- Home

- »

- Automotive & Transportation

- »

-

Canada E-bikes Market Size, Share & Trends Report, 2030GVR Report cover

![Canada E-bikes Market Size, Share & Trends Report]()

Canada E-bikes Market (2023 - 2030) Size, Share & Trends Analysis Report By Battery (Li-ion, Lead-acid), By Application (Cargo, Trekking), By End-use (Personal, Commercial), By Drive Type, By Propulsion, And Segment Forecasts

- Report ID: GVR-4-68040-096-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 203 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

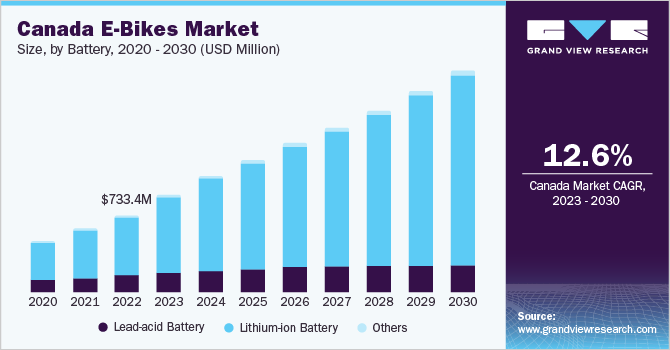

The Canada e-bikes market size was estimated at USD 733.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.6% from 2023 to 2030. The market growth is attributed to the factors, such as the growing awareness regarding alternative clean transportation options, increasing traction toward micro-mobility, and uptake of e-bikes for off-road activities, such as bike trialing and adventure biking. Moreover, growing traction for e-bike sharing and rental services is expected to create numerous growth opportunities for the market players. In addition, rapid developments in connected e-bike technology and the growing focus of e-bike manufacturers on improving range, power, and battery backup along with making the end product affordable to end-users are expected to drive the market growth over the forecast period.

Another major factor positively impacting the market growth includes government initiatives, such as rebate programs and subsidies offered by Canadian provinces, to enhance the affordability and accessibility of e-bikes in the country. Several provinces in Canada will be investing more than USD 4.4 million in the rebates program, which is poised to attract about 9,000 buyers to purchase e-bikes at a lower cost. For instance, effective from February 2021, the Electrify Nova Scotia Rebate Program provides a point-of-sale discount of USD 366.9, for e-bikes bought from retailers and dealers located in Nova Scotia. The e-bikes’ retail price cap is USD 941.8 or more to redeem the rebate. Similarly, in May 2023, the Province of British Columbia announced a rebate scheme effective from June 2023 on purchasing e-bikes for British Columbian residents above the age group of 19 years based on their income bracket.

The rebate cap ranges from USD 258.2 to USD 1,032.8. Moreover, to include e-bikes in public transportation fleets, the local government is implementing initiatives, such as partnerships with rental e-bike companies to set up rental e-bikes stations across major areas situated in different Canadian cities. For instance, in April 2023, Neuron Mobility, an E-scooter and e-bikes rental firm, announced its partnership with the Region of Waterloo, to deploy 500 e-bikes and 500 e-scooter in the region based on the e-bikes rental model. Electric bikes and scooters are available for rent in key areas, including Galt areas, Uptown Waterloo, and Victoria Park. The bike and scooter fleet is equipped with safety features, such as Rapid Geofence Detection (RGD) and High Accuracy Location Technology (HALT).

In addition, the vehicles’ helmets are integrated with a topple detection system, a 911 emergency button, and vice guidance. Implementing a rental e-bike model is a cost-effective alternative for intra-city commuting while reducing carbon footprint, positioning them as a favorable choice among end-users. The integration of connected vehicle technology has become a new standard for the electric bikes segment. Moreover, the growing emphasis of manufacturers on integrating enhanced motor, gearbox, and Anti-lock Braking Systems (ABS) in the newly produced e-bikes is contributing to the sales of e-bikes in Canada. In addition, the inclusion of crash detection systems, battery analytics, advanced telematics, and anti-theft features has created significant traction in the market.

Thus, the integration of such features is aimed at enhancing the rider’s experience, thereby creating new growth opportunities for e-bike manufacturers. E-bikes manufacturers, such as Cycling Sports Group, Inc., Velcro Canada Inc, and iGO Electric Bikes CA, view connected e-bike portfolios as a strategic opportunity to create product differentiation in the local market. Moreover, for e-bike rental fleet managers, data collected from connected e-bikes offers advantages, such as fleet security, maintenance optimization, and real-time fleet supervision, ensuring efficient management of e-bike fleets operating at different locations, which further supports the demand for connected e-bikes in the market. The high cost of e-bikes and the lack of proper charging infrastructure are major factors affecting the market growth.

