- Home

- »

- Animal Health

- »

-

CBD Pet Market Size, Share, Growth, Industry Report,2033GVR Report cover

![CBD Pet Market Size, Share & Trends Report]()

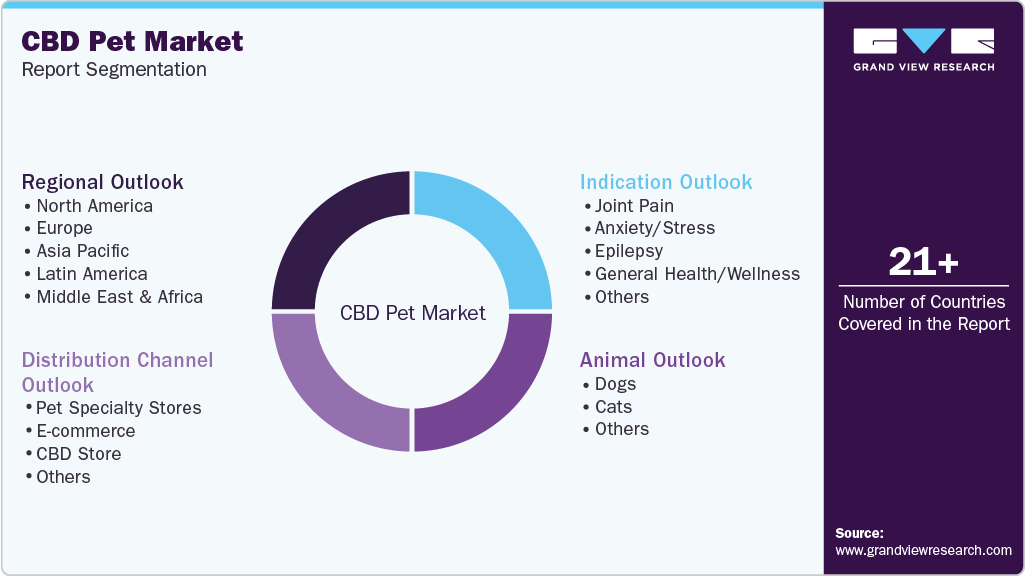

CBD Pet Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Dogs, Cats), By Indication (Joint Pain, Anxiety/Stress, Epilepsy), By Distribution Channel (Pet Specialty Stores, E-commerce, CBD Store), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-103-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

CBD Pet Market Summary

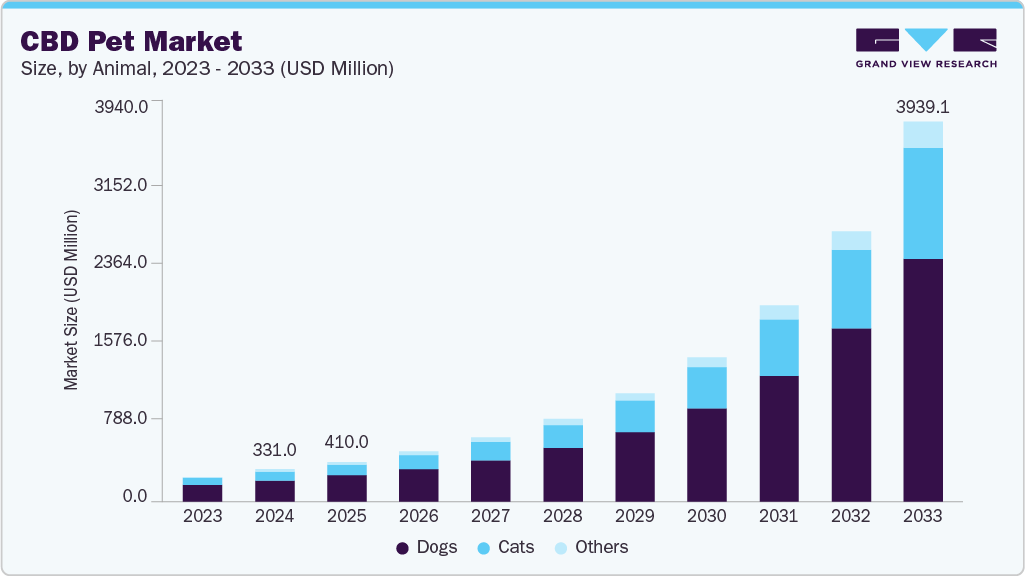

The global CBD pet market size was estimated at USD 331.0 million in 2024 and is projected to reach USD 3,939.1 million by 2033, growing at a CAGR of 32.69% from 2025 to 2033. Some of the key factors driving the market growth are rising investment in R&D and product innovation, growing awareness of CBD’s therapeutic benefits, and expansion of distribution channels and product accessibility.

