- Home

- »

- Medical Devices

- »

-

Corporate Wellness Market Size, Industry Report, 2030GVR Report cover

![Corporate Wellness Market Size, Share & Trends Report]()

Corporate Wellness Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Health Risk Assessment, Fitness), By End Use, By Category, By Delivery Model (Onsite, Offsite), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-395-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Corporate Wellness Market Summary

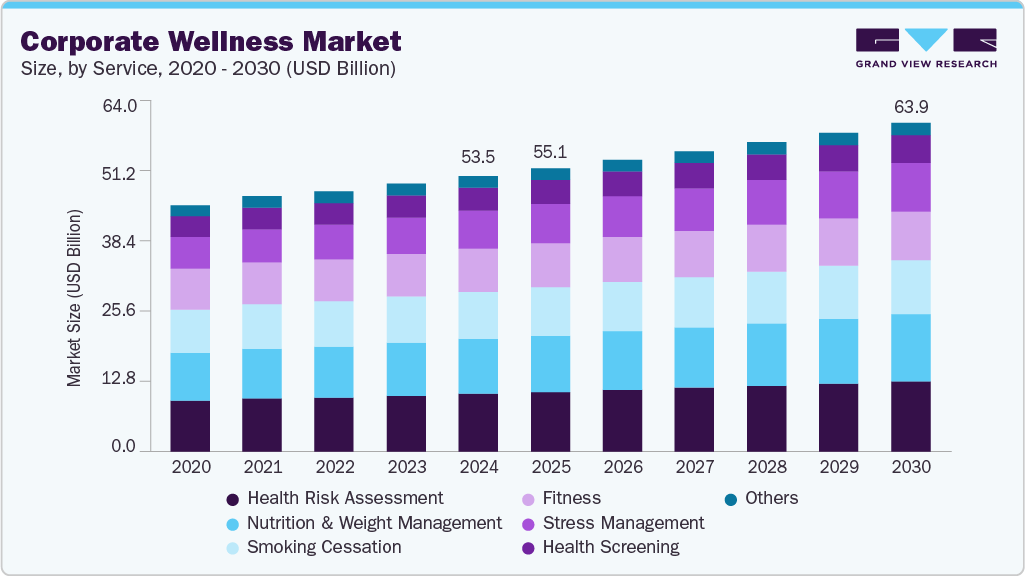

The global corporate wellness market size was estimated at USD 53.54 billion in 2024 and is projected to reach USD 63.90 billion by 2030, growing at a CAGR of 3.01% from 2025 to 2030. The rising awareness regarding employee health and well-being is driving market growth.

Key Market Trends & Insights

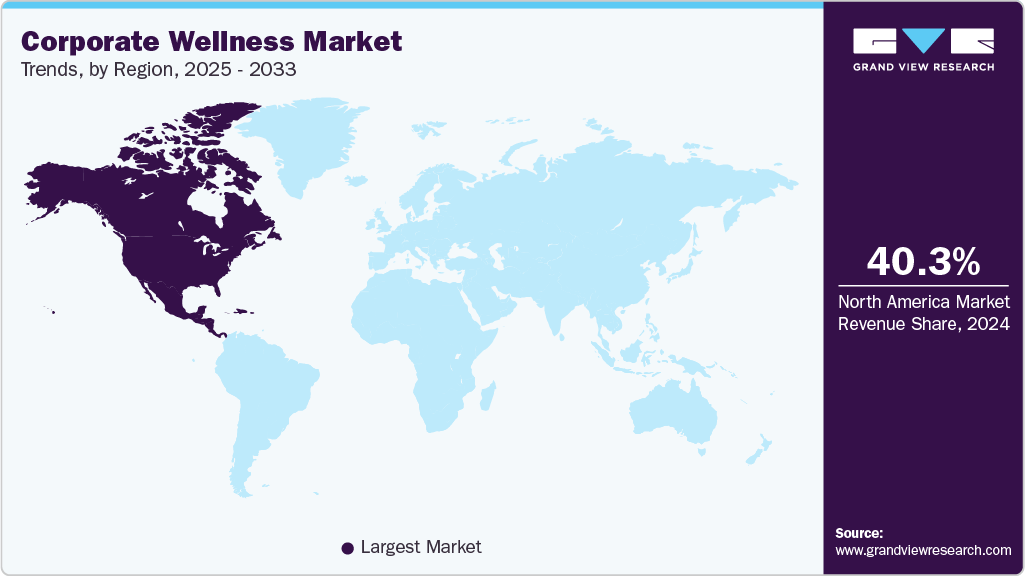

- North America dominated the global corporate market with the largest revenue share of 40.30% in 2024.

