- Home

- »

- Clinical Diagnostics

- »

-

Latent Tuberculosis Infection Detection Market Report, 2033GVR Report cover

![Latent Tuberculosis Infection Detection Market Size, Share & Trends Report]()

Latent Tuberculosis Infection Detection Market (2026 - 2033) Size, Share & Trends Analysis Report By Brand (QFT-Plus), By Test (TST, IGRA), By Application (Household Contacts with Pulmonary TB, PLHIV), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-994-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Latent Tuberculosis Infection Detection Market Summary

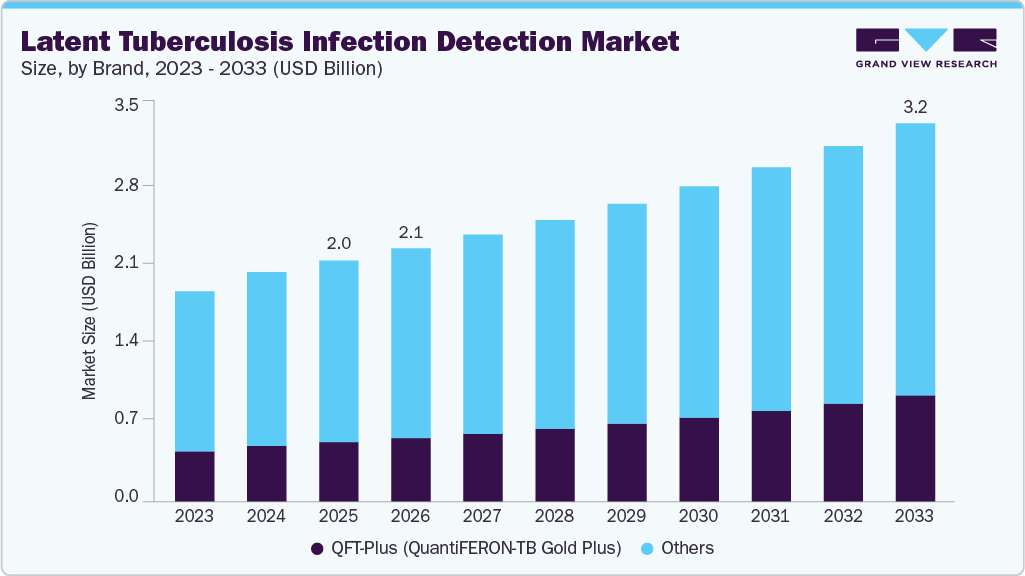

The global latent tuberculosis infection detection market size was valued at USD 2.01 billion in 2025 and is projected to reach USD 3.16 billion by 2033, growing at a CAGR of 5.90% from 2026 to 2033. The growth of the market is attributed to the increasing risk of developing active tuberculosis and the growing awareness among people to diagnose tuberculosis infection at an early stage.

Key Market Trends & Insights

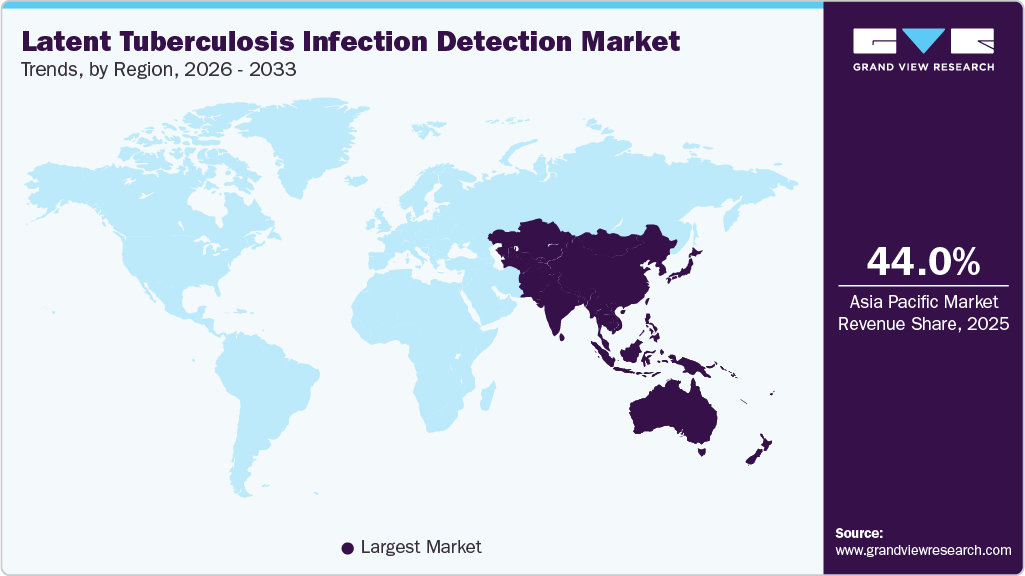

- Asia Pacific latent tuberculosis infection detection industry dominated the global market and accounted for the largest revenue share of 44.03% in 2025.

