- Home

- »

- Pharmaceuticals

- »

-

Cannabidiol Market Size And Share, Industry Report, 2033GVR Report cover

![Cannabidiol Market Size, Share & Trends Report]()

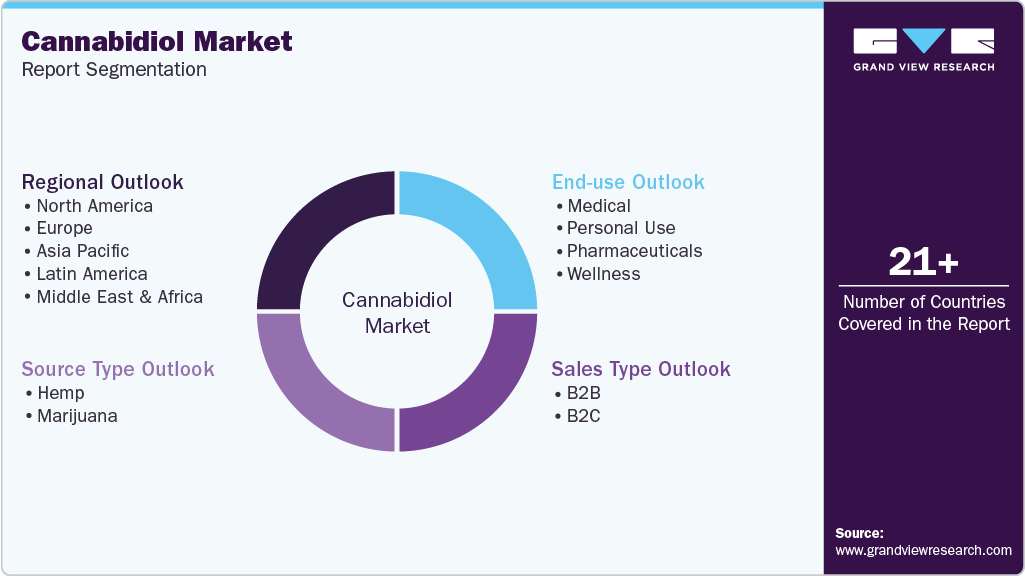

Cannabidiol Market (2026 - 2033) Size, Share & Trends Analysis Report By Source Type (Hemp, Marijuana), By Sales Type (B2B, B2C), By End Use (Medical, Personal Use, Pharmaceuticals, Wellness), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-122-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannabidiol Market Summary