Key Market Trends & Insights

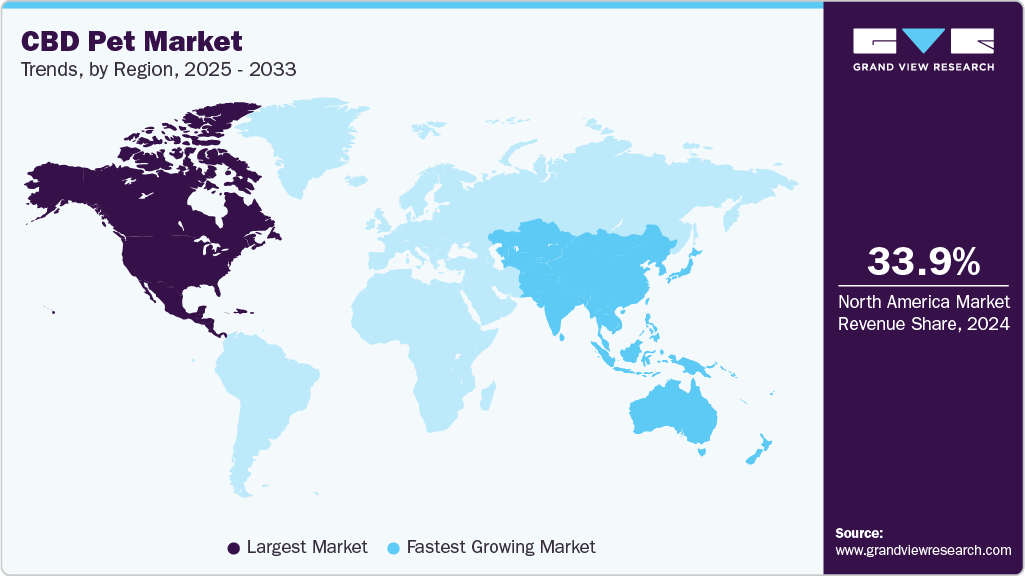

- North America dominated the global CBD pet market with the largest revenue share of 33.97% in 2024.

- The CBD pet market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By animal, the dogs segment led the market with the largest revenue share of 65.45% in 2024

- By indication, the joint pain segment accounted for the largest market revenue share in 2024.

- Based on distribution channel, the e-commerce segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 331.0 Million

- 2033 Projected Market Size: USD 3,939.1 Million

- CAGR (2025-2033): 32.69%

- North America region: Largest market share in 2024

- Asia Pacific region: Fastest growing market

In addition, the market is experiencing growth due to supportive regulatory developments in the regions.Investments by manufacturers in research and development are enhancing product efficacy, safety, and formulation, thereby driving the CBD pet industry. The key companies are exploring novel delivery methods such as flavored chews, oils, capsules, and topicals to improve palatability and ease of administration. Many scientific studies on CBD’s effects on stress, anxiety, arthritis, and inflammation in pets help validate claims and promote research initiatives. A study published by the Journal of Cannabis Research in November 2025, highlighted CBD’s therapeutic potential, especially for anxiety, sleep, and psychosis, where the global institutions continue investigating its broader applications.

In addition, innovation also extends to customized, breed-specific, and life-stage-targeted products, increasing relevance for pet owners. For instance, in August 2025, Rooted Owl was awarded the 2025 Pet Innovation Award for its CBD calming oil, recognized for innovative, veterinarian-developed, organic formulations that ease pet stress, promote relaxation, and exemplify premium pet wellness solutions. Such innovations are expanding CBD pet wellness market.

In addition, the availability and accessibility of CBD pet products through online platforms, pet specialty stores, veterinary clinics, and retail chains are driving market growth. Partnerships between CBD manufacturers and distributors, as well as retail collaborations, ensure products reach a wider audience, including pet parents in both urban and semi-urban areas. For instance, in January 2025, Greenlane expanded in U.S. through an exclusive distribution deal with Green Gruff, offering veterinarian-approved, broad-spectrum CBD treats and supplements for dogs’ health and wellness. Moreover, e-commerce platforms allow convenient purchasing, product comparisons, and subscription-based delivery, boosting repeat purchases. In addition, product diversification ranging from tinctures, chews, and capsules to topicals caters to varying pet needs.