- India led the Asia Pacific market and held the largest revenue share in 2025.

- By brand, the QFT-Plus (QuantiFERON-TB Gold Plus) segment is the fastest growing during the forecast period with CAGR of 7.65%.

- By test, the tuberculin skin test (TST) diagnosis segment held the largest revenue share of 69.66% in 2025.

- By application, the PLHIVsegment held the largest revenue share of 41.86% in 2025.

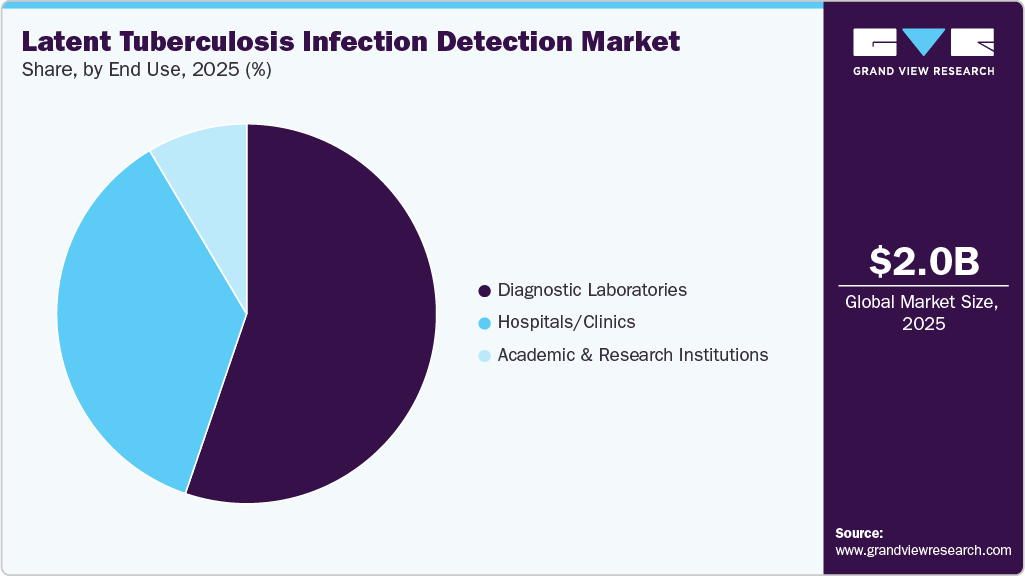

- By end use, the diagnostic laboratories segment held the largest revenue share of 55.23% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.01 Billion

- 2033 Projected Market Size: USD 3.16 Billion

- CAGR (2026-2033): 5.90%

- North America: Largest Market in 2025

Moreover, ongoing government initiatives to combat the threat of tuberculosis and the increasing introduction of novel diagnostic solutions are anticipated to fuel the latent tuberculosis infection (LTBI) detection market growth.Individuals with LTBI face a lifetime risk of reactivation, which is expected to be around 5% to 15%, with the majority of the population developing TB within the first 5 years. For those with LTBI, untreated HIV infection and no LTBI treatment can lead to a high risk of about 7%-10% per year, emphasizing the importance of timely intervention. In addition, most TB cases in the U.S. result from the progression of LTBI acquired over 2 years ago, highlighting the significance of addressing LTBI to prevent future cases.

