- Home

- »

- Biotechnology

- »

-

CAR T-cell Therapy Market Size, Share, Industry Report 2030GVR Report cover

![CAR T-cell Therapy Market Size, Share & Trends Report]()

CAR T-cell Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Abecma, Breyanzi, Carvykti, Kymriah), By Disease Indication (Lymphoma, Leukemia, Multiple Myeloma), By End-use, By Region and Segment Forecasts

- Report ID: GVR-4-68040-090-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

CAR T-cell Therapy Market Summary

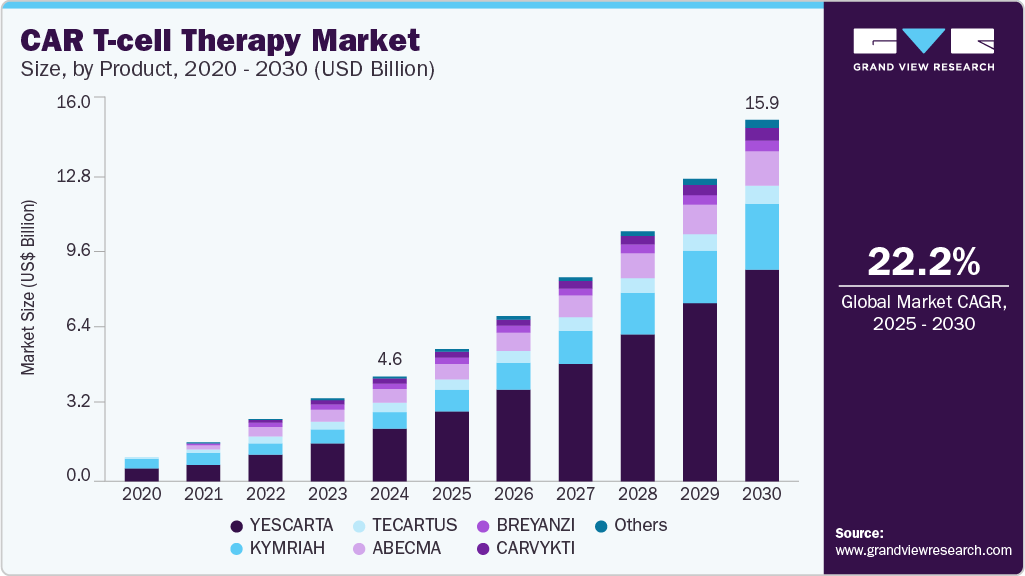

The global CAR T-cell therapy market size was estimated at USD 4.65 billion in 2024 and is estimated to reach USD 15.97 billion by 2030, growing at a CAGR of 22.2% from 2025 to 2030. Remarkable success in treating blood cancers, such as acute lymphoblastic leukemia (ALL) and non-Hodgkin lymphoma (NHL), has increased the adoption of CAR T-cell therapy and is anticipated to boost the industry's growth.