Moreover, the CBD pet industry is also being driven by increasing awareness of CBD’s potential health benefits for pets. The market is witnessing rise in research and clinical studies demonstrating CBD’s efficacy in managing stress, anxiety, pain, inflammation, arthritis, and mobility issues in dogs and cats. Veterinarians and pet wellness professionals are also recommending CBD-based supplements for chronic conditions, supporting its acceptability. In addition, marketing campaigns and educational initiatives by brands highlight CBD’s natural, non-psychoactive properties, making it an attractive choice for pet owners seeking alternative therapies. For instance, in April 2024, Pet Supermarket highlighted its CBD and hemp-based products across U.S. locations, emphasizing stress and anxiety relief for pets, supporting active, healthy lifestyles under veterinarian guidance, promoting complete pet wellness. As consumers gain confidence in CBD’s safety and effectiveness, adoption grows rapidly, fueling product innovation and higher sales in the veterinary and pet wellness markets.

Furthermore, regulatory frameworks in several regions are increasingly permitting the sale and use of CBD pet products, fueling market growth. Countries such as U.S., Canada, and parts of Europe have clarified legal guidelines regarding THC content, manufacturing standards, and labeling requirements. This provides manufacturers with confidence to innovate and expand their product portfolios while ensuring consumer safety. Regulatory support also facilitates veterinary endorsement and encourages retailers to stock CBD pet products. As legal clarity improves, more pet owners feel comfortable purchasing these supplements, driving wider adoption.

Summary of AVMA 2025 Report on CBD Use in Dogs and Cats

Aspect

Dogs

Cats

Uses/Benefits

Pain relief, osteoarthritis, inflammation, anxiety, seizures

Therapeutic effects inconclusive; mainly safety studied

Sensitivity

Susceptible to THC toxicity, balance issues

Fewer studies; hypersalivation, lip smacking, head shaking observed

Common Side Effects

Mild diarrhea, soft stool, increased liver enzymes (ALP) in up to 36%

Mild, transient effects; no sustained liver/kidney issues

Long-Term Effects

Generally well tolerated; higher doses may increase soft feces and ALP

Limited data; no major long-term effects reported

Research Gaps

Need for controlled clinical trials to validate efficacy and safety

Significant need for studies on therapeutic outcomes and long-term effects

AVMA Recommendation

Emphasizes controlled studies vs. anecdotal evidence

Calls for more research to understand benefits and risks

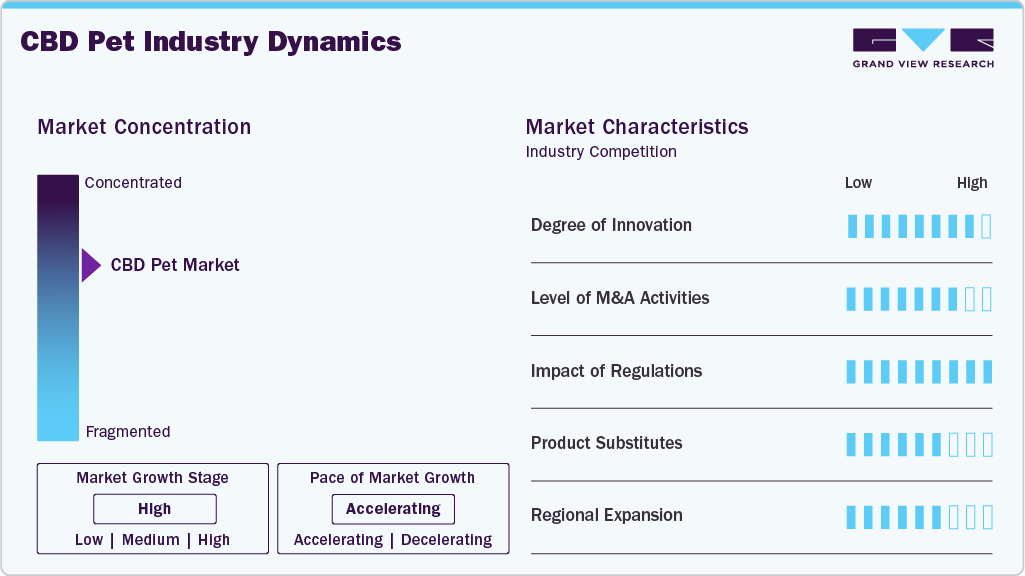

Market Concentration & Characteristics

The CBD pet industry is at a high growth stage, and the pace is accelerating. Rapid developments in veterinary diagnostics, as well as increased R&D expenditure by leading players, are key drivers of market growth. Market concentration is influenced by the pace of technological advancements. Companies that invest in research and development to introduce innovative products with enhanced features and efficacy can gain a competitive advantage and increase their market share. Conversely, companies that do not succeed to keep up with technological advancements, risk losing market share to competitors.

