Canada Draught Beer Market Summary

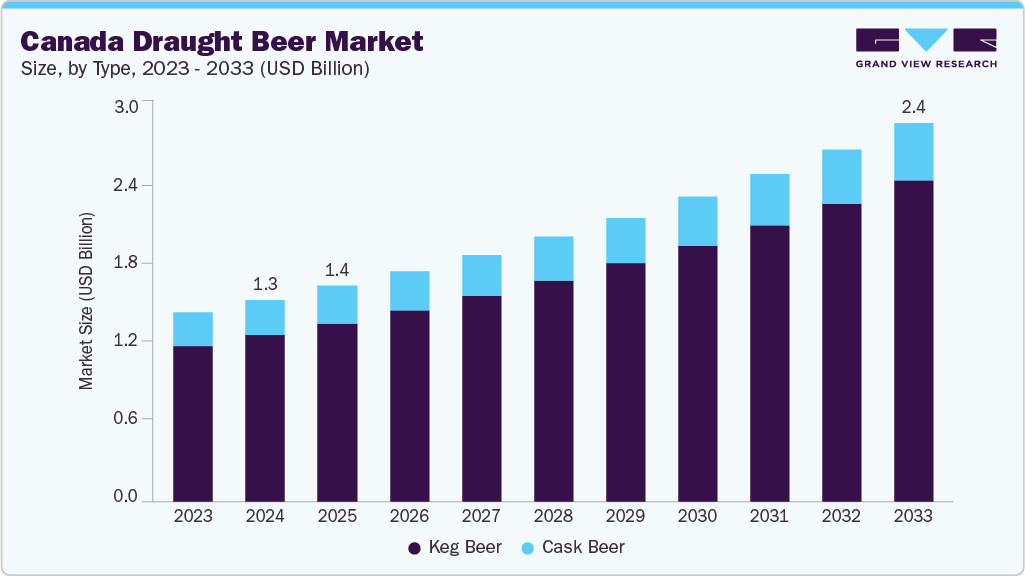

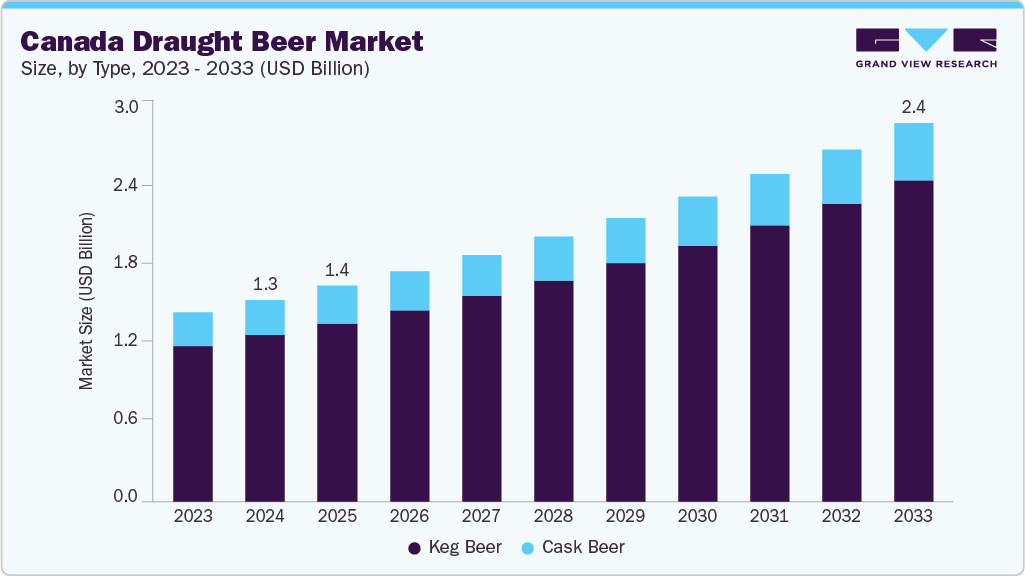

The Canada draught beer market size was estimated at USD 1.27 billion in 2024 and is projected to reach USD 2.38 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The market is witnessing strong demand as consumers increasingly seek craft varieties, premium offerings, and locally brewed options, driven by a desire for diverse and authentic tasting experiences.