- The corporate wellness market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By service, the health risk assessment segment led the market with the largest revenue share of 20.94% in 2024.

- By end use, the large-scale segment led the market with the largest revenue share of 53.27% in 2024.

- By category, the organizations/ employers segment led the market with the largest revenue share of 49.61% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 53.54 Billion

- 2030 Projected Market Size: USD 63.90 Billion

- CAGR (2025-2030): 3.01%

- North America: Largest market in 2024

Hence, numerous firms and enterprises across diverse industries are establishing wellness programs for their employees, propelling the demand. In addition, workplace wellness initiatives are designed to aid employees in maintaining good health. These initiatives assist businesses in increasing productivity while simultaneously lowering overall operating costs. Moreover, these programs promote a better lifestyle among employees.

In the U.S., physicians, nurses, technicians, and other healthcare staff charge higher fees than professionals in other countries, such as the UK, Canada, and Germany, increasing the overall cost of treatment. Moreover, employers pay a substantial healthcare premium to insurance providers, especially in a large-scale organization. A higher number of unhealthy employees increases the premium cost, boosting the financial burden of an organization. Corporate wellness programs are considered preventative measures as they help inculcate healthy habits and reduce absenteeism of employees due to health issues. Thus, employers readily invest in corporate wellness programs to reduce healthcare costs and increase productivity at work.

In addition, corporate wellness programs include benefits, programs, and policies, addressing various risk factors and conditions and influencing employees & the organization. As per the National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP) in the U.S., corporate programs promote health and well-being, along with disease prevention plans, which are expected to influence more than 159 million employees, significantly reducing the cost of healthcare. According to the International Foundation of Employee Benefits Plans, in the 2024 plan year, the medical plan cost is expected to increase by around 7%. Hence, to reduce such employee expenses, the companies are shifting toward corporate wellness programs and solutions, which are expected to contribute to the market growth over the forecast period.

In addition, market growth is being driven by an increase in the prevalence and early onset of chronic diseases, as well as a decrease in employee healthcare costs. Today's work culture means that the majority of individuals do not have enough time to engage in mental and physical activities after work or during their free time, resulting in health problems. Globally, chronic diseases are a significant threat, since the prevalence of many of these disorders continues to rise. For instance, the World Health Organization (WHO) estimates that cancer will claim around 15.3 million lives by 2040.

Furthermore, according to the American Cancer Society's 2024 statistics, in 2022, approximately 20 million new cancer cases were diagnosed globally, and 9.7 million people succumbed to the disease. By 2050, the number of new cancer cases is expected to rise to 35 million. Chronic conditions such as heart disease, obesity, and diabetes have become widespread in many countries, particularly in industrialized nations, due to unhealthy and sedentary lifestyles. Consequently, the prevalence of these diseases continues to rise. However, they are largely preventable. This has led to an increasing demand for comprehensive workplace wellness programs that educate employees on the importance of cultivating healthy habits and the benefits of staying committed to fitness goals.

