- Home

- »

- Homecare & Decor

- »

-

Capsule Hotel Market Size & Share, Industry Report, 2030GVR Report cover

![Capsule Hotel Market Size, Share & Trends Report]()

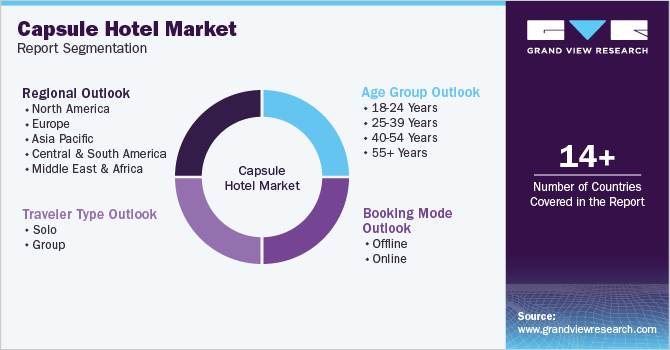

Capsule Hotel Market (2025 - 2030) Size, Share & Trends Analysis Report By Age Group (18-24 Years, 25-39 Years, 40-54 Years, 55+ Years), By Traveler Type (Solo, Group), By Booking Mode (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-514-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Capsule Hotel Market Summary

The global capsule hotel market size was estimated at USD 262.9 Million in 2024 and is projected to reach USD 432.5 Million by 2030, growing at a CAGR of 8.8% from 2025 to 2030.The pod hotels market is experiencing significant growth as travelers across the globe prioritize affordability and convenience.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- The U.S. capsule hotel market held a dominant 80% share of the North American market in 2024

- By age group, the use of capsule hotels among travelers aged 18- 24 accounted for a share of about 41% in 2024.

- By traveler type, the solo travelers segment account for about 71% of the capsule hotel market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 262.9 Million

- 2030 Projected Market Size: USD 432.5 Million

- CAGR (2025-2030): 8.8%

- Asia Pacific: Largest market in 2024

Once a concept exclusive to Japan, capsule hotels have expanded into diverse markets, catering to urban travelers seeking compact yet comfortable accommodations. The shift towards minimalism and cost-efficiency is driving this evolution, particularly among millennials and Gen Z, who value functionality and unique experiences. This trend is reshaping the capsule hotel industry, blending budget-friendly options with design-focused spaces, creating a new category within the broader hospitality industry.

A key factor propelling the capsule hotel market is the growing demand for affordable yet premium experiences. Travelers increasingly seek "affordable luxury" with essential amenities like high-speed Wi-Fi, compact workspaces, and comfortable sleeping arrangements without unnecessary frills. As businesses tighten travel budgets, the pod hotels industry offers a compelling alternative for corporate travelers. Moreover, the flexibility to book pods by the hour appeals to those with layovers or short stays, further diversifying the customer base and strengthening the market’s appeal.

Innovation is at the heart of the evolving capsule hotel industry, with operators introducing cutting-edge features to attract modern travelers. Pods now integrate IoT technology, transforming them into smart, interactive spaces. Capsule hotels have also embraced themed designs, such as book-centric stays or craft beer breweries, to enhance the guest experience. These trends highlight the emphasis on personalization and community-building, which are crucial to staying competitive in the pod hotels industry, particularly as travelers seek novel and memorable stays over traditional accommodations.

The global expansion of pod hotels underscores their increasing popularity beyond the Asia Pacific region. Cities like London, New York, and Paris are now incorporating capsule accommodations into their urban landscapes. This expansion reflects the broadening acceptance of compact living solutions and the growing influence of experiential travel. As the capsule hotel industry continues to evolve, its ability to address diverse traveler needs with innovative, personalized offerings will ensure its relevance in the dynamic global hospitality industry.

Consumer Surveys & Insights

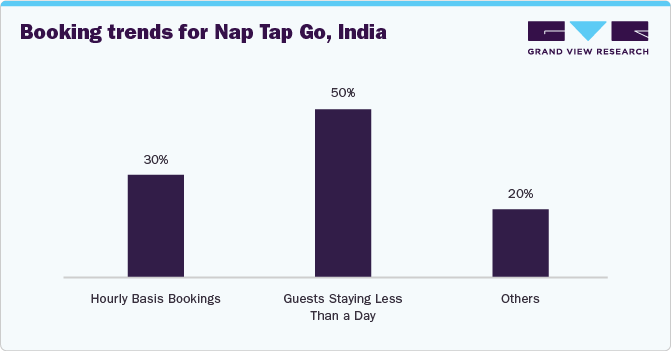

A 2025 article by ThePrint highlights booking trends at Nap Tap Go, a capsule hotel located in a vibrant business district near offices, hospitals, and start-ups. The hotel’s strategic location draws a substantial number of corporate travelers. With 30% of bookings made hourly and 50% of guests staying for less than a day, it effectively serves the fast-paced needs of professionals, with typical stays ranging from just a few hours to five days.

