- Home

- »

- Medical Devices

- »

-

Canada Corporate Wellness Market Size & Share ReportGVR Report cover

![Canada Corporate Wellness Market Size, Share & Trends Report]()

Canada Corporate Wellness Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Health Risk Assessment, Fitness), By End-use, By Category, By Delivery Model (Onsite, Offsite), And Segment Forecasts

- Report ID: GVR-4-68039-249-7

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

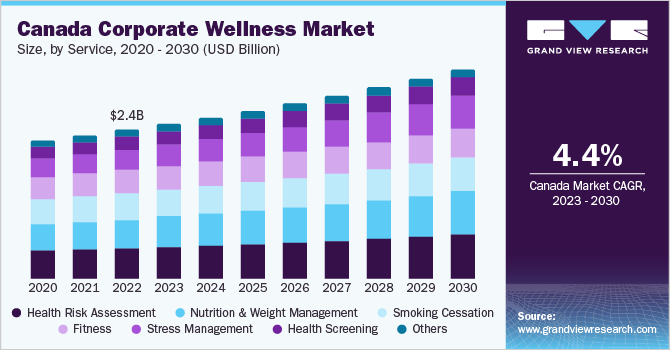

The Canada corporate wellness market size was valued at USD 2.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4.42% from 2023 to 2030. The rising awareness regarding the available employee wellbeing services and the increasing onset of chronic diseases are the factors expected to drive the market growth. As per the study by the Conference Board of Canada, workplace wellness programs can lead to a return on investment of up to USD 2.62 for each dollar spent. Furthermore, as per the survey by the Mental Health Commission of Canada, around 20% of Canadian employees report suffering mental health problems in the workplace. This emphasizes the importance of focusing on mental health and supporting the employees. Chronic conditions, such as cancer, asthma, diabetes, and hypertension, are also responsible for an increase in absenteeism and loss of productivity.

Health and wellness services for employees are beneficial for organizations. According to a study published in the Journal of Occupational and Environmental Medicine, in March 2018, considerable improvements were observed after one year of implementing corporate well-being services in reducing fatigue (6 to 11%), high emotional stress (15 to 21%), and poor sleep quality (28 to 33%) among employees in Canada. Growing awareness regarding high return-on-investment on corporate health services expenditure on employees is expected to boost the adoption of these services at the workplace by employers in Canada.

The Canadian government and non-profit organizations, such as the Mental Health Commission of Canada (MHCC), are supporting initiatives to create and maintain mentally healthy workplaces. However, according to the Canadian Mental Health Association, 42% of business leaders are interested in taking initiatives for mental health at the workplace but have not acted due to a lack of time, resources, or knowledge. To address this, key companies and the government are collaborating to provide tools and information, such as the MindsMatter tool developed by CivicAction, which has already benefited 3.1 million employees in over 1500 organizations. The MHCC now manages this tool to support workplace mental health.

The pandemic negatively impacted the mental health of employees all around the world. According to a Teladoc survey conducted in 2020, 50% of Canadian employees reported that COVID-19 has had a detrimental effect on their mental health. Employees reporting excellent or very good mental health have decreased significantly in comparison to pre-pandemic levels. Hence, many companies adopted strategies to promote mental health and reduce stress among employees.

Service Insights

Based on services, the market is segmented into health risk assessment, fitness, smoking cessation, health screening, nutrition & weight management, stress management, and others. The health risk assessment segment dominated the market in 2022 with a revenue share of 20.1% owing to the high adoption of health risk assessment services by employers. Health Risk Assessment (HRA) analyzes information, such as height, weight, level of physical activity, smoking habits, and stress levels, of the employees to derive the risk factors affecting employee health. However, various additional factors need to be considered before performing an HRA, such as the quality of health information, the impact of risk factors on employee health, and the usability of the information.

The stress management segment is likely to witness the fastest CAGR during the forecast period. The rising adoption of remote patient monitoring devices is expected to drive the growth of the fitness segment. High incidences of smoking as well as the rising awareness about the adverse effects are major factors driving the growth of the smoking cessation segment. Health screening involves checking vital body stats such as blood sugar levels, cholesterol, and urine among others to ensure normal body functioning. It has been found that many diseases are preventable if detected at the right time. Hence, if organizations make investments in health screenings, diseases will be detected earlier and can be prevented. Thus, investing in health screening can help save costs on employee healthcare plans.

Category Insights

In terms of category, the market is segmented into fitness & nutrition consultants, psychological therapists, and organizations/employers. The organizations/employers segment held the maximum market share of 49.8% in 2022. These service providers offer services, such as physician and psychologist consultations, health screening, and education sessions for large- and small-scale corporations. A rise in the number of personalized health programs along with the expansion of digital wellness and well-being tools is expected to drive the segment growth. The fitness & nutrition consultants segment is anticipated to witness the fastest CAGR over the forecast years due to the increased availability of fitness services, such as yoga, massage, and nutrition consultation.

Organizations hire fitness coaches for their employees, where one-on-one coaching is offered. Some employers also provide various activities and gym services. Employers often provide their employees with meditation and yoga sessions for stress release as stress can potentially impact employee performance, thereby affecting the business. Thus, organizations provide art therapy, which is a unique technique for releasing stress. It is considered a form of expressive psychotherapy that uses art to improve a person’s emotional, physical, and mental well-being. Professionals also use this therapy for people suffering from emotional and mental disorders. The increasing demand for such therapies is propelling the growth of the psychological therapist segment.