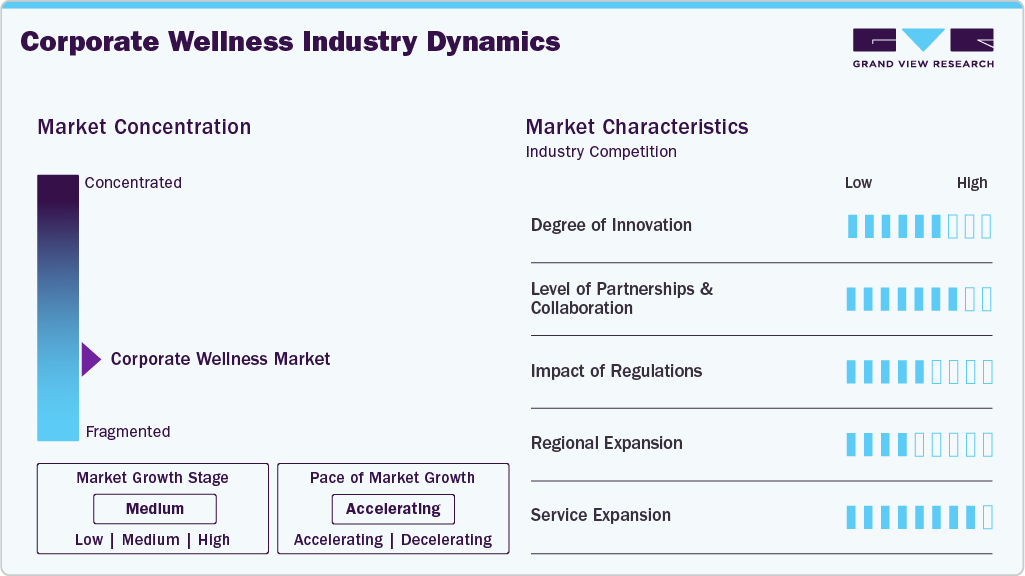

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including the impact of regulations, degree of innovation, industry competition, regional expansion, and level of partnerships & collaboration activities. The market is fragmented, with the presence of many local providers in the market. Furthermore, the degree of innovation is high, and the level of M&A activities is moderate to high. The impact of regulations on the market is high, and service expansion is also high while regional expansion is moderate.

The degree of innovation is high in the corporate wellness industry. Companies are adopting wearable technology to monitor employee health metrics, encouraging physical activity and health awareness. These devices provide real-time data that can be used to tailor wellness programs to individual needs. In addition, artificial intelligence is being leveraged to create personalized wellness programs. These AI-driven solutions can analyze data to identify health risks and suggest tailored interventions, thus enhancing employee engagement and health outcomes. For instance, in January 2022, Headspace Inc. announced Sayana, an AI-powered mental health company.

The level of Mergers and Acquisitions (M&A) activity in the corporate wellness industry has been steadily increasing in recent years. This rise in M&A is driven by several factors related to the growing demand for workplace wellness solutions, advancements in technology, and the need for companies to offer more comprehensive and integrated services to improve employee health and productivity. For instance, in August 2023, WebMD Health Services, a business segment of WebMD LLC, acquired Limeade. Through this acquisition, both companies can offer a more comprehensive well-being solution that addresses all aspects of health, from physical activity and nutrition to mental health & financial well-being.

Corporate wellness activities are health-related and need to adhere to regulations. Wellness programs are regulated via the Internal Revenue Code, the Americans with Disabilities Act (ADA), and the Health Insurance Portability and Accountability Act (HIPAA). HIPAA prohibits an employer from charging a higher premium to sick employees. Regulations also provide tax exemption for the expenditure on employee wellness programs. For instance, all wellness programs are not eligible for tax exemption, according to the Internal Revenue Service (IRS). A health service may be eligible for tax exemption if found as a valid medical expense under Code Section 213(d). These regulations provide a structured framework for employee wellness programs and are expected to have a positive impact on their adoption.

In the global corporate wellness industry, the presence of service substitutes is high. While various corporate wellness that cater to specific needs, such as period tracking, pregnancy monitoring, and overall wellness, are available, the level of direct substitutes that offer identical features and functionalities may not be as high as in some other industries.

The corporate wellness industry is experiencing significant regional expansion, driven by various factors including increased health awareness, rising healthcare costs, and a growing emphasis on employee well-being. For instance, in February 2023, WebMD Health Services, a division of WebMD LLC, launched an enhanced WebMD ONE well-being program, extending its reach to encompass over 190 countries spanning Europe, Asia, and Latin America. This latest expansion incorporates human-translated editions in languages such as Arabic, Hindi, Thai, Vietnamese, Korean, Slovakian, and more.