The CBD pet industry is witnessing a high degree of innovation, particularly with the development of innovative products for pets. For instance, in March 2024, Colorado State University researchers conducted a clinical trial showing CBD oil reduced seizure days in dogs with idiopathic epilepsy, with minimal side effects, though some exhibited elevated liver enzymes. Moreover, veterinary institutes are shifting their studies toward CBD and its potential applications in animal health & wellness.

The CBD pet industry is experiencing an increase in collaboration and partnership activities by key players to expand the distribution network. For instance, in December 2025, Astrasana Holding AG completed a majority acquisition of Releaf for Pets, advancing Europe’s approved CBD veterinary product line, available in multiple countries, highlighting CBD’s strong efficacy, especially in dogs.

Regulatory frameworks significantly influence the CBD pet industry. Strict laws on cannabinoid use, labeling, and claims can limit product availability, delay launches, and increase compliance costs. In countries with clear, supportive regulations facilitate market growth, enabling safe, legal distribution and boosting consumer confidence. Regulatory clarity also encourages investments and innovation in pet wellness products.

Product substitutes in the CBD pet industry include traditional pharmaceuticals, natural supplements, and herbal remedies. These alternatives, such as valerian root, chamomile, and prescription medications for anxiety and pain, offer similar benefits without the regulatory complexities associated with the products. They can serve as viable options for pet owners seeking effective treatments.

Geographic expansion drives market growth as companies target new markets with rising pet ownership and disposable income. Growth is particularly strong in North America, Europe, and Asia-Pacific, where awareness and acceptance of CBD for pets are increasing. Strategic partnerships, distribution networks, and regulatory alignment are crucial for successful regional penetration and revenue growth.

Animal Insights

The dogs segment led the market with largest revenue share of 65.45% in 2024. The segment is driven by high pet ownership, increasing awareness of natural wellness solutions, and rising incidences of stress, anxiety, pain, and mobility issues among canines. Dog owners are seeking alternative therapies to improve their pets’ quality of life, favoring CBD products such as oils, treats, capsules, and topicals. The availability of veterinarian-approved formulations and scientifically proven studies demonstrates CBD’s efficacy in managing conditions like anxiety, arthritis, and epilepsy further fuels adoption. For instance, in May 2023, the National Animal Supplement Council (NASC) study demonstrated that daily doses of broad-spectrum CBD, CBD with CBG, or CBD with CBDA were well-tolerated in healthy dogs over 90 days, supporting pet owners’ growing preference for cannabinoid-based wellness products.

The cats segment is projected to grow at the fastest CAGR from 2025 to 2033. The market’s expansion is fueled by growing concerns over the health & immunity of cats, as well as increasing owners' preferences for providing natural wellness solutions for their feline companions. Leading players are investing in feline-related research and development (R&D) due to the rapidly increasing adoption of cats and the growing demand for their medications. In addition, the growing availability of cat-specific CBD products such as oils, treats, and soft chews tailored to feline physiology is encouraging adoption. Rising infectious diseases among the cats drive market growth for research and development activities. According to a study published in January 2024, the findings suggest that THC-free CBD is well-absorbed and tolerated in healthy cats. However, veterinary checks are advised for cats with liver issues or infections, and further research is needed to confirm its efficacy. Such initiatives highlight the potential for growth in the feline CBD market, with cautious and informed veterinary use.

Indication Insights

The joint pain segment accounted for the largest market revenue share in 2024, driven by awareness among pet owners about age-related musculoskeletal issues in dogs and cats. Chronic conditions like arthritis, hip dysplasia, and mobility limitations are common, particularly in aging pets, prompting owners to seek safe, natural alternatives to traditional pharmaceuticals.CBD’s alleged anti-inflammatory and analgesic properties have positioned it as a preferred solution for supporting joint health, improving mobility, and enhancing overall quality of life.CBD also interacts with receptors in the skin, muscles, and nerves of pets to relieve any physical pain. Therefore, oils, supplements, and mobility chews are increasingly purchased by pet owners to support their pets suffering from joint pain.