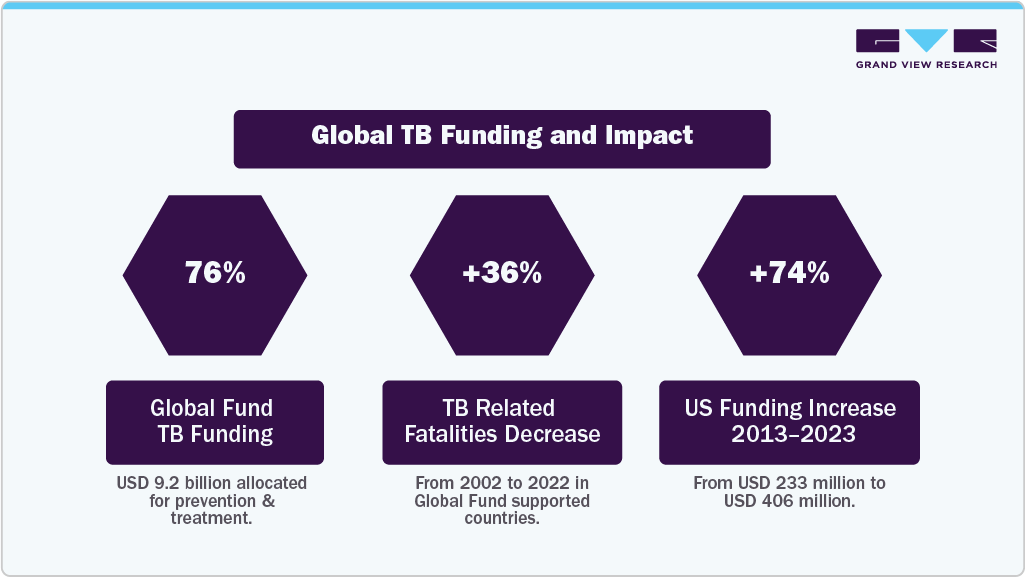

The increasing funding for TB diagnosis programs is crucial in the fight against this global disease. The current funding for prevention, diagnosis, and treatment is insufficient to meet the demand, hindering progress in reducing incidence & mortality rates. For instance, an annual investment of USD 22 billion by 2027 was set, with an additional USD 5 billion for research, and only USD 5.8 billion was allocated for TB services, falling short of the required amounts to achieve global targets. Moreover, WHO emphasizes the need for sustained & increased funding to combat TB effectively.

Hence, the U.S. government has significantly increased its funding for TB initiatives, from USD 233 million in 2013 to USD 406 million in 2023. Investments in screening and preventive treatment have shown significant health & economic benefits, with a return on investment of up to USD 39 for every dollar spent. Hence, expanding investments in TB diagnosis programs is essential to improve access to diagnosis, treatment, and prevention to eliminate the TB epidemic by 2033. Moreover, the Global Fund contributes 76% of total international funding for TB, having allocated USD 9.2 billion toward prevention & treatment programs and an extra USD 1.5 billion for TB/HIV initiatives by June 2023. In countries receiving support from the Global Fund, TB-related fatalities have decreased by 36% from 2002 to 2022.

Moreover, the increasing number of elderly individuals worldwide poses a major hurdle in the control of TB within this age group. The rates of TB case detection & incidence are particularly high among older adults, emphasizing the importance of incorporating specific measures in TB response strategies to address their increased risk. In the Western Pacific, where the population is aging rapidly, there has been a notable increase in TB cases among older individuals, propelling the need for customized approaches to diagnosis, treatment, and care for this vulnerable demographic. This is expected to improve the need for the development of effective & efficient diagnostics to meet the rising demand for management among older populations.

However, the regulatory framework for approvals poses major restraints on the growth rate of the pharmaceutical, biotechnology, and medical technology industries. Globally, usage & safety profiles of diagnostic tests vary and are evaluated by health regulatory agencies of each country differently. This makes the approval of novel products slower.

