- Home

- »

- Pharmaceuticals

- »

-

CBD Consumer Health Market Size & Share Report, 2030GVR Report cover

![CBD Consumer Health Market Size, Share & Trends Report]()

CBD Consumer Health Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Medical OTC Products, Nutraceuticals), By Distribution Channel (Online Stores, Retail Stores, Retail Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-762-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

CBD Consumer Health Market Size & Trends

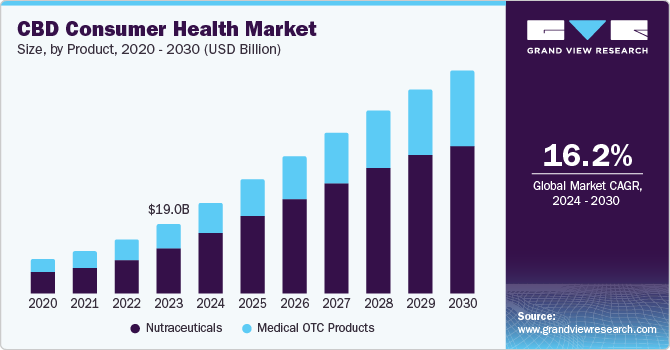

The global CBD consumer health market size was valued at USD 19.05 billion in 2023 and is projected to grow at a CAGR of 16.2% from 2024 to 2030. The leading factor attributed to this growth is the increasing number of positive government reforms for legalizing cannabidiol (CBD) in various regions worldwide. CBD consumer products are gaining significant acceptance due to rising awareness of their health benefits. Furthermore, the demand for hemp-derived CBD products is increasing globally due to the legalization of hemp in various countries.

Cannabidiol has become increasingly popular in dietary supplements due to its health benefits and non-narcotic properties. Unlike Tetrahydrocannabinol (THC), it helps users to gain beneficial features of cannabis without intoxication. People believe that CBD supplements offer more natural alternatives when compared to prescription or over-the-counter drugs for relieving stiffness, pain, anxiety, stress, and other medical conditions. Hemp-derived CBD is a preferred source by manufacturers owing to the low concentration of THC. The presence of favorable regulations concerning hemp cultivation in various countries, such as the U.S., Canada, China, India, the UK, and several European economies, has supported the demand for hemp-derived CBD products and helped these countries boost their exports.

Cannabidiol has become a prevalent consumer trend, owing to changing cultural perceptions about the product and its noticeable advantages for health. Additionally, leading participants' innovative marketing and advertising efforts have become a major factor driving product demand. Subsequently, a noticeable increase in consumer product options, such as topicals, analgesics, edibles, oils, tinctures, and many other products, is driving substantial growth in this market. In addition, increasing awareness about the health benefits of CBD-infused products has increased the number of people willing to buy these products, irrespective of their cost.

Witnessing this sudden growth in demand, mainstream retailers earlier engaged in selling non-CBD products are now focusing on selling CBD-based products due to the higher profit margins and sales generated. For instance, in March 2023, CV Sciences, Inc., a U.S.-based consumer wellness company involved in selling hemp extracts and other scientific natural ingredients, announced the addition of +PlusCBD Daily Balance THC-Free Gummies and Softgels to the company's +PlusCBD product portfolio, which offers wellness benefits of CBD to consumers. Such developments have become more frequent in recent years, boosted by legalization and a positive approach by health authorities and governments in this industry.

Product Insights

Nutraceuticals segment accounted for the largest revenue share of 63.9% in 2023 in the CBD consumer health market. The increasing adoption of CBD-infused nutraceutical products in various applications such as weight management, sports nutrition, and health & wellness are contributing to this segment’s growth. Additionally, increasing awareness among consumers regarding the health benefits of cannabidiol, shifting consumer preferences towards organic ingredients in their dietary supplements, and favorable government reforms regarding CBD are key factors driving market expansion.

Moreover, an increase in the number of companies entering the CBD nutraceuticals space in recent years, the presence of lucrative investment opportunities, and a growing consumer base are likely to drive the demand for these products at a substantial pace over the forecast period. In January 2023, Medical Marijuana, Inc., the first publicly traded cannabis company in the U.S., launched two new full-spectrum products in Brazil under its subsidiary HempMeds Brasil. These competitively priced products are available in 30 and 60 mL jars, offering 3,000 to 6,000mg of CBD with significant cost savings for the rapidly expanding Brazilian market. The subsidiary's competitive pricing model aims to capitalize on this growing market.