Key Market Trends & Insights

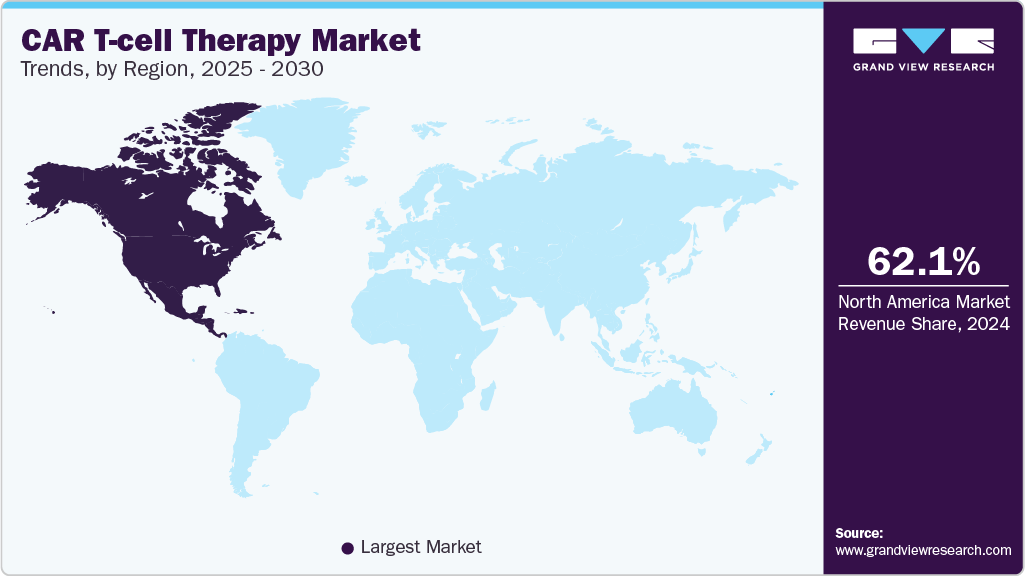

- North America accounted for the largest share of 62.1% in 2024.

- The U.S. CAR T-cell therapy market dominated the regional market in 2024.

- By product, yescarta segment held the major share of 50.0% in 2024.

- By disease indication, the lymphoma segment held the largest market share in 2024.

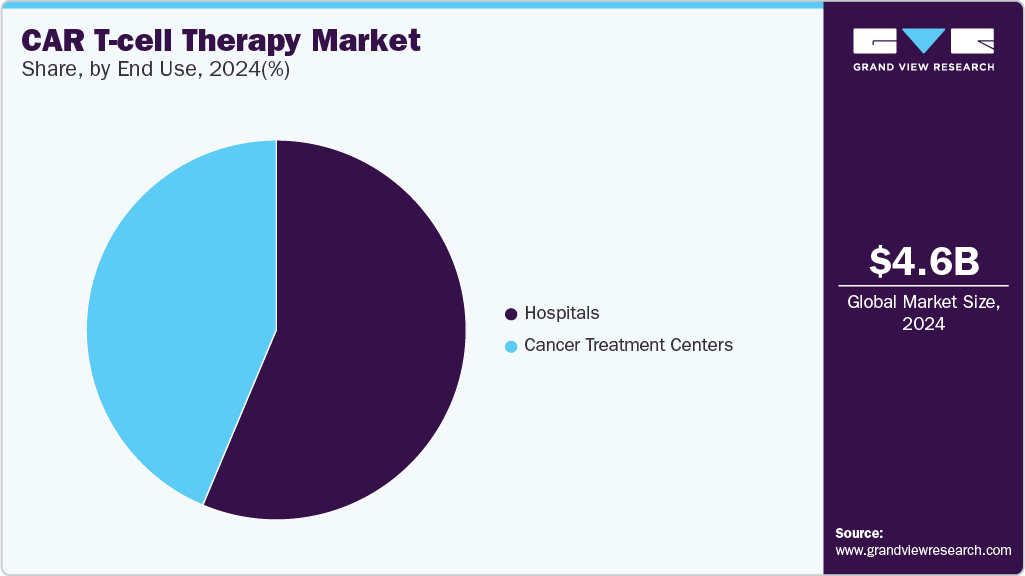

- By end use, the hospital segment held the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.65 Billion

- 2030 Projected Market Size: USD 15.97 Billion

- CAGR (2025-2030): 22.2%

- North America: Largest market in 2024

- Europe: Fastest growing market

CAR T-cell therapy provides a highly targeted treatment targeting cancer cells and leaves healthy cells unharmed. The accelerated approvals by global health authorities are a key force shaping the CAR T-cell therapy landscape. Regulatory agencies such as the U.S. FDA and the European Medicines Agency (EMA) have expanded indications for several therapies, signaling growing institutional confidence. For instance, in April 2024, the FDA approved Janssen’s CARVYKTI (ciltacabtagene autoleucel) for treating adult patients with refractory multiple myeloma and patients who received minimum one prior line of therapy.