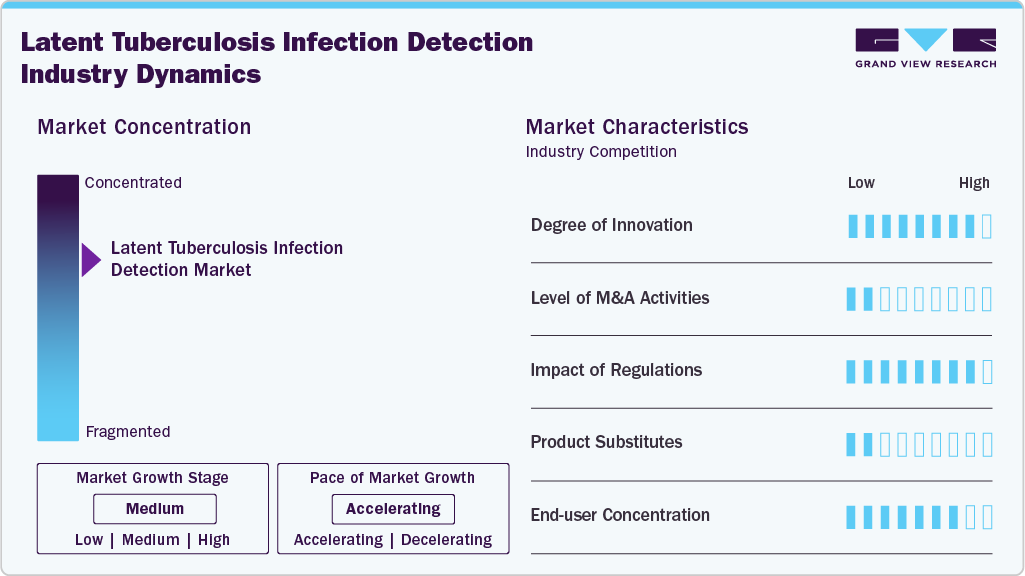

Market Concentration & Characteristics

Innovation appears to be at a high level in the LTBI detection market, given the ongoing improvement and development in diagnostic technology. Interferon-Gamma Release Assays (IGRAs) including QuantiFERON-TB Gold and T-SPOT. TB-have transformed the quality of LTBI detection by improving the specificity, sensitivity and quality of the diagnosis relative to traditional Tuberculin Skin Tests (TSTs). Similarly, companies are continuing to invest in laboratory automation, artificial intelligence based diagnostic interpretation and point-of-care testing to increase turnaround time and availability in both developed and emerging geographies. In addition, the deployment of digital health tools including remote data collection and cloud-based analysis is facilitating ongoing improvements in the diagnosis and care of LTBI. These types of innovations not only improve diagnostic efficiency but also create new commercial opportunities for companies and organizations focused on next-generation molecular and immunological diagnostics platforms.

Presently, the LTBI detection industry has a low amount of merger and acquisition activity. Instead of large-scale consolidation, there is a pattern of strategic alliances, collaborations, and distribution arrangements to reach the market and reinforce technology portfolios. Emerging into joint ventures with regional diagnostic laboratories, regional hospitals, or government health programs for more extensive adoption of LTBI testing solutions is becoming an increasing trend. For example, diagnostic companies participate in collaborative arrangements with national TB control programs for improvement of testing infrastructures in high burdened countries. Such partnerships facilitate low-cost market access and avoid the complexity in financials and operations that accompany merger and acquisition activity.

The regulatory landscape has a decisive influence over the LTBI detection market while acting as a significant barrier. Diagnostic test regulatory approvals vary significantly by country or region and often take considerable time and complexity to approve. For novel diagnostics, especially those with novel biomarkers or molecular platforms, the regulatory process in the U.S. by the FDA or in Europe by the EMA is a significant challenge to gain approval. In some emerging economies, the absence of clear, harmonized regulatory guidelines specific to diagnostics can incur delays in launching, market uptake, adoption, understanding, and reimbursement. The increased demand for clinical validation and the requirement for quality assurance and compliance with standard of care further compound the financial barrier for manufacturers. Innovations are welcomed; however, the regulatory burden remains a primary constraint and could slow the pace for this aspect of the market moving forward.

The LTBI testing may be interpreted as a low-substitutable market, as there remain relatively few external alternatives to the TST and IGRAs, which are the two primary and clinically proven diagnostic methods of LTBI. However, internal substitution is occurring in the LTBI detection market due to newer technologies replacing older or less effective testing methods. For instance, IGRAs are superceding the TST as the preferred method due to their accuracy, significantly lower cross-reactivity to the BCG vaccine, and fewer false positives. Future advances in technology, such as testing based on novel biomarkers, multi-pathogen testing panels, and AI-based imaging solutions, may further change the product landscape and facilitate portfolios of diagnostic companies as well.

The demand for LTBI detection in terms of regional market dynamics is mostly concentrated on diagnostic laboratories, as they are important end users. In order to detect LTBI, laboratories are constantly adding novel, more effective blood-based assays to their testing repertoire. QuantiFERON-TB Gold Plus and T-SPOT are now being offered by independent diagnostic service providers like Dynacare, LifeLabs, and Quest Diagnostics. Competitive TB test costs improve affordability and accessibility. This spread is bolstered by robust government screening programs and sophisticated healthcare infrastructure in developed nations (North America and Europe). Public-private partnerships and national TB eradication programs that encourage LTBI testing as part of preventative healthcare measures present growth potential in emerging countries (Asia-Pacific, Latin America, and Africa). Regional diversity expands the market and propels the expansion of the industry as a whole.

Brand Insights

QFT-Plus (QuantiFERON-TB Gold Plus) segment is anticipated to grow at the fastest CAGR over the forecast period. QFT-Plus is the latest generation of interferon-gamma release assays (IGRAs) approved by the U.S. FDA, replacing its predecessor, QuantiFERON-TB Gold In-Tube (QFT-GIT). QFT-Plus offers several advantages over the Tuberculin Skin Test (TB skin test), including higher sensitivity (>95%) and the highest specificity among all TB infection tests. One of its key innovations is its ability to elicit response from both CD4 and CD8 T cells, providing a more comprehensive assessment of the cell-mediated immune response to TB infection.

