- Home

- »

- Medical Devices

- »

-

Cannula Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Cannula Market Size, Share & Trends Report]()

Cannula Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cardiac, Nasal, Dermatology, Others), By Type, By Material, By Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-568-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannula Market Summary

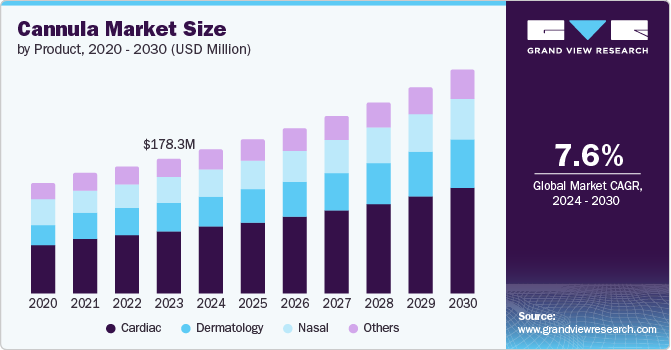

The global cannula market size was estimated at USD 178.3 million in 2023 and is projected to reach USD 294.6 million by 2030, growing at a CAGR of 7.6% from 2024 to 2030. The increase in demand for minimally invasive surgeries, the rise in the number of surgeries among the geriatric population, and the significant increase in the prevalence of chronic lifestyle-related diseases such as diabetes and cardiovascular diseases are the primary factors that are driving the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, India is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, cardiac accounted for a revenue of USD 82.7 million in 2023.

- Dermatology is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 178.3 Million

- 2030 Projected Market Size: USD 294.6 Million

- CAGR (2024-2030): 7.6%

- North America: Largest market in 2023

In May 2024, the Centers for Disease Control and Prevention (CDC) reported that 38.4 million people have diabetes (11.6% of the U.S. population).

Supportive government initiatives to provide primary healthcare services at affordable rates and increase awareness regarding chronic diseases are anticipated to further help the market grow significantly during the forecast period. The increase in healthcare spending by many countries, along with government efforts to provide affordable healthcare and raise awareness, is anticipated to drive the market further. For instance, in August 2023, a retrospective cohort study published by the National Institutes of Health found that dermatologists utilizing cannula for filler injections held 77.1% lower odds of vascular occlusion than those using needles. The article also showed that dermatologists with over five years of injection experience had 70.7% lower odds of occlusion than those with less experience.

The increasing demand for cannulas is being met by a rising number of manufacturers and suppliers across the globe. These market leaders, with their extensive distribution networks, make technologically advanced products readily available worldwide. The evolution of nasal cannulas, such as the use of silicone material, extra soft and latex-free designs, curved and flared cannulas, has greatly enhanced comfort and flexibility.For instance, Intersurgical’s i-flo cannula is a single-use patient interface developed to supply High-Flow Oxygen Therapy (HFOT). HFOT has evolved into a critical method of respiratory aid in patients with hypoxemic respiratory failure and provides several advantages over traditional oxygen treatments.

Minimally invasive surgeries are gaining popularity in the healthcare industry. There has been a rapid increase in the preference of minimally invasive surgeries for the treatment of cardiovascular diseases. This is since minimally invasive surgeries cause less surgical trauma and result in a better aesthetic appearance. It offers advantages such as smaller incisions, minimized infection risks, smaller scars, a lesser amount of bleeding, and lesser pain & trauma. Thus, this is leading to an increased preference for minimally invasive surgeries which in turn is expected to boost the market growth.A 2023 study in Clinical, Cosmetic, and Investigational Dermatology found that using a cannula to inject an RHA 4 filler was non-inferior to using a needle for nasolabial fold treatment. The methods showed equivalent efficacy and safety, with no serious adverse events. Cannulas are increasingly used for hyaluronic acid fillers as they may improve patient comfort and tolerability.

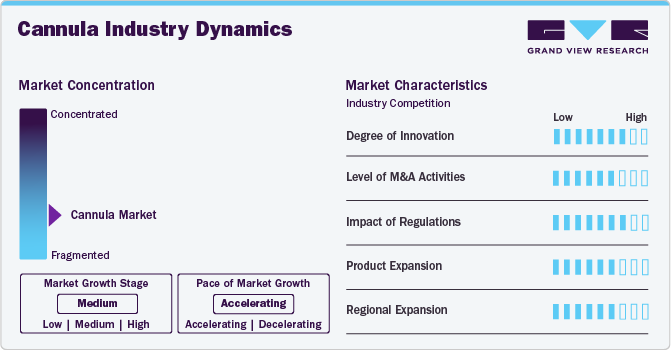

Market Concentration & Characteristics

The degree of innovation is currently high, driven by technological advancements and the increasing demand for minimally invasive procedures. Companies significantly invest in R&D to introduce innovative cannula designs that improve patient outcomes and enhance surgical precision. For example, companies such as Boston Scientific and Medtronic focus on developing advanced cannula materials to improve flexibility and reduce tissue trauma during procedures. Integrating robotics and 3D printing technologies further pushes the boundaries of innovation in the global market.