CAR T-cell Therapy represents a strong paradigm treatment shift in the cancer treatment approach. The CAR T-cell approach utilizes genetically modified cytotoxic immune T-cells to approach tumor-specific antigens, which help in durable remissions of relapsed or refractory B-Cell Lymphoma. B-Cell lymphoma is the most common type of malignant lymphoma, and relapsed or refractory lymphoma has shown a higher cause of treatment failure. For instance, as per Cancer Network 2022, diffuse large B-cell lymphoma (DLBCL) holds a significant presence under the category of Non-Hodgkin Lymphoma and approximately 30-40% of the patients develop relapsed/refractory DLBCL during the first 2 years. Thereby, the introduction of CAR T-cell therapy has shown immense promise for cancer treatment, and the side effects of the therapy can be properly managed.

The growing cases of cancer malignancies continue to propel the market for CAR T-cell therapy. Additionally, various product launches and approvals provide significant traction to the market players. CAR T-cell Therapy is immunotherapy using genetically modified T cells to attack cancer cells in the body. The process involves using the patient’s T cells and engineering them to express chimeric antigen receptors (CAR) on the surface. The following CARs are specifically designed to recognize and bind to specific proteins in cancer cells, which in turn triggers the T cells to kill the cancer cells.

Product launches and timely approvals have led to strategic competencies in using CAR T-cell therapy. For instance, in May 2023, the European Commission approved Bristol Myers Squibb's CD19-directed CAR T-cell therapy, Breyanzi. The therapy is used to treat diffuse large B-cell lymphoma in adult patients. Similarly, in February 2022, the U.S. FDA approved Cltacabtagene autoleucel (Carvykti) for adults suffering from multiple myeloma. The following approval is second in line and provides an alternative for people suffering from multiple myeloma via CAR T-cell therapy.

Product Insights

Yescarta segment held the major share of 50.0% of the CAR T-cell therapy market in 2024. It is also expected to be the fastest-growing product segment during the forecast period. Yescarta is also known as axicabtagene ciloleucel and targets the CD19 antigen. Yescarta is primarily prescribed for large B-cell lymphoma when the first treatment does not work, or cancer returns within the first year of treatment, or when at least two kinds of treatment for follicular lymphoma have failed. The strong share can be attributed to the improved survival rates for adults with relapsed large B-cell lymphoma. For instance, as per Gilead 2022, around 2 times more patients taking Yescarta (40.5%) were alive for two years without disease progression, and the median event-free survival was four-fold greater than the current standard of care.

The Carvykti segment is expected to witness lucrative growth over the forecast period from 2025 to 2030. Carvykti is also an autologous immunotherapy to find and destroy B cell maturation antigen or BCMA-expressing cells. Strong regulatory support in the forms of clinical trials and approvals has allowed the cancer drug to grow exponentially. For instance, in February 2022, Ciltacabtagene autoleucel was approved by the U.S. FDA, promising a wider application, specifically for patients suffering from multiple myeloma, relapsed or refractory. Moreover, clinical trials have shown robust results with around 98% of the study participants responding to the treatment, with 78% of participants showing no signs of cancer in bone marrow or blood. The results lasted for a median of 22 months showing a strong premise for treatment in cancer patients.

Disease Indication Insights

The lymphoma segment held the largest CAR T-cell therapy market share in 2024. It is also expected to be the fastest-growing segment over the forecast period. The dominant market share can be attributed to the presence of various CAR-T drugs focusing on targeting lymphoma. For example, Breyanzi, Kymirah, Tecartus, and Yescarta help target the CD-19 antigen, which in turn helps eliminate large B-cell lymphoma in both adults and children. In addition, lymphoma has a significant prevalence across the world, which allows CAR T-cell therapy to eliminate and mitigate life-threatening conditions.

According to the American Cancer Society’s estimates for 2025, non-Hodgkin lymphoma (NHL) will account for about 4% of all cancers in the U.S., with approximately 80,350 new cases expected, including both adults and children.