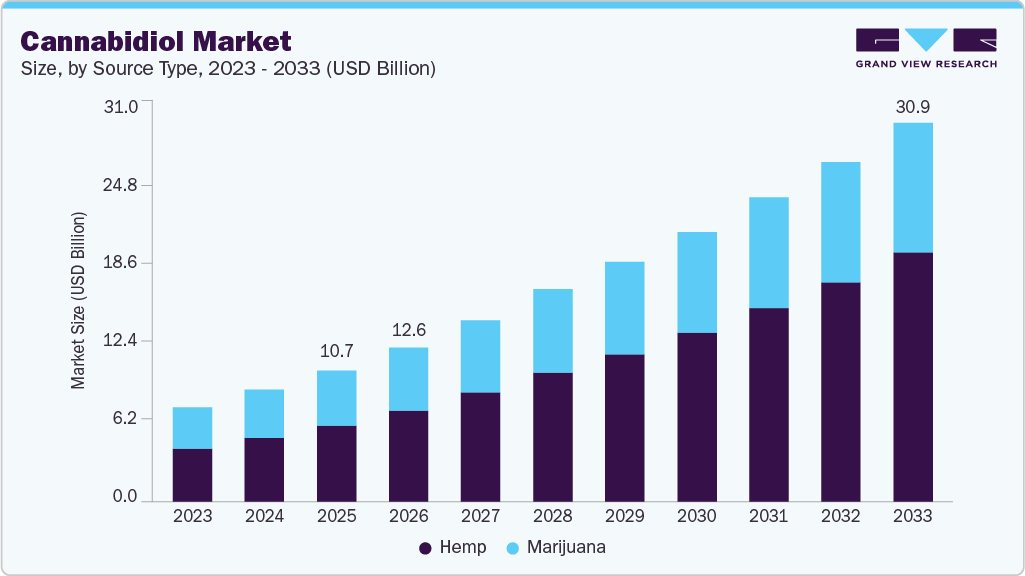

The global cannabidiol market size was estimated at USD 10.68 billion in 2025 and is projected to reach USD 30.96 billion by 2033, growing at a CAGR of 13.70% from 2026 to 2033. The market growth is driven by increasing consumer awareness of the potential therapeutic benefits of cannabidiol (CBD) for conditions such as chronic pain, anxiety, insomnia, and inflammation, coupled with a growing preference for natural and plant-based wellness solutions.

Key Market Trends & Insights

- The North America cannabidiol market accounted for the largest global revenue share of 85.80%% in 2025.

- The U.S. cannabidiol industry is anticipated to register the fastest CAGR from 2026 to 2033.

- By source type, the hemp segment held the largest revenue share in 2025.

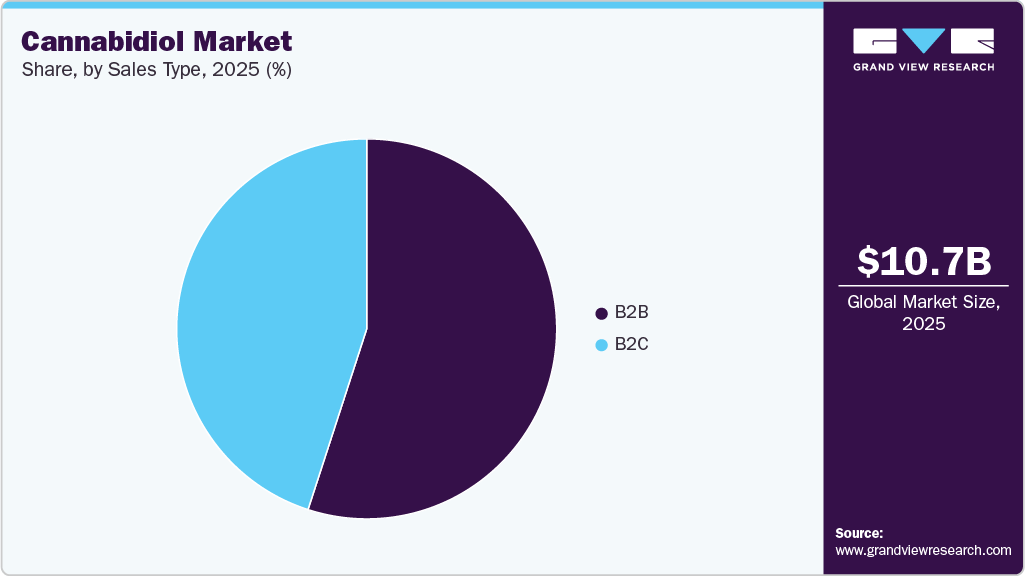

- By sales, the B2B segment held the largest revenue share in 2025.

- By end use, the pharmaceuticals segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10.68 Billion

- 2033 Projected Market Size: USD 30.96 Billion

- CAGR (2026-2033): 13.70%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

Expanding product diversification across oils, topicals, edibles, and pharmaceuticals is also supporting market uptake. In addition, evolving regulatory frameworks, rising investments in clinical research, and the broader retail availability of products from pharmacies to e-commerce are accelerating adoption in the cannabidiol industry.The market is expected to grow with the increasing legalization of hemp-based products. Companies are developing a variety of cannabidiol products, including edibles, topicals, and beverages, to meet the demand from consumers. The rise of e-commerce has enabled companies to reach a broader audience and boost sales through online channels. For instance, in March 2025, Edible Brands, the parent company of Edible (formerly Edible Arrangements), introduced Edibles.com, a wellness-oriented e-commerce platform that offers same-day delivery of reliable THC-infused products from top brands, including Cann, Wana, and 1906.

In addition, growing interest in the potential health benefits of cannabidiol has led to increased investment in research and development to understand its effects better and develop new products. The cannabidiol market is becoming more competitive, with a growing number of companies entering the market and offering similar products.