The level of merger and acquisition (M&A) activities in the global market is currently moderate. Companies are engaging in strategic acquisitions to expand their product portfolios, enhance their market presence, and gain access to new technologies. This strategic move shows a moderate level of M&A activity to strengthen competitive positions and drive market growth.In May 2022, the French company SoftFil, a pioneer in micro-cannulas and cosmetic innovations, was acquired by the Canadian dermal filler group Prollenium. This acquisition completes Prollenium's brand portfolio, which now includes Revanesse dermal fillers and SoftFil's innovative medical devices.

The impact of regulations on the market is significant, with stringent regulatory requirements governing product quality, safety standards, and manufacturing processes. Regulatory changes, such as the EU Medical Device Regulation (MDR), have led companies to invest more in compliance efforts to meet the new regulatory standards. These regulations aim to ensure patient safety, product efficacy, and transparency within the industry. Companies operating in the market must navigate these regulatory landscapes effectively to maintain market access and uphold compliance standards.

Product expansion within the market is high as companies strive to diversify their product offerings to cater to evolving customer needs and preferences. Key players such as Becton Dickinson and Company are expanding their product lines by introducing specialized cannulas for specific medical procedures such as laparoscopy, endoscopy, and cardiovascular surgeries. This trend toward product expansion reflects a strategic approach by companies to capture a larger market share by addressing niche segments with tailored solutions.

Regional expansion efforts within the market vary across geographies but is considered moderate. Companies are increasingly looking towards expanding their presence in emerging markets such as Asia-Pacific and Latin America due to growing healthcare infrastructure and rising demand for minimally invasive procedures. While some players are actively pursuing regional expansion strategies, challenges related to varying regulatory environments and market dynamics influence the pace of expansion efforts.

Product Insights

The cardiac segment led the market with the largest revenue share of 46.4% in 2023. The market is segmented into cardiac (arterial, venous, cardioplegia and others) dermatology, nasal and others. The cardiac segment’s growth is attributed to the high prevalence of cardiovascular diseases. Increasing shift towards sedentary lifestyle, consumption of processed foods and reduced amounts of physical activity is leading to a rise in prevalence of cardiovascular disease.In May 2024, the CDC reported that heart disease remains the leading cause of death in the U.S., claiming one life every 33 seconds due to cardiovascular disease. In addition, the increase in geriatric population that is higher risk of developing these diseases is also contributing to a significant rise in cardiovascular diseases.

The dermatology segment is expected to grow at the fastest CAGR during the forecast period. This is due to the increasing use of micro-cannula to avoid complications during and after procedures. Moreover, there is a significant rise in the number of cosmetic surgeries being carried out which is anticipated to further boost the demand for dermatology segment. In June 2024, the International Society of Aesthetic Plastic Surgery (ISAPS) released its annual Global Survey, showing a 5.5% increase in surgical procedures, with 15.8 million surgical and 19.1 million non-surgical procedures. The overall increase over four years is 40%.

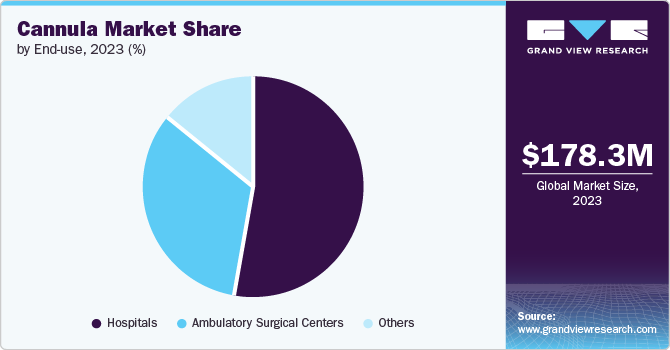

End-use Insights

Based on end-use, the market is classified into hospitals, ambulatory surgical centers, and others. The others segment includes blood banks, research centers, and pathology labs. The hospitals segment led the market with the largest revenue share of 53.1% in 2023. This is due to the rise in hospitalization rate for a variety of causes and associated treatment. Cannulas are used in a wide variety of specialty departments in the hospitals including orthopedic surgery, cardiovascular surgery, neurology, gynecology, general surgery, oxygen therapy, dermatology, and many more.According to AAFA statistics from April 2024, approximately 27.0 million Americans, or about 1 in 12 individuals, live with asthma.

