- Home

- »

- Advanced Interior Materials

- »

-

Canopy Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Canopy Market Size, Share & Trends Report]()

Canopy Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (PTFE, ETFE, PVC, Polyester Cloth), By End Use (Residential, Non-residential), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-495-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canopy Market Summary

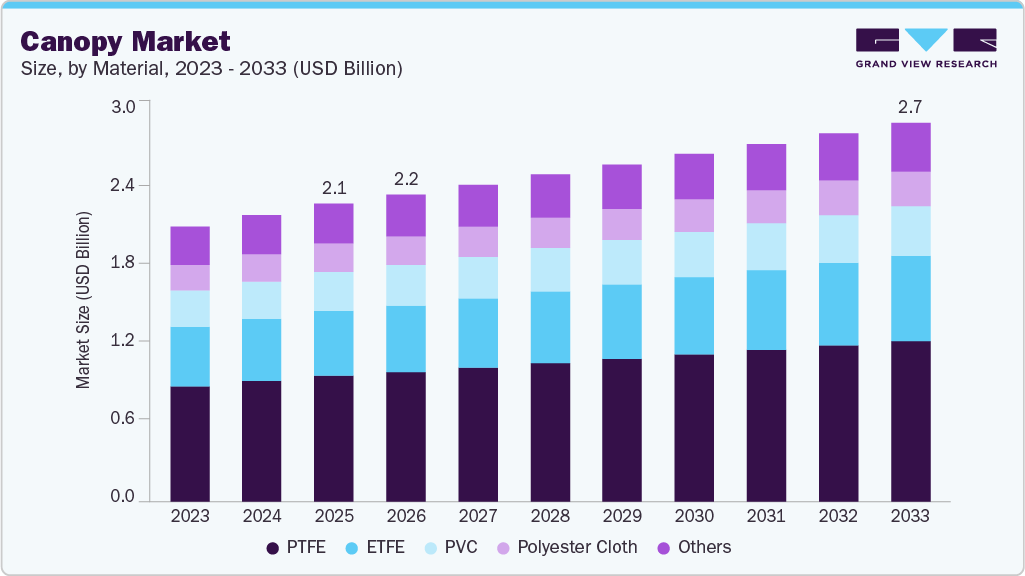

The global canopy market size was estimated at USD 2.15 billion in 2025 and is projected to reach USD 2.72 billion by 2033, growing at a CAGR of 3.1% from 2026 to 2033. Growth is primarily driven by the increasing adoption of canopies across residential and non-residential buildings.

Key Market Trends & Insights

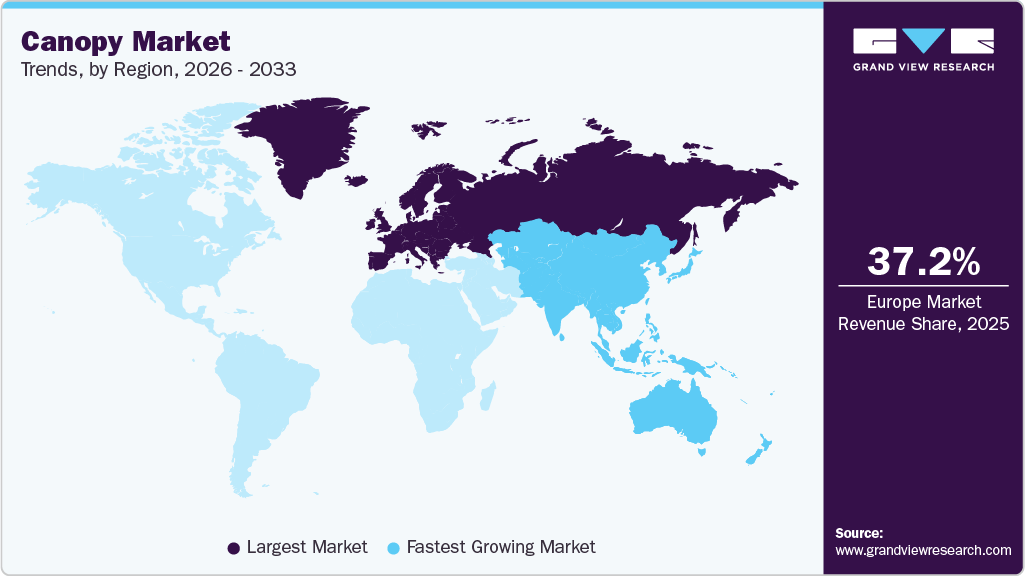

- Europe dominated the canopy market with the largest revenue share of 37.2% in 2025.

