- Home

- »

- Pharmaceuticals

- »

-

Legal Marijuana Market Size, Share & Growth Report, 2030GVR Report cover

![Legal Marijuana Market Size, Share & Trends Report]()

Legal Marijuana Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Medical, Adult Use), By Product Type (Flower, Oils and Tinctures), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-152-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2016 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Legal Marijuana Market Summary

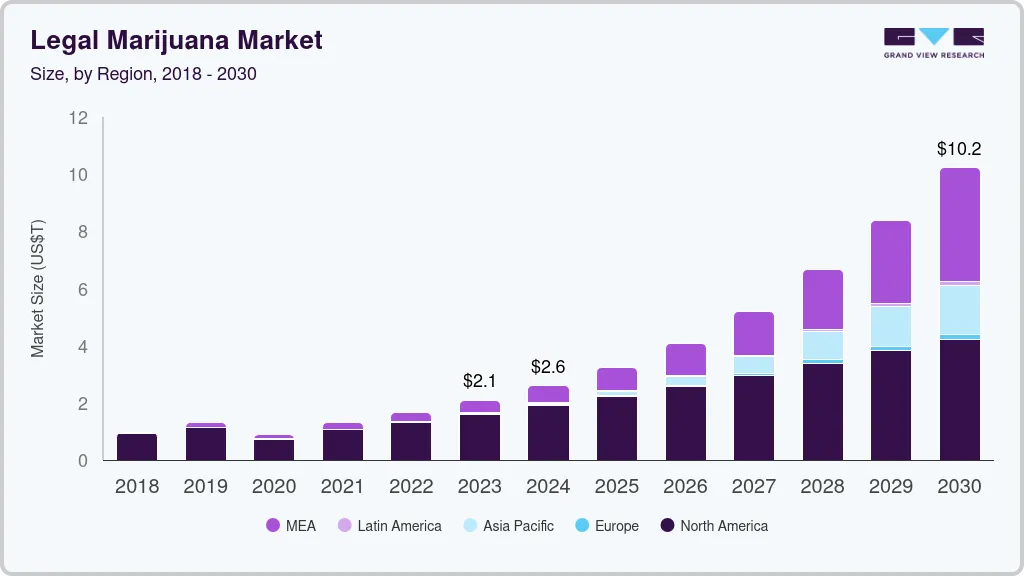

The global legal marijuana market size was estimated at USD 21.0 billion in 2023 and is projected to reach USD 102.2 billion by 2030, growing at a CAGR of 25.4% from 2024 to 2030. Increasing demand for legal marijuana is a major factor in growth of the market.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 76.0% in 2023.

- U.S. is expected to register the highest CAGR from 2024 to 2030.

- By application, the medical segment led the market and accounted for 79.1% of the global revenue in 2023.

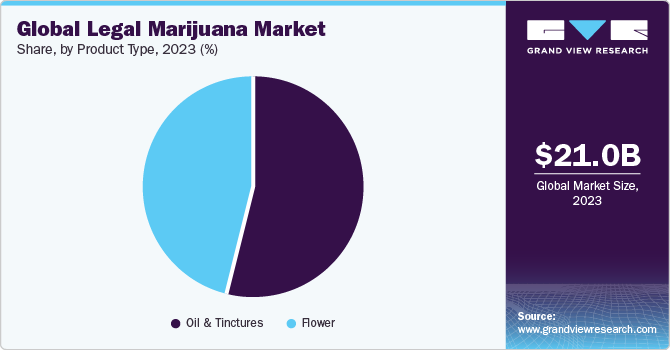

- By product type, oil and tinctures segment accounted for largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 21.0 Billion