Growing recognition of the therapeutic benefits of cannabidiol has driven consumers to purchase these products, even if they are expensive. As a result, commercial retailers are now focusing on selling cannabis-based items, which have a higher profit margin. For instance, Abercrombie & Fitch-a clothing retailer-plans to sell CBD-infused body care products in more than 160 of its 250-plus stores. Many health and wellness stores, such as Walgreens Boots Alliance, CVS Health, and Rite Aid, now offer CBD-based products. CBD is a non-psychoactive compound found in the hemp plant and is used in various forms, such as cream, edibles, oils, and tinctures. It is marketed for its potential health benefits, such as reducing anxiety and pain. It has seen a surge in demand due to the increasing legalization and normalization of marijuana and hemp-based products.

It effectively treats conditions such as anxiety, seizures, and pain. Demand for CBD for health and wellness is the primary factor driving the market's growth. Additionally, the increasing acceptance and use of these products, driven by government approvals, is expected to boost production and sales. Furthermore, CBD oil is growing in popularity as an ingredient in skincare products for treating acne and wrinkles. For instance, Sephora recently added a line of CBD skincare products to its stores, and Ulta Beauty plans to launch its line of CBD-based products. Many new companies are also entering the market for CBD-infused cosmetic products.

Companies such as Echo Pharmaceuticals have created products such as Arvisol, an oral tablet containing pure cannabinoids for treating conditions such as epilepsy and schizophrenia. Moreover, companies in the market are launching various products and services to maintain a competitive edge. For instance, in December 2021, Avicanna Inc., a biopharmaceutical company specializing in the development and sale of cannabinoid-based products derived from plants, announced the introduction of the re+PLAY sports recovery brand in partnership with Harrington Wellness. This brand focused on using CBD for sports recovery and was created through a collaboration with NBA veteran Al Harrington, who founded Harrington Wellness.

Sales of cannabis vapes, pre-rolls, and beverages have surged among youth who are less inclined toward engaging in riskier activities such as sharing joints. Furthermore, it is expected that innovation & diversity in the cannabis market will be fueled by the increasing variety of cannabis-infused products designed to cater to consumers' evolving tastes during the forecast period. For instance, in December 2023, Tilray Brands, Inc., a provider of cannabis-infused products, launched the cannabis-infused premium Belgian chocolates with the Chowie Wowie edibles brand.

