- Home

- »

- Clinical Diagnostics

- »

-

Canada Latent Tuberculosis Infection (LTBI) Detection MarketGVR Report cover

![Canada Latent Tuberculosis Infection Detection Market Size, Share & Trends Report]()

Canada Latent Tuberculosis Infection Detection Market Size, Share & Trends Analysis Report By Test Type (Tuberculin Skin Test, Interferon Gamma Release Assays), By End-use, By Province, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-984-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

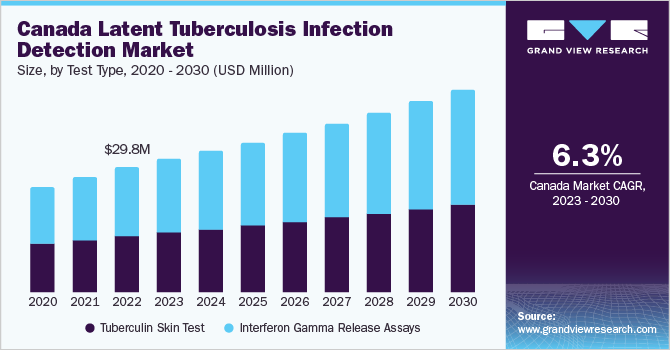

The Canada latent tuberculosis infection detection market size was valued at USD 29.79 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.27% from 2023 to 2030. The market growth is mainly driven by the increasing immigration in Canada and increasing awareness about tuberculosis infection in the country. According to Immigration, Refugees and Citizenship Canada (IRCC), around 437,120 individuals were granted permanent residency in the country in 2022. High inbound traveling and increasing immigration are expected to increase the risk of latent tuberculosis infections (LTBI) in the country.

Government initiatives to increase awareness about tuberculosis disease and improvement in healthcare facilities are expected to fuel the market growth over the forecast period. For instance, the healthcare authorities at the province level in Canada monitor tuberculosis and submit related data to the federal government to analyze the trend of TB infection in the country.

The government of Canada also announced its intention to welcome over 1.3 million new immigrant workers by the end of 2024. Thus, the increase in the number of immigrants in the country is increasing the risk of latent tuberculosis infection, hence, it is anticipated to increase the demand for tuberculosis infection testing in the country.

The incidence of tuberculosis is lower in Canada compared to other developed countries; however, the risk of developing TB disease is higher among the indigenous population of Canada. For instance, in 2020, the rate of active TB among the Canadian indigenous population was 12.7 per 100,000 population. Moreover, the prevalence of latent TB infection in indigenous communities is also high in the country.

The Canadian Tuberculosis Standards recommends tuberculosis infection screening of people younger than 20 years of age in the country. If the results are found positive, then the treatment of LTBI is recommended for the same. At the state level, the Public Health authorities recommend both TST and IGRA tests for latent TB screening, which are expected to drive the demand for these tests during the forecast period.

Furthermore, the ongoing government efforts and initiatives to detect and treat tuberculosis in vulnerable populations are likely to facilitate market expansion. For instance, in March 2022, the government of Canada announced a contribution of USD 11 million to Stop TB Partnership’s TB REACH initiative. This funding will help to promote the detection of tuberculosis, thereby supporting the industry's growth.

In addition, the presence of various market players and non-government organizations that are engaged in promoting awareness regarding tuberculosis is expected to support the Canada latent TB infection detection market expansion. For instance, the National Collaborating Centre for Infectious Diseases and Stop TB Canada are the major organizations in the country that support TB awareness and education for healthcare workers and the public.

Test Type Insights

The interferon gamma release assays (IGRA) segment dominated the market with a revenue share of 55.12% in 2022 and is anticipated to maintain its dominance throughout the forecast period. Increasing awareness about TB infection and increasing recommendations for IGRAs from various public health authorities has boosted its adoption for latent tuberculosis infection detection. Health Canada has approved two IGRAs tests; QuantiFERON-TB Gold (QFT-GIT) assay by Qiagen and T-SPOT.TB assay by Oxford Immunotec for the detection of latent TB infections.

The IGRA segment is anticipated to experience the fastest growth over the forecast period. High test sensitivity and increasing adoption of IGRAs due to their advantages over TSTs are some of the key factors driving the segment growth over the forecast period.

However, the tuberculin skin test segment dominated in terms of the number of tests performed for the detection of LTBI. High market penetration and cost-effectiveness of the test have boosted the adoption of tests in the country. In Canada, Tubersol 5 tuberculin units of purified protein derivative are recommended to conduct a tuberculin skin test. Sanofi is one of the major players providing tuberculin-purified protein derivatives in Canada.

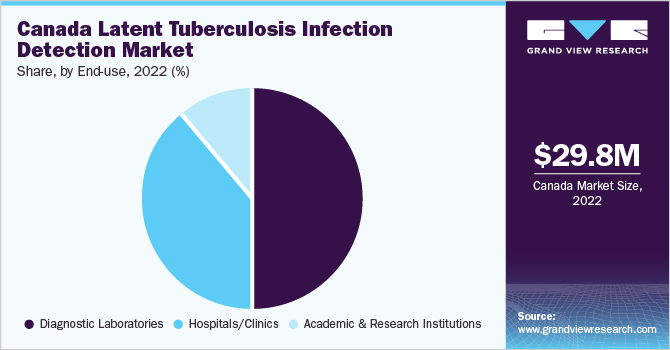

End-use Insights

The diagnostic laboratories segment dominated the Canada latent tuberculosis infection (LTBI) detection market, having 50.51% share, owing to efforts to improve patient outcomes by providing precise & prompt reporting at the retail level. Moreover, the ability of laboratories to handle a large volume of tests at an expedited rate is expected to further fuel the segment over the forecast period. Diagnostics laboratories such as Dynacare and Life Labs provide blood tests for the detection of latent TB infection in the country.

