- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Cannabis Packaging Market Size & Share Report, 2030GVR Report cover

![U.S. Cannabis Packaging Market Size, Share & Trends Report]()

U.S. Cannabis Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Rigid, Flexible), By Material (Plastic, Metal, Glass, Paper), By Product (Bottles & Jars, Tubes), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-985-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

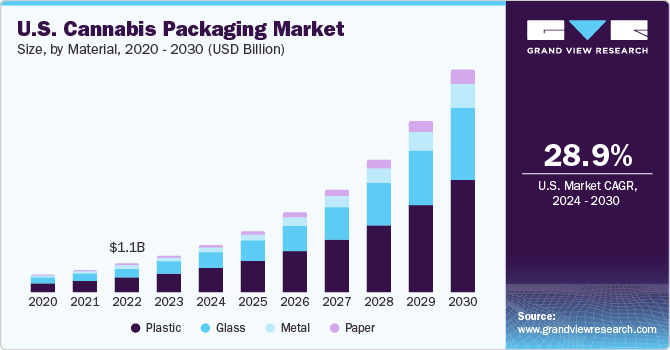

The U.S. cannabis packaging market size was estimated at USD 1.36 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 28.9% from 2024 to 2030. The current legalization of cannabis for recreational and medical use in several states of the country has substantially driven market expansion. The major revenue-generating states include Colorado, California, Florida, Michigan, Nevada, Oregon, Washington, Massachusetts, Arizona, and Illinois. They are understood to be the more mature markets of the U.S. that have legalized cannabis usage in the medical sector due to the various health benefits of the product.

Moreover, several U.S. states are in the process of legalizing cannabis for recreational purposes, with many anticipated to obtain legal permission in the coming years. Furthermore, states such as Arkansas, Alaska, Hawaii, Connecticut, Maryland, Louisiana, Minnesota, Rhode Island, Utah, Montana, and Vermont have already set up extensive medical cannabis programs, highlighting a widespread acceptance of the product for medicinal purposes. This industry is witnessing rapid growth due to the rising cannabis demand among consumers, driven by its various health benefits.

The health advantages of cannabis include better lung capacity, regulation and prevention of diabetes, weight loss assistance, anti-cancer properties, and seizure control. Cannabis is also an effective pain reliever, and aids in decreasing anxiety, insomnia, and muscle stiffness. The consumption of cannabinoids is effective against nausea and vomiting due to chemotherapy. In 2018, the U.S. Food and Drug Administration (FDA) approved Epidiolex (cannabidiol - CBD), an oral solution for addressing Lennox-Gastaut syndrome, epilepsy, and Dravet syndrome.

The rising cannabis demand has stimulated the growth of the country's cannabis packaging market. The health benefits of this product have led to more people supporting its legalization in the country, particularly for medical usage. Thus, steadily rising awareness among consumers is expected to drive product demand, boosting the growth of its packaging market in the forecast period. The use of recreational cannabis is on the rise, owing increasing government approval for legal cannabis product sales in the market. Thus, rising product sales for adult consumption is expected to drive market demand in the coming years.

Moreover, increasing environmental concerns have pushed the cannabis business towards the adoption of sustainable packaging solutions. Biodegradable and eco-friendly packaging materials are becoming very popular as both businesses and consumers aim to minimize their environmental footprint. This has led to the development and adoption of innovative packaging solutions made from biodegradable or recycled materials, which cater to eco-conscious consumers. This is anticipated to fuel product demand during the forecast period.

Technological advancements in the cannabis packaging segment have been pivotal, addressing regulatory requirements as well as consumer convenience. Manufacturers have adopted innovative designs that use mechanisms such as push-and-turn caps, blister packs, and resealable pouches. These designs are not only child-resistant but also user-friendly. Technologies including induction seals, shrink bands, and tear tapes offer clear visual cues to consumers, ensuring product integrity. These advancements have met stringent regulatory standards and improved overall consumer experience, contributing substantially to the exponential growth observed in the cannabis packaging industry.

On the other hand, guidelines regarding cannabis and cannabis packaging product usage vary across states in the U.S., creating limitations for market expansion. Regulations put forth by the Bureau of Cannabis Control (BCC) of California define child-resistant packaging as plastic packaging that is at least 4 mil (1 mil=0.0254 mm) thick and heat-sealed without an easy-open tab, dimple, corner, or flap. Child-resistant and tamper-evident packaging, as well as opaque packaging in the case of edible cannabis products, are some primary requirements for these packaging products.

