- Home

- »

- Alcohol & Tobacco

- »

-

Canada CBD Pouches Market Size, Industry Report, 2033GVR Report cover

![Canada CBD Pouches Market Size, Share & Trends Report]()

Canada CBD Pouches Market (2025 - 2033) Size, Share & Trends Analysis Report By Content (Up to 10 mg, 10 mg - 20 mg), By Type (Flavored, Unflavored), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-675-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada CBD Pouches Market Summary

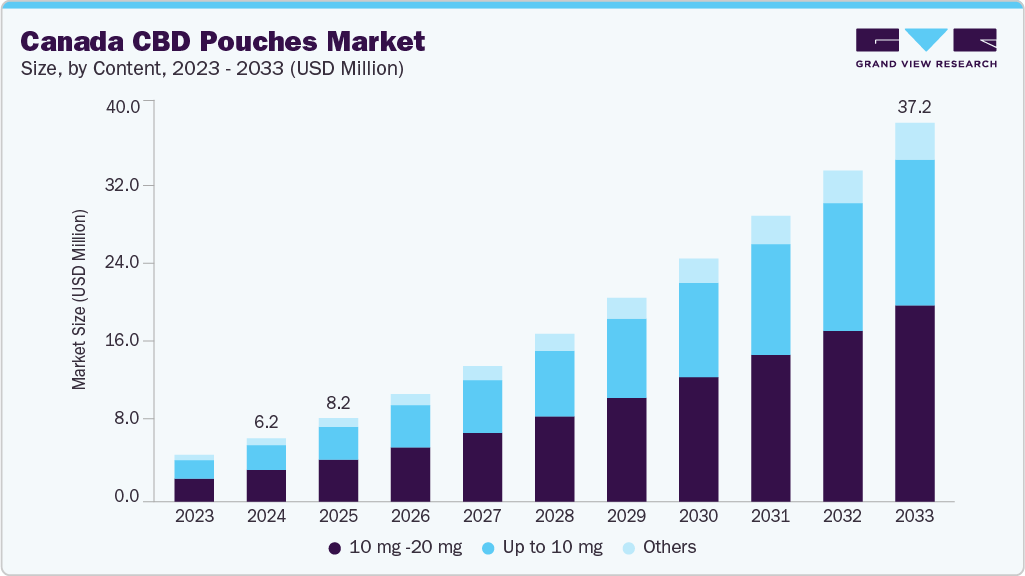

The Canada CBD pouches market size was estimated at USD 6.21 million in 2024 and is expected to reach USD 37.19 million by 2033, growing at a CAGR of 20.8% from 2025 to 2033. The market is growing rapidly due to rising demand for discreet, smoke-free cannabis alternatives and expanding retail availability post-legalization.

Key Market Trends & Insights

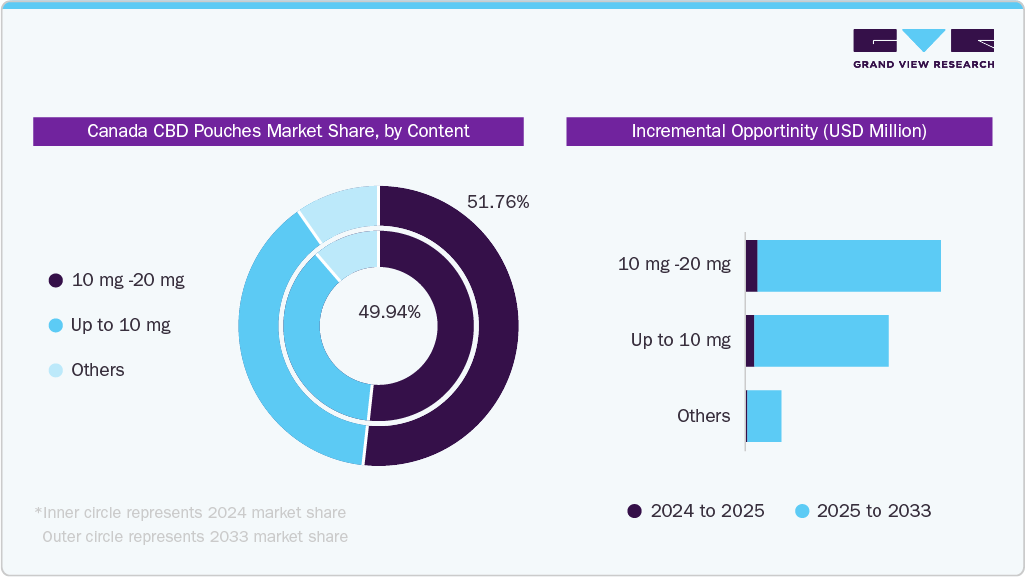

- By content, 10 mg - 20 mg CBD pouches led the market and accounted for a share of 49.94% in 2024.