Medical OTC products are expected to register a faster growth rate over the forecast period. It is owing to the increasing recognition of CBD's therapeutic benefits and the growing demand for self-care and wellness products. Medical OTC products, such as pain relief creams, balms, and supplements, have gained significant traction among consumers seeking natural alternatives for managing chronic pain, inflammation, and anxiety. The easing of regulatory restrictions and increasing availability of CBD-based products have further fueled segment growth. Additionally, expanding distribution channels, including online platforms and retail stores, has increased the accessibility of medical OTC CBD products to consumers.

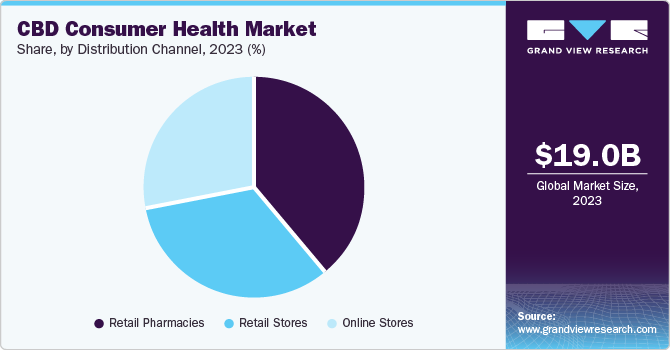

Distribution Channel Insights

In 2023, the retail pharmacies segment accounted for the highest revenue share in the global market. After the legalization of CBD products in various geographies, the avenues for supplying those products to consumers have broadened exponentially. This is mainly due to the higher consumption of cannabidiol-infused OTC medicines or products through retail pharmacies.

Meanwhile, the online stores segment is estimated to register the fastest CAGR during the forecast period, owing to the ease of availability of products through online portals. A majority of the companies have launched their online portals to purchase CBD-based products. This has increased the visibility of cannabidiol products to consumers, even in remote locations. For instance, in May 2024, Capital CBD American Shaman, a Texas-based manufacturer of CBD edibles and topicals, among other products, announced the launch of its e-commerce website to boost its online sales. Companies are also collaborating with specialty stores, such as Sephora or GNC, to generate online and offline sales.

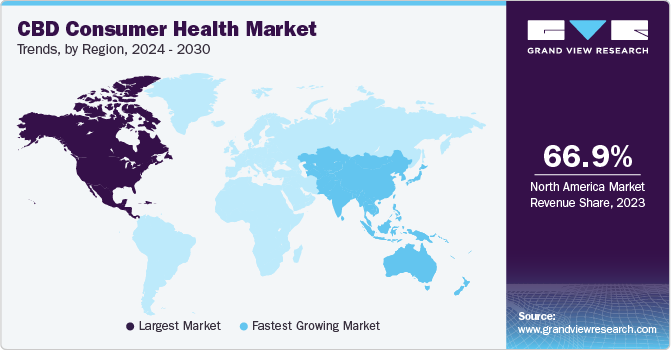

Regional Insights

North America dominated the market for CBD consumer health products with a revenue share of 66.9% in 2023. This is attributed to the higher concentration of CBD companies and relaxed laws regarding the utilization of such products in this region. In addition, an increase in CBD consumption, a rise in awareness about its health benefits, the growing popularity of CBD-based food and health products, and the introduction of the Farm Bill 2018 that has legalized hemp cultivation and manufacturing of hemp-derived products in the U.S. are some major factors driving regional demand.

U.S. CBD Consumer Health Market Trends

Increasing acceptance and adoption of cannabis-derived products among consumers have been a major growth driver for the U.S. market. The decriminalization of these products has led to an increased adoption among a larger consumer base. For instance, the U.S. Food and Drug Administration (FDA) has approved the use of cannabis-derived drug product Epidiolex (Cannabidiol) and three synthetic CBD-derived products: Marinol (dronabinol), Cesamet (nabilone), and Syndros (dronabinol), for medical purposes. A well-developed infrastructure for crop production and distribution in the economy has facilitated the efficient production and supply of CBD products.

Europe CBD Consumer Health Market Trends

Europe is anticipated to witness a notable CAGR during the forecast period, attributed to rising consumer awareness and positive perception regarding CBD and its products, as well as strategic investments of major companies operating in this region. Moreover, there is a growing adoption of CBD oil in countries such as Switzerland, Germany, and the UK, which is expected to drive the regional market. According to a study by Frontier Financial Group, Inc., European cannabis consumers are embracing CBD edibles and topicals. In September 2022, Medical Marijuana, Inc. announced that its subsidiary, Kannaway, had signed a distribution agreement with Complete Hemp Technologies (CHT) to expand its presence in the European market.