The QFT-Plus (QuantiFERON-TB Gold Plus) sector is expected to expand the most quickly during the projected period. QFT-Plus is the FDA-approved current generation of interferon-gamma release assays (IGRAs), succeeding the QuantiFERON-TB Gold In-Tube (QFT-GIT) model. QFT-Plus has significant advantages over the Tuberculin Skin Test (TB skin test), including better sensitivity (>95%) and the greatest specificity of any TB infection test. One of its important improvements is its capacity to elicit responses from both CD4 and CD8 T cells, allowing for a more thorough assessment of the cell-mediated immune response to tuberculosis infection.

Furthermore, the others segment is fueling the growth of the market during the forecast. There are 13 in vitro tests for TB infection currently in the pipeline or commercialized but not endorsed by the WHO. Twelve of these tests are whole-blood interferon-gamma release assays (IGRAs), while the GBTsol Latent TB Test Kit utilizes a novel patented technology, which will be described later. Additionally, five new skin tests are also in the pipeline. Among the ELISA-based whole-blood IGRAs are STANDARD E TB-Feron (SD Biosensor), LIOFeron TB/LTBI (LIONEX Diagnostics & Therapeutics), and AdvanSure TB-IGRA ELISA (LG Chem) all of which are commercially available. These tests operate on a technological principle and have operational characteristics similar to QFT-GIT technology.

Test Insights

Tuberculin skin test led the market with a revenue share of 69.66% in 2025. The dominance of the segment is attributed to the popularity associated with the test. It is a reliable test to screen LTBI and is performed by injecting tuberculin purified protein derivative into the inner surface of the skin. An induration of 15 mm and more is considered positive in individuals with no risk factor for tuberculosis. Administration and reading of tests require standardization of procedures, training, and practice. The TST should be read between 48 to 72 hours after administration of tuberculin. High market penetration rate of test, rising awareness about tuberculosis infection in the country, and cost-effectiveness of the test are likely to drive the segment over the forecast period.

Moreover, the interferon gamma released assay segment is expected to develop at the fastest CAGR over the forecast period, owing to increased usage of IGRAs due to its advantages over TSTs and the high sensitivity of the test assay. IGRAs evaluate the immunological response to Mycobacterium tuberculosis germs in blood samples. When an infected person's white blood cells react with tuberculosis bacteria antigens, they produce Interferon-gamma (IFN-g). To conduct an IGRA test, only one visit is required to collect the blood sample, and healthcare providers are encouraged to use blood tests to screen. IGRAs are the preferred blood test for people who have recently received the BCG vaccine, as results are not affected by BCG vaccination status, preventing the likelihood of false positives. However, IGRAs require laboratories with adequate equipment and professional technicians to conduct tests.

Application Insights

PLHIV led the market with a revenue share of 41.86% in 2025. In 2020, an estimated 9.9 million people worldwide were afflicted with tuberculosis (TB), and a quarter of the global population has been exposed to latent TB. People living with HIV (PLHIV) accounted for 8% of TB cases and contributed to around 14% of TB-related deaths that year. HIV is the most significant known risk factor for developing active TB, with PLHIV being 20-30 times more likely to advance TB than those without HIV. Among the approximate 37 million PLHIV globally, at least one-third are infected with M. tuberculosis. Screening all PLHIV for TB at least once is recommended. Treating LTBI in PLHIV is of utmost importance.

Furthermore, household connections with the Pulmonary TB category are expected to rise at the fastest CAGR over the projected period. Household contacts of people with infectious pulmonary tuberculosis are at a higher risk of developing tuberculosis (TB) and progressing to active disease. This group is prioritized for contact investigation and tuberculosis preventative treatment (TPT). Treating tuberculosis infection in these individuals is critical to preventing disease progression and is a main priority of India's National Tuberculosis Elimination Program, which seeks to eradicate tuberculosis by 2025. A study of 118 pulmonary tuberculosis cases and 330 home contacts found that 26.36% of contacts had latent TB and 3.03% had active TB. These findings highlight the value of focused therapy.

End Use Insights

Diagnostic laboratories led the market with a revenue share of 55.23% in 2025 and are anticipated to grow at the fastest CAGR over the forecast period owing to efforts to improve patient outcomes by providing diagnostic facilities at the retail level. Moreover, the ability of laboratories to handle a large volume of tests at an expedited rate is expected to further fuel the segment over the forecast period. Furthermore, diagnostic laboratories also deal with samples received from clinics and hospitals. Diagnostic laboratories are providing newer blood tests for the screening or detection of LTBIs. For instance, independent laboratories such as Dynacare and Life Labs provide tests, such as QuantiFERON-TB blood tests and T-SPOT.TB tests, for the detection of LTBI at comparatively lower prices. Moreover, independent laboratories are booking online appointments for latent TB infection diagnosis, as per customer convenience.

