- Home

- »

- Homecare & Decor

- »

-

Car Wash Service Market Size, Share & Growth Report 2030GVR Report cover

![Car Wash Service Market Size, Share & Trends Report]()

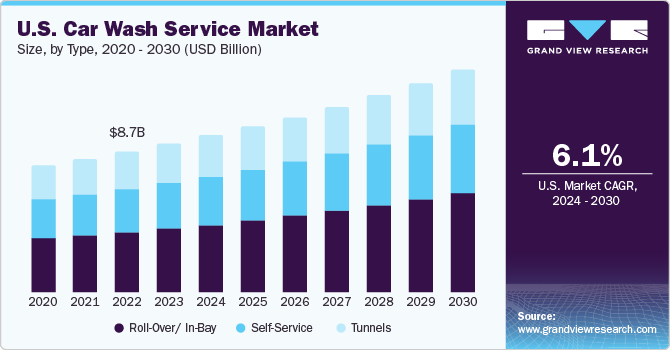

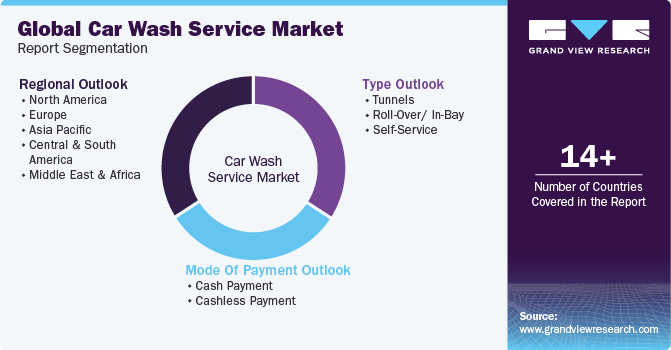

Car Wash Service Market Size, Share & Trends Analysis Report By Type (Tunnels, Roll-over/ In-bay, Self-Service), By Mode Of Payment (Cash, Cashless), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-850-3

- Number of Report Pages: 121

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Car Wash Service Market Size & Trends

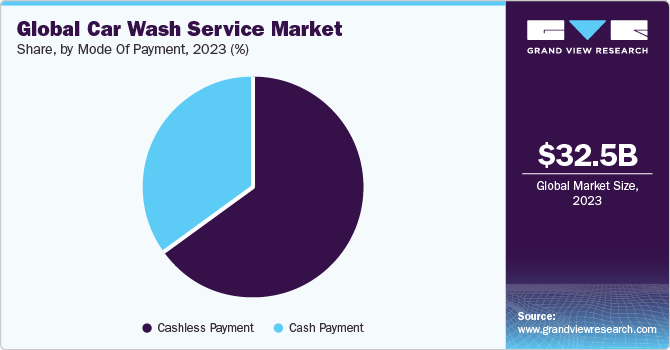

The global car wash service market size was estimated at USD 32.47 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030. As environmental restrictions forbidding residential car washing techniques become more stringent, the customer base for professional car washes is expected to rise, fueling the demand for these services. In addition, growing consumer interest in automobile maintenance is one of the major factors driving the market. Car wash services catering to corporate fleets and businesses represent a growing segment. Companies often invest in maintaining a clean and professional-looking fleet, creating opportunities for bulk services.

AMP, a 100% managed, ready-to-go membership platform, was created by a leading mobile application developer in collaboration with Autowash, a high-growth, multi-location car wash firm, and can enhance car wash income by 20%. The AMP platform will be unveiled at the Southwest Car Wash Association Conference in Fort Worth, Texas, from June 9 to 11, 2021. On-demand vehicle wash services are also changing due to ongoing technological advancements. The main purpose of improving car wash technology is to reduce friction and manual vehicle preparation time, resulting in cleaner, drier vehicles in less time. Touchless car washing and hybrid car washing are two technologies that are moving the business forward.

Urbanization and densely populated areas provide a fertile ground for car wash services, meeting the demands of busy individuals with limited time for vehicle maintenance. The industry's professionalism and expertise, coupled with the adoption of advanced cleaning technologies, contribute to its appeal. Car wash services, often characterized by convenience and accessibility, leverage drive-through and self-service facilities to offer quick and efficient solutions. Subscription models, loyalty programs, and corporate fleet services underscore the industry's adaptability to diverse consumer segments.