Germany’s progressive stance on medical cannabis has fostered a conducive regulatory environment for CBD-based products. The legalization of cannabis for medical purposes in Germany has accelerated research and development activities in the CBD domain, leading to a surge in product innovation and availability. Regulatory authorities in the country have relaxed their restrictions on the possession of cannabis. For instance, the Federal Ministry of Food and Agriculture (BLE) has relaxed its regulations on cannabis and allowed the opening of Cannabis Social Clubs (CSC) for the regulated purchase of cannabis. Germany’s position as a European powerhouse has attracted substantial investments in the CBD sector.

Asia Pacific CBD Consumer Health Market Trends

Asia Pacific CBD consumer health market is estimated to register the fastest CAGR during the forecast period. This is attributed to the increasing awareness of the health benefits of CBD, especially for chronic pain, anxiety, insomnia, epilepsy, and skin conditions. Moreover, the acceptance of CBD products in major Asian economies such as Thailand, South Korea, Japan, and India, which create a favorable environment for the industry and consumers, is another factor propelling regional industry growth.

The CBD consumer health market in China held a substantial revenue share in 2023, owing to rising CBD-based healthcare initiatives and increased spending capacity of middle-class consumers. China’s growing economy and high disposable income have allowed consumers to spend more on health and wellness products, thus creating demand for CBD nutraceuticals and OTC products. In addition, a large proportion of the aging population in China is a major driver for CBD nutraceuticals, focusing on senior health solutions such as pain relief and easy-to-use applications such as CBD tinctures, capsules, and softgels.

Key CBD Consumer Health Company Insights

Some key companies involved in the CBD consumer health market include Medical Marijuana, Inc., CV Sciences, Inc., and ENDOCA, among others.

-

Medical Marijuana Inc. is a California-based U.S. company that develops, manufactures, and sells hemp-derived CBD products through its subsidiaries. For instance, the company sells CBD-derived products in Brazil through its subsidiary HempMeds Brasil. The company offers various CBD-derived products such as CBD oils, tinctures, capsules, and others. CBD Gummies offered by the company are among the company’s most sought-after items.

-

CV Sciences, Inc. is a U.S.-based specialty pharmaceuticals and consumer wellness company that develops, manufactures, and sells nutraceuticals and herbal-based CBD products. The company sells its products majorly through two brands: +PlusCBD and +PlusCBD Pet, which include oils, softgels, capsules, topicals, and gummies. In addition, the company sells pain-relief products such as CBD Pain Relief Arthritis Cream, Muscle Cream, Balms, Sprays, and Roll-Ons.

Key CBD Consumer Health Companies:

The following are the leading companies in the CBD consumer health market. These companies collectively hold the largest market share and dictate industry trends.

- Elixinol

- ENDOCA

- NuLeaf Naturals, LLC

- Kazmira

- Charlotte's Web, Inc.

- Joy Organics

- The Cronos Group

- Medical Marijuana, Inc.

- CV Sciences, Inc.

- Isodiol International Inc.

Recent Developments

-

In June 2024, Charlotte's Web, Inc. announced its debut in Walmart stores across the U.S. in the states of Illinois, Texas, California, Pennsylvania, and Florida. Over 800 Walmart stores in these states will sell this company’s CBD topical products. This product availability will ensure an accessible and expanded supply to a large consumer base in the country.

-

In May 2024, CV Sciences, Inc. announced the acquisition of Elevated Softgels, which manufactures encapsulated softgels and tinctures for the nutrition and supplement industry. The strategic move is expected to offer CV Sciences flexibility in the production of soft gels and tinctures to cater to the requirements of its consumer base while also acquiring new clients.

CBD Consumer Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.86 billion

Revenue Forecast in 2030

USD 61.17 billion

Growth Rate

CAGR of 16.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, Australia, South Korea, India, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Elixinol; ENDOCA; NuLeaf Naturals, LLC; Kazmira;

Charlotte's Web, Inc.; Joy Organics; The Cronos Group; Medical Marijuana, Inc.; CV Sciences, Inc.; Isodiol International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CBD Consumer Health Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the CBD consumer health market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical OTC Products

-

CBD Analgesic Products

-

CBD Dermatology Products

-

CBD Mental Health Products

-

CBD Sleeping Aids Products

-

Other OTC Products

-

-

Nutraceuticals

-

CBD Vitamins and Dietary Supplements (VDS)

-

CBD Sports Nutrition

-

CBD Weight Management and Wellbeing

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Stores

-

Retail Stores

-

Retail Pharmaci

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.