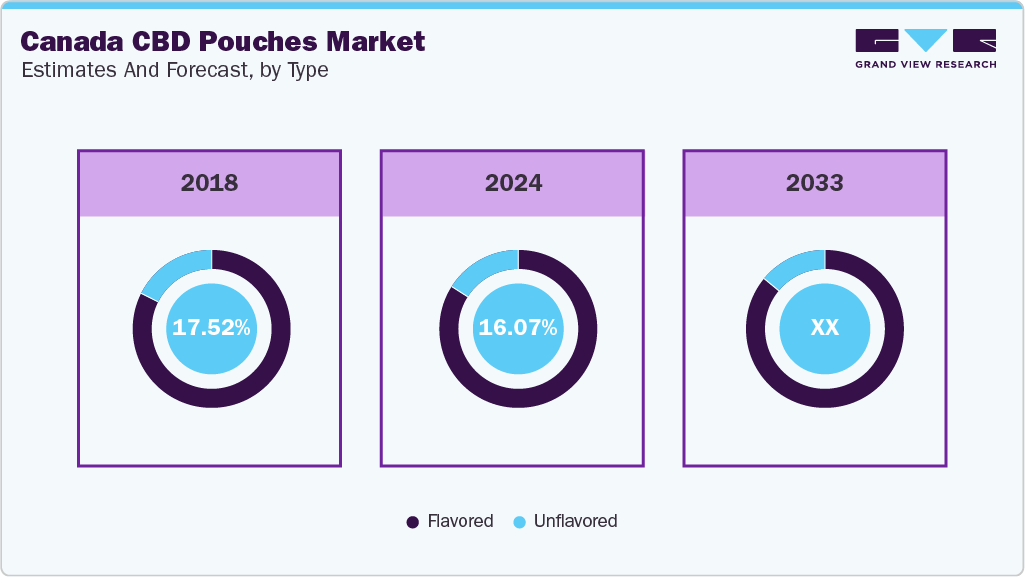

- By type, flavored CBD pouches dominated the market with a share of 83.93% in 2024.

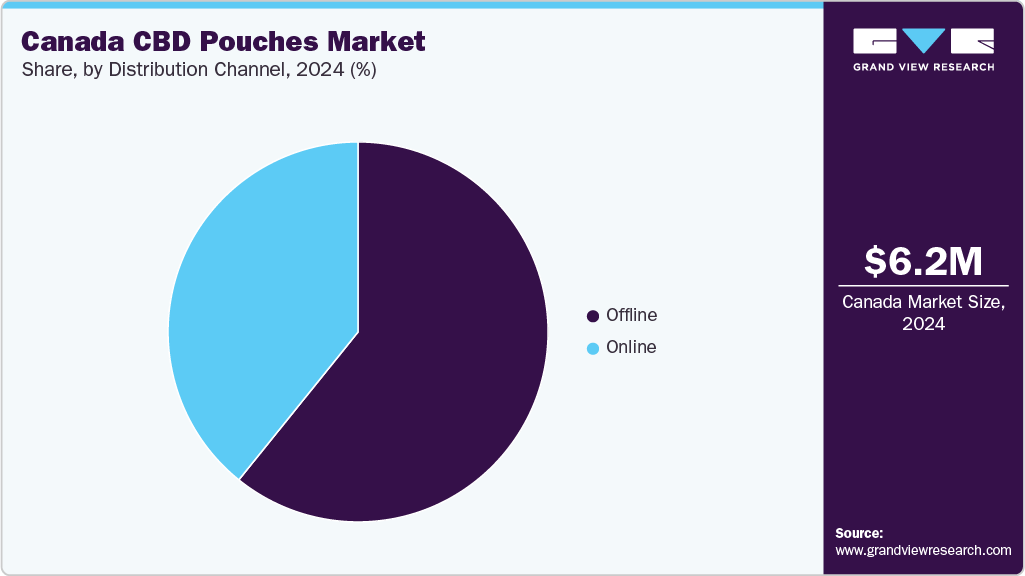

- By distribution channel, the offline sales held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.21 Million