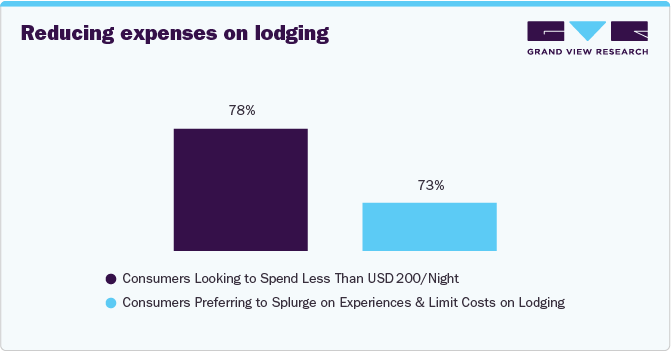

According to a July 2023 survey by Choice Hotels International, Inc., consumers are prioritizing experiences while exploring the U.S. and plan to spend less than USD 200 per night on accommodations. This trend bodes well for capsule hotels, as they offer affordable, experience-focused lodging options that align with budget -conscious travelers' preferences. Capsule hotels provide an ideal solution for those seeking cost-effective stays without compromising on comfort or convenience.

Age Group Insights

The use of capsule hotels among travelers aged 18- 24 accounted for a share of about 41% in 2024. Consumers of this age group are drawn to capsule hotels for their affordability and practicality, especially as financial constraints often accompany tuition and living expenses. These compact accommodations provide private, secure spaces with essentials like Wi-Fi and breakout rooms, making them ideal for academic trips, exchange programs, or budget-friendly travel adventures. The efficient use of space and cost-saving benefits perfectly align with young travelers' needs.

Demand for capsule hotels among the age group 25-39 years is projected to increase at a CAGR of 9.2% from 2025 to 2030, as they seek affordable yet modern accommodations that blend privacy, convenience, and connectivity. With features like compact yet comfortable capsules, prime urban or transport-linked locations, and a futuristic appeal, these hotels cater perfectly to the preferences of millennials balancing budget travel with unique experiences.

Traveler Type Insights

Solo travelers account for about 71% of the capsule hotel market. They prefer pod hotels due to the combination of privacy, affordability, and comfort that these accommodations offer. With features like tech-enabled lockers, mood lighting, and smart amenities, capsule hotels provide a secure and personalized environment for independent adventurers. The quiet, soothing atmosphere and efficient use of space make them ideal for solo travelers seeking a unique and hassle-free lodging experience.

Demand for capsule hotels among group travelers is expected to increase at a CAGR of 9.2% from 2025 to 2030. This is due to their affordability, flexibility, and convenient locations near business districts, transport hubs, and tourist destinations. With features like hourly bookings and the ability to accommodate short stays, capsule hotels cater well to the needs of group travelers looking for budget-friendly, secure, and practical accommodations. These hotels provide a comfortable base for corporate workers, backpackers, and tourists who prioritize efficiency and ease of access during their trips.

Booking Mode Insights

Bookings of capsule hotels through offline mode accounted for about 60% of the overall market in 2024. This booking mode remains prominent due to the convenience and flexibility it offers, especially for last-minute travelers or those on the go. Since many capsule hotels operate on a walk-in basis and rarely face full occupancy, travelers often prefer to book on-site, eliminating the need for advance reservations.

Bookings of pod hotels through online booking mode are expected to rise at a CAGR of 9.2% from 2025 to 2030. This can be attributed to the convenience of securing affordable accommodations, especially for last-minute travelers. With savings of up to 80-90% compared to traditional hotels, online platforms offer easy access to cost-effective options, making them ideal for travelers seeking budget-friendly stays in unpredictable situations. The ability to compare prices and book in advance ensures peace of mind, particularly for those facing delays or unforeseen circumstances.

Regional Insights

The capsule hotel market in North America accounted for a market share of around 10% in 2024 in the global capsule hotel market. The industry here is gradually gaining traction as cities face increasing demand for affordable yet quality accommodations. While the concept has been slower to catch on due to the abundance of budget hotels, rising tourism and business travel are driving interest in these compact, cost-effective lodging options. Hotels like Vancouver’s Panda Pod Hotel are bridging the cultural gap by adapting pod sizes and amenities to suit North American preferences, offering travelers a blend of comfort, community, and affordability.

U.S. Capsule Hotel Market Trends

In 2024, the capsule hotel market in the U.S. held a dominant 80% share of the North American market. Cities like New York and Washington, D.C., are witnessing a rise in pod-style accommodations tailored to urban travelers seeking affordable luxury. Properties like the U Street Capsule Hotel cater to this growing demand, combining small, efficient spaces with communal lounges to foster social interactions. As travel trends evolve, these hotels are poised to carve a niche within the U.S. hospitality industry.