The ambulatory surgical centers segment is expected to witness at the fastest CAGR over the forecast period. Ambulatory surgical centers are modern healthcare facilities that offer same-day surgical care, along with preventive and diagnosis procedures. Thus, there is a rise in the shift towards ambulatory surgical centers to undergo treatment and avoid hospitalization. This in turn is leading to a rise in the number of ambulatory surgical centers. Currently, there are more than 9,280 active ambulatory surgical centers in the U.S.

Type Insights

Based on type, the straight cannula segment led the market with the largest revenue share of 35.5% in 2023. The market is fragmented into neonatal, straight, winged, a wing with port, and winged with stop cork cannula.Straight cannula dominated is due to its design which makes it simpler to use. The product’s extra sharp needle makes it easier to insert as well. Therefore, these types of cannula are used in cardiac surgeries to avoid any mishaps and cut down any unnecessary delay that may lead to stretching the entire process.For instance, Boston Scientific provides RF Cannula, developed for significant manufacturers’ electrodes. All straight cannula are available in various sizes, color-coded to correspond to the related electrode, and consistent with all Boston Scientific RF Electrodes of matching measurement.

The winged cannula segment is expected to grow at a rapid CAGR over the forecast period. The winged cannula segment is driven by their user-friendly design and increasing adoption of modern cannulas with improved features. Winged cannula are preferred for their ease of use and reduced risk of complications during insertion.For instance, GBUK Group Ltd. provides a safety-winged infusion set with a small Japanese steel needle for smooth atraumatic insertion. The shield smoothly glides over the needle until it securely seals into a fast system, deterring needle-stick harm.

Material Insights

Based on material, the market is segmented into plastic, metal, and silicone. The plastic segment led the market with the largest revenue share of 56.7% in 2023, due to its increased adoption rate in both in-patient and out-patient procedures. Most plastic cannulas are translucent and allow surgeons to visualize instrumentation & sutures passing through the cannula in shoulder arthroscopy. Thus, making it suitable for using it in maximum procedures which are leading to its dominance throughout the forecast period. In April 2024, Produits Dentaire SA (PD-Dental) introduced a flexible plastic cannula to replace metal irrigation cannulas in root canal surgery, citing improved safety and effectiveness in navigating complex root canal curves and enabling more complete irrigation.

The silicone segment is expected to witness at the fastest CAGR over the forecast period. This is attributed to increasing usage of silicone cannulas in oxygen therapies, to ensure the continuous supply of oxygen to patients during surgery and for people suffering from respiratory disorders. Moreover, silicone cannulas are soft and flexible which makes them a preferred choice for application among healthcare professionals and patients.For instance, Med Europe s.r.l.'s True Flow RDB cannula features two lumens: the main lumen for brain blood infusion via the innominate and left carotid arteries, and a second lumen for the positioning balloon near the tip.

Size Insights

Based on size, the market is segmented into 14G, 16G, 18G, 20G, 22G, 24G, and 26G. Different sized cannulas are represented by different colors. The 18G size segment led the market with the largest revenue share of 28.8% in 2023, owing to the 18G size cannula widely used in hospitals for adults as well as adolescents. 18G cannulas are used to infuse blood products and deliver medications. These cannulas aim for quick blood transfusion. They are used for computed tomography/pulmonary embolism protocols or other testing that needs large IV sizes. A study published in the Journal of Emergency Medicine in October 2023 found no difference in patient pain or clinician difficulty when using 18G versus smaller cannulas, suggesting that 18G may be the preferred choice in the unpredictable emergency department setting.

The 22G segment is projected to grow at the fastest CAGR from 2024 to 2030. This can be attributed to its small gauge size which allows a faster flow of fluid in patients with complicated veins. In May 2022, a study published in the International Journal of Health Sciences and Research found that 50.5% of nursing students indicated a preference for using a 22G cannula for adult patients.