- 2033 Projected Market Size: USD 37.19 Million

- CAGR (2025-2033): 20.8%

Increasing consumer awareness of CBD’s wellness benefits is also accelerating adoption across age groups. The expansion of the CBD pouches market in Canada is driven by a combination of favorable federal regulation, increasing consumer demand for alternative cannabis delivery systems, and advances in formulation technology. Unlike many international markets, Canada’s legalized cannabis framework under the Cannabis Act enables the controlled development, distribution, and sale of CBD-infused products, including pouches, through licensed producers and retailers. This regulatory clarity has allowed companies to invest confidently in innovation, leading to the emergence of fast-absorbing, water-soluble pouch formulations that cater to health-conscious consumers seeking discreet and non-inhalable formats. Additionally, the growing normalization of cannabis for wellness and functional use, particularly among urban and younger demographics, has broadened market participation and retail acceptance, positioning CBD pouches as a convenient, scalable, and compliant solution within the Canadian cannabis ecosystem.

Canada’s CBD pouches market is experiencing rapid growth largely due to the country’s clear and supportive regulatory environment. The legalization of cannabis at the federal level under the Cannabis Act has eliminated many of the legal ambiguities that still challenge other markets. This has enabled licensed producers to develop and market CBD products such as pouches through regulated retail channels, both in-store, online, fostering consumer trust and encouraging innovation.

Consumer preferences are also shifting in favor of discreet, smokeless, and convenient CBD delivery methods. CBD pouches appeal particularly to health-conscious individuals and new cannabis users who seek wellness benefits like stress relief or improved focus without the stigma or complexity of vaping or edibles. The portability and consistent dosing offered by pouches further enhance their attractiveness for everyday, on-the-go use.

In response to this demand, Canadian manufacturers are investing in advanced formulation technologies, including water-soluble CBD for faster absorption and higher bioavailability. Coupled with clean-label and flavor innovations, these developments are broadening the appeal of CBD pouches across diverse demographics. As wellness culture continues to gain momentum in Canada, the market is expected to grow steadily, driven by both consumer demand and institutional support.

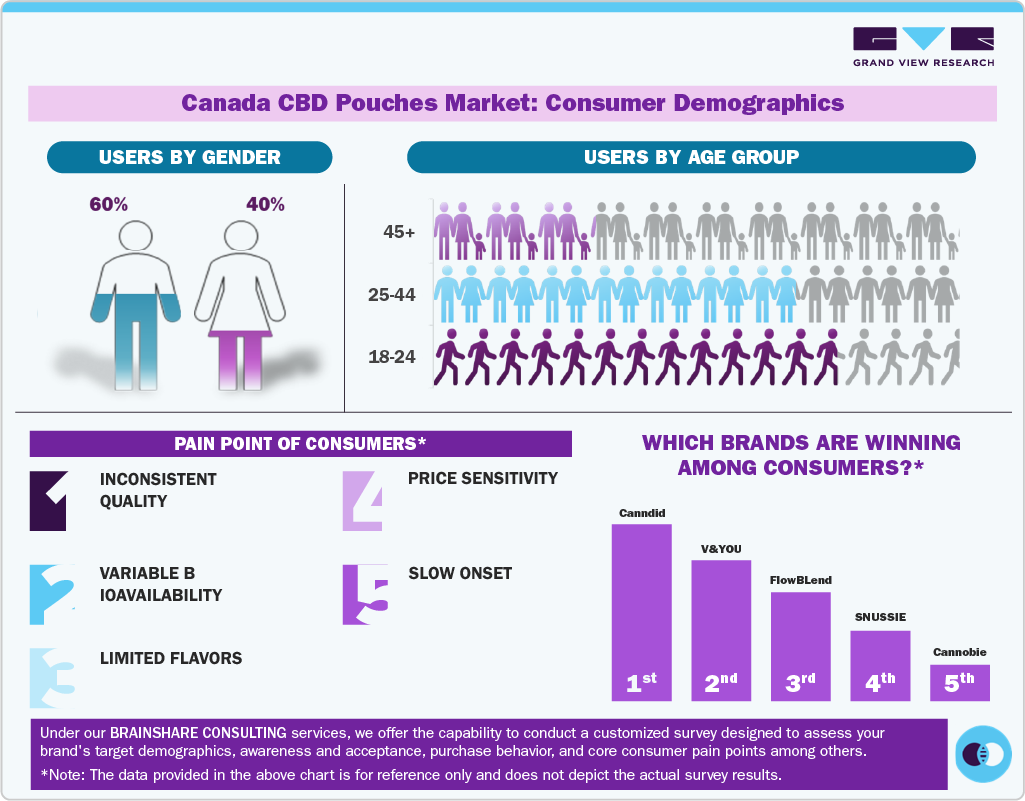

Consumer Insights for Canada CBD Pouches Market

In Canada, CBD pouch usage reflects a modest gender imbalance, with men representing a slightly larger share of regular users. This is influenced by higher overall cannabis familiarity among male consumers and greater openness to alternative delivery formats such as pouches. However, female participation is steadily increasing, particularly among wellness-focused consumers seeking discreet, non-inhalable options.