- By material, the ETFE segment is expected to grow at fastest CAGR of 3.6% over the forecast period.

- By application, the event tent or large canopy segment is expected to grow at fastest CAGR of 3.3% over the forecast period.

- By end use, the residential segment is expected to grow at fastest CAGR of 3.3% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 2.15 Billion

- 2033 Projected Market Size: USD 2.72 Billion

- CAGR (2026-2033): 3.1%

- Europe: Largest market in 2025

- Asia Pacific: Fastest market

Rising consumer interest in enhancing outdoor living spaces and the growing popularity of inside-outside lifestyles fuel demand. Canopies are used for shading and protection, along with architectural elements that enhance aesthetics and expand functional areas.A wide range of canopy types is available in the market, including shade canopies, garden canopies, event structures, and portable garage canopies, catering to diverse application needs. These products are manufactured using materials such as fabrics, metals, glass, and wood, with the choice depending on durability, design, and end-use application.

The canopy industry is increasingly focusing on innovation, offering customizable and multifunctional solutions with features such as rainwater harvesting and weather resistance. Such advancements improve product utility and align with growing sustainability preferences. Broader trends, including rapid urbanization, rising home improvement spending, and the increasing demand for versatile outdoor structures support overall market growth. These factors collectively fuel the growth and expansion of the canopy market over the forecast period.

Market Concentration & Characteristics

The growth stage of the canopy material industry is low, but the pace is accelerating. The canopy industry is moderately concentrated, with key players holding notable shares regionally and by application. In the U.S., companies such as Eide Industries, Sunair Awnings, and Impact Canopies lead in residential and commercial solutions, while Lawrence Fabric, Inc., focuses on event canopies, and Shade Structures specializes in architectural shades. In the UK, Canopies UK Ltd. dominates the domestic and school markets, and JAY JAY Enterprise serves the Asian market through retail and outdoor canopies. This balanced competition supports regional focus, product variety, and steady innovation.

The canopy material industry is witnessing steady growth, supported by increasing adoption across residential, commercial, and public infrastructure segments. Urban-focused innovations play a key role in shaping demand patterns. For instance, the City of Sydney began installing over 340 modular bus shelters equipped with thermal glass roofs and digital transit screens in November 2021 to enhance comfort, accessibility, and outdoor usability. These developments highlight how smart infrastructure upgrades create new opportunities for canopy applications, particularly in enhancing the functionality and appeal of public spaces.

The canopy material industry experiences a low to medium level of mergers and acquisitions (M&A) activity. Unlike industries such as technology or pharmaceuticals, where high-frequency consolidations are common, the canopy sector sees fewer large-scale mergers. However, strategic acquisitions do occur, primarily aimed at regional expansion or vertical integration. The market faces moderate regulatory oversight, especially around fire safety, structural stability, and environmental standards. In California, commercial canopies must comply with the 2022 California Building Code and California Fire Code, requiring flame-resistant materials and wind-load compliance. Cities such as Monterey enforce these rules to ensure public safety in outdoor spaces.

Material Insights

The PTFE segment led the market with the largest revenue share of 42.2% in 2025. Canopies made of PTFE fiberglass, which are experiencing steady growth, are driven by the embranes and are suitable for regions with extreme temperatures due to their high strength and durability. Furthermore, the material's low surface free energy enables easy cleaning of the surface by rainwater.

The ETFE segment is expected to grow at the fastest CAGR of 3.6% during the forecast period. ETFE-based canopies have self-cleaning properties due to their non-stick surface. Variation in canopy size is possible owing to the material's stretching ability. Furthermore, the material is highly resistant to ultraviolet radiation. These factors are likely to drive the segment demand over the forecast years.