The hospital & clinics segment held the second-largest market share in 2022 owing to the high risk of getting tuberculosis infections in healthcare facilities. Moreover, individuals with medical conditions, such as HIV/AIDS, chronic renal failure, and other diseases that weaken the immune system, increase the risk of LTBI and its development into an active TB case. However, the academic & research institutions segment is expected to experience the fastest growth rate over the forecast period.

Province Insights

Ontario province led the market with a market share of 17.99% in 2022 and it is expected to maintain its dominance over the forecast period. The large market share of the province can be attributed to its large population base, high immigration rate compared to other provinces, and better healthcare infrastructure. The immigration rate is highest in Ontario; it welcomes around 40% of the total immigrants of Canada every year. Similarly, British Columbia, Quebec, Alberta, and Manitoba also held a significant share of the LTBI detection market. Moreover, rise in awareness campaigns regarding tuberculosis is further expected to drive the demand for LTBI testing. For instance, on World TB Day 2023, in March of that year, the Public Health Agency of Canada launched the "Yes! We can end TB" campaign. The aim of this campaign was to raise awareness about tuberculosis and encourage industry leaders to undertake proactive measures to eradicate tuberculosis within the country.

North Canada region including Yukon, Northwest Territories, and Nunavut is expected to grow at a faster growth rate compared with other parts of Canada. Improvement of healthcare facilities, a high portion of the indigenous population, and other factors increasing the risk of developing tuberculosis disease are driving the growth of the market in these regions.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product development, merger & acquisition, partnership, and awareness campaign to increase their market share in the country. For instance, in March 2023, QIAGEN actively embraced the theme of "The Stop TB Partnership" for World TB Day by organizing a 24-hour event dedicated to raising awareness about tuberculosis. Additionally, the company is consistently undertaking initiatives to enhance healthcare services for screening tuberculosis infections, thereby demonstrating their commitment to improving tuberculosis detection and management. Some prominent players in the Canada latent tuberculosis infection detection market include:

-

Abbott

-

QIAGEN

-

F. Hoffmann-La Roche Ltd

-

ARKRAY, Inc

-

Oxford Immunotec USA, Inc.

-

BD (Becton, Dickinson, and Company)

-

BIOMÉRIEUX

Canada Latent Tuberculosis Infection Detection Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 48.41 million

Growth rate

CAGR of 6.27% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test Type, End-use, Province

Regional scope

Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, Prince Edward Island, Quebec, Saskatchewan, Northwest Territories, Nunavut, Yukon, Newfoundland & Labrador

Country scope

Canada

Key companies profiled

F. Hoffmann-La Roche Ltd, Abbott, QIAGEN, BD (Becton, Dickinson, and Company), bioMérieux SA., Oxford Immunotec USA, Inc., ARKRAY, Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Latent Tuberculosis Infection Detection Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the Canada latent tuberculosis infection detection market report on the basis of test type, end-use, and province.

-

Test Type Outlook (Revenue, USD Million; Volume, Number of Tests, 2018 - 2030)

-

Tuberculin Skin Test

-

Interferon Gamma Release Assays

-

-

End-use Outlook (Revenue, USD Million; Volume, Number of Tests, 2018 - 2030)

-

Diagnostic Laboratories

-

Hospitals/Clinics

-

Academic and Research Institutions

-

-

Province Outlook (Revenue, USD Million; Volume, Number of Tests, 2018 - 2030)

-

Alberta

-

British Columbia

-

Manitoba

-

New Brunswick

-

Nova Scotia

-

Ontario

-

Prince Edward Island

-

Quebec

-

Saskatchewan

-

Northwest Territories

-

Nunavut

-

Yukon

-

Newfoundland & Labrador

-

Frequently Asked Questions About This Report

b. The Canada latent tuberculosis infection detection market size was estimated at USD 29.79 million in 2022 and is expected to reach USD 31.62 million in 2023

b. The Canada latent tuberculosis infection detection market is expected to grow at a compound annual growth rate of 6.27% from 2023 to 2030 to reach USD 48.41 million by 2030.

Which segment accounted for the largest Canada latent tuberculosis infection detection market share?b. Ontario province dominated the Canada LTBI detection market with a share of 17.99% in 2022. This is attributable to the high immigration rate, better healthcare infrastructure, and large population base in the region.

b. Some key players operating in the Canada latent tuberculosis infection detection market include Abbott, QIAGEN, Oxford Immunotec USA, Inc, F. Hoffmann-La Roche Ltd, ARKRAY, Inc., and bioMérieux SA.

b. Key factors that are driving the Canada latent tuberculosis infection detection market growth include high immigration from high-risk areas, increasing awareness about tuberculosis, improvement in healthcare facilities, and government initiatives to manage TB in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."