By age, the majority of CBD pouch users fall within the 18–49 demographic, driven by younger adults seeking stress relief, mood regulation, and functional wellness support. Usage declines in older age groups, though interest is slowly growing among adults aged 45 and above as they explore non-traditional methods for pain management and relaxation without smoking or vaping.

Consumers in Canada report several consistent pain points with CBD pouches. These include inconsistent product quality, lack of flavor variety, unclear labeling or dosage information, high pricing, and limited retail availability in certain provinces. These challenges impact trust and adoption, especially among first-time users and older demographics.

Among the brands resonating most with Canadian consumers are Canndid, FlowBlend, and SNUSSIE, which focus on clean-label ingredients, user-friendly formats, and accessible dosing. These companies are gaining visibility through both online and licensed in-store channels, offering flavor diversity, transparency, and improved formulation, helping them lead in a competitive and fast-evolving market.

Content Insights

CBD pouches with 10 mg -20 mg content accounted for a revenue share of 49.94% in 2024 as they offer a moderate and effective dose that appeals to both regular users and cautious newcomers. This range provides noticeable effects for stress relief or pain management without overwhelming the user. It also aligns with popular wellness use cases, making it a versatile option across demographics. The prevalence of this dosage reflects consumer demand for a reliable, single-serving format that fits into daily routines.

CBD pouches with up to 10 mg content are anticipated to witness a CAGR of 20.5% from 2025 to 2033. Lower-dose CBD pouches, particularly those with up to 10 mg of CBD, are gaining momentum due to their appeal among microdosers and health-conscious users. This segment is expected to grow rapidly as first-time users and older adults look for gentle, manageable entry points into CBD. These products are often marketed as calming or focus-enhancing tools, used throughout the day without sedating effects, contributing to their fast-growing appeal in wellness-focused communities.

Type Insights

Flavored CBD pouches held the largest share of 83.93% in 2024, as consumers continue to prefer pleasant-tasting, enjoyable products, especially those new to CBD. Popular flavor profiles such as mint, citrus, and berry help mask the natural bitterness of hemp extract, enhancing the overall user experience. Flavored offerings are more likely to be purchased as impulse buys in stores or added to online carts by those curious to try CBD without the strong herbal taste.

Unflavored CBD pouches are expected to grow at a CAGR of 18.9% from 2025 to 2033, as wellness-focused consumers increasingly seek natural, clean-label alternatives. These users often prioritize purity and minimal ingredients, preferring the unaltered hemp experience over artificially flavored versions. This growth reflects a broader trend in functional health products, where transparency and ingredient simplicity drive loyalty among more informed users.

Distribution Channel Insights

The sales of CBD pouches through offline channels accounted for a share of around 60.80% in 2024. Physical retail allows consumers to interact with knowledgeable staff, assess product legitimacy, and make more confident purchase decisions, especially important for newcomers or older users. Licensed cannabis stores, wellness retailers, and pharmacies provide a trusted environment, contributing to higher offline engagement despite rising online access.

Sales of CBD pouches through online channels are the fastest-growing segment, expected to grow at a CAGR of 21.4% from 2025 to 2033, driven by consumer demand for convenience, variety, and discreet purchasing. E-commerce allows for detailed product comparisons, access to lab results, and subscription services that support consistent use. As more licensed producers enhance their digital presence and provincial regulations ease, online platforms are expected to capture increasing market share, especially among younger, tech-savvy consumers.