Understanding Different User Groups Helps in Targeting and Product Development

Category

Consumer Behavior

Examples / Notes

Segments

Recreational, Medical, Wellness, Enthusiasts

Relaxation, pain relief, mood support, high-potency exploration

Demographics

18–34 core users; balanced gender

Legal states have higher penetration

Frequency

Daily, occasional, first-timers

Medical users often use daily

Time of Use

Evenings, weekends, daytime microdosing

Relaxation & socialization patterns

Methods

Inhalation, edibles, tinctures, topicals

Edibles growing fastest

Trends

Microdosing, high-potency, THC:CBD blends

Category diversification rising

Brand Loyalty

Lab-tested, organic claims, consistency

Strong packaging preference

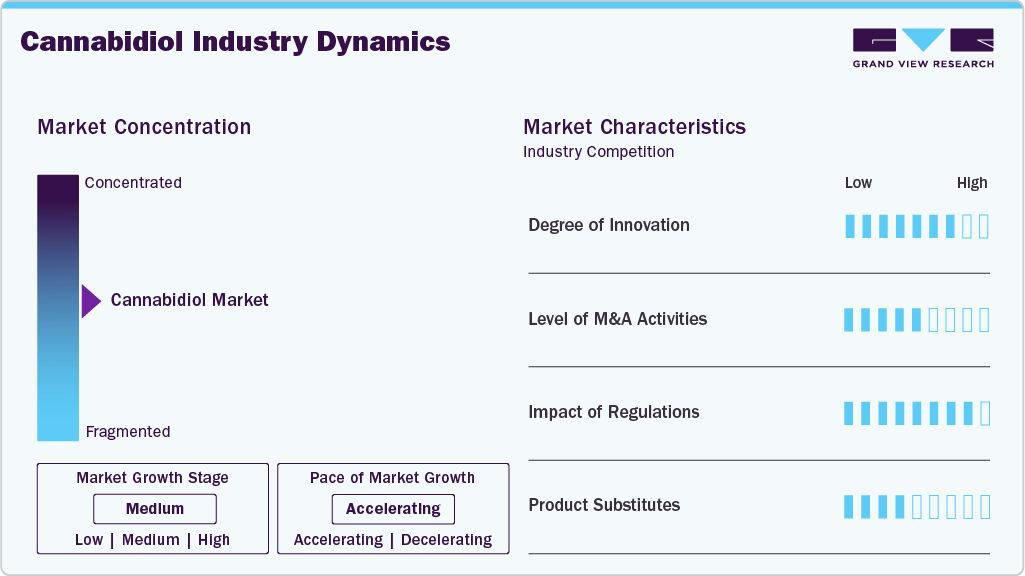

Market Concentration & Characteristics

The cannabidiol market growth stage is high, and the pace of growth is accelerating. The market is characterized by a high degree of innovation owing to increased R&D activities on the use of cannabis and its medicinal properties, rising product demand due to its health benefits without intoxication, and increasing preference for cannabis extracts such as oils and tinctures. In January 2023, Medical Marijuana, Inc. announced that its subsidiary, HempMeds Brasil, had launched two new full-spectrum products in Brazil. The concentrations range from 3,000 to 6,000 mg and are available in 30 mL and 60 mL bottles.

The cannabidiol industry is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. Through M&A activity, these companies can expand their product portfolio, enter new territories, and strengthen their market position. In June 2025, Vireo Growth finalized a $102 million acquisition of Missouri-based Proper Brands, which includes 11 dispensaries and a large cultivation/manufacturing facility spanning over 100,000 sq ft.

Regulatory changes continue to shape the CBD industry by influencing product safety, licensing, packaging, and market access. For instance, in March 2025, Health Canada amended its cannabis regulations, allowing for more flexible packaging and labeling of cannabis products, including transparent packaging, new label formats, QR codes, simpler potency labeling, and relaxed co-packing requirements. These reforms help lower the compliance burden for producers and make CBD products more consumer-friendly and accessible, supporting market growth.

The legal CBD market often competes with or includes substitutes beyond traditional cannabis flower, notably hemp-derived CBD oils, tinctures, edibles, cosmetics, and wellness-oriented products rather than high-THC items. Many of the prominent CBD companies now offer oils, tinctures, edibles, skincare, and wellness supplements. For instance, in October 2025, Awshad introduced its 6,500 mg CBD oil, the highest-strength formulation. The product is marketed for potential use in addressing conditions such as chronic pain, cancer-related symptoms, epilepsy, severe anxiety, and insomnia. This diversification attracts consumers seeking non-psychoactive, wellness-oriented alternatives.

Source Type Insights

In 2025, the hemp segment dominated the cannabidiol industry, generating 58.03% of the revenue. This segment is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the rising demand from the pharmaceutical industry and growing consumer awareness of health benefits. Legalizing medicinal cannabis and growing consumer disposable income are also expected to boost the demand for cannabidiol in the pharmaceutical sector. High demand for CBD products encompasses oils, tinctures, concentrates, capsules, topical solutions such as salves, lip balms, lotions, and edibles, including baked goods, coffee, chocolate, gum, and candies.

Furthermore, the use of CBD derived from hemp is growing quickly because of its abilities to fight inflammation, aging, and act as an antioxidant. Various industries, including pharmaceuticals, personal care products, nutraceuticals, and food and beverage companies, are developing products that utilize CBD for health and wellness purposes. Due to these factors, the segment is expected to experience significant growth in the future.

Sales Type Insights

The B2B segment dominated the cannabidiol market, accounting for the largest revenue share of 55.22% in 2025. This segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the rise in the number of wholesalers offering CBD oil and the growing demand for CBD oil as a raw material. The legalization of CBD products in various countries has opened up more opportunities for supplying these products, thanks to the expanding consumer base.