The mobile car wash industry refers to a service sector that provides on-the-go car cleaning and detailing solutions at the customer's location. Unlike traditional car washes where customers bring their vehicles to a fixed location, mobile car wash services bring the car wash experience directly to the customer, whether at their home, workplace, or another specified location. The increasingly busy and fast-paced lifestyles of individuals make on-demand services like mobile car washes highly appealing. Customers appreciate the flexibility to schedule a car wash without disrupting their daily routines.

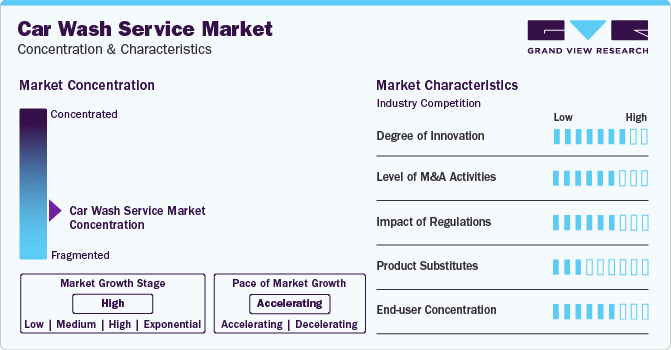

Market Concentration & Characteristics

The degree of innovation in the car wash services market has seen notable advancements in recent years. The adoption of advanced cleaning technologies has significantly improved the efficiency and effectiveness of car wash services. Touchless or frictionless washing systems, high-pressure water jets, and automated brushes contribute to a thorough and gentle cleaning process. Car wash services are increasingly incorporating water recycling systems to address environmental concerns and adhere to water conservation practices. Recycling and reusing water reduce overall water consumption and align with sustainability goals.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion.

Car wash services must adhere to regulations governing the disposal of wastewater. Proper handling and treatment of wastewater, which may contain contaminants from cleaning chemicals and vehicle residues, are essential to prevent environmental harm.Many regions have enforced strict environmental regulations to ensure that car wash services operate in an eco-friendly manner. Compliance with these regulations often involves the use of environmentally friendly cleaning products and practices to minimize the impact on local ecosystems.

The integration of mobile apps for car wash services has streamlined the customer experience. Customers can schedule appointments, make payments, and receive real-time updates on their mobile devices, enhancing convenience and accessibility.

Type Insights

The roll-over or in-bay type segment accounted for the largest share of 51.24% in 2023. The segment is projected to expand further at the fastest CAGR retaining its dominant position over the forecast period. Roll-over or in-bay facilities have lower running expenses than tunnel washes since they use just 10-50 gallons for each car against 14-60 gallons in a tunnel. This section is the most profitable because it saves the client time and money.

Furthermore, touchless washes are available with in-bay automatic systems, in which high-pressure water is used to clean the vehicle and provide friction, and soft-cloth brushes are used to clean and disseminate the detergent and shine on the vehicle before it is rinsed off. These in-bay/roll-over automatic vehicle wash services have a number of advantages, including easier client connection, impulsive purchases, and the ability to fit into smaller locations.

There has been a wide application of technology in the car wash services like soft-touch car wash services. These services offer car wash services by automated systems and specialized equipment used in these car washes which can efficiently clean the vehicle in a relatively short amount of time. For instance, Splash Car Wash is offering soft-touch car wash services with a focus on quality and convenience.

There has been an increasing requirement among consumers for personalized and tailored services like mobile car wash services in the market. These services employ trained professionals that specialize in car cleaning and detailing. They also have the necessary equipment and expertise to provide a high-quality service, ensuring that the vehicle receives a thorough and meticulous cleaning. For instance, MobileWash is a popular on-demand mobile car wash service available in the U.S. They have a network of professional detailers who come to the consumer’s location to wash the car.

Moreover, the increasing popularity of convenience stores installing tunnel wash systems represents a new potential opportunity for this market segment. Furthermore, market participants are primarily focused on the environmentally friendly elements of effective vehicle washing services, attracting many clients. In addition, the increasing penetration of auto dealerships in the car wash service industry has fueled the installation of automatic wash facilities on their sites.

Auto dealerships add automated car washes to scale up their Customer Satisfaction Index (CSI) scores, with in-bay washes being the most popular consumer choice. This boosts the growth of in-bay/roll-over automatic car wash services. Moreover, the availability of combination washes is a popular trend among roll-over/in-bay vehicle wash services. Customers can pick between touchless, friction, or a combination of both types of washes using this service.

