systems opens opportunities for innovation. Manufacturers can capitalize on these trends to offer advanced, eco-friendly products in response to global sustainability goals.

Product Insights

Water-cooled chillers held a significant share of the market and accounted for a share of 59.4% in 2025, owing to its compact size, high energy-efficiency and long life. Water-cooled chillers offer a broad cooling capacity of 10-4,000 tons and are an ideal choice for indoor applications. They are best suited for various industrial applications with high thermal output. Water-cooled chillers can handle wide cooling loads, generally observed in chemical plants, manufacturing facilities, and medical facilities.

The demand for air-cooled chillers is expected to surge worldwide during the forecast period owing to their smooth operations at extremely low temperatures as these chillers eliminate the problems associated with the activity of cooling towers during the winter season. Moreover, increasing water scarcity across the world is anticipated to contribute to the demand for air-cooled chillers as they eliminate the requirement for water.

Application Insights

Commercial application segment holds substantial share in the chillers market around 48.9% in 2025. Chillers play a crucial role in commercial buildings by providing essential cooling effects. Their primary function is to counterbalance the heat accumulated from various internal and external sources. External factors, such as sunlight, wind, and outdoor temperature, contribute to heat gain, while internal influences include moisture from individuals, lighting, and heat generated by electrical or mechanical equipment. The advantages provided by chillers in managing these diverse factors within commercial spaces are expected to drive their demand in the coming years.

In industrial applications, chillers play a vital role in managing and controlling temperatures for various processes and equipment. They are extensively employed in manufacturing facilities, chemical plants, and other industrial settings to cool machinery, control ambient temperatures, and ensure optimal conditions for production. Chillers contribute to process efficiency and product quality by preventing overheating, maintaining consistency in manufacturing processes, and facilitating precise temperature control.

Compressor Type Insights

The screw chillers compressor type segment dominated the market and accounted for 50.0% in 2025. Screw chillers can be an air-cooled or water-cooled chillers depending on their functions and designs. They comprise two helical slot rotors, which compress refrigerant gases for cooling purposes. These chillers are used in applications that have high-power circulation requirements. Screw chillers are used in the chemicals, automotive, and printing industries. Moreover, they offer highly energy-efficient cooling capabilities required by industrial and commercial end users.

Scroll chillers use scroll compressors to remove heat from spaces or specified rooms by compressing refrigerating fluids. They have a higher coefficient of performance (COP) compared to the other types of chillers as their compressors produce high cooling output per unit of energy input. These types of chillers are usually installed in large industrial or commercial settings. Moreover, scroll chillers are designed to be compatible with a wide range of refrigerants such as R-407C, R-134a, and R-410A making them suitable for various industrial applications.

Regional Insights

The North American chiller market is experiencing significant growth driven by increasing demand for energy-efficient solutions across commercial and industrial sectors. Rising environmental concerns and stringent regulations on energy consumption are pushing businesses to adopt more sustainable cooling systems.

U.S. Chillers Market Trends

The chillers market in the U.S. is expected to grow at a CAGR of 4.9% from 2026 to 2033. In the U.S., the chiller market is expanding due to rising demand for energy-efficient cooling solutions in the commercial, industrial, and residential sectors. Government regulations, such as those from the EPA, are promoting the use of eco-friendly refrigerants and reducing the carbon footprint of cooling systems. The demand for advanced, smart chillers with features like predictive maintenance is increasing.

The chillers market in the Canada is expected to grow at a CAGR of 4.0% from 2026 to 2033. Canada’s chiller market is driven by the adoption of energy-efficient and sustainable cooling systems, particularly in the commercial and industrial sectors. The country’s stringent environmental regulations are promoting the use of eco-friendly refrigerants and advanced chiller technologies. The demand for chillers in data centers and the growing construction industry are key contributors to market expansion.

Europe Chillers Market Trends

The European chiller market is growing steadily, with a focus on energy efficiency and sustainable cooling solutions. Stringent environmental regulations, such as the EU F-Gas Regulation, are driving the adoption of chillers with low-GWP (Global Warming Potential) refrigerants. The demand for energy-efficient HVAC systems in commercial buildings, data centers, and industrial facilities is increasing.