The anxiety/stress segment is expected to grow at the fastest CAGR during the forecast period, driven by rising pet ownership and increased awareness of pets’ emotional well-being. Modern pets, particularly dogs and cats, are frequently exposed to stressors such as separation, travel, loud noises, and urban environments, leading pet parents to seek natural alternatives for calming their pets. Cannabidiol (CBD) has gained attention for its anxiolytic properties, which help reduce behaviors such as pacing, excessive barking, restlessness, and fear responses. In addition, clinical studies and real-world evidence suggest that CBD can improve pets’ mood, social interactions, and improve health. For instance, a literature review indicated that pets experience anxiety, urging owners to explore cannabidiol (CBD) products for calming effects. Evidence in dogs suggests CBD can reduce behaviors like panting, pacing, and anxiety during stress‑inducing events

Distribution Channel Insights

The e-commerce segment accounted for the largest market revenue share in 2024. Growth of this segment is driven by convenience, wide product availability, and increasing consumer comfort with online shopping. Pet owners can access a diverse range of CBD products, including oils, treats, capsules, and topicals, from trusted brands, often with detailed product information, third-party lab reports, and customer reviews. Subscription services and direct-to-consumer models also enhance accessibility and repeat purchases. The seasonal discount options available on e-commerce websites have added benefits. In addition, e-commerce allows small and niche CBD pet brands to reach national and international audiences efficiently, making it the dominant sales channel in the market.

The others segment, such as veterinary hospitals and clinics, is anticipated to grow at the fastest CAGR over the forecast period, as pet owners often prefer licensed veterinarians for guidance and treatment. U.S. federal law prohibits veterinarians from prescribing cannabis or related products, where evolving regulations may allow broader access in the future. In contrast, countries like Australia already permit veterinary prescriptions of CBD for specific conditions, with clinics such as CBD Vets Australia enabling registered veterinarians to provide medicinal cannabis and CBD oils to pets legally. This highlights the potential for regulated, professional channels to expand market reach globally.

Regional Insights

North America dominated the CBD pet market with the largest revenue share of 33.97% in 2024. The market is driven by companies focusing on product innovation, expanding their portfolios to include oils, treats, and capsules targeting anxiety, pain, and inflammation. In addition, the rising legalization of hemp-derived CBD and the rising pet humanization trends further intensify competition, driving differentiation through transparency, quality assurance, and scientifically backed formulations.

Furthermore, an overall increase in the acceptance of cannabidiol for pet care, pharmaceuticals, and wellness is expected to fuel market growth. The market growth can also be attributed to the increasing R&D activities of major CBD pet companies. These companies launch new products and increase strategic collaborations with other market players. In addition, multiple owners are moving toward pet parenting from pet ownership, which in turn is boosting the market growth.

U.S. CBD Pet Market Trends

The CBD pet market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by rising pet wellness trends and increasing acceptance of cannabidiol-based products. For instance, in the U.S., 65% of pet owners utilized CBD for their animals in 2023. Moreover, the market growth is fueled by high spending on pet food & treats, care procedures, and pet supplies. According to the American Pet Products Association, spending on pet food and treats reached USD 65.8 billion in 2024, reflecting the growing focus on premium nutrition and wellness for companion animals. In addition, regulatory actions by the FDA created heightened scrutiny and compliance pressure.

For instance, in June 2025, the FDA’s Center for Veterinary Medicine (CVM) issued warning letters to Bailey’s Wellness, Holista, and House of Alchemy-Hamet & Love for marketing unapproved CBD products for animals. The FDA emphasized that these products lack proven safety and efficacy for animal use, encouraging manufacturers to pursue approved, evidence-based CBD pet formulations.

The Canada CBD pet market is expected to grow at a significant CAGR during the forecast period. The region is transforming due to strict federal regulations under the Cannabis Act, ensuring only licensed producers can sell approved CBD products for animals. Some of the key players, such as True Leaf Pet, CannaBiscuit, and Creating Brighter Days, dominate the market, focusing on therapeutic formulations for anxiety, pain, and joint care. Growing consumer acceptance, veterinary endorsements, and legalization of hemp-derived CBD drive innovation. In contrast, compliance demands and Health Canada’s cautious stance on veterinary CBD approvals continue to shape competition and product diversification across the country.