Multiple Myeloma is expected to grow rapidly over the forecast period. The global incidence of multiple myeloma has been on the increase. According to a report published by Lancet Hematology 2020, the age-standardized rate of multiple myeloma was 1.78 per 100,000 people globally. The research highlighted a steep increase in the overall incidence in countries where the incidence among men aged 50 or older is relatively high.

According to Cancer Research UK, around 6,200 people are diagnosed with myeloma each year, which equates to approximately 17 new cases daily. The condition is more common in men than in women and predominantly affects older adults, with nearly 45% of cases occurring in individuals aged 75 and over. It is considered very rare in those under the age of 40. For instance, in April 2025, the UK MHRA approved two new combination therapies using GSK’s Blenrep (belantamab mafodotin) for relapsed or refractory multiple myeloma. Based on late-stage trials, the approvals showed enhanced survival and disease control.

End use Insights

The hospital segment held the largest share of CAR T-cell therapy industry in 2024. The dominant market share can be attributed to robust technology, well-equipped operating facilities like theatres, and strong buying power for hospitals across major geographies. Furthermore, hospitals that leverage the in-house CAR T process can reduce the overall cost pertinent to the therapy, which increases the footprint towards such spaces. For instance, Sheba Hospital in Israel utilizes in-house processes pertinent to the process which reduces the overall treatment time to less than 10 days and exponentially reduces costs by at least 50%.

Cancer treatment centers are expected to be the fastest-growing segment over the forecast period. It is owing to the availability of a wide range of treatment choices and patient comfort options. Additionally, patients are treated within the communities, which increases the overall CAR T Treatment reach. Lastly, strategic initiatives taken by renowned administrative institutions will enhance patient coverage. For instance, in February 2023, the UVM Cancer Center in Vermont, U.S., announced the availability of a new CAR T-cell treatment for patients suffering from blood cancer.

Regional Insights

North America accounted for the largest share of 62.1% in 2024. The presence of major companies, increased government funding, and research activities, along with strong coverage via various insurance policies allow the region to hold a strong position. The cost pertinent to CAR T therapies on average reaches USD 400,000 and above, thereby, strong insurance policies guarantee patient comfort and market proliferation.

U.S. CAR T-cell Therapy Market Trends

The U.S. CAR T-cell therapy market dominated the regional market in 2024. The growing prevalence rate of various diseases, including lymphoma and multiple myeloma, and the increasing geriatric population are driving market growth. In addition, continuous technological advancements in diagnostics and therapeutics, along with improvements in healthcare infrastructure, are further contributing to the expansion of the cancer treatment landscape.

The U.S. has 73 NCI-Designated Cancer Centers across 37 states and D.C., providing advanced cancer care and research. Each year, around 400,000 patients are diagnosed, with many more treated and enrolled in clinical trials at these centers.

Europe CAR T-cell Therapy Market Trends

Europe is estimated to be the fastest-growing CAR T-cell therapy industry region over the forecast period. The growth is driven by the growing geriatric population, increasing prevalence of cancer and early diagnosis, and rising adoption of personalized medicine. Strong healthcare infrastructure, research funding, and early access to CAR T therapies help drive the market in the European region.Each year, approximately 300,000 individuals across the European Union are diagnosed with a hematologic malignancy, including leukemia, lymphoma, and multiple myeloma. Each type of blood cancer creates specific challenges for healthcare systems, requiring clear strategies to prevent, detect, diagnose, and treat these diseases effectively.

Germany accounted for the largest revenue share of the European CAR T-cell therapy market in 2024. This is driven by robust clinical infrastructure and government-backed treatment centers. Strategic collaborations between pharma companies and academic institutions, along with supportive reimbursement policies, are accelerating adoption. Rising cases of blood cancers such as lymphoma and multiple myeloma further boost demand, positioning Germany as a key hub for CAR T-cell innovation in Europe.

According to the National Library of Medicine, multiple myeloma (MM) is a malignant disorder of plasma cells that typically develops from a precursor condition known as monoclonal gammopathy of undetermined significance (MGUS). The disease predominantly affects older adults, with the median age at diagnosis being over 70 years. In Germany, the incidence rate is approximately eight new cases per 100,000 individuals annually, translating to around 6,000 newly diagnosed patients nationwide.

