- Home

- »

- Electronic & Electrical

- »

-

Car Wash Ancillary Products Market Size, Share Report, 2030GVR Report cover

![Car Wash Ancillary Products Market Size, Share & Trends Report]()

Car Wash Ancillary Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Car Wash Vacuum System, RO Systems, Bay Doors, Others), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-791-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Car Wash Ancillary Products Market Trends

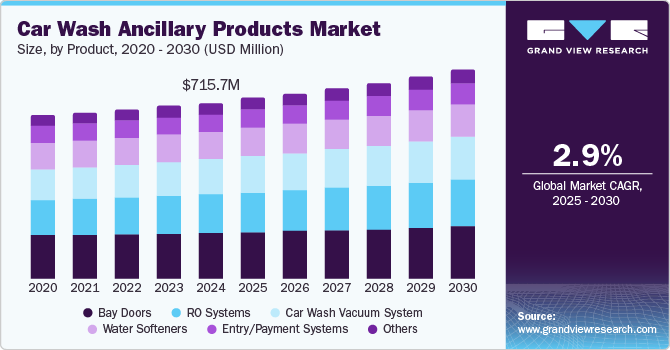

The global car wash ancillary products market size was valued at USD 715.7 million in 2024 and is projected to grow at a CAGR of 2.9% from 2025 to 2030. The steadily increasing popularity of car wash services worldwide due to the availability of different price-based offerings and convenience offered by these services is a major driver of market expansion. Furthermore, enforcing stringent environmental regulations that discourage homeowners from washing their vehicles is expected to boost the usage of professional car wash facilities, aiding the growth of the car wash ancillary products industry in the coming years.

In recent years, there have been significant developments in the car wash industry with the emergence of new technologies, advanced products, and the latest practices, which have helped transform both customer expectations and industry norms. For instance, paid vacuum center systems are replacing free vacuums, with operators retrofitting bulky and costly free vacuum centers with their credit-card or membership-integrated alternatives. Express car wash services are installed with equipment that offers brisk car washing, appealing to vehicle owners who are frequently on the road or face time constraints for a full-service wash. As a result, there has been a notable growth in the demand for in-bay automatic or conveyor/tunnel washes. Eco-friendly services are also gaining noticeable traction, creating diverse revenue avenues for the industry. While home car washes use around 140 gallons of water per cleaning operation, their eco-friendly alternatives utilize only 45 gallons, saving 60% more water.

The car wash industry has been intensifying its focus on only using water pressure and chemicals in its processes, replacing conventional cleaning methods and equipment. This has led to adopting RO systems and water softeners that provide optimal results and elevate customer satisfaction. Leveraging RO systems helps provide high-quality, purified water, resulting in spot-free finishes that are particularly important in high-end detailing services. Moreover, the technology helps prevent scale formation on equipment, pipes, and vehicles, which can otherwise lead to inefficiency and maintenance costs. Water softeners have become essential in car wash services across areas with hard water supply, as they play a crucial role in maintaining the performance of car wash systems and ensuring a clean, streak-free finish on vehicles. Cleaning stations that use hard water require more soap and detergent to clean the car effectively. A water softener system reduces the amount of soap required, allowing detergents to work optimally. This leads to cost savings on chemicals and improves overall operational efficiency.

Product Insights

The bay doors segment accounted for the largest revenue share of 25.7% in the global car wash ancillary products industry in 2024. Bay doors are essential components that help regulate access to the wash area, ensure the safety and efficiency of the operation, and improve customer experience. They serve several key purposes, from providing security and weather protection to maintaining operational flow within the car wash bays. Bay doors efficiently manage the flow of vehicles within a car wash, keeping the operation highly organized. For example, in an automatic tunnel car wash, they guide vehicles into the right position and help control the timing and sequencing of each car’s entry and exit. Additionally, in certain types of car washes, especially self-service and tunnel systems, bay doors can help contain water spray and prevent it from splashing out into the parking area. This containment ensures that the surrounding area stays clean and safe for customers and employees.

The car wash vacuum system segment is anticipated to advance at the highest CAGR during the forecast period. Vacuum systems are typically designed for use in self-service car washes, automatic car washes, or full-service car washes where attendants need to remove dirt, debris, and dust from the interior of vehicles. A well-designed vacuum system improves the overall service quality and adds convenience for customers, encouraging repeat visits and enhancing the business’s profitability. Car wash vacuum systems are designed to withstand frequent use and the wear and tear from cleaning vehicles. These vacuum systems are durable and equipped with robust motors and sturdy filters for continuous operation. Modern vacuum systems can be equipped with built-in maintenance alert systems that notify the operator when it’s time to clean or replace filters, empty the collection bin, or perform other routine maintenance tasks, ensuring effective output.