- 2030 Projected Market Size: USD 102.2 Billion

- CAGR (2024-2030): 25.4%

- North America: Largest market in 2023

Recently, many countries have legalized the use of medical marijuana for treating various conditions. For instance, in June 2023, Luxembourg legalized possession and cultivation of cannabis for recreational use and became the second European Union member country to legalize it. In addition, North America (the U.S. and Canada) has gone a step further and has sanctioned the use of recreational marijuana as well. More than two-thirds of the U.S. states have legalized marijuana. The industry is experiencing growth owing to growing awareness regarding various therapeutic benefits of the product, such as reducing eye pressure, appetite enhancement, and pain management.Several studies have shown that medical marijuana and its derivatives can be used to treat symptoms of various diseases. For instance, according to articles published by the National Center for Biotechnology Information (NCBI), cannabis has been successfully used to treat patients with chemotherapy-induced nausea, chronic pain, Alzheimer’s, Parkinson’s, and other neurological diseases. Furthermore, the FDA and other such associations have now started accepting marijuana derivatives for the prescription of diseases, which has proven to be useful. For instance, the FDA has approved the cannabinoids cannabidiol (Epidiolex) for certain forms of severe epilepsy and dronabinol (Marinol, Syndros) for nausea and vomiting caused by cancer chemotherapy. This is another factor that drives the market growth.

With a changing government policy, the demand for medical marijuana is also increasing. A lot of countries that have legalized the use of medical marijuana are also paving the way for its cultivation to cut imports and earn revenue in the form of taxes. This, in turn, has generated industry jobs, and many more companies are dabbling in this industry. For instance, in the Netherlands, marijuana is a big business, and annually, the Dutch government earns 400 million euros (USD 437.96 million) in taxes from the nation's 730 marijuana-selling coffee shops.

Several startups in the U.S. and Europe are now focusing on alternate uses of cannabis other than recreational and medicinal. With so much happening in and around the cannabis industries, the countries are paving way for more liberal policies regarding its cultivation and usage in the medical field as well as industrial use. For instance, Sanity Group, a Berlin-based Startup founded in 2018, offers Vayamed and AVAAY Medical (medicinal cannabis) and Endosane Pharmaceuticals (finished cannabis pharmaceuticals).

A growing number of cultivators for cannabis, including marijuana, since this rakes in more revenues for the various governments. Since being legalized, its sales have increased exponentially, leading to diverse applications across various industries, from medical to industrial, which has generated new opportunities to increase revenues. For instance, the sales of medical and non-medical based cannabis in Canada is as follows,

Table 1 Total Medical And Non-Medical Sales In Packaged Units In Canada

Cannabis product type

Total medical and non-medical sales (units)

Percentage share of total sales

Dried cannabis

10,634,524

53%

Edible cannabis

4,416,270

22%

Cannabis Extracts

4,907,319

24%

Seeds

5,552

<0.1%

Topicals

76,564

0.3%

Vegetative cannabis plant

10,278

<0.1%

With the FDA-level authorizations underway, the market for legal marijuana is only going to expand. A large number of clinical trials are anticipated to support marijuana derivatives for it to be legally prescribed for indications. For instance, in October 2023, Avextra Pharma GmbH announced the new double-blind Phase 2 clinical trial for the use of cannabis in the treatment of cancer patients in palliative care.

Market Concentration & Characteristics

The market growth stage is high, and pace of the market growth is accelerating. The legal marijuana market is characterized by a moderate-to-high degree of growth owing to rising investment in R&D programs and increased demand for cannabis-containing vapes, pre-rolls, and gummies. For instance, the Philadelphia College of Osteopathic Medicine (PCOM) conducts medical marijuana research to assess the impact of medical cannabis on behavior, quality of life, chronic pain, and more .

The market is characterized by a high degree of innovation owing to ongoing clinical trials on the use of cannabis and its medicinal properties, increasing product demand due to its health benefits, and growing preference for cannabis extracts such as oils and tinctures. For instance, in November 2023, a Tasmanian medicinal cannabis farm tripled its production as demand for cannabis-based products increased.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by the leading players. Through M&A activity, these companies can expand their product portfolio, enter new territories, and strengthen their market position. For instance, in May 2022, Canopy Growth Corporation entered into definitive agreements to acquire Lemurian, Inc., a producer of high-quality cannabis extracts, to broaden Canopy Growth’s portfolio of premium brands with significant opportunities to scale across North America.

The global market for legal marijuana is flourishing owing to the increasing number of countries legalizing and providing a systematic regulatory framework for the cultivation and sale of cannabis. For instance, in Asia, in February 2021, Thailand became the first country to legalize the use and purchase of cannabis leaves. Later, in June 2022, the legalization was extended to the whole plant, following the 2019 allowance for medical purposes. Thus, increased legalization for cannabis boosts the market growth.

Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance, in October 2023, Cantourage Group SE, a producer and distributor of medical cannabis, launched a range of high-THC medicinal cannabis flowers in Switzerland in collaboration with Astrasana.

The popularity of cannabis-containing foods and the legalization of cannabis is rapidly rising due to the various health benefits associated with cannabis. Due to legalization, many market players are expanding their market presence in such areas. For instance, in October 2022, Canopy Growth Corporation, a Canadian-based cannabis company, sped up its entry into the U.S. cannabis market with a new holding company, i.e., Canopy USA. This move allowed Canopy Growth Corporation to complete its acquisition of California extracts maker Jetty, Colorado-based edibles specialist Wana Brands, and New York-based Acreage Holdings.

Application Insights

By application, market is segmented into medical and adult use. The medical segment led the market and accounted for 79.1% of the global revenue in 2023. Factors such as recent legalization and decriminalization of marijuana for medical use attributed to growth of this segment. Patients in these geographic regions have been seen preferring the medical use of marijuana due to the ease of availability and economical pricing. For instance, according to the National Conference of State Legislatures, as of April 2023, in the U.S., cannabis products were legalized in 38 states, three territories, and the District of Columbia for medical use.

Furthermore, cannabis derivatives have been extensively studied for their potency as an analgesic. It has shown far better results with fewer side effects than the regular medicines being prescribed till now. It has been proven to reduce arthritic pain significantly with negligible side effects. For instance, according to a study published in Jama Network Open in 2023, more than half of adults (948 out of 1661) used cannabis to manage their chronic pain. With an increase in awareness surrounding the use of medical cannabis and its derivatives, the market is expected to grow over the forecast period.

Adult-use segment is expected to witness fastest CAGR growth over the forecast period. In countries like the U.S. and Canada, where adult-use and medical-use cannabis have both been legalized, people are still preferring adult-use marijuana due to the lack of reimbursements available for medical marijuana. For instance, according to the National Conference of State Legislatures, as of November 2023, in the U.S., 24 states, two territories, and the District of Columbia have enacted guidelines to regulate cannabis for adult or recreational use. Moreover, changing consumer behavior toward recreational marijuana is another factor anticipated to boost segment growth.

Product Type Insights

By product type, market is divided into oil & tinctures and flowers. Oil and tinctures segment accounted for largest market revenue share in 2023. Marijuana oil and tinctures are being studied extensively for multiple indications in a lot of countries. Oils extracted from cannabis are utilized for the treatment of nausea and vomiting caused due to cancer. Furthermore, rising introduction of cannabis-based products for medical use drives the market growth. For instance, in May 2023, Stenocare received approval from the Federal Institute for Drugs and Medical Devices (BfArM) for its medical cannabis oil for prescription-based sales to German patients.

In addition, oil and tinctures are anticipated to register the fastest growth rate over the forecast period. Cannabinoids that are present in the oil help in improving sleep disorders and alleviate anxiety and stress. For instance, according to an article published in NCBI, preliminary research on insomnia and cannabis suggested that cannabidiol (CBD) may have therapeutic potential for the treatment of insomnia. The demand for oils and tinctures is anticipated to increase over the forecast period owing to a substantial increase in patients preferring oil compared to flowers. Moreover, children who need cannabis derivatives for their treatment cannot be suggested to use flowers to smoke and are instead being prescribed oils and tinctures due to the respiratory problems caused by smoking flowers.

Regional Insights

North America dominated the market with a revenue share of 76.0% in 2023. The rapid increase in the rate at which the government is decriminalizing cannabis for both medical and adult use or recreational use of marijuana is a key factor driving the regional market. The presence of majority of market players in the cannabis market and structured regulatory framework further strengthens this position. For instance, in February 2023, the FDA issued guidance on cannabis and cannabis-derived compounds, specifically for the development of drugs for human use. With more than two-thirds of the U.S. falling under the legal territory for cannabis, the demand and supply both have increased, which is further boosting North America’s position as the forerunner.