Europe CBD Pet Market Trends

The CBD pet market in Europe is expanding rapidly, driven by the widespread legalization of CBD across most European nations. The European Food Safety Authority (EFSA) recognizes CBD as a novel food, while the EU deems it legal for consumption and storage due to its safety profile. Rising pet healthcare awareness and a high number of insured pets, such as Sweden’s 90% dog insurance rate, are further fueling growth. In addition, regional trade bodies like the European Free Trade Association (EFTA) enhance cross-border trade and market opportunities.

The UK CBD pet market is expected to grow at a significant CAGR over the forecast period. The market is expanding rapidly, driven by rising research opportunities, growing consumer acceptance of CBD-based wellness products for animals and supportive regulatory progress. According to a study published by the Waltham Petcare Science Institute in February 2023 in Frontiers in Veterinary Science, a single THC-free CBD dose was found to reduce stress in dogs during travel and separation significantly. This finding strengthened scientific validation for CBD’s efficacy in pets, boosting consumer confidence and accelerating market adoption of CBD-based stress relief products for companion animals.

The CBD pet market in Germany held a significant share in 2024. The market is expanding rapidly, driven by progressive regulatory frameworks, high pet ownership rates, and growing consumer awareness of pet anxiety and pain management. In Germany, CBD pet products can be sold outside pharmacies if not marketed as medicinal, with strict advertising rules and a legal THC limit of 0.2% for animal formulations. CBD is classified as a novel food; therefore, manufacturers are investing in compliant formulations and adhering to high-quality standards.

Additionally, the German market is focused on expanding CBD platforms within the country. For instance, companies like Cannaable are expanding their presence in Europe, including Germany, through significant investments, which could significantly contribute to market growth. Cannaable, Germany's largest CBD and hemp marketplace, has rapidly expanded its platform to include over 160 hemp merchants offering approximately 2,700 products, including successful categories such as CBD oils and pet CBD products. Cannaable not only provides a diverse selection of CBD and hemp products but also supports educational and marketing efforts, enhancing accessibility and driving market growth.

Asia Pacific CBD Pet Market Trends

The CBD pet market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's market is expanding due to factors such as the increasing authorization of CBD in various countries and supportive government initiatives by Thailand, South Korea, & Australia for the use of CBD. The country's CBD companies are now allowed to cultivate, manufacture, and sell cannabis. However, in February 2023, Hong Kong imposed a complete ban on cannabidiol (CBD) due to THC contamination risks and insufficient scientific validation for CBD’s health claims. This regulatory suppression significantly restricts the sale of these medicines.

The Japan CBD pet market held significant revenue share in Asia Pacific in 2024andis witnessing new growth opportunities due to a rising elderly population viewing pets as valuable companions, increasing pet ownership, and consumer demand for natural, organic products like CBD oils. Though this country faces strict legal regulations imposed on CBD products, they remain accessible in major cities such as Tokyo, driving market growth through premium service offerings and wellness-focused innovations.

The CBD pet market in India is emerging, driven by increasing awareness among pet owners and the emergence of startups offering hemp-based pet care products. For instance, Awshad expanded from a niche CBD startup to a leading wellness brand in India, diversifying into oils, gummies, and pet products, driving nationwide cannabis-based wellness adoption and market growth. However, regulatory uncertainty under India’s Narcotic Drugs and Psychotropic Substances (NDPS) Act limits large-scale commercialization. Though the country faces certain challenges, increasing advocacy for hemp legalization, expanding e-commerce channels, and the influence of global pet wellness trends are fostering the gradual acceptance and growth of CBD-infused pet supplements.

Latin America CBD Pet Market Trends

The CBD pet market in Latin America is poised by cannabis decriminalization, domestic hemp cultivation, and recognition of CBD’s therapeutic potential. The increasing government efforts toward legalization and favorable regulatory reforms are fostering expansion. In addition, rising demand for CBD-based medicinal treatments and international companies promoting accessible frameworks further accelerate market development, as several LATAM and Caribbean nations advance cannabis legalization for medical use while working to curb illegal trade and support a structured, compliant industry ecosystem.