Asia Pacific CAR T-cell Therapy Market Trends

Asia Pacific is projected to be a significant region in the coming years, driven by an expanding patient population and supportive regulatory frameworks that facilitate product approvals and market entry for key players. This favorable situation is further strengthened by the increasing prevalence of cancer, which continues to fuel demand for innovative treatment options. Moreover, growing efforts by major companies to develop technologically advanced therapies are accelerating market expansion across the region.

Key CAR T-cell Therapy Company Insights

Some key companies operating in the CAR T-cell therapy market include Novartis AG, Gilead Sciences, Inc., and Bristol Myers Squibb (BMS). Major players in this market are actively investing in innovation, strategic collaborations, and the adoption of next-generation manufacturing technologies to expand treatment access and improve patient outcomes.

-

Novartis AG is a global healthcare company that researches, develops, and manufactures innovative therapies. In the CAR T-cell therapy market, Novartis is a pioneer with its FDA-approved product Kymriah (tisagenlecleucel), indicated for relapsed/refractory B-cell precursor ALL and diffuse large B-cell lymphoma.

-

Gilead Sciences, Inc. is a biopharmaceutical company known for its innovative therapies in oncology and virology. The company is advancing its pipeline to broaden CAR-T applications across various cancer types.

Key CAR T-cell Therapy Companies:

The following are the leading companies in the CAR T-cell therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Bristol-Myers Squibb Company

- Novartis AG

- Gilead Sciences, Inc.

- Johnson & Johnson Services, Inc.

- JW Therapeutics (Shanghai) Co., Ltd.

- bluebird bio, Inc.

- Merck & Co., Inc.

- Sangamo Therapeutics

- Sorrento Therapeutics, Inc.

- GSK plc.

Recent Developments

-

In April 2025, Johnson & Johnson announced that the European Commission approved an expanded indication for Darzalex (daratumumab) subcutaneous formulation in combination with bortezomib, lenalidomide, and dexamethasone for the treatment of newly diagnosed multiple myeloma (NDMM) patients, now including those

regardless of transplant eligibility. Previously, it was approved only for transplant-eligible (ASCT) patients.

-

In March 2025, Bristol Myers Squibb announced that it would acquire 2seventy Bio for around USD 286 million. The companies partnered on Abecma, a CAR T-cell therapy for multiple myeloma.

-

In November 2024, the Food and Drug Administration (FDA) approved obecabtagene autoleucel (Aucatzyl, Autolus Inc.), a CD19-directed genetically modified autologous T cell immunotherapy, for the treatment of adult patients with relapsed or refractory B-cell precursor acute lymphoblastic leukemia (ALL).

CAR T-cell Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.85 billion

Revenue forecast in 2030

USD 15.97 billion

Growth rate

CAGR of 22.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, disease indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Rest of World

Country scope

U.S.; Canada; UK; Germany; Japan; China;

Key companies profiled

Bristol-Myers Squibb Company; Novartis AG; Gilead Sciences, Inc.; Johnson & Johnson Services, Inc.; JW Therapeutics (Shanghai) Co., Ltd.; bluebird bio, Inc.; Merck & Co., Inc.; Sangamo Therapeutics; Sorrento Therapeutics, Inc.; GSK plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CAR T-cell Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the CAR T-cell therapy market report on the basis of product, Disease Indication, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Abecma (idecabtagene vicleucel)

-

Breyanzi (lisocabtagene maraleucel)

-

Carvykti (ciltacabtagene autoleucel)

-

Kymriah (tisagenlecleucel)

-

Tecartus (brexucabtagene autoleucel)

-

Yescarta (axicabtagene ciloleucel)

-

Others

-

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Leukemia

-

Lymphoma

-

Multiple Myeloma

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cancer Treatment Centers

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

Rest of Asia Pacific

-

-

Rest of World

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.