Service Insights

The health risk assessment segment led the market with the largest revenue share of 20.94% in 2024. HRA is the first and most important component of any wellness program as it involves assessing health-related information, which helps in designing the wellness programs. HRA increases the productivity of the employees by checking their health status, in turn saving huge costs for the employers. For instance, in May 2019, Moda Health, a health plan provider based in Oregon, replaced its manual HRA process with Wellsource’s NCQA-certified HRA solution. The solution offers real-time health data reporting & results, focusing on the emotional and mental well-being of the employees.

The stress management segment is anticipated to grow at the fastest CAGR over the forecast period. Stress management is an important service of the wellness portfolio as it directly contributes to promoting employees' mental health. The pandemic has significantly contributed to stress among employees. Moreover, younger individuals are more open to discussing issues related to their mental health & consider the availability of mental health benefits as a factor when deciding on the workplace. Such factors are increasing the demand for stress management solutions in the market.

End-Use Insights

The large-scale segment led the market with the largest revenue share of 53.27% in 2024. Large-scale organizations need corporate wellness programs pertaining to the huge workforce. According to the 2024 Employer Health Benefits Survey, around 56% of the large firms offer Health Risk Assessments (HRAs), and around 44% offer biometric screening to employees as a part of health promotion & wellness programs. Many large firms offer corporate wellness programs to their employees to promote balance in work & life. For instance, Google provides various services on its campus, such as physicians, therapists, chiropractors, and masseuse. This saves its employees time from going outside and making an appointment, which also increases productivity. It also offers courses like guitar lessons, cooking classes, and coding degrees. Employees are also provided with community bikes and free entry to fitness classes & gyms.

The medium scale organizations segment is expected to grow at the fastest CAGR over the forecast period. One of the medium-scale companies, Motley Fool, offers fun wellness programs for its employees, such as spinning classes & boot camps. For instance, they have named April as Active April, which aims at holding one active meeting a day. In these meetings, members are allowed to perform pushups and walk around the office space, which keeps them engaged & stress-free. In addition, they encourage employees to participate in races of several kinds and pay 50% of the total fee. The company has 86% wellness engagement.

Category Insights

The organizations/ employers segment led the market with the largest revenue share of 49.61% in 2024. Corporate wellness providers incorporate components such as nutrition, exercise, medication, social connectedness, behavioral health, and character strength, in their wellness service offerings. The different programs deliver diversified solutions along with a holistic view of healthcare. The rise in personalized wellness programs, along with the expansion of wellbeing and digital wellness tools is anticipated to drive the organization category of the market.

The fitness & nutrition consultants segment is expected to grow at the fastest CAGR over the forecast period. Fitbit’s employees get hefty discounts on their products. All its products-both existing & new -are available at a 50% discount for them. In addition, its employees are offered health coaches and other health benefits. They are also provided with doctors, and the company bears their consultation fees. In addition, it provides flexible working hours and plenty of vacations. This expected to drive the segment growth during the forecast period.

Delivery Model Insights

The onsite segment led the market with the largest revenue share of 55.84% in 2024. Onsite wellness programs usually include health screenings, lectures, meditation sessions, and other activities. Some providers, such as Marino Wellness, even offer an onsite massage service with the necessary spa equipment, eliminating the need for employees to waste their time & money on outside spas and fitness centers. The meditation and yoga sessions provided in the office are designed to be short, preventing any loss of productivity for the employees.

The offsite segment is expected to grow at the fastest CAGR over the forecast period. Offsite wellness programs include one-to-one interaction to improve employee health at different locations. The adoption of advanced technology constantly upgrades health services. For instance, in January 2020, Virgin Pulse, via the acquisition of a digital therapeutics’ provider, Blue Mesa Health, Inc., plans to leverage its Diabetes Prevention Program to promote diabetes prevention.

Regional Insights

North America dominated the global corporate market with the largest revenue share of 40.30% in 2024 and is projected to maintain its dominant position during the forecast period. Several enterprises and businesses across diverse industries are increasingly adopting health initiatives for their employees, which is anticipated to drive the demand and contributing to the growth of the market in the region.