The sub-segment of hospital pharmacies within the B2C segment is expected to experience significant growth over the forecast period. This growth is attributed to an increase in companies partnering with retail pharmacies to enhance their visibility and establish a dedicated space for customers to purchase CBD products. The market is anticipated to offer ample opportunities for market participants due to the increase in pharmacies stocking up on the products, the formation of exclusive partnerships between companies and retail pharmacies, and the growing number of patients choosing CBD as a treatment option.

End Use Insights

The pharmaceuticals segment accounted for the largest revenue share of the cannabidiol industry in 2025. The segment is expected to see substantial growth over the forecast period. A growing number of clinical trials to assess the effects of CBD on various health conditions is likely to fuel demand for these products over the forecast period. In addition, many companies purchase bulk CBD oil and produce CBD-infused products that consumers widely use as an alternative for managing pain and stress. These products are likely to be in a growth phase in the market.

The pharmaceutical segment is expected to experience the quickest growth over the forecast period. The transformation of cannabidiol from herbal remedies to prescription drugs is expected to drive market growth. Growing recognition of the medical benefits of cannabidiol, including its therapeutic properties, is expected to fuel demand for these products in the pharmaceutical sector.

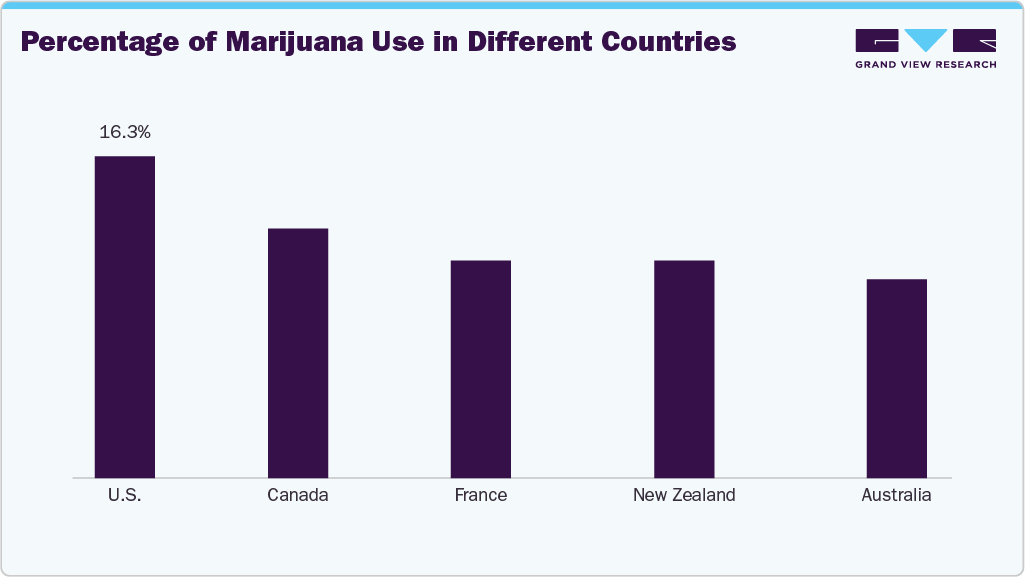

Regional Insights

In 2025, North America dominated the cannabidiol market, with a revenue share of 85.80%, driven by several factors, including a large number of health-conscious individuals, growing acceptance of CBD products, the presence of major manufacturers, and the approval of the U.S. Farm Bill. The region is considered the most advanced in cannabis and its products, including cannabidiol, with the highest number of CBD companies and favorable laws regarding the use of CBD products.

U.S. Cannabidiol Market Trends

The U.S. CBD market continues to grow, driven by increasing consumer interest in wellness products and expanding retail availability across major distribution channels. Increasing investment, supportive public perception, and ongoing product innovation are helping expand market opportunities across the country. For instance, The Cannabist Company, a New York-based cannabis company, expanded its retail footprint by launching adult-use sales of cannabis in New Jersey, Maryland, and Virginia in July 2024. The company already has its operations in 16 U.S. states.