The cost of e-bikes is higher than traditional bikes rendering them unaffordable for low- or middle-income groups. Also, growing fluctuations in the pricing and sourcing of raw materials required for component manufacturing are leading to increased prices of end products. In addition, strict mandates for registration, license, and insurance to operate e-bikes have enforced consumers to make necessary provisions of documents, which also affected the product sales growth in past years. However, rising awareness regarding required documents and government norms of preliminary requirements is anticipated to overcome the challenges in the market, thereby offering growth opportunities in the years to come.

Drive Type Insights

The chain drive segment accounted for the largest share of over 92% in 2022.The chain is the most common drive type found among e-bikes. Factors, such as higher speed ratio, low maintenance cost, high transmission efficiency, ability to operate in different weather conditions, and ideals for long- and short-distance travel, position chain drive as a preferred option for daily commuting and off-road biking. This is expected to support the segment growth over the forecast period.

The belt drive segment is expected to register the fastest growth rate during the forecast period. The growth of this segment is expected to offer numerous opportunities owing to advantages, such as low maintenance, longevity, and lighter weight. Belt-drive-based e-bikes provide better performance, motor condensation, and enhanced pickup while protecting the e-bike from overloading and slips. Over the forecast period, belt-drive e-bikes are expected to experience higher adoption.

Battery Insights

The Lithium-ion battery segment accounted for the largest share of above 76% of the overall revenue in 2022. The segment growth is attributed to the availability of e-bikes integrated with li-ion batteries over other batteries. The extensive proliferation of li-ion-powered e-bikes in Canada is also subjected to the benefits, such as high performance, charging efficiency, & high energy density, and low weight. This enables the commuter to travel long distances without the constraint of range anxiety, thereby, positioning lithium-ion as a preferred battery choice over their other counterparts.

The li-ion segment is also expected to register the fastest growth rate over the forecast period. Technological development in li-ion batteries, such as increased energy storage capacity and the development of lithium-ion batteries with different cell chemistry, is expected to create new growth opportunities for the segment. In addition, the market players are focusing on several competitive strategies to source raw materials including li-ion, which is further poised to drive the segment growth in the coming years.

Propulsion Insights

On the basis of propulsion, the industry has been categorized into pedal-assisted and throttle-assisted. The pedal-assisted segment accounted for the largest share of about 58% of the overall revenue in 2022. Pedal-assisted e-bikes generate greater power from the motor, enabling riders to move faster and pedal easily. Moreover, these bikes are widely adopted for use on hills and steep routes. A surge in demand for pedal-assisted e-bikes among the youth that provides a better riding experience is observed as one of the key factors driving the growth of this segment.

The throttle-assisted segment is expected to register the fastest growth rate during the forecast period. Various initiatives by the Canadian government to develop special biking pavements over the existing roads and the rising interest of consumers in using e-bikes in off-road activities are some of the key factors expected to drive the segment growth. Moreover, rising competition in the local market is poised to enable manufacturers to launch e-bikes with substantial product differentiations, which is also anticipated to offer numerous growth opportunities in this segment over the forecast period.

Application Insights

On the basis of application, the industry has been further categorized into cargo, trekking, city/urban, and others. The trekking application segment accounted for the largest share of about 52% of the overall revenue in 2022. The rising consumer preference for outdoor cycling, recreational, and trekking activities is driving the growth of this segment. The growing traction toward adventure sports, along with the increasing demand for off-road e-bikes among customers, is further driving segment growth.

In addition, manufacturers are developing product portfolios including all-terrain e-bikes, fat-tier bikes, and enduro e-bikes, which are suitable for off-road cycling. This is another key factor expected to drive the segment growth. The cargo application segment is expected to register the fastest growth rate over the forecast period. The increasing demand for e-bikes for logistic purposes to carry commodities from one location to another is likely to augment the growth of this segment during the forecast period. A rise in last-mile delivery and freight activity in Canada is also predicted to drive segmental growth in the years to come.