U.S. Corporate Wellness Market Trends

The corporate wellness market in the U.S. accounted for the largest market revenue share in North America in 2024. In the U.S., the market is expected to grow due to technological advancements, the adoption of software platforms & wearable devices, and the growing awareness regarding corporate wellness programs among employees. This is likely to drive corporate wellness programs as they can be considered a way to cut healthcare costs. In March 2022, medical care benefits were available to around 70% of private industry employees, with 47% of these workers actively enrolled in the medical care plans provided by their employers, as reported by the U.S. Bureau of Labor Statistics. Similarly, in March 2022, employer-sponsored medical plans were accessible to 26% of private industry employees with average wages in the lowest 10%, whereas 96% of workers with average wages in the highest 10% had access to these plans.

The Canada corporate wellness market is expected to grow at the fastest CAGR during the forecast period, due to the rising uptake of technology-driven corporate wellness solutions, the substantial burden of mental health in organizations, and the surging adoption of corporate wellness programs by employers. Moreover, the rising mental stress at the workplace and the increasing onset of chronic diseases are some of the factors expected to drive market growth. According to benefitscanada.com, in April 2023, around 71% of the employees in Canada suffer from mental health problems at the workplace. This highlights the necessity of focusing on mental health and supporting the employees.

Europe Corporate Wellness Market Trends

The corporate wellness market in Europe is expected to grow at a moderate CAGR during the forecast period, owing to the European employers are planning to mandate wellness programs in their respective organizations. Employers are also providing flexible working hours and the option to work from home. Implementation of these programs has led to reduction in attrition rates and increase in employee engagement.

The UK corporate wellness market is growing rapidly. In the UK, the many companies offer employees with Private Medical Insurance (PMI), which covers several unexpected short-term diseases and assists employees by providing them with access to private hospitals and healthcare centers. This is generally implemented to reduce absenteeism and healthcare costs. However, some organizations offer a health cash plan. This cost-effective insurance plan reimburses partial or full amount to the employees.

The corporate wellness market in Spain is shaped by specific regulations and trends. In Spain, a smaller number of companies offer comprehensive corporate wellness programs. However, the country has a high penetration rate of smartphone apps and a high adoption rate of digital propositions, proving future potential in the corporate wellness industry. ACCIONA is an organization based in Spain, involved in the development of renewable energy and infrastructure. In the field of workplace preventive care, the company, in collaboration with Spain's National Cardiovascular Research Center (CNIC), is conducting an epidemiological study to discover factors that enhance workplace wellness. In addition, the company set up a physiotherapy service, at various office locations across Spain.

Asia Pacific Corporate Wellness Market Trends

The corporate wellness market in Asia-Pacific is expected to grow at a significant CAGR during the forecast period, mainly due to increasing awareness. The acceptance rate has increased in China as organizations realize the importance of corporate wellness programs. India-being one of the fastest developing countries-seeks help from wellness providers to increase productivity and employee engagement.

The Japan corporate wellness market is also following the trend of corporate wellness programs. They are introducing the programs for their corporate image and management strategies. Employers are putting in efforts to improve employee health by promoting wellness tourism. They send their employees to health resorts over the country and train them in beneficial exercises that help improve their daily lives. A Tokyo-based company distributed wearables to those employees who were at a higher risk of developing lifestyle-based diseases. This anticipated to drive the market growth during the forecast period.

Latin America Corporate Wellness Market Trends

The corporate wellness market in Latin America is expected to grow at a rapid CAGR during the forecast period. In Latin America, Brazil and Mexico are major countries contributing to the market growth. Rapid economic growth in these countries is one of the key factors propelling market growth during the forecast period. Moreover, the increasing adoption of corporate wellness programs by companies fueled the market growth in the region. In addition, the region’s large employee population is expected to drive the market.

The Brazil corporate wellness market is experiencing significant growth as companies increasingly recognize the value of investing in employee well-being to enhance productivity and reduce healthcare costs. This trend is driven by a rising awareness of the importance of preventive health measures and a strong focus on mental health support, particularly in the wake of the COVID-19 pandemic. Companies are adopting comprehensive wellness programs that include physical fitness initiatives, nutritional guidance, mental health counseling, stress management workshops, and hybrid work arrangements.