Key Market Trends & Insights

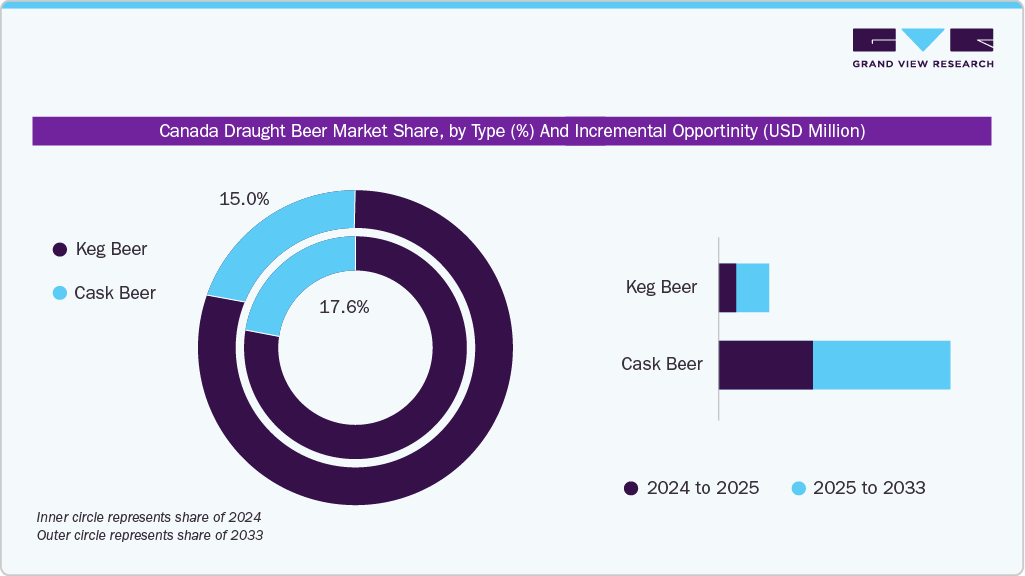

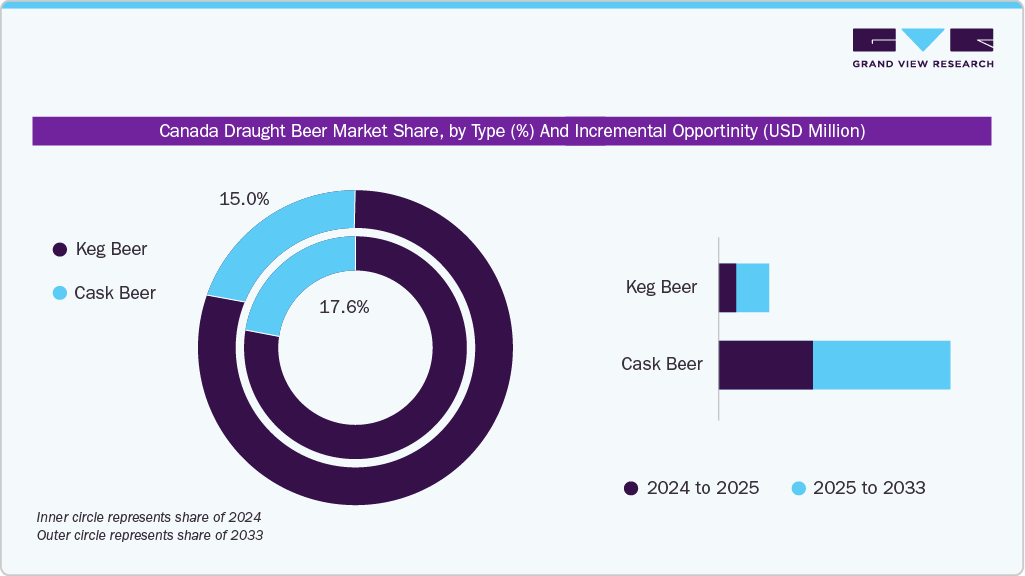

- Based on type, the keg beer segment held the largest market share of 82.4% in 2024.

- Based on category, the regular category segment held the largest market share of 60.5% in 2024.