Several countries are legalizing cannabis in the Asia Pacific region, and growing cannabis research programs boost the market growth. For instance, in July 2023, the 'Cannabis Research Project' at CSIR-IIIM Jammu was established in India through a Canadian company and government partnership. This project has the potential to benefit people by exploring the use of cannabis to treat conditions such as epilepsy, neuropathies, and cance. Due to clinical studies confirming its effectiveness as a pain reliever, countries with a significant elderly population are expected to accelerate the legalization process, which can spur the industry's growth in the region.

Key Companies & Market Share Insights

Some of the key players operating in the market include Canopy Growth Corporation, AURORA CANNABIS INC., Tilray Brands Inc. (Aphria, Inc.), and The Cronos Group. Lexaria Bioscience, Organigram Holdings Inc., and MARICANN INC., are some of the emerging market participants in the legal marijuana market.

-

Canopy Growth Corporation is a one of the leading producer and distributor of medical cannabis. The company offers a range of brands in Canada, the U.S., and across the globe. Some of its brands in Canada are Tweed, DOJA, Quatreau, and Deep Space, and in the U.S. are CBD & Quatreau. The company is focusing on their innovation and R&D capabilities and introducing innovative edibles and beverages.

-

AURORA CANNABIS INC. is a producer and distributor of dried cannabis and cannabis oil. The company has a presence in more than 20 countries. It has entered into strategic agreements with various companies, catering to industry verticals such as pharmaceuticals, food & beverages, and others for its cannabis supply.

-

Organigram Holdings Inc. produces and markets medical cannabis within Canada. Some of the company's key brands include Banook, Rossignol, Shubie, and Utopia.

Key Legal Marijuana Companies:

- Canopy Growth Corporation

- AURORA CANNABIS INC.

- Tilray Brands Inc. (Aphria, Inc.)

- ABcann Medicinals, Inc. (VIVO Cannabis Inc.)

- The Cronos Group

- MARICANN INC.

- Organigram Holdings Inc.

- Lexaria Bioscience

- GW Pharmaceuticals (Jazz Pharmaceuticals, Inc.)

- Tikun Olam

- United Cannabis Corporation

Recent Developments

-

In January 2024, Village Farms International, Inc., announced the launch of two cannabis brands in the UK, such as Pure Sunfarms and The Original Fraser Valley Weed Co. (Fraser Valley). 4C LABS, a UK-based medical cannabis company, will distribute these brands.

-

In March 2023, Canopy Growth introduced six new beverage flavors. Under the Deep Space brand, the company announced Canada's first cannabis-infused beverage with naturally occurring caffeine. The company also launched four flavors under the Tweed brand for springtime.

Legal Marijuana Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.0 billion

Revenue forecast in 2030

USD 102.2 billion

Growth rate

CAGR of 25.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/ billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; Netherlands; Spain; Croatia; Poland; Czech Republic; Switzerland; Japan; China; India; New Zealand; Australia, Thailand; Brazil; Mexico; Colombia; Uruguay; South Africa, Israel

Key companies profiled

Canopy Growth Corporation; AURORA CANNABIS INC.; Tilray Brands Inc. (Aphria, Inc.); ABcann Medicinals, Inc. (VIVO Cannabis Inc.); The Cronos Group; MARICANN INC.

Organigram Holdings Inc.; Lexaria Bioscience; GW Pharmaceuticals (Jazz Pharmaceuticals, Inc.); Tikun Olam; United Cannabis Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Legal Marijuana Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global legal marijuana market report based on application, product type and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical

-

Chronic Pain

-

Cancer

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Adult Use

-

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flower

-

Oil & Tinctures

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Netherlands

-

Croatia

-

Poland

-

Czech Republic

-

Switzerland

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

New Zealand

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Uruguay

-

Colombia

-

-

Middle East & Africa (MEA)

-

South Africa

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global legal marijuana market size was estimated at USD 21.0 billion in 2023 and is expected to reach USD 26.00 billion in 2024.

b. The global legal marijuana market is expected to grow at a compound annual growth rate of 25.7% from 2024 to 2030 to reach USD 102.2 billion by 2030.

b. The medical-use segment dominated the legal marijuana market with a revenue share of 79.1% in 2023 and is expected to witness significant growth from 2023 to 2030.

b. The oil and tinctures segment dominated the legal marijuana market in 2023 with a revenue share of 54.2%.

b. The chronic pain segment dominated the legal marijuana market in 2023 with a share of 26.2%.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.