Europe Cannabidiol Market Trends

Europe is expected to witness the fastest growth over the forecast period. The increasing awareness of the health benefits among consumers, combined with easy availability and affordable prices, has led to the growing popularity of CBD oil in this region. The increasing awareness of the health benefits among consumers, combined with easy availability and affordable prices, has led to the growing popularity of CBD oil in the UK. Furthermore, CBD oil is often incorporated into personal care products, including shampoos, creams, and lotions. The products offered at stores comprise a low percentage of CBD and are mixed with other substances. CBD is marketed in various forms, namely CBD capsules, CBD edibles, CBD hemp oil, and CBD vaping e-liquid. For instance, under Ambiance Cosmetics, Eos Scientific launched six lines of CBD-infused cosmetics, including oils, balms, and moisturizers.

Asia Pacific Cannabidiol Market Trends

The Asia Pacific cannabidiol industry is anticipated to record significant growth over the forecast period, driven by the establishment of hemp production facilities, particularly in China. China is the leading hemp producer in Asia, accounting for nearly half of the world's hemp. It exports around 90% of its products to the U.S., Germany, the UK, the Netherlands, and Japan, and has started growing hemp in three provinces for CBD extraction purposes. The new government policies supporting the industry, combined with low CBD production costs and unique large-scale manufacturing infrastructure and expertise, are anticipated to create intense competition for hemp companies in the U.S., Canada, and the European Union, offering low-cost CBD supplies.

Key Cannabidiol Company Insights

Some of the key players operating in the market include ENDOCA; Cannoid, LLC; Medical Marijuana, Inc.; Canopy Growth Corporation; and Folium Europe B.V.

-

ENDOCA primarily manufactures and distributes pharmaceutical-grade hemp-derived cannabidiol (CBD) products across the globe. The vertically integrated company is involved in cultivating, processing, extracting, and selling CBD products.

-

Cannoid, LLC produces hemp-based therapeutics and works on a contract basis. The company’s primary focus is on encapsulating cannabinoid oil. It offers softgels for various purposes. Its product portfolio includes soft gels with Cannabidivarin (CBDV) for neuromodulation, as well as soft gels with controlled Cannabidiolic Acid (CBDA) and Cannabigerolic Acid (CBGA) fractions intended for immune support.

NuLeaf Naturals, LLC; Isodiol International Inc.; PharmaHemp; and The Cronos Group Cannoid, LLC are some of the emerging participants in the cannabidiol market.

-

NuLeaf Naturals, LLC manufactures and distributes hemp-derived CBD products in the U.S. market. The company provides wholesale, lab-tested, and organic CBD oil & extracts to its consumers in the global market.

-

PharmaHemp produces and supplies a range of Cannabidiol (CBD) products. The company provides a range of CBD products under its brand “PharmaHemp CBD.”

Key Cannabidiol Companies:

The following are the leading companies in the cannabidiol market. These companies collectively hold the largest market share and dictate industry trends.

- ENDOCA

- Cannoid, LLC

- Medical Marijuana, Inc.

- Folium Europe B.V.

- Canopy Growth Corporation

- Elixinol

- NuLeaf Naturals, LLC

- Isodiol International, Inc.

- PharmaHemp

- The Cronos Group

Recent Developments

-

In October 2025, CR Wellness partnered with the global cannabis brand Cookies to launch premium cannabis and CBD wellness products in Brazil, marking Cookies’ entry into South America’s largest market. The rollout begins with prescription-only THC/CBD tinctures and gummies, supported by full regulatory compliance and lab testing.

-

In October 2025, medical cannabis wellness startup Awshad launched a 6500 mg CBD oil aimed at managing chronic pain and severe conditions, marking its most potent formulation to date. The launch coincided with the company achieving profitability in its fourth year, reflecting rising acceptance of cannabis-based wellness in India.

-

In September 2025, the UK Food Standards Agency opened a consultation on approving the first CBD food products as novel foods in Great Britain. The review covers three applications and proposes mandatory safety warnings, signalling progress toward formal regulation of CBD foods in the UK.