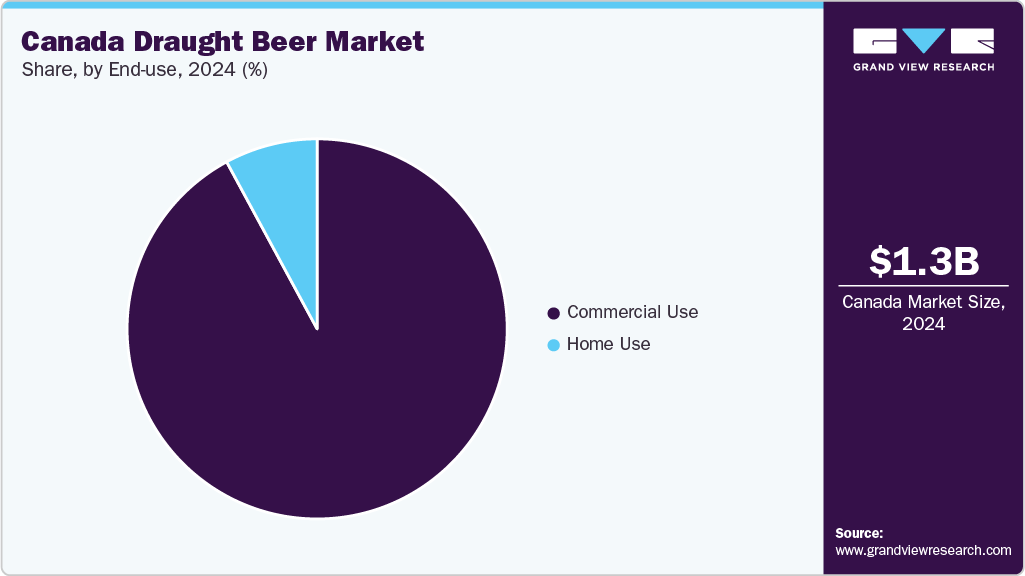

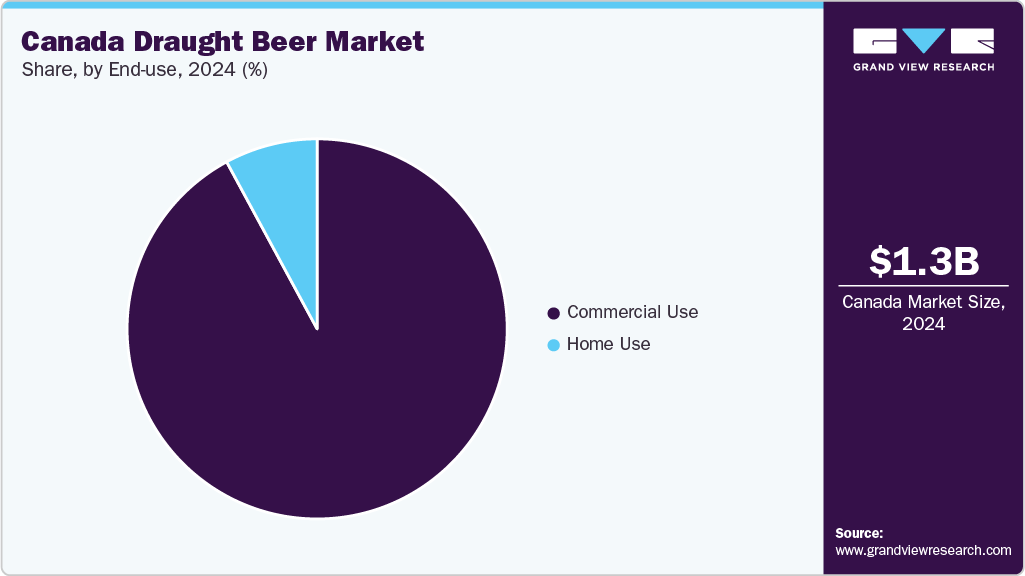

- Based on end-use, the commercial use segment held the highest market share of 92.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.27 Billion

- 2033 Projected Market Size: USD 2.38 Billion

- CAGR (2025-2033): 7.3%

Unique and locally crafted brews with rich flavor profiles that reflect regional brewing traditions are gaining popularity. The draught beer industry is witnessing a significant surge in demand in Canada. Beer remains one of the most popular alcoholic beverages in the country, surpassing spirits and wine in overall volume. The increasing number of local microbreweries and brewpubs across provinces significantly contributes to market expansion, as consumers increasingly seek fresh, high-quality, locally produced beer.

Consumers in Canada are showing a rising interest in exploring new flavors and styles, which is encouraging experimentation and product innovation among brewers. The growing popularity of beer-related experiences, such as brewery tours, festivals, and tasting events, also fuels consumer interest and engagement. This combination of shifting tastes, enhanced accessibility, and experiential marketing is expected to continue to drive the growth of Canada’s draught beer market.