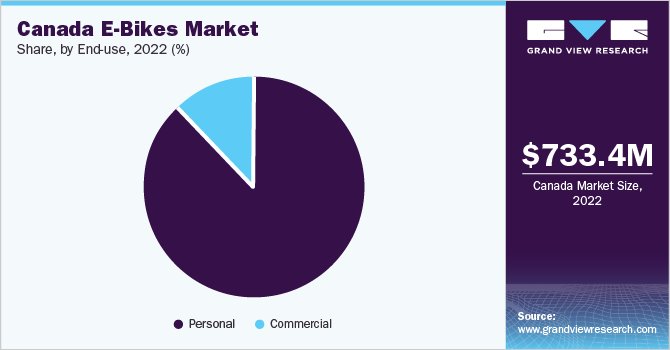

End-use Insights

The personal end-use segment accounted for the largest share of over 88% of the overall revenue in 2022. E-bikes are changing the idea of personal commute, positioned as affordable, low-maintenance, eco-friendly, lightweight, and easily maneuverable. These bikes are popular among youth and middle- and low-income brackets for cost-effective commuting. Major manufacturers are leveraging connected vehicle technology through apps in e-bikes to put forth an enhanced driving experience. For personal usage, manufacturers also provide facilities to install private charging facilities or a designated spot to charge the vehicles, supplementing the adoption of e-scooters among consumers.

The commercial end-use segment is expected to register the fastest growth rate during the forecast period. In spaces like universities, factories, industrial sites, warehouses, and construction with large land areas, e-scooters may be an option for efficient and fast transportation. As the trend of shared mobility is becoming prevalent, vehicle renting facilities are maintaining e-bike fleets that can be used based on rental or subscription package models. This is also expected to help support the growth of the commercial end-use segment.

Key Companies & Market Share Insights

The market is competitive consisting of regional and global players. Companies are focusing on strategies, such as product launches, mergers & acquisitions, partnerships, and product development. Moreover, as the market is witnessing expansion, new entrants are also debuting in the industry. For instance, in August 2022, Himiway Electric Power LLC announced its entry into the market with its long-range fat-tier e-bikes range.

The unique selling point ofHimiway Electric Power LLC in Canada includes long rage e-bikes, which have a 43% higher range of 80 miles per charge than regular e-bikes. The incumbents operating in the industry are differentiating themselves on the basis of factors, such as battery packs, range, and product portfolio ranging from all-terrain bikes to cargo bikes while adopting different sales channels like dealerships, e-commerce, and flagship stores. Some prominent players operating in the Canada e-bikes market include:

-

BH Bikes

-

Brompton Bicycle Ltd.

-

Dorel Industries Inc.

-

Envo Drive Systems Inc.

-

myStromer AG

-

Royal Dutch Gazelle

-

Rize Bikes Inc.

-

Riese & Müller GmbH

-

Specialized Bicycle Components Holding Company, Inc.

-

VoltBike Electric Inc.

Canada E-bikes Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.14 billion

Growth rate

CAGR of 12.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking and market share, competitive landscape, growth factors, and trends

Segments covered

Drive type, battery, propulsion, application, end-use

Country scope

Canada

Key companies profiled

BH Bikes; Brompton Bicycle Ltd.; Dorel Industries Inc.; Envo Drive Systems Inc.; myStromer AG; Royal Dutch Gazelle; Rize Bikes Inc.; Riese & Müller GmbH; Specialized Bicycle Components Holding Company, Inc.; VoltBike Electric Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada E-bikes Market Report Segmentation

This report forecasts volume and revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada e-bikes market report based on drive type, propulsion, battery, application, and end-use:

-

Drive Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Belt Drive

-

Chain Drive

-

-

Propulsion Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Pedal-assisted

-

Throttle-assisted

-

-

Battery Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Lead-acid Battery

-

Lithium-ion Battery

-

Others

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

City/Urban

-

Trekking

-

Cargo

-

Others

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Personal

-

Commercial

-

Frequently Asked Questions About This Report

b. The Canada e-bikes market size was estimated at USD 733.4 million in 2022 and is expected to reach USD 933.5 million in 2023.

b. The Canada e-bikes market is expected to grow at a compound annual rate of 14.3% from 2023- 2030 to reach USD 2.14 billion in 2030.

b. The lithium-ion battery segment has the largest share of 76.59% in 2022. The segmental growth is attributed to the deflation in lithium-ion prices, which is another factor positively impacting the Canada e-bikes market growth.

b. Some of the key players operating in the Canada e-bikes market include: BH Bikes, Brompton Bicycle Limited, Dorel Industries Inc. , Envo Drive Systems Inc., myStromer AG, Royal Dutch Gazelle , Rize Bikes Inc., Riese & Müller GmbH, Specialized Bicycle Components Holding Company, Inc. and VoltBike Electric Inc.

b. The Canada e-bikes market growth is attributed to the factors such as improving awareness regarding alternative clean transportation options, increasing traction towards micro-mobility, and uptake of e-bike for off-road activities such as bike trialing and adventure biking. The emerging trend of shared mobility and rental services of e-bikes in Canada is further expected to create growth opportunities for the marketers in the Canada E-Bike market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.