-

In November 2024, The Cannabist Company entered a partnership with Veda Warrior, an Ayurvedic wellness brand based in New Jersey. The collaboration focuses on introducing cannabis-infused cooking products such as ghee, olive oil, and coconut oil, with plans to expand into edibles and topicals that integrate Ayurvedic herbal blends.

-

In September 2024, Aurora Cannabis, with Vectura and Fertin Pharma, introduced a newly developed LUO CBD lozenge. The product is designed to deliver cannabidiol through an oral dissolvable format, offering an alternative method of CBD administration for consumers seeking non-inhalation options.

-

In June 2024, Rodedawg International Industries, Inc., a cannabis manufacturer and distributor, introduced the Nutrient CBD, which includes five innovative SKUs, such as two CBD Oil Tinctures, two CBD Creams, and one CBD Roll-On, to meet the various needs of consumers seeking natural and effective wellness solutions.

-

In April 2023, Aurora Cannabis Inc. partnered with Strainprint and announced the launch of the tracking program through the Strainprint App. The tracking program is designed for Aurora patients to keep track of their medical cannabis journey.

-

In January 2023, Medical Marijuana, Inc. announced that HempMeds Brasil, its subsidiary, had launched two new full-spectrum products in Brazil. The concentrations range from 3,000 to 6,000 mg and are available in 30 mL and 60 mL bottles.

Cannabidiol Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.60 billion

Revenue forecast in 2033

USD 30.96 billion

Growth rate

CAGR of 13.70% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Source type, sales type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Netherlands; Switzerland; Italy; France; Poland; Czech Republic; Croatia; China; Japan; India; South Korea; New Zealand; Australia; Brazil; Argentina; Mexico; Colombia; Uruguay; Chile; South Africa; Israel

Key Companies Profiled

ENDOCA; Cannoid, LLC; Medical Marijuana, Inc.; Folium Europe B.V.; Canopy Growth Corporation; Elixinol; NuLeaf Naturals, LLC; Isodiol International, Inc.; PharmaHemp; The Cronos Group

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannabidiol Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cannabidiol market report based on source type, sales type, end use, and region:

-

Source Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hemp

-

Marijuana

-

-

Sales Type Outlook (Revenue, USD Million, 2021 - 2033)

-

B2B

-

By End Use

-

Pharmaceuticals

-

Wellness

-

Food & Beverages

-

Personal Care & Cosmetics

-

Nutraceuticals

-

Others

-

-

-

-

B2C

-

By Sales Channel

-

Hospital Pharmacies

-

Online

-

Retail Stores

-

-

By End Use

-

Medical

-

Chronic Pain

-

Mental Disorders

-

Cancer

-

Others

-

-

Personal Use

-

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical

-

Chronic Pain

-

Mental Disorders

-

Cancer

-

Others

-

-

Personal Use

-

Pharmaceuticals

-

Wellness

-

Food & Beverages

-

Personal Care & Cosmetics

-

Nutraceuticals

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Netherlands

-

Switzerland

-

Italy

-

France

-

Poland

-

Czech Republic

-

Croatia

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

New Zealand

-

Australia

-

-

Latin America

-

Argentina

-

Brazil

-

Mexico

-

Colombia

-

Uruguay

-

Chile

-

-

Middle East & Africa (MEA)

-

Israel

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cannabidiol market size was estimated at USD 10.68 billion in 2025 and is expected to reach USD 12.60 billion in 2026.

b. The global cannabidiol market is expected to grow at a compound annual growth rate of 13.70% from 2026 to 2033 to reach USD 30.96 billion by 2033.

b. Hemp segment dominated the CBD market and accounted for a revenue share of over 58.03% in 2025. This is attributable to the high availability of hemp-derived products in dispensaries, government-approved pharmacies, and stores.

b. Some key players operating in the cannabidiol market include ENDOCA; Cannoid, LLC; Medical Marijuana, Inc.; Folium Europe B.V.; Canopy Growth Corporation; Elixinol; NuLeaf Naturals, LLC; Isodiol International, Inc.; PharmaHemp; The Cronos Group

b. Key factors that are driving the CBD market growth include increasing demand for cannabidiol (CBD) for medical and wellness purposes owing to its healing properties.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.