Type Insights

The keg draught beer segment accounted for the largest revenue share of 82.4% in 2024 and is expected to record the fastest CAGR from 2025 to 2033. Kegs are widely preferred for their ability to preserve freshness and carbonation over extended periods, ensuring optimal taste and quality. This makes them popular in bars, restaurants, and large-scale events where beer is served in high volumes. Standardized keg sizes streamline storage, handling, and compatibility with existing tap systems, improving operational efficiency and minimizing product waste. These benefits, quality retention, convenience, and cost-effectiveness, create strong demand for kegged beer across Canada’s on-premise channels.

The cask beer market is projected to grow at a CAGR of 5.4% from 2025 to 2033. Cask beer delivers a fresher and more authentic taste due to its unfiltered and unpasteurized nature, allowing complex flavors to evolve through secondary fermentation within the cask. Its rising popularity is fueled by the renewed interest in traditional brewing techniques and a growing consumer preference for artisanal, locally crafted beverages.

Category Insights

The regular draught beer market accounted for a revenue share of 60.5% in 2024. Regular beers are considered the classic and dependable choice in the alcoholic beverage market. They cater to a broad consumer base as they are known for their well-balanced flavor profiles, neither too strong nor too mild, which makes them highly accessible and appealing across different age groups and demographics. Their universal taste makes them ideal for casual consumption, social gatherings, and pairing with various foods, contributing to their widespread popularity in both on-trade and off-trade channels.

The super-premium draught beer is expected to record the fastest CAGR of 10.4% from 2025 to 2033.With rising disposable incomes, consumers are expected to increasingly gravitate toward premium offerings, leading to growing interest in artisanal and specialty beers that deliver unique flavor profiles and an elevated drinking experience. This shift is further supported by a strong preference for locally brewed products and the use of authentic, high-quality ingredients, fueling the expansion of the super-premium draught beer segment.

Production Type Insights

Draught beer manufactured through macro breweries accounted for the largest share in 2024.Large breweries benefit from economies of scale, enabling them to produce beer at a lower cost per unit and offer competitive pricing, which ensures its broad availability across bars and restaurants. Their strong brand recognition, significant investments in advanced brewing technologies, and stringent quality control measures further strengthen their market position. Moreover, these breweries have extensive distribution networks that allow them to reach urban and rural markets efficiently. Their consistent product offerings and marketing capabilities also help maintain consumer loyalty in a highly competitive landscape.

The microbreweries segment is anticipated to grow at the fastest CAGR from 2025 to 2033, driven by their focus on unique, high-quality, and locally crafted beers that cater to consumers seeking authentic and distinctive drinking experiences. The craft beer trend has sparked interest in various flavors and styles, an area where microbreweries have particularly gained popularity. Furthermore, growing consumer support for local businesses and personalized, community-focused experiences that microbreweries provide are expected to significantly accelerate their growth over the coming years.

End-use Insights

The commercial use segment accounted for a revenue share of 92.1% in 2024. This growth is largely attributed to the strong popularity of draught beer in bars, pubs, and restaurants, where it remains a staple beverage choice. The expansion of the hospitality sector, particularly the pub and bar industry, has been a key factor contributing to the commercial demand for draught beer. As more establishments open or scale up their operations, there is a rising need for efficient, cost-effective, and high-capacity beer dispensing systems to meet consumer demand.

The home use segment is projected to grow at the fastest CAGR from 2025 to 2033.Advances in home beer dispensing technology, such as compact kegerators and easy-to-use beer taps, have enabled consumers to enjoy a bar experience from the comfort of their homes. This shift is further supported by the growing popularity of home-hosted social events and gatherings, where serving fresh draught beer adds a premium touch. Moreover, the availability of craft and specialty beers in keg formats has made at-home consumption more appealing to enthusiasts.