Application Insights

The shade canopy segment accounted for the largest market revenue share in 2025. This strong performance is primarily driven by the segment’s extensive adoption in the residential sector, where shade canopies provide essential protection from weather elements while enhancing the aesthetic appeal of outdoor spaces. Beyond residential use, shade canopies have gained significant traction in commercial applications, including restaurants and hotels, which increasingly leverage them to expand outdoor seating areas, enhance the customer experience, and optimize space utilization. In addition, the rising popularity of gardening and urban outdoor living has contributed to the segment’s demand, as canopies offer crucial protection for plants from harsh sunlight, wind, and rain, aligning with emerging lifestyle trends.

The event tent or large canopy segment is expected to grow at the fastest CAGR over the forecast period. This growth is fueled by the segment’s versatility and convenience, especially in commercial settings. Large canopies and event tents offer easy installation and the ability to create extended outdoor spaces, making them ideal for a variety of commercial events such as product launches, exhibitions, and large gatherings. These developments reflect a broader shift toward multifunctional canopy solutions catering to consumer lifestyle upgrades and business-driven space optimization.

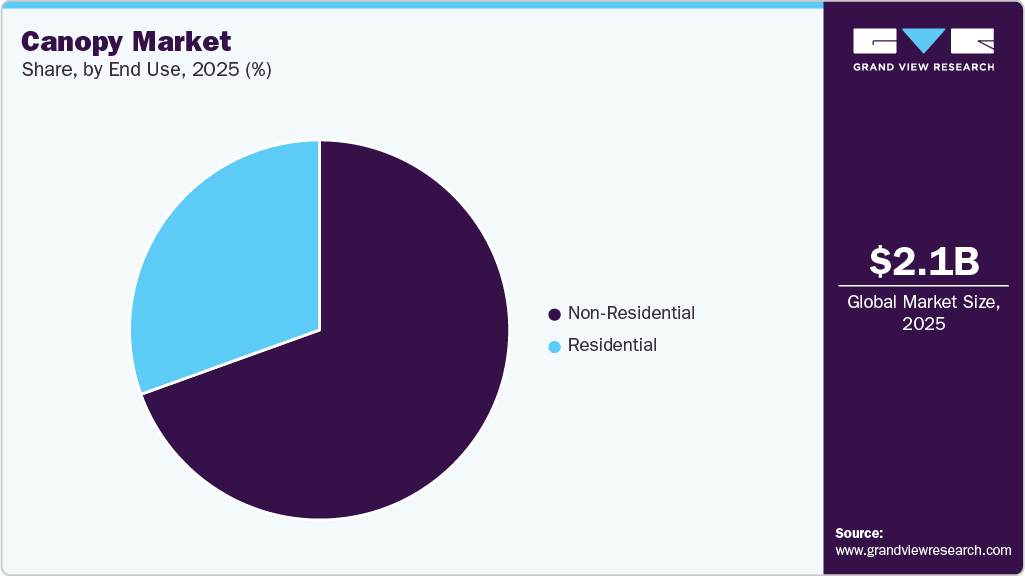

End Use Insights

The non-residential segment led the market with the largest revenue share of 69.5% in 2025. Increasing market demand across various commercial applications such as retail shops, hotels, restaurants, and cafes due to the provision of extended dining space for visitors and various other recreational activities is expected to drive the demand for canopies and, in turn, trigger the growth of the canopy industry over the forecast period.

The residential segment is expected to grow at the fastest CAGR over the forecast period, driven by the availability of the product in several materials, designs, and dimensions. Furthermore, canopies are utilized in several buildings to enhance the aesthetic value of bungalows and mansions, which, in turn, is likely to propel the market growth over the forecast period. The installation of a canopy offers advantages such as increased living space in open areas adjacent to and above the buildings. Furthermore, advanced canopies, including solar canopies and rain-harvesting canopies, offer additional benefits to end-users. The aforementioned factors are, therefore, anticipated to augment the demand for canopies in various buildings.