Regional Insights

North America dominated the cannula market with the revenue share of 40.98% in 2023, owing to the availability of advanced healthcare facilities in the region and the presence of dominant market players. In addition, the increasing prevalence of lifestyle diseases in the region is a major factor in its dominance. Other factors such as greater awareness about minimally invasive surgeries and the increasing adoption rate of cosmetic surgeries in this region are further driving the growth in this region. According to the American Society of Plastic Surgeons, about USD 26.2 billion was spent on cosmetic procedures in 2022 in the U.S, which further fuels this market’s growth.

U.S. Cannula Market Trends

The cannula market in the U.S. is projected to grow at the fastest CAGR during the forecast period. In the U.S. market, the increasing demand for minimally invasive procedures across various medical specialties is a significant trend. This trend is driven by technological advancements in cannula design, which allow for more precise and less invasive procedures, leading to reduced patient recovery times and healthcare costs. The rising prevalence of chronic diseases such as cardiovascular diseases and cancer is fueling the adoption of cannulas for diagnostic and therapeutic purposes. The market is also witnessing a shift towards disposable cannulas due to infection control and patient safety concerns.In May 2020, Medtronic plc launched the Kyphon Assist Directional Cannula for balloon kyphoplasty to treat vertebral compression fractures, offering physicians enhanced control and height restoration capabilities compared to standard cannulas.

Europe Cannula Market Trends

The cannula market in Europe is recognized as a lucrative region owing to the growing emphasis on R&D activities to introduce innovative products with enhanced features. Companies focus on developing cannulas with improved materials, designs, and functionalities to cater to the evolving needs of healthcare professionals and patients. For instance, in October 2022, the developers of the MIC-Cannula, a minimally invasive central aortic perfusion device, were awarded the EACTS Techno-College Innovation Award. Regulatory initiatives promoting single-use medical devices influence market dynamics in Europe, leading to a higher adoption rate of disposable cannulas.

The UK cannula market is expected to grow at a significant CAGR over the forecast period. There is a growing trend towards value-based healthcare in UK which prompts healthcare providers to seek cost-effective solutions such as reusable cannulas that offer long-term durability and performance benefits. The National Health Service (NHS) is crucial in shaping procurement practices for medical devices such as cannulas in the UK market.

The cannula market in France is anticipated to grow at the fastest CAGR over the forecast period. In France, the market is witnessing a growing trend towards adopting minimally invasive procedures, increasing the demand for cannulas. The market is influenced by a rising prevalence of chronic diseases and an aging population, leading to a higher demand for surgical interventions where cannulas are used. There is a focus on technological advancements in cannula design to improve patient outcomes and reduce procedure times. French regulations emphasizing patient safety and quality standards play a significant role in shaping the market landscape.

The Germany cannula market is expected to grow at a substantial CAGR over the forecast period. With strong presence of local manufacturers known for their high-quality, precision-engineered medical devices, the market in Germany is expected to grow faster. German companies are renowned for their adherence to strict quality standards and compliance with regulatory requirements, positioning them as key players in the global market. An increasing focus on sustainability and environmental responsibility is leading to a preference for eco-friendly materials in cannula production. This emphasis on sustainability aligns with consumer preferences for green products and drives innovation in biodegradable or recyclable cannula materials.

Asia Pacific Cannula Market Trends

The cannula market in Asia Pacific is expected to witness at the fastest CAGR from 2024 to 2030. Growth in this region is driven by a drastic rise in the geriatric population which creates a massive patient pool with individuals suffering from chronic diseases such as cardiovascular diseases and diabetes.In September 2023, according to WHO, cardiovascular diseases account for 3.9 million deaths annually in the South-East Asia Region, comprising a quarter of all non-communicable diseases (NCD) related deaths, with most being preventable. The increasing efforts by the government to introduce favorable policies to transform the healthcare sector, especially in the rural areas, is further expected to boost the market growth in this region.

The China cannula market is expected to grow at the fastest CAGR over the forecast period.The market in China is experiencing rapid growth driven by increasing healthcare expenditure, a growing elderly population, and rising awareness about minimally invasive procedures. In China, the government’s initiatives to improve healthcare infrastructure and provide better access to healthcare services in rural areas. This has led to an expansion of healthcare facilities and an increase in surgical procedures using cannulas across different regions in China.

The cannula market in Japan is anticipated to grow at a significant CAGR over the forecast period. In Japan, the market is characterized by a strong emphasis on precision engineering and high-quality medical devices. Japanese consumers prioritize safety, reliability, and efficiency in medical products such as cannulas. This focus on quality has led to stringent regulatory standards governing medical device manufacturing and distribution, including cannulas. The market is also influenced by a growing demand for cosmetic surgeries and aesthetic procedures, driving the adoption of specialized cannulas designed for such applications.