Type Insights

In terms of type, the market is segmented into rigid and flexible, of which the rigid segment held the dominant revenue share of more than 63.3% in 2023. Rigid packaging materials, including glass jars and metal tins, offer excellent protection against air, light, and moisture, thus preserving product potency and freshness. Furthermore, it enables the use of intricate designs, labeling, and printing, which is expected to create significant growth opportunities for market players in the coming years.

The flexible segment is poised to advance at the highest CAGR of 29.3% during the forecast period. This projected growth is on account of the cost-effectiveness, lightweight, and portable nature of flexible packaging. Flexible packaging materials, such as pouches and bags, are generally more economical than rigid packaging solutions such as glass or plastic containers. Moreover, it also offers benefits such as easy-open seals and portion control, improving consumer convenience. This factor is expected to significantly drive purchasing decisions, thus aiding market expansion.

Material Insights

In terms of material, the market is classified into metal, plastic, glass, and paper. The plastic segment held the largest revenue share of more than 52.6% in 2023. These materials can be molded into different sizes and shapes, making them very adaptable for different cannabis product forms, including concentrates, edibles, and oils. This adaptability allows for customized packaging solutions tailored to specific products, meeting the diverse needs of the cannabis industry.

The paper material segment is expected to grow at the fastest compound annual growth rate (CAGR) of 32.9% during the forecast period. The growing demand for eco-friendly packaging materials is expected to drive the paper material cannabis packaging segment as it is biodegradable and renewable. In addition, the development of packaging solutions such as kraft paper pouches by Elevate Packaging is also supporting the segment growth significantly.

Product Insights

Based on the product, the U.S. cannabis packaging industry is segmented into bottles & jars, tubes, tins, pouches, blisters & clamshells, and others. The bottles & jars segment accounted for the largest revenue share of over 46.1% in 2023. Governments and regulatory bodies enforce strict guidelines concerning the packaging of cannabis products, especially those used for medicinal purposes. Bottles and jars are designed to meet child-resistant and tamper-evident regulations, ensuring that the products are safely stored and handled, thus driving the segment's growth.

The blisters & clamshells segment is expected to grow at the fastest CAGR of 33.8% during the forecast period. The growth of the blisters and clamshells product segment in the cannabis packaging sector is driven by a combination of regulatory requirements, the need for product protection, branding opportunities, and consumer convenience.

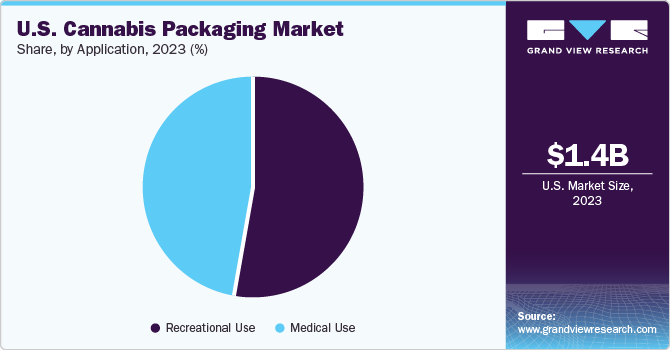

Application Insights

Based on application, the recreational use segment held the largest revenue share of over 54.16% in 2023 and is expected to grow at the fastest CAGR of 33.1% over the forecast period. The legalization of cannabis for recreational purposes in the U.S. has led to a surge in demand for packaging specifically designed for recreational use. This shift signifies the approval of cannabis products for personal enjoyment, distinct from medicinal applications. In terms of recreational usage, cannabis packaging is primarily utilized for dry marijuana, which comprises a blend of shredded green and brown components, including flowers, leaves, stems, and seeds.

The medical use segment is anticipated to experience steady growth over the forecast period. The early legalization of cannabis for medical usage in major U.S. states, including California, Colorado, Florida, and Washington is a major factor responsible for this expected growth. In 2018, the U.S. Food and Drug Administration (FDA) approved cannabidiol Epidiolex for treating seizures associated with two rare and severe forms of Dravet syndrome, epilepsy, and Lennox-Gastaut syndrome. Besides, it approved two cannabinoid medicines including dronabinol (Marinol, Syndros) and nabilone (Cesamet) to help relieve the side effects of chemotherapy, such as nausea and vomiting.