The hospital & clinics segment is projected to witness a lucrative CAGR over the forecast period. Individuals with medical conditions, such as HIV/AIDS, chronic renal failure, and other diseases that weaken the immune system, increase the risk of LTBI and its development to an active TB case. Increasing prevalence of diseases that affect the immune system is likely to boost the testing rate for LTBIs in hospitals and clinics. The penetration of TST is higher in hospitals and clinics, as it requires standardization of procedures and trained professionals to conduct tests & read the skin test reaction. Moreover, TST does not require specific equipment and reagent kits to detect latent tuberculosis infection.

Regional Insights

North America latent tuberculosis infection detection industry is anticipated to grow lucratively over the forecast period. North America is the most developed latent tuberculosis infection detection industry. The increasing geriatric population, rising prevalence of TB, and high market penetration of technologically advanced diagnostic techniques are expected to drive market growth over the forecast period. Raising patient awareness, increasing preference for novel approaches, and the availability of favorable reimbursement policies are also expected to drive the regional market.

Furthermore, favorable government initiatives and robust funding for tuberculosis prevention and control programs, such as those led by the US Centers for Disease Control and Prevention (CDC) and the Public Health Agency of Canada, have hastened the adoption of advanced diagnostic tools such as interferon-gamma release assays (IGRAs) and tuberculin skin tests (TSTs).

In addition, the presence of major diagnostic businesses such as Qiagen, Thermo Fisher Scientific, and Abbott Laboratories promotes ongoing technological innovation and easy access to next generation testing kits. The region also benefits from rigorous regulatory requirements that protect the quality and accuracy of diagnostic tests, creating trust between healthcare providers and patients.

U.S. Latent Tuberculosis Infection Detection Market Trends

Latent tuberculosis infection detection industry in the U.S. is growing owing to the rising incidence of tuberculosis (TB) and the country's emphasis on early diagnosis and disease prevention. About 7,882 TB cases, or 2.4 cases per 100,000 people, were recorded in the U.S. in 2021, according to the Centers for Disease Control and Prevention (CDC). The prevalence of TB, particularly among immigrant groups, immunocompromised individuals, and those with chronic diseases like diabetes and HIV, continues to be a major public health concern, despite the overall incidence being relatively low when compared to global estimates.

Moreover, tuberculosis is a dangerous airborne infectious illness caused by Mycobacterium tuberculosis, and diagnosing latent infections is crucial to minimizing disease progression and spread. Increasing awareness campaigns, government-funded screening programs, and technological advances in diagnostic methods-such as interferon-gamma release assays (IGRAs) and molecular testing-are all driving market growth. Furthermore, solid healthcare infrastructure, federal support for tuberculosis control, and the existence of top diagnostic businesses are projected to fuel the U.S. market's expansion in the approaching years.

Europe Latent Tuberculosis Infection Detection Market Trends

Europe latent tuberculosis infection detection industry was identified as a lucrative market due to the presence of major research institutes and market players operating in the region. Moreover, favorable initiatives undertaken by the government & other nonprofit organizations to fund R&D activities and create awareness about the benefits of early disease diagnosis are expected to boost market growth.

Furthermore, rising cancer rates, more investments in healthcare infrastructure, and the expanding use of AI and digital pathology technologies are all contributing to the steady growth of the latent tuberculosis infection detection industry in Europe. Across Europe, countries are prioritizing precision medicine and early disease detection with the help of strong government initiatives and favorable reimbursement policies. The area is also well known for the extensive collaborations that pathology labs and pharmaceutical companies have established to speed up the development of biomarkers and diagnostics. However, regulatory complexity and national healthcare system differences impede consistent market growth. Despite these challenges, advances in molecular pathology and heightened patient and clinician awareness are driving an increase in the demand for advanced diagnostic services.

The latent tuberculosis infection (LTBI) diagnostics industry in the UK will witness a steady growth during the forecast period, driven by the market drivers like the rising incident of tuberculosis, awareness about the value of early diagnosis, and major improvements in the healthcare system. Even though TB is recognized as a low-incidence country, it still affects some vulnerable groups, including migrants from high burden countries, healthcare workers, and immunocompromised individuals. The UK government, supported by the NHS and the UK Health Security Agency (UKHSA), are encouraging better screening interventions and providing modern testing options such as the interferon-gamma release assays (IGRA), which have more sensitivity than the traditional tuberculin skin tests. Moreover, ongoing investments in public health awareness campaigns, advanced diagnostic laboratories, and digital health technologies are improving access to timely testing and treatment. Therefore, these factors offer a conducive environment for growth in the LTBI diagnostic market and bolster the UK position in the European latent tuberculosis infection (LTBI) diagnostics market.