Distribution Channel Insights

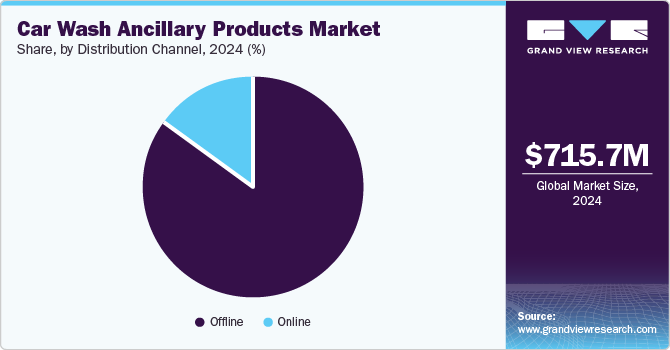

The offline segment accounted for a dominant revenue share in the global car wash ancillary products industry in 2024 due to the higher demand for ancillary products via manufacturers, distributors, and dealers. A majority of car wash businesses prefer to buy these solutions offline due to easy product availability, extensive customization options, and premium customer services. Moreover, manufacturers and distributors offer comprehensive product guidance and assistance, in-house and on-site training, installation assistance, 24/7 technical support, and extensive repair services, which appeal to customers. Cost efficiency for car wash operators and business owners during bulk equipment procurement from manufacturers and distributors further drives market expansion through this segment.

The online segment is expected to witness the highest CAGR from 2025 to 2030 in the global market. This mode includes the sale of car wash ancillary products via e-commerce platforms, company websites, and other third-party sites. Technological advancements and a steadily increasing preference for online distribution channels to purchase products, particularly among smaller car wash operators with fewer requirements, have created growth avenues for this segment. Online sales of car wash products allow consumers to easily access a wide range of items, from cleaning supplies and chemicals to equipment such as vacuums, water softeners, and pressure washers. This shift in consumer behavior has prompted manufacturers and retailers to adapt their strategies to utilize the rapidly expanding digital marketplace. This is expected to bring positive developments in the car wash ancillary products industry in the coming years.

Regional Insights

The North America car wash ancillary products market accounted for the largest revenue share of 38.6% globally in 2024. The demand for car wash services in the region has grown steadily due to factors such as rising car ownership rates and heightened awareness about the importance of vehicle cleanliness and maintenance. For instance, according to DesRosiers Automotive Consultants, overall vehicle sales in Canada reached around 1.9 million in 2024, an increase from 1.7 million units sold in 2023. Thus, the increasing presence of passenger and commercial vehicles on roads in regional economies has boosted the number of automatic car wash services in operation, driving sales of ancillary products such as detergents, waxes, and polishes. Furthermore, innovations in car wash products, such as advanced waxes, high-performance cleaning agents, and faster drying materials, have helped drive interest and expanded the products available to businesses and consumers in the region.

U.S. Car Wash Ancillary Products Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by the increasing sales of vehicles in the economy and the extensive use of advanced maintenance and cleaning options by car wash companies. The emergence of automated car washes, express tunnels, and self-service car wash stations in urban and suburban areas has further increased the use of professional services among American consumers. As these services expand, there is an increased demand for ancillary products such as car wash chemicals, waxes, drying agents, and brushes for such businesses to operate effectively. According to data from the U.S. Census Bureau, in 2020, around 70% of car owners used carwash facilities instead of washing their vehicles at home. Moreover, a majority of car owners in the U.S. utilize these services on a monthly or bi-monthly basis, indicating a continued usage of ancillary solutions such as bay doors and water softeners in these locations.

Europe Car Wash Ancillary Products Market Trends

Europe accounted for a substantial revenue share in the global car wash ancillary products market in 2024. The growing presence of passenger and commercial vehicles on roads in the region, particularly in Western European economies, has resulted in the rising establishment of professional car wash stations. According to data from the European Automobile Manufacturers’ Association (ACEA), there were over 252 million cars on roads in the European Union in 2022. This directly influences the demand for car wash services and, by extension, ancillary solutions. Additionally, many regional consumers increasingly seek eco-friendly car wash services that use less water, biodegradable detergents, or waterless washes, which has helped shape market expansion in recent years.

Asia Pacific Car Wash Ancillary Products Market Trends

The Asia Pacific region is expected to witness the highest CAGR during the forecast period in the car wash ancillary products market. The increasing pace of urbanization in regional economies such as India and China, coupled with the rapidly growing adoption of four-wheelers, has resulted in the expanded presence of advanced car wash facilities. With more people residing in densely populated cities such as Mumbai, Tokyo, and Shanghai, car owners are often limited in terms of space and resources to wash their vehicles at home. This has increased the demand for professional car wash services, particularly in urban centers, where convenience and time-saving are a priority. Additionally, increasing focus on vehicle aesthetics and maintenance has led to a surge in the use of high-end detailing products such as waxes, polishes, leather cleaners, and specialty tools such as microfiber towels, steam cleaners, and vacuum systems.