Regional Insights

Based on region, the U.S. cannabis packaging market is segmented into Northeast, Southeast, Midwest, West, and Southwest. The Southeast region accounted for the largest revenue share of over 26.8% in 2023. This positive outlook is due to the high demand for cannabis products in the Southeast region which created a need for robust packaging, which in turn benefitted the market growth.

The Northeast segment is expected to grow at the fastest CAGR of 30.3% during the forecast period. Several states in the Northeast U.S., including Massachusetts, Maine, and New York, have legalized recreational use of cannabis. Legalization leads to increased demand, creating opportunities for businesses related to the cannabis industry, including packaging, thus is anticipated to aid the market growth over the forecast period.

Key Companies & Market Share Insights

The companies are working on their product offerings to appeal to the target audience respective to the specific applications. The packaging manufacturers are offering customization as per the client requirement associated with the quantity and design of the final solution. In addition, the growing marketing strategies are further bolstering the need for the printing and labeling of packaged products on the packaging, thus the players are also offering customized printing services to their customers. For instance, KushCo Holdings, Inc. offers custom-branded packaging with a variety of quality packaging options, such as glass jars, barrier bags, and others.

Key players are implementing diverse strategies, including product introduction, merger and acquisition, joint venture, and expansion, to enhance their market presence and stimulate growth. For instance, in September 2022, Cannabis packaging company RXDco, a manufacturer of child-resistant containers and bags, introduced eco-friendly, sustainable, and renewable packaging collections, namely Atid, PearlLoc, and EcoPro. These are paper-based biodegradable, recyclable, child-resistant packaging solutions created with the trending requirements in the cannabis industry for environmentally sustainable packaging. Some prominent players in the U.S. cannabis packaging market include:

-

KacePack

-

KushCo Holdings Inc.

-

JL Clarks Inc.

-

Kaya Packaging

-

Cannaline U.S. Cannabis Packaging Solutions

-

Dymapak

-

Diamond Packaging

-

Greenlane Holdings Inc.

-

N2 Packaging Systems LLC

-

Green Rush Packaging

-

Elevate Packaging Inc.

-

Berry Global Inc.

-

Tin Canna

-

MMC DEPOT

-

Norkol Packaging LLC (Grow Cargo)

-

Pollen Gear

-

IMPAK Corporation

U.S. Cannabis Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,358.4 million

Revenue forecast in 2030

USD 7,991.7 million

Growth rate

CAGR of 28.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, material, product, application, region

Country scope

U.S.

Key companies profiled

KacePack; KushCo Holdings Inc.; JL Clarks Inc.; Kaya Packaging; Cannaline U.S. Cannabis Packaging Solutions; Dymapak; Diamond Packaging; Greenlane Holdings Inc.; N2 Packaging Systems LLC; Green Rush Packaging; Elevate Packaging Inc.; Berry Global Inc.; Tin Canna; MMC DEPOT; Norkol Packaging LLC (Grow Cargo); Pollen Gear; and IMPAK Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cannabis Packaging Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cannabis packaging market report based on type, material, product, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Glass

-

Paper

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles & Jars

-

Tubes

-

Tins

-

Pouches

-

Blisters & Clamshells

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Recreational Use

-

Medical Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Southeast

-

Northeast

-

Midwest

-

West

-

Southwest

-

Frequently Asked Questions About This Report

b. The U.S. cannabis packaging market was estimated at around USD 1.07 billion in the year 2022 and is expected to reach around USD 1,358.4 million in 2023.

b. The U.S. cannabis packaging market is expected to grow at a compound annual growth rate of 28.8% from 2023 to 2030 to reach around USD 7.99 billion by 2030.

b. The recreational use segment emerged as a dominating application segment with a value share of around 52.5% in the year 2022 owing to the legalization of recreational cannabis in various states. The legalization has created a massive legal market as more states legalized recreational use, hence, the demand for cannabis and its related products witnessed significant growth.

b. The key market player in the U.S. cannabis packaging market includes KacePack, KushCo Holdings Inc., JL Clarks Inc., Kaya Packaging, Cannaline U.S. Cannabis Packaging Solutions, Dymapak, Diamond Packaging, Greenlane Holdings Inc., N2 Packaging Systems LLC, Green Rush Packaging, Elevate Packaging Inc., Berry Global Inc., Tin Canna, MMC DEPOT, Norkol Packaging LLC (Grow Cargo), Pollen Gear, and IMPAK Corporation.

b. The legalization of medical and recreational cannabis in various states across the U.S. has increased the demand for cannabis, which in turn is anticipated to trigger the demand for cannabis packaging solutions during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.