The latent tuberculosis infection (LTBI) detection industry in Germany is expected to rise gradually over the projected period, owing to the country's well-established biopharmaceutical sector, rising research and development (R&D) activities, and tuberculosis (TB) prevalence. Germany's solid foundation in biotechnology and diagnostics fosters the development and commercialization of sophisticated tuberculosis detection technologies such as interferon-gamma release assays (IGRAs) and molecular diagnostic tools.

Major biopharmaceutical businesses and research institutions are increasing their efforts in TB diagnostics, which is speeding innovation, enhancing test sensitivity, and reducing turnaround time. Furthermore, Germany's strong healthcare infrastructure and favorable government measures targeted at improving infectious disease surveillance and control are driving market expansion.

While the general TB prevalence in Germany remains lower than in many other countries, the presence of latent infections in high-risk groups, such as refugees and immunocompromised people, highlights the importance of extensive screening. Together, these factors are likely to drive sustainable expansion in Germany's LTBI detection market over the forecast period.

Asia-Pacific Latent Tuberculosis Infection Detection Market Trends

Asia Pacific latent tuberculosis infection detection industry accounted for 44.03% share in 2025 and is anticipated to grow at fastest growth over the forecast period. The presence of high untapped opportunities in the form of unmet medical needs, increasing opportunities for scientific research, and positive economic growth are some primary growth drivers of this market. Moreover, expanding the healthcare regulatory scenario in high-growth countries is expected to attract international players to capitalize and invest in existing opportunities. Positive changes, such as increased awareness, healthcare benefits provided by the government, and the urge to avail high-end medical diagnostics, are also expected to drive market growth. In addition, the high prevalence of Tuberculosis (TB) in the region and presence of a large, affected population are some of the factors expected to fuel the market growth.

The latent tuberculosis infection detection industry in India is expected to grow over the forecast period. Due to many existing R&D institutions and rich resources in the country, India has become one of the major areas for setting up research laboratories and production units by multinational companies. In addition, public sector enterprises, such as Biotechnology Industry Research Assistance Council (BIRAC) and the Department of Biotechnology (DBT), have promoted R&D in the field of biotechnology across the country. Hence, rapidly growing biotechnology & pharmaceutical industries and frequent government initiatives to support R&D activities in the country are expected to create lucrative opportunities for growth.

The latent tuberculosis infection (LTBI) detection industry in Japan is expected to advance steadily over the next several years, led by different testing requirements as well as physician preferences and choices for tests. Japan also has a robust public health framework focused on preventing TB, which allows for steady demand for accurate and reliable LTBI detection options. Physicians in Japan often select tests-specifically interferon-gamma release assays (IGRAs) or tuberculin skin tests (TSTs)-based on the patient history, clinical setting, and payor precursors; thus, a dynamic market.

In addition, public health initiatives and nationwide TB control programs led by the government snowball efforts to detect and treat latent infections whenever possible, ideally to avoid transmission of the disease. The market is also poised for steady expansion by advanced diagnostic technologies and Japan's commitment to a higher quality of health care and expanding screening coverage among high-risk groups. It is likely that as awareness of latent TB builds, the market will continue to grow steadily throughout the duration of this report.

Latin America Latent Tuberculosis Infection Detection Market Trends

Latin America latent tuberculosis infection detection industry is burgeoning owing to the steady growth of healthcare facilities in developing economies along with increasing healthcare spending. The growth of new diagnostic & pharmaceutical manufacturing companies in Brazil and Argentina, which also includes a growing government attention to building stable health care facilities is also expected to boost this market opportunity in this region. Brazil is one of the lucrative markets in the region. The increasing prevalence of TB, developing economy, and reforms in the country’s healthcare system are key factors driving the growth of the latent tuberculosis infection detection industry.

Middle East and Africa Latent Tuberculosis Infection Detection Market Trends

MEA latent tuberculosis infection detection industry was identified as a lucrative region in this industry. The growth in this region can be attributed to the steady development of healthcare facilities in emerging economies and increasing healthcare expenditure. The market in Saudi Arabia is expected to grow over the forecast period owing to increased consumer demand due to the growing prevalence of chronic illnesses, a higher need for localized testing, and decreasing sequencing prices.

Key Latent Tuberculosis Infection Detection Company Insights

Some of the leading players operating in the latent tuberculosis infection detection industry include QIAGEN, BIOMÉRIEUX, Oxford Immunotec, and Par Pharmaceutical, Inc. Companies focus on capturing the market by increasing their presence using various business initiatives, such as partnerships & collaborations with government. Moreover, these companies have well established product portfolio, which helps capture major market share.