Mode of Payment Insights

The cashless payment segment is expected to register the highest CAGR of 6.5% from 2024 to 2030. Installing an integrated payment solution, or Point-Of-Sale (POS) system, across pay stations helps car wash business owners increase efficiency, boost sales, and gain detailed insights into their customers. Customers in the millennial generation expect to be able to pay using whatever manner is most convenient for them, such as tokens, debit cards, loyalty cards, EMV-enabled credit card payments, or smartphone payments.

By making it easier to track suppliers, collect important client data, and accept numerous payment methods, an integrated payment system improves the way a firm is operated. For both operators and customers, an integrated system simplifies the entire car wash experience. Carwashes have long offered loyalty clubs and monthly membership plans as a popular payment option. Owners and consumers alike have found that charging a monthly price for all-you-can-wash access to a site or chain of carwashes has proven to be successful. These subscriptions are purchased by customers through online platforms or the company's website.

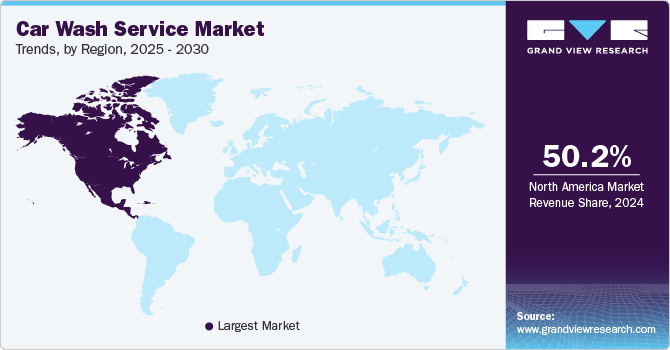

Regional Insights

North America dominated the global market, accounting for over 50% of the revenue share in 2023. This development can be attributed to increased consumer spending on comfort and leisure, as well as the widespread use of professional vehicle wash services. More than 72% of drivers in the U.S. use professional car wash services regularly, with conveyor car wash being the most profitable service. The covid-19 outbreak had led to different regulations by the service providers. For instance, in April 2021, New York State allowed car washes to reopen under strict guidelines limiting the number of employees allowed to be onsite and banning-in person payment. Major Service providers in the U.S. car wash services market are inclined toward mergers and acquisitions to increase their service footprint and boost their revenue.

In response to environmental concerns, European countries like Germany and the U.K. have implemented regulations to address issues such as water conservation in the car wash service market. A notable example is the hosepipe prohibition in the U.K., where persistent droughts in regions like the Southwest restrict private automobile owners from washing their vehicles at home. As a result, individuals are compelled to rely on professional car wash services, contributing to the growth of the market. The regulatory emphasis on water conservation encourages car wash businesses in the U.K. to adopt sustainable practices, with many facilities recycling a significant portion of the water used in their operations. standards but also propels the expansion of the U.K. car wash service market.

Germany car wash service market

The car wash service market in Germany is expected to register a CAGR of 4.9% over the forecast period. Green Carwash is a car wash chain in Germany that focuses on environmentally friendly practices, including water conservation. They utilize advanced water recycling systems and eco-friendly cleaning products to minimize water consumption and reduce environmental impact. By complying with environmental concerns and attracting environmentally concerned consumers, these services are creating the potential for market growth in the country.

The Asia Pacific car wash service market is likely to gain traction due to the rise in the adoption of different technologies in the region. Waterless car washes are gaining immense popularity in Australia, Spain, France, Indonesia, Japan, Malaysia, Singapore, India, Romania, the U.S., and UAE. For instance, EWash, in Singapore EWash has washed 173,759 cars by 2020 and has saved 24,317,920 liters of water. EWash’s waterless carwash method uses just one cup of water to clean a car compared to the average car wash service station which uses 140 liters of water. The increasing number of privately owned vehicles in China contributes to the growth of car wash service market in China. As more individuals own cars, the need for regular cleaning and maintenance becomes prominent. Furthermore, car wash service market in Japan is expected to register a CAGR of 6.1% from 2024 to 2030.

India car wash service market

The car wash service market in India is witnessing substantial growth due to rapid urbanization, which has led to a concentrated vehicle population in urban and semi-urban areas. Limited space and water restrictions in urban settings make professional car wash services more attractive to vehicle owners. Additionally, the expansion of car care chains and franchise models in India, offering standardized and convenient services with modern facilities and advanced technologies, has contributed significantly to the market's growth.