Europe Capsule Hotel Market Trends

The capsule hotel market in Europe is expected to grow at a CAGR of 9.6% from 2025 to 2030. Demand here is set to rise as budget-conscious travelers seek affordable yet comfortable accommodations amidst inflation-driven increases in room rates and airfares. With compact designs enabling higher density and profitability per square foot compared to traditional hotels, pod hotels are increasingly appealing to real estate investors. Flexible layouts and lean cost structures further enhance their profitability. Notable developments, such as Melford Capital’s SoHostel conversion and Kabannas’ USD 200 million backed acquisitions, highlight growing investor confidence, ensuring robust demand and expansion across key European cities.

Asia Pacific Capsule Hotel Market Trends

The capsule hotel market in Asia Pacific accounted for a share of about 58% in 2024. Demand is projected to grow, driven by innovative ventures like India’s Nap Tap Go, founded in 2023. These pod hotels address gaps in budget-friendly hospitality by offering clean, affordable, and flexible accommodations for backpackers, corporate travelers, and pilgrims near key locations like business hubs, tourist destinations, and hospitals. With rising intra-APAC travel, urbanization, and a preference for cost-effective stays, capsule hotels cater to diverse demographics, including short-stay and hybrid workers, ensuring sustained demand.

Key Capsule Hotel Company Insights

The capsule hotel market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Nine Hours, The Pod Hotels, First Cabin, Book and Bed Tokyo, and The O Pod Hotel among others. Market players are differentiating through expansions, investments, and launches to cater to evolving consumer preferences.

Key Capsule Hotel Companies:

The following are the leading companies in the capsule hotel market. These companies collectively hold the largest market share and dictate industry trends.

- Nine Hours

- The Pod Hotels

- First Cabin

- Book and Bed Tokyo

- The O Pod Hotel

- Petra Capsule Hostel

- Capsule Inn Osaka

- Cabana

- CityHub

- Bloc Hotel

Recent Developments

-

In January 2025, Uumen Hotel announced the launch of Finland's first micro-room hotel in Tampere in May 2025. Located in the historic Finlayson factory area, the hotel will offer compact accommodations inspired by Japan’s capsule hotels. Each five-square-meter room will feature a cozy bed, storage, and privacy, providing an affordable and comfortable stay. While the bathrooms are shared, the hotel’s low-cost pricing makes it an attractive option for budget-conscious travelers seeking a unique lodging experience.

-

In January 2025, Indonesian capsule hotel and cabin operator Bobobox announced the launch of five new properties, expanding its portfolio to 37 locations nationwide. The new sites included Bobocabin Dieng, Bobopod Thamrin, Bobocabin Sukawana, Bobocabin Patra Parapat, and Bobocabin Ijen. The company plans to open 12 more locations in 2025, focusing on popular tourist destinations like Surabaya, Medan, Bali, and Bromo.

-

In October 2024, Panda Pod Hotel opened in Vancouver, offering budget-friendly pod-style rooms for digital nomads and solo travelers. With rooms priced under USD 100 per night, including taxes, it provides an affordable alternative in one of Canada's priciest cities. The hotel caters to independent travelers by offering a self-check-in process and essential amenities, emphasizing simplicity, efficiency, and cost-effectiveness without compromising on quality.

Capsule Hotel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 284.0 million

Revenue forecast in 2030

USD 432.5 million

Growth rate (Revenue)

CAGR of 8.8% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, traveler type, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Japan; South Korea; Australia & New Zealand; South Africa; UAE; Brazil; Argentina

Key companies profiled

Nine Hours; The Pod Hotels; First Cabin; Book and Bed Tokyo; The O Pod Hotel; Petra Capsule Hostel; Capsule Inn Osaka; Cabana; CityHub; Bloc Hotel

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Capsule Hotel Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Capsule hotel market report based on age group, traveler type, booking mode, and region.

-

Traveler Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Solo

-

Group

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18-24 Years

-

25-39 Years

-

40-54 Years

-

55+ Years

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The capsule hotel market was estimated at USD 262.9 million in 2024 and is expected to reach USD 284.0 million in 2025.

b. The capsule hotel market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 432.5 million by 2030.

b. Asia Pacific dominated the capsule hotel market in 2024 with a share of about 58%. Demand is projected to grow, driven by innovative ventures. These pod hotels address gaps in budget-friendly hospitality by offering clean, affordable, and flexible accommodations for backpackers, corporate travelers, and pilgrims near key locations like business hubs, tourist destinations, and hospitals.

b. Key players in the capsule hotel market are Nine Hours; The Pod Hotels; First Cabin; Book and Bed Tokyo; The O Pod Hotel; Petra Capsule Hostel; Capsule Inn Osaka; Cabana; CityHub; Bloc Hotel

b. Key factors driving the capsule hotel market include affordability, space efficiency, growing demand for budget travel, rising urbanization, and the shift towards minimalist, experience-focused lodging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.