Delivery Model Insights

Based on delivery model, the onsite segment dominated the market in 2022 and accounted for a maximum revenue share of 55.0%. Service providers are taking initiatives to widen the scope of onsite services made available to the employees, fueling the market growth. Onsite well-being programs generally consist of activities, such as health screening/biometric screening, lectures, and meditation sessions, among others. A few service providers have also integrated services, such as an onsite massage along with the required spa equipment in the office, reducing the wastage of employees’ time and money on spa & fitness centers.

Offsite programs include one-to-one interaction at different location that helps improve employee health. Health services are constantly upgraded with the adoption of advanced technologies. This, coupled with increased adoption of well-being services by employees, is expected to drive the growth of the offsite segment over the forecast period. Demand for offsite services witnessed high growth during the pandemic when the majority of employees were working from home. Sessions on mental health and nutrition, training, and consultations were done online during the pandemic, which boosted the segment’s growth.

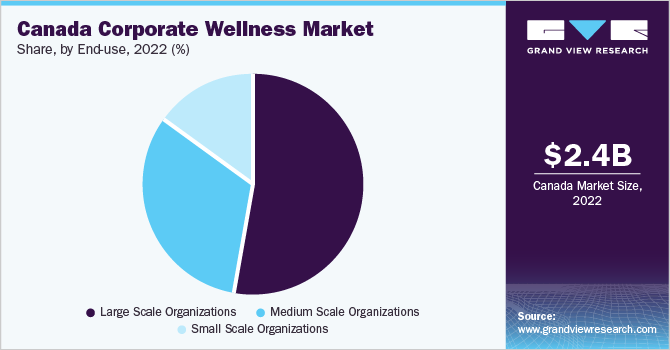

End-use Insights

In terms of end-use, the market is segmented into large-scale organizations, medium-scale organizations, and small-scale organizations. The large-scale organizations segment dominated the market with a share of 53.1% in 2022. Large-scale organizations can readily invest in wellness services and can make sufficient space for service providers for onsite wellness services. Large-scale organizations offer various services on their campuses, such as therapists, chiropractors, and physicians. This eventually saves employees time and also contributes to their productivity.

The medium-scale organizations, on the other hand, is expected to register the fastest growth rate during the forecast period. This growth can be attributed to the quick adoption of corporate wellness services in medium-scale companies. These organizations are generally at a growing stage, which leads to the quick adoption of corporate wellness programs. Moreover, these require employee-friendly policies to engage and retain their employees, which, in turn, reduces the cost of attrition. In addition, healthier employees lead to fewer healthcare premiums, which bodes well for the organization.

Key Companies & Market Share Insights

The market is characterized by increased awareness regarding the benefits of corporate wellness and initiatives, such as the launch of new services, mergers & acquisitions, and partnerships, by service providers to offer improved services and increase their market presence. In July 2022, Sun Life's Group Benefits announced the launch of a new Employee Assistance Program (EAP) for its clients in Canada. The EAP platform is available on Lumino Health Virtual Care. In October 2021, a new app for workplace mental health app named iHealthOX was launched in Canada. Some prominent players in the Canada corporate wellness market include:

-

Curtis Health

-

Bridges Health

-

Pamela Dempster Wellness Consulting

-

Employee Wellness Solutions Network, Inc.

-

INLIV

-

Medcan

-

Medpoint Health Care Centre

-

Preventacare

-

Well Street

-

ComPsych Corporation

Canada Corporate Wellness Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.5 billion

Revenue forecast in 2030

USD 3.4 billion

Growth rate

CAGR of 4.42% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, category, delivery model

Country scope

Canada

Key companies profiled

Curtis Health; Bridges Health; Pamela Dempster Wellness Consulting; Employee Wellness Solutions Network, Inc.; INLIV; Medcan; Medpoint Health Care Centre; Preventacare; Well Street; ComPsych Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Corporate Wellness Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada corporate wellness market report based on service, end-use, category, and delivery model:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Health Risk Assessment

-

Fitness

-

Smoking Cessation

-

Health Screening

-

Nutrition & Weight Management

-

Stress Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Scale Organizations

-

Medium Scale Organizations

-

Large Scale Organizations

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness & Nutrition Consultants

-

Psychological Therapists

-

Organizations/Employers

-

-

Delivery Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Onsite

-

Offsite

-

Frequently Asked Questions About This Report

b. The Canada corporate wellness market size was estimated at USD 2.4 billion in 2022 and is expected to reach USD 2.5 billion in 2023.

b. The Canada corporate wellness market is expected to grow at a compound annual growth rate of 4.42% from 2023 to 2030 to reach USD 3.4 billion by 2030.

b. The health risk assessment segment dominated the Canada corporate wellness market with the highest share in 2022. This is attributable to the high adoption of health risk assessment services by employers while offering employee wellness services.

b. Some key players operating in the Canada corporate wellness market include Curtis Health, Bridges Health, Pamela Dempster Wellness Consulting, Employee Wellness Solutions Network, Inc., INLIV, Medcan, Medpoint Health Care Centre, Preventacare, Well Street, and ComPsych Corporation.

b. Key factors that are driving the Canada corporate wellness market growth include the increase in awareness regarding available employee wellness services and a reduction in overall healthcare costs of the employee.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.