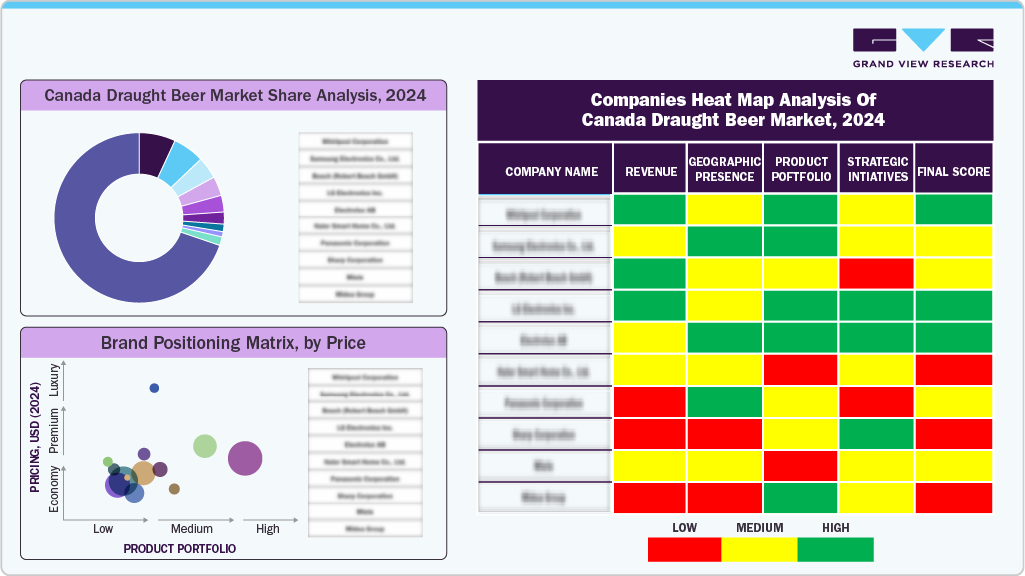

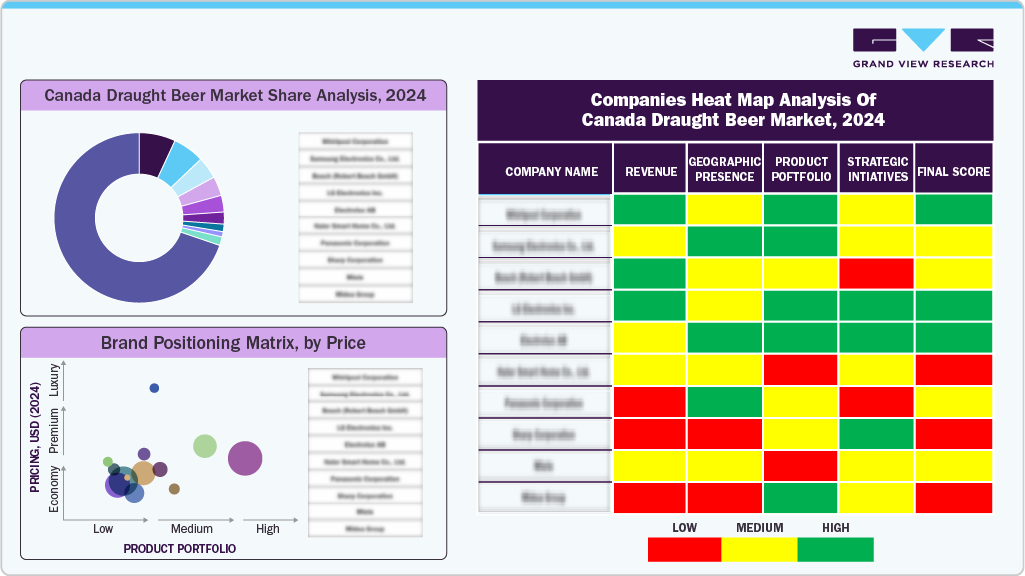

Key Canada Draught Beer Company Insights

Some key players in the Canada draught beer industry include Labatt Brewing Company Ltd., and Granville Island Brewing.

Key Canada draught Beer Companies:

- Steam Whistle Brewing

- Labatt Brewing Company Ltd

- Granville Island Brewing

- Wild Rose Brewery

Recent Developments

-

In January 2024, Molson Coors Beverage Company introduced Madrí Excepcional to the Canadian market, expanding the reach of the UK’s fast-growing beer brand. The beer will be offered on draught at select on-premise locations, served in its signature glassware, and available in 6-pack and 12-pack formats of 473-milliliter cans at major retail stores throughout Canada.

Canada Draught Beer Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.36 billion

|

|

Revenue forecast in 2033

|

USD 2.38 billion

|

|

Growth rate

|

CAGR of 7.3% from 2025 to 2033

|

|

Actual data

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Type, category, production type, end-use

|

|

Key companies profiled

|

Steam Whistle Brewing, Labatt Brewing Company Ltd., Granville Island Brewing, Wild Rose Brewery

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Canada Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Canada draught beer market report based on type, category, production type, and end-use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

Production Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)