Middle East & Africa Corporate Wellness Market Trends

The corporate wellness market in MEA is expected to witness at a lucrative CAGR during the forecast period. The growth in this region is expected to be static as compared to the other regions. This is mainly due to lack of awareness about these programs. In addition, in countries such as the UAE, acceptance is low and skepticism is high, further blocking the growth of the market. However, in countries such as South Africa, the South African Board for People Practices (SABPP) implemented few wellness laws for employees.

The South Africa corporate wellness market plays a significant role in shaping the market. The main roles of the SABPP are transformation, sourcing, training, and retention of talent. It also promotes harmonious relations at work. An employee wellness strategy was formulated by a group of HR managers in the country by following the SABPP guidelines. Most of the wellness programs curated by companies mainly target physical and mental wellness only. In these wellness programs, health data of the employees is collected and assessed, and probable risks are calculated at regular intervals. This is mainly used to study the effectiveness of these wellness programs.

Key Corporate Wellness Company Insights

The market is characterized by the increasing focus of companies on expansion to include in-house corporate wellness services. In the U.S., there are more than 550 organizations offering employee health programs. Market players are focusing on expanding their market presence through investment activities, mergers, and acquisitions, in order to accommodate and cater to larger groups of employees. Some of the emerging players includes Headspace Health, Wellness Corporate Solutions (WCS), Limeade, and Gympass.

Key Corporate Wellness Companies:

The following are the leading companies in the global corporate wellness market. These companies collectively hold the largest market share and dictate industry trends.

- ComPsych

- Wellness Corporate Solutions

- Virgin Pulse

- EXOS

- Marino Wellness

- Privia Health

- Vitality

- Wellsource, Inc.

- Central Corporate Wellness

- Truworth Wellness

- SOL Wellness

- Wildflower Health

Recent Developments

-

In August 2024, Alight launched Alight Worklife, its employee experience platform. It includes several enhancements and new features designed to help employees improve their overall well-being.

-

In April 2023, Alight expanded its partnership with Workday, Inc. Through this partnership, the company delivers a global, unified HCM and payroll experience. The partnership combined Workday's HCM platform with Alight's global payroll expertise to provide organizations with a single solution for managing their workforce and paying their employees.

-

In February 2023, Limeade announced a new integration with Microsoft Teams to allow employees to engage with their well-being program seamlessly within Microsoft Teams.

-

In December 2022, Wellable, a wellness technology and services provider, acquired the assets of DailyEndorphin. The acquisition was expected to benefit DailyEndorphin's customers with access to Wellable's modern technology and extensive challenge options.

Corporate Wellness Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 55.10 billion

Revenue forecast in 2030

USD 63.90 billion

Growth rate

CAGR of 3.01% from 2025 to 2030

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, category, delivery model, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Poland; Netherlands; Switzerland; Austria; Norway; Sweden; Denmark; China; Japan; India; South Korea; Thailand; Australia; Singapore; Taiwan; Russia; New Zealand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ComPsych; Wellness Corporate Solutions; Virgin Pulse; EXOS; Marino Wellness; Privia Health; Vitality; Wellsource, Inc.; Central Corporate Wellness; Truworth Wellness; SOL Wellness; Wildflower Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corporate Wellness Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the global corporate wellness market based on service, end-use, category, delivery model, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2030)

-

Health Risk Assessment

-

Fitness

-

Smoking Cessation

-

Health Screening

-

Nutrition & Weight Management

-

Stress Management

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2021 - 2030)

-

Small Scale Organizations

-

Medium Scale Organizations

-

Large Scale Organizations

-

-

Category Outlook (Revenue, USD Million, 2021 - 2030)

-

Fitness & Nutrition Consultants

-

Psychological Therapists

-

Organizations/Employers

-

-

Delivery Model Outlook (Revenue, USD Million, 2021 - 2030)

-

Onsite

-

Offsite

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

Switzerland

-

Austria

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Australia

-

Singapore

-

Taiwan

-

Russia

-

New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

South Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.