The Germany chillers market held 22.2% share in the European market. Germany is a key player in the European chiller market, driven by its strong industrial base and emphasis on energy efficiency. The demand for high-performance, energy-efficient chillers is growing in sectors like manufacturing, automotive, and healthcare. Germany's strict environmental regulations, along with the increasing focus on renewable energy sources, are pushing businesses to adopt sustainable chiller systems.

The UK chillers market is driven by rising commitment to reducing carbon emissions, and its transition toward green technologies is encouraging the adoption of advanced, eco-friendly chillers. Furthermore, smart chiller systems with IoT integration are gaining traction in the market.

Asia Pacific Chillers Market Trends

Asia Pacific region led the market and accounted for 46.3% of the global chillers market in 2025. The market is witnessing rapid growth due to rapid industrialization, urbanization, and increased demand for cooling solutions. Countries like China, India, and Japan are driving market growth with rising infrastructure development, industrial activities, and the need for air conditioning systems.

The China chillers market held a significant share in the Asia Pacific market. The demand for energy-efficient cooling systems is growing across industrial, commercial, and residential sectors. Stringent government regulations on energy consumption and sustainability are driving the adoption of advanced chillers. Additionally, local manufacturers are enhancing their production capabilities, creating both domestic and export opportunities.

The chillers market in the India is expected to grow at a CAGR of 6.9% from 2026 to 2033. India's chiller market is experiencing strong growth due to rapid industrialization, expanding infrastructure, and increased demand for air conditioning. The government's initiatives to improve energy efficiency and reduce carbon emissions are encouraging the adoption of eco-friendly and energy-efficient chillers. The healthcare, commercial, and industrial sectors are major contributors to market demand.

Middle East & Africa Chillers Market Trends

The chiller market in the Middle East and Africa is witnessing growth, particularly in regions with expanding commercial, residential, and industrial sectors. Countries in the Gulf Cooperation Council (GCC), such as Saudi Arabia and the UAE, are key drivers of market expansion due to their booming construction sectors and extreme weather conditions, creating high demand for cooling solutions.

The Saudi Arabia chiller market is growing rapidly due to the country’s significant construction boom and rising industrial activities. The demand for chillers is driven by the need for air conditioning in commercial, industrial, and residential sectors, particularly due to the extreme temperatures. Additionally, the government’s focus on energy efficiency and reducing environmental impact is driving the adoption of energy-efficient and eco-friendly chiller technologies. The healthcare and hospitality sectors also contribute significantly to market demand.

Latin America Chillers Market Trends

The Latin American chiller market is expanding, fueled by growing infrastructure development, industrialization, and the rising demand for cooling solutions. Countries like Brazil and Mexico are experiencing increased demand for commercial and industrial chillers. The focus on energy efficiency and environmental sustainability is driving the adoption of chillers with low environmental impact. Moreover, the growth in sectors like healthcare, retail, and manufacturing is spurring the need for reliable and efficient cooling systems.

Brazil is the largest market for chillers in Latin America, driven by rapid urbanization, infrastructure development, and increased industrial activities. The demand for energy-efficient and sustainable chillers is growing, especially in sectors like healthcare, commercial real estate, and manufacturing. Brazil’s commitment to reducing energy consumption and improving environmental standards is pushing businesses to adopt advanced, eco-friendly chiller technologies.

Key Chillers Manufacturers Insights

Some of the key players operating in the market include Trane, Carrier, and Daikin Industries, Ltd.

-

Carrier provides boilers, air conditioners, furnaces, air purifiers, humidifiers, heat pumps, air scrubbers, ventilators, thermostats, UV lamps, dehumidifiers, building controls, and energy services to the retail, commercial, transport, and foodservice sectors. The company was acquired by United Technologies Corporation in 1979; however, it was separated into a separate business in April 2020.