Regional Insights

The canopy market in North America accounted for the second-largest market revenue share in 2025. The product is majorly used in the backyard of residential buildings and as a stand-alone structure for patio furniture and additional space. The market is anticipated to witness increasing demand due to factors such as expanded living space and the aesthetic enhancements offered by the product. Furthermore, the increasing popularity of inside-outside living and the availability of a wide range of canopy designs are likely to augment the demand for the product in North America.

U.S. Canopy Market Trends

The canopy market in the U.S. accounted for the largest market revenue share in North America in 2025, driven by sustained demand across commercial, residential, and outdoor hospitality sectors. Canopies are increasingly valued for their role in providing sun protection, enhancing outdoor spaces, and improving energy efficiency. The market momentum is reinforced by demographic expansion. As per the Hampton Roads Alliance in March 2025, the U.S. metropolitan areas added nearly 3.2 million residents between 2023 and 2024, accounting for a 1.1% growth rate, which outpaced the growth of the overall population in the U.S. This urban growth is translating into higher investments in outdoor shading solutions.

Asia Pacific Canopy Market Trends

The Asia Pacific canopy market is expected to grow at the fastest CAGR of 3.8% during the forecast period. In Asia Pacific, countries such as China and Australia accounted for the majority share of the market due to increasing penetration of the product in commercial outlets such as restaurants and hotels. The rising adoption of canopies in these economies can be attributed to the provision of extended outdoor space for various activities, such as promotional events and exhibitions.

The canopy market in China is emerging as a significant contributor to the Asia Pacific, driven by rapid urbanization, infrastructure development, and growing demand from the hospitality and retail sectors. The canopy industry is experiencing strong adoption in commercial spaces such as malls, open-air restaurants, hotels, and exhibition venues, where canopies enhance functionality and visual appeal. Government-led urban development programs, such as the new urbanization plan and the green building action plan, also promote energy-efficient, space-saving canopy solutions. In addition, China’s growing events and exhibition sector is driving demand for modular and temporary canopy structures. Frequent outdoor promotional activities, trade shows, and cultural festivals boost the need for flexible installations. With rising consumer interest in stylish and functional outdoor spaces, coupled with strong investment from both the public and private sectors, the canopy industry in China is poised for sustained growth.

Europe Canopy Market Trends

Europe dominated the canopy market with the largest revenue share of 37.26% in 2025, driven by the growing demand for outdoor functional spaces in densely populated urban areas, alongside sustained activity in the construction sector. Ongoing residential, commercial, and public infrastructure projects across key European economies contribute to increased canopy installations, particularly in outdoor shading, aesthetics, and energy efficiency applications. Regulatory frameworks are further strengthening market fundamentals. The European Union’s Circular Economy Action Plan, under the European Green Deal, promotes the use of sustainable materials across the construction lifecycle. The initiative sets clear standards for durability, recyclability, and energy efficiency, encouraging manufacturers to adopt eco-friendly materials such as recycled textiles and secondary raw materials. This regulatory push aligns well with shifting consumer preferences and tightening building codes, which drive the demand for green canopy solutions.

The canopy market in Germany held a significant position within the European region, driven by a strong emphasis on sustainable urban development, advanced construction practices, and eco-conscious consumer behavior. The canopy industry in Germany benefits from increasing investments in residential renovation and urban greening initiatives, particularly as citizens and municipalities prioritize climate-adaptive infrastructure. The German government’s push toward climate-neutral construction under its Climate Action Programme 2030 also reinforces market growth. This initiative supports sustainable building designs and encourages the adoption of durable, low-impact materials, creating fertile ground for innovation in canopy design and manufacturing.

Latin America Canopy Market Trends

The canopy market in Latin America is driven by the growth of the retail, hospitality, and event sectors, where canopies are used to enhance customer experience and expand functional outdoor areas. The increased development of cafés, restaurants, and hotels, especially in tourism-driven economies, supports the demand for lightweight, customizable, and aesthetically appealing canopy solutions. Urban regeneration projects across major cities also encourage the installation of canopies in walkways, public plazas, and commercial hubs.