The Brazil CBD pet market is gaining momentum, rising pet humanization, growing awareness of CBD’s therapeutic benefits, and increasing demand for natural pet wellness products. Local startups and international players, such as HempMeds Brasil and GreenCare, dominate, focusing on premium formulations and veterinary partnerships to expand their reach. CBD remains tightly regulated under ANVISA. Products require medical prescriptions and import authorization, but ongoing policy discussions around cannabis reform suggest a gradual shift toward broader legalization and market growth.

Middle East & Africa CBD Pet Market Trends

The CBD pet market in the MEA is driven by rising pet adoption and increasing owner awareness, supported by government initiatives that enhance animal healthcare. The market growth may be constrained by complex cannabis regulations, myths, energy-intensive cultivation, and product consistency challenges. Moreover, increasing recognition of CBD’s potential benefits for inflammation, pain, anxiety, and other animal health issues is driving demand across the region.

South Africa CBD pet market held the largest revenue share in Middle East & Africa in 2024 and is expanding, fueled by rising awareness of CBD’s therapeutic benefits, and demand for natural wellness solutions for companion animals. Major players, including local startups and international brands, offer CBD oils, treats, and supplements, fostering competitive innovation and distribution. SAHPRA is responsible for regulating the CBD sale and commercialization, requiring strict licensing for medicinal cannabis cultivation. At the same time, veterinarians can legally prescribe CBD products for pets under Rule 10, ensuring safe, controlled use within a veterinarian-client-patient relationship.

The CBD pet market in Saudi Arabia is limited due to strict legal and ethical restrictions, insufficient research on medical applications, and minimal funding for studies. Cannabis and its derivatives remain banned across Arab and Middle Eastern countries. However, growing global acceptance of medical cannabis and rising investments in pet care products may create future opportunities for market growth as legalization and treatment applications expand regionally.

Key CBD Pet Company Insights

Key players in the global CBD pet industry include Greenlane Holdings, Green Gruff USA, Mars Petcare, Waltham Petcare Science Institute, Awshad, and Fi Smart Collars. These companies lead through product innovation, strategic partnerships, and expanding distribution networks, capturing significant market share across North America, Europe, and the Asia-Pacific regions. For instance, in March 2025, Kradle expanded its U.S. retail presence through Tractor Supply Co., making CBD pet wellness products available in over 1,400 stores nationwide, enhancing accessibility for pet parents.

Key CBD Pet Companies:

The following are the leading companies in the CBD pet market. These companies collectively hold the largest market share and dictate industry trends.

- Honest Paws LLC

- Canna-Pet LLC

- Laboratoire Francodex

- Pet Releaf

- HolistaPet

- Joy Organics

- Wet Noses Natural Dog Treat Co.

- CBD Living

- PETstock

- Garmon Corp.

- Charlotte’s Web, Inc.

- Green Roads

- HempMy Pet

- FOMO Bones

Recent Developments

-

In November 2025, Fusion CBD Products highlighted ongoing research in November 2025 showing CBD’s therapeutic potential for anxiety, sleep, psychosis, and other conditions, with more clinical trials needed. This continued research fuels product development and market credibility.

-

In March 2025, Fusion CBD Products launched Wiggles and Paws Dog Treats and Pet Drops in March 2025 to support aging pets with arthritis, anxiety, and reactivity, using organic, GMO-free hemp extract. Conclusion: The rising demand for pet wellness drives innovation in CBD.

-

In March 2024, CV Sciences introduced +PlusCBD Pet Hip and Joint Health Chews and Calming Care Chews in March 2024, combining CBD with antioxidants and anti-inflammatory agents, supported by NASC safety studies. These evidence-backed products strengthen consumer trust and market growth.

CBD Pet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 410.0 million

Revenue forecast in 2033

USD 3,939.1 million

Growth rate

CAGR of 32.69% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, indication, distribution channel, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Honest Paws LLC; Canna-Pet LLC; Laboratoire Francodex; Pet Releaf; HolistaPet; Joy Organics; Wet Noses Natural Dog Treat Co.; CBD Living; PETstock; Garmon Corp.; Charlotte’s Web, Inc.; Green Roads; HempMy Pet; FOMO Bones

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CBD Pet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global CBD pet market report based on animal, indication, distribution channel, and region:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Foods/Treats

-

Vitamins & supplements

-

-

Cats

-

Foods/Treats

-

Vitamins & supplements

-

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Joint Pain

-

Anxiety/Stress

-

Epilepsy

-

General Health/Wellness

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Pet Specialty Stores

-

E-commerce

-

CBD Store

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.