The India cannula market is anticipated to grow at a rapid CAGR over the forecast period. The market in India is witnessing significant growth due to increasing disposable income, expanding healthcare infrastructure, and a rising burden of chronic diseases requiring surgical interventions. The prevalence of medical tourism, with India emerging as a hub for affordable healthcare services, is a significant trend attracting patients worldwide. This created opportunities for domestic and international manufacturers to cater to diverse patient needs through a wide range of cannula products.

Middle East and Africa Cannula Market Trends

The cannula market in Middle East and Africa is projected to grow at the fastest CAGR during the forecast period. In the Middle East and Africa region, the market is witnessing significant growth driven by increasing healthcare expenditure, rising prevalence of chronic diseases, and advancements in medical technology. There is a growing adoption of minimally invasive procedures, which has led to a higher demand for cannulas across various medical specialties. The increasing focus on improving healthcare infrastructure and access to quality medical services also expands the Middle East and Africa cannula market.

The Saudi Arabia cannula market is expected to grow at a rapid CAGR over the forecast period. Saudi Arabia’s market is experiencing notable growth due to a rapidly growing population, government initiatives to enhance healthcare services, and a rise in lifestyle-related diseases. The increasing investment in R&D activities related to medical devices, including cannulas. This emphasis on innovation is driving the introduction of advanced cannula products tailored to meet the specific needs of healthcare providers and patients in the country.For instance, in January 2023, UK-based manufacturer Sterimedix showcased its creation of ophthalmic and aesthetic cannulas at the Arab Health Exhibition as a portion of its continuous expansion into global markets

The cannula market in Kuwait is anticipated to witness at a significant CAGR over the forecast period. In Kuwait, the market is witnessing steady growth propelled by factors such as a growing senior population, increased surgical procedures, and a focus on expanding healthcare facilities. A distinctive factor impacting the market in Kuwait is the emphasis on medical tourism, with the country positioning itself as a hub for advanced healthcare services in the region. This focus on attracting international patients for complex medical treatments drives the demand for high-quality medical devices like cannulas in Kuwait.

Key Cannula Company Insights

Key players operating in the global market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Cannula Companies:

The following are the leading companies in the cannula market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Becton Dickinson (BD)

- Edward Lifesciences

- LivaNovaca

- Smiths Medical

- Boston Scientific Corporation

Recent Developments

-

In January 2023, Inspira Technologies reported that the U.S. Patent and Trademark Office (USPTO) had granted them a patent for their convertible dual lumen cannula device and its technique of service, designed specifically for the INSPIRA ART System. The patent encompasses 20 claims found to be novel, indicating resourceful steps and industrial relevance

-

In April 2023, Australian medical device company VeinTech secured USD 500,000 to advance its innovative VeinWave, a portable, AI-driven vein imaging system that helps clinicians successfully target the right vein on the first attempt when performing cannulations

-

In February 2021, Masimo introduced softFlow, an innovative pulmonary therapy that provides high-flow, warmed, and humidified respiratory support to spontaneously breathing adult patients through a soft nasal cannula

Cannula Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 189.9 million

Revenue forecast in 2030

USD 294.6 million

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, material, size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Becton Dickinson (BD); Edward Lifesciences; LivaNova; Smiths Medical; Boston Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannula Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cannula market report based on product, type, size, material, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac

-

Arterial

-

Venous

-

Cardioplegia

-

Femoral

-

-

Dermatology

-

Nasal

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neonatal cannula

-

Straight cannula

-

Winged cannula

-

Wing With Port

-

Winged With Stop Cork

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Silicone

-

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

14G

-

16G

-

18G

-

20G

-

22G

-

24G

-

26G

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cannula market size was estimated at USD 178.3 million in 2023 and is expected to reach USD 189.9 million in 2024.

b. The global cannula market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 294.6 million by 2030.

b. North America dominated the cannula market with a share of 41.0% in 2023. This is attributable to the availability of advanced healthcare infrastructure and greater awareness about minimally invasive surgeries among patients and physicians.

b. Some key players operating in the cannula market include Medtronic, Becton Dickinson (BD), Edward Lifesciences, LivaNova, Smiths Medical, and Boston Scientific Corporation.

b. Key factors that are driving the cannula market growth include a surge in awareness about minimally invasive surgeries, increasing infant mortality rate, improving healthcare infrastructure in emerging economies, and a rising number of hospitals and clinics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.