Middle East & Africa Canopy Market Trends

The canopy market in Middle East & Africa is driven by the region’s expanding construction activities across residential, commercial, and hospitality sectors. Growing investments in urban development, outdoor recreational spaces, and tourism infrastructure encourage the use of canopies for shading, weather protection, and architectural enhancement. Governments across the region are promoting modern public facilities and open-air designs, which further boost demand for durable and aesthetically adaptable canopy systems.

Key Canopy Material Companies Insights

Some of the key players operating in market includeEide Industries, Inc., ADVANCED DESIGN AWNINGS & SIGNS

-

Eide Industries, Inc. is a leading U.S.-based manufacturer specializing in custom-designed commercial canopies, tensile membrane structures, awnings, and shade solutions. The company is known for its engineering excellence, turnkey project capabilities, and durable fabric structures that serve various sectors, including hospitality, education, and transportation.

-

ADVANCED DESIGN AWNINGS & SIGNS offers a wide range of customized canopy and awning solutions for retail storefronts, restaurants, and public buildings. Known for blending aesthetics with function, the company integrates branding elements into its designs while prioritizing weather resistance and energy efficiency.

Sunair Awnings, Shade Structures, Inc. are some of the emerging market participants in canopy industry.

-

Sunair Awnings offers a broad range of products, including retractable awnings, pergola systems, tensioned shade structures, exterior screens, and commercial-grade shading solutions. These products are available in multiple fabric options, automation systems, and structural configurations to suit both small and large installations.

-

Shade Structures, Inc. provides an extensive portfolio that includes fabric canopies, cantilever structures, steel-frame shade systems, playground shades, walkway covers, and large-span tensile structures. Products are offered in multiple shapes, sizes, and materials to address sun protection, weather resistance, and aesthetic objectives.

Key Canopy Material Companies:

The following are the leading companies in the canopy material market. These companies collectively hold the largest market share and dictate industry trends.

- Eide Industries, Inc.

- ADVANCED DESIGN AWNINGS & SIGNS

- Sunair Awnings.

- Shade Structures, Inc.

- Canopies UK Ltd.

- Lawrence Fabric, Inc.

- Impact Canopies USA

- KD KANOPY, INC.

- JAY JAY Enterprise

Recent Developments

-

In May 2024, Canopies UK Ltd. achieved ISO 14001:2015 certification, underscoring its commitment to environmental responsibility. The certification reflects the company's dedication to minimizing its environmental impact through initiatives such as waste reduction, energy efficiency improvements, and sustainable material sourcing.

Canopy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.21 billion

Revenue forecast in 2033

USD 2.72 billion

Growth rate

CAGR of 3.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; Australia; South Korea; Thailand; Australia; Brazil; Saudi Arabia

Key companies profiled

Eide Industries, Inc.; ADVANCED DESIGN AWNINGS & SIGNS; SUNAIR AWNINGS.; Shade Structures, Inc.; Canopies UK Ltd.; Lawrence Fabric, Inc.; Impact Canopies USA; KD KANOPY, INC.; JAY JAY Enterprise

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Canopy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global canopy market report based on material, application, end use and region:

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

PTFE

-

ETFE

-

PVC

-

Polyester Cloth

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Shade Canopy

-

Event Tent or Large Canopy

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the canopy market include the rapid growth of the residential sector in the North American and European economies, and the increasing popularity of inside-outside living are likely to augment the demand for canopies.

b. The global canopy market size was estimated at USD 2.15 billion in 2025 and is expected to reach USD 2.21 billion in 2026.

b. The global canopy market is expected to grow at a compound annual growth rate of 3.1% from 2026 to 2033 to reach USD 2.72 billion by 2033.

b. The PTFE segment accounted for the largest revenue share, 42.2%, in 2025. Canopies with PTFE fiberglass membranes are suitable for regions with extreme temperatures owing to their high strength and durability.

b. Some of key players in the canopy market are Eide Industries, Inc.; ADVANCED DESIGN AWNINGS & SIGNS; SUNAIR AWNINGS.; Shade Structures, Inc.; Canopies UK Ltd.; Lawrence Fabric, Inc.; Impact Canopies USA; KD KANOPY, INC.; JAY JAY Enterprise

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.