China accounted for the largest revenue share in the Asia Pacific market for car wash ancillary products in 2024. The economy is one of the leading automotive markets globally, with data from CEIC stating that there were around 330 million registered vehicles in the country as of December 2023. Consequently, the need for advanced car maintenance and cleaning services has increased substantially, creating a major growth opportunity for providers of ancillary solutions. Moreover, automated car washes and high-tech solutions have driven the use of high-performance ancillary products. China has been strengthening regulations on environmental standards, especially in large cities. These regulations influence car wash businesses to adopt more sustainable solutions to comply with water usage and chemical disposal regulations. The need for water reclamation systems, eco-friendly cleaning agents, and effluent treatment solutions is growing among car wash businesses in the country.

Key Car Wash Ancillary Products Company Insights

Some major companies involved in the global car wash ancillary products industry include AutoVac Industrial Vacuum & Air Systems, Vacutech, and Goff’s Enterprises, among others.

-

AutoVac Industrial Vacuum & Air Systems is an American company specializing in developing energy-efficient vacuum and drying systems, particularly for the car wash equipment business. The company is known for its vacuum producers, filtration devices, piping and support structures, advanced motor controls and software, and parts and accessories. Autovac’s AutoDryer is a proprietary car wash drying system with durable cast aluminum housings. It features energy-efficient technologies such as DryerIQ, which reduces energy consumption by up to 70% and extends equipment lifespan.

-

Vacutech LLC is a U.S.-based organization in the vacuum technology sector that develops and manufactures vacuum systems and equipment. Vacuum systems include express exterior, full service, flex service, vehicle detailing, self-service, and in-bay automatic offerings. Meanwhile, the company offers arches (booms), stanchions and separators, awnings and canopies, separators, accessories, and turbines in the equipment category.

Key Car Wash Ancillary Products Companies:

The following are the leading companies in the car wash ancillary products market. These companies collectively hold the largest market share and dictate industry trends.

- Mr. Nozzle, Inc.

- AutoVac Industrial Vacuum & Air Systems

- Ginsan Industries

- Coleman Hanna Carwash Systems

- WashTec AG

- Vacutech LLC

- Eurovac (Clean Air Technologies, Inc.)

- Fragramatics Manufacturing Company, Inc.

- JE Adams Industries, Ltd.

- Sonny’s Enterprises, LLC

- Airlift Doors, Inc.

- Hamilton Manufacturing Corporation

- Goff's Enterprises LLC

- AVW Equipment Company, Inc.

- Extractomat

- National Carwash Solutions, Inc.

Recent Developments

-

In December 2024, Sonny's Enterprises, a provider of conveyorized car wash parts and equipment, announced the integration of payment processing solutions from Fiserv through the latter’s ISV Partner Program. The integration is expected to offer benefits such as uninterrupted subscription services through the account updater feature and rapid credit card processing capabilities. Other advantages include transparent and competitive pricing as per customer statements, optimized cash flow for day-to-day operations, and a dedicated merchant portal for operators.

-

In September 2024, WashTec AG announced the launch of the SoftCare offering for gantry car wash operations to address challenges, including changing customer demands regarding wash quality and larger vehicle sizes. The new solution provides a wash height and width of up to 2.9 meters and 2.6 meters, respectively, and offers environment-friendly and highly efficient chemical dosing options. The system is equipped with a combination of FlexControl brush wash and optional high-side pressure, along with SofTecs brushes, to ensure effective and gentle cleaning.

Car Wash Ancillary Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 732.7 million

Revenue forecast in 2030

USD 846.8 million

Growth Rate

CAGR of 2.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Argentina, Brazil, South Africa, UAE

Key companies profiled

Mr. Nozzle, Inc., AutoVac Industrial Vacuum & Air Systems, Ginsan Industries, Coleman Hanna Carwash Systems, WashTec AG, Vacutech LLC, Eurovac (Clean Air Technologies, Inc.), Fragramatics Manufacturing Company, Inc., JE Adams Industries, Ltd., Sonny’s Enterprises, LLC, Airlift Doors, Inc., Hamilton Manufacturing Corporation, Goff's Enterprises LLC, AVW Equipment Company, Inc., Extractomat, National Carwash Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Car Wash Ancillary Products Market Report Segmentation

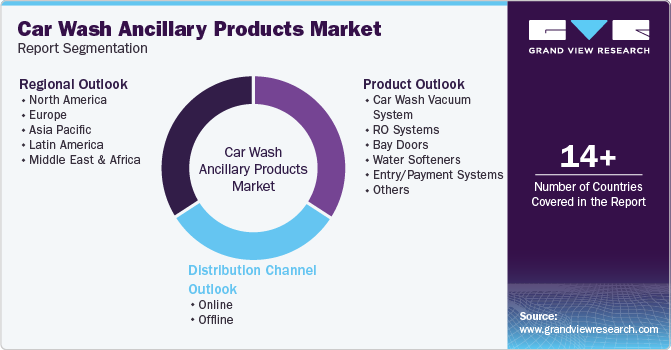

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global car wash ancillary products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Car Wash Vacuum System

-

RO Systems

-

Bay Doors

-

Water Softeners

-

Entry/Payment Systems

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.