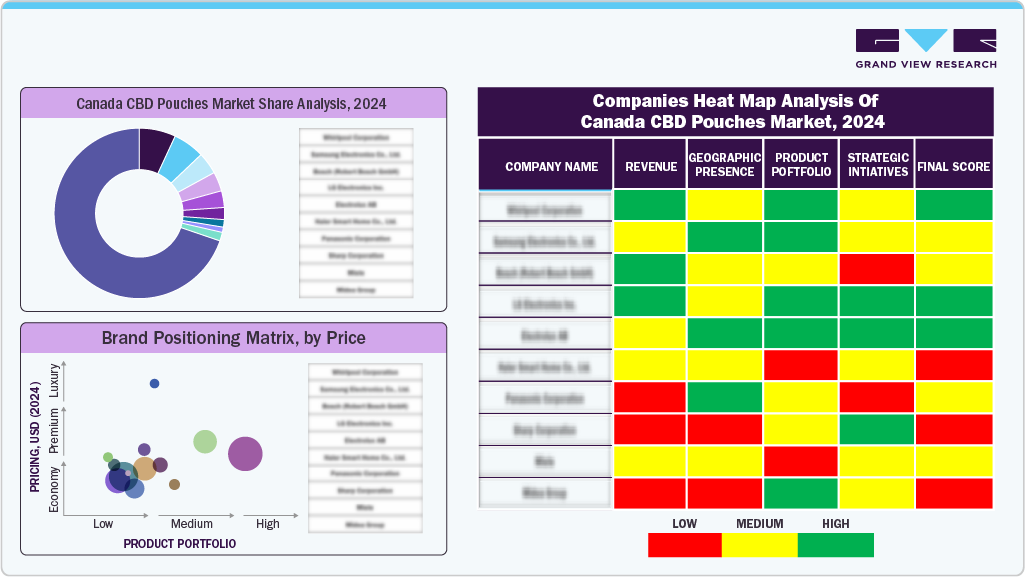

Key Canada CBD Pouches Companies Insights

Key players operating in the Canada CBD pouches market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Canada CBD Pouches Companies:

- Cannadips

- Jake's Mint Chew

- Vibe CBD+CBG

- FlowBlend

- Chill.com

- Metolius Hemp Company

- Canndid

- Chillbar

- V&YOU

- Nicopods ehf.

Recent Developments

-

In February 2023, Cannadips, a SpectrumLeaf brand renowned for its premium CBD snus products tailored for the European market, partnered with Haypp Group to develop the revolutionary Cannadips Terpene Pouch Collection, featured on Haypp’s online platform snusbolaget.se. The pouches leverage the unique qualities of plant-derived terpenes, condensed into convenient pouches. Free from tobacco, nicotine, CBD, and THC, these pouches offer an ideal solution for snus enthusiasts seeking a healthier option.

-

In January 2020, Cannadips CBD Kretek, a product from Cannadips, expanded its core CBD microdose collection with the introduction of Wintergreen and Mango flavors at the Tobacco Plus Expo (TPE), 2020. This expansion marked the brand's international debut, signifying a strategic move to broaden its market reach and offer new flavor options to consumers. The Kretek line aimed to capitalize on the growing interest in CBD products and the appeal of flavored options.

Canada CBD Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.19 million

Revenue Forecast in 2033

USD 37.19 million

Growth rate

CAGR of 20.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content, type, and distribution channel

Key companies profiled

Cannadips; Jake's Mint Chew; Vibe CBD+CBG; FlowBlend; Chill.com; Metolius Hemp Company; Canndid; Chillbar; V&YOU; Nicopods ehf.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada CBD Pouches Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Canada CBD pouches market report by content, type, and distribution channel.

-

Content Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 10 mg

-

10 mg - 20 mg

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The Canada CBD Pouches market size was estimated at USD 6.21 million in 2024 and is expected to reach USD 8.19 million in 2025.

b. The Canada CBD Pouches market is expected to grow at a compound annual growth rate (CAGR) of 20.8% from 2025 to 2033 to reach USD 37.19 million by 2033.

b. CBD pouches with 10 mg -20 mg content accounted for a revenue share of 49.94% in 2024 in Canada, as they offer a moderate and effective dose that appeals to both regular users and cautious newcomers. This range provides noticeable effects for stress relief or pain management without overwhelming the user. It also aligns with popular wellness use cases, making it a versatile option across demographics.

b. Some key players operating in the Canada CBD Pouches market include Cannadips, Jake's Mint Chew, Vibe CBD+CBG, FlowBlend, Chill.com, Metolius Hemp Company, Canndid, Chillbar, V&YOU, Nicopods ehf.

b. The market is growing rapidly due to rising demand for discreet, smoke-free cannabis alternatives and expanding retail availability post-legalization. Increasing consumer awareness of CBD’s wellness benefits is also accelerating adoption across age groups.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.