-

Trane is a member of the Ingersoll Rand family of brands. The company operates its business in two segments, namely climate and industrial. The industrial segment offers products and services that enhance energy efficiency, operations, and productivity. It includes power tools, compressed air & gas systems, fluid management systems, material handling systems, and utility & low-speed consumer vehicles. The climate segment provides energy-efficient products and services, including HVAC systems. The company is engaged in the manufacturing of residential, industrial, and commercial HVAC systems. It offers products, such as HVAC accessories, thermostat controls, ductless systems, geothermal systems, packaged systems, heat pumps, coils, gas & oil furnaces, air handlers, and air conditioners.

Key Chillers Companies:

The following are the leading companies in the chillers market. These companies collectively hold the largest market share and dictate industry trends.

- Trane

- Cold Shot Chillers

- Tandem Chillers

- Drake Refrigeration, Inc

- Refra

- Carrier

- FRIGEL FIRENZE S.p.A.

- Midea

- Daikin Industries, Ltd.

- Johnson Controls

- Rite-Temp

- General Air Products

- ClimaCool Corp.

- Fluid Chillers, Inc.

- Multistack International Limited

Recent Developments

-

In January 2025, Midea announced it is expanding its manufacturing in Thailand, a key production base, by building two new plants in Rayong. A 66.4 million baht plant, expected to open in Q2 of this year, will produce VRF systems and chillers (600,000 units annually, 90% for export). Another plant, projected for completion in 2026, will produce microwaves, refrigerators, and freezers.

-

In December 2024, Vertiv Group Corp acquired certain assets and technologies of BiXin Energy Technology (BSE), a China-based chiller manufacturer. This acquisition expands Vertiv's chiller portfolio, particularly for high-performance computing and AI applications. BSE specializes in water-cooled and air-cooled systems with up to 5.5 MW capacity, plus heat recovery solutions.

Chillers Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11,220.6 million

Revenue forecast in 2033

USD 15,643.1 million

Growth rate

CAGR of 4.9% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, Compressor Type, and Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Trane; Cold Shot Chillers; Tandem Chillers; Drake Refrigeration, Inc.; Refra; Carrier; FRIGEL FIRENZE S.p.A.; Midea; Rite-Temp; Multistack, LLC.; DAIKIN INDUSTRIES, Ltd.; General Air Product; ClimaCool Corp.; Johnson Controls; Fluid Chillers, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chillers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global chillers market report based on product, application, compressor type, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Water-Cooled

-

<50kW

-

51-100kW

-

101-500kW

-

501-1000kW

-

1001-1500kW

-

>1501kW

-

-

Air-Cooled

-

<50kW

-

51-100kW

-

101-500kW

-

501-1000kW

-

1001-1500kW

-

>1501kW

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Corporate Offices

-

Data Centers

-

Public Buildings

-

Mercantile & Service

-

Healthcare

-

Others

-

-

Industrial

-

Chemicals & Petrochemicals

-

Food & Beverage

-

Metal Manufacturing & Machining

-

Medical & Pharmaceutical

-

Plastics

-

Others

-

-

Residential

-

-

Compressor Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Screw Chillers

-

Centrifugal Chillers

-

Absorption Chillers

-

Scroll Chillers

-

Reciprocating Chillers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the chillers market include Trane, Cold Shot Chillers, Tandem Chillers, Drake Refrigeration, Inc., Refra, Carrier, FRIGEL FIRENZE S.p.A., Midea, Rite-Temp, Multistack, LLC., DAIKIN INDUSTRIES, Ltd., General Air Product, ClimaCool Corp., Johnson Controls, Fluid Chillers, Inc

b. Key factors that are driving the chillers market growth include the rising temperatures due to global warming are likely to drive the demand for cooling equipment. Increasing adoption of chillers owing to their ability to remove heat from the building and maintain internal temperature is anticipated to drive the market.

b. The global chillers market size was estimated at USD 10,758.6 million in 2025 and is expected to be USD 11,220.6 million in 2026.

b. The global chillers market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2026 to 2033 to reach USD 15,643.1 million by 2033.

b. Water-cooled chillers held a significant share of the market and accounted for a share of 59.4% in 2025, owing to its compact size, high energy-efficiency and long life. Water-cooled chillers offer a broad cooling capacity of 10–4,000 tons and are an ideal choice for indoor applications. They are best suited for various industrial applications with high thermal output.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.