SD Biosensor, Inc., Wantai BioPharm, Lionex GmbH, Serum Institute of India Pvt. Ltd, ARKRAY, Inc. are some of the emerging market participants in the latent tuberculosis infection detection industry. Developing & launching new and improved diagnostic tools that offer faster results, higher accuracy, and easier usability are observed as prevalent operating strategies by these companies. The players may face challenges in penetrating the market due to competition and regulatory hurdles.

Key Latent Tuberculosis Infection Detection Companies:

The following key companies have been profiled for this study on the latent tuberculosis infection detection market.

- QIAGEN

- BIOMÉRIEUX

- Oxford Immunotec

- SD Biosensor, INC.

- Wantai BioPharm

- Lionex GmbH

- Sanofi

- Serum Institute of India Pvt. Ltd

- ARKRAY, Inc.

- Par Pharmaceutical, Inc.

Recent Development

-

In February 2025, Revvity received FDA approval for improved automated LTBI test. The automated tests integrates Auto-Pure liquid handling platform with the T-SPOT TB test.

-

In March 2024, QIAGEN entered into partnership with the International Panel Physicians Association (IPPA) to educate and support panel physicians worldwide on the latest TB screening requirements. The focus will be on the new IGRA requirements and their benefits for patients & healthcare providers.

-

In November 2023, Revvity launched its T-SPOT TB test for latent TB screening in India, during the 46th Edition of MICROCON in Lucknow. The company emphasizes that it is the sole commercially available IGRA based on ELISPOT technology to have received FDA approval.

-

In February 2023, QIAGEN announced the certification of its QFT-Plus test under the European Union’s 2017/746 IVD Medical Devices Regulation, replacing the 98/79/EC In Vitro Diagnostic Directive. QFT-Plus is a leading TB blood test authorized by the WHO, aiding in the indirect detection of TB-causing bacteria. This certification follows the IVDR CE-marking of QIAGEN’s ipsogen JAK2 RGQ PCR Kit, NeuMoDx Systems, and reagents in late 2022.

Latent Tuberculosis Infection Detection Market Report Scope

Report Attribute

Details

Market size in 2026

USD 2.11 billion

Revenue forecast in 2033

USD 3.16 billion

Growth rate

CAGR 5.90% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in thousands and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Brand, test, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Belgium; Netherlands; Iceland; Finland; Luxembourg; China; Japan; India; Australia; Thailand, South Korea; Singapore; Bangladesh; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

QIAGEN; BIOMÉRIEUX; Oxford Immunotec; SD Biosensor, INC.; Wantai BioPharm; Lionex GmbH; Sanofi; Serum Institute of India Pvt. Ltd; ARKRAY, Inc.; Par Pharmaceutical, Inc.

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Latent Tuberculosis Infection Detection Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the latent tuberculosis infection detection market report based on brand, test, application, end use, and region:

-

Brand Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

QFT-Plus (QuantiFERON-TB Gold Plus)

-

Others

-

-

Test Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

Tuberculin Skin Test (TST)

-

Interferon Gamma Released Assay (IGRAa)

-

-

Application Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

Household Contacts with Pulmonary TB

-

PLHIV

-

Others

-

-

End Use Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

Diagnostic Laboratories

-

Hospitals/Clinics

-

Academic & Research Institutions

-

-

Regional Outlook (Volume, Thousands; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Belgium

-

Netherlands

-

Iceland

-

Luxembourg

-

Finland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Singapore

-

Bangladesh

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The increasing incidence of developing active TB from LTBI, increasing awareness among people about early diagnosis of diseases, and government initiatives to reduce disease burden are the major factors driving the latent tuberculosis infection detection market growth over the forecast period.

b. Some key players operating in the latent tuberculosis infection detection market include QIAGEN, BIOMÉRIEUX, Oxford Immunotec, SD Biosensor, INC., Wantai BioPharm, Lionex GmbH, Sanofi, Serum Institute of India Pvt. Ltd, ARKRAY, Inc., Par Pharmaceutical, Inc. among others.

b. The global latent tuberculosis infection detection market size was estimated at USD 2.01 billion in 2025 and is expected to reach USD 2.11 billion in 2026.

b. The global latent tuberculosis infection detection market is expected to grow at a compound annual growth rate of 5.90% from 2026 to 2033 and is expected to reach USD 3.16 billion by 2033.

b. The PLHIV segment is expected to dominate the latent tuberculosis infection detection market with a share of 41.86% in 2025 due to the high risk of developing active TB disease and the increasing adoption of testing for latent tuberculosis infections.

b. Asia Pacific held the largest share of 44.03% in 2025 and is expected to register a lucrative growth rate over the forecast period. The presence of high untapped opportunities in the form of unmet medical needs, increasing opportunities for scientific research, and positive economic growth are some primary growth drivers of this market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.