U.S. car wash service market

The car wash service market in the U.S. is projected to grow at a CAGR of 6.1% from 2024 to 2030. The country has a high rate of car ownership, and as a result, there is a consistent demand for car wash services, thus leading to the growth of car wash service market in U.S. Vehicle owners seek professional cleaning to maintain the appearance and value of their cars.

Key Car Wash Service Company Insights

The market includes both international and domestic participants. Key market players focus on strategies, such as mergers, acquisitions, and new operating establishments, in different regions to enhance their portfolio offerings in the market.

Key Car Wash Service Companies:

The following are the leading companies in the car wash service market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these car wash service companies are analyzed to map the supply network

- Zips Car Wash

- Splash Car Wash

- International Car Wash Group (ICW)

- Autobell Car Wash

- Quick Quack Car Wash

- Super Star Car Wash

- True Blue Car Wash, LLC

- Magic Hands Car Wash

- Hoffman Car Wash

- Wash Depot Holdings Inc.

Recent Developments

-

In December 2023, Magnolia Wash Holdings announced that it has undergone a rebranding to become Whistle Express Car Wash, uniting over 100 car wash locations across local and regional chains. This strategic move aims to provide customers with a consistent and elevated wash experience across the company's nine-state footprint. Whistle Express, now the 10th largest car wash brand in the U.S., plans aggressive expansion with up to 50 additional locations in 2024, supported by recent investments from Oaktree Capital Management, L.P. The rebranding aligns with the company's goal of creating uniformity and standardizing services across its diverse network of car washes, emphasizing a more cohesive and recognizable brand presence.

-

In August 2022, Mister Car Wash, Inc. announced the acquisition of Top Wash, three express exterior locations in Anoka, Fridley, and Champlin, Minnesota. The acquisition expanded the presence of Mister Car Wash in the northern suburbs of Minneapolis.

-

In June 2022, announced the opening of its newest location in Oviedo, Florida. The new location offers a Platinum package that offers Mister’s signature products including the waterfall HotShine Carnauba wax, Repel Shield, and Platinum Seal. The new location features a state-of-art tunnel experience with Mister’s proprietary cleaning systems.

Car Wash Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.31 billion

Revenue forecast in 2030

USD 49.06 billion

Growth Rate (Revenue)

CAGR of 6.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million transactions, million units, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment covered

Type, mode of payment, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, China, India, Japan, South Korea, Australia, Brazil, Chile, Colombia, UAE, Saudi Arabia

Key companies profiled

Zips Car Wash; Splash Car Wash; International Car; Wash Group (ICWG); Autobell Car Wash; Quick Quack Car Wash; Super Star Car Wash; True Blue Car Wash, LLC; Magic Hands Car Wash; Hoffman Car Wash; Wash Depot Holdings Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Car Wash Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global car wash service market report on the basis of mode of payment, type, and region:

-

Type Outlook (Volume, Million Units & Million Transactions; Revenue, USD Million, 2018 - 2030)

-

Tunnels

-

Roll-Over/ In-Bay

-

Self-Service

-

-

Mode of Payment Outlook (Volume, Million Units & Million Transactions; Revenue, USD Million, 2018 - 2030)

-

Cash Payment

-

Cashless Payment

-

-

Regional Outlook (Volume, Million Units & Million Transactions; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Chile

-

Colombia

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global car wash service market size was estimated at USD 30.80 billion in 2022 and is expected to reach USD 32.47 billion in 2023.

b. The global car wash service market is expected to grow at a compound annual growth rate of 6% from 2023 to 2030 to reach USD 49.06 billion by 2030.

b. Roll-over/in-bay car wash service dominated the car wash service market with a share of 51% in 2022. Low operating costs, less space required for installation, and low water consumption are some of the major factors driving demand for in-bay car washes among operators.

b. Some key players operating in the car wash service market include Mister Car Wash; Zips Car Wash; International Car Wash Group (ICWG); Autobell Car Wash; Quick Quack Car Wash; Super Star Car Wash; True Blue Car Wash; Magic Hand Car Wash; Hoffman Car Wash; and Wash Depot Holdings Inc.

b. Key factors that are driving the car wash service market growth include the increasing focus of consumers on vehicle maintenance and rising spending power. Busy schedules and time constraints have also led to consumers giving their vehicles to